What is the most underrated aspect for an economy to thrive? It is the certainty and predictability of business and global partners. However, President Trump is targeting this very fabric of global trade with his barrage of tariffs on international trading partners. Most of these tariffs are already in effect and are rapidly changing and reshaping the world ties. So let's address the main question here: how will these tariffs affect us back home, and will we be the only ones to suffer? Check out this blog to get answers to these questions and more on Trump Tariffs and their ultimate impact on your portfolio.

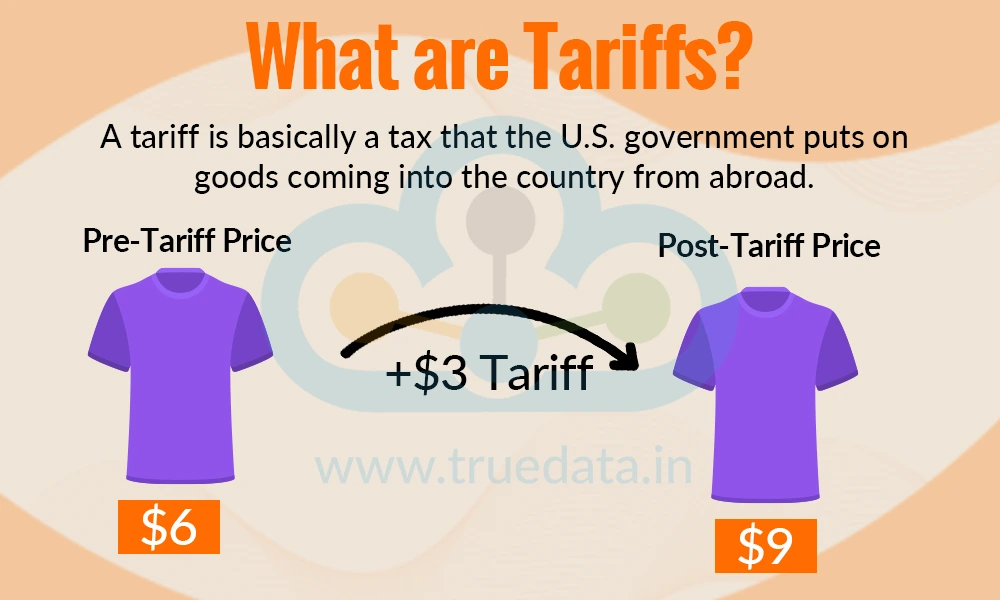

Let us first understand the meaning of tariffs and their intended purpose. A tariff is basically a tax that the U.S. government puts on goods coming into the country from abroad. Imagine you run a shop in America and want to sell clothes made in India. Before your goods can enter the U.S., the government might charge you a certain amount of money (a percentage of the product’s value or a fixed amount per item), which is known as the tariff.

The main purposes of U.S. tariffs are

to make imported goods more expensive so that American-made products look cheaper and more attractive to buyers

to protect local industries and jobs from being undercut by cheaper foreign goods, and

to raise money for the government.

In the U.S., tariffs are legal under its Constitution and trade laws, but they must follow rules set by Congress and international agreements, such as those made through the World Trade Organisation (WTO). However, the President has certain powers to impose tariffs quickly if they believe it is necessary for national security, to counter ‘unfair’ trade practices, or to balance trade deficits. While tariffs have been a long-standing tool in U.S. trade policy, they can also become a source of tension between countries, as seen in the recent trade disputes under President Trump.

President Trump has been riding on the ‘Make America Great Again’ campaign promise ever since he got into office, and an extension of this campaign is the trade wars that he has initiated with countries across the globe. According to President Trump, if a country has a trade surplus against the US, it is deemed to consider that they are taking advantage of the US. To counter this, the US government has been renegotiating the trade deals with their trading partners and imposing a varied degree of tariffs, the baseline tariff being 10%.

While this has been the primary argument for the trade wars, along with other reasons like empowering the American workforce with more opportunities and also arm-twisting countries like India under the guise of broad geopolitics.

Some of the reasons or arguments given by the US for imposing the recent Tariffs are highlighted below.

One of the biggest reasons the U.S. puts tariffs on goods from other countries is to protect its own industries. For example, if steel from another country is much cheaper than US-made steel, American factories might lose business, and workers could lose their jobs. By adding a tariff, the imported steel becomes more expensive, which makes US-made steel more competitive in the market. This is called ‘protectionism’, i.e., protecting local businesses from being harmed by cheaper imports.

