Investing in mutual funds is now quite easy, and with advanced technology, it is literally at the tips of your fingers. However, there are some basic questions that you may need answers to. For example, did you know mutual funds are also classified as direct and regular mutual funds? What do these categories of mutual funds mean and what is the difference? Read on to get answers to these questions and more on direct and regular mutual funds in this blog.

Direct mutual funds are a way of investing in mutual funds without involving intermediaries like brokers or financial advisors. When investors choose a direct mutual fund plan, they invest directly through the Asset Management Company (AMC) or fund house via their website, mobile apps, or office. This eliminates the distributor’s commission or fees, which are included in the expense ratio of regular plans. As a result, direct plans have a lower expense ratio leading to a lower cost of investment which eventually translates into more savings passed on to the investor. Over time, this difference can significantly boost the returns due to compounding. Direct mutual funds are ideal for investors who are comfortable researching and selecting funds independently and are looking to maximise their returns while keeping costs low. However, the primary requirement is to be well-informed about the financial goals and the funds that align with them for optimum investment and desired results.

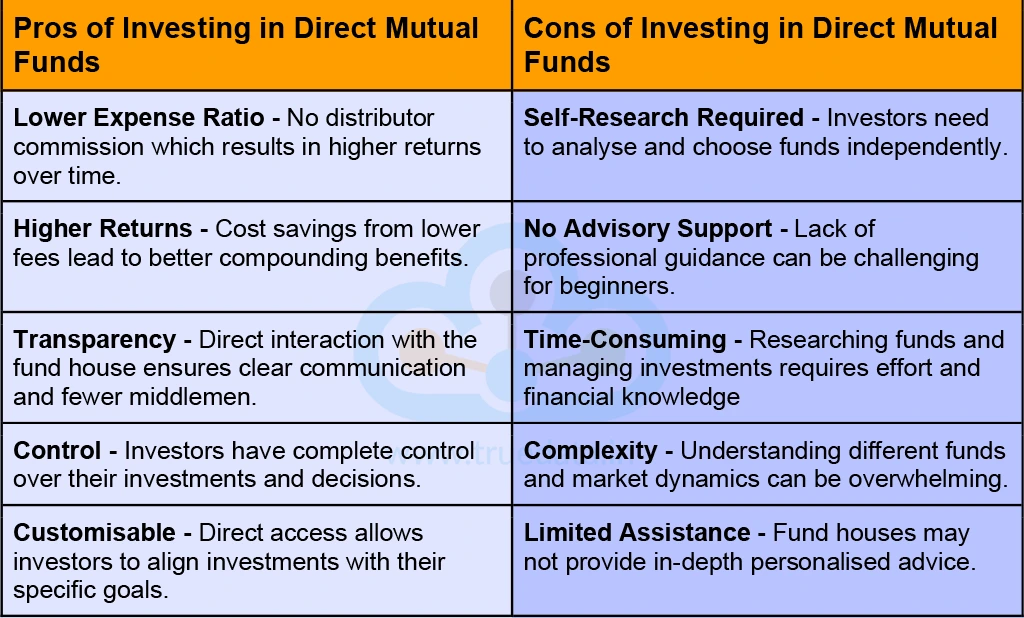

After learning the basic meaning of direct mutual funds, here is a list of its pros and cons for better analysis of these funds.

