Imagine you are a fresher and at the start of your career, what will be the most distant thing on your mind? Well, the short answer is retirement. While retirement indeed is a very distant concept for a fresher, retirement planning should definitely not take a backseat. But what exactly is retirement planning and why is it an important concept in financial planning? Get all your answers here in this blog and make retirement planning easy and efficient.

Read More: Best financial books to read for beginners in stock market

Retirement is often referred to as the golden years when individuals are free of their responsibilities and finally get to enjoy their life on their terms. However, the sad reality is that most Indians think retirement planning is simply having a corpus in their PF account and some decent savings in their bank account. The fact is that while this worked for our previous generation, it is just not enough anymore. It is also commonly observed that young professionals do not give much importance to retirement planning and when retirement is staring right in their face, it is too late to build a healthy corpus to last these golden years.

Now let us move to the meaning of retirement planning. To put it simply, retirement planning is essentially creating a robust financial plan for the time when the individual has retired from the active workforce and has enough resources to meet their daily expenses as well as fund their lifestyle and retirement goals. It involves a series of steps like careful analysis of income requirements and expenses during the retirement phase, preparing for emergencies as well as having a buffer to meet long-term hobbies or long pending adventures.

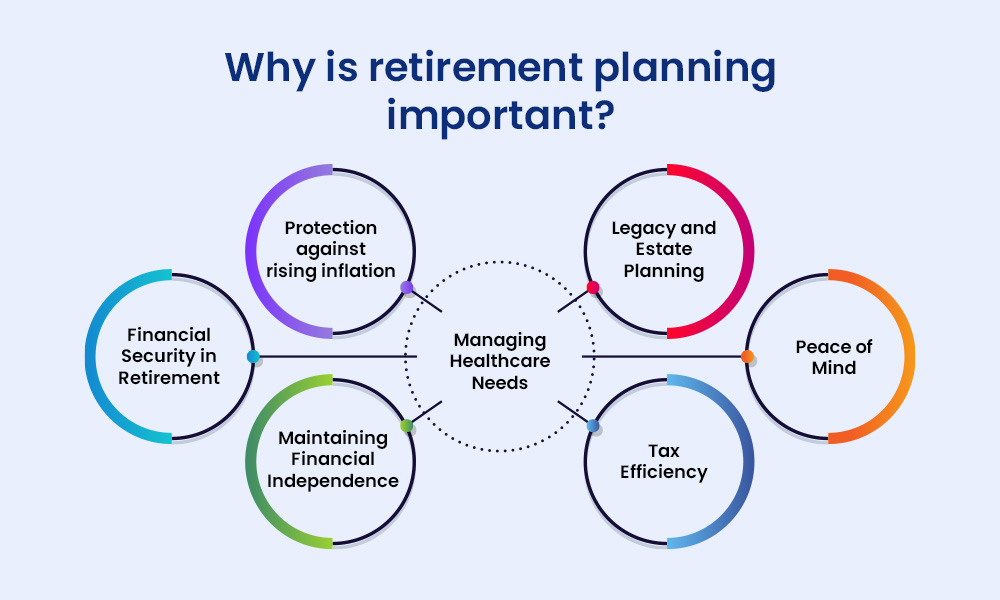

Now that we have taken care of the meaning of retirement planning, let us now understand why retirement planning is important. The term retirement planning is quite common and is often used quite casually too. However, the importance of retirement planning is highlighted in the points hereunder.

One of the primary reasons for retirement planning is to ensure financial security during your retirement years. While India is largely considered to be a young country, we do have our fair share of an ageing population. With longer life expectancies, it is vital to have enough savings and investments to sustain the same or better level of lifestyle after retiring from the active workforce. A robust retirement plan helps in accumulating sufficient funds that can cover living expenses and other needs without having to rely solely on pensions or family support.

Inflation has been one of the growing concerns of global economies, especially post-COVID. It is the persistent increase in the cost of goods over time and reduction in the purchasing power of money. Therefore, considering inflation in retirement planning is essential to ensure that the planned resources and the corpus available at the time of retirement are sufficient to meet the true cost of needs along with a sufficient buffer to meet all retirement goals.

The biggest concern in retirement is the financial hurdles one faces due to being out of the active workforce. This leaves them with limited options which are either being financially dependent on their family or struggling to meet their needs during this phase. Therefore, having an efficient retirement plan in place allows individuals to maintain their financial freedom and live their lives with dignity, manage their preferences and enjoy their golden years on their terms.

Healthcare expenses are one of the biggest financial drains for retirees, especially in India where healthcare costs are on a constant rise. An efficient retirement plan includes adequate provision for healthcare expenses including regular check-ups and medications as well as for potential emergencies. This helps mitigate financial stress and also provides opportunities to get optimum quality medical care which is of utmost importance in the later years of life.

