As we move into the second half of 2025, global trade tensions continue to dominate headlines, especially those sparked by the recently announced US tariffs on Indian exports. Leading economies seem to be navigating the fallout, but India stands firm, reinforcing its economic sovereignty. Meanwhile, foreign institutional investors have turned cautious, pulling out significant funds. Yet, right here at home, a different story is unfolding. Domestic investors have poured a staggering Rs. 1.79 lakh crore into mutual funds in July alone. The mutual fund inflows were at a record high in July 2025. What do these numbers mean for our economy, markets, and investors like you? Let us unpack the opportunities, the risks, and why this moment could be a turning point in India’s financial narrative.

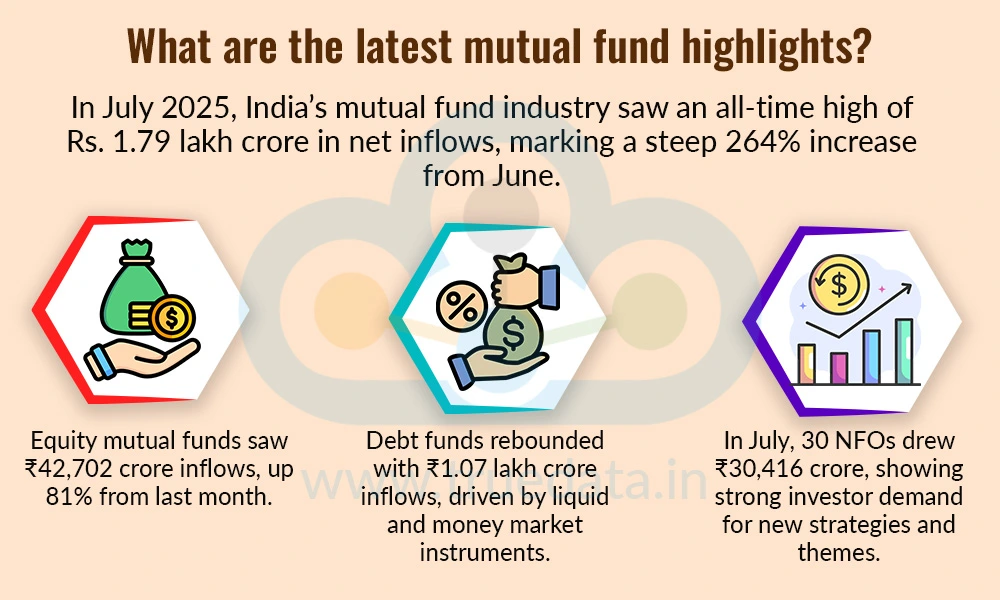

In July 2025, India’s mutual fund industry saw an all-time high of Rs. 1.79 lakh crore in net inflows, marking a steep 264% increase from June. Systematic Investment Plans (SIP) continued their upward trend, with Rs. 28,464 crore collected in July 2025, which recorded the highest monthly SIP inflows ever. The key details of mutual fund inflows in various categories are highlighted below,

Equity Fund Performance - Equity-oriented mutual funds recorded a massive Rs. 42,702 crore, an 81% jump from the previous month. This marked the 53rd consecutive month of positive equity inflows, a sign of sustained investor confidence. These investments into equity, especially across small-cap, mid-cap, and thematic/flexi-cap funds, showcase investors seeking higher growth opportunities.

Debt Funds Rally - Debt mutual funds bounced back strongly, registering around Rs. 1.07 lakh crore in inflows, led by liquid and money market instruments looking to benefit from better liquidity. This investment also shows investors balancing their portfolios with stability and liquidity.

New Fund Offers (NFOs) - The inflows are also seen due to multiple new fund launches (NFOs), 30 in the month of July. These funds alone attracted a whopping Rs. 30,416 crore in fresh capital. These continued investments by seasoned and new investors showcase the appetite for fresh strategies and themes.

