The world moves in patterns and rhythms, rising and falling, expanding and contracting. The stock market is no different. Just like nature, companies and markets go through phases, each with distinct characteristics. These phases form what are known as market cycles. Understanding these cycles is key to grasping how stocks evolve over time, how fundamentals shift, and how your investment strategy should adapt. Check out this blog to explore the meaning of market cycles and how they can shape your financial decisions.

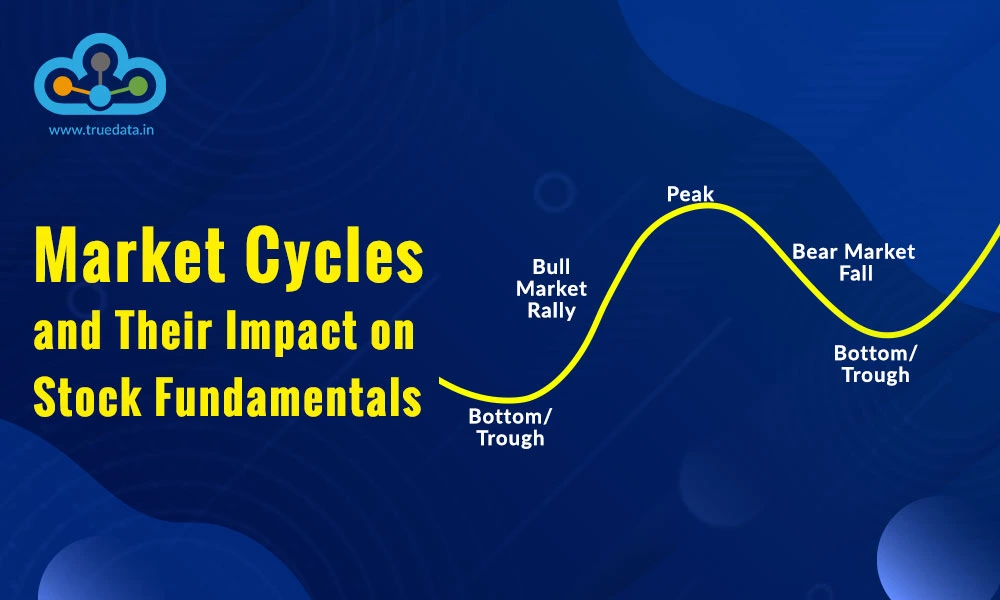

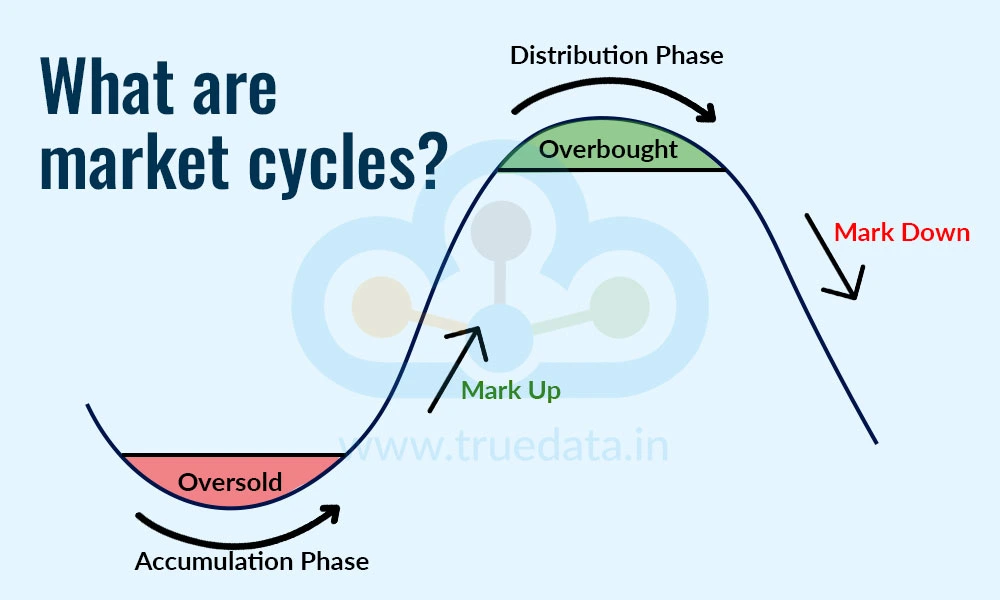

Market cycles are the natural rise and fall of the stock market or economy over time. Just like seasons, summer, monsoon, and winter, the market also moves through different phases. These cycles reflect how businesses grow, slow down, recover, and sometimes struggle. A typical market cycle has four main stages, i.e., accumulation, mark-up, distribution, and mark-down. Understanding each market cycle and its impact