Have you ever noticed that mutual funds with the same assets can give different returns? While there are many contributing factors to this outcome, one of the deciding factors is the TER of the mutual funds. Have you heard of this word or seen the expense ratio mentioned in the fund details? Here is all you need to know about the total expense ratio of mutual funds, how it is calculated and why it is important to make informed portfolio decisions.

The Total Expense Ratio (TER) is the fund's expense ratio or the annual charges investors must pay to invest in the fund. These expenses are made up of many components that add up to the total cost of investment. These costs are associated with the management and operations of the fund and are expressed as a percentage of the fund's total assets. Some of the expenses that are included in the TER of a mutual fund are fund manager’s fees, administration expenses, marketing expenses, etc. A lower TER is beneficial for investors as it implies that a lower amount from their investment is deducted in the form of expenses which ultimately leads to higher returns from the investment.

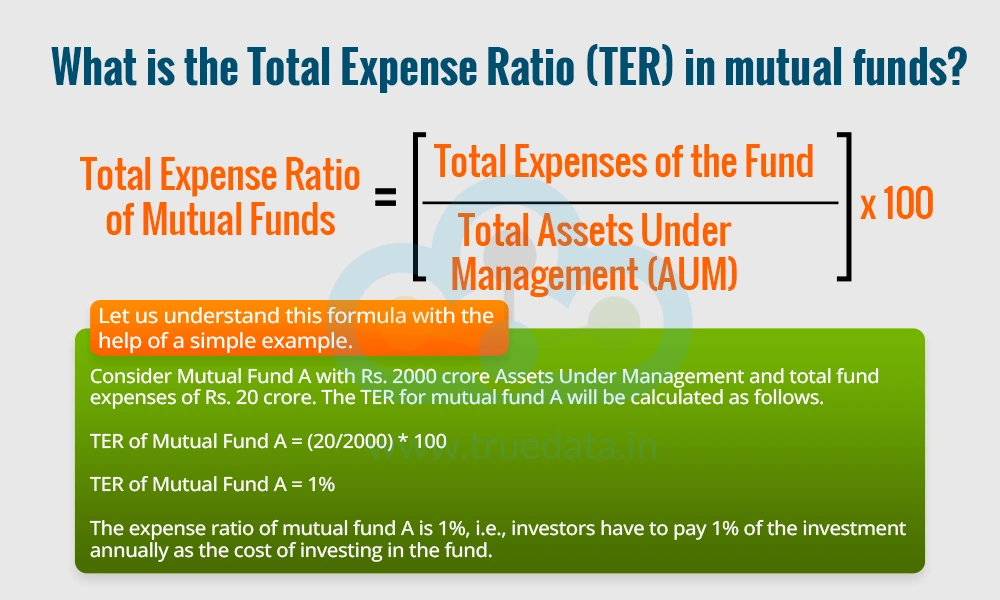

The formula to calculate the TER of mutual funds is,

Total Expense Ratio of Mutual Funds = [Total Expenses of the Fund / Total Assets Under

Management (AUM)] * 100

Let us understand this formula with the help of a simple example.

Consider Mutual Fund A with Rs. 2000 crore Assets Under Management and total fund expenses of Rs. 20 crore. The TER for mutual fund A will be calculated as follows.

TER of Mutual Fund A = (20/2000) * 100

TER of Mutual Fund A = 1%

The expense ratio of mutual fund A is 1%, i.e., investors have to pay 1% of the investment annually as the cost of investing in the fund.