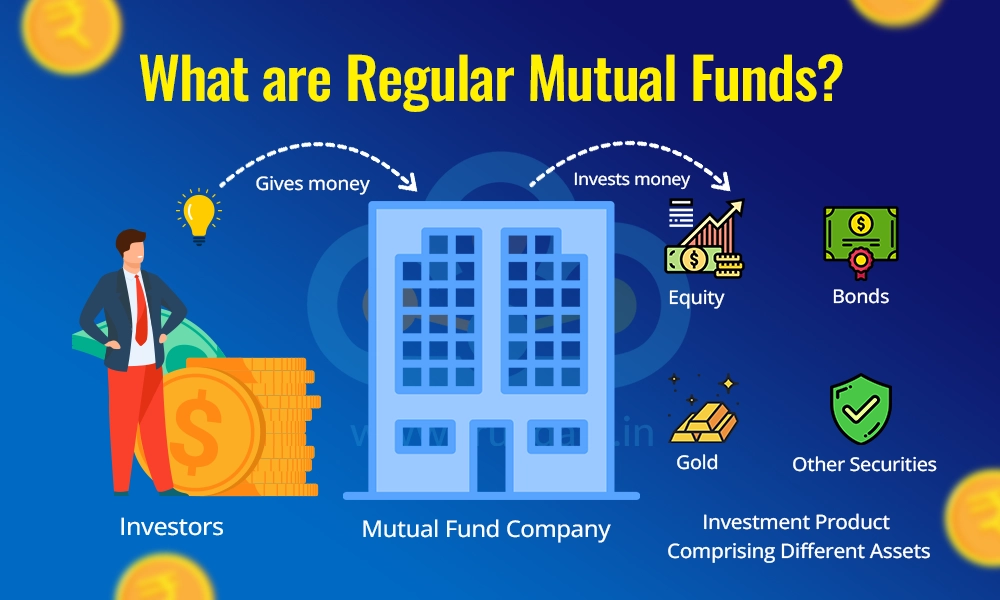

Regular mutual funds are mutual fund plans where investors invest through a middleman, such as a broker, financial advisor, or distributor. These intermediaries act as a link between the investors and the fund house, helping them choose and manage their investments. They earn a commission in return for their services which is included in the expense ratio of the fund. This means regular plans have slightly higher fees compared to direct plans. With this increased cost, regular mutual funds are a convenient way for investors who prefer professional advice and assistance. This makes it an easier form of investment especially for those who are new to investing or need clarification on selecting the right funds. The advisor provides guidance on portfolio management, helps with paperwork, and offers ongoing support, making the process easier for the investor.

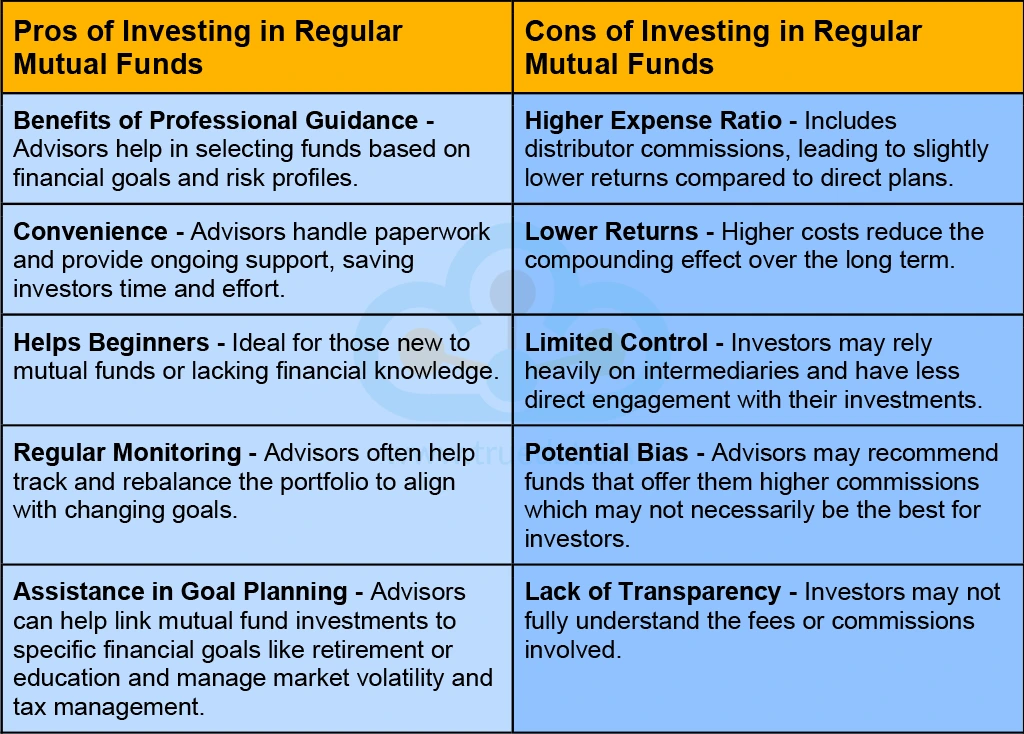

An essential step for investing in regular mutual funds requires a careful analysis of its pros and cons. Here is a list of the same to help investors make an informed decision.

