Depreciation is a term that frequently appears in business and financial statements, yet it is often misunderstood. While it is a mandatory accounting practice, depreciation also plays a crucial role in reflecting the true value of business assets over time. So why is depreciation necessary, and how does it really affect a company’s profits and cash flows? Read on as we break down depreciation in simple terms and explain its real impact on a business.

Depreciation is an accounting concept that shows how the value of a business asset reduces over time due to regular use, wear and tear, ageing, or technological changes. Assets like machinery, vehicles, computers, furniture, and factory equipment do not last forever, and depreciation helps spread their cost over their useful life instead of showing the full expense in one year. For example, if a company buys a machine for Rs. 10,00,000 and expects to use it for 10 years, depreciation allows the cost to be charged each year gradually. This gives a more realistic picture of a company’s profits, as expenses are matched with the income generated from the asset. Understanding depreciation is important for investors because it affects reported profits, tax calculations, and helps assess how efficiently a company is using and maintaining its assets.

Depreciation can be calculated using different methods, depending on how a business wants to spread the cost of an asset over its useful life. The most common methods of calculating depreciation are explained hereunder.

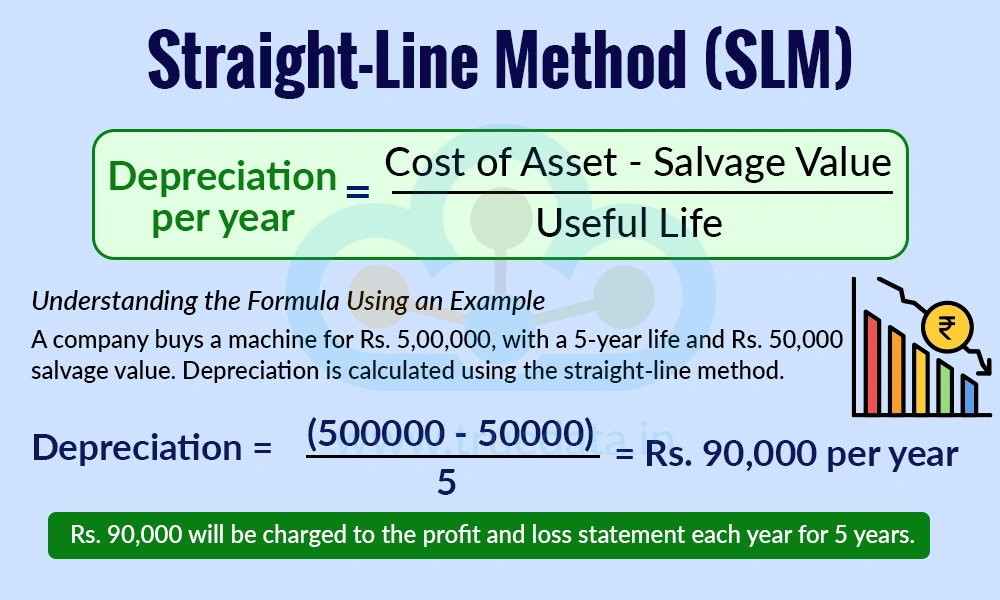

This is the simplest and most commonly used method. Under this method, the asset loses the same value every year over its useful life. This method can be used for small-scale businesses or asset-light businesses. The formula to calculate depreciation using the straight line method is,

Depreciation per year = Cost of Asset - Salvage Value / Useful Life

Understanding the Formula Using an Example

Consider a company that bought a machine for Rs. 5,00,000 with a useful life of 5 years and a salvage value of Rs. 50,000. The depreciation for this asset using the straight line method is shown below.

Depreciation per year = Cost of Asset - Salvage Value / Useful Life

Depreciation = (500000 - 50000) / 5 = Rs. 90,000 per year.

This amount of Rs. 90,000 will be charged in the profit and loss statement every year for a period of 5 years.