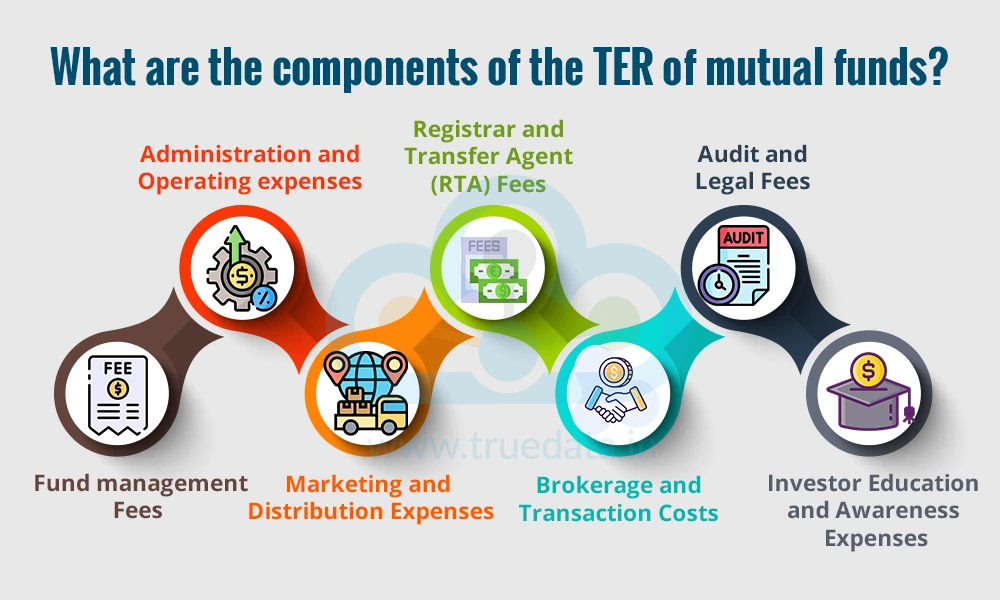

The Total Expense Ratio (TER) is made up of multiple components that add up to become the total expense ratio of the fund. Some of these components are explained hereunder.

Fund management Fees - The fee paid to the fund manager and investment team for managing the fund and making investment decisions

Administration and Operating expenses - Expenses related to office maintenance, employee salaries, legal compliance, and record-keeping.

Marketing and Distribution Expenses - Costs incurred for advertising, promotions, and commissions paid to brokers and distributors in regular plans.

Registrar and Transfer Agent (RTA) Fees - Charges paid to RTAs like CAMS and KFintech for handling investor records, transactions, and customer support.

Brokerage and Transaction Costs - Fees paid for buying and selling stocks or bonds, which are higher in actively managed funds with frequent trading.

Audit and Legal Fees - Expenses for financial audits and legal services to ensure compliance with SEBI regulations and investor protection.

Investor Education and Awareness Expenses - SEBI-mandated costs for investor education programs and financial literacy initiatives.

