Investment Bias: Overweight large-cap integrators with Gen-AI stacks; selective preference for captive data-centre REITs and GPU-leasing outfits

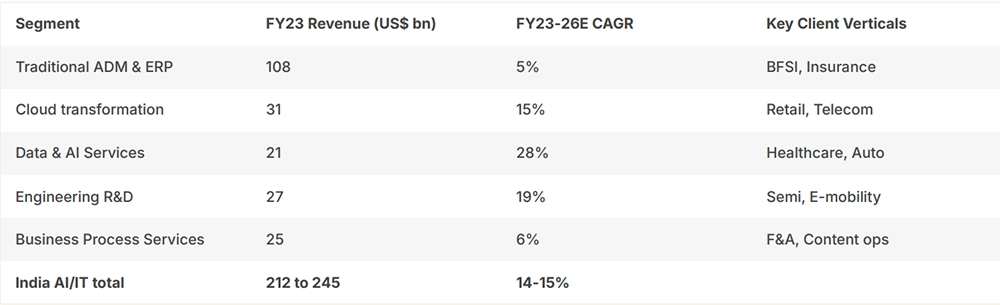

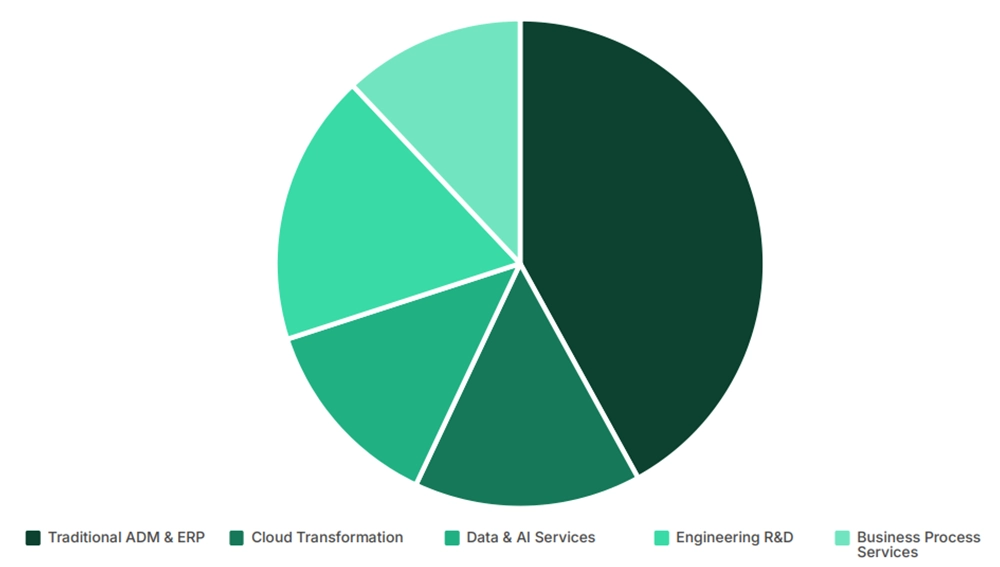

Revenue Pools (FY23 actual, revised post-AI breakout)

Note: Cloud s AI share rising from 16% of total (FY22) to 28% (FY26E)

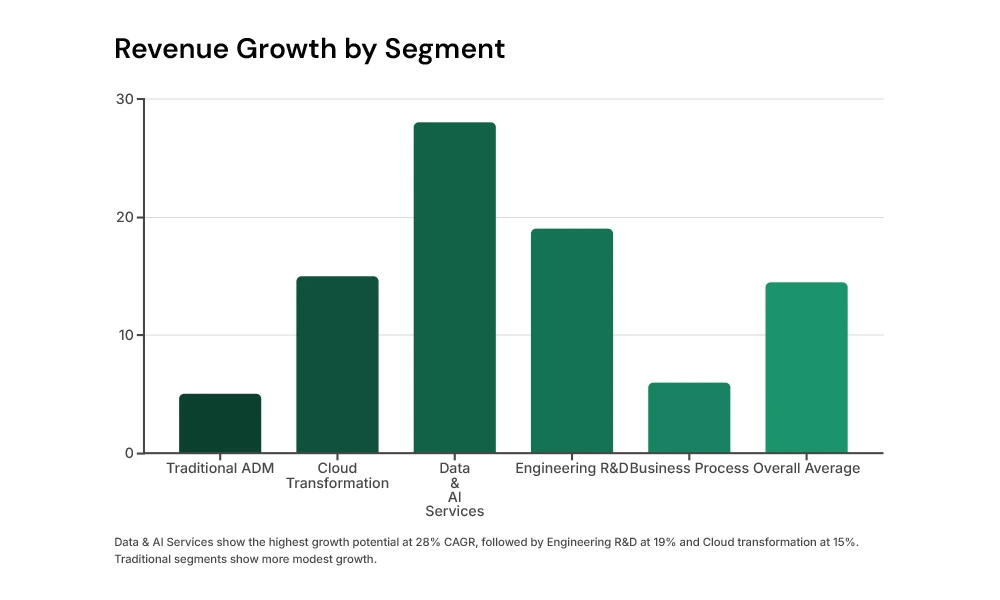

Data & AI Services show the highest growth potential at 28% CAGR, followed by Engineering R&D at 19% and Cloud transformation at 15%. Traditional segments show more modest growth.