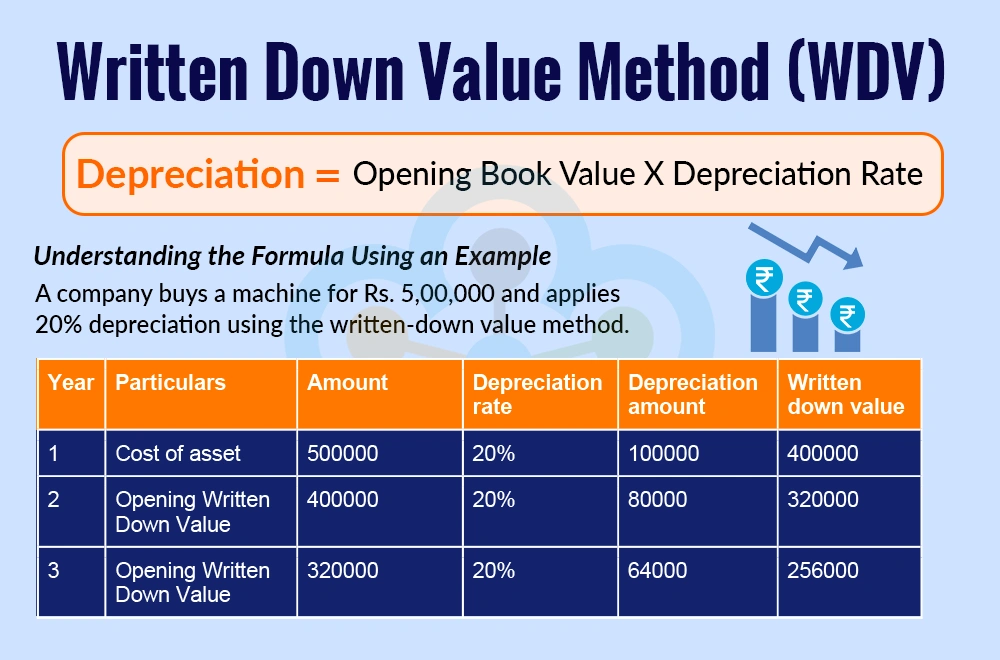

This is a practical and statutorily accepted method to calculate depreciation. In this method, depreciation is charged on the remaining value of the asset each year, not on the original cost. The depreciation amount in this method decreases annually, unlike the straight-line method, where the depreciation amount remains constant for the asset's useful life. The Companies Act 2013 lays down the details of the rate of depreciation which is applicable based on the nature of the asset and its use. This rate is then used to calculate depreciation on the cost of the asset in the year of purchase and then the opening written-down value of the asset or the block of assets thereafter. The formula to calculate depreciation using the written-down value method is,

Depreciation = Opening Book Value * Depreciation Rate

Understanding the Formula Using an Example

Consider a company that bought a machine for Rs. 5,00,000, and the applicable depreciation rate is 20%. The depreciation for this asset using the written-down value method is shown below.

Depreciation is applied over the useful life of the asset or till the closing written-down value of the asset reaches the residual value or nil.

