Corporate financial data is the backbone of smart investing. It helps investors decode financial statements, track performance, and understand key ratios. However, mutual fund managers go a step further. They dig deeper into corporate data to identify strong businesses, manage risk, and build portfolios that can perform across market cycles. Want to have an insight into what goes on behind the scenes? Let us break down how mutual fund managers use corporate financial data to shape their investment decisions and what it means for you as an investor.

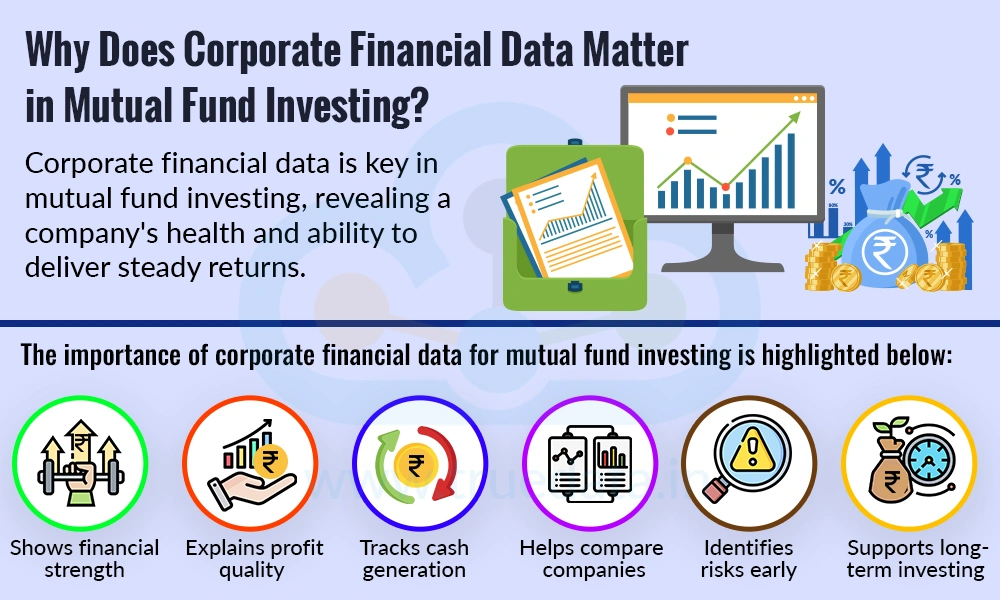

Corporate financial data plays a crucial role in mutual fund investing as it shows the true financial health of the companies a fund invests in. Mutual fund managers use this data to decide whether a business is strong enough to deliver steady returns and handle market ups and downs. Understanding the science of using corporate data for mutual fund investing helps investors build confidence in how funds are selected and managed.

The importance of corporate financial data for mutual fund investing is highlighted below.

Shows financial strength - Balance Sheets reveal whether a company has manageable debt and enough assets to support future growth.

Explains profit quality - Profit and Loss Statements help fund managers see if earnings are consistent or driven by one-time gains.

Tracks cash generation - Cash Flow data shows whether a company actually generates cash, not just paper profits.

Helps compare companies - Financial ratios make it easier to compare companies within the same sector, especially in Indian markets.

Identifies risks early - Weak margins, rising debt, or poor cash flows can signal potential trouble ahead.

Supports long-term investing - Strong financials indicate businesses that can survive economic cycles and deliver sustainable returns.