·

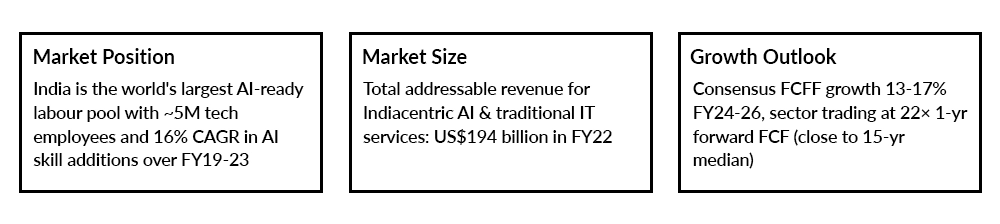

Global digital spend expanding at 7% CAGR (2× slower than previous years)

Offshore share rising from 41% (FY22) to 47% (FY26E) creating pure volume tailwind

TCO arbitrage 55-60% vs US staff

AI tools embedded improve offshore efficiency to 4-labour-hour reduction per developer

·

US budget flush from Infrastructure Act + Chips Act represents 22% of India export invoices

Sticky inflation keeps on-premise workload re-hosting in play

Gen-AI copilot requests accelerate instead of cannibalizing existing business

These cyclical factors provide near-term tailwinds for Indian IT service providers, particularly those with AI capabilities.

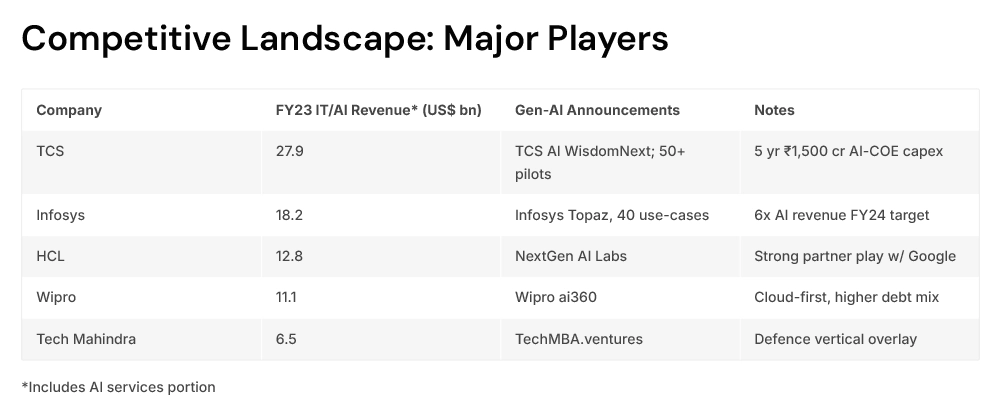

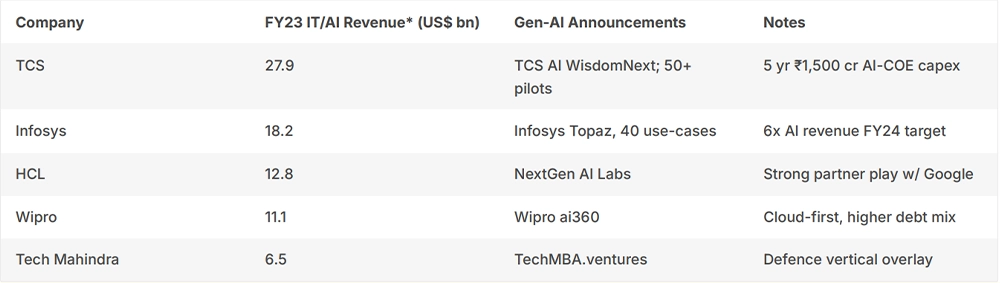

*Includes AI services portion

Revenue: US$4.1 bn

Key Differentiator: 5 new MsAs

AI Strategy: AI on cloud cost optimization

Revenue: US$1.1 bn

Key Differentiator: Large IP stake in Snowflake

Gross Margin: >55%

Revenue: US$0.9 bn

Key Differentiator: GPU leasing joint lab

Strength: Deep auto OEM relationships

Digital India Act 2024 (draft): Introduces Data Empathy Board 3 extra compliance cost US$2.3 mn per large provider

AI Advisory 2024: Non-binding so far, but likely to add bias-audit norm by FY26 3 modeled as 40-50 bps drag on billable rates

SEBI sandbox: Allows AI-generated stock tips only with risk disclaimers + 3-yr traceability logs

