The volatility of the stock markets is one of the biggest deterrents for investors to invest in equities. This is why mutual funds are a highly popular investment mode as they offer the benefits of investment in equities at diversified risks. While conservative investors prefer to invest in large-cap funds for their relative stability and long-term appreciation, mid-cap funds also offer a good investment option for investors looking to invest in companies with good growth potential at moderate risks. So let us delve into the world of mid-cap funds and see what makes them a good investment option.

Mid-cap funds are mutual funds that invest in companies that rank between 101th to 250th in the stock markets in terms of market capitalisation. These funds aim to strike a balance between the stability of large-cap funds and the growth potential of small-cap funds by investing in companies with strong fundamentals and the potential to become industry leaders often due to their technological advancements and competitive niches. This offers investors a chance to benefit from companies with the potential for substantial growth while managing a moderate level of risk.

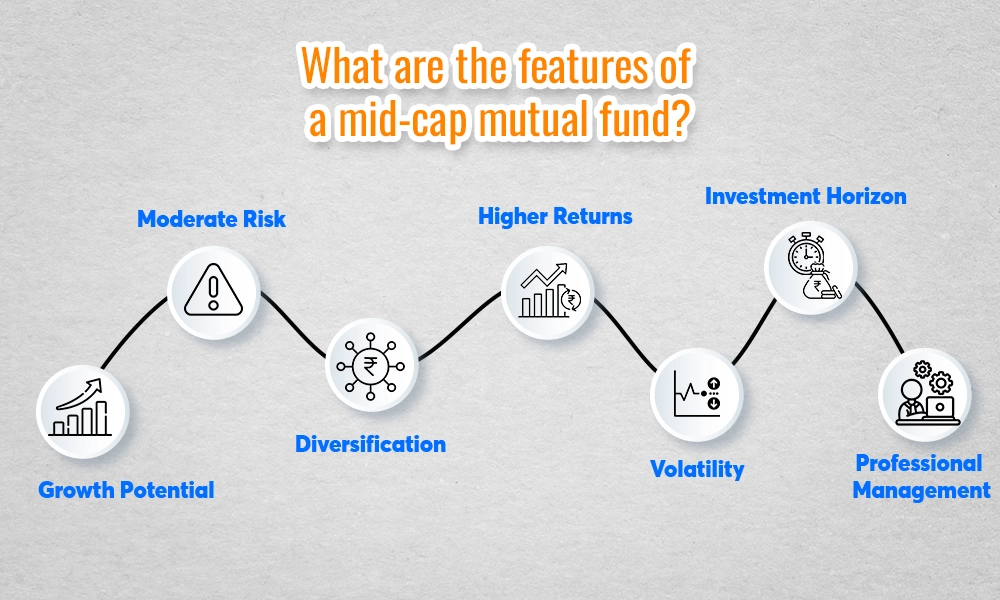

Some of the top features of mid-cap funds are,

Growth Potential - Mid-cap companies often have significant room for expansion, offering higher growth prospects compared to large-cap companies.

Moderate Risk - These funds carry more risk than large-cap funds but less than small-cap funds, making them a middle-ground investment.

Diversification - Investing in mid-cap funds provides diversification, spreading investment across various sectors and companies.

Higher Returns - Historically, mid-cap funds have the potential to deliver higher returns than large-cap funds, especially during economic growth phases.

Volatility - While less volatile than small-cap funds, mid-cap funds can still experience price fluctuations, requiring a longer investment horizon to ride out market volatility.

Investment Horizon - Ideal for investors with a medium to long-term investment horizon (typically 5-7 years or more), allowing time to capitalise on the growth potential.

Professional Management - Managed by experienced fund managers who analyse and select promising mid-cap stocks, reducing the need for individual stock selection.

Now that we have seen the features of mid-cap funds, let us focus on the factors that need to be considered while investing in them.