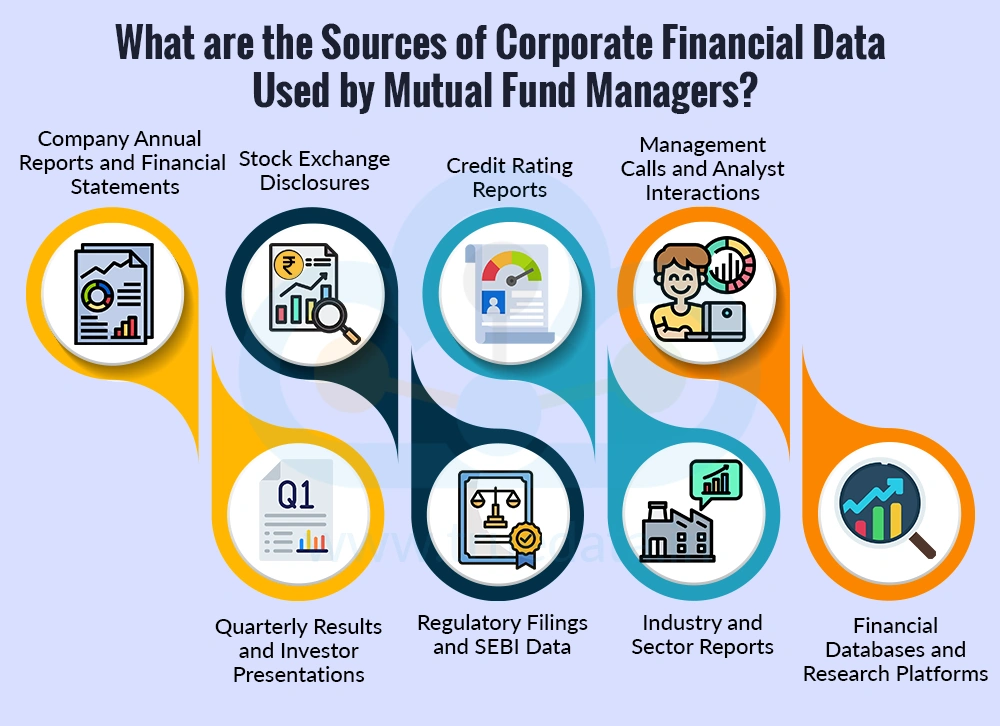

Mutual fund managers rely on multiple reliable sources of corporate financial data to understand a company’s performance, risks, and long-term potential. Using data from different sources helps them cross-check information and make well-informed investment decisions. The key sources of corporate data are explained below.

Company Annual Reports and Financial Statements - Annual Reports are the most important source of financial data. They include the balance sheet, profit & loss statement, cash flow statement, and detailed notes. Fund managers study these to understand revenues, profits, debt levels, cash generation, and business strategy. The management discussion section also provides insights into future plans and challenges.

Quarterly Results and Investor Presentations - Listed companies regularly publish quarterly financial results. These updates help fund managers track short-term performance trends and spot any sudden changes in growth or margins. Investor presentations explain business updates, sector outlook, and expansion plans in a simple, structured way.

Stock Exchange Disclosures - Companies are required to make timely disclosures on stock exchanges like the National Stock Exchange and the Bombay Stock Exchange. These include financial results, mergers, acquisitions, management changes, and major business events. Such disclosures ensure transparency and help fund managers react quickly to new information.

Regulatory Filings and SEBI Data - Regulatory filings submitted to the Securities and Exchange Board of India provide audited and standardised financial information. These filings ensure that the data follows accounting rules and reduces the risk of misleading numbers.

Credit Rating Reports - Credit rating agencies analyse a company’s financial strength, debt repayment ability, and cash flows. Fund managers use these reports to assess financial risk, especially for companies with high borrowing or those issuing bonds.

Industry and Sector Reports - Industry reports offer a broader view of how a company compares with peers. They highlight sector trends, growth drivers, regulatory changes, and demand outlook, which is important for understanding whether strong financials are sustainable.

Management Calls and Analyst Interactions - Earnings calls and analyst meetings allow fund managers to hear directly from company management. These interactions help clarify financial numbers, understand decision-making quality, and judge management confidence and transparency.

Financial Databases and Research Platforms - Professional data platforms compile financial statements, ratios, historical data, and peer comparisons in one place. Fund managers use them to analyse trends and quickly benchmark companies across sectors.

Mutual fund managers study financial statements closely to understand how strong, stable, and sustainable a company’s business really is. These statements go beyond headlines like revenue growth or profits and reveal whether a company can generate long-term value for investors. Here is a snapshot of how mutual fund managers potentially use the financial statements to gain strategic insights into a company.

