Did you know that Indian IPOs have raised over Rs. 1 trillion in each of the years 2021, 2024, and 2025? And 2025 is not even over yet? That is a clear sign of growing investor confidence, especially among domestic investors. But while the excitement around new listings is real, smart investing is all about being informed. No, that is where things get tricky. How do you evaluate a newly listed company when there is limited historical data to rely on?

Check out this blog where we walk through practical ways to assess newly listed companies, so you can make confident, well-informed decisions and build a stronger investment portfolio.

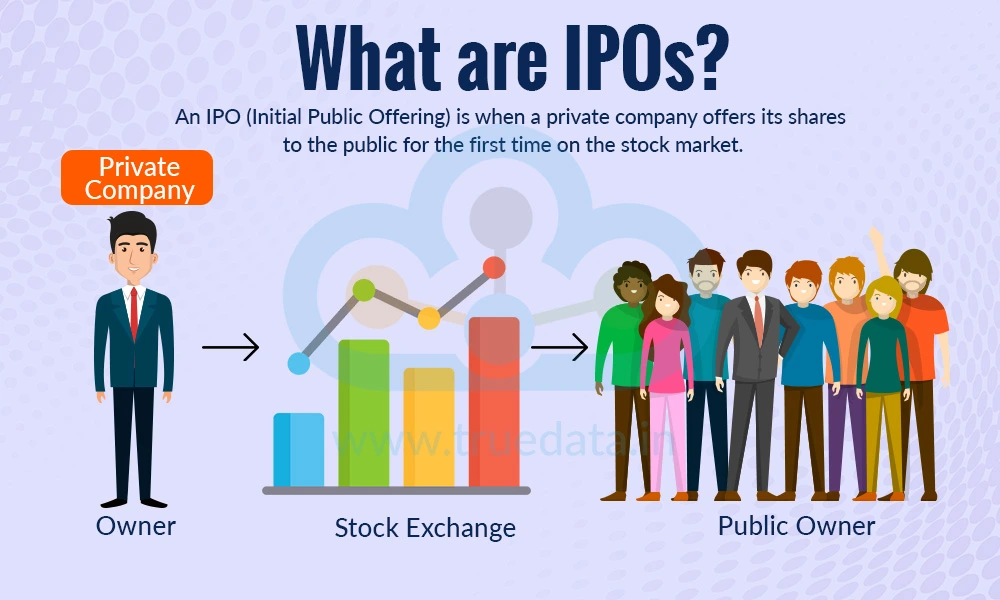

Let us begin with the basics, i.e., the meaning of IPOs. While this is a common term in the stock markets and companies, for a layman or a new investor, here is its meaning and explanation.

An IPO (Initial Public Offering) is when a private company offers its shares to the public for the first time on the stock market. In simple terms, it is how a company moves from being privately owned (by founders, promoters, or early investors) to becoming a publicly traded company. Through an IPO, the company raises money from investors, which it can then use to expand its business, reduce debt, or fund new projects. In return, investors get a chance to become part-owners of the company by buying its shares. In India, IPOs are regulated by the Securities and Exchange Board of India (SEBI) to ensure transparency and protect investors. Once listed, the company’s shares can be bought and sold on recognised stock exchanges, i.e., NSE and BSE.

Listing of a new company is an opportunity for investors to be part of its growth story and gain the advantage of early investment. However, such an investment must be made after a thorough review and analysis of the company's key details and post-listing performance. Here are a few key factors to be considered while evaluating a newly listed company.

