Dividends are a classic source of additional income that most investors favour. However, one of the most challenging issues arises when you have to pick specific shares that yield more dividends, especially for beginners. This is where mutual funds targeting dividend stocks come into the picture. Yes, we are talking about dividend yield funds. Do you know about them? Check out this blog to learn about dividend yield funds and the merits of investing in them.

A dividend is a part of the company’s profit that is given to investors as a reward. Dividend Yield Funds are a type of mutual fund that mainly invests in shares of companies that regularly give dividends to their shareholders. These funds focus on companies that have a high dividend yield, which means the dividend they pay is high compared to their share price. These companies are usually stable, well-established, and have a steady income. Dividend Yield Funds can give investors regular income in the form of dividends and may also offer long-term growth if the value of the shares increases over time. These funds are good for investors who want a mix of income and growth with lower risk than investing in newer or riskier companies.

The features of dividend yield funds are,

These funds focus on stocks that regularly give good dividends and usually pick companies with a strong track record and steady profits.

These funds are categorised under low-risk funds as compared to growth funds that invest primarily in fast-growing but uncertain companies.

Dividend yield funds, like all mutual funds, are managed by expert professionals, making them a better investment option, especially for beginners who may lack the time or expertise to pick stocks based on their investment goals.

These funds are ideal for investors looking for medium to long-term investments (3-5 years) as well as a more or less stable source of income, along with capital appreciation in the long term.

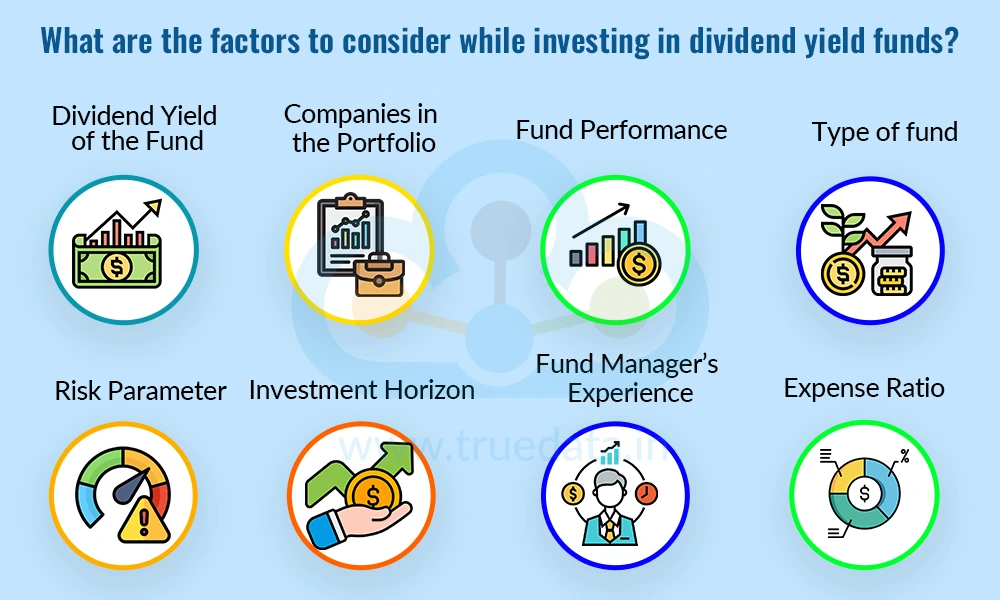

Investing in dividend yield funds can be a good addition to a portfolio as it can be a good way to invest in equities while earning more or less steady income and wealth creation. However, investors need to consider the following factors while selecting a fund.

Investors should first look at the dividend yield of the fund before investing. Dividend yield is the percentage of a company’s share price that is paid out as a dividend. A high dividend yield suggests that the fund invests in companies likely to offer regular income. However, a high yield alone is not enough. It is important to ensure that the companies in the fund’s portfolio have a consistent record of paying dividends and are financially stable. This helps avoid the risk of investing in companies that may give high dividends temporarily but are not reliable in the long run.

Dividend yield funds typically invest in large, well-established companies known for their stable profits and regular dividend payments. These are often companies from sectors like banking, utilities, and FMCG. Investors should review the list of companies in the fund's portfolio. A good fund will be diversified across different sectors, reducing the risk of loss from poor performance in any one sector. This also gives the investor a balanced exposure to the stock market.

