Listing on the stock exchange is a moment of pride and excitement for any company. The iconic Opening Bell ceremony not only celebrates this milestone but also signals the start of the company’s journey in the world of public trading. While this moment is thrilling, it also raises an important question for investors, how does the exchange decide which sector or industry a company belongs to? And why does this classification matter when you are making investment decisions? Check out this blog to understand the classification of companies on the stock exchanges and their relevance for investors.

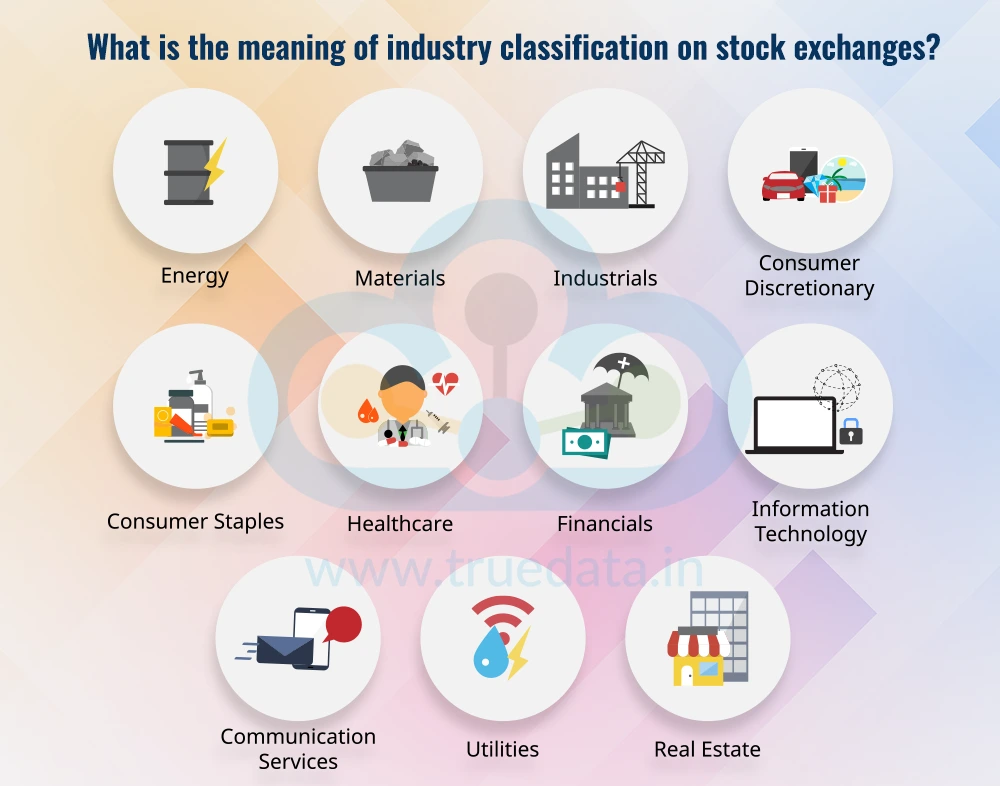

Industry classification on stock exchanges is the process of grouping companies into categories based on the nature of their business. Every company, whether it makes cars, sells clothes, provides banking services, or produces software, belongs to a particular industry. Stock exchanges (NSE or BSE) classify companies into sectors and industries so that investors can easily understand what a company does and compare it with others in the same field. For example, all IT companies may be grouped under the ‘Information Technology’ sector, while banks fall under the ‘Financial Services’ sector. This classification is important because it helps investors see trends within an industry, understand risks, and make informed decisions. It also makes it easier to track performance, as companies in the same sector often react similarly to economic changes, government policies, or market demand. In simple terms, industry classification acts like an organised ‘shelf’ in the stock market, helping investors quickly find and compare companies doing similar kinds of business.

The need for industry classification of companies and the benefits of the same are explained hereunder.