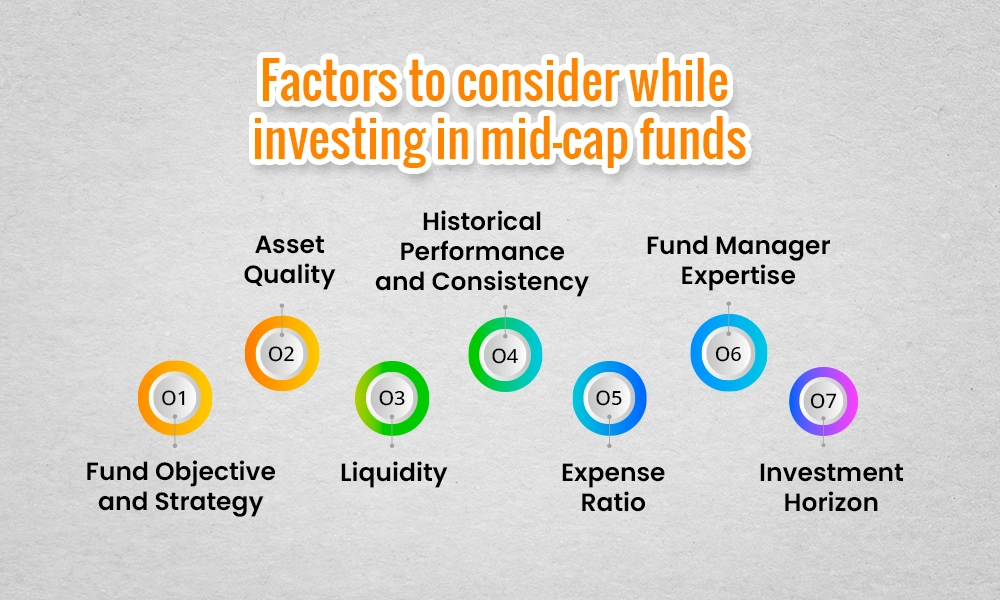

When investing in mid-cap funds, it is essential to understand the fund's objective and strategy. Each mid-cap fund has a specific goal, such as focusing on growth, value, or a mix of both. Investors should ensure that the fund's strategy aligns with their own investment goals and risk tolerance. Knowing how the fund plans to achieve its objectives can help investors determine if it fits their financial plan.

Asset quality is a crucial factor in evaluating mid-cap funds. High-quality assets typically represent companies with strong financial health, low debt, and consistent earnings growth. Investing in funds that focus on high-quality assets helps mitigate risks and ensures that the investment is backed by fundamentally sound companies. This can provide greater stability and potential for long-term growth.

Liquidity refers to how easily shares of the mid-cap fund can be bought or sold without significantly affecting the fund's price. Mid-cap funds may have lower liquidity compared to large-cap funds due to less trading volume. Investors need to consider liquidity to ensure they can access their money when needed without facing substantial price changes or delays in transactions.

Reviewing the historical performance and consistency of returns of mid-cap funds is vital. While past performance does not guarantee future results, it provides insights into how the fund has managed different market conditions. Similarly, consistent returns with fewer fluctuations are often more desirable, as they indicate the fund manager's ability to maintain performance across varying market environments.

The expense ratio is the annual fee charged by the fund for managing investments. A lower expense ratio means that more of the investor's money is working for them, rather than being consumed by fees. Comparing the expense ratios of different mid-cap funds helps investors choose funds that offer better value, maximising their potential returns.

The expertise of the fund manager plays a significant role in the success of mid-cap funds. Experienced fund managers analyze market trends, evaluate company fundamentals, and make informed investment decisions. Investors should look for funds managed by reputable and seasoned professionals, as their expertise can significantly impact the fund's performance.

Mid-cap funds are best suited for investors with a medium to long-term investment horizon, typically 5-7 years or more. This period allows investors to ride out market volatility and fully benefit from the growth potential of mid-cap companies. Understanding the appropriate investment horizon helps investors set realistic expectations and stay committed to their financial goals.

Mid-cap funds are ideal for investors with a medium to long-term investment horizon, typically 5-7 years or more, seeking a balance between risk and reward. These investors should be comfortable with moderate levels of risk and market volatility, as mid-cap companies can experience significant price fluctuations. Mid-cap funds are suitable for those who are looking for higher growth potential than what large-cap funds typically offer, and who are willing to invest in companies with the potential to become market leaders.

