For many of us, owning a piece of real estate feels like the ultimate milestone! It is something we dream about for security, pride, and long-term wealth. However, given the current cost of living and the ever-rising inflation, this dream remains quite out of reach for a significant portion of our population, even in a growing economy. But wait, there is a middle ground to owning a property without burning through your life savings in the process or getting into heavy debt. The answer comes in the form of REITs. Have you heard of it? Check out this blog to learn all about REITs and how they can be an excellent addition to your portfolio.

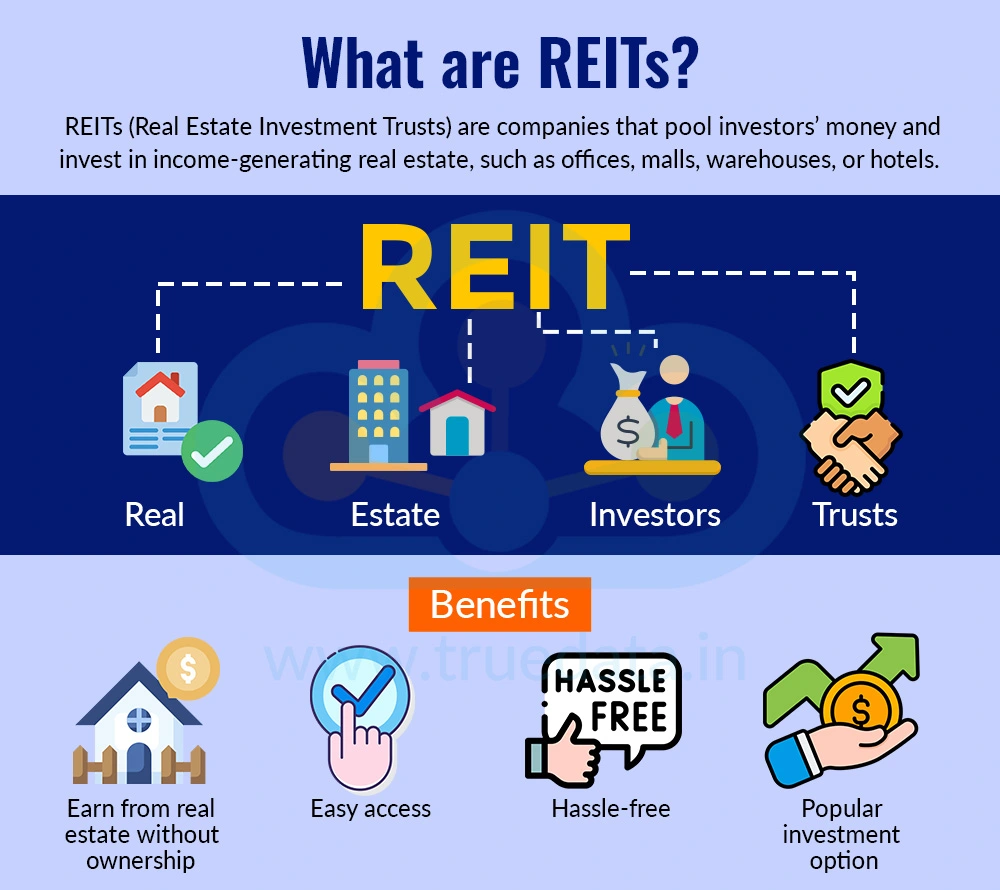

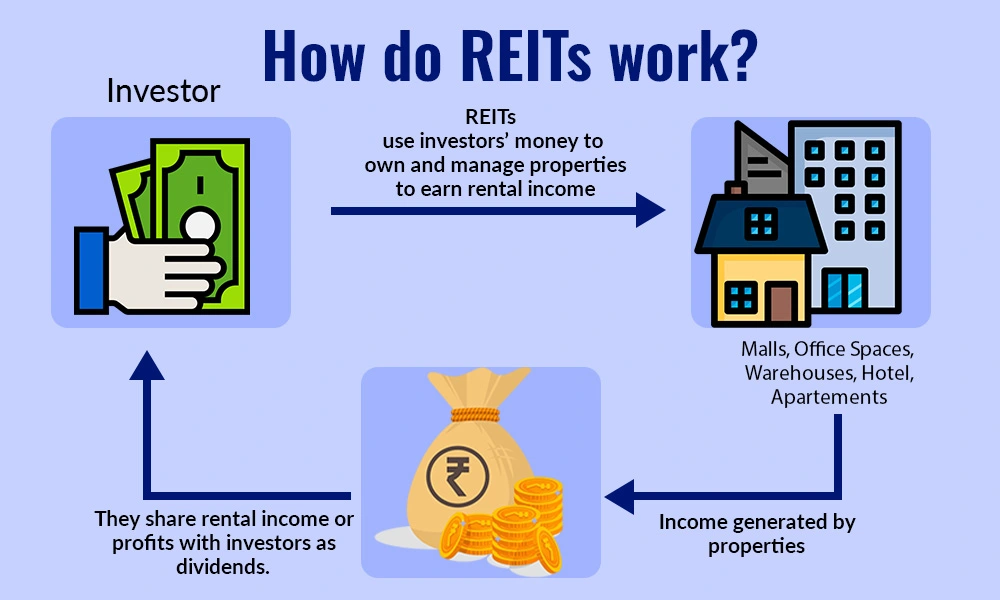

Let us start with the meaning of REITs. REITs stand for Real Estate Investment Trusts and are companies that own and operate income-generating real estate. They function similarly to mutual funds. However, unlike mutual funds that pool investors’ funds and invest in company stocks and other assets, REITs pool investors’ funds and invest in income-generating real estate, like office buildings, shopping malls, warehouses, or hotels. They then share the rental income or profits with these investors in the form of dividends. Thus, even if you do not own the property in the conventional sense, you can still get the benefit of earning money from real estate.

REITs were first introduced in the United States in 1960, when the U.S. Congress created a law that allowed regular investors to invest in large-scale, income-producing real estate. The idea was to give small investors the same access to real estate returns as big institutions. Over time, REITs spread worldwide and became a popular investment product.

REITs are relatively new to the Indian market, with SEBI introducing rules for REITs in 2014 and the first REITs launched in 2019 by Embassy Office Parks. Since then, they have become a very popular investment instrument, especially for investors seeking exposure to the real estate market without the hassles of actually owning and maintaining a property.

REITs have become a very popular investment option in India by opening a new investment arena to millions of small investors. While there are many types of REITs in the US, the REIT market is relatively new in India. Hence, the primary category of REITs available here is the equity REITs, and other popular types of REITs may be available for investors soon.