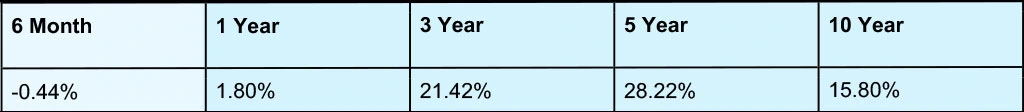

While past performance does not guarantee future results, it can provide useful insight into how the fund has handled different market conditions. Investors should look at the 3-year and 5-year return records of the fund and compare them with other similar funds and with benchmark indices like the Nifty Dividend Opportunities 50. A fund with stable and consistent returns over time is usually better than one with extreme ups and downs.

Dividend yield funds usually offer two types of investment options:

Growth Option - In this, the dividends received by the fund are reinvested, and the investor may receive a higher value later.

IDCW (Income Distribution cum Capital Withdrawal) Option - Here, the investor receives regular payouts whenever the fund declares them.

Those looking for regular income can choose the IDCW option, while those aiming for wealth creation over time may prefer the growth option.

Although dividend yield funds are often seen as more stable than high-growth equity funds, they still carry market risk. The value of the investment can go up or down based on market movements. These funds are usually suited for moderate-risk investors who are looking for both income and steady long-term growth. Investors must assess their own risk appetite before choosing this type of fund.

Dividend yield funds are more suitable for investors who can stay invested for the medium to long term, ideally for at least 3 to 5 years. This gives the fund enough time to grow and to benefit from regular dividend payments. Those who need their money back quickly or are looking for short-term profits may not find these funds suitable.

