Most new investors think that investing in all mutual funds will give them tax deduction under section 80C. However, that is not the case! Did you know only ELSS funds qualify for this benefit? Yes, you heard it right! So, what are these ELSS funds, and why do they get the special tax benefit? Check out this blog to know all about the ELSS funds and the benefits of investing in them.

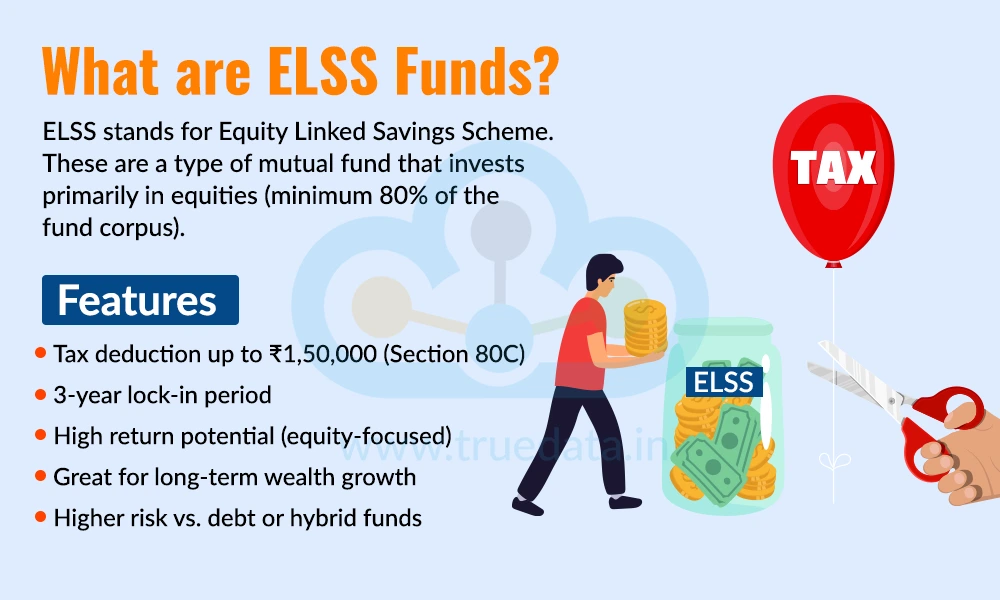

ELSS stands for Equity Linked Savings Scheme. These are a type of mutual fund that invests primarily in equities (minimum 80% of the fund corpus). ELSS funds are popular among investors because they help grow their money by investing in shares of companies, and at the same time, they give tax benefits under Section 80C of the Income Tax Act. Investors can invest in ELSS with a small amount (as low as Rs. 500), and the money gets locked for three years, which means investors cannot withdraw it during that time. This lock-in period is shorter compared to other tax-saving options. ELSS funds have the potential to give higher returns, but they also carry some risk because they are linked to the stock market. They are a good option for people who want to save taxes and are willing to take some risk for better long-term returns.

Features of ELSS Funds

Tax deduction up to Rs. 150000 under section 80C of the Income Tax Act

Lock-in period of 3 years

Higher return potential due to the majority investment in equities

Ideal tool for long-term wealth creation

Higher risk of investment compared to other mutual funds, like debt mutual funds or hybrid mutual funds.