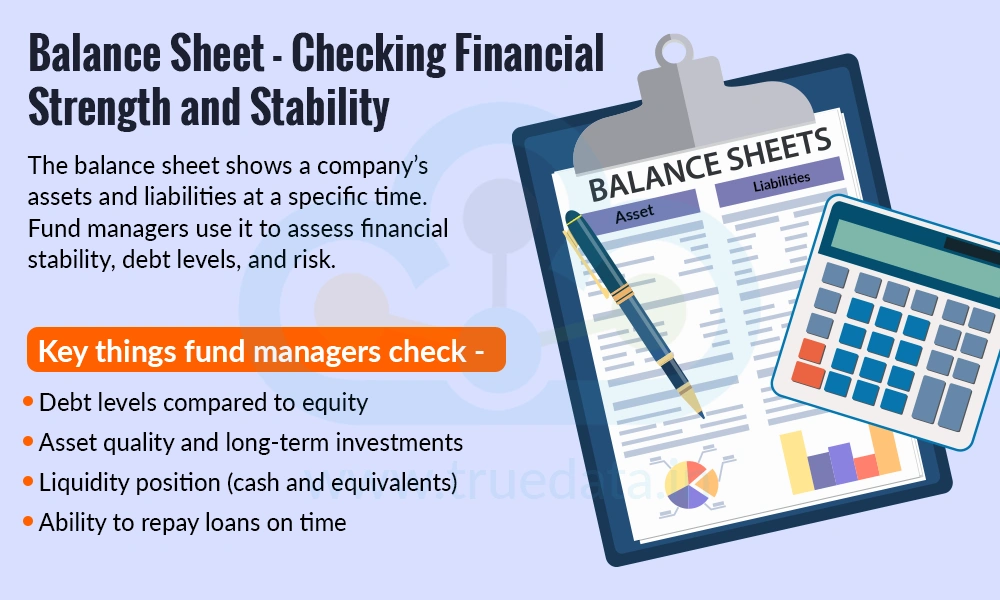

The balance sheet shows what a company owns and what it owes at a specific point in time. Mutual fund managers use it to judge financial stability and risk. They focus on whether the company has manageable debt, enough assets to meet its obligations, and a healthy mix of equity and borrowings. A strong balance sheet means the company can survive economic slowdowns and fund future growth without excessive risk.

Key things fund managers check -

Debt levels compared to equity

Asset quality and long-term investments

Liquidity position (cash and equivalents)

Ability to repay loans on time

The profit and loss (P&L) statement explains how a company earns money and what it spends over a period. Fund managers look beyond net profit numbers to see how sustainable the earnings are. They analyse revenue growth trends, cost control, and operating margins. One-time gains or losses are separated from core business performance to avoid misleading conclusions.

Key areas of focus -

Consistent revenue growth

Stable or improving profit margins

Operating profit vs. net profit gap

Impact of taxes and interest costs

![]()

Cash flow statements are critical because profits do not always mean cash. Mutual fund managers check whether the company actually generates cash from its operations. Strong operating cash flows indicate a healthy business, while weak cash flows may signal stress even if profits look good on paper.

What fund managers look for -

Positive and growing operating cash flows

Cash spent on expansion and investments

Ability to fund growth without heavy borrowing

Consistency between profits and cash flows

Notes to accounts explain accounting policies, contingent liabilities, and one-time adjustments. Fund managers carefully read these sections to understand the quality of reported numbers. Any changes in accounting methods, legal disputes, or hidden liabilities can significantly affect future performance. Hence. This section is quite vital for the overall analysis of the financial health of a company.

Fund managers always analyse the corporate data of more than a year and prefer companies that show steady improvement and predictable performance across market cycles. Thus, sudden spikes or drops in numbers raise red flags and require deeper investigation. This helps them judge business quality, financial discipline, and long-term sustainability, thereby helping protect investor capital and improve returns over time.

