The Japanese Yen (JPY) has long been one of the world’s major currencies, and it is used widely in international trade and finance. Japan’s central bank, the Bank of Japan (BoJ), controls the country’s monetary policy, including setting interest rates. For years, Japan has maintained extremely low, and sometimes negative, interest rates to stimulate its economy. Low interest rates are designed to encourage borrowing and spending by making loans cheaper. However, these rates can also have broader implications, especially in global economics. Check out this blog to learn about the latest changes in the Japanese interest rates and currency rates and how they have created a ripple effect across the world, especially in the US economy.

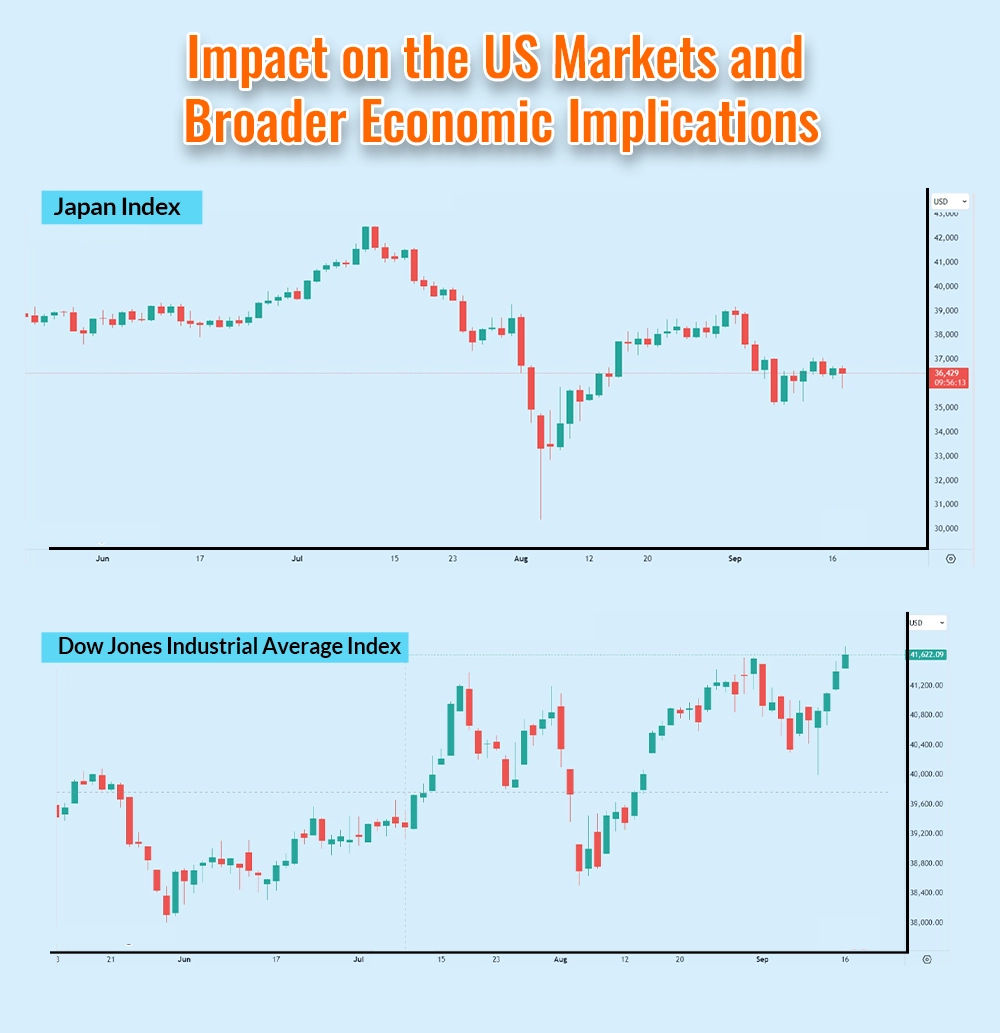

Over the past week, Japan's stock market experienced a sharp and sudden downturn, largely driven by a surprising shift in the value of the Japanese Yen. For more than a year, the weak Yen had fueled a strong rally in Japanese stocks, especially benefiting major exporters like Toyota, whose profits soared as their overseas earnings were boosted. Investors flocked to Japanese stocks, attracted by the potential for high returns. This rally was supported by the significant gap between Japanese and US interest rates, with Japan maintaining ultra-low rates while the US rates climbed.

However, this dynamic abruptly changed when the Bank of Japan unexpectedly raised its key interest rate for the first time in nearly two decades, i.e., from 0.1% to 0.25%. This move, combined with signals from the US Federal Reserve about potential rate cuts, led to a rapid appreciation of the Yen. As the Yen strengthened, particularly crossing the critical 150-yen-to-dollar threshold, panic set in among investors. The concern was that a stronger Yen would erode the profits of Japanese companies, especially those that had benefited from the weak currency. This led to a massive sell-off in Japanese stocks, with indexes like the Topix and Nikkei 225 experiencing their worst declines since major crises in the past.