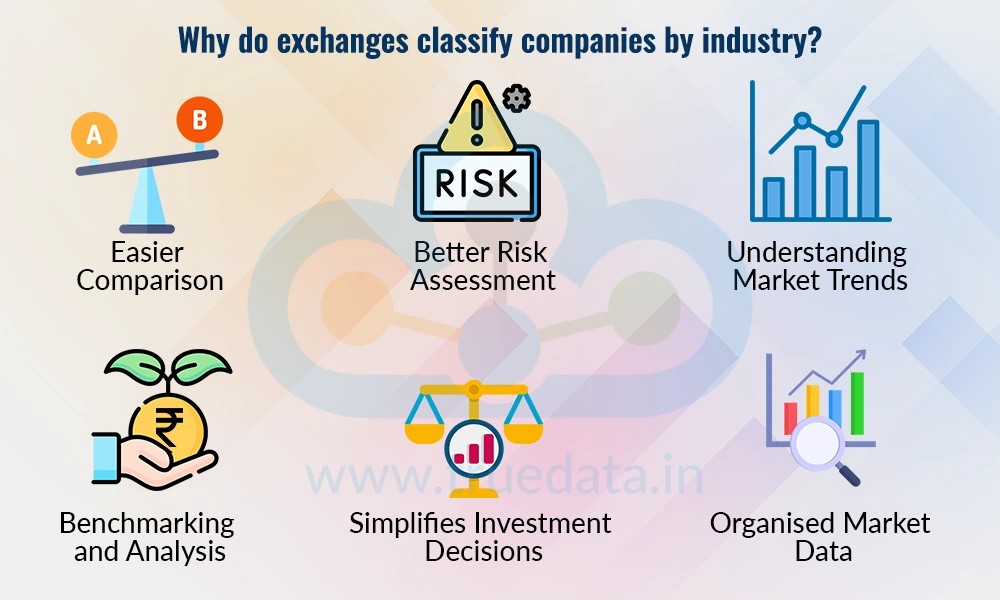

Stock exchanges classify companies by industry to help investors compare similar businesses more easily. Comparing companies within the same industry makes sense because they usually face similar challenges, operate under similar regulations, and follow comparable business models. For example, comparing two banks or two IT companies is more meaningful than comparing a bank with a software firm, as their core operations and revenue sources are very different. This classification helps investors make more informed and relevant comparisons.

Companies within the same industry often respond in similar ways to changes in the economy, government policies, or market demand. By classifying companies by industry, investors can assess risks more effectively. For example, during a slowdown in the Real Estate market, most construction and infrastructure companies may see a decline in performance. Knowing the industry classification helps investors anticipate such risks and plan their investments accordingly.

Industry classification allows investors to track trends in specific sectors of the economy. For instance, if the IT industry is growing or experiencing a boom, investors can focus on IT companies to take advantage of potential opportunities. Similarly, if the automobile or energy sector is facing challenges, investors can adjust their strategies accordingly. This organised view of industries makes it easier to spot patterns and emerging opportunities in the stock market.

Exchanges and financial analysts often create benchmarks and indices for specific industries. This allows investors to measure a company’s performance against its peers. For example, an IT company can be compared with the performance of other IT firms using an IT sector index. Such comparisons help investors identify which companies are leading their industry and which are lagging behind.

Industry classification also helps investors make smarter investment decisions and diversify their portfolios. By understanding which companies belong to which industries, investors can spread their investments across multiple sectors. This reduces the risk of putting all their money in a single industry that might be affected by economic or regulatory changes. For example, an investor may choose to invest in IT, banking, and consumer goods companies to balance potential gains and losses.

Finally, classifying companies by industry makes stock market data easier to access and organise. Investors can quickly search for companies in a particular sector without sifting through unrelated stocks. This systematic arrangement saves time and provides clarity, especially for investors who want to focus on specific areas of the economy, such as banking, pharmaceuticals, or energy.