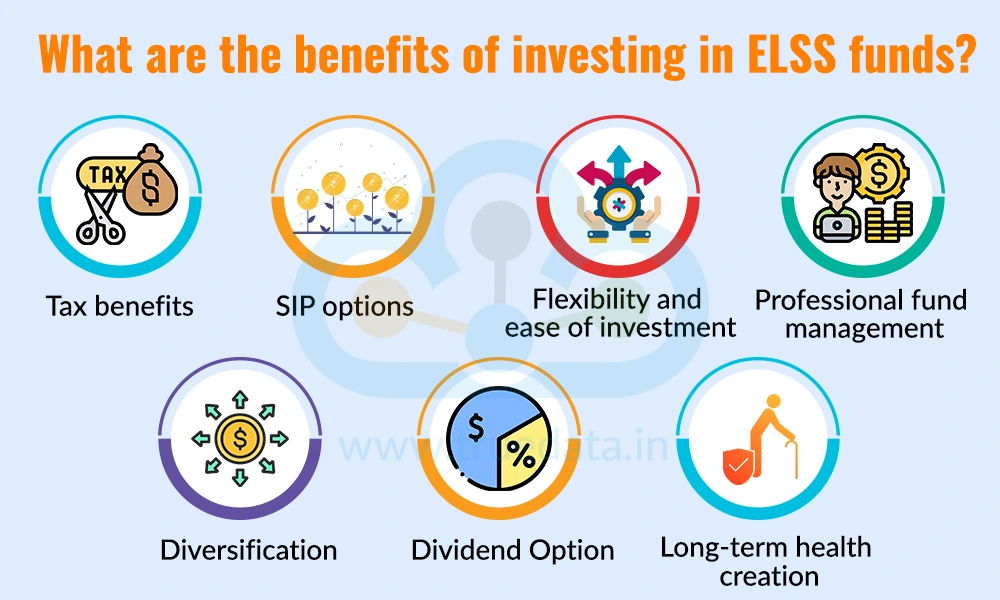

Investing in ELSS funds comes with many benefits for investors. Some of these benefits are explained below.

One of the biggest reasons people invest in ELSS (Equity Linked Savings Scheme) is the tax-saving benefit. ELSS is eligible for a deduction under Section 80C of the Income Tax Act, allowing an investor to reduce their taxable income by up to Rs. 1,50,000 in a financial year. This can lead to significant savings in income tax. Furthermore, like any other equity mutual fund, capital gains from ELSS funds are taxed at a lower rate as compared to debt funds and also have a tax exemption on gains of up to Rs. 1,25,000.

ELSS funds offer the option of a Systematic Investment Plan (SIP), where an investor can put in a fixed amount every month. This makes it easier to invest regularly without feeling a big burden. SIPs also help in averaging the purchase cost, especially in a market that goes up and down, and they encourage disciplined, long-term investing habits.

ELSS funds are very easy to invest in. Investors can start with a small amount (as low as Rs. 500), and they can invest online through mutual fund platforms, apps, or banks. Unlike traditional tax-saving options that may require paperwork, ELSS offers digital convenience, making it flexible and simple for new and experienced investors alike.

Investment in ELSS funds is managed by professional fund managers. These experts analyse the market, study different companies, and make investment decisions on behalf of the investor. This means even if the investor does not have deep knowledge of the stock market, they can still benefit from expert guidance.

ELSS funds invest in a variety of companies across different industries, such as banking, technology, healthcare, etc. This spread is called diversification, and it helps to reduce risk. If one sector or company performs poorly, others may perform well, helping to balance the overall performance of the investment.

Some ELSS funds offer a dividend option, which allows investors to receive periodic payouts from the profits earned by the fund. These dividends can be a good way to get some regular income during the lock-in period, though the amount and frequency are not guaranteed. It’s a helpful choice for those looking for income along with investment.

ELSS funds have a 3-year lock-in period, but they are best used for long-term financial goals. The value of investments may grow significantly over time due to investment in the stock market. Staying invested for longer periods can help investors build wealth, beat inflation, and meet future goals like buying a house, funding children’s education, or retirement.

ELSS funds allow investors to benefit from investment in equities with relatively lower risk as compared to investment in pure equities. This makes them an ideal investment option for a diverse class of investors. Some of these investors include,

Investors looking for tax savings along with wealth creation

First-time investors looking for equity exposure along with professional management.