on the company and eventually all the stakeholders helps them make smart decisions about when to invest, hold, or sell, rather than reacting emotionally to short-term market moves.

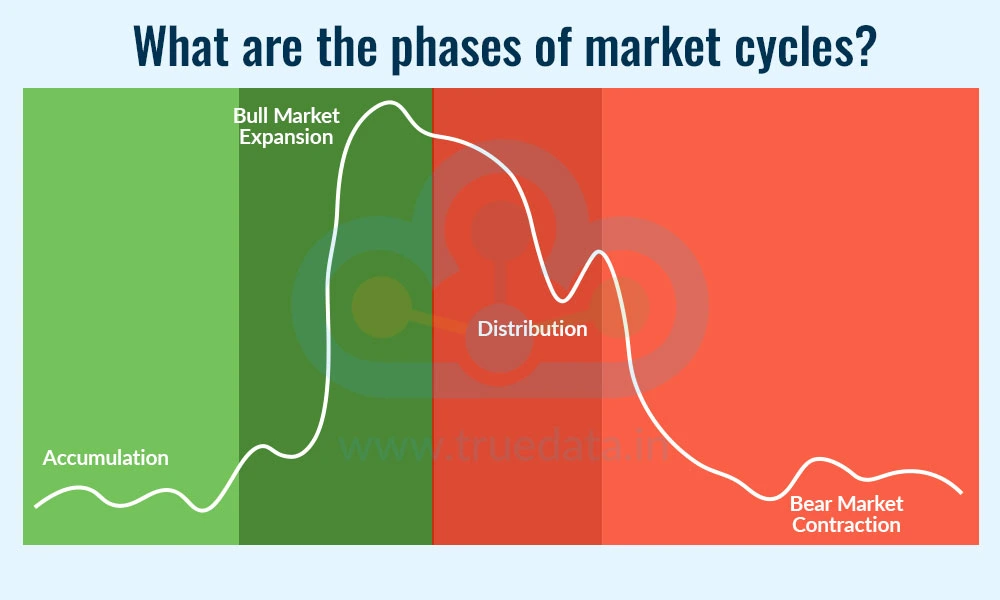

Market cycles are divided into four phases that reflect the market sentiment or the investor behaviour. These phases are explained below.

This is like the calm after a storm and the beginning of a new cycle, usually after a big fall or market crash (bear market). At this point, most investors are scared or unsure about the market, as the news is still negative, and people are hesitant to invest. However, this is when smart investors and experienced investors (like big institutions or long-term players) quietly start buying good quality stocks at low prices. Prices stay low for a while, and the market feels dull with very little excitement. This phase is usually the best time to start investing, but most people miss it because they are still recovering from losses or are too fearful to act.

