Despite the multiple market swings and changes in taxation, mutual funds continue to remain one of the most popular investment options for the masses of India. However, given the turmoil that the stock markets are facing, most portfolios are in deep red. So what should you do? Redeem your mutual fund units? The answer is a big no! Investors should always focus on the long-term benefits of investing in mutual funds. Hence, one of the safest and most popular mutual fund categories is the large-cap funds. Check out this blog to know all about the large-cap funds and the top funds in this category.

Large-cap funds are a category of equity mutual funds that invest mainly in shares of blue-chip and well-established companies. These companies are part of the top 100 listed companies on the stock exchange by market value, representing the financially strong companies with a good track record of performance. These companies are stable and less likely to face sudden ups and downs due to market fluctuations, and hence are considered safer compared to funds that invest in smaller or newer companies. These funds aim to give steady returns over the long term and are suitable for investors who want growth with relatively lower risk. Thus, they are an attractive choice of investment for beginners or investors looking for reliable investment options.

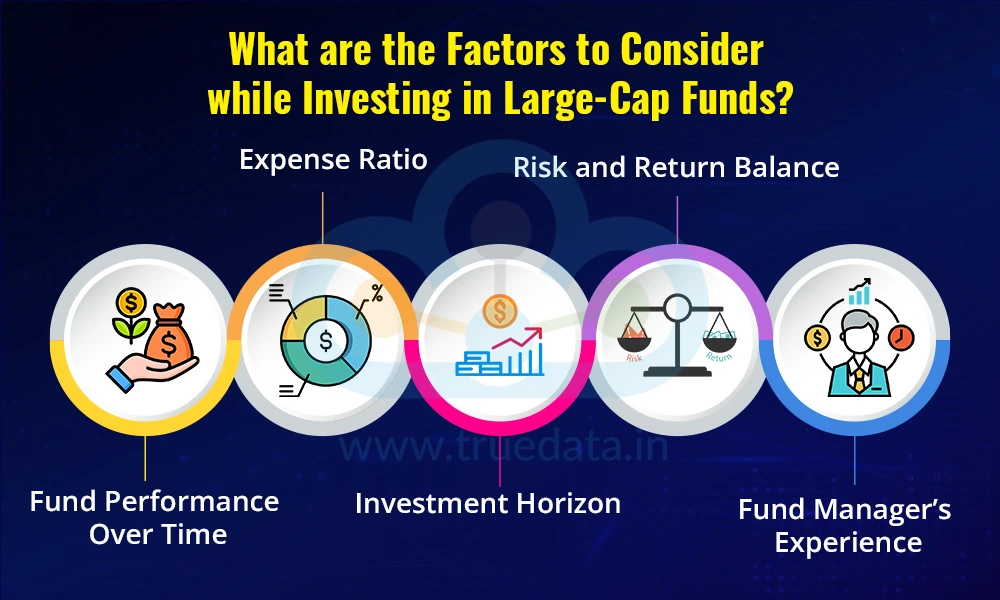

Investment in large-cap funds is a safer investment choice as compared to investment in other aggressive funds like small-cap or mid-cap funds. However, some of the key factors to be considered while investing or selecting large-cap funds include,

Investors should review the fund’s performance over the past few years. A strong large-cap fund generally shows steady and consistent growth across different market cycles. It is advisable not to rely solely on one year of high returns.

The expense ratio is the fee charged by the fund house for managing the investment. A lower expense ratio helps investors retain more of their returns. Comparing expense ratios among similar large-cap funds can help in making a cost-effective choice.

Large-cap funds are better suited for long-term investments. Investors with a time horizon of five years or more are likely to benefit more from the steady growth and compounding effect of these funds.

Although large-cap funds are relatively stable, they are still subject to market risks. Investors should assess their own risk tolerance and select a fund that provides a balanced mix of risk and return according to their comfort level.