Investors with long-term financial goals

Investors seeking a diversified portfolio at lower costs

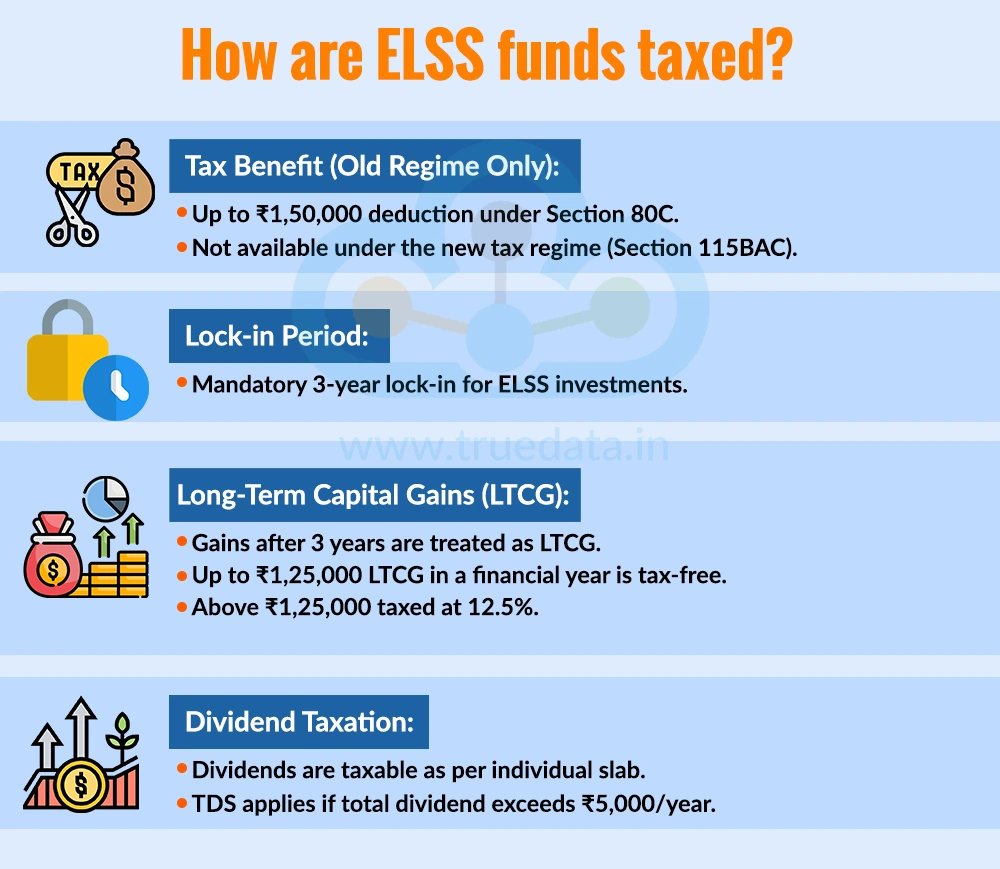

ELSS (Equity Linked Savings Scheme) funds offer a dual benefit, i.e., tax savings on investment and the potential for capital appreciation. Under Section 80C of the Income Tax Act, an individual can claim a tax deduction of up to Rs. 1,50,000 in a financial year by investing in ELSS. This benefit is available under both the old tax regime. Investors who choose the new tax regime (under Section 115BAC) do not get this deduction, hence, it is important to pick the right tax structure based on individual income and financial goals.

Investors can redeem units of ELSS funds after a mandatory lock-in period of 3 years. When an investor redeems ELSS units after three years, any profit made is considered long-term capital gains. As per the latest tax laws, LTCG up to Rs. 1,25,000 is exempt from tax and gains over this limit are taxed at the rate of 12.5%. Furthermore, the dividends received from the fund are added to the investor’s total income and taxed according to the applicable income tax slab. Companies may also deduct TDS if the dividend exceeds Rs. 5,000 in a financial year, according to the provisions of the Income Tax Act.

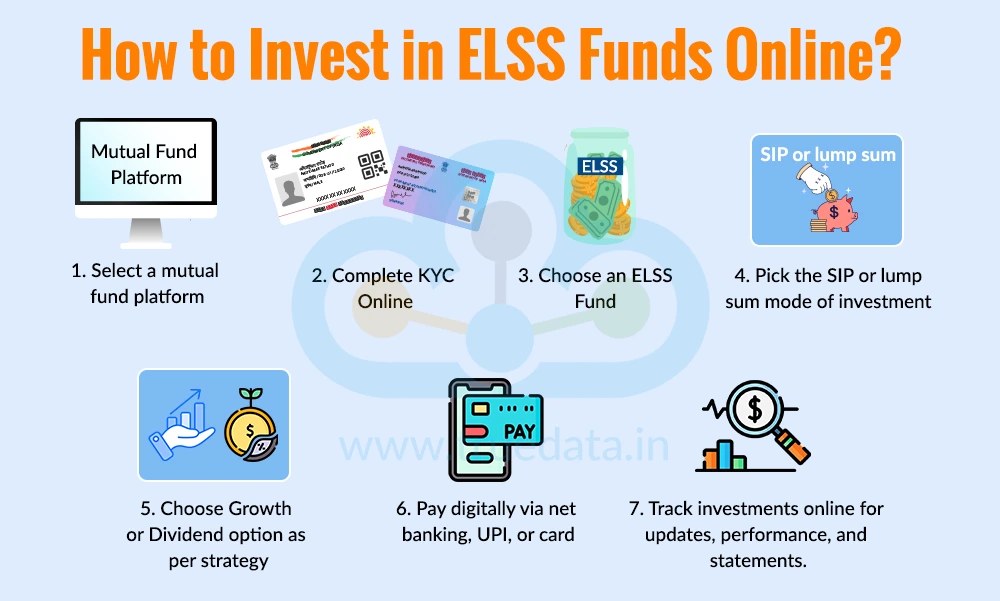

Investment in ELSS funds can be made either through online or offline options. The steps for investment in ELSS funds are explained below.

