Mutual fund investments are subject to market risks.’ There is a generation of investors who have listened to this investment advice and have made mutual funds a staple in their investment portfolios. But what if you want to transfer these investments to the next generation or to a third party? Can you do that? And if yes, then what is the process? Check out this blog to get answers to these questions and more, and enhance your investment journey.

The transfer of mutual funds means moving the ownership of mutual fund units from one person to another. In India, this is not commonly allowed unless it is a special case, like when the original investor passes away. In such situations, the mutual fund units are transferred to the nominee or legal heir through a process called transmission. Investors cannot usually gift or sell their mutual fund units directly to someone else, as is the case with property or gold. However, investors can move their mutual fund investments from one broker to another, or from a regular plan to a direct plan, or even shift them into a demat account. These types of transfers do not change the owner; rather, they just change where or how the investment is held.

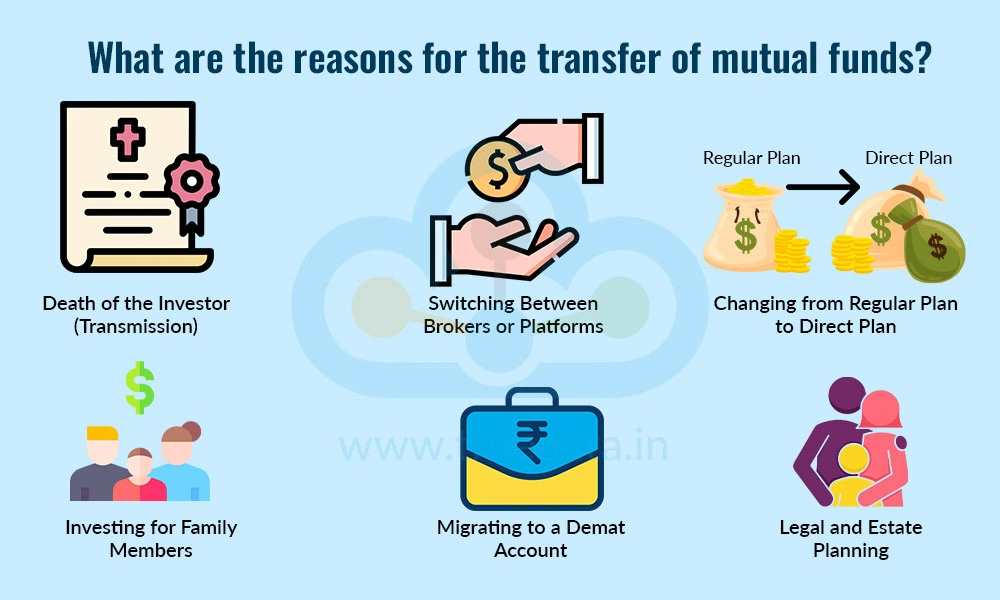

The transfer of mutual funds in India is allowed under specific situations and by adhering to the conditions laid down by SEBI and AMFI in this regard. Some of the cases that can warrant a transfer of mutual funds include,

Death of the Investor (Transmission) -

In cases where the original investor passes away, mutual fund units are transferred to the nominee or legal heir. This process is known as transmission and is one of the few situations where ownership changes are permitted.

Switching Between Brokers or Platforms -

An investor may wish to shift their mutual fund holdings from one investment platform to another. This move is administrative and does not involve a change in ownership.

Changing from Regular Plan to Direct Plan -

Investors often transfer their investments from a regular plan to a direct plan to reduce expenses by avoiding distributor commissions. This change happens within the same mutual fund scheme and keeps the ownership intact.

Investing for Family Members -

If an individual wants to invest for their child, spouse, or parent, it is advisable to make the investment in the family member’s name from the beginning. Mutual funds cannot be gifted easily, as transferring mutual fund units between individuals while both are living is generally not allowed in India.

Migrating to a Demat Account -

Some investors prefer to hold mutual fund units in a dematerialised (demat) format for better tracking and management. This is a backend transfer and does not change the investor’s identity.