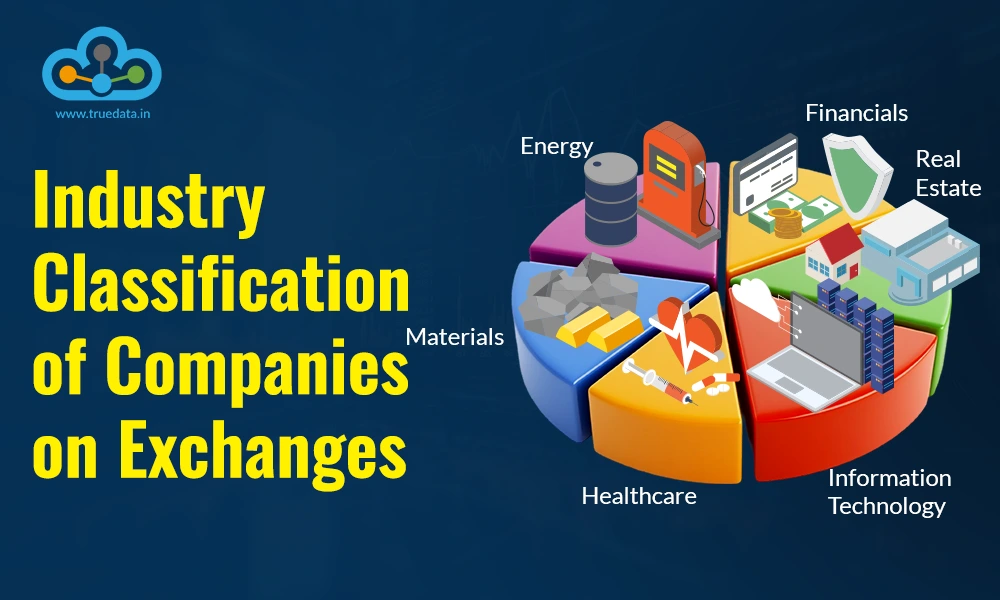

The first step in analysing a newly listed company is to understand what the business does and how it earns money. A clear idea of the company’s products or services, customer base, and competitors helps in judging its potential. Investors should go through the Draft Red Herring Prospectus (DHRP), which every company must publish before its IPO. This document explains the company’s operations, strengths, and risks. It is also important to see whether the company operates in a growing sector, such as renewable energy, technology, or healthcare. A company that has a unique offering or competitive advantage, like strong brand recognition, patented products, or efficient processes, may have better chances of long-term success.

Newly listed companies may not have a long financial history, but their past few years’ financial statements still reveal valuable insights. These can be found in the DRHP or annual reports.

Key points to review include -

Revenue growth - A consistent increase in income suggests strong demand for the company’s products or services.

Profitability - Understanding whether the company is profitable or still in the early stages of growth helps assess risk.

Debt levels - Companies with manageable debt are usually safer investments.

Cash flow - Positive cash flow indicates that the company is generating real money rather than just accounting profits.

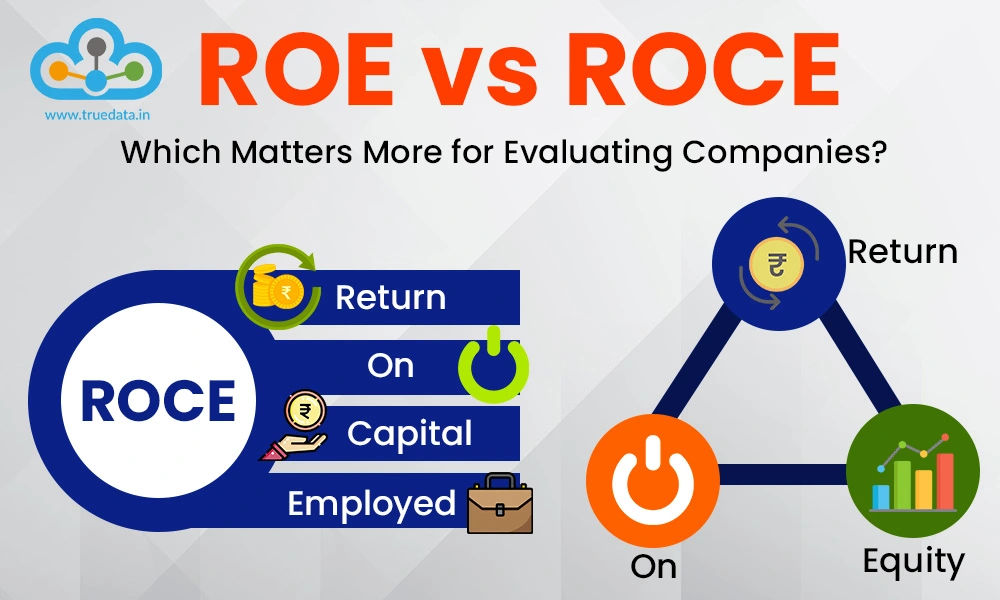

It is common for companies to launch IPOs at attractive prices to draw attention, but sometimes the price can be higher than the company’s actual worth. Therefore, it is important to evaluate whether the valuation is reasonable. This can be done by comparing financial ratios such as Price-to-Earnings (P/E) and Price-to-Sales (P/S) with those of similar listed companies in the same industry. If the valuation appears significantly higher, it may be wise to wait for a better entry point. Focusing on facts and financial data rather than market excitement helps avoid costly mistakes.