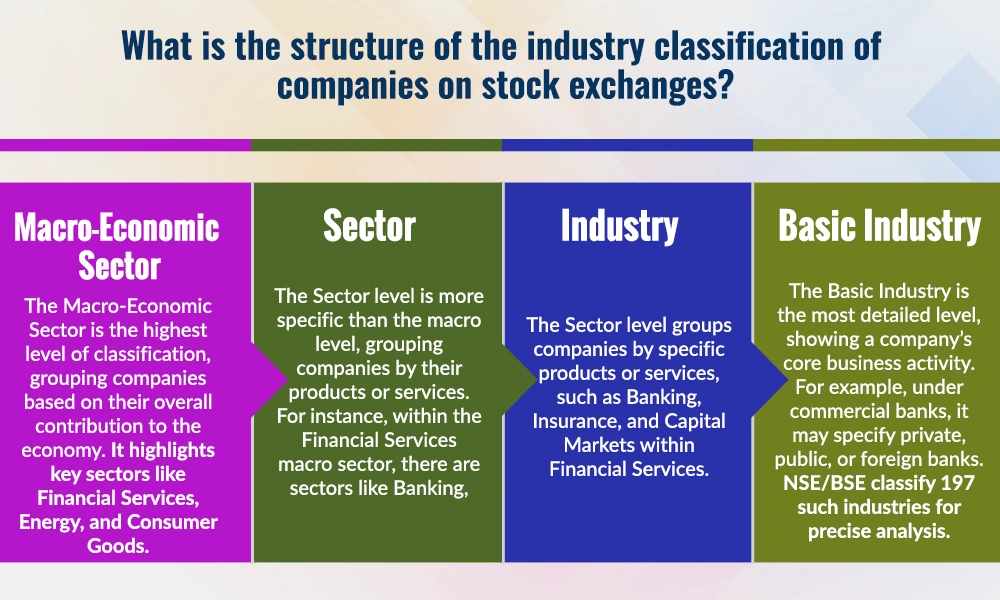

The NSE/BSE classification system in India works like a 4-Tier pyramid. It starts from a broad view of the economy (Macro-Economic Sector), narrowing down to specific sectors, then industries, and finally the detailed Basic Industry. This structured approach helps investors understand companies better, compare them effectively, and make smarter investment decisions. Each tier of the industry clarification is explained hereunder.

The Macro-Economic Sector is the broadest level of classification. It shows the company’s business activity at a very high, overall economic level by focusing on the prime sectors or pillars of the economy and fitting the company in a sector by understanding the contribution of the company at a macroeconomic level. For example, companies may belong to sectors like Financial Services, Energy, or Consumer Goods. NSE/BSE has 12 Macro-Economic Sectors, which help investors understand the main area of business a company is part of.

The Sector level is a bit more specific than the macro level. It groups companies based on the type of products or services they provide. For example, the Financial Services represent the macro sector and can have sectors like Banking, Insurance, or Capital Markets. NSE/BSE uses 22 sectors in total, allowing investors to narrow down their focus from a broad economic activity to a more specific field.

The Industry level goes further into details to identify the exact type of business a company does. It shows investors which group of companies are truly comparable. For example, within the Banking sector, the industry level could distinguish commercial banks, cooperative banks, or regional banks. NSE/BSE classifies companies into 59 industries, helping investors compare companies that operate in similar lines of business.

The Basic Industry is the most detailed, micro-level classification. It highlights the core business activities of the company. For instance, under commercial banks, the basic industry could identify private sector banks, public sector banks, or foreign banks. NSE/BSE have 197 Basic Industries, which makes it easy for investors to see the exact nature of a company’s business and analyse it alongside similar businesses.

The NSE and BSE provide a specific methodology for classifying companies into the 4-tier pyramid and primarily into the basic industry categories. This methodology focuses on the true nature of the business for optimal categorisation. It helps investors understand a company’s main business focus and compare it with similar companies. It also clarifies whether a company is specialised in one industry or spread across multiple industries, which can influence investment decisions and risk assessment. The exchange methodology is explained below.