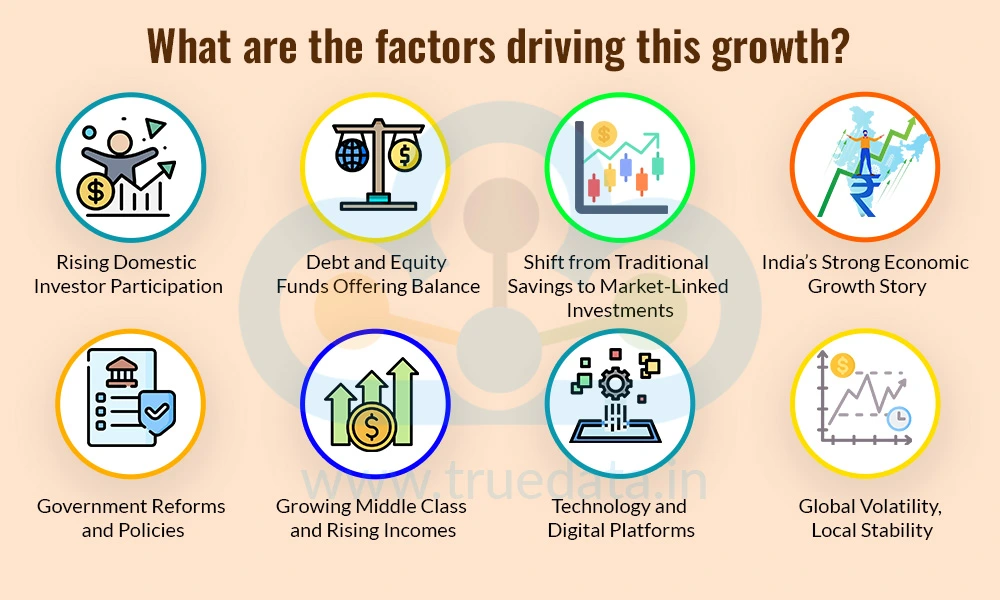

The growth of India’s mutual fund industry is not happening in isolation. It is closely linked to the broader strength of the Indian economy. A young population, rising incomes, better financial awareness, supportive policies, and digital access are all working together. The factors driving this growth are explained below.

For years, India’s markets depended heavily on foreign money. However, now, Indian investors, including salaried individuals, professionals, and even small-town savers, are driving the growth. Systematic Investment Plans (SIPs) have become a household name. In July 2025 alone, SIP contributions touched a record Rs. 28,464 crore. This steady and reliable flow of funds gives the mutual fund industry a strong backbone and reduces dependence on foreign capital.

The industry’s growth is broad-based. On one hand, equity funds are booming because investors want to capture India’s long-term growth story. On the other hand, debt funds attracted over Rs. 1 lakh crore in July 2025 alone, as investors looked for safe and liquid options amid market volatility. This balanced growth across segments shows that mutual funds are serving both risk-takers and conservative investors.

Earlier, Indians preferred fixed deposits, gold, or real estate. However, with rising awareness, easier access through digital apps, and campaigns like ‘Mutual Funds Sahi Hai’, people now see mutual funds as a smarter way to grow wealth. The flexibility of starting with just Rs. 500 and the ability to invest in diverse asset classes have attracted millions of first-time investors, helping the industry expand rapidly.

India continues to be one of the fastest-growing major economies in the world. Strong domestic consumption, government spending on infrastructure, and robust corporate earnings are creating a positive environment. This growth encourages investors to put money into markets through mutual funds, expecting better long-term returns compared to developed countries, where growth is slower.

Policies like tax benefits on Equity Linked Saving Schemes (ELSS), easier KYC norms, and digitisation of financial services have made investing smoother. At the same time, India’s push for Make in India, infrastructure development, and renewable energy investments boost overall economic confidence, and that confidence spills over into the mutual fund industry.