Mutual fund managers track key financial ratios to quickly understand a company’s profitability, risk, efficiency, and overall financial health. These ratios turn complex financial statements into easy-to-compare numbers, helping managers choose quality businesses and avoid risky ones. The broad ratios analysed by fund managers are explained below.

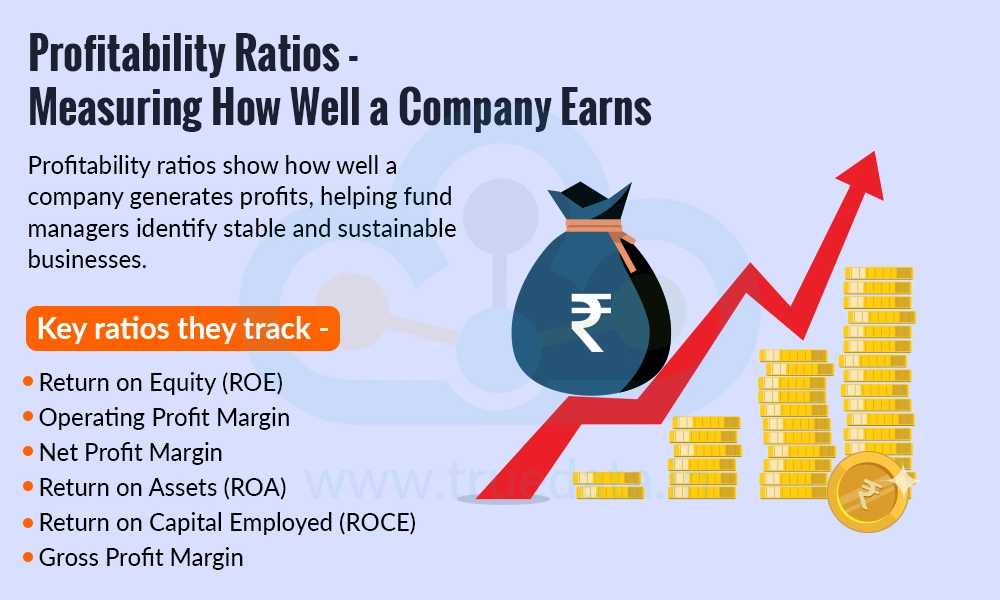

Profitability ratios show whether a company can generate healthy profits from its operations. Fund managers prefer companies that earn stable and sustainable profits over time.

Key ratios they track -

Return on Equity (ROE) - Shows how efficiently the company uses shareholders’ money to generate profits. A consistently high ROE signals strong management quality.

Operating Profit Margin - Indicates how much profit the company makes from its core business after operating costs.

Net Profit Margin - Reflects the final profit after all expenses, taxes, and interest, which is important for judging overall efficiency.

Return on Assets (ROA) - Shows how efficiently a company uses its total assets to generate profits. Useful when comparing companies with different capital structures.

Return on Capital Employed (ROCE) - Measures returns earned on both equity and debt. A rising ROCE signals improving business efficiency.

Gross Profit Margin - Helps assess pricing power and cost control at the production level.

Liquidity ratios help fund managers understand whether a company can meet its short-term obligations without stress. These ratios are especially important for companies operating in volatile or cyclical sectors.

Important liquidity ratios analysed -

Current Ratio - Compares current assets with current liabilities. A healthy ratio shows the company can pay near-term bills.

Quick Ratio - Excludes inventory to focus on the most liquid assets like cash and receivables.

Cash Ratio - Focuses only on cash and cash equivalents to assess immediate payment ability.

Working Capital Ratio - Indicates how efficiently short-term assets and liabilities are managed.

Operating Cash Flow Ratio - Compares operating cash flow with current liabilities for a more realistic liquidity check.

Leverage Ratios or Solvency Ratios show how much debt a company uses to run its business. Fund managers carefully track these to avoid companies with excessive borrowing. Lower debt and strong interest coverage reduce the risk of financial trouble during economic slowdowns.

Common leverage ratios analysed by fund managers -

Debt to Equity Ratio - Indicates how much debt the company has compared to shareholders’ funds.