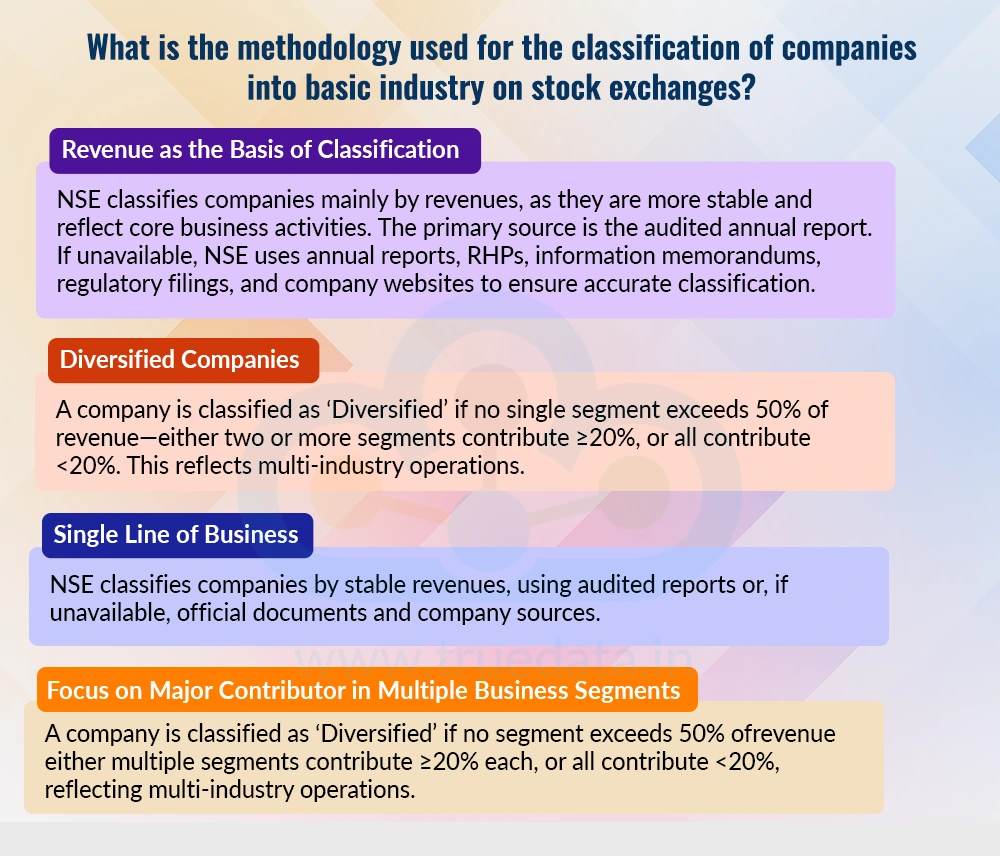

Revenue as the Basis of Classification -

NSE classifies companies primarily based on revenues, not profits, because revenues are usually more stable and provide a clearer picture of a company’s core business activities. This approach ensures that each company is grouped according to what it mainly does, making the classification more accurate and meaningful for investors. The primary source of this information for classification is the company’s audited consolidated annual financial report. If revenue information is unavailable, insufficient, or if the company is newly listed or has changed its line of business, NSE refers to other official documents, including,

Information memorandums

Regulatory filings

The company’s website and business descriptions

This ensures that even without detailed financial data, the company is accurately classified according to its actual business activities.

Single Line of Business -

If a company has only one line of business, it is straightforwardly classified according to that business. For example, a company that only manufactures automobiles will be classified under the Automobile Basic Industry.

Focus on Major Contributor in Multiple Business Segments -

Companies with more than one business segment are classified based on the segment that contributes more than 50% of the total revenue. This ensures that the company is categorised according to its primary business activity. For example, if a company earns 60% of its revenue from IT services and 40% from hardware sales, it will be classified under Information Technology Services.

Diversified Companies -

If a company has multiple business segments, and no single segment contributes more than 50% of total revenue, it is classified as ‘Diversified’. This can happen in any of the following two cases,

Two or more segments each contribute at least 20% of the total revenue.

All segments contribute less than 20% of total revenue.

This classification recognises companies that do not rely on a single core business but operate across multiple industries.