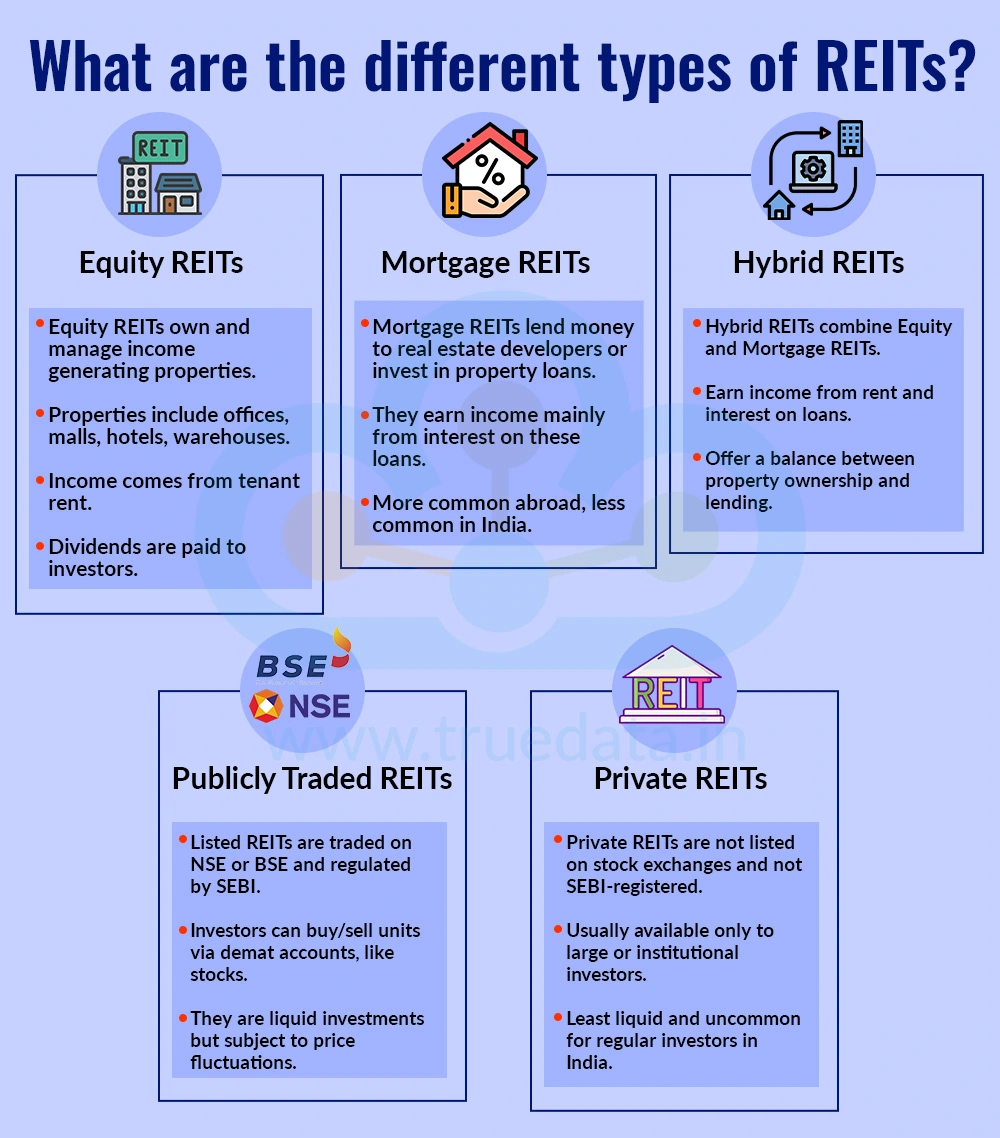

The types of REITs are explained below.

Equity REITs - Equity REITs are companies that directly own and manage income-generating properties, such as offices, malls, hotels, and warehouses. These companies earn mostly from the rent paid by tenants, and this income is distributed to the investors in the form of dividends.

Mortgage REITs (mREITs) - Instead of owning properties, these REITs lend money to real estate developers or invest in property loans. They earn income mainly from the interest on these loans. This type of REIT is more popular abroad and is not very common in India.

Hybrid REITs - As the name suggests, Hybrid REITs are a mix of Equity and Mortgage REITs. They earn money both from rent (like Equity REITs) and from interest on loans (like Mortgage REITs). This provides a balance between property ownership and lending.

Publicly Traded REITs - These REITs are listed on stock exchanges like NSE or BSE and are regulated by SEBI. Investors can easily buy and sell their units through their demat account, just like company shares. They are liquid investments, but are subject to price fluctuations similar to stocks.

Private REITs - Private REITs are not listed on stock exchanges and are not registered with SEBI. They are usually available only to large or institutional investors. They are the least liquid among all types and are not common for regular investors in India.

REITs are similar to mutual funds as they also pool money from investors to invest in income-generating real estate properties. The properties owned by the REIT are rented out to companies or tenants. The rent collected becomes the main source of income for the REIT. As per SEBI rules, a REIT must distribute at least 90% of its income (after expenses) to investors. Investors receive this income as dividends or interest, usually a few times a year. Investors can buy and sell publicly traded REITs that are listed on the NSE and the BSE through a demat account. A REIT has a manager who takes care of running the properties, collecting rent, and maintaining them and a Trustee to ensure investors’ interests are protected. The value of the REIT’s properties is reviewed regularly by independent valuers to ensure investors make informed portfolio decisions.

SEBI has laid down many rules for companies to qualify for REITs to ensure the protection of investors’ interests. Some of the key rules in this regard are mentioned below.

Minimum Asset Value - A REIT must have assets worth at least Rs. 500 crore to qualify.

Minimum Issue Size - When a REIT is listed on the stock exchange, the issue size (the value of units offered to investors) must be at least Rs. 250 crore.

Public Holding Requirement - At least 25% of the REIT units must be held by public investors (not just promoters or big institutions).

Investment in Real Estate Assets - At least 80% of the REIT’s assets must be invested in completed and revenue-generating properties (like rented office buildings). Furthermore, no more than 20% can be invested in under-construction projects, debt, or other instruments.

Distribution of Income - REITs must distribute at least 90% of their net distributable income to investors in the form of dividends or interest, and this should be done at least twice a year.

Leverage (Borrowing) Limit - REITs are allowed to borrow money, but the total borrowings cannot exceed 49% of the value of their assets. If borrowings go above 25%, they need approval from investors.