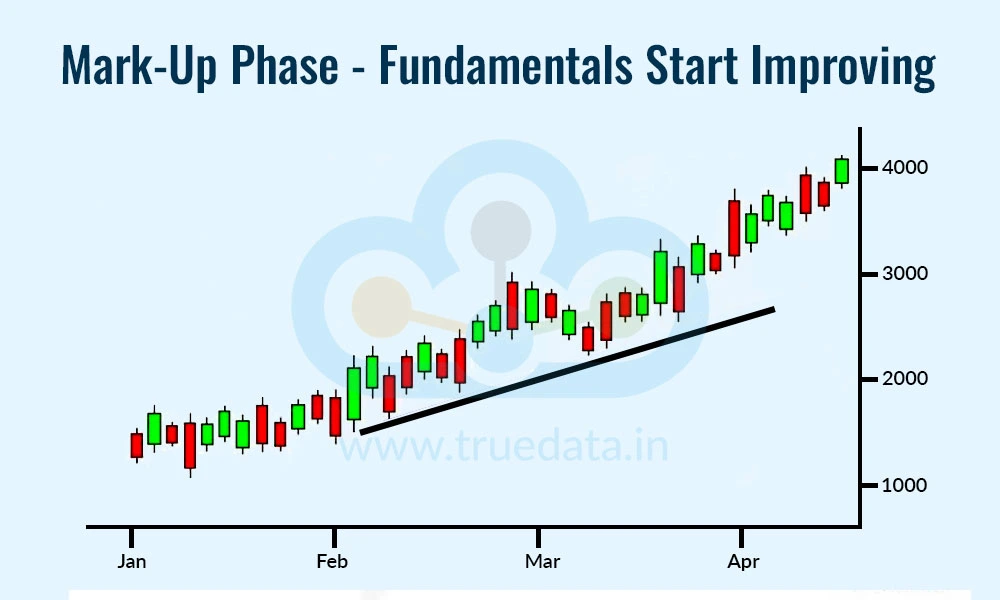

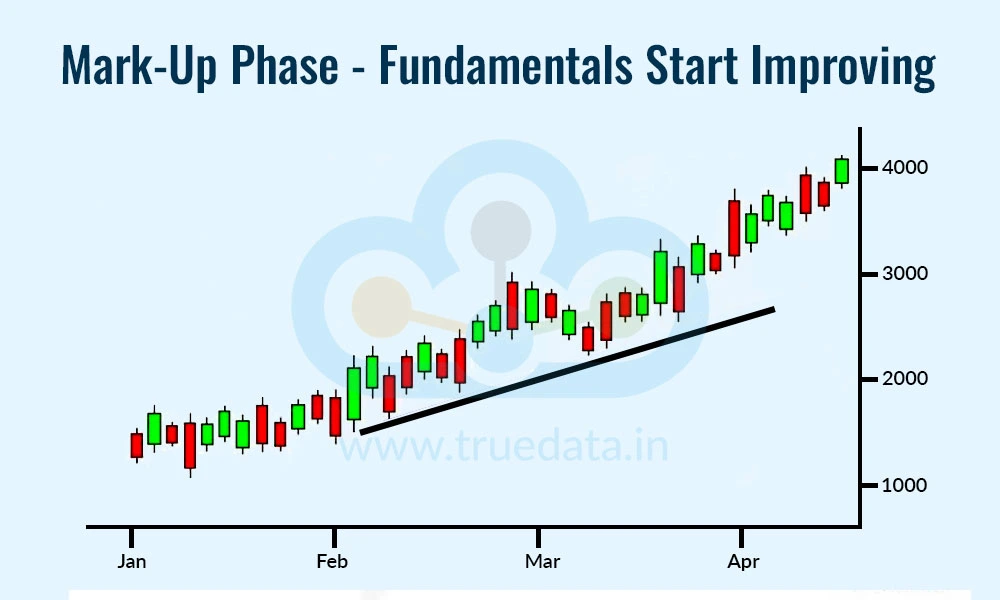

This is the phase where the market rises. There is a surge of confidence in the market where investors start to invest more (rise of a bull market), leading to the market showing signs of recovery. There is an increase in positive news, like better company profits, government reforms, falling interest rates, or economic growth. This leads to new investors entering the market, increasing the demand for stocks, and thus the stock prices. The mark-up phase often sees strong upward movement, and is often the longest and most profitable phase of the cycle. There is a sense of euphoria where everyone seems optimistic, and the stock markets reach new highs.

The next phase is when the market reaches its peak. This is the turning point, and prices stop rising sharply but start moving sideways. The news is mostly positive, and many people believe the market will keep going higher. However, smart investors start becoming cautious. They begin selling their stocks to lock in profits while the market still looks strong. Retail investors, on the other hand, stay invested or keep pouring more money into the market, driven by FOMO (Fear of Missing Out). The media and analysts give mixed reviews, saying the rally will continue, while others warn of a crash. Thus, it is time to be cautious and review the portfolio to rebalance it and book profits where needed.