Legal and Estate Planning -

Many investors nominate family members or create a Will to ensure mutual fund holdings are smoothly transferred after their death. Proper legal planning avoids disputes and simplifies the transmission process.

The transfer of mutual funds is a very defined and restricted area and is permissible only in certain cases. Mutual fund unitholders have to follow the rules and the requirements set by SEBI.

Transferring mutual fund units from one person to another is generally not allowed unless it happens due to the original investor’s death. In such cases, the mutual fund units can be passed on to the nominee or legal heir. A nominee can claim the units by submitting a claim form, a death certificate, and identity proof to the mutual fund company (AMC). If there is no nominee, the legal heir must provide extra documents like a will, succession certificate, and an indemnity bond. Direct transfers of mutual funds as gifts or between individuals (such as between friends or spouses) are usually not accepted, and mutual fund companies do not allow units to be registered under someone else's name using third-party money. Gifting mutual fund units is more of a theoretical idea and rarely works in practice due to strict rules. If someone truly wants to ‘transfer’ mutual fund ownership to another person, the practical way is to sell the units in the market and let the other person buy them separately at the current market price.

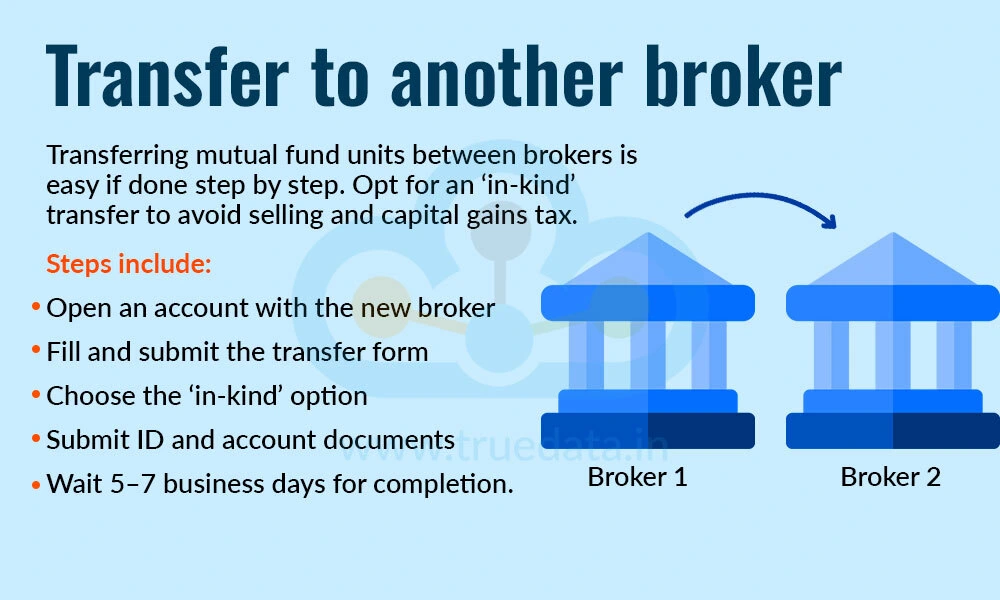

Transferring mutual fund units from one broker to another is a smooth process if done step by step. The best option is to go for an ‘in-kind’ transfer, which moves the mutual fund units without selling them. This helps avoid taxes on capital gains.

Here is the process for the same.

Open an account with the new broker - Make sure the new account is ready to receive your mutual funds.

Request the transfer - Ask the new broker for a transfer form and fill in the details of your mutual fund holdings and your old broker’s account.

Choose the transfer type - Select the ‘in-kind’ option to keep your investment as it is, without selling and rebuying.

Submit documents - Provide your identity proof, account details, and the filled transfer form to both brokers.

Wait for the transfer to complete - It usually takes around 5 to 7 business days for the mutual funds to reflect in your new account.

Also, remember to check for any exit load charges from your old broker and possible service fees from the new one before starting the transfer.