A company’s success depends heavily on the people running it. Investors should research the background of promoters and key management personnel to understand their experience, leadership skills, and reputation in the industry. It is a good sign if the promoters hold a substantial stake in the company, as it shows confidence and long-term commitment. Checking for any legal or regulatory issues in the past is also essential. Reliable and transparent management is often the backbone of a successful company.

Beyond past performance, what truly matters is the company’s future growth potential. The DRHP and company reports usually mention how the raised IPO funds will be used, whether for expansion, debt reduction, or new projects. Investors should look for clear plans that align with industry trends and market demand. For example, companies tapping into emerging areas such as digital services, green energy, or infrastructure may have stronger long-term prospects. Understanding economic policies, government initiatives, and technological trends can also help in judging growth potential.

After the IPO, it is important to monitor how the company performs both on the stock market and in its business results. Investors can follow quarterly financial reports, stock exchange filings, and news updates to track progress. Observing the behaviour of institutional investors, such as mutual funds or insurance companies, can also provide clues about the company’s strength. A steady rise in institutional holdings often indicates growing confidence. However, short-term price movements should not be the only factor in decision-making.

Investing in newly listed companies can offer great opportunities, but it also carries higher risks. Not every IPO will turn out to be a long-term winner. Therefore, investors should take a cautious and diversified approach. It is advisable to invest only after proper research and to avoid putting too much money into a single new company. Building a diversified portfolio and maintaining a long-term perspective can help reduce risk and improve the chances of steady returns.

Market sentiment is one of the key indicators and contributors to the success of an IPO. It shows how investors feel about a newly listed company, i.e., whether they are optimistic, cautious, or negative. These emotions often influence buying and selling decisions in the early days after an IPO. The importance or the need to considering market sentiment for evaluating a newly listed company is explained hereunder.

Affects Short-Term Price Movements - Strong positive sentiment can drive stock prices up quickly, even if the company’s fundamentals are not very strong. Similarly, negative sentiment can push prices down temporarily, creating opportunities for careful investors.

Helps Identify Overvaluation or Undervaluation - By studying market sentiment, an investor can judge whether a stock is being overhyped or overlooked. This helps in avoiding overvalued stocks and spotting undervalued ones with potential for long-term gains.

Indicates Market Confidence - Sentiment around a newly listed company also reflects overall confidence in its management, business model, and sector. When investors show sustained interest, it signals trust in the company’s future performance.

Shows Retail and Institutional Behaviour - Sentiment helps track how different types of investors (like retail investors and institutional buyers) are reacting to the company. For example, strong institutional buying usually builds confidence among smaller investors.

Reflects Broader Market Conditions - Sometimes, a newly listed company’s performance depends not just on its own strength but on the overall market mood. A bullish market can lift new stocks higher, while a bearish market can affect even good companies.

Helps in Understanding Post-IPO Trends - Studying sentiment after listing helps investors see whether the initial excitement is sustainable or just short-lived. This can provide clues about the company’s long-term stability and investor trust.

While sentiment can guide short-term decisions, investors must balance it with financial and business analysis. Understanding both emotions and facts helps in making wiser, more stable investment choices.

Investment in newly listed companies can be like a double-edged sword. Hence, it is important to know the pros and cons of investing in such companies to make informed decisions.

Investing in a newly listed company can be exciting and rewarding, but it also requires careful study and patience. Investors should understand key factors like the company’s business model, financial performance, future plans and market sentiment. By balancing research with a calm, long-term approach and diversifying their investments, investors can make smarter choices and build a stronger, more confident portfolio.

This article sheds light on a key aspect of the IPO frenzy that has become part of the Indian stock markets. You can read this article in extension of our other IPO articles to understand and evaluate them efficiently and make informed investment decisions. Let us know your thoughts on this topic or if you need further information on the same.

Till then, Happy Reading!

Read More: Impact of Buyback on Shareprices

Thestock market never stands still, and prices swing constantly with every new h...

Listing on the stock exchange is a moment of pride and excitement for any compan...

When it comes to judging how well a company is really performing, two numbers of...