The expertise and experience of the fund manager play a key role in the fund’s performance. A seasoned fund manager can make better decisions during market volatility. Investors should consider the manager’s past record and experience in handling large-cap funds.

The top features of large-cap funds that make them attractive for investors include,

Investment in blue-chip stable companies.

Stable and reliable returns, even though they may be relatively lower as compared to mid-cap or small-cap funds.

Lower risk of investment as compared to mid-cap or small-cap funds.

Good long-term investment when held for a long-term period of 5 years or more.

Managed by professional fund managers.

Higher liquidity, as units of large-cap funds can be easily redeemed as compared to small-cap funds.

Relatively more regular dividend payouts.

Ideal for those who want equity exposure with relatively lower risk.

Investment in large-cap funds is among the most favoured options for conservative investors with a lower risk appetite. However, before investing in large-cap funds, it is important to understand the benefits and limitations of this investment to ensure that it is aligned with the individual investment parameters. Here is a brief insight into a few pros and cons of investing in large-cap funds, enabling investors to make informed investment choices.

Lower volatility - Large-cap funds are a relatively stable form of investment in mutual funds as they are less volatile in the face of market swings.

Stability and Safety - Large-cap funds invest in big, trusted companies, making them more stable and less risky compared to small or mid-cap funds.

Good for Long-Term Goals - These funds are ideal for long-term investments like retirement, children’s education, or wealth building over 5+ years.

Diversification - Large-cap funds usually invest in a wide range of sectors (like banking, IT, FMCG, etc.), thereby reducing the risk tied to any one industry.

Steady Returns - These funds may not offer very high returns, but the returns are consistent with reliable growth over time, making them a favoured choice for investors looking for a stable alternate source of income.

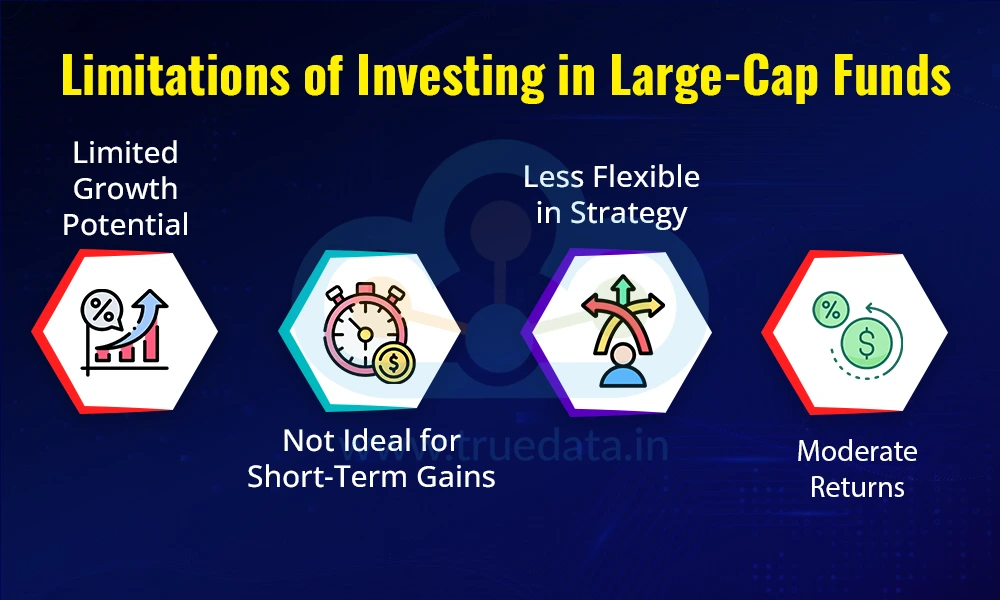

Limited Growth Potential - Large companies grow slowly compared to smaller ones, so the scope for rapid profit is limited.

Not Ideal for Short-Term Gains - These funds are not usually subject to high volatility or market swings, hence, may not be suitable for those who want quick profits in a short time.