A trade deficit happens when a country buys (imports) more from other countries than it sells (exports) to them. The US has a big trade deficit with countries like China, meaning it imports far more than it exports. Tariffs are one way the government tries to reduce this gap. By making imported goods more expensive, the hope is that Americans will buy more local products instead, improving the trade balance.

Tariffs are not only an economic tool but also a political weapon. The US usually imposes sanctions or tariffs as a show of strength or to punish a country for actions unrelated to trade. It is a way to apply pressure without using military force. On a similar note, it has imposed tariffs on India in a bid to stop it from buying Russian Crude Oil, stating that by doing so, India is indirectly funding the Russia-Ukraine war. While this argument is absurd, it also shows the hypocrisy of the Western world and its discomfort with the progress of emerging economies.

Tariffs can make imported goods costlier, which gives U.S. companies an advantage. The idea is that if imports are more expensive, American factories will produce more, which can create jobs and boost the local economy. This is part of the ‘Buy American’ approach.

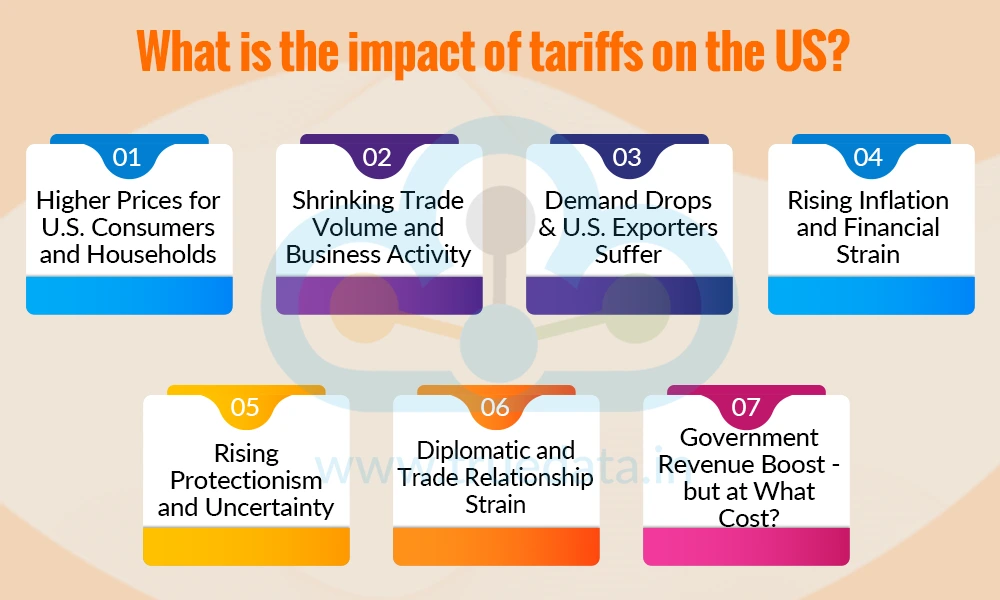

The US tariffs have already been implemented, barring a few cases where the trade deals are yet to be signed or the US has hit a temporary pause on the levy of tariffs, for example, China. The impact of these tariffs, although not entirely, can be seen on the US economy in the form of rising prices. The full effect of these tariffs is yet to be seen in the coming days. However, let us discuss the broad scope of these tariffs and how they can affect the US economy in the coming days, if not already in some ways.

Tariffs are like extra taxes on imports, and unfortunately, the cost often passes on to U.S. consumers. For example, everyday items like groceries, clothing, electronics, and alcohol are becoming noticeably more expensive. Analyses estimate that in the short term, U.S. households may see about a 1.8% rise in prices, which means a potential $2,400 loss per household in income equivalence. Similarly, cars could cost $4,000 to $15,000 more, reducing disposable income by up to $2,000.

Higher tariffs reduce the competitiveness of imported goods, leading to a drop in trade volumes. For U.S. exporters and domestic firms dependent on imports, this can slow production, diminish sales, and result in job losses. Slower business activity can drain the economy of dynamism.

Tariffs not only make goods costlier but also create uncertainty. Businesses may hold off on investing or hiring until they’re sure of policies. For example, American soybean farmers are losing Chinese buyers to Brazil since U.S. tariffs make their prices less competitive. Broader research finds that this type of uncertainty typically slows down investment and can harm sectors dependent on trade.

