One of the many features of investing in mutual funds is the ease of entering and exiting the fund. But did you know this is not the fundamental characteristic of all mutual funds? This flexibility of investing is offered under open-ended mutual funds. Have you heard about them or know about them in detail? Check out this blog for all you need to know about open-ended mutual funds to make informed investment decisions.

Open-ended funds are the most popular category of mutual funds in India and are found in every category of mutual funds as per the SEBI classification. In these types of funds, investors can buy and sell units anytime, making the investment flexible and convenient for them. These funds do not have a fixed number of units at the inception of the fund and the fund continuously issues or buys back the units at the current Net Asset Value (NAV). The NAV is, therefore, determined daily based on the value of the fund’s underlying assets. These funds are ideal for investors looking to invest in funds with higher liquidity allowing them to invest or withdraw their money whenever needed.

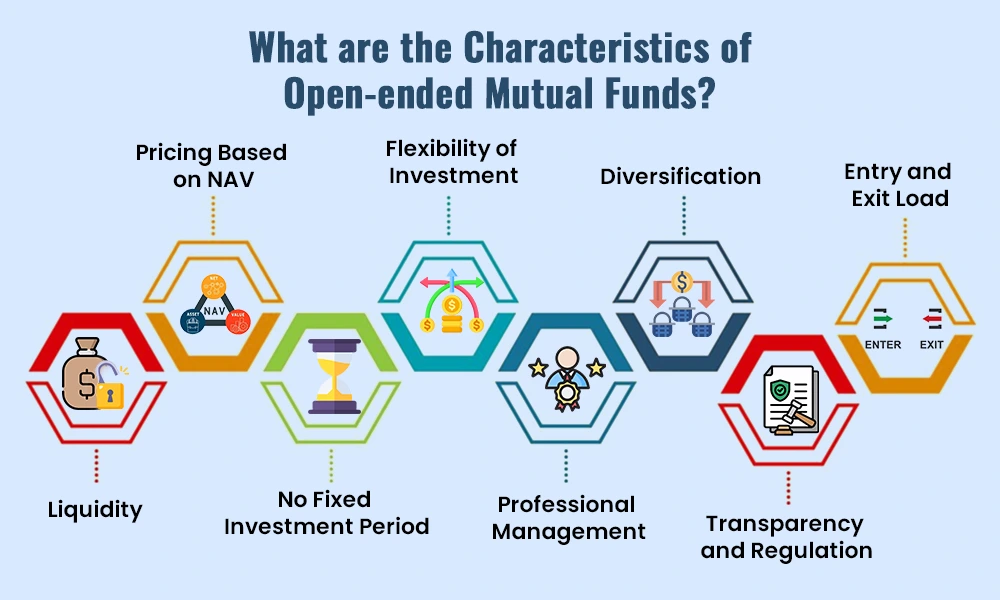

The typical features or characteristics of open-ended funds are explained hereunder.

Open-ended mutual funds provide high liquidity, meaning investors can buy and sell units at any time. There is no fixed maturity period, and the fund continuously issues or redeems units. This makes it easier for investors to access their money when needed.

The price of units in open-ended mutual funds is determined by the Net Asset Value (NAV). The NAV is calculated daily based on the current market value of the fund's assets. Investors purchase and redeem units at this daily NAV price.

Unlike fixed-term investments, open-ended mutual funds don't have a set duration. Investors can stay invested for as long as they like or exit at any time without any penalties, depending on the type of fund and exit load (if applicable).

Investors can invest in open-ended mutual funds via lump sum or Systematic Investment Plan (SIP). This gives flexibility in terms of investment amounts and frequency, allowing investors to choose what suits their financial situation and goals.

Open-ended mutual funds are managed by professional fund managers who decide how to invest the pooled money. They aim to maximise returns by investing in a mix of assets like stocks, bonds, or other securities, based on the fund's objective.