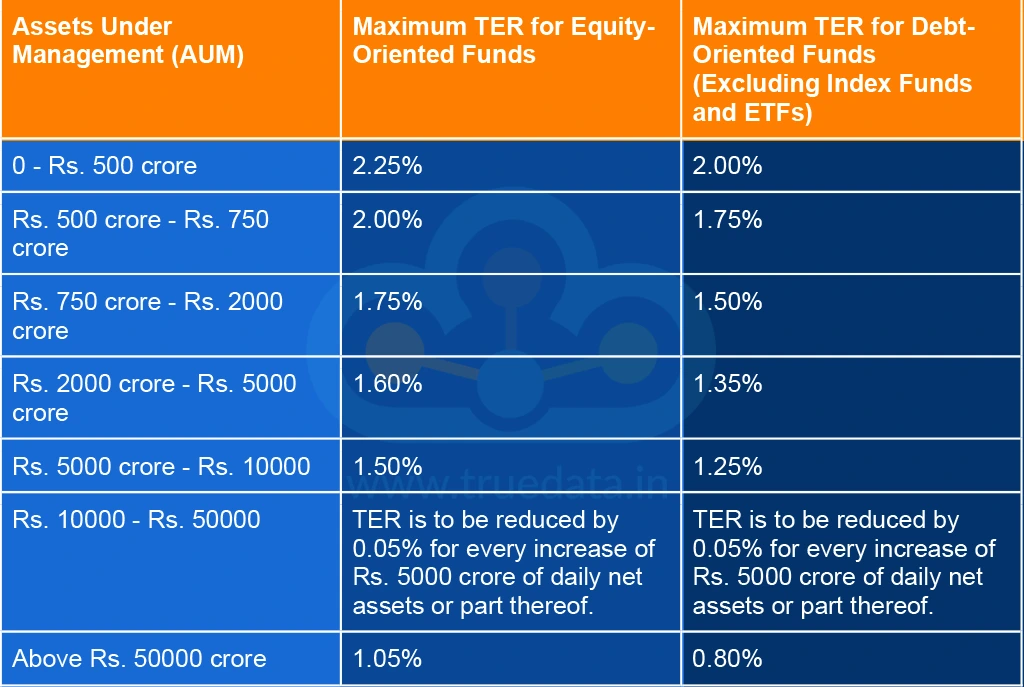

The expense ratio of a fund has a direct impact on the net returns available to the investors. Therefore, in order to protect the investor’s interests, SEBI has notified the upper limits for mutual funds based on the various categories or types of funds. AMCs can thus have the expense ratios for all their funds within these ranges to stay competitive as well as meet the required SEBI compliances.

The SEBI-specified TER limits effective from 1st April 2020 are explained below.

Important Note -

In addition to the limits mentioned above, investors also have to remember a few more points mentioned above.

TER for Index Funds and ETFs - Index funds and Exchange-Traded Funds (ETFs) have a TER limit of 1%.

Mutual funds are allowed to charge an extra 0.30% TER if they attract investments from smaller cities (beyond the top 30 cities).

However, this additional charge can be applied if 30% of new inflows or 15% of average assets come from these cities (whichever is higher).

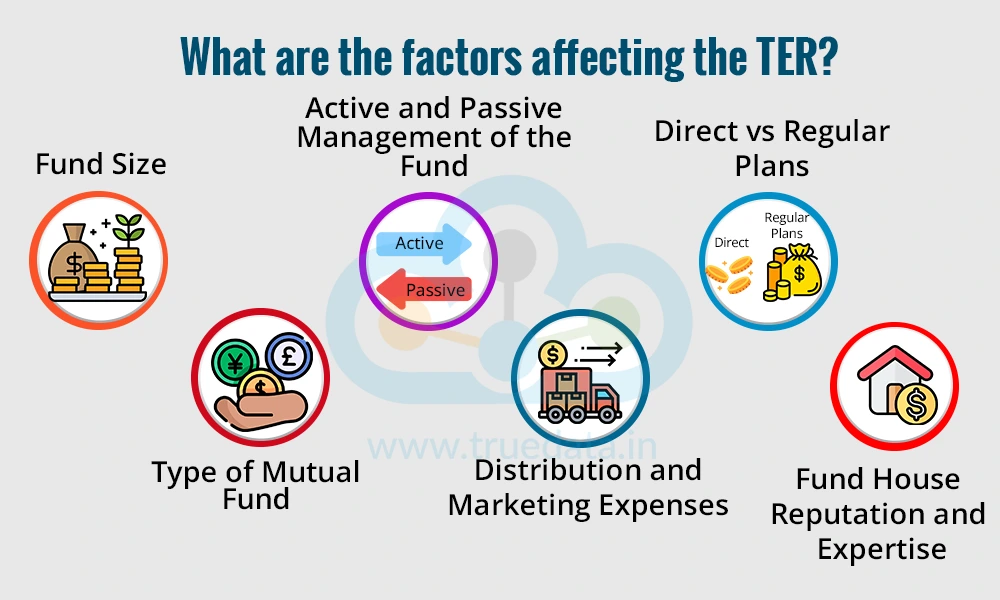

The total expense ratio of a fund can be influenced by numerous factors that ultimately determine the amount investors have to pay annually as charges for investment. These factors include the percentage of fund management fees, the overall marketing expenses, and more. Understanding these factors can help investors understand the composition of the fund expenses and thus make informed investment decisions.