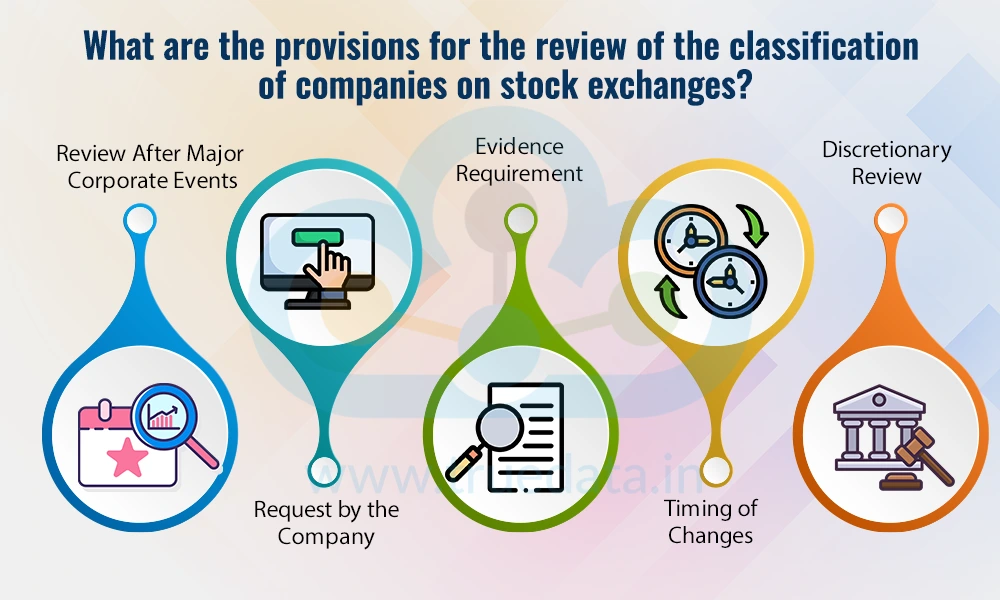

NSE/BSE reviews the classification of all listed companies every year after receiving their annual reports. The provisions for review of the classification of companies on stock exchanges are,

Review After Major Corporate Events - Classification may be reviewed if there is a significant change in the company’s business, such as a merger, acquisition, demerger, or restructuring.

Request by the Company - A company can request a review of its classification by contacting NSE Indices Ltd., providing a rationale and supporting documents according to NSE’s classification rules.

Evidence Requirement - No changes are made based on non-public information, promises, aspirations, or unverified claims. Any revision must be supported by audited financial statements or formally authenticated documents.

Timing of Changes - Any change in classification due to a corporate event is implemented when the event is officially completed.

Discretionary Review - NSE Indices Ltd. may also review a company’s classification at its own discretion or based on a request from the company or its professional advisors.

Apart from reviewing the company classification, the stock exchange also reviews the industry classification of companies. However, they are more complex, usually evolutionary and long-term in nature. Any temporary ups and downs in a particular industry are generally not considered when updating the classification. NSE Indices conducts an annual review of the industry classification structure, taking into account its own internal assessment, feedback from the market, and consultations with relevant stakeholders such as investors, companies, and analysts. This careful and structured approach ensures that any changes reflect long-term trends and the true nature of business activities, rather than short-term market fluctuations. This provides confidence that the industry classification of companies is stable, reliable, and meaningful for making investment decisions.