Legacy and estate planning may not be a popular concept for the vast majority of the population in India but it is nevertheless an essential requirement for the smooth transfer of assets as intended by the individuals. Therefore, it is an essential part of retirement planning to allow individuals to strategically transfer assets and investments to their intended heirs or charitable causes as per their wishes and create a legacy that aligns with their core values. Estate planning and legacy planning through legal tools like wills or trusts are also important to minimise disputes among families and maintain an orderly distribution of assets.

While tax is an important factor to consider during the active workforce, there is no permanent escape from taxes even in retirement. A good retirement plan helps in allocating resources to assets that are tax-efficient and can also meet the investment goals at different stages of life. Some of the popular investment options that are tax efficient as well as meet the basic requirements of capital preservation and regular income include the classic PPF account (Public Provident Fund), ELSS Funds (Equity Linked Savings Scheme), NPS (National Pension Scheme) and more.

Having peace of mind is one of the most underrated yet fundamental requirements in the retirement phase and the right investment plan is the key ingredient for the same. A proper retirement plan allows individuals to have much-needed financial security as well as contingency plans for adverse scenarios. This allows a person to enjoy their retirement enabling them to focus on their hobbies, travel, family time, and other fulfilling pursuits.

The steps to create a robust retirement plan are not set in stone and can be made flexibly based on the individual needs of a person. The key to a successful retirement plan is to start as early as possible, preferably at the start of one’s career to maximise the benefit of compounding in the investments. However, here is a list of a few common points to consider while making a retirement plan.

The first step to begin creating any financial plan is to understand the current position. This involves analysing the income, expenses, assets, and liabilities along with current savings and financial obligations.

The next step is to define the retirement goals and the estimated age at which a person wishes to retire. This will help in understanding the approximate corpus needed at the time of retirement and the time frame available to build the corpus.

Before selecting the assets and investment options for a retirement plan it is important to understand them thoroughly. This involves understanding their features as well as the impact of market fluctuations and macroeconomic factors like inflation, interest rate changes, etc on the ultimate corpus and the projected income flow.

After considering the above factors of investment goals, the corpus needed and the nature of the investments selected, it is time to move towards making a sound budget that can allocate regular resources towards building the corpus over the targeted time frame. The important thing to remember here is consistency as without concrete action any sound plan is nothing but a piece of paper or wasted potential.

A sound retirement plan also diversifies investments across different asset classes to reduce the overall risk of the portfolio. It is essential to consider a healthy mix of equity-based investments for long-term growth and fixed-income investments for stability.

Finally, one of the most important and often ignored steps for retirement planning is to constantly review or monitor the retirement plan and make changes as and when needed when the investments no longer are in alignment with the investment goals along with changes in other factors like income, expenses, retirement timeline, market conditions and more.

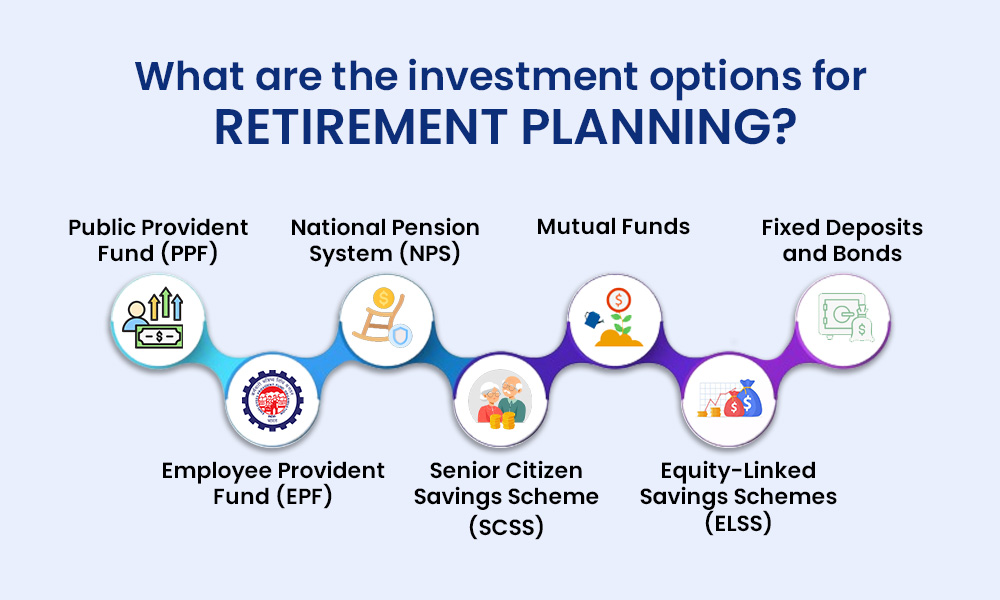

Some of the popular investment options to include in a retirement plan and their details are mentioned below.