Interest Coverage Ratio - Shows how easily a company can pay interest on its loans using operating profits.

Debt-to-Assets Ratio - Shows the portion of assets funded by debt.

Net Debt to EBITDA - Helps assess how many years a company would need to repay debt using operating earnings.

Fixed Charge Coverage Ratio - Measures the ability to cover fixed costs like interest and lease payments.

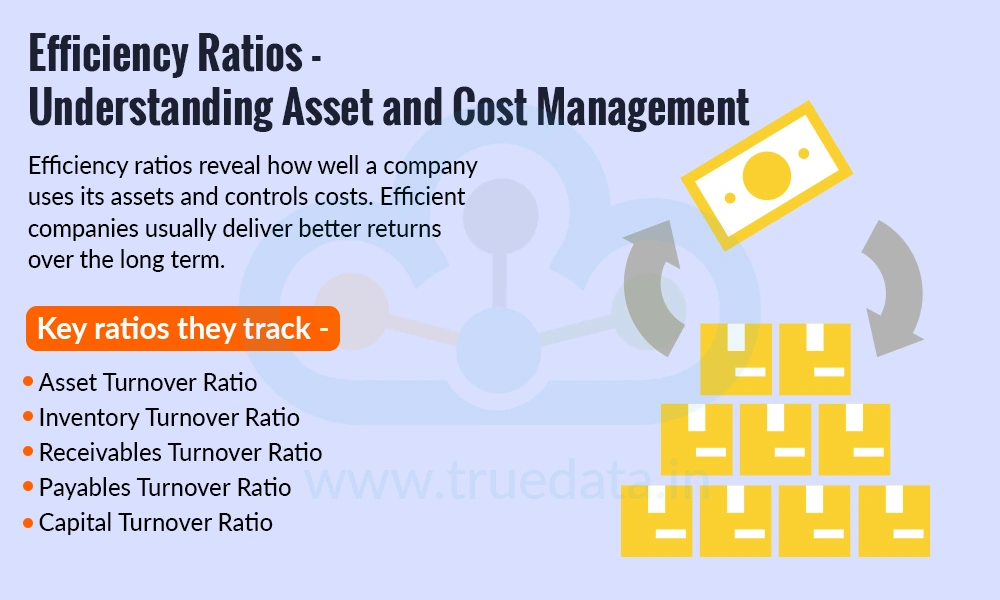

Efficiency ratios reveal how well a company uses its assets and controls costs. Efficient companies usually deliver better returns over the long term.

Key efficiency ratios include -

Assets Turnover Ratio - Measures how effectively assets are used to generate revenue.

Inventory Turnover Ratio - Shows how quickly inventory is sold, important for manufacturing and retail companies.

Receivables Turnover Ratio - Shows how quickly a company collects money from customers.

Payables Turnover Ratio - Indicates how efficiently a company manages supplier payments.

Capital Turnover Ratio - Measures revenue generated per unit of capital employed.