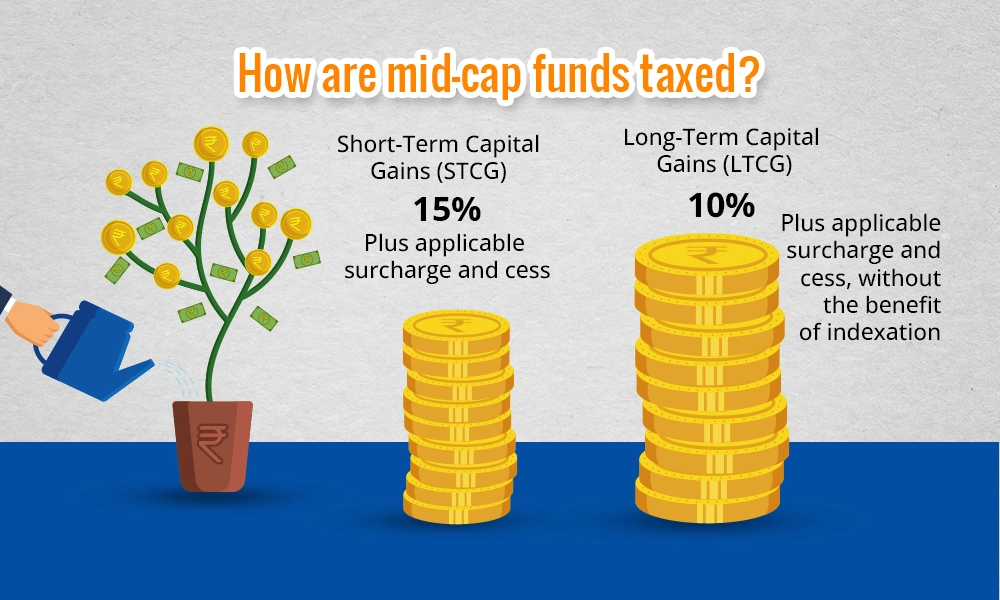

Mid-cap funds are taxed along the lines of equity mutual funds as per the Income Tax Act, 1961. Income from mid-cap funds is in the form of dividends and capital gains. The dividends from mid-cap funds are taxed in the hands of the investors as per their applicable slab rates. The details of capital gains tax on mid-cap funds are explained hereunder.

Short-Term Capital Gains (STCG) - If units of mid-cap funds are sold within three years of investment, the gains are classified as short-term capital gains. These are taxed at a rate of 15% plus applicable surcharge and cess.

Long-Term Capital Gains (LTCG) - If units are held for more than three years before being sold, the gains are considered long-term capital gains. LTCG exceeding ?1 lakh in a financial year are taxed at 10% plus applicable surcharge and cess, without the benefit of indexation.