The size of the mutual fund, also known as Assets Under Management (AUM), plays a big role in determining TER. Generally, a larger fund has a lower TER because the expenses are spread across more investors. In contrast, a smaller fund may have a higher TER since fixed costs like fund management and administration are divided among fewer investors.

SEBI classifies mutual funds into various categories based on their asset class as well as the type of management of the fund. Equity mutual funds, which invest maximum funds in stocks, generally have a higher TER due to research, stock selection, and active fund management while debt mutual funds which invest primarily in debt instruments have comparatively lower TER. Similarly, index funds and ETFs have the lowest TER as are passive investment options requiring the least fund manager involvement.

As mentioned above, the fund expenses also depend on the type of fund management. Actively managed funds require fund managers to research, analyse, and actively buy or sell stocks to outperform the market. This leads to higher expenses and a higher TER. On the other hand, passively managed funds simply replicate an index (e.g., Nifty 50), requiring minimal intervention, resulting in a lower TER.

The distribution and marketing expenses can account for a huge portion of the TER as they are the primary pillars to attract investors for the fund. Hence, mutual funds that are highly and actively promoted through distributors, advertisements, and agents have higher TERs due to commissions and marketing costs.

Investors in India have the option to invest in mutual funds either through direct plans (direct investment through the AMC) or through regular plans (investment through intermediaries like brokers or agents). The expense ratio of the same fund can differ for direct or regular plans. Direct plans have a lower TER since they avoid distributor commissions while regular plans have a higher TER as they include commission fees. Thus, choosing a direct plan can help investors save on costs and maximise returns.

Well-established fund houses with a strong track record and experienced fund managers may charge a slightly higher TER due to their expertise in managing investments. Investors often pay a premium for a fund house’s brand value, believing that experienced management may lead to better returns. However, newer fund houses or smaller asset management companies (AMCs) may offer a lower TER to attract investors.

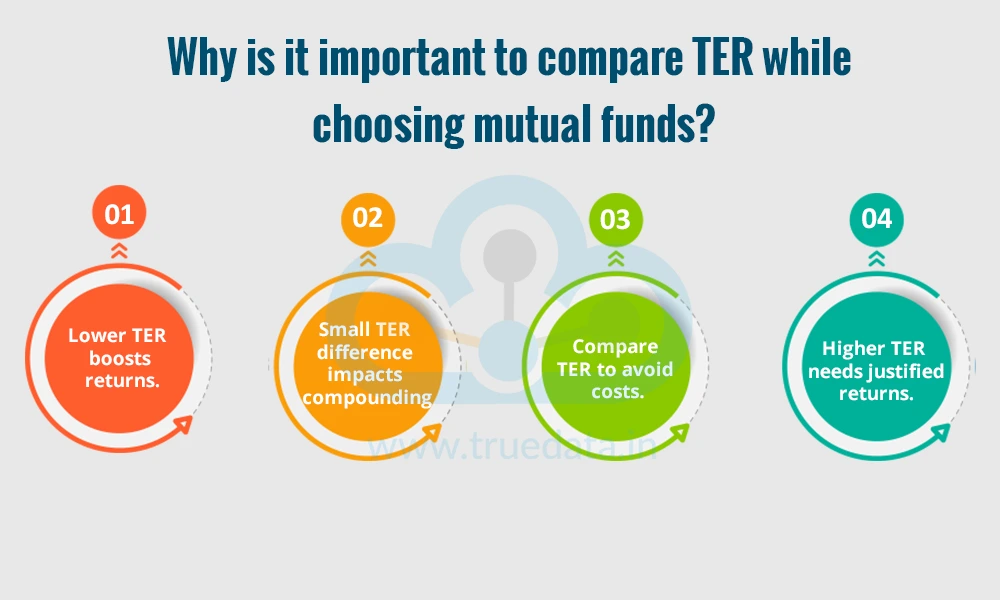

The TER of mutual funds has a direct impact on the portfolio returns. Hence, it is often the deciding factor when choosing funds. A higher TER implies lower net returns ultimately reducing the profitability of the portfolio.