Sponsor Requirements - A REIT must have at least one sponsor (a developer or company that sets it up). The sponsor should have at least 5 years of experience in real estate development or fund management. Sponsors must hold a minimum 15% stake in the REIT for at least 3 years after listing.

Manager and Trustee - A REIT must appoint a manager (responsible for day-to-day operations) and a trustee (responsible for protecting investors’ interests). The manager should have at least 5 years of experience in real estate or fund management.

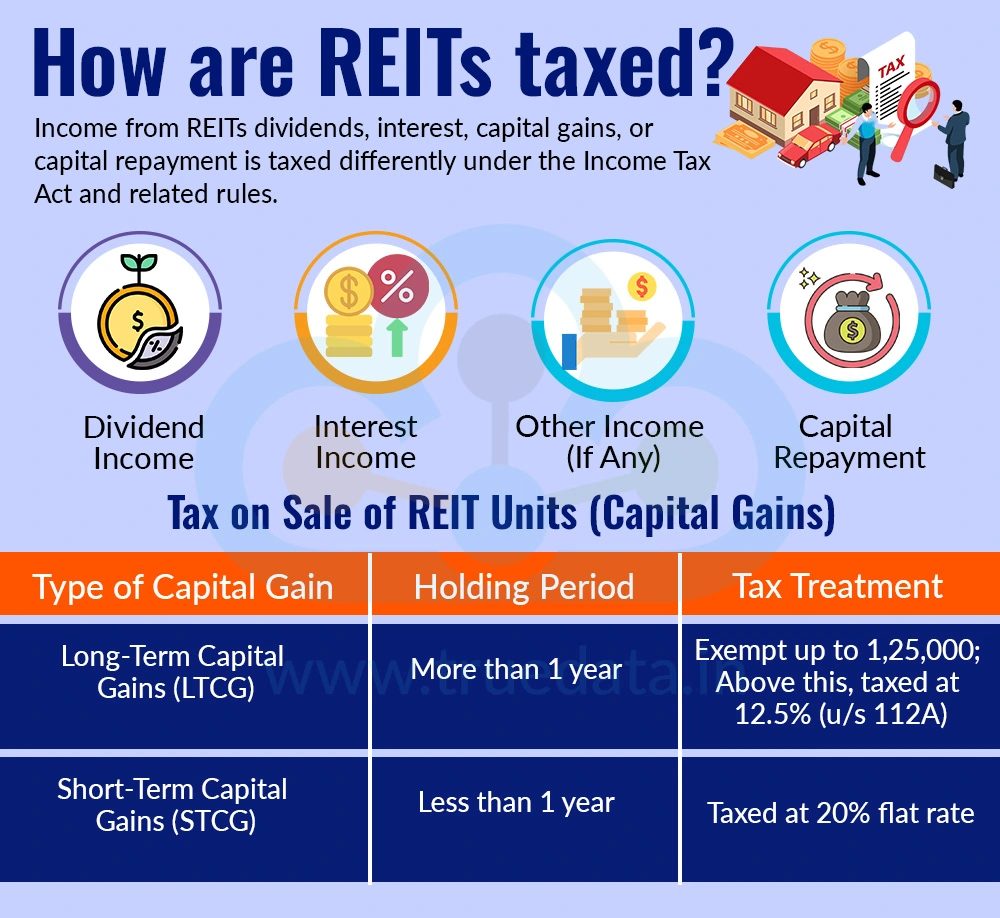

Income from REITs can be in the form of dividend income, interest income, capital gains and capital repayment. The tax treatment of each of these forms of income is different and is guided by the provisions of the Income Tax Act and related rules. This tax treatment of income from REITs is explained below.

Normally, dividend income received from a REIT is exempt from tax in the hands of the investor. However, there is an important exception. If the REIT’s Special Purpose Vehicle (SPV) has opted for the concessional corporate tax regime under Section 115BAA, then the dividend is taxable as per the investor’s income tax slab rates. In such cases, the REIT will also deduct TDS at 10% if the dividend paid is above the prescribed limit (Rs. 5,000 currently, Rs. 10,000 from FY 2025-26 onwards).

If the REIT earns income through debt instruments or loans, this is passed on to investors as interest income. This interest is taxed in the hands of investors according to their individual income tax slab. In addition, TDS at 10% is deducted before payment (5% in the case of NRIs).