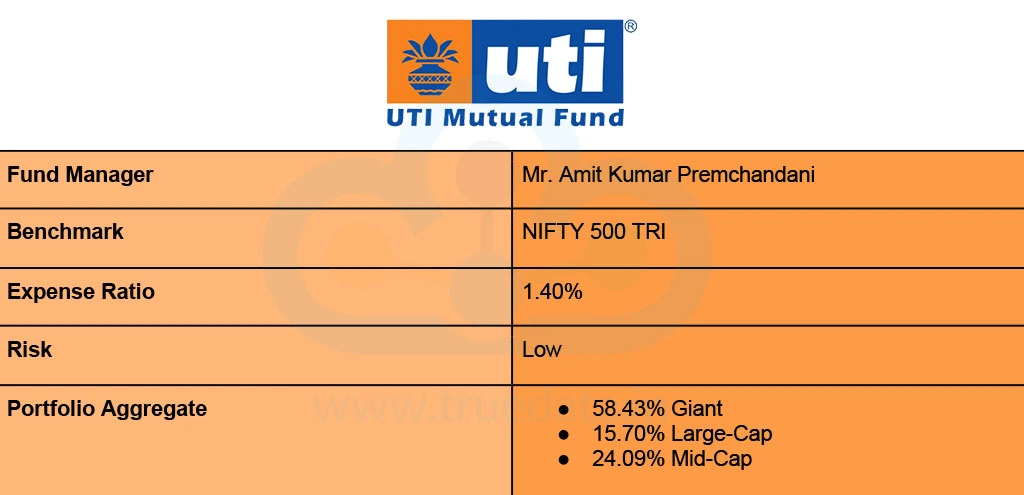

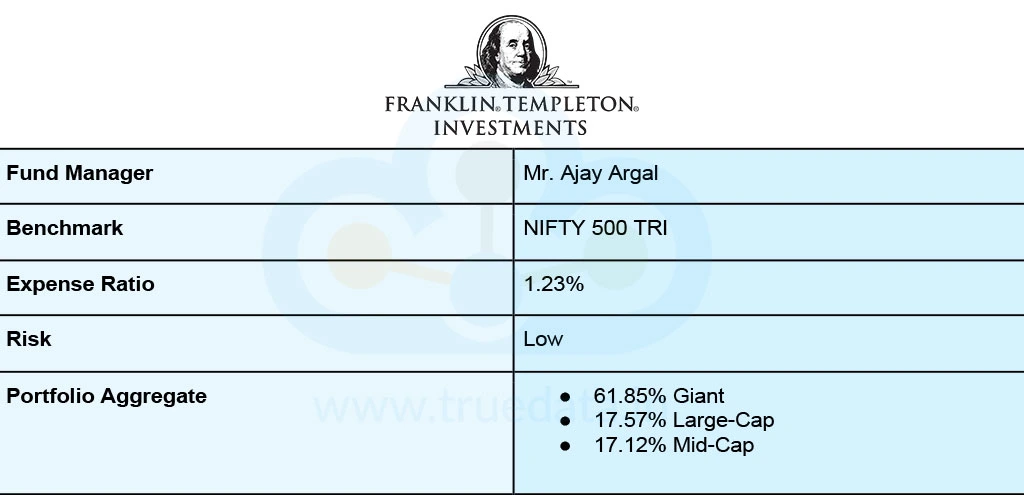

The skills and experience of the fund manager play an important role in the success of any mutual fund. A good manager can choose strong, dividend-paying companies and adjust the portfolio when needed. Investors should check who is managing the fund and whether the person has a good track record in managing similar funds. A reliable and experienced fund manager adds value to the investment.

Every mutual fund charges a fee to manage the investment, called the expense ratio. A lower expense ratio means the investor keeps more of the returns. Even a small difference in the expense ratio can affect the overall return over time. Investors should compare the expense ratios of different dividend yield funds and choose one that offers good performance with a reasonable fee.

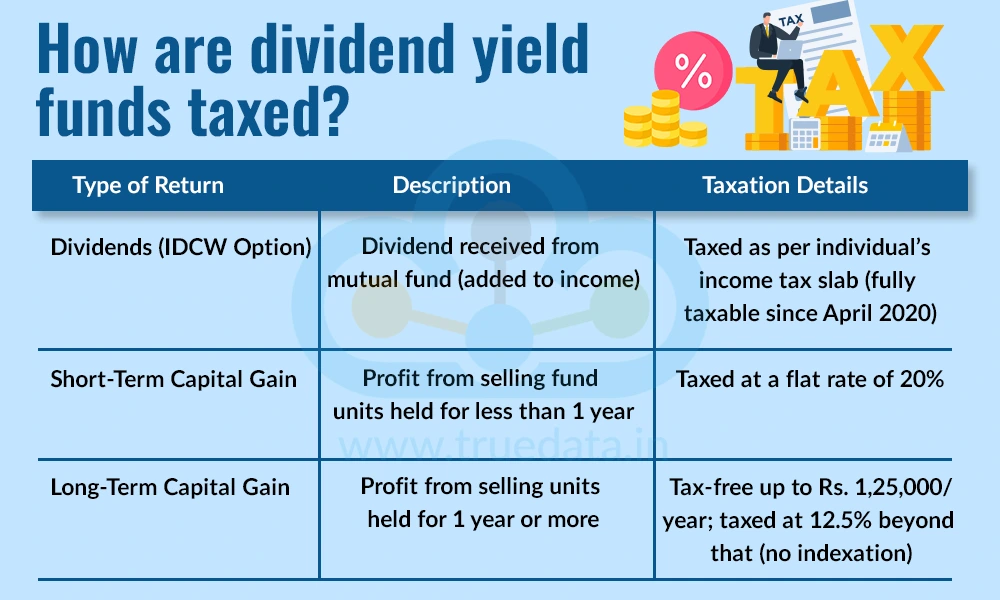

The returns from dividend yield mutual funds are taxed in two main ways, i.e., dividends received and capital gains.

When a fund pays dividends to investors (under the IDCW – Income Distribution cum Capital Withdrawal option), that dividend amount is added to the investor’s total income and is taxed according to their income tax slab rate. This means that a person in a higher tax bracket will pay more tax on dividends than someone in a lower bracket. Earlier, dividends were tax-free in the hands of investors, but since April 2020, they are fully taxable as regular income.

Apart from dividends, when an investor sells the fund units and makes a profit, this is called a capital gain. If the investment is held for less than one year, it is considered a short-term capital gain and is taxed at a flat rate of 20%. If the investment is held for one year or more, it becomes a long-term capital gain (LTCG). LTCG is tax-free up to Rs. 1,25,000 per year, but any amount above this limit is taxed at 12.5% without indexation benefits.