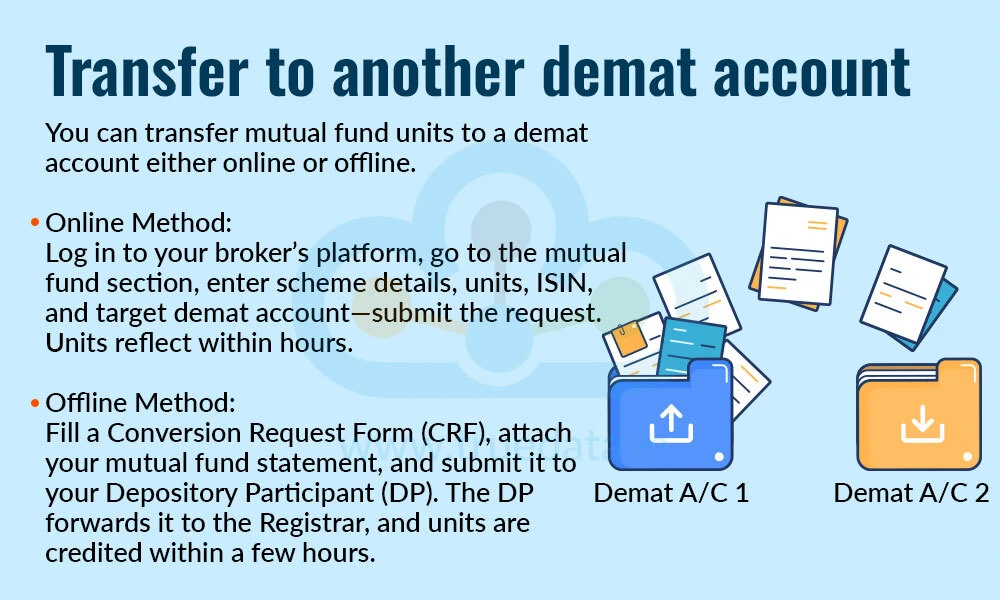

Transferring mutual funds to a demat account can be done in two ways: online or offline. Both methods require careful attention to details like account numbers and fund information.

The steps for such a transfer process are,

Online Method

Log in to your demat account through your broker’s website or app.

Go to the ‘Mutual Funds’ section and choose the ‘Transfer’ option.

Select the mutual fund scheme and enter the number of units to transfer.

Enter the ISIN (a unique code for the fund) and the target demat account number.

Review and submit the transfer request.

The units are usually transferred within a few hours, and you will see them in your demat statement.

Offline Method

Get a Conversion Request Form (CRF) from your Depository Participant (DP) (usually your broker or bank).

Fill and sign the CRF with details like your demat account number, mutual fund scheme name, and number of units.

Attach a statement of account from the mutual fund (showing your current holdings).

Submit the form and statement to your DP.

Your DP will send the documents to the mutual fund’s Registrar and Transfer Agent (RTA).

The RTA verifies the details and credits the units to your demat account, usually within a few hours.