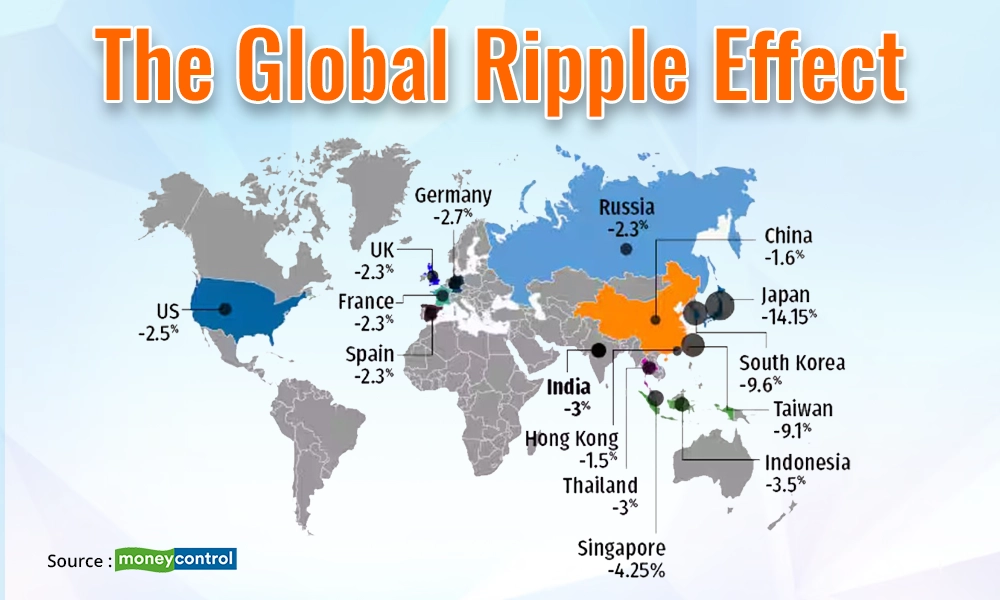

The turmoil in Japan’s stock market has had significant implications for the US economy and financial markets. The strengthening Yen, in response to Japan's interest rate hike, is causing concern for US markets because of the interconnectedness of global economies. As Japanese stocks tumbled, the fear of a broader economic slowdown spread, leading to volatility in the US stock market as well. Investors, worried about the potential impact on global trade and corporate earnings, began pulling out of riskier assets, including stocks.

This uncertainty also drove investors to seek safety in US Treasury bonds, which are considered a secure investment during times of market stress. The increased demand for these bonds pushed their prices up, which in turn lowered their yields. Lower yields on Treasury bonds can have a wide range of effects, such as reducing borrowing costs in the US, including for mortgages, but they can also complicate the Federal Reserve's efforts to manage inflation.

The future outlook remains uncertain. If the Yen continues to strengthen and Japan's market instability persists, it could lead to prolonged volatility in global markets, including in the US. The strength of the Yen and its impact on Japanese corporate profits will be crucial in determining whether the recent stock rally was sustainable or merely a bubble inflated by currency weakness. For the US, ongoing fluctuations in bond yields and potential changes in Federal Reserve policy could further influence economic stability. In both Japan and the US, investors and policymakers will be closely watching how these dynamics unfold in the coming weeks.

The recent turmoil in Japan's stock market, driven by a sudden strengthening of the Yen and shifts in monetary policy, is causing significant global ripple effects, particularly in the US. The weakening Yen had previously fueled a stock rally in Japan, but its rapid appreciation has now exposed the fragility of that rally, leading to market instability. This instability is influencing investor sentiment worldwide, sparking volatility in both Japanese and US markets. The increased demand for US Treasury bonds as a safe haven is impacting bond yields, while potential changes in Federal Reserve policy add to the uncertainty. As Japan's economic challenges unfold, the situation is being closely monitored by investors and policymakers globally, highlighting the interconnected nature of modern economies and the importance of these developments for the broader global market.

The US-Japan is one of the world's strongest currencies and the most traded currencies. The relationship between these countries is further complicated with Japan being the biggest investor in the US. At the end of 2023, Japan held the largest amount of U.S. treasury securities among foreign countries, with its banks, pension funds, insurance companies, and other financial institutions collectively owning $1.138 trillion worth of these assets. However, by April, Japan's holdings had decreased slightly to $1.128 trillion, down from $1.15 trillion. Despite this reduction, Japan continues to be the largest foreign holder of U.S. treasury securities, reflecting its significant role in global financial markets. The world is watching the latest developments in the Japanese markets and their ripple effect on the global economies with hawk eyes to take timely action to buffer the impact.

This article talks about the recent developments in the Japanese economy and its impact on the world, especially the US. Watch this space to know more on this topic as well as on similar global events that impact investors and economies as a whole.

Till then Happy Reading!

Read More: Relationship between Macroeconomic Factors and Indian Stock Markets

Cryptocurrencies A Cryptocurrency is an advanced payment system that doesn't de...

In the world of high-speed trading, success often hinges on capitalising on even...

Another year, another Union Budget. On 1st February 2026, the Modi government pr...