As imported goods become pricier, overall consumer prices can climb. This type of inflation can dampen consumer spending, which is an important driver of the U.S. economy. This can further result in the push for the Federal Reserve to keep interest rates high longer, making borrowing more expensive for both individuals and businesses.

Tariffs can tempt U.S. firms to shift production domestically, aiming to substitute imports. However, this can backfire as domestic producers may lack efficiency or scale, leading to higher prices or lower product quality. Moreover, unpredictable tariff changes introduce uncertainty, making businesses wary of long-term investments.

Tariffs often trigger tension with trading partners, potentially sparking retaliatory measures. For example, U.S. tariffs on India have heightened tensions, and Indian leaders have pushed back on what they see as unfair decisions. This can raise geopolitical risks, creating uncertainty in markets.

Yes, tariffs bring in more money for the U.S. government, which is one of the reasons for levying them. According to the Committee for a Responsible Federal Budget, monthly tariff revenue has jumped from $7 billion to about $25 billion, with projections of $1.3 trillion extra by 2025 and $2.8 trillion through 2034. Still, these gains can be offset by slower growth, reduced investment, and higher inflation, not to mention legal challenges that may curb revenue if some tariffs are struck down in court.

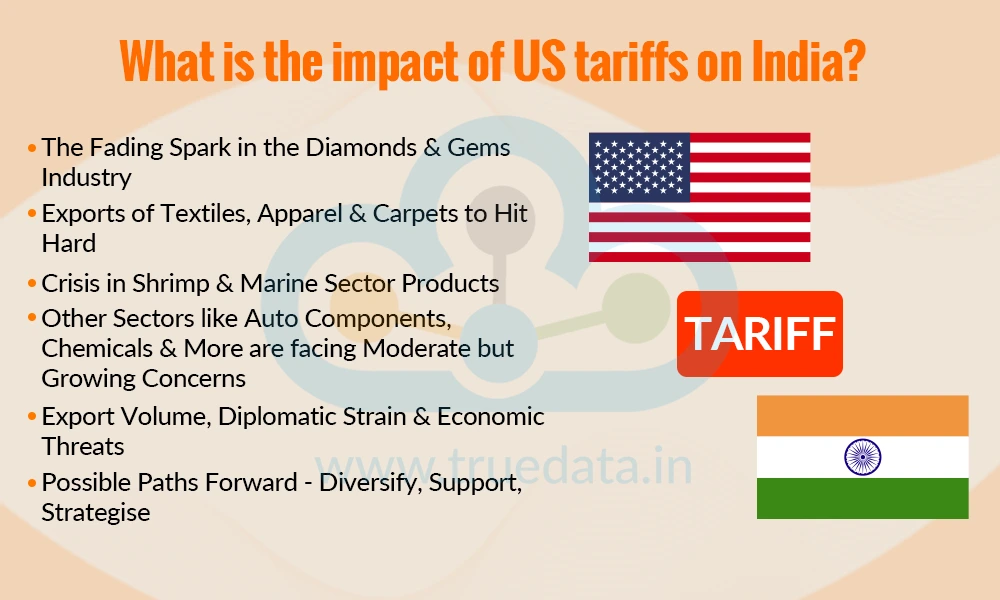

The US tariffs are a tool in the trade wars initiated by President Trump against US trading partners. India is among the many countries bearing the brunt of these trade wars due to a variety of reasons, including our growing reach with Russia, the Global South and even with our traditional nemesis, China, through BRICS. While India was once seen as a counterbalance to the growing Chinese dominance, the US seems to have changed its tune, which may be attributed to recent events, like the ceasefire credit dispute during the India-Pakistan war in May 2025, as well as the US's desire to have unrestricted access to Indian markets at the expense of local businesses and industries.

Reasons aside, India remains among the countries currently facing the highest US tariffs. The impact of the tariffs on the Indian economy can be explained hereunder.