India’s young population, growing middle class, and rising disposable incomes mean more households have savings to invest. Unlike the older generation that relied mostly on FDs and gold, younger investors prefer mutual funds for better returns and flexibility. This demographic shift is a long-term driver for both the mutual fund industry and the economy.

Apps and online platforms have made it possible for even small-town investors to start SIPs or buy funds with just a few clicks. Instant onboarding, UPI payments, and easy monitoring of portfolios have removed old barriers. This ‘fintech revolution’ is one of the biggest enablers of mutual fund growth in India.

While global markets face uncertainty due to tariffs, wars, or interest rate changes, India has shown relative stability. Investors see India as a resilient economy with strong domestic demand. This makes them confident in continuing to invest through mutual funds, even when FIIs (foreign investors) pull out.

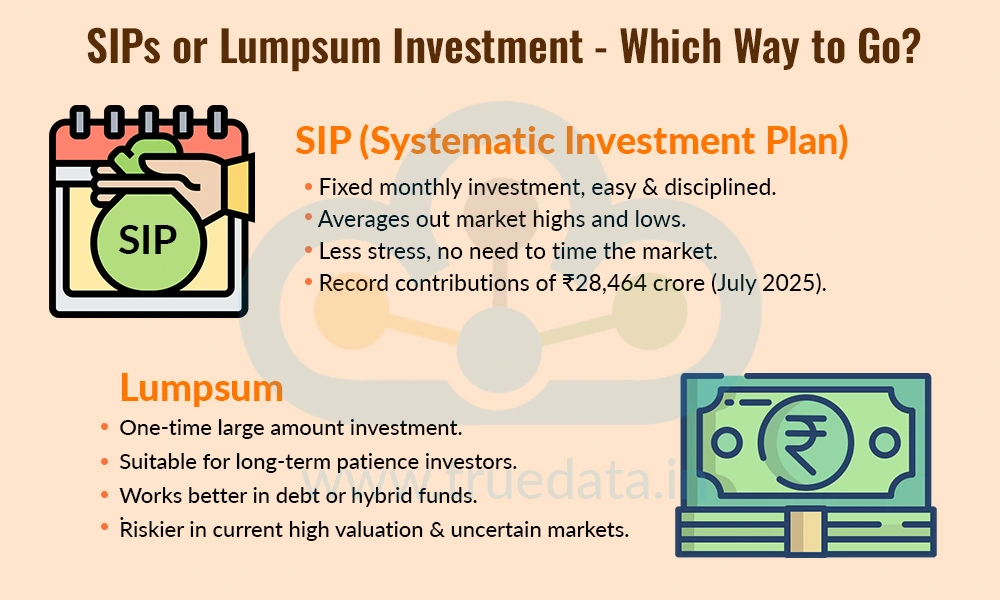

In the current environment, where India’s economy continues to show strong long-term potential but global uncertainties such as U.S. tariffs and foreign investor withdrawals create short-term volatility, Systematic Investment Plans (SIPs) appear to be the more reliable route for most investors. With SIPs, a fixed amount is invested every month, allowing investors to average out the cost of purchase without worrying about market highs and lows. This disciplined approach has already gained strong acceptance, with SIP contributions reaching a record Rs. 28,464 crore in July 2025. On the other hand, lumpsum investments can be suitable for those who have a larger amount of money available and the patience to stay invested for the long term, particularly in debt or hybrid funds that carry less volatility. However, given today’s conditions of high equity valuations and global uncertainties, SIPs provide a stable, consistent path to wealth creation while reducing the stress of trying to time the market.