The importance of the total expense ratio while choosing mutual funds is explained hereunder.

A lower Total Expense Ratio (TER) means fewer expenses deducted from your investment, leading to higher overall returns.

A small difference in TER can significantly impact returns over the long term due to the power of compounding.

Comparing TER helps investors identify funds with high costs that may not justify their performance.

Some funds with slightly higher TERs may justify this with better management and returns, while others may not. This makes comparing the TERs of different funds important.

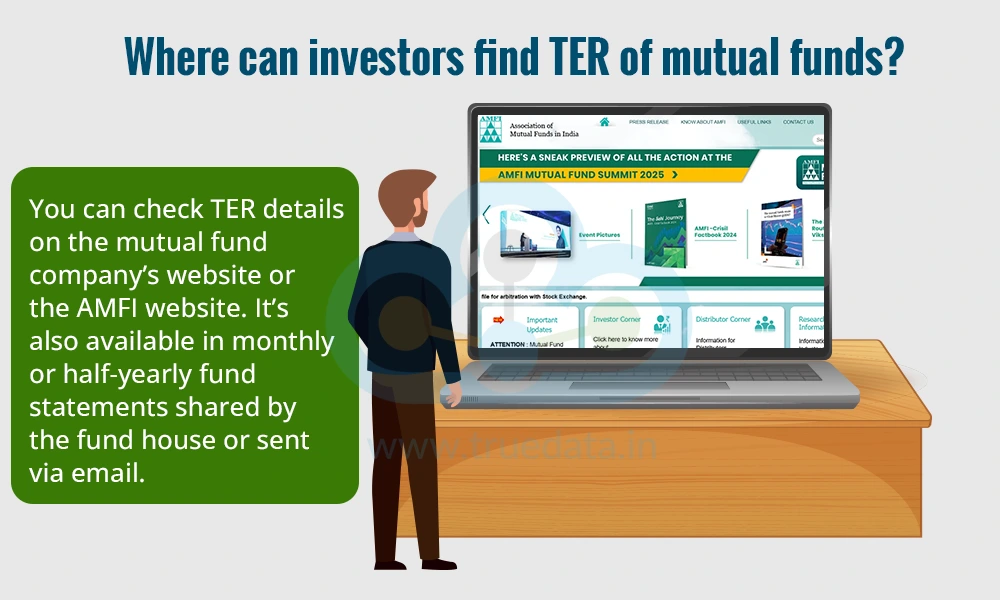

The total expense ratio is one of the most important parameters in making investment decisions. There are many sources to locate the TER of mutual funds. One of the most reliable sources of getting this information is the mutual fund house’s official website, where fund fact sheets and scheme-related documents are updated regularly. Another source is the Association of Mutual Funds (AMFI) website which provides the TER details for all mutual funds in India. Investors can also find TER information in the monthly and half-yearly fund statements, which are available on fund house websites and sent to investors via email. Furthermore, many financial portals, investment apps, and fund comparison websites also display TER, making it easier for investors to compare expenses before making an investment decision.

The total expense ratio of a fund is the cost that investors pay to invest in a fund. This makes it an important parameter especially while comparing funds. However, it is important to note that a TER cannot be the sole benchmark for evaluating between funds. A fund with a higher TER may justify the same with better fund management and high returns while a fund with a lower TER may not necessarily yield good returns if it has a poor asset allocation or fund manager expertise.

This article talks about an important aspect of mutual fund investments, the expense ratio and its significance while selecting funds. Let us know your thoughts on this topic or if you need further information on the same and we will address it.

Till then Happy Reading!

Read More: What are the Differences Between Trailing Returns and Annual Returns?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...