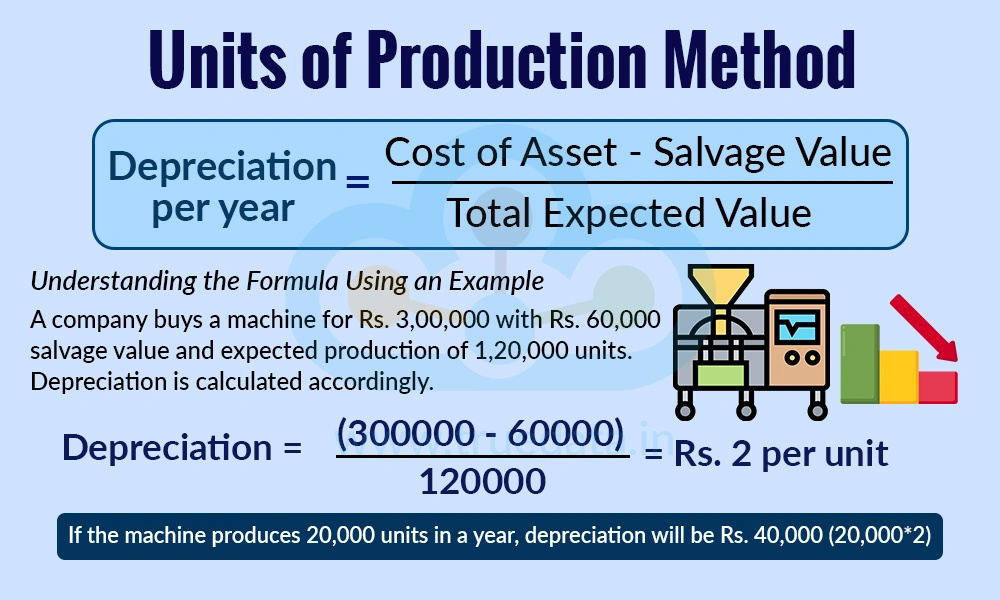

The depreciation in this case depends on how much the asset is used, not on time. It is useful for machines where usage varies each year. The formula to calculate depreciation using this method is,

Depreciation per unit = (Cost - Salvage Value) / Total Expected Value

Understanding the Formula Using an Example

Consider a company buying a machine at the cost of Rs. 3,00,000 and with a salvage value of Rs. 60,000. The total expected production from the machine is 1,20,000 units. The depreciation in this case will be,

Depreciation per unit = (300000 - 60000) / 120000 = Rs. 2 per unit

Thus, if the machine produces 20000 units in a year, the depreciation amount will be Rs. 40,000 (20,000*2)

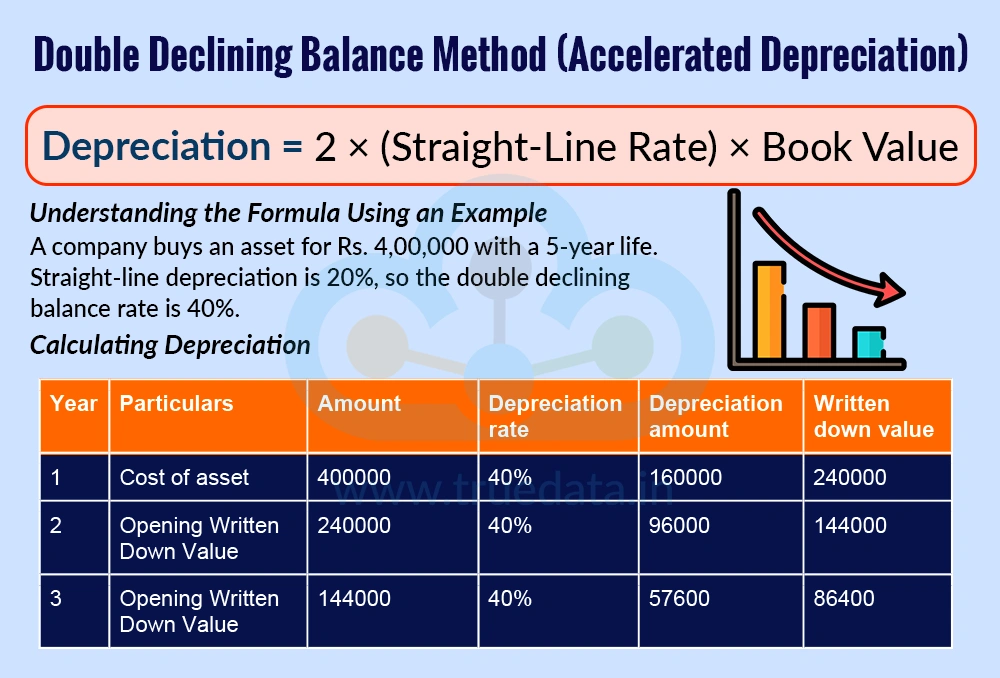

This method charges higher depreciation in the early years and lower depreciation in later years. It is useful when assets lose value quickly. The formula to calculate depreciation using this method is,

Depreciation = 2 × (Straight-Line Rate) × Book Value

Understanding the Formula Using an Example

Consider a company buying an asset costing Rs. 4,00,000 and a useful life of 5 years. The straight line depreciation rate is 20%; hence, the double declining rate is 40%.