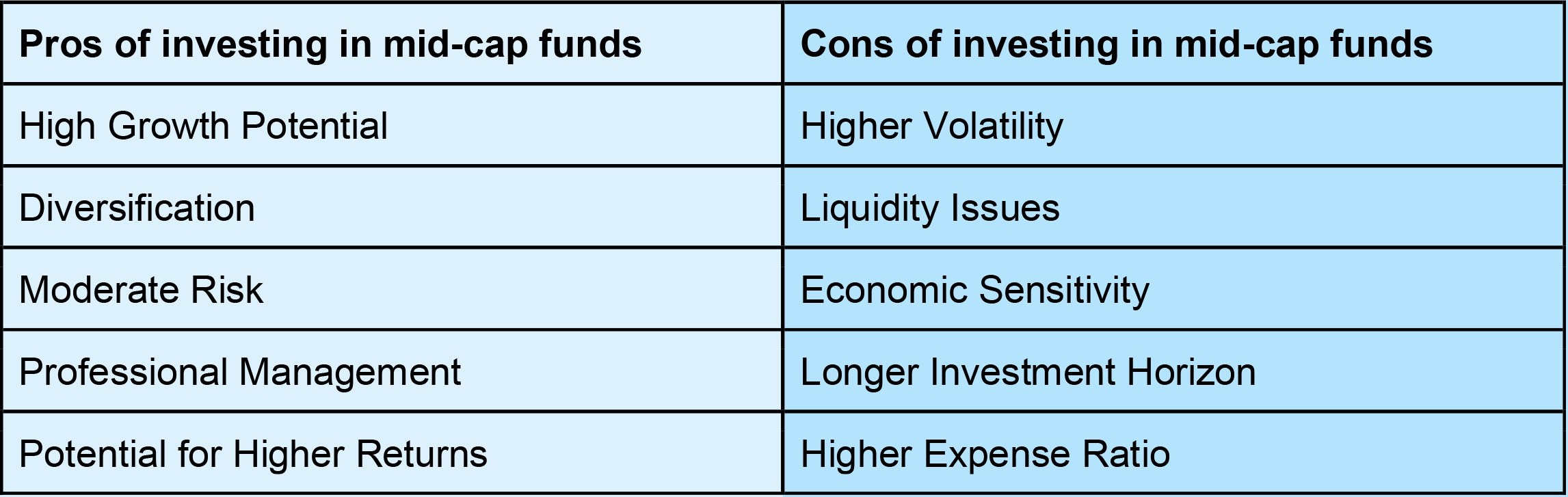

The pros and cons of investing in mutual funds are tabled hereunder.

Here are the top mutual funds in the mid-cap segment based on their net assets and rating*.

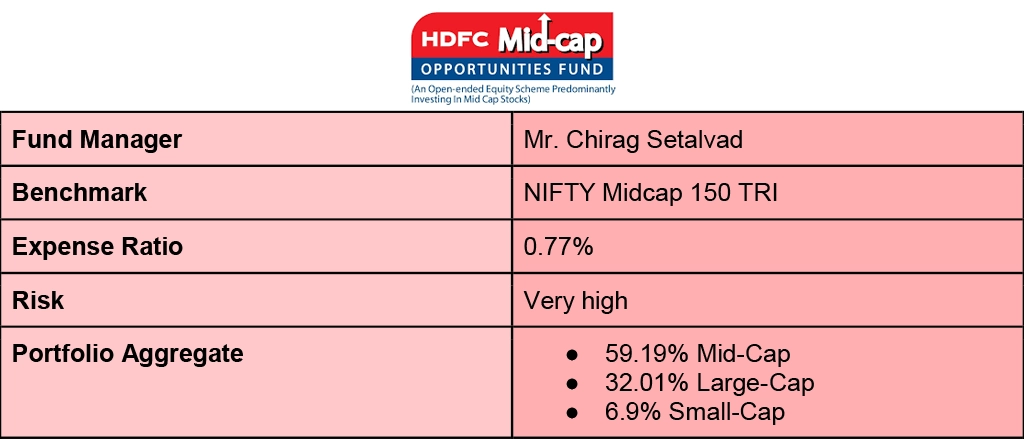

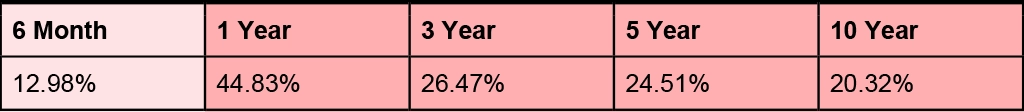

This scheme aims to provide long-term capital appreciation to its investors by investing predominantly in mid-cap stocks that align with its investment strategy. The fund seeks to identify and invest in companies with strong growth potential to capitalise on their future growth prospects.