Select a mutual fund platform or app

Complete KYC Online, if not already KYC-compliant, by uploading documents like PAN card, Aadhaar card, a photo, and a bank statement.

Choose an ELSS Fund after comparing different funds based on returns, risk, and fund manager experience and choose one that suits their goals.

Pick the SIP or lump sum mode of investment

Select the Growth or Dividend Option of the fund based on investment strategy

Make the payment digitally using net banking, UPI, debit card, or other available digital methods.

Track investment online to monitor the performance through the platform or app and get regular statements and updates.

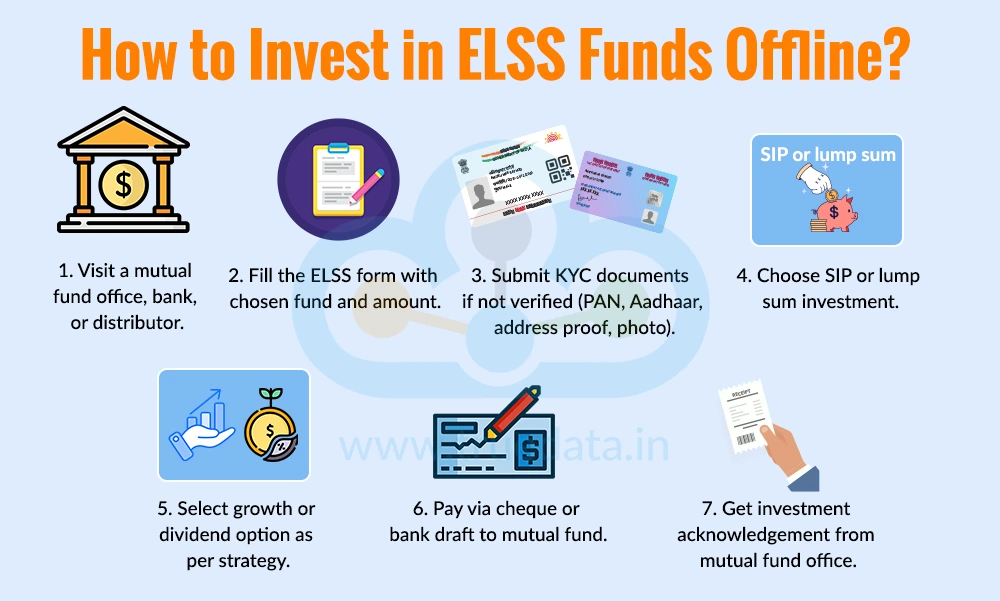

Visit a Mutual Fund Office, or a Bank Branch or approach a certified mutual fund distributor.

Collect and fill out the ELSS fund investment form, choosing the desired fund and amount.

Submit KYC documents, if not already KYC-verified, like photocopies of PAN card, Aadhaar, address proof, and a passport-size photo.

Choose a SIP or a lump sum investment option

Select the Growth or Dividend Option based on the investment strategy

Pay using a cheque or a bank draft drawn in favour of the mutual fund scheme.

Receive acknowledgement from the mutual fund office or distributor as proof of investment.

ELSS funds are among the most popular categories of mutual funds and have millions of investors across the country. These funds provide a dual benefit of long-term wealth creation and tax savings that make it particularly attractive for the taxpayer base in the country. With the multiple benefits and the ease of investment, ELSS funds are suitable for both first-time investors and those with experience, especially people with long-term goals who are comfortable with some market risk.

We have explored one of the major categories of mutual funds in this article. Stay tuned for such details on other mutual fund categories in our upcoming blog. Reach out to us if you need further information on the topic or have any queries or any information on any particular category of mutual funds, and we will address them soon.

Till then, Happy Reading!

Read More: Common Mistakes to Avoid while Investing in Mutual Funds

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...