Calculating Depreciation

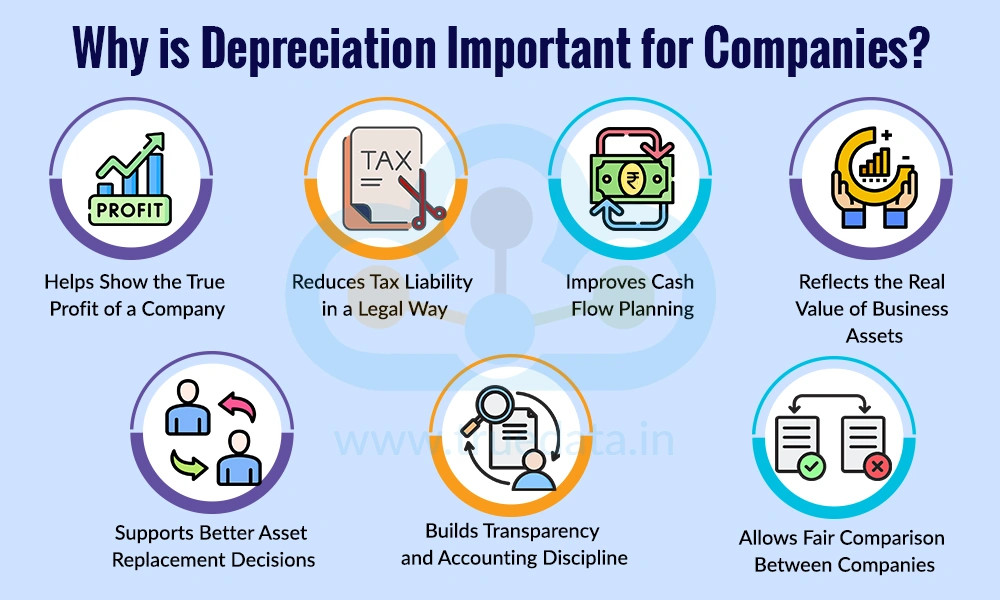

Depreciation is an integral part of any business and helps understand the true value of its assets. The importance of depreciation for companies is explained hereunder.

Depreciation is important because it helps companies show a more realistic picture of their profits. When a business buys a costly asset like machinery or equipment, it is used over many years to earn income. If the entire cost is shown as an expense in one year, profits would look very low in that year and misleadingly high in later years. Depreciation spreads this cost over the asset’s useful life, matching expenses with the income generated. This makes profit numbers more reliable and easier to compare across years.

Depreciation is allowed as an expense under Indian income tax laws. Since it reduces the company’s taxable profit, it helps lower the tax payable. This is especially important for asset-heavy businesses like manufacturing, infrastructure, or logistics. Investors benefit indirectly because tax savings improve the company’s cash position and overall financial health.

Although depreciation reduces profits on paper, it does not involve any actual cash outflow. This means companies can report lower profits while still having strong cash flows. This extra cash can be used for business expansion, debt repayment, or dividend payments. Understanding depreciation helps investors and management in correctly analysing cash flow statements instead of relying only on profit numbers.

Assets lose value over time due to usage, wear and tear, or becoming outdated. Depreciation helps reflect this reduction in value in the company’s books. Without depreciation, assets would continue to appear at their original purchase price, which may be far from their actual worth. This helps investors understand whether a company’s balance sheet truly reflects the condition and age of its assets.

By charging depreciation every year, companies gradually account for the cost of assets they are using. This helps management plan in advance for future replacements or upgrades of machines and equipment. This highlights whether a company is preparing well for maintaining and upgrading its productive capacity.

Depreciation is a mandatory accounting practice, and following it shows that a company is maintaining proper financial discipline. Regular depreciation signals transparency and compliance with accounting standards. This increases confidence in the company’s financial statements and overall governance.

Depreciation helps create uniformity in financial reporting, especially when companies in the same industry follow similar depreciation methods. This makes it easier for management and investors to compare profitability, asset usage, and efficiency across companies. Without depreciation, comparisons would be distorted and less meaningful.