The key details of the fund are,

The trailing returns of the fund as of 5th June 2024 are,

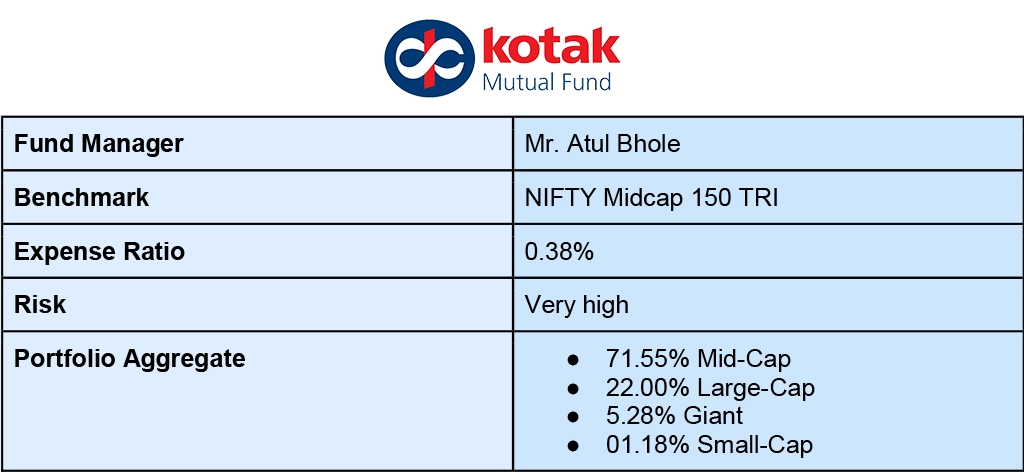

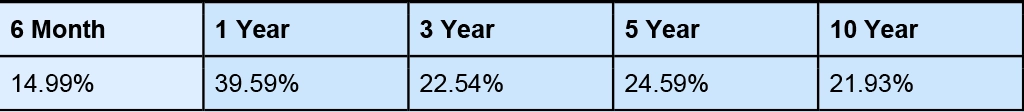

The Kotak Emerging Equity Fund - Direct Plan is a mutual fund scheme offered by Kotak Mahindra Asset Management Company. The primary objective of this fund is to generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of mid-cap companies. The fund aims to capture growth opportunities in mid-sized companies that have the potential to become future leaders in their respective industries.

The key details of the fund are,

The trailing returns of the fund as of 5th June 2024 are,

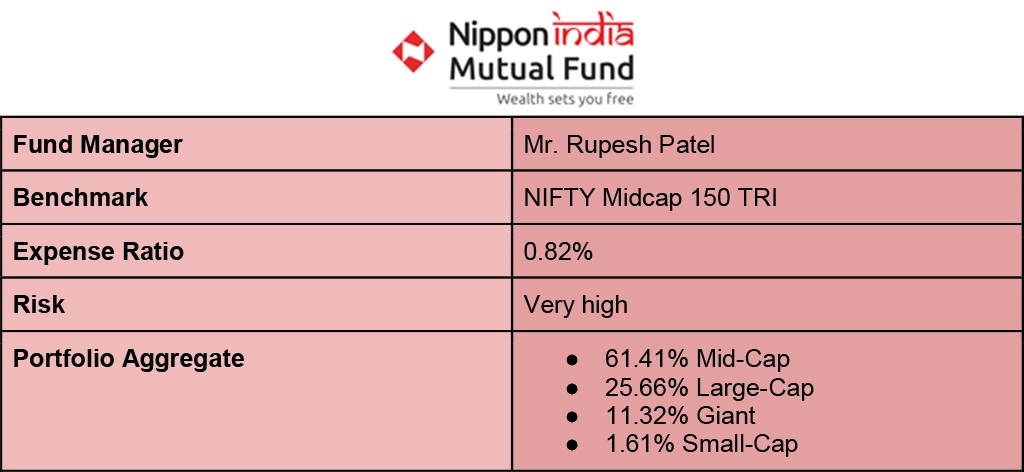

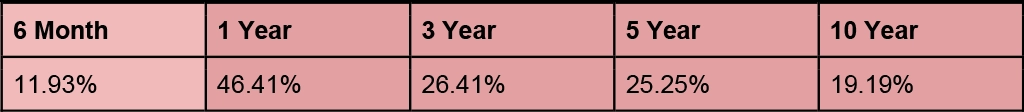

The Nippon India Growth Fund - Direct Plan is a mutual fund scheme managed by Nippon Life India Asset Management Limited. Its main objective is to achieve long-term capital growth by investing primarily in a diversified portfolio of equity and equity-related securities, with a focus on mid-cap companies.

The key details of the fund are,

The trailing returns of the fund as of 5th June 2024 are,

*rating and net assets data as per Moneycontrol, Valueresearchonline, and ETMoney.

Mid-cap funds are an excellent way to tap into the growth potential of mid-cap stocks and enhance the overall returns of the portfolio at manageable risks. However, investors should ensure that the objectives of the mid-cap fund that they want to invest in are aligned with their personal investment horizon and investment goals for maximum return potential.

This blog talked about the basics of mid-cap funds and what investors need to focus on while selecting them. Let us know if you need more details on this topic or more information about any mid-cap funds that you have in your mind and we will address them.

Till then Happy Reading!

Read More: Retirement Planning - When to start and how to do it?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...