Any income from the REIT that is not categorised as rent, dividend, or interest is treated as ‘Other Income’. This is also taxed as per the investor’s applicable income tax slab.

Sometimes, investors receive a portion of their invested money back from the REIT. This is known as capital repayment. It is not taxed immediately. Instead, it is treated as a reduction in the cost of acquisition of the REIT units. This means that when the investor eventually sells the units, the reduced cost will increase the capital gains, and tax will be paid at that stage.

Capital gains arise when investors sell their REIT units. These gains are taxed as per the holding period, i.e., how long they have held them.

Long-Term Capital Gains (holding period > 1 year) - If the total gains in a year are up to Rs. 1,25,000, they are exempt under Section 112A. Any gains above this limit are taxed at a flat 12.5% rate.

Short-Term Capital Gains (holding period < 1 year) - If the units are sold within a year, the gains are taxed at a flat 20% rate.

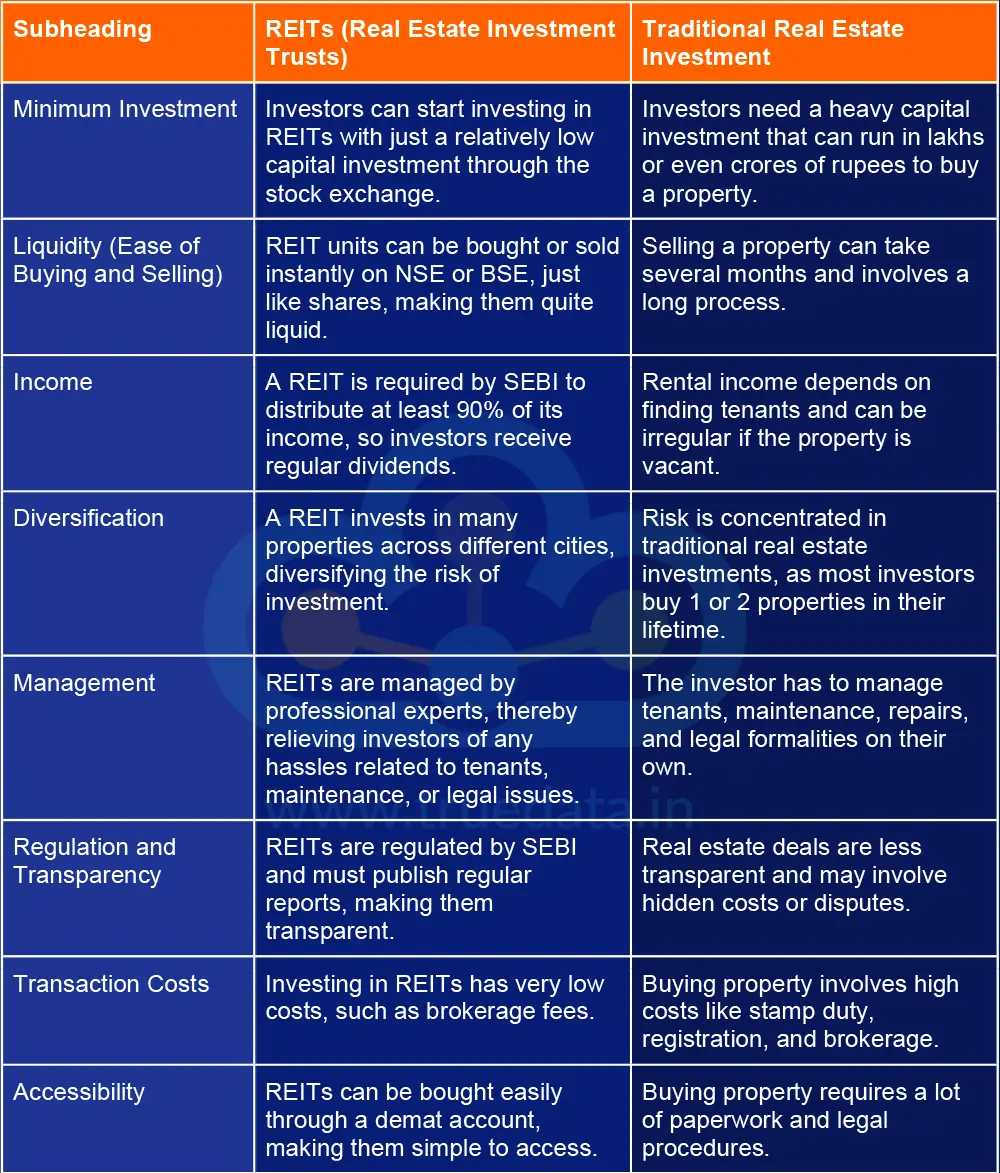

REITs have increasingly become a popular choice of alternative investment for investors in India. However, since they are relatively new products in the Indian market, conservative investors may still be wary of this investment. Here is a comparison between REITs and traditional real estate investments that can help investors make an informed decision.