India dominates the global diamond-cutting industry. In 2024, India accounted for 68% of the U.S.’s diamond imports by volume and 42% by value. India’s diamond industry, centred in Surat, processes over 80-90% of the world’s cut and polished diamonds and supports around 6-10 lakh workers. Since April, tariffs rose from 10% to 25%, and have now doubled to 50% by August 27. The consequences are severe and can result in nearly 100,000 job losses, cancelled or delayed orders, and many small factories bringing operations to a halt due to paused orders meant for the festive season that typically bring in half of the year’s sales. India is pushing urgent relief in the form of duty drawback schemes, extended credit, and reimbursement mechanisms to tide over this crisis until December 2025.

These sectors are centred around job-intensive MSMEs. The US is a major buyer in these sectors, receiving 60% of home textiles and 50% of carpets. The 50% tariff has made exports nearly unviable. The manufacturing has ground to a halt in many factories, and the industry workers face job losses as without no or few new orders, and the uncertainty, along with severe competition with countries having lower tariffs, the industry outlook seems gloomy.

India is a key global shrimp supplier, with 48% of U.S. sales coming from Indian exporters. The steep tariffs (now totalling nearly 60% when accounting for additional duties) are pushing these exporters to their limits. The steep tariffs could shrink export volumes, hurting both income and global market share, especially in major states like Andhra Pradesh, West Bengal, and Odisha. Farm-gate prices have dropped, and suppliers are looking at markets like Ecuador or Mexico as alternatives; however, switching markets is easier said than done.

New tariffs significantly hit auto components, threatening a 15-20% drop in exports and affecting nearly 8% of India’s production in this sector. Pharmaceuticals, energy products, electronics, and solar panels are exempt from the highest tariffs. Ready-made garments, agrochemicals, and capital goods have moderate exposure. These sectors will have tougher conditions but may partly absorb or pass on costs.

The U.S. takes about 20% of India’s merchandise exports, which contributes 2% to India’s GDP. Think tank ICRIER warns that up to 70% of India’s exports to the U.S. could be affected. Indian stock markets responded swiftly, and export-linked sectors saw stock drops of up to 6% and export volume fears triggered a cautious sentiment. Former RBI Governor Subbarao warns that the tariffs could shave 50 basis points off India’s economic growth, deepening recovery challenges. Diplomatic and strategic ties are under heavy pressure, and analysts suggest these tariffs are less about trade and more about geopolitical signalling, thus raising questions about trust, autonomy, and alignment.

The industry participants are looking at the government for support through measures like interest subsidies, moratoriums, and incentives tied to employment. This will help cushion the impact of tariffs on these sectors. Ahead of the tariff deadline, gem and jewellery exporters reported a 16% spike in exports in July, partly by speeding up shipments to beat the higher duties. India has moved quickly to sign free-trade agreements with the UK, UAE, Australia, and the European Free Trade Association, allowing near-zero duty access on many lines. Furthermore, rating agency S&P says India’s macroeconomic strength and global trade network help shield it against full-blown economic disruption

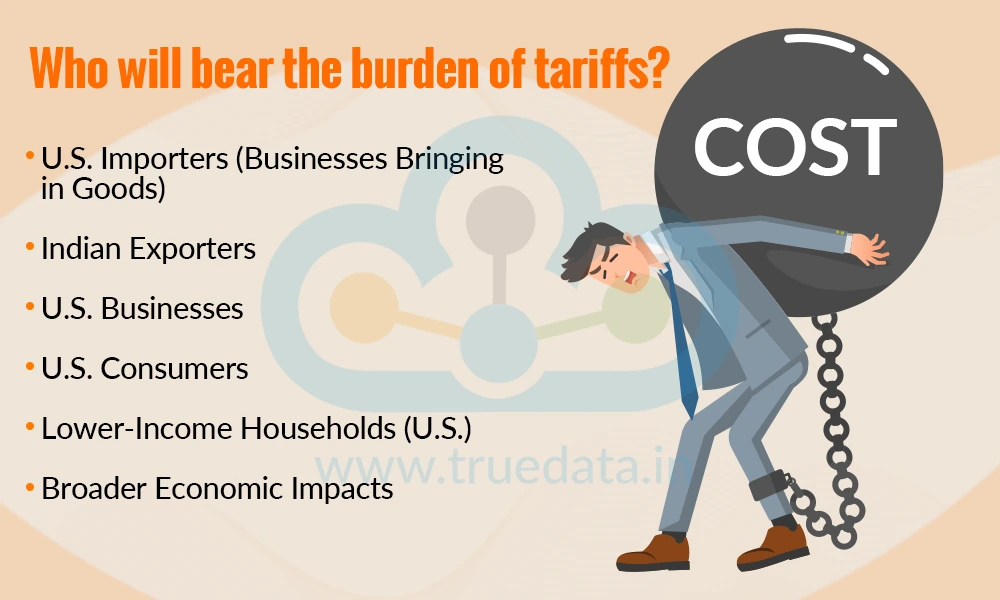

Tariffs do not just affect one group; rather, they ripple across exporters, importers, businesses, and consumers in the U.S., while also squeezing Indian sellers. The net effect of these tariffs or the breakdown of the burden shared by the parties involved is explained below.

