The accessibility and ease of investing in mutual funds have made it the go-to investment option for millions of investors. However, one of the biggest benefits of mutual funds is access to multiple assets through a single unit of the fund. This inherent benefit of diversification is what sets it apart from other investment options. But do you know this diversification is like a double-edged sword? Too little and you are overexposed, too much and you lose out on its benefits. So how do you find a balance? Check out this blog to understand diversification in mutual funds and the perils of overdiversification.

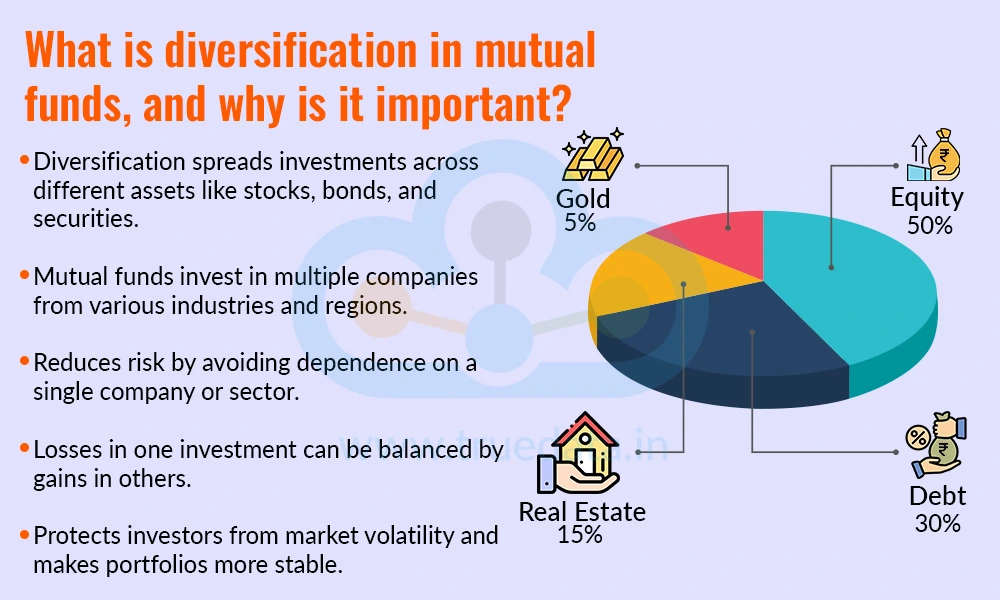

Diversification in mutual funds means spreading investments across many different types of assets, like stocks, bonds, and other securities, to reduce risk. Instead of putting all the money into one company or sector, a mutual fund invests in a variety of companies from different industries and regions. This helps protect the investor’s money because if one company or sector does badly, the losses can be balanced by gains in another. For example, if the value of shares in one company goes down, the impact on the total investment is less because there are many other investments in the fund. Diversification makes the portfolio more stable and less affected by the ups and downs of the market.

The stock market can be unpredictable due to factors like inflation, interest rates, elections, and global economic changes. Diversification helps reduce the impact of these risks. If an investor puts all their money into one sector, such as real estate or IT, and that sector performs poorly, they could face major losses. However, by investing in a diversified mutual fund that includes various sectors, like banking, healthcare, manufacturing, and technology, any poor performance in one area is cushioned by better performance in others.

Mutual funds help investors receive steadier returns over time. While some investments in the fund may not do well in a certain period, others may grow and make up for the loss. This balance helps investors avoid sudden drops in the value of their investments. For long-term goals like children’s education, retirement, or buying a home, having consistent returns is very important. Diversification helps achieve those goals with fewer shocks.

Diversification gives investors access to a mix of asset classes like equity, debt, and sometimes gold. It also offers exposure to different sectors of the economy and even international markets in some mutual funds. This wide range of investments increases the chances of growth and reduces dependency on the performance of a single market or company. It is especially useful for new or small investors who may not have the time or knowledge to research and invest in individual stocks.

Investors often invest in mutual funds for long-term goals such as retirement, buying property, or children’s education. Diversification supports these goals by reducing the chances of major losses and making the returns more stable over the years. With a diversified portfolio, investors are more likely to stay invested during market ups and downs, which is key to building wealth over time.

Different people have different levels of risk they are comfortable with. Diversification allows fund managers to create mutual funds that suit various risk levels, i.e., some with higher equity (more risk, more return), and others with more debt (less risk, steady return). This gives investors the flexibility to choose a fund based on their personal financial situation and risk appetite, while still enjoying the benefits of diversification.