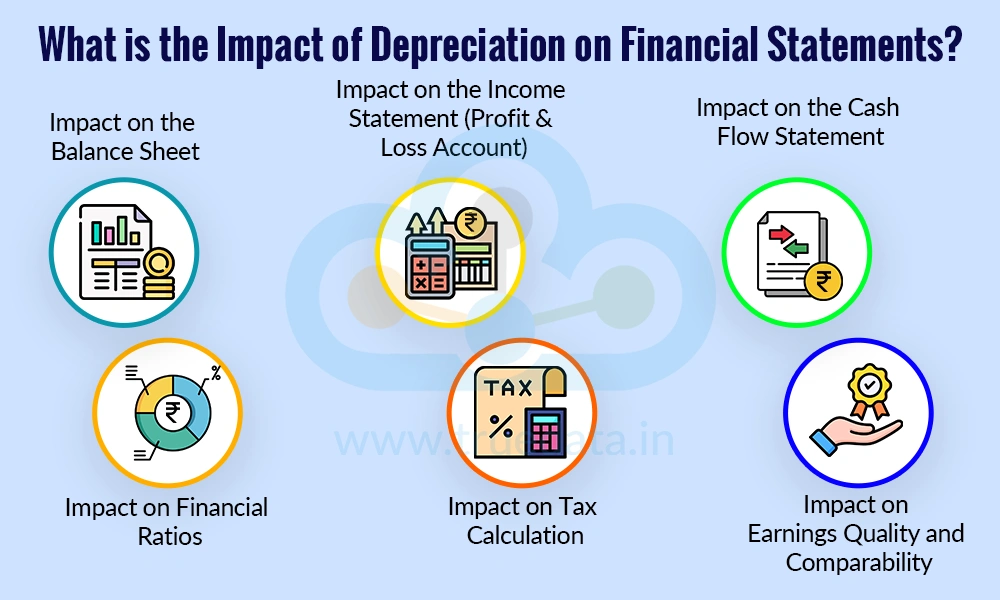

Depreciation affects all three major financial statements and plays a key role in understanding a company’s real financial position. Understanding depreciation helps separate accounting adjustments from actual business performance, leading to better investment decisions based on long-term financial strength rather than short-term profit figures. The impact of depreciation on financial statements is explained hereunder.

On the balance sheet, depreciation reduces the value of fixed assets year after year. Assets are shown at their original purchase cost minus accumulated depreciation, which represents the total depreciation charged to date. This method shows a more realistic value of what the assets are actually worth today. Without depreciation, assets would continue to appear at their original cost, which can be misleading for investors and other stakeholders. Thus, depreciation helps in judging how old the assets are, whether the company may need future capital expenditure, and how efficiently the company is maintaining its asset base.

Depreciation appears as an expense in the company’s Profit and Loss Account every year. When depreciation is charged, it reduces the operating profit and net profit shown in the financial statements. Even though no actual cash is paid out, this expense reflects the gradual usage of assets like machinery, vehicles, and equipment that help the company earn revenue. By spreading the cost of assets over their useful life, depreciation ensures that profits are not overstated in the early years. This helps in understanding the true earning capacity of a business rather than just looking at inflated short-term profits.

Depreciation does not involve any cash outflow, but it still affects the cash flow statement. Since depreciation reduces accounting profit, it is added back to net profit while calculating cash flow from operating activities. This adjustment explains why a company may report lower profits but still generate strong cash flows. This helps in understanding cash flows effectively and reflects the company’s actual ability to fund operations, pay dividends, or reduce debt, which is often more important than reported profits alone.

Depreciation influences many important financial ratios used by investors. Since it reduces profits, ratios such as Return on Equity (ROE) and Return on Assets (ROA) may appear lower. At the same time, because asset values decline due to depreciation, efficiency ratios like asset turnover may improve. It is important to consider depreciation methods while comparing companies, as different methods can make ratios look better or worse without any real change in business performance.

Depreciation reduces taxable income, which helps companies lower their tax liability in a legal manner. In India, depreciation for tax purposes is calculated using rates prescribed under the Income Tax Act, which may be different from depreciation shown in the financial statements. Due to this difference, the profit reported to shareholders and the profit reported to tax authorities may not be the same. Understanding this difference helps in analysing the company’s effective tax rate and the sustainability of its tax savings.

