As the world shifts toward advanced technologies and clean energy, metals like silver, lithium, and rare earth minerals are becoming the new gold. This surge in demand has sparked a wave of theme-based mutual funds focused on these critical resources. Check out this blog to know why these energy and metal-focused funds are gaining traction and how they could add a spark to your investment portfolio.

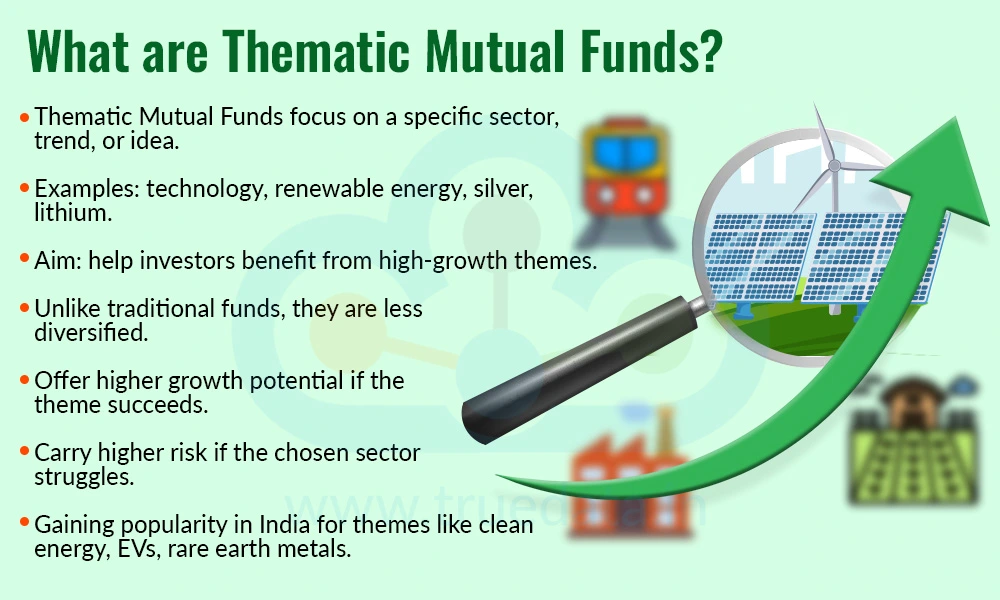

Thematic Mutual Funds are a type of investment fund that focuses on a specific sector, trend, or idea in the economy rather than spreading investments across all kinds of industries. For example, a fund may focus only on technology companies, renewable energy, or precious metals like silver and lithium. The idea is to let investors benefit from the growth potential of a particular theme or trend that they believe will perform well in the future. While traditional mutual funds aim for broad diversification, thematic funds are more targeted, which means they can offer higher growth if the theme succeeds. However, they also carry a higher risk if that sector faces challenges. These funds are becoming popular in India as investors look for opportunities in fast-growing areas like clean energy, electric vehicles, and rare earth metals.