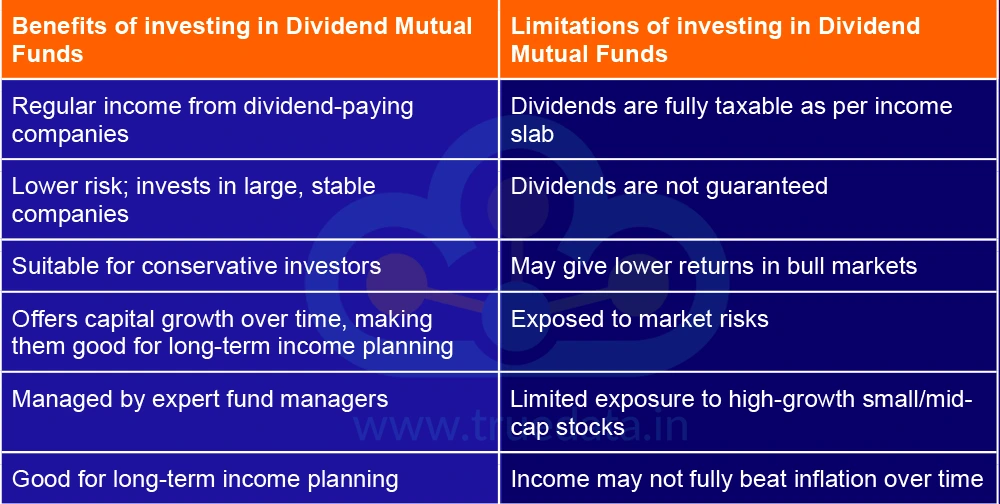

Understanding the key details about dividend yield funds is necessary to make informed investment decisions. We have discussed the features and factors to consider while investing in these funds, along with their taxation. Let us now focus on the pros and cons of including them in a portfolio.