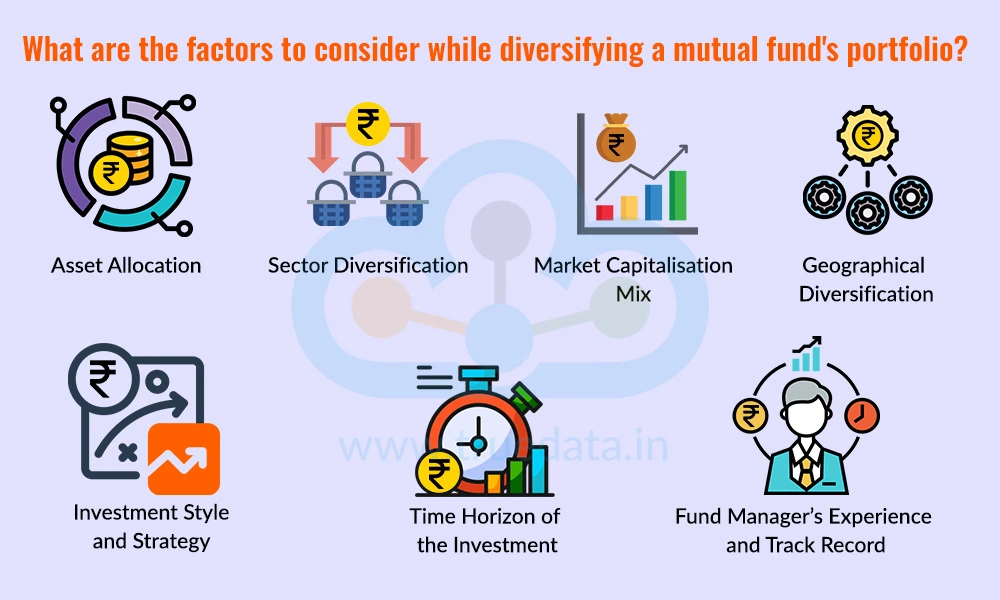

Diversifying a mutual fund portfolio requires understanding many factors that can affect its overall performance. Some of these factors are explained hereunder.

Asset allocation implies deciding how much money to invest in different types of assets like equity (stocks), debt (bonds), gold, and cash. It is one of the most important steps in diversification. An Indian investor should consider their financial goals, age, income level, and risk tolerance before choosing the right asset mix. For example, a young investor saving for retirement may choose more equity for long-term growth, while a retired person may prefer more debt for safety and regular income. Proper asset allocation helps reduce the overall risk of the portfolio.

Different sectors of the economy, such as banking, IT, pharma, energy, FMCG (fast-moving consumer goods), and infrastructure, perform differently at different times. If a mutual fund invests only in one or two sectors, the risk becomes high. To manage this risk, the portfolio should be diversified across multiple sectors. This way, if one sector performs poorly due to market conditions or government policies, the other sectors may help balance the loss.

Market Capitalisation refers to the size of the companies in which the fund invests, i,.e, large-cap (big companies), mid-cap (medium-sized companies), and small-cap (smaller companies). Each category has its own risk and return profile. Large-cap stocks are more stable but may grow slowly, while small-cap stocks can grow fast but are riskier. A well-diversified mutual fund should include a mix of large, mid, and small-cap companies based on the investor’s risk appetite and investment horizon. This ensures both stability and growth potential in the portfolio.

Many Indian mutual funds now offer international exposure by investing in foreign markets like the US, Europe, or Asia. Geographical diversification helps protect the investor’s money from country-specific risks, such as inflation, interest rate changes, or political uncertainty. If the Indian market is not performing well, global investments may provide better returns. Including a small portion of international funds can make a mutual fund portfolio stronger and more balanced.

Mutual fund managers follow different investment styles, i.e., some focus on value investing (buying undervalued stocks), while others focus on growth investing (buying fast-growing companies). A good diversification strategy also includes a mix of different styles. This helps balance the risk because different strategies perform well under different market conditions. Investors should check the investment strategy used by the mutual fund and make sure it adds variety to their overall portfolio.

The time horizon means how long the investor plans to stay invested. For short-term goals, diversification should lean towards safer assets like debt or hybrid funds. For long-term goals, the investor can take more risk with equity investments. A well-diversified mutual fund should match the investor’s time horizon so that it grows safely over time without unnecessary risk.

The success of a diversified mutual fund also depends on the skill of the fund manager. An experienced manager knows how to pick the right mix of assets, sectors, and companies. They adjust the portfolio based on market conditions. Investors should look at the fund manager’s past performance, qualifications, and how they have handled market ups and downs before choosing a fund.