The PPF (Public Provident Fund) is a long-term savings scheme backed by the Government of India with the objective of providing retirement benefits and tax savings to the citizens of the country. Individuals can open a PPF account with designated banks or post offices and contribute up to Rs. 1,50,000 annually. It is an excellent tax-saving tool. PPF account holders are eligible for deduction under section 80C up to a maximum of Rs. 1,50,000. The investment in PPF has a lock-in period of 15 years, but partial withdrawals are allowed after the completion of 5 years. PPF belongs to the EEE class of investments therefore, the returns from the PPF account as well as the corpus at the time of investment are tax-free along with the deduction on the yearly contributions to the PPF account.

The EPF is a government-backed retirement savings scheme available to salaried employees in India. Under this option, the employee and employer both contribute a fixed portion of the employee's salary to the EPF account. These contributions are eligible for a fixed interest rate set by the government subject to changes from time to time. EPF contributions are eligible for tax deduction under Section 80C of the Income Tax Act, making it a popular choice for retirement savings.

The NPS is a voluntary, contributory pension scheme launched by the Government of India to provide retirement income to individuals. It offers two types of accounts namely, Tier-I (mandatory) and Tier-II (optional). Contributions to NPS qualify for tax benefits under Section 80C and 80CCD(1) up to Rs. 1,50,000, and an additional deduction under section 80CCD(1B) of the Income Tax Act of up to Rs. 50,000. NPS investments are diversified across equity, government securities, corporate bonds, and alternative assets, providing an opportunity for long-term growth. At the time of retirement, 60% of the NPS corpus can be withdrawn as a lump sum which is tax-free and the balance 40%, also tax-free, must be used to purchase an annuity which will then yield regular income.

The SCSS is designed specifically for senior citizens aged 60 years and above, providing them with a safe and guaranteed investment option for retirement. SCSS accounts can be opened at designated banks or post offices where a person can deposit funds ranging from a minimum of Rs. 1,000 up to 30,00,000 and have a maturity period of five years, extendable for another three years. The interest rate currently under SCSS is 8.2% annually which will be credited to the depositor’s account on a quarterly basis. This gives the depositors a higher interest rate than most fixed deposit rates, making SCSS an attractive choice for retirees seeking regular income and capital protection.

Mutual funds offer a diverse range of investment options suitable for every class of investors any any stage in life. Investors can include a variety of mutual funds in their portfolio like equity funds, debt funds, hybrid funds, and retirement-focused funds depending on their risk appetite and investment goals. Equity mutual funds are known to provide maximum growth potential over the long term, while debt funds offer stability in income generation and relative safety of the corpus. Retirement-focused funds, also known as pension plans or target-date funds, are specifically designed to align with retirement goals, adjusting asset allocation based on the investor's age and risk tolerance.

ELSS funds are one of the most popular categories of mutual funds with tax-saving options. These funds primarily invest in equity and equity-related instruments. They offer dual benefits of tax savings under Section 80C up to Rs. 1,50,000 and the potential for higher returns compared to traditional fixed-income investments. ELSS funds have a lock-in period of three years, encouraging long-term wealth creation and retirement planning. Investors can choose from a range of ELSS funds based on their risk appetite and investment goals.

Fixed deposits (FDs) and bonds are among the traditional investment options suitable for conservative investors. FDs offer a fixed interest rate for a specified period, providing stable returns and capital preservation. Furthermore, tax-saving fixed deposits also qualify for tax benefits under Section 80C up to Rs. 1,50,000. On the other hand, bonds, including government bonds, corporate bonds, and tax-free bonds, offer fixed income with varied maturities to provide a balanced retirement portfolio.