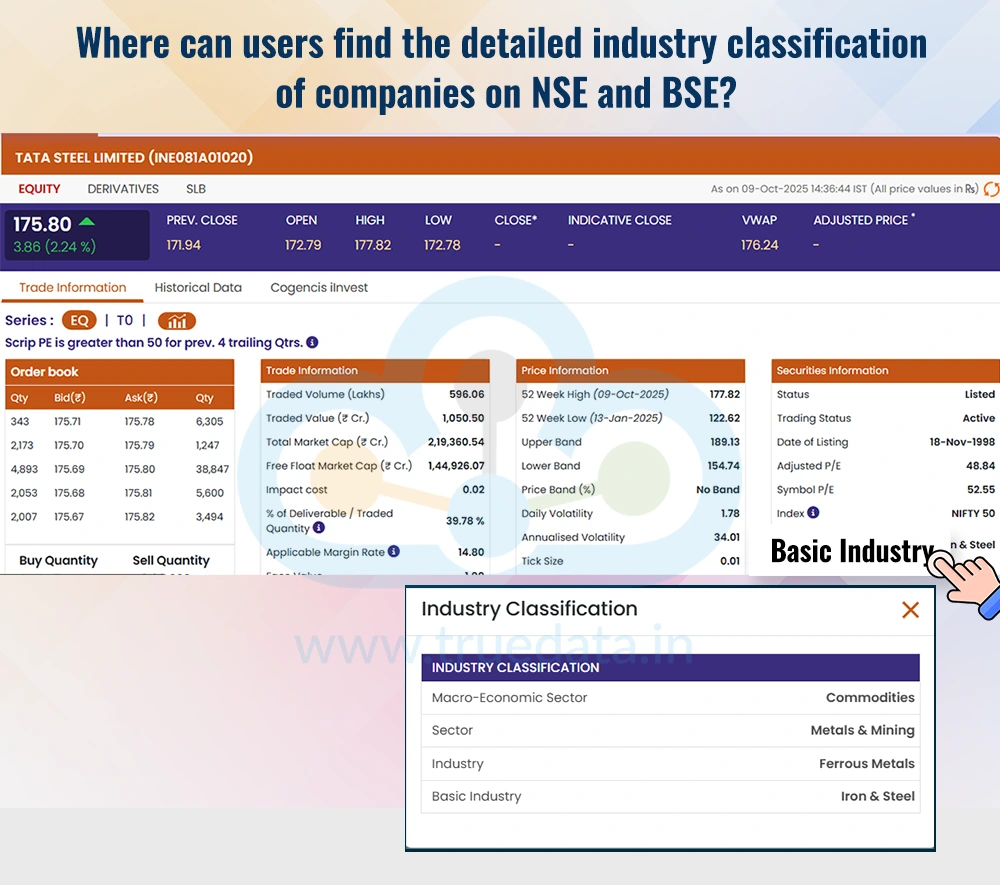

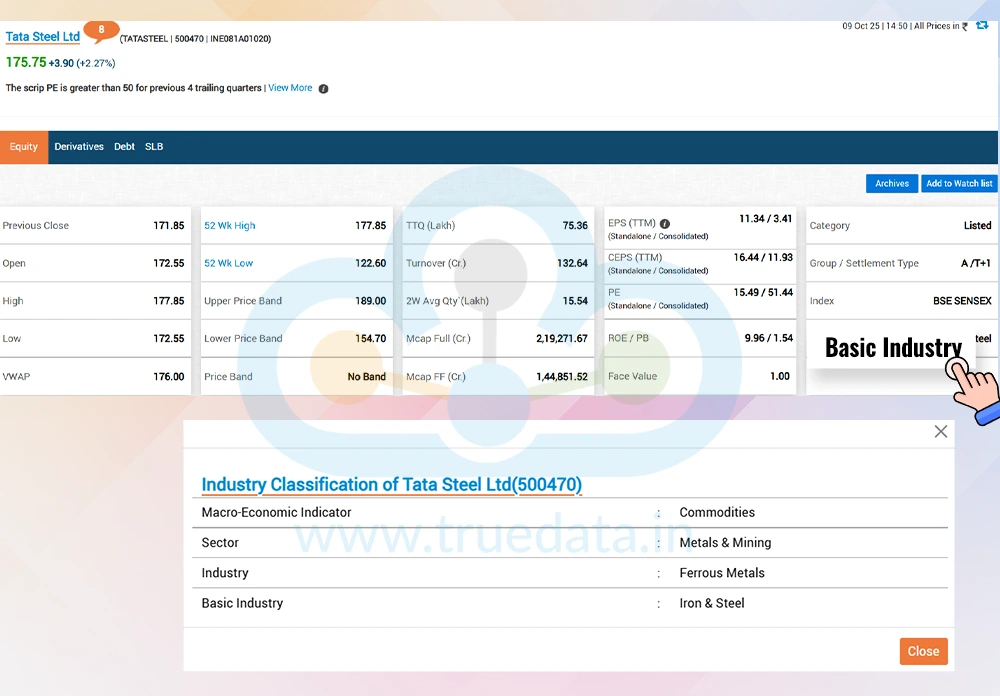

The details of the industry classification of companies on NSE and BSE are displayed in the standard 4-tier format mentioned above. This information is updated on the exchanges from time to time, reflecting any changes or reclassification as per the provisions of the exchanges. Investors can find this information in the following manner.

Visit the official NSE or BSE

Enter the company name in the search bar at the top of the page.

Select the desired company

The key highlight of the company’s stock, including the industry classification, is displayed on the page under the ‘Basic Industry’ section.

The industry classification of companies on stock exchanges (NSE and BSE) is a structured way of grouping companies based on their core business activities. Annual revenues are used as the core basis for this categorisation of companies into a 4-tiered detailed classification, i.e., Macro-Economic Sectors, Sectors, Industries, and Basic Industries. This analysis helps investors in a better understanding of the company and the sector or industry it belongs to, thereby enabling effective comparison and informed decision-making.

This article sheds light on the grouping of companies and their classification based on the industry they belong to. Let us know your thoughts on this topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: How to Analyse a Company Competitive Advantage Using Porter’s Five Forces?

Introduction In an attempt to curb speculative trading, the exchanges move stoc...

Introduction In an attempt to curb speculative trading, the exchanges move stoc...

The start of the year has not brought good news for stock markets around the gl...