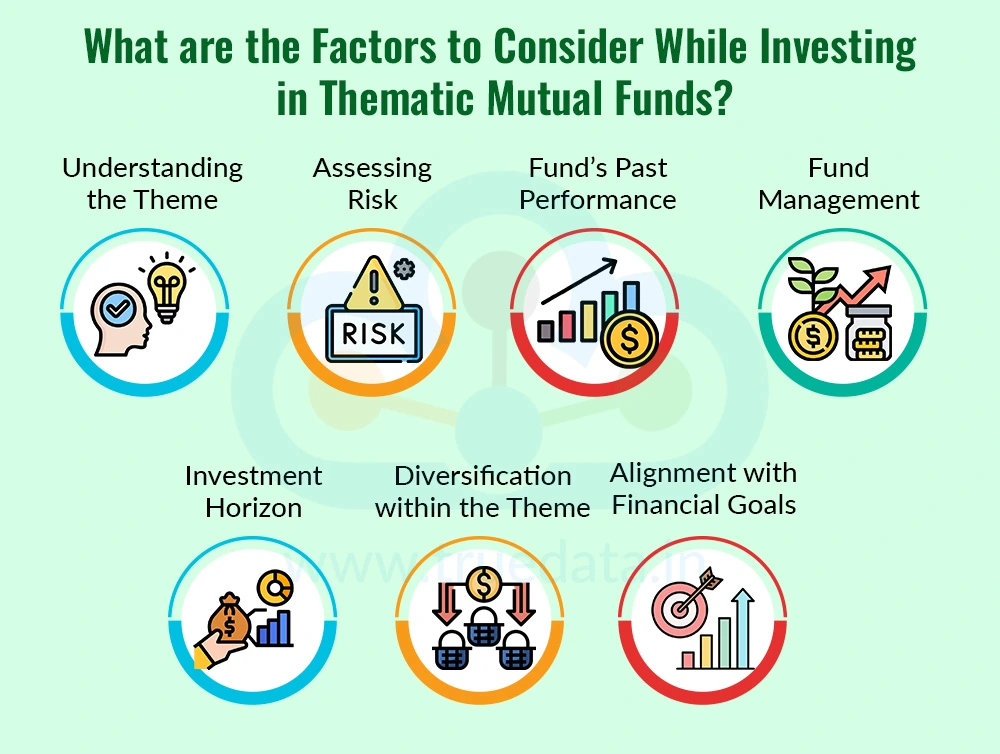

Investing in thematic mutual funds is relatively less popular than investing in more traditional categories like mid-cap, large-cap or ELSS Funds. This is largely due to the low awareness or risk appetite of the average inverter in India. However, this scenario is fast changing, especially among the young investors with a more aggressive approach. The factors to be considered while investing in thematic mutual funds include,

Understanding the Theme - Investors should first understand the theme of the fund. Whether it focuses on silver, lithium, renewable energy, or technology, knowing what drives growth in that sector is important. A clear understanding helps investors assess potential opportunities as well as risks.

Assessing Risk - Themed funds can be riskier than regular diversified funds because they focus on a single sector. Investors should consider whether they are comfortable with potential ups and downs and how much of their portfolio they want to allocate to this fund.

Fund’s Past Performance - It is important to check how the fund has performed over the past few years. While past performance does not guarantee future returns, it provides an idea of how well the fund has managed investments in its chosen sector compared to similar funds.

Fund Management - The experience of the fund house and the fund manager is crucial. Skilled management can help navigate market fluctuations and make the most of sector-specific opportunities.

Investment Horizon - Themed funds are generally more suitable for medium to long-term investments. Sectors take time to grow, so investors are advised to stay invested for a few years to maximise potential returns.

Diversification within the Theme - Even within a single sector, some funds invest in a mix of companies or sub-sectors. Investors should check how diversified the fund is within its theme, as this can help reduce risk.

Alignment with Financial Goals - Investors should ensure that investing in a themed fund fits their overall financial goals. These funds are best for investors who are willing to take moderate to high risk for potentially higher returns, rather than for those seeking guaranteed or stable income.

