The mutual fund industry has millions of investors across India, with SEBI at the helm of protecting investors’ interests. While SEBI is in charge of the securities market as a whole, the mutual fund industry has a specific regulator in the form of AMFI. Check out this blog to know the role of AMFI and its related details for the mutual fund industry.

AMFI stands for the Association of Mutual Funds in India. It is an organisation that works for the mutual funds industry in India. AMFI was set up in 1995 and includes all the mutual fund companies in the country as its members. Its main job is to make sure that mutual funds follow the rules and act in a fair and transparent way. AMFI also works to protect investors' interests, spread awareness about mutual funds, and help people understand how mutual funds work. It provides guidelines to the mutual fund companies and ensures that they are honest and professional. AMFI also keeps a list of certified mutual fund distributors, which helps investors know who is qualified to give advice. Thus, AMFI is like a watchdog and guide that makes mutual fund investing safer and easier for common people in India.

AMFI, or the Association of Mutual Funds in India, plays a key role in making mutual fund investments safe and trustworthy for people in India. It sets rules and guidelines that mutual fund companies must follow, helping ensure that these companies act fairly and honestly. AMFI also trains and certifies people who sell mutual fund products, so only qualified individuals are allowed to give investment advice. This helps protect investors from being misled or given wrong information. If an investor faces any issue or has a complaint, AMFI can step in to help resolve it and make sure the investor is treated fairly.

Another major role of AMFI is to spread awareness and educate people about mutual funds. Many Indians are unsure or unaware of how mutual funds work, so AMFI runs campaigns like ‘Mutual Funds Sahi Hai’ to explain the benefits and risks in simple ways. It provides useful information to help people make smart investment choices. AMFI also works closely with SEBI, the financial regulators in India, to make sure mutual fund companies are following all the rules. Overall, AMFI helps build trust in mutual funds, making them a safer and more accessible option for people who want to invest and grow their money over time.

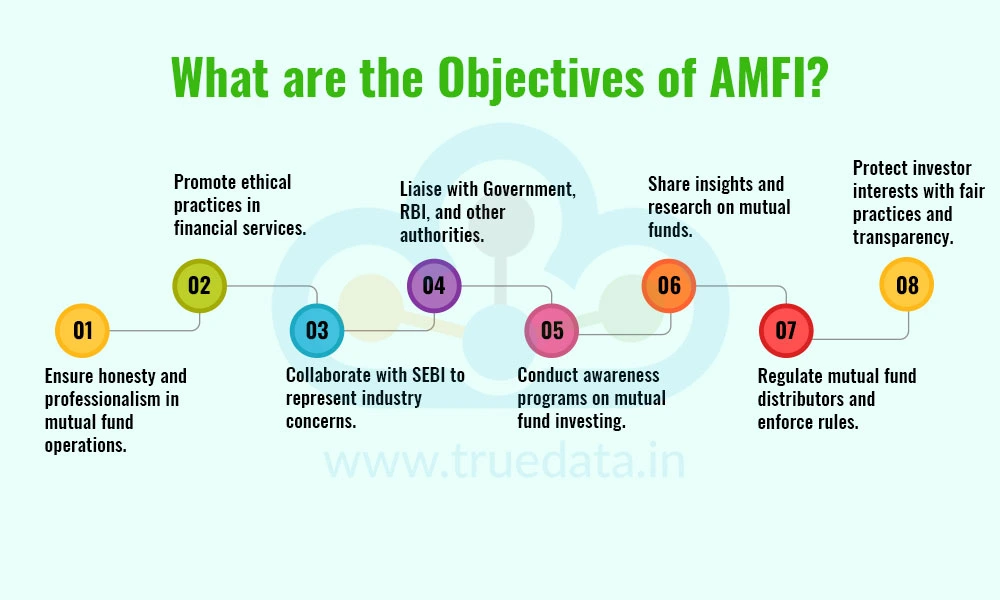

AMFI has defined objectives that highlight its core principles and its way of working. These objectives are mentioned below,

To ensure high standards of honesty and professionalism in all mutual fund activities.