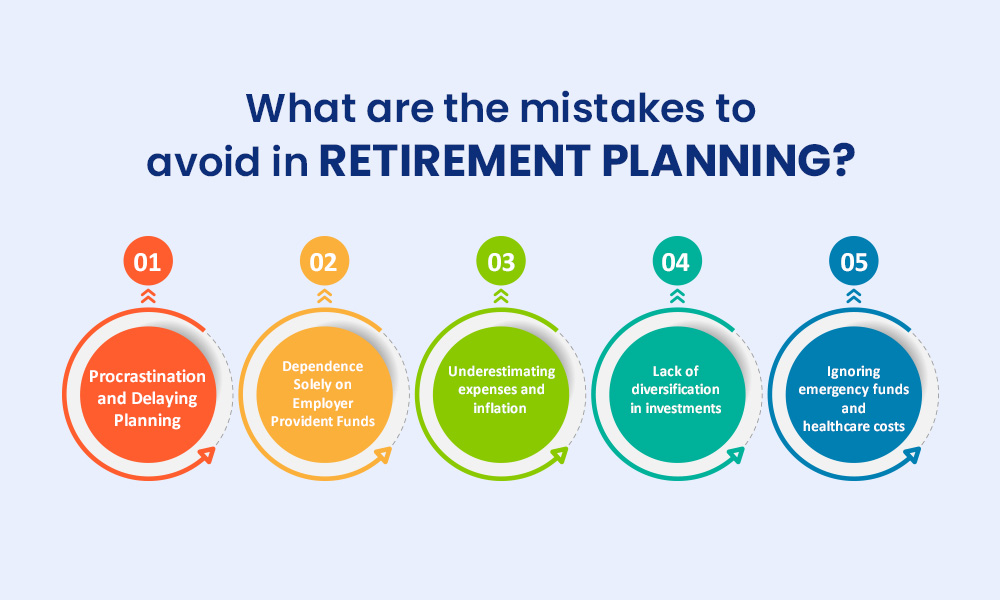

We have seen the importance of retirement planning and the various avenues to park funds for retirement planning. Let us now focus on the mistakes to avoid in this crucial process.

One of the most significant and common mistakes in retirement planning is delaying the process. Many individuals often prioritise immediate financial needs or assume they have plenty of time to plan for retirement. However, it is a very well-known fact that starting early can significantly impact the size of your retirement corpus by harnessing the power of compounding. The result of waiting too long to start retirement planning is the need to save aggressively or compromise on the retirement lifestyle.

It is still often seen that most people in India rely solely on employer-provided retirement benefits like EPF (Employees' Provident Fund) which can be quite risky. While EPF is a valuable component of retirement planning, it is definitely not enough to meet all the financial needs during retirement. Therefore, it is important to supplement EPF with additional savings and diversified investments to build a more comprehensive retirement portfolio.

Another common error in retirement planning is a gross underestimation of the post-retirement expenses and also not accounting for inflation. Individuals can underestimate the healthcare costs or increase in travel expenses while planning their retirement corpus which will ultimately leave them with limited resources to meet their needs or retirement goals. Therefore, it is important to have a prudent estimation of the expenses in the post-retirement phase and plan for them accordingly. Seeking professional help for the same is also advisable if individuals are unable to make a fair estimation of the inflation cost or the assets needed to help them meet their retirement corpus.

It is a well-established fact that diversification is the key to a healthy and successful portfolio. One of the many mistakes most novice investors often make is putting all their eggs in one basket in the name of being aggressive investors or capitalising on the current momentum the asset may have. While this can provide short-term returns in the long term it can potentially erode the retirement corpus if the tide turns against the asset in consideration. Therefore, it is prudent to select multiple investment options to create the retirement plan and to ensure maximising profits as well as spreading the overall risk of the portfolio.

Finally, among the list of significant mistakes to avoid in retirement planning is to not ignore creating an emergency fund and accounting for adequate healthcare costs. An emergency fund is an essential safety net that a person requires no matter what stage of life they are in. Similarly, creating a buffer to meet the increasing healthcare costs in the form of quality healthcare plans that cover preventive health check-ups as well as a range of illnesses or health emergencies is of utmost importance in a retirement plan. The cost of quality healthcare plans significantly increases with the increase in the age of the applicant. Therefore, buying a healthcare plan for oneself and their family in the prime of age or being included in the healthcare plan of earning children can not only take care of the medical expenses but also provide tax benefits along the way.

The awareness around financial planning has been on an increasing trend for quite some time now with the new class of investors. This enables them to manage their finances in a more efficient manner with room for taking measured risks as well as protecting their interests in the long term. Retirement planning is often considered to be the core of financial planning as the ultimate goal for any person is to have financial security till their last breath as well as safeguard the financial future of their family.

This article talks about retirement planning in detail and highlights its importance as well as showing the popular options to include in a retirement plan. Let us know if you want to know about any more investment options for retirement plans or want to know about similar financial concepts and we will take them up in our coming blogs.

Till then Happy Reading!

Read More: Enhance Your Trading Success with Real-Time Market Data Provider in India

In the uncertain times that we live in, the financial security of families is fr...

Imagine you are a fresher and at the start of your career. What you don’t ...

Did you know that the inflation in the education sector in India is approximatel...