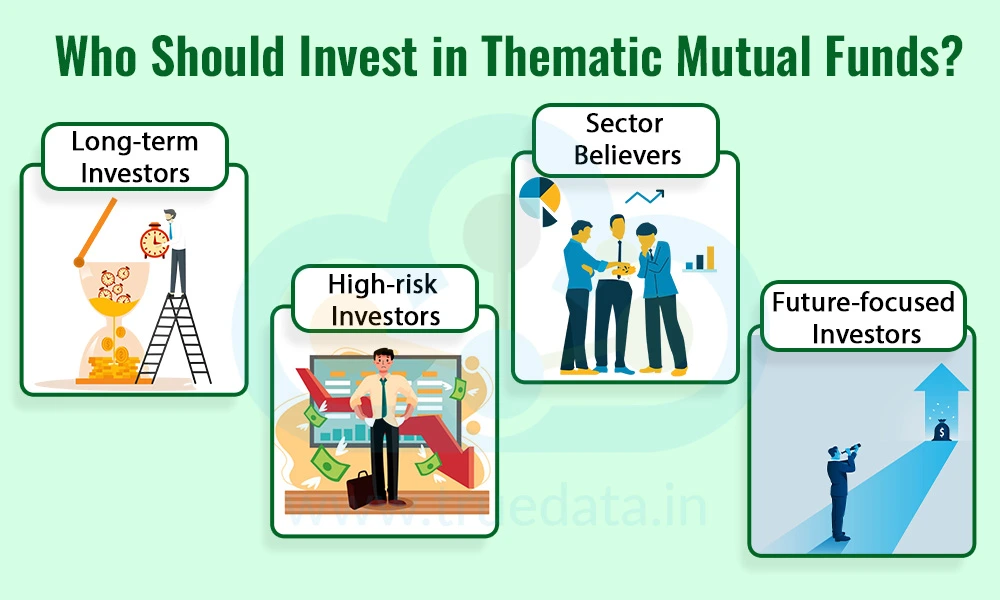

Thematic mutual funds are best suited for investors who have a strong belief in the long-term growth of a particular sector or idea and are willing to take higher risks for potentially higher rewards. These funds are not ideal for someone looking for stable or guaranteed returns, as they focus on specific themes like technology, clean energy, infrastructure, or metals such as silver and lithium, which can see sharp ups and downs depending on market conditions. They are more suitable for investors with a medium- to long-term horizon, usually five years or more, since it can take time for the chosen sector to deliver meaningful growth. Thematic funds are also better for those who already have a diversified portfolio of regular equity funds and debt funds, and now want to add an extra layer of targeted exposure to high-potential trends. In short, these funds are meant for investors with moderate to high risk appetite, patience, and a desire to participate in future-focused growth stories.

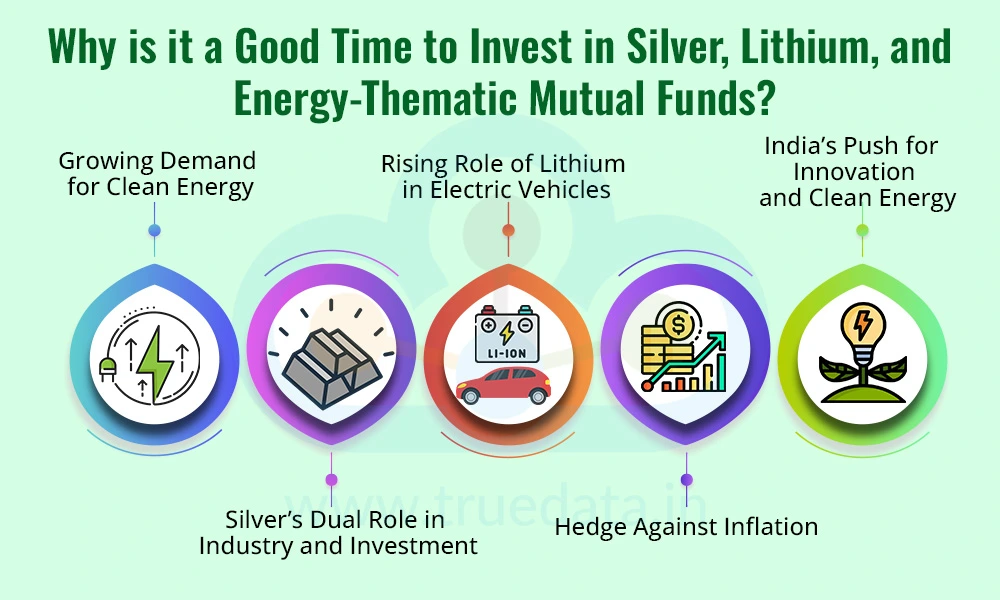

Silver, Lithium and rare earth magnets and minerals are commodities that are instrumental in reshaping technologies and, by extension, the world order, as seen in the recent US tariff disputes. Some of the reasons that make this an opportune time for investing in silver, lithium, and energy-based thematic mutual funds are,

The world is moving quickly towards cleaner and greener energy. From solar panels to electric vehicles, renewable energy sources are replacing traditional fuels. This shift creates a huge demand for metals like lithium, silver, and other rare minerals that are essential for making batteries, charging systems, and energy storage solutions. As India also pushes towards renewable energy and electric mobility, these sectors are likely to grow further, making it a good time to invest.