These funds provide diversification as the pooled money is invested across multiple assets and sectors. This reduces the risk for individual investors because losses in one investment can potentially be offset by gains in another.

Open-ended mutual funds are regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and investor protection. Investors receive regular updates on the fund’s performance, holdings, and expenses through monthly or quarterly reports.

While some open-ended mutual funds do not have any charges, others may impose an entry or exit load. An entry load is a fee charged at the time of investment, and an exit load is a charge for redeeming units within a specific time frame after investment.

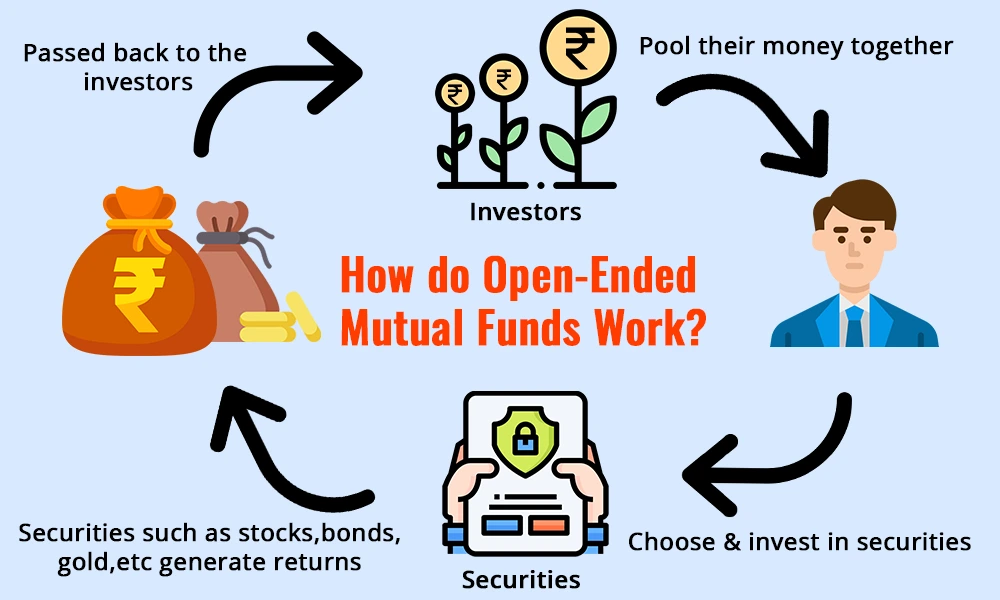

Open-ended mutual funds pool money from multiple investors to create a large investment fund, which is then managed by a professional fund manager. This fund invests in a mix of assets, such as stocks, bonds, or a combination of both, depending on the fund’s objective. Investors can buy units of the fund at any time, and the price of these units is based on the fund’s Net Asset Value (NAV), which is calculated daily based on the market value of the underlying investments. When investors want to withdraw their money, the fund buys back their units at the current NAV, giving them the flexibility to exit when needed. The fund does not have a fixed number of units or a maturity period, so investors can stay invested for as long as they want. Open-ended mutual funds provide the benefit of professional management, diversification, and liquidity, making them a popular choice for investors looking to grow their wealth over time.