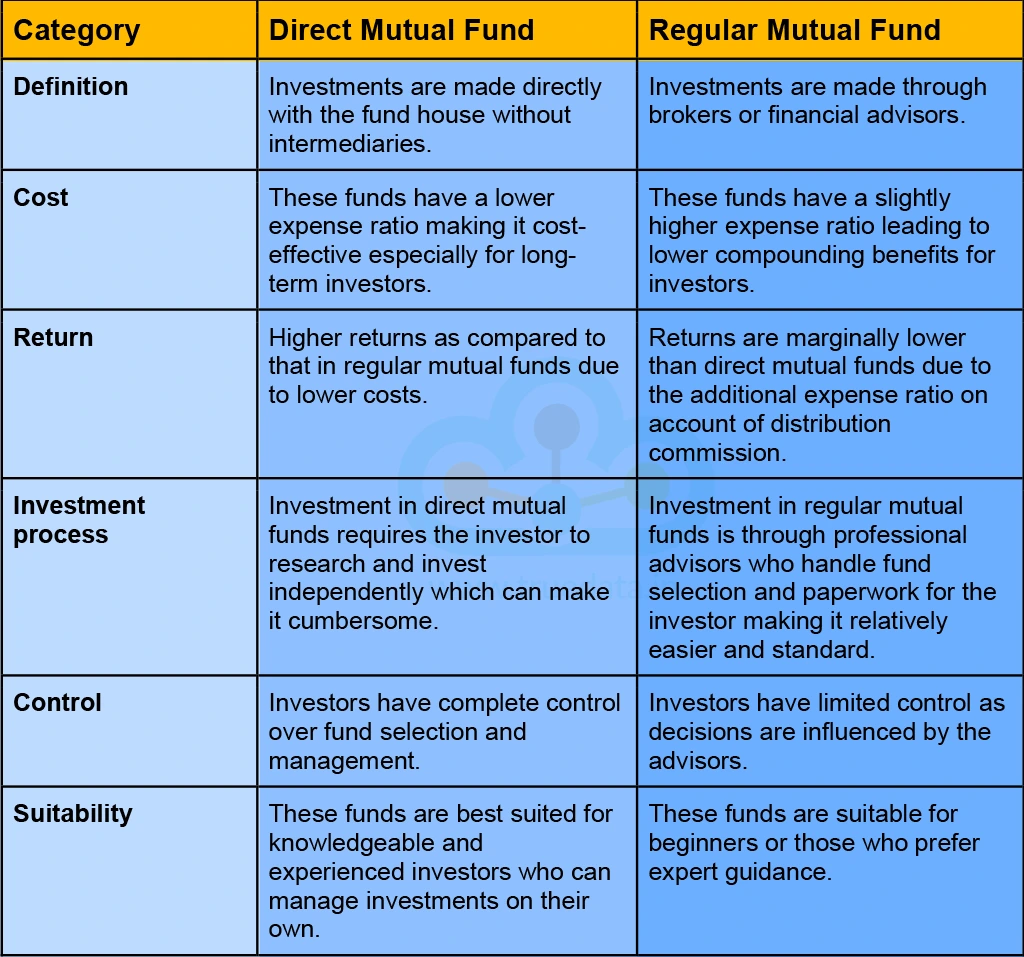

We have discussed the meaning of direct and regular mutual funds along with the essential benefits and risks of investing in them. Let us now focus on the key points between these two categories that make them distinct.

The choice between direct and regular mutual funds depends on many factors like the investor’s market knowledge, the time and expertise needed to navigate stock markets as well as the investment goals. Direct funds are suitable for investors who are confident in their investment choices and strategies to meet their financial goals. On the other other, regular funds are more beneficial for investors with limited market knowledge or time to manage their investments. Ultimately, the choice between direct and regular mutual funds relies on evaluating one’s comfort in financial decision-making or relinquishing control as well as seeking a balance between the returns and the cost of convenience for the same.

Direct mutual funds and regular mutual funds are the two essential branches of mutual funds with their set of pros and cons respectively. However, evaluating the two options thoroughly and making an informed decision is essential for investors to have a robust investment portfolio that is in alignment with their returns and cost expectations.

This blog talks about the two primary categories of mutual funds available for investment aiding investors in enhancing their market knowledge leading to sound investment decisions. Let us know if you have any queries on this topic and watch this space for more insights on mutual funds.

Till then Happy Reading!

Read More: What are open-ended mutual fund schemes?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...