Silver is not only a traditional precious metal but also a key industrial material. It is used in solar panels, electronics, and medical equipment. This dual role makes silver unique because its value can rise both as an investment asset and as a commodity driven by industrial demand. With global green initiatives, silver demand is likely to remain strong, as evidenced by the recent price increases over the past few months.

Lithium is often called the ‘white gold’ of the energy industry because it is the key material used in making rechargeable batteries. With global sales of electric vehicles (EVs) increasing every year and India planning to expand its EV adoption, the demand for lithium is expected to rise sharply. Thematic funds focusing on lithium give investors exposure to this growing market.

During times of high inflation, metals like silver or gold have historically acted as a safeguard in such situations, as their value usually holds steady or even goes up when inflation is high. Therefore, including silver through thematic mutual funds can provide a layer of protection in their portfolio. This way, even if rising prices affect other investments or everyday expenses, the value of silver-linked funds can help balance the impact and preserve wealth over the long term.

India is actively promoting clean energy, electric mobility, and self-reliance in critical minerals through subsidies for EVs, solar power projects, and investments in battery manufacturing. At the same time, rapid technological advancements in areas like artificial intelligence, smart grids, and energy storage are driving new uses for metals such as lithium and silver. Together, these government initiatives and innovations create a strong foundation for long-term growth, making thematic funds in energy and rare metals an attractive opportunity for investors.

Investing in thematic mutual funds can be a high-risk, high-reward scenario, and thus requires a thorough understanding of the pros and cons of investing in such funds. Here is a brief analysis of the pros and cons of investing in Silver, Lithium and Energy-based thematic mutual funds.

These funds allow investors to participate in high-growth global trends such as renewable energy, electric vehicles, and advanced battery technologies.

Precious metals like silver provide stability during inflation, helping to protect purchasing power when prices rise.

The increasing demand for lithium, driven by the electric vehicle revolution, offers strong long-term growth potential.

Professional fund management makes it easier for investors to access opportunities in global markets that might otherwise be difficult to reach individually.

They offer diversification beyond traditional equity and debt funds, giving exposure to future-focused sectors.

Since these funds focus on just one sector or theme, they are riskier than diversified funds. If that sector does poorly, the investor’s returns can drop sharply.

Prices of metals like silver and lithium can rise or fall quickly due to global supply and demand changes, trade policies, or geopolitical tensions. This makes returns uncertain in the short term.

Thematic funds focusing on silver, lithium, or energy are still few in India compared to broader categories. This limits investor choices and may reduce flexibility in picking funds.

These sectors may take years to show their true growth potential. Investors must be patient and ready to stay invested for the medium to long term rather than expecting quick profits.

These funds carry moderate to high risk, so they may not be the right choice for conservative investors who want steady income or capital safety. They are better suited for those with a higher risk appetite.

The rise of silver, lithium, and energy-themed mutual funds offers Indian investors an opportunity to participate in fast-growing sectors like clean energy, electric vehicles, and advanced battery technologies. These funds can provide an opportunity for both growth potential and diversification for a well-rounded portfolio. These funds can be a valuable addition for investors with a medium to long-term horizon and a moderate to high risk appetite.

This post sheds light on an emerging theme of mutual funds to help investors understand the global changes in a better light and make informed portfolio decisions. Let us know your thoughts on this topic or if you need further information on the same and we will address it.

Till then, Happy Reading!

Read More: Record High Mutual Fund Inflows in India - What it Means for Average Investors?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...