U.S. Importers (Businesses Bringing in Goods) - Legally, U.S. importers (like retail or wholesale companies) are the ones who pay tariffs at the border. However, just paying the tariff does not mean they bear all the cost, as negotiations can shift it elsewhere.

Indian Exporters - Exporters in India may see pressure to lower their prices if their U.S. buyers demand it. This can reduce their profits. The extent of tariffs they absorb depends on their contract terms, market competition, and negotiating power.

U.S. Businesses - Many U.S. businesses absorb a part of the tariff cost themselves, especially in the short term, to avoid losing customers. According to Goldman Sachs, so far, U.S. businesses have borne about 64% of the tariff burden.

U.S. Consumers - Over time, businesses increasingly pass costs down to consumers through higher prices. Goldman Sachs expects that eventually, U.S. consumers could bear up to two-thirds of the tariff cost.

Lower-Income Households (U.S.) - Tariffs act like a regressive tax, and those with lower incomes are hit harder proportionally. Even though higher-income households pay more in absolute dollars, lower-income groups lose a larger share of their income.

Broader Economic Impacts - Studies show tariffs reduce overall economic output and lower national welfare, benefiting only a few protected industries while harming the larger economy. The disruptions often lead to job losses in industries that rely on imported inputs, even if jobs are gained in the protected sectors.

We have discussed the nature of these tariffs and their impact on the domestic and international markets. Now, let us address the core question that concerns every average investor, what should they do and how do they safeguard their portfolio? Here is a quick guide to help you navigate these murky waters.

Diversify Your Portfolio - Do not put all your money in sectors directly hit by tariffs (like gems, jewellery, textiles, seafood). Spread investments across industries less dependent on U.S. exports, such as domestic consumption, IT services, renewable energy, and pharmaceuticals.

Watch Export-Dependent Stocks - Companies heavily dependent on the U.S. market may face falling orders and lower profits. Track their quarterly earnings and consider reducing exposure if signs of a slowdown appear.

Consider Domestic-Focused Businesses - Businesses that serve the Indian market (FMCG, retail, banking, healthcare) will be less affected by tariffs. This can help shield your portfolio from global trade tensions.

Look for Long-Term Opportunities - Market reactions to tariffs can be short-term and emotional. Quality companies with strong fundamentals may become undervalued, thereby creating buying opportunities.

Keep an Eye on Government Policies - India may respond with trade deals, subsidies, or incentives for affected sectors. These policy moves could boost specific industries, thus opening up investment opportunities.

Monitor Currency Movements - Tariffs can weaken the rupee due to lower export revenues. Investors can consider hedging or investing in companies that benefit from a weaker rupee, like IT exporters.

Avoid Panic and Stay Informed - Global trade disputes tend to be cyclical. Reacting too quickly can lock in losses; hence, it is wise instead to follow reliable financial news and data before making big changes.

U.S. tariffs are like a sudden roadblock in global trade, making it costlier for countries like India to sell goods in the American market. While some industries will feel the heat more, the ripple effects can touch the whole economy through slower exports, weaker currency, and lower investor confidence. Still, these challenges are not permanent as economies adapt, businesses find new markets, and governments strike new trade deals. The key for India will be to stay flexible, protect its vulnerable sectors, and turn this disruption into an opportunity to grow stronger at home and diversify its global trade.

This blog is an attempt to explain the ongoing international crisis and its impact on the domestic and international markets. We hope this helps you understand the recent development in a better manner and also safeguards your portfolio from adverse exposure. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till Then, Happy Reading!

Read More: Market Cycles and Their Impact on stock Fundamentals

The Union Budget 2025 created a huge buzz due to its changes in the income tax s...

Taxation is one of the key points to consider while making any career or investm...

The world today is bursting with opportunities, and the spirit of hustling defin...