The way depreciation is calculated can significantly affect the quality of reported earnings. Higher depreciation reduces profits but improves earnings quality by being conservative, while lower depreciation can artificially boost profits in the short term. If companies frequently change depreciation methods or assumptions, it becomes difficult to compare their performance over time. Thus, consistent depreciation policies and a clear explanation in the financial statements increase confidence in reported numbers and allow meaningful comparison across companies in the same industry.

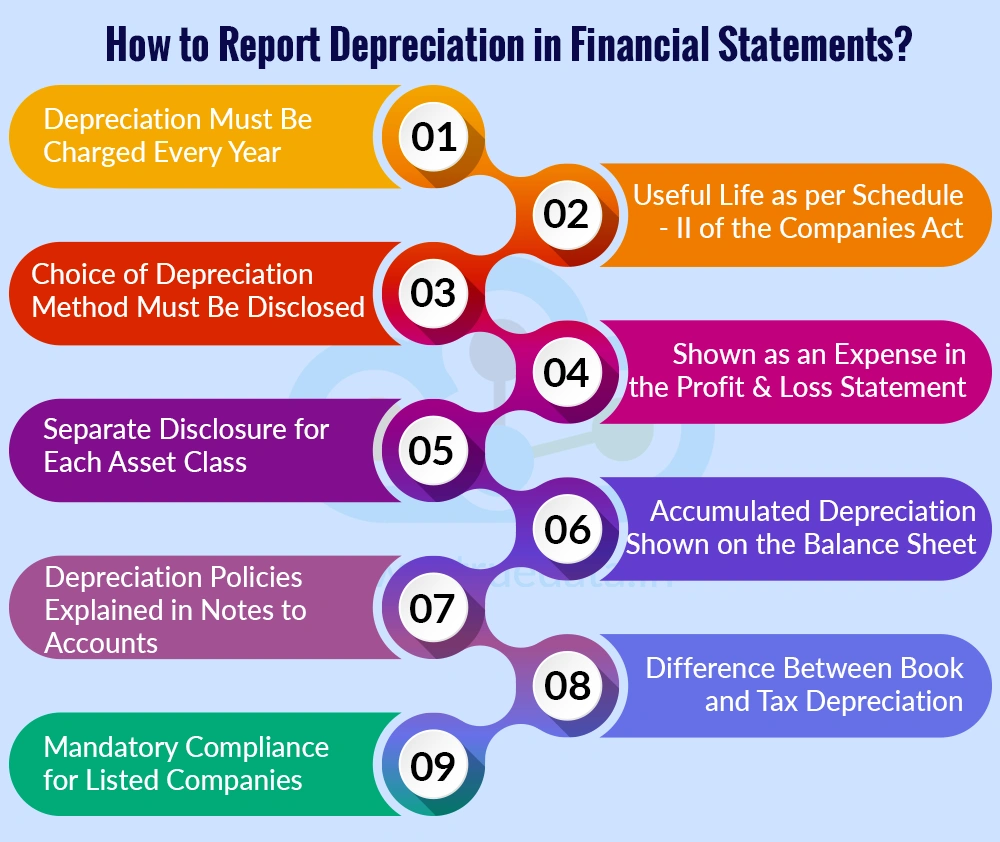

Depreciation has to be reported based on specific guidelines as per the SEBI and Companies Act 2013 regulations. A correct reporting of depreciation ensures profits are realistic, assets are fairly valued, and financial statements can be trusted. Investors who understand depreciation reporting can better judge earnings quality, cash flows, and long-term sustainability of a business. The basic guidelines for reporting of depreciation in financial statements are,

Depreciation Must Be Charged Every Year - Companies are required to charge depreciation on all tangible fixed assets every financial year. This is mandatory under the Companies Act, 2013. Assets like plant, machinery, buildings, vehicles, and equipment must not be shown at full cost forever. This ensures investors that profits and asset values are not overstated.

Useful Life as per Schedule II of the Companies Act - Depreciation must be calculated based on the useful life of assets prescribed in Schedule II of the Companies Act, 2013. Companies can use a different useful life only if they provide proper technical justification and disclose it clearly. Investors should check these disclosures to understand whether depreciation assumptions are conservative or aggressive.