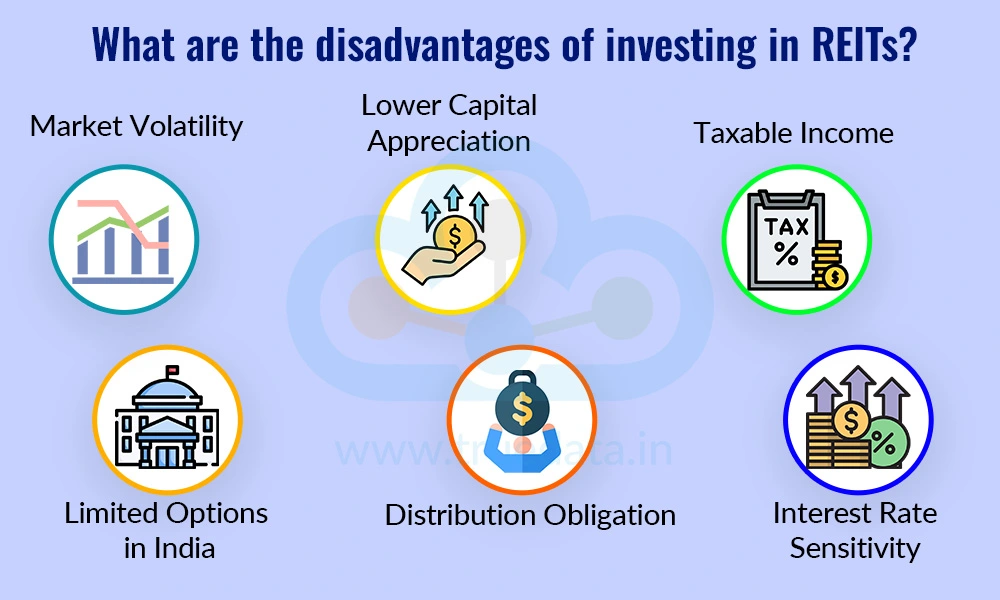

After exploring the advantages of investing in REITs, let us now focus on their limitations.

Market Volatility - Since REITs are listed on the NSE and BSE, their prices go up and down like shares. This means the value of investment can fluctuate daily.

Lower Capital Appreciation - Unlike owning physical property, where values may rise sharply over time, REITs generally give steady income but limited price growth.

Taxable Income - Income from REITs, such as dividends (in some cases), interest, and capital gains, is taxable for investors, which may reduce overall returns.

Limited Options in India - Currently, India has only a handful of listed REITs (like Embassy, Mindspace, Brookfield). This gives investors fewer choices compared to developed markets like the US.

Distribution Obligation - REITs must distribute 90% of their income, which limits their ability to reinvest profits for growth. This means returns may not increase very fast.

Interest Rate Sensitivity - When interest rates rise, REITs may become less attractive compared to safer options like fixed deposits, which can affect REIT prices.

REITs give investors in India an easy and affordable way to invest in high-quality real estate without needing huge capital or dealing with the hassles of property ownership. They provide regular income, high transparency, and liquidity through stock exchanges, making them a strong alternative to traditional real estate. Like any other investment option, they do have some limitations. However, REITs remain a regulated, low-cost, and convenient option for investors looking to diversify their portfolio and earn steady returns from India’s growing commercial real estate sector.

This blog sheds light on an alternative investment option that is slowly spreading its footprint among the investor class. Let us know your thoughts on this topic or if you need further information on the same, and we will address it soon.

Read More: Compounding In Investing

Thestock market is always buzzing with news, opinions, and updates, and as inves...

Dividends are a great way for investors to enjoy a steady income from theirinves...

Executive Snapshot Investment Bias: Overweight large-cap integrators with Gen-A...