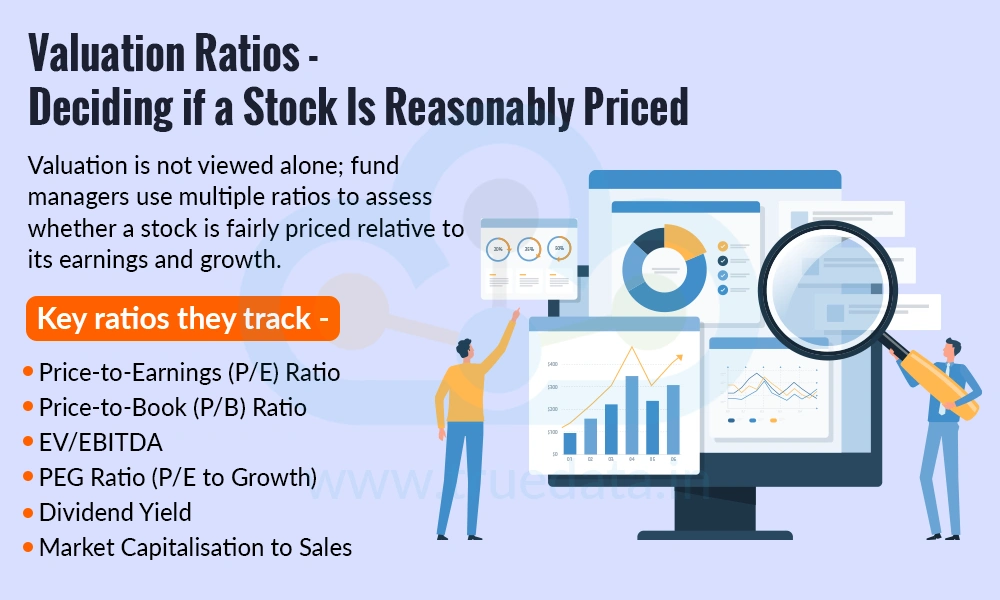

Valuation is never looked at in isolation, and fund managers use multiple ratios to avoid overpaying for a stock. Valuation ratios help fund managers judge whether a stock is cheap, expensive, or fairly valued compared to its earnings and growth potential.

Popular valuation ratios analysed by fund managers -

Price-to-Earnings (P/E) Ratio - Compares share price with earnings; used widely across Indian markets.

Price-to-Book (P/B) Ratio - Useful for banks and asset-heavy companies.

EV/EBITDA - Helps compare companies with different capital structures.

PEG Ratio (P/E to Growth) - Adjusts P/E for earnings growth, useful for growth-oriented stocks.

Dividend Yield - Important for income-focused funds and defensive portfolios.

Market Capitalisation to Sales - Helps compare early-stage or cyclical companies.

Cash flow ratios are an additional layer of analysis to help fund managers understand and ensure that profits are supported by actual cash generation. This eliminates any chances of profit manipulation or window dressing of the financial statements.

Fund managers track the following ratios -

Operating Cash Flow to Net Profit - Confirms whether profits are backed by cash.

Free Cash Flow - Shows surplus cash available for expansion, debt repayment, or dividends.

Free Cash Flow to Equity - Shows cash available to shareholders after expenses and debt servicing.

Cash Flow Margin - Measures cash generated per rupee of revenue.

Cash Conversion Ratio - Compares operating cash flow with operating profit to check earnings quality.

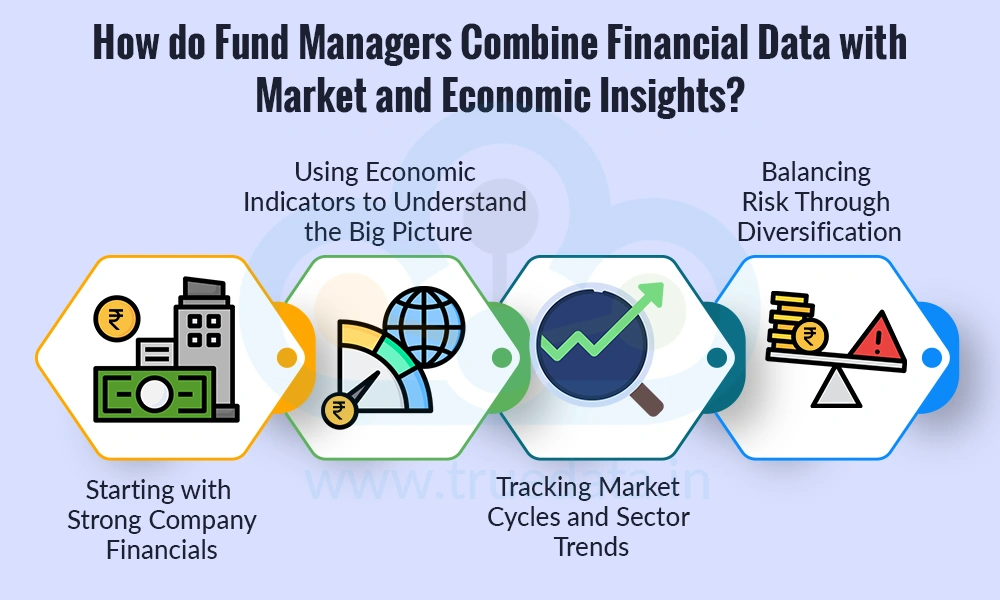

Fund managers do not rely only on company financial numbers when making investment decisions. While financial statements and ratios show how strong a business is, market and economic insights help managers understand when and where to invest. This balanced approach helps them invest in strong businesses at the right time, manage volatility, and aim for steady returns over the long term for investors.