This is the final phase, or the falling phase, of a market cycle where the stock prices start falling. This is a gradual fall at first, and then as the market catches up, the decline becomes sharper. The market is flooded with negative news, like the falling company fundamentals (poor company results), global issues, inflation and rising interest rates. Investors who bought during the distribution phase may panic and start selling at a loss. This leads to further falls in the market, leading to a bear market. Sentiment turns negative, and many people avoid or exit the stock market. The mark-down phase continues until prices reach very low levels, and the cycle prepares to start again with a new accumulation phase.

Each phase of the market cycle not only affects stock prices but also has an impact on a company’s fundamentals (factors like earnings, revenues, valuations, and investor confidence). Understanding how each phase of the market cycle affects company fundamentals helps investors avoid chasing stocks at the wrong time.

The impact of each phase on the company or stock fundamentals is explained below.

During the accumulation phase, the economy is slowly recovering from a downturn, and most companies have gone through a tough time. Their sales and profits are low, and many are still reporting losses or flat earnings. However, this is when the worst is usually over. Some strong companies begin showing signs of improvement through measures like cost-cutting, reducing debt, or launching new products. Even though the fundamentals may not look great yet, smart investors look for these early signals and start buying good stocks at low prices. Valuations (like P/E ratios) are often cheap in this phase, which makes it a good time to invest in quality businesses for the long term.

As the economy strengthens, company fundamentals begin to improve visibly. Businesses report better sales, higher profits, and more positive guidance for the future. Some sectors like banking, IT, FMCG, or infrastructure might start showing growth. Investor confidence grows, and more people enter the stock market. As earnings rise, valuations also see a gradual increase, but this is generally supported by real growth in performance. This phase often sees new product launches, expansion plans, and job creation. Overall, company balance sheets look healthier, and this attracts both Indian and foreign investors.

In the distribution phase, companies are still posting strong earnings and good results, but the rate of growth slows down. The fundamentals may still look solid on the surface, but deeper analysis might show that the best phase of growth is over. For example, profits may rise but at a slower pace, or sales may flatten in some sectors. Still, investors remain optimistic and keep buying, which pushes stock valuations to very high levels. Stocks often become overvalued, i.e., their prices are much higher than the actual worth of the business. Smart investors start exiting quietly, even though the fundamentals still seem strong.

In the mark-down phase, the economy slows down, and company fundamentals start getting weaker. Businesses may report lower sales, falling profits, rising costs, or other negative indicators. Investors lose confidence, and stock prices fall, sometimes faster than the drop in actual earnings. Many companies may also face debt problems, poor cash flow, or project delays. Even good companies see a decline in their stock prices due to the overall negative sentiment. Valuations become more reasonable or even cheap, but most people are afraid to invest during this phase due to the overall market negativity.