To promote good business practices and ethical behaviour among mutual fund companies and all others involved in financial services.

To work closely with SEBI (the main financial regulator) and share the mutual fund industry's views and concerns with them.

To communicate with the Government, RBI, and other authorities on issues related to the mutual fund industry.

To run awareness programs across India so that people can understand how mutual funds work and how to invest wisely.

To share useful information and do research on mutual funds, either on its own or in partnership with other organisations.

To monitor and manage the behaviour of mutual fund distributors, and take action, like cancelling their license (ARN), if they break the rules.

To safeguard investors’ interests and make sure they are treated fairly and given the right information.

AMFI is a reservoir of all the information on the mutual fund houses that enables users to get quick access to the same and related updates. Here are the services offered by MAFI apart from meeting its objectives.

AMFI shows daily updates of mutual fund details like NAV (Net Asset Value) and TER (Total Expense Ratio), enabling investors to check the current value of their investments.

Investors can view the past performance of mutual funds on AMFI’s website to help them compare and analyse returns.

AMFI also enables a quick search for mutual fund distributors within the city or area on AMFI’s platform.

AMFI shares important updates and notices that help investors and distributors stay informed about mutual fund rules and news.

ARN stands for AMFI Registration Number. It is a unique number given by AMFI (Association of Mutual Funds in India) to individuals or companies who are authorised to sell or distribute mutual fund products in India. Anyone who wants to become a mutual fund distributor must first pass a certification exam (called the NISM Mutual Fund Distributor exam). After passing the exam, they can apply to AMFI and receive their ARN. This number acts like an official license to sell mutual funds.

ARN validates or proves that a person or company giving mutual fund advice is qualified and officially registered. Such entities have to pass the proper exam and be approved by AMFI to sell mutual fund products. Thus, it shows that they understand how mutual funds work and have agreed to follow the rules and guidelines set by AMFI. This helps ensure that investors get the right advice and are not misled.

Having an ARN also helps in protecting investors from fraud and wrong guidance. Anyone can claim to know about mutual funds, but only those with an ARN are trained and trusted. Investors can always check a distributor’s ARN on AMFI’s website to make sure they are genuine and not fake. This adds safety and trust to investors’ investment journey.

In simple terms, ARN is like an identity card for mutual fund distributors. It helps AMFI keep track of them and take strict action if they do anything wrong, like giving false information or breaking the rules. Working with someone who has a valid ARN ensures that investors are taking help from someone who is certified, monitored, and answerable to a trusted body. This makes mutual fund investments more secure and reliable.

The AMFI has various committees under its banner that are responsible for meeting its various objectives.

Valuation Committee - Looks after how mutual fund assets are valued fairly and correctly.

Operations & Compliance Committee - Focuses on making sure mutual fund companies follow all rules and operate smoothly.

Registration of Distributors Committee - Manages the process of giving and renewing ARN numbers for mutual fund distributors.

Financial Literacy Committee - Works on spreading awareness and educating people about mutual funds and smart investing.

Investor Awareness Committee - Plans campaigns and programs to help the public understand mutual funds better.

ETF Committee - Deals with matters related to Exchange Traded Funds (ETFs) and helps in their smooth functioning.

Risk Management Committee - Ensures mutual funds are managing risks properly to protect investors’ money.

Committee on Information Technology - Looks after the use of technology to improve services and systems in the mutual fund industry.

AMFI (Association of Mutual Funds in India) is a crucial link between the investors, mutual fund companies and regulatory bodies. It plays a vital role in making mutual fund investing safe, fair, and transparent for investors. This makes mutual fund investing a more dynamic yet trustworthy space for millions of investors who aim to create wealth in the long term through mutual fund investments.

This article provides information on one of the pillars of the mutual fund industry and its core details. Let us know your thoughts on this topic, or if you have any queries on the same.

Till then, Happy Reading!

Read More: Types of Mutual Funds - How to Choose the Right Mutual Fund

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...