20% MAT on AI-driven captive units in SEZs from FY25 sunset replacement

Impact: EBITDA haircut by 120 bps for Tier-1 players

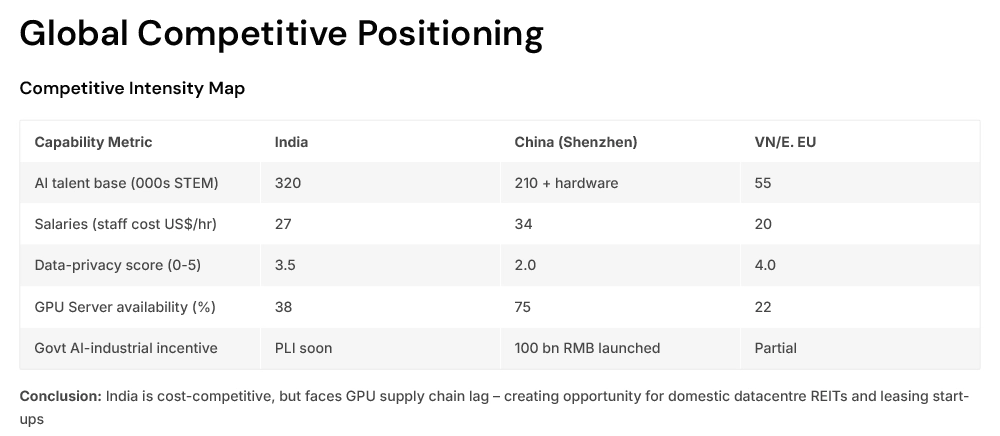

Conclusion: India is cost-competitive, but faces GPU supply chain lag 3 creating opportunity for domestic datacentre REITs and leasing start- ups

Talent Pool: Largest AI-ready workforce globally with 320,000 STEM professionals skilled in AI

Infrastructure Gap: GPU server availability at 38% represents both challenge and investment opportunity

Cost Advantage: 55-60% TCO arbitrage vs US staff with competitive hourly rates of $27/hr

Data Privacy: Moderate-to-strong data privacy framework (3.5/5) providing client confidence

AI-tooling drives efficiency gains of 1.5-2 hrs per developer ³ +100 bps EBIT margin for every 5% adoption among billing base

AI revenue mix projected to climb to 32% of incremental billable hours by FY26 vs 11% today

The efficiency gains from AI implementation create a virtuous cycle of margin improvement and competitive advantage for firms that successfully integrate these technologies.

Consensus estimates as of April 2024 show attractive FCF yields and growth rates across the sector, with mid-caps like Persistent showing highest growth potential.

Probability: Medium

Impact: 3-5% revenue hit

Mitigant: Localisation, improved remote delivery ratios

Probability: Low

Impact: Margin drag

Mitigant: Tier-1 buying Y1,000 cr cyber- insurance

Probability: High

Impact: FX tail-wind becomes head- wind

Mitigant: Hedge ratio ~60% already

Overweight: Infosys, HCL Tech 3 early Gen-AI revenue traction, FCF yield >5%

Equal-weight: Pure-play AI middle-ware (LTIMindtree, Persistent) 3 volatility premium priced in

Trade via: Sector ETF during tax0loss bouts: Nippon India ETF IT (daily AUM US$2 bn)

Exit trigger: Sector FCF yield < 4% AND global big-tech capex slowing > 30% YoY

Current AI revenue mix: 11% of billable hours

Projected FY26 AI revenue mix: 32% of incremental billable hours

Infosys targeting 6x AI revenue in FY24

TCS investing Y1,500 cr in AI-COE capex over 5 years

The rapid growth in AI-related services represents a significant opportunity for Indian IT firms to capture higher-margin business.

38% Current GPU Availability

India's current GPU server availability rate compared to 75% in China

55-60% TCO Arbitrage

Cost advantage vs US staff creating margin cushion

28% Data & AI CAGR

Projected growth rate for Data s AI Services segment FY23-26

The GPU infrastructure gap presents a significant investment opportunity for data center REITs and GPU-leasing startups in the Indian market.

By FY26, Cloud s AI share is projected to rise from 16% (FY22) to 28% of total revenue, demonstrating the sector's shift toward higher-growth, higher-margin services.

Growth Opportunity:

14-15% CAGR for India AI/IT sector with Data s AI services growing at 28%

Competitive Advantage:

World's largest AI-ready labor pool with 55-60% cost advantage vs US

Investment Strategy:

Overweight large-cap integrators with Gen-AI stacks; focus on FCF yield >5%

Infrastructure Gap:

GPU supply chain lag creates opportunity for data center REITs and leasing startups

NASSCOM Strategic Review FY24

Capitaline database

BSE research desk filings

PLI scheme handbook (MoCsI)

Frost s Sullivan India AI Market Tracker Q1-24

The above report is intended solely for institutional clients authorized to receive regulated equity research. No financial instrument recommendation is made to any retail resident in jurisdictions that restrict same.

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Did you know that stock trading is fast becoming one of the most popular searche...

Depreciation is a term that frequently appears in business andfinancial statemen...