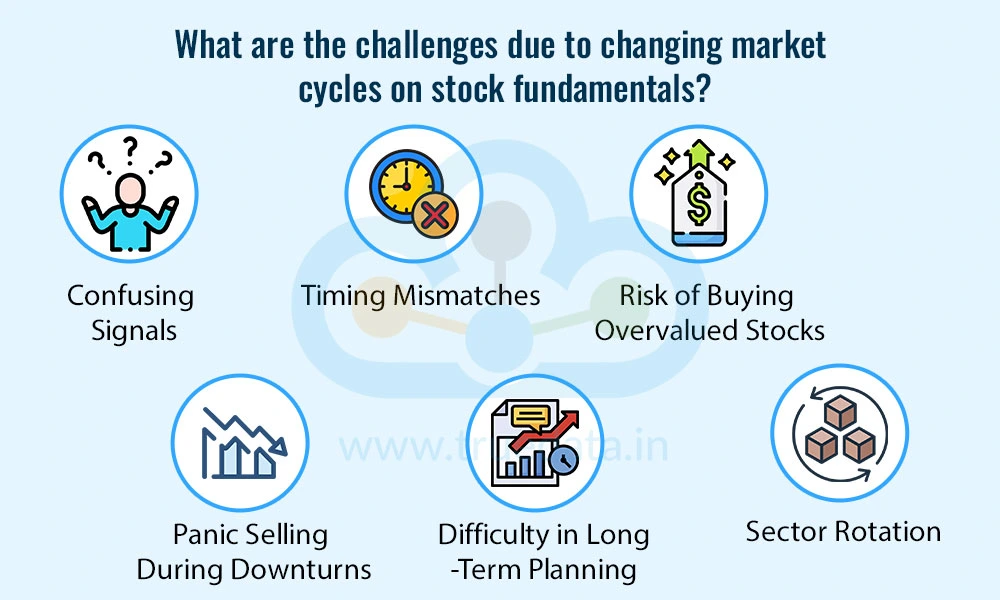

The changing market cycles can pose severe challenges to the company's fundamentals and thus ultimately impact the investors. These challenges are explained below.

During changing market cycles, stock prices often move up or down based on emotion or news and not on company performance. This creates confusion because a stock may fall even if the company is doing well, or rise even if it is not. It becomes hard for investors to understand the difference between real news and market noise.

Stock prices can change very quickly when the market enters a new phase, but company fundamentals like profits, revenue, or growth take time to reflect those changes. This mismatch can mislead investors into thinking something is wrong with the company when it is just a normal market cycle.

In the mark-up or distribution phase, many stocks become overvalued, i.e., their prices are much higher than what the company is actually worth. Investing during this time without checking the fundamentals may lead to losses when the market turns.

When the market enters a downtrend (mark-down phase), even good companies see their stock prices fall. Many investors panic and sell at a loss, thinking the fundamentals are broken when in reality, the company may still be strong and only temporarily affected by the market cycle. This leads to investors losing out on long-term opportunities on good companies affected by market cycles by ignoring strong fundamentals and overreacting to small changes.

Changing market cycles can tempt investors to keep buying and selling based on short-term movements. This makes it difficult to stay focused on long-term goals or stick to a proper investment plan, which can affect overall returns.

In each market phase, some sectors do better than others. For example, banks may perform well when the economy is growing, while pharma or FMCG companies may do better during slowdowns. Thus, tracking market cycles and sector performance is important to avoid holding stocks in sectors that are falling, even if the stock fundamentals are weakening.

Changing market cycles have a direct impact on investors and their portfolios, whether directly or indirectly. This warrants a deep understanding of these market cycles for better control of the portfolio and smart investment strategies. Investors should focus on building robust portfolios with a long-term vision instead of reacting to short-term market ups and downs. A few tips to meet this objective include,

Understanding the phase of the market cycle, i.e., whether prices are low and it is a good time to invest, or whether the market is overheated and it is time to be cautious.

Always look at the fundamentals of the company, like profits, sales, debt, and future plans, rather than just following stock price movements.

Avoid getting carried away by fear when the market falls or by greed when it rises sharply.

Diversify investments across sectors to avoid a drastic impact on the portfolio if one sector performs badly.

Consider using SIPs (Systematic Investment Plans) in mutual funds or quality stocks to invest regularly and reduce the impact of market volatility.

Most importantly, stay patient and have a long-term view of the portfolio.

Market cycles are natural ups and downs in the stock market that affect stock prices, investor behaviour, and company fundamentals. This cycle moves in four phases, where each phase impacts the company's performance and investor decisions differently. Fundamentals like profits, sales, and valuations may improve, slow down, or weaken depending on the phase, while investors face many challenges to keep their portfolio profitable. Thus, understanding market cycles and their impact is important to have a strong portfolio and make confident investment choices.

This article is an effort to provide a deeper understanding of the stock market movements and investor behaviour. Let us know your thoughts on this topic or if you need further information on the same.

Till then, Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

India has seen a tremendous stock market boom in the post-COVID world and this h...

For analyzing the stock markets, Fundamental Analysis and Technical Analysis are...