They start by analysing corporate financial data to identify quality companies with strong balance sheets, steady profits, and healthy cash flows. Once such companies are shortlisted, fund managers study broader market conditions to judge whether the timing and valuation are favourable. For example, even a strong company may be avoided if market prices are too high or if sector sentiment is weak.

Economic indicators play an important role in this process. Factors such as interest rates, inflation, GDP growth, and government policies influence how businesses perform. Fund managers study these trends to understand which sectors may benefit or face pressure. In India, policy changes, interest rate movements, and demand trends often guide sector-level allocation decisions.

Market trends and investor behaviour are also closely watched. Fund managers observe stock market cycles, sector rotations, and liquidity flows from domestic and foreign investors. This helps them decide which sectors may perform better in different phases of the market, even if company fundamentals remain strong.

Risk management is another key reason for combining financial and economic insights. Fund managers use market data to diversify portfolios across sectors and market capitalisations. If economic conditions suggest higher uncertainty, they may increase exposure to defensive stocks or hold more cash, while still focusing on financially sound companies.

Financial analysis plays a key role in deciding where to invest and how much risk to take in a mutual fund portfolio. It helps fund managers balance returns with safety and protect investor money during market ups and downs. Here is a snapshot of how financial analysis can help shape a portfolio.

Identifies strong companies - Financial analysis helps pick companies with stable profits, low debt, and healthy cash flows.

Decides allocation size - Stronger and more consistent companies get higher weight in the portfolio, while riskier ones get smaller exposure.

Controls downside risk - Weak balance sheets or falling cash flows act as early warning signs, helping managers reduce exposure in time.

Supports sector diversification - Financial data across sectors helps spread investments and avoid overdependence on one area.

Manages market volatility - Companies with solid financials tend to perform better during market corrections.

Improves long-term stability - Focusing on quality businesses reduces the chances of sharp losses over time.

Helps rebalance portfolios - Regular financial review ensures the portfolio stays aligned with changing market and company conditions.

Protects investor capital - Overall, financial analysis helps limit losses while aiming for steady and sustainable returns.

Retail investors can learn from mutual fund managers the importance of focusing on business quality rather than short-term price movements. Fund managers study company financials in detail to understand whether a business is strong, profitable, and financially stable. They look at factors like steady revenue growth, manageable debt, and healthy cash flows before investing. This highlights the value of checking basic fundamentals and not relying only on market tips or daily stock price changes.

Another key lesson is disciplined and long-term investing. Fund managers diversify across companies and sectors to manage risk and review their portfolios regularly instead of reacting emotionally to market ups and downs. Retail investors can apply the same approach by spreading investments, staying patient during volatility, and sticking to a clear investment plan. By learning from this structured and data-driven process, retail investors can make more confident decisions and improve their chances of achieving long-term financial goals.

Mutual fund managers use corporate financial data as the foundation of every investment decision. A careful study of financial statements, key ratios, cash flows, and business trends and combining this analysis with market and economic insights, helps to identify strong, sustainable companies and manage risks effectively. This disciplined and data-driven approach helps in building diversified portfolios that can perform across market cycles, offering investors a more structured, informed, and long-term path to wealth creation.

This article shares a brief overview of how mutual fund managers meet fund objectives and asset allocation. Let us know your thoughts on the topic, or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: Understanding the Riskometer in Mutual Fund Scheme

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Thestock market never stands still, and prices swing constantly with every new h...

Introduction For the longest time, investment in stock markets was thought to b...