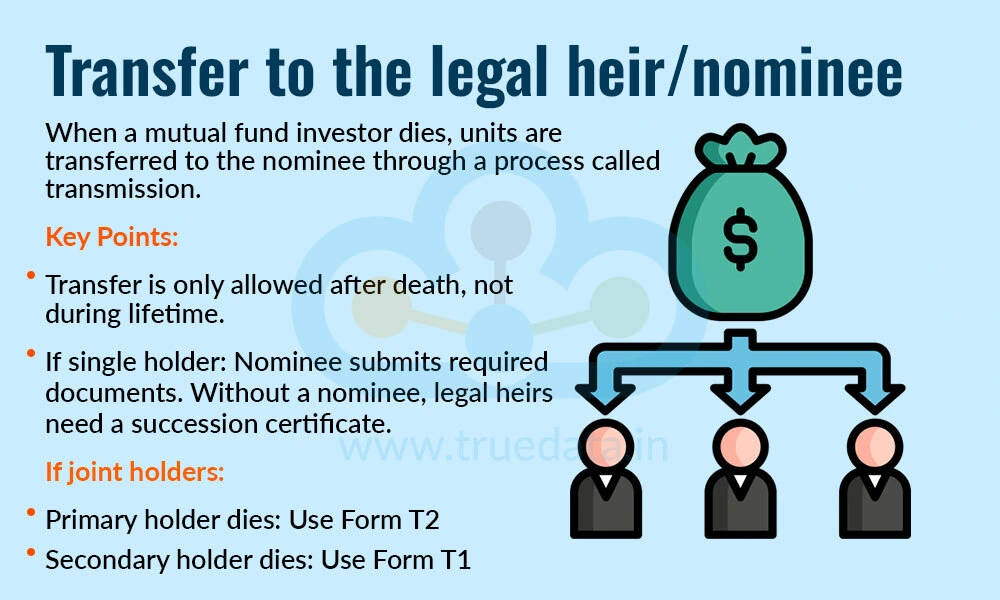

When a mutual fund investor in India passes away, the transfer of their mutual fund units is handled through a formal process, usually based on the nomination details provided at the time of investment. If the investor had nominated someone, that nominee would become the legal recipient of the units. This helps avoid long legal delays and ensures the money reaches the intended person smoothly. However, mutual fund units can only be transferred to someone else in case of the unit holder’s death, and not during their lifetime (except under certain legal conditions).

The documents required and the process for such transfer are detailed below.

Documents Required to Claim the Mutual Fund Units

Death certificate of the investor

Letter from the co-holder (if it was a joint account)

KYC documents of the nominee

Proof of identity of the nominee or legal heir

Bank account registration form for transferring money to the nominee’s account

Indemnity bond, if the value of the units is above Rs. 1,00,000.

If the Investor Was the Only Holder (Single Ownership)

The nominee can easily claim the mutual fund units by submitting the required documents.

If no nominee was added, the legal heirs must go through a longer process, possibly involving a succession certificate or court documents.

Hence, it is strongly advised that investors nominate someone and review or update the nomination from time to time.

If There Were Multiple Unit Holders (Joint Ownership)

If the primary unit holder dies, the surviving holder(s) must fill Transmission Request Form T2 and submit the necessary documents to get the units transferred in their name.

If the second or third holder dies, the surviving holder(s) need to fill out Form T1 to request the removal of the deceased holder’s name from the records.

Gifting mutual funds is a grey area in India, and is possible but with some restrictions. Unlike cash or gold, you cannot simply hand them over. SEBI and AMFI regulate the transfer of mutual fund units, and whether gifting is possible depends on how the units are held. If the mutual fund units are in demat form, they can be gifted through an off-market transfer. However, if the units are held in physical (non-dematerialised) form, gifting is not allowed, except in the case of the investor's death (this is known as transmission). Also, writing a Gift Deed alone is not enough to transfer mutual fund units, as it must follow the formal process to be acceptable.

The easiest way to gift mutual funds is by investing directly in the name of the recipient, such as a spouse or child. For instance, if a parent wants to gift a mutual fund to their daughter, they should use her PAN, KYC, and bank details and make the investment directly in her name. If the recipient is a minor, the investment is made under their name with a parent or guardian managing it until the child turns 18. However, once the child becomes an adult, they get full control over the investment. Also, as per income tax rules (clubbing provisions), any income or gains from the gifted mutual fund may still be taxed under the investor’s name if gifted to a spouse or minor child.

If the mutual fund units are already held in demat form, they can be gifted using an off-market transaction, which is the only SEBI-approved method.

Steps to Gift Mutual Funds via Demat Transfer -

Both the giver (donor) and the receiver (recipient) must have demat accounts (under CDSL or NSDL).

The donor must fill out a Delivery Instruction Slip (DIS), which can be obtained from their Depository Participant (broker).

In the DIS, they need to mention the recipient’s demat account number and clearly mark the transaction as a gift.

Submit the DIS to the broker to process the transfer.

Once the transfer is complete, the mutual fund units will appear in the recipient’s demat account. This is the only formal and accepted way to gift existing mutual fund units in India.