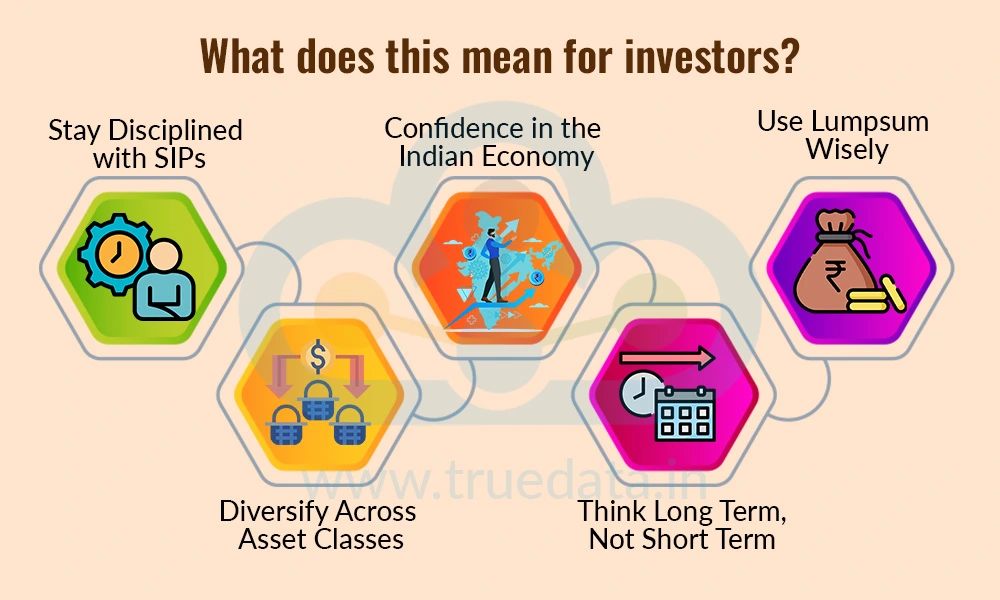

The record mutual fund inflows and rising SIP contributions send a very encouraging signal. It means that despite global challenges, the Indian economy and markets are being strongly supported by domestic money, not just foreign capital. The key takeaways from the current scenario for an average investor are explained below.

Systematic Investment Plans (SIPs) have reached an all-time high because they help investors build wealth steadily, without worrying about market timing. Investors should continue (or start) their SIPs, as they allow investments to ride through market ups and downs and create a long-term compounding effect. SIPs work best when investors remain consistent, even during volatile times.

The record inflows into mutual funds show that domestic investors trust the strength of India’s economy, even when foreign investors are pulling out due to global issues. This means investors can feel reassured that they are not alone, as millions of fellow investors are steadily putting money into the markets. This collective confidence supports market stability and creates a strong base for future growth.

Those with extra money, like bonuses, property sale proceeds, or savings, can consider lumpsum investments. However, instead of putting the entire amount in equities at once, investors could spread it across debt funds, hybrid mutual funds, or stagger the amount into equity funds through Systematic Transfer Plans (STPs). This helps reduce the risk of entering the market at a peak.

The inflows show growth in both equity and debt funds. Investors should learn from this trend and keep their portfolios balanced. Equity funds can provide long-term growth, while debt funds offer safety and liquidity. Adding hybrid funds or index funds can further spread risk. Diversification is the key to reducing stress while still aiming for healthy returns.

The current market is influenced by global news like U.S. tariffs and FII withdrawals, which may cause short-term volatility. However, India’s long-term growth story remains strong. Investors should focus on their financial goals, like retirement, children’s education, or wealth creation, instead of reacting to short-term market noise. Patience and consistency are the biggest strengths an investor can have right now.

The record mutual fund inflows show that Indian investors are stepping up with confidence even as foreign investors pull back. Strong flows into both equity and debt funds, along with more than Rs. 30,000 crore raised through new fund offers, reflect the growing trust in India’s markets and economy. By staying consistent and patient, investors can benefit from both the resilience of India’s economy and the growing strength of its mutual fund industry.

This post highlights the resilience of the Indian investors and their confidence in the economy despite global pressures. We hope this can help investors make informed investment decisions and create a robust portfolio to meet their investment objectives. Watch this space for more mutual fund related topics.

Till then, Happy Reading!

Read More: How to Complain About Mutual Funds?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...