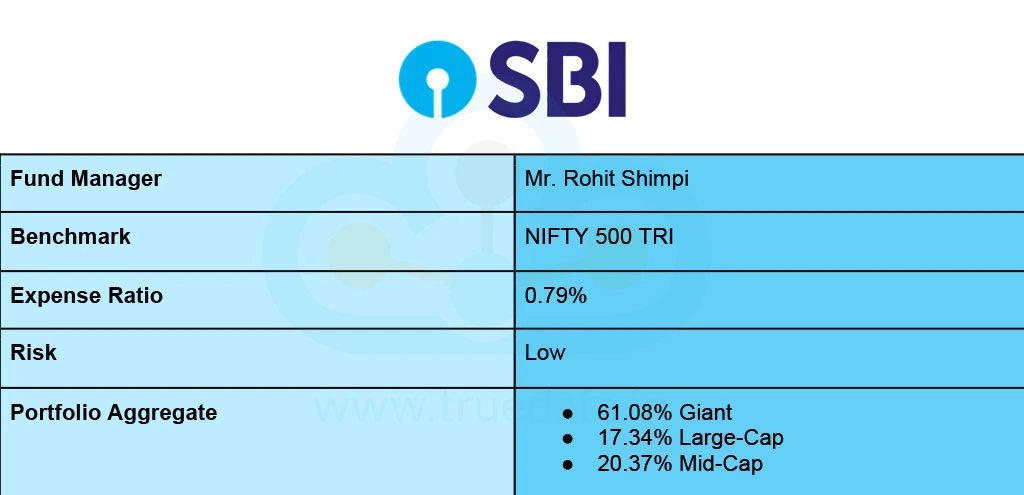

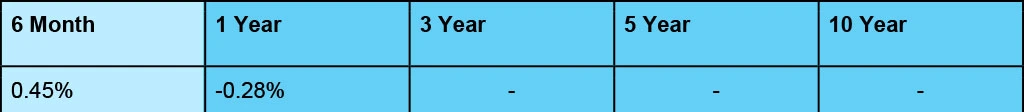

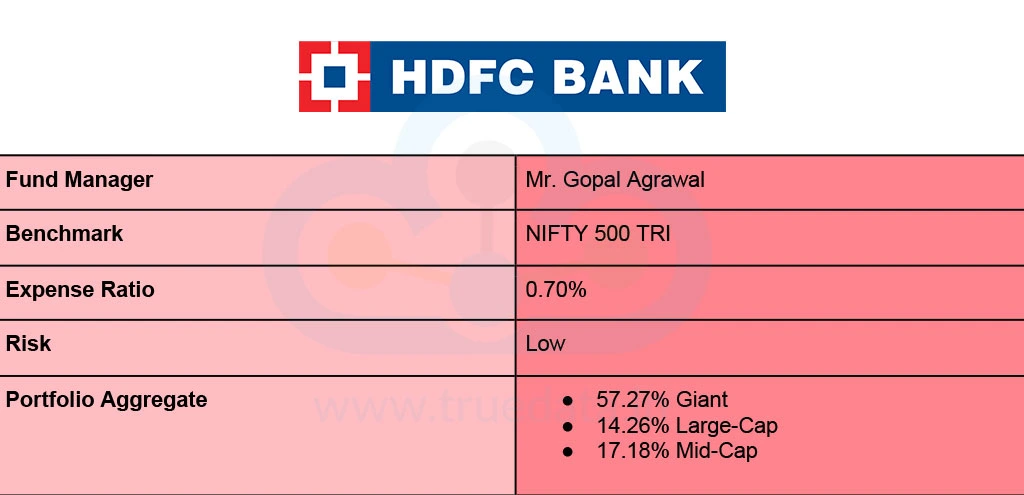

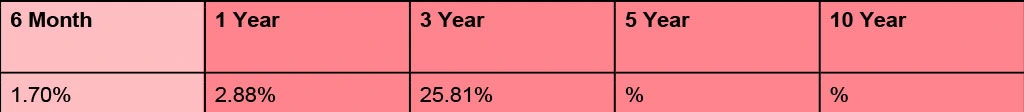

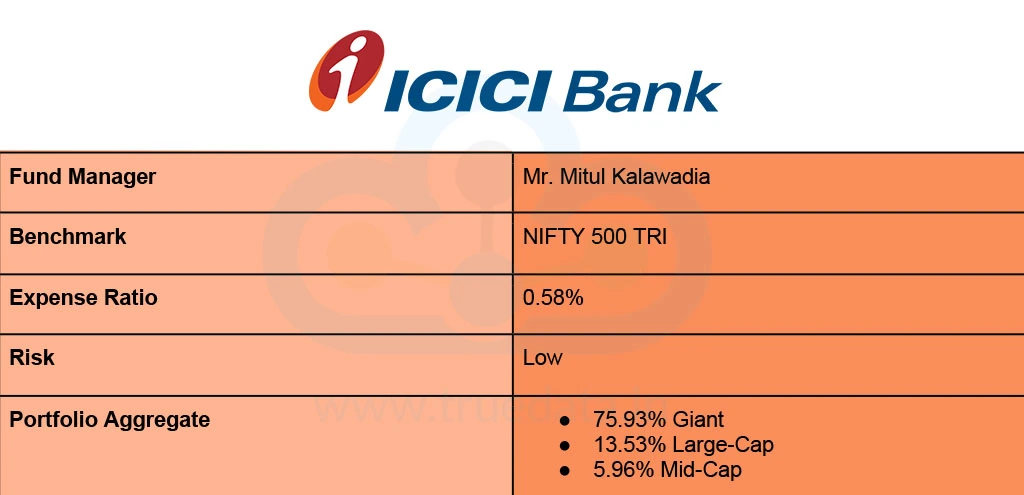

The trailing returns of the fund as of 25th June 2025 are,

The trailing returns of the fund as of 25th June 2025 are,

The trailing returns of the fund as of 25th June 2025 are,

The trailing returns of the fund as of 25th June 2025 are,

The trailing returns of the fund as of 25th June 2025 are,

Dividend Yield Funds are one of the most common and popular mutual fund categories. They are ideal for investors looking for an alternate source of income, at the same time want equity exposure for long-term wealth creation. However, while they make an excellent addition to the investment portfolio, inventors should ensure that their choice of fund aligns with their investment goals and risk appetite before investing in them.

This article talks about a key category of mutual funds. Let us know your thoughts on the topic, or if you need further information on the same.

Till then, Happy Reading!

Read More: 5 Reasons to Consider Mutual Fund for Child Education Planning

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...