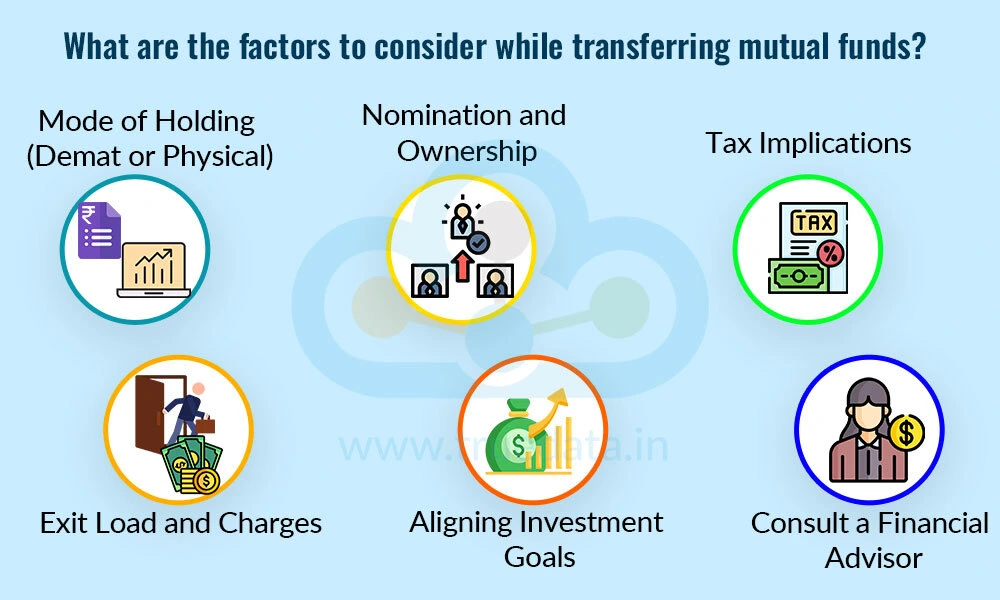

Investors have to consider the following factors before transferring mutual funds in any of the above cases.

Before transferring mutual funds, check whether the units are held in demat or physical (non-demat) form. Transfers are much easier if the units are in demat form, especially for gifts or changing brokers. If they are held physically, transfers are only allowed in case of the investor’s death (not for gifting or other reasons).

Always check if a nominee is registered for the mutual fund. In case of death, having a nominee simplifies the transfer. If there are joint holders, the surviving holder can get the units transferred easily, but proper forms must be submitted.

Transfers may attract taxes depending on the situation. If you sell and re-buy units during the transfer (instead of doing an ‘in-kind’ transfer), you may face capital gains tax. Also, gifting mutual funds to a spouse or minor child can result in income being taxed under your name due to clubbing provisions.

Some mutual funds charge an exit load if you sell or move the units before a certain period. Also, when transferring between brokers, there may be processing fees or service charges, so check with both the old and new platforms in advance.

Transfer or change in mutual fund investments should not be done unless it fits your long-term financial plan. Whether you are planning for retirement, a child’s education, or wealth creation, ensure the move helps you meet those goals. Avoid making emotional or impulsive decisions.

Before making big changes to your portfolio, like switching brokers, gifting funds, or selling existing investments, it is always advisable to talk to a trusted financial advisor. They can help you understand the tax impact, timing, and strategy based on your unique situation and financial goals.

Transferring mutual funds in India is possible, but it depends on the situation and how the units are held. Transfers can happen in cases like switching brokers, moving to another demat account, or after the death of the investor through a legal process called transmission. While gifting mutual funds is allowed only through demat accounts using an off-market method, the easier option is to invest directly in the recipient’s name. Understanding these processes and the nuances of the same enables investors to move their mutual fund holdings in a structured and legal manner without any hassles or discrepancies.

This article talks about a crucial part of mutual fund investments. Let us know your thoughts on the topic or if you have any queries on the same and we will address them.

Till then, Happy Reading!

Read More: Copying a mutual fund portfolio - Should you do it?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...