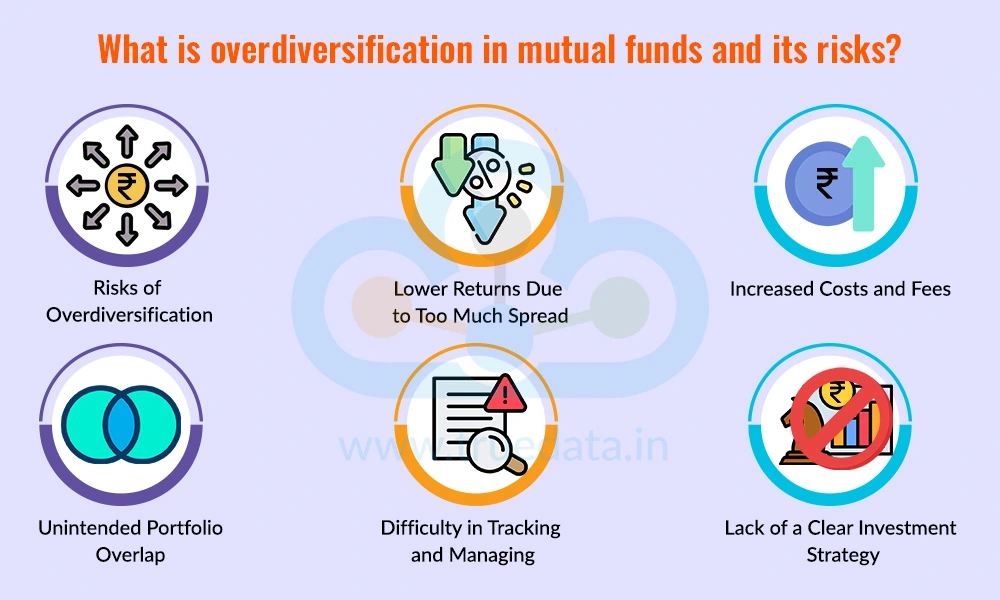

Overdiversification in mutual funds happens when an investor spreads their investments across too many mutual funds, sectors, or asset classes in an attempt to reduce risk. While diversification is important for managing risk, doing it excessively can lead to problems. For example, if an investor holds 10 or more similar mutual funds, where many of them invest in the same type of companies or sectors, they may end up with a portfolio that is too complex, hard to manage, and delivers average or below-average returns. Overdiversification means the investor is trying to be too safe, but in the process, they lose the real benefits of focused investing.

While diversification helps in building a robust portfolio, overdiversification can lead to more damage rather than benefiting the investors in the long run. The risks of overdiversification in a mutual fund portfolio are explained below.

When money is spread across too many mutual funds, the strong performers may not have a big enough impact on the overall portfolio. This is because their gains are diluted by the presence of average or poor-performing funds. As a result, the investor may end up with returns that are similar to or worse than just investing in a few well-performing funds. Overdiversification takes away the chance to benefit from the high growth of selected funds.

Each mutual fund comes with its own expense ratio or management fee. If an investor holds many funds, they may unknowingly pay higher combined fees, even if the individual funds charge low fees. These charges can eat into the overall returns. For investors who are trying to grow their money efficiently, paying extra fees for unnecessary funds is a hidden loss that reduces the net gain from the investment.

Many mutual funds invest in the same popular stocks or sectors. When an investor holds too many funds, especially of the same category (like multiple large-cap funds), there is a high chance of portfolio overlap. This means the same stocks are held in different funds, defeating the purpose of diversification. In reality, the investor is not diversified but has repeated exposure to the same assets. This increases risk without providing real benefit.

Managing too many mutual funds can be confusing and time-consuming. It becomes harder for the investor to keep track of each fund’s performance, portfolio holdings, and changes made by fund managers. This makes decision-making difficult, especially when it is time to rebalance or switch funds. For investors who are busy with work or family, overdiversification creates more stress instead of making investing easier.

Overdiversification often leads to an unfocused investment approach. Instead of following a clear strategy aligned with financial goals, investors may end up chasing returns or blindly investing in new funds. This can create a portfolio that is large but poorly structured. For investors trying to achieve goals like saving for children’s education, retirement, or buying a home, such a scattered approach can delay progress and reduce efficiency.

Diversification in mutual funds is a smart way for investors to reduce risk, get more stable returns, and invest across different sectors, companies, and asset types. It helps protect the investment from market ups and downs and supports long-term goals like retirement or education. However, too much diversification, also called overdiversification, can reduce returns, increase costs, and make the portfolio hard to manage. Hence, it is important to understand this fine line and find the right balance, as a focused and well-diversified portfolio is the key to building wealth safely and effectively.

This article talks about a key aspect of mutual fund investing, and we hope this helps you in building a strong portfolio that meets your investment goals in a targeted manner. Let us know your thoughts on this topic, and watch this space for more mutual fund related posts!

Till then, Happy Reading!

Read More: Copying a Mutual Fund Portfolio - Should You Do It?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...