Less Flexible in Strategy - Large-cap funds must invest at least 80% in large-cap stocks as per SEBI rules, which limits the fund manager’s ability to explore high-growth opportunities in other segments.

Moderate Returns - The returns may be lower compared to mid and small-cap funds. Investors looking for very high returns might find these funds less attractive.

Now that we have seen the key details of the large-cap funds, let us now focus on the top large-cap funds in terms of net assets.

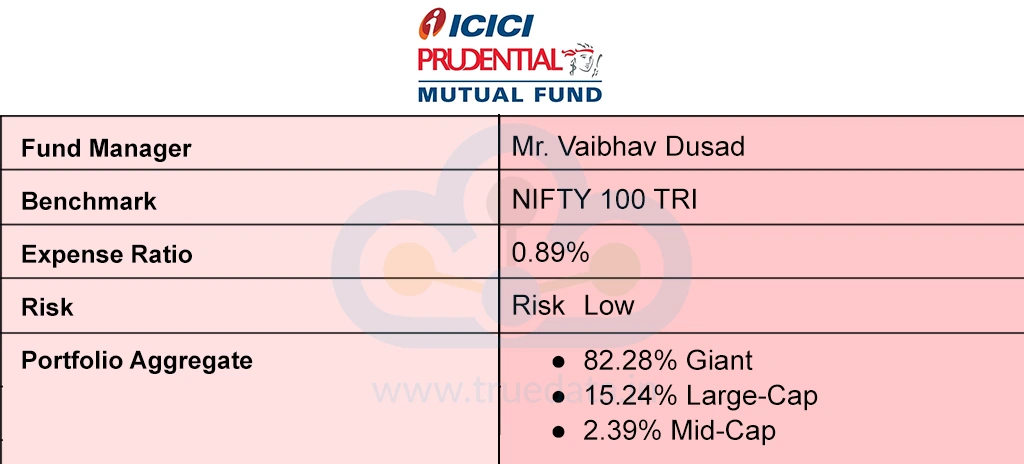

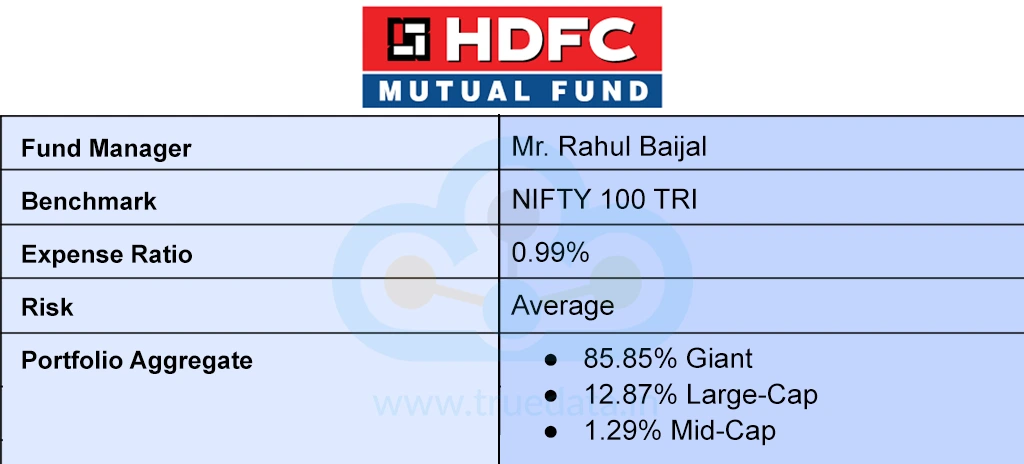

The key details of the fund are,

The trailing returns of the fund as of 10th April 2025 are,

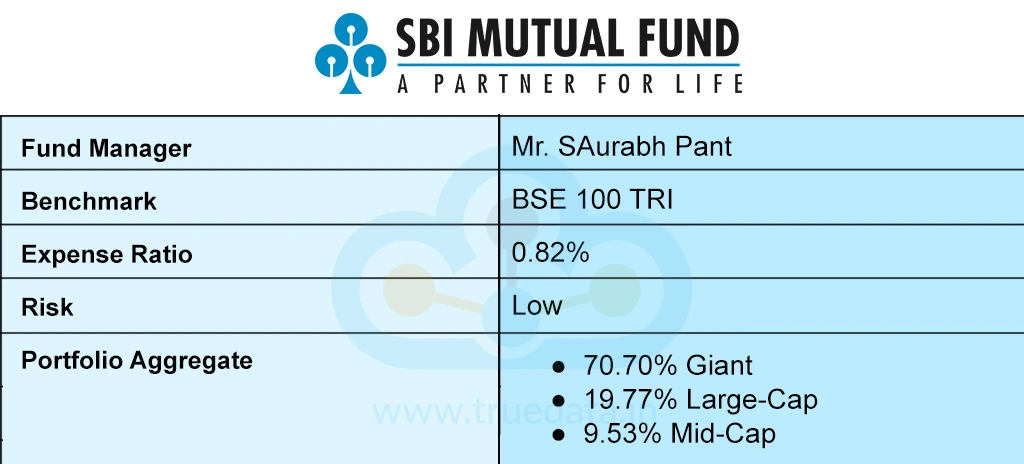

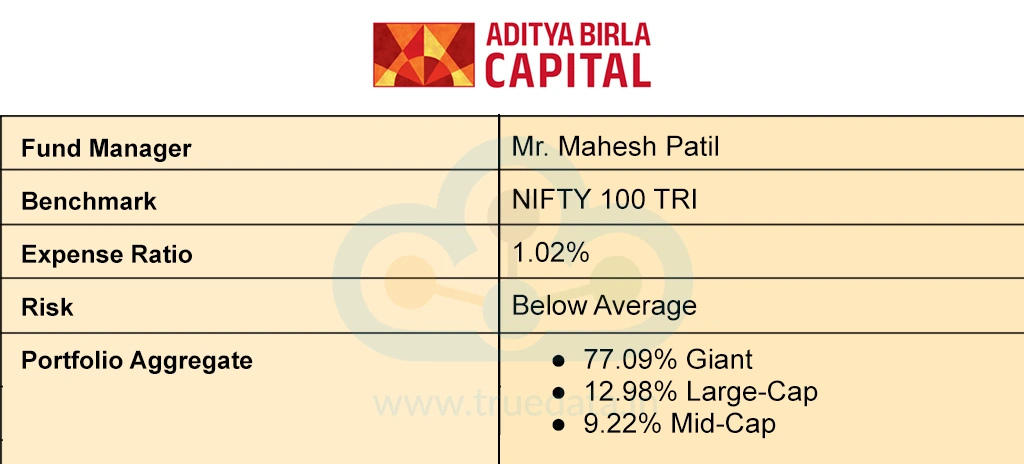

The key details of the fund are,

The trailing returns of the fund as of 10th April 2025 are,

The key details of the fund are,

The trailing returns of the fund as of 10th April 2025 are,

The key details of the fund are,

The trailing returns of the fund as of 10th April 2025 are,

The key details of the fund are,

The trailing returns of the fund as of 10th April 2025 are,

Large-cap funds are one of the most popular categories of mutual fund with a huge investor base seeking stable returns with minimal risk. These funds, with the power of SIPs, make investment easier, more flexible and accessible for investors belonging to diverse classes, even though they may have limited market knowledge.

We hope this blog was able to shed valuable insights into investing in large-cap funds. Let us know if you need any further information on this topic, and watch this space for details on similar mutual fund categories.

Till then, Happy Reading!

Read More: Why Invest in Equity Mutual Funds?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...