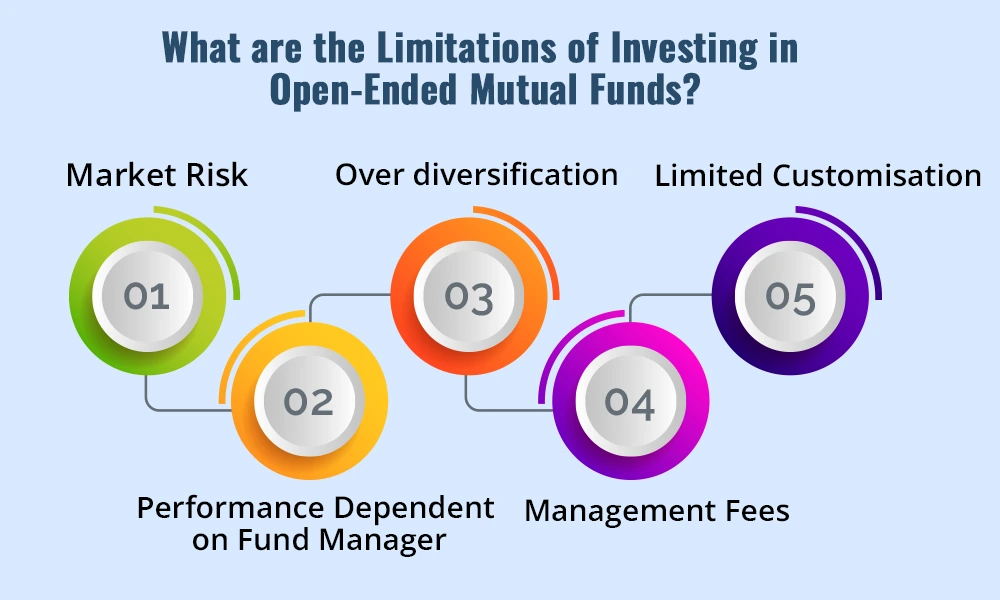

Although investors across different categories and risk appetites widely prefer open-ended funds, these funds do carry significant limitations that should not be ignored. Here is a brief list of key limitations of open-ended funds to help investors make informed investment decisions.

Open-ended mutual funds are subject to market fluctuations. Since these funds invest in stocks, bonds, or other assets, their value can rise or fall based on market conditions. During periods of high market volatility, the value of an investment can decrease significantly with no guarantee of returns.

While diversification reduces risk, too much diversification in an open-ended mutual fund can sometimes limit potential gains. If a fund invests in too many assets or sectors, the strong performance of one asset might not significantly impact the overall returns, leading to more moderate growth.

The success of an open-ended mutual fund heavily depends on the skill and strategy of the fund manager. If the manager makes poor investment decisions or fails to adapt to changing market conditions, the fund’s performance could suffer, affecting the ultimate returns for investors.

Since investors are investing in a pre-structured portfolio, they have no say in the specific assets the fund invests in. This lack of customisation may be a limitation if they prefer more control over their investments or want to focus on particular sectors or companies.

Professional fund managers oversee open-ended mutual funds, and for their services, they charge management fees, also known as the expense ratio. These fees can reduce the overall returns, especially in funds with higher expense ratios. Over time, these costs can affect the growth of an investment.

Open-ended mutual funds are suitable for a wide range of investors, depending on their financial goals, risk tolerance, and need for liquidity. These funds are ideal for long-term investors looking to grow their wealth gradually over time. These funds are also a suitable option for first-time or inexperienced investors who may not have the time and experience to understand and manage stock market investments. The professionally managed mutual funds are therefore a good option for such investors who want to invest without having to constantly monitor the market. The biggest advantage of open-ended funds is their liquidity. These funds are, therefore, suitable for investors with flexible investment horizons and the need to access funds at short notice. Investors with moderate risk tolerance can also benefit from open-ended mutual funds. Since these funds invest in a diversified portfolio of assets, they help balance risk. While market fluctuations can impact returns, diversification helps to reduce the impact of poor performance in individual investments.

Open-ended mutual funds are a flexible and accessible investment option for a variety of investors with diverse risk tolerance. These funds provide investors access to professionally managed funds along with multiple benefits like liquidity, tax benefits, diversification and opportunity for wealth creation over long term. However, it is also important for investors to understand the various risks involved while investing in open-ended funds to make informed portfolio decisions.

This article talks about open-ended mutual funds in detail which is a fundamental concept of mutual funds. Let us know if you need any additional information on this topic. Also, the other spectrum of mutual funds is close-ended mutual funds. Watch this space for a detailed account of close-ended mutual funds in our coming blogs.

Till then Happy Reading!

Read More: What is AMC in Mutual Fund?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...