Choice of Depreciation Method Must Be Disclosed - Companies are allowed to use methods such as the Straight-Line Method (SLM) or Written Down Value (WDV). However, the chosen method must be applied consistently. If a company changes its depreciation method, it must clearly explain the reason and financial impact. This transparency helps investors compare performance across years.

Shown as an Expense in the Profit & Loss Statement - Depreciation is reported as an operating expense in the Profit & Loss Account. This reduces the company’s reported profit for the year. This explains why profits may fall even when business operations remain stable.

Separate Disclosure for Each Asset Class - Companies must disclose depreciation details for different asset categories such as buildings, plant and machinery, furniture, and vehicles. This breakup allows investors to understand which assets are being used heavily and where future replacement costs may arise.

Accumulated Depreciation Shown on the Balance Sheet - On the balance sheet, assets are shown at cost minus accumulated depreciation. Accumulated depreciation represents the total depreciation charged since the asset was purchased. This helps investors assess the real value and age of the company’s assets.

Depreciation Policies Explained in Notes to Accounts - The depreciation method, useful life, residual value, and any changes made during the year must be clearly explained in the notes to financial statements. SEBI regulations require listed companies to ensure full and clear disclosure. Investors should always read these notes, not just headline profit numbers.

Difference Between Book and Tax Depreciation - Depreciation shown in financial statements (book depreciation) may differ from depreciation claimed under income tax laws. Companies must disclose this difference, especially in notes to accounts. This helps in understanding tax savings and deferred tax adjustments.

Mandatory Compliance for Listed Companies - SEBI requires listed companies to follow uniform accounting standards and make timely, accurate disclosures. Improper or inconsistent depreciation reporting can raise governance concerns. Proper depreciation reporting is seen as a sign of financial discipline and transparency by investors and other stakeholders.

Amortisation is an accounting method used to spread the cost of intangible assets over their useful life. Intangible assets are assets that cannot be seen or touched but still provide value to a business, such as software, patents, trademarks, copyrights, or licences. Just like physical assets lose value due to usage and time, intangible assets also lose value as their benefits reduce over the years. Amortisation helps companies show this gradual reduction in value in a systematic way, giving investors a more accurate picture of profits and asset values.

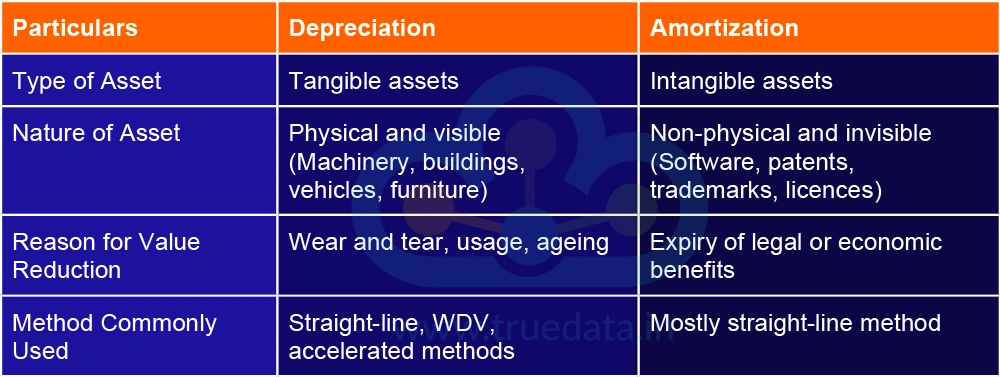

The differences between depreciation and amortisation are tabled below.

Book Depreciation

Book depreciation is the depreciation shown in a company’s financial statements, prepared for shareholders and investors. It is calculated as per accounting standards and the Companies Act, 2013, based on the useful life of assets and the method chosen by the company, such as the Straight-Line Method (SLM) or Written Down Value (WDV). The main purpose of book depreciation is to show a true and fair view of profits and asset values. Book depreciation helps investors in understanding the real operating performance of a business and comparing it with other companies over time.

Tax Depreciation

Tax depreciation is the depreciation allowed while calculating a company’s taxable income under the Income Tax Act, 1961. It is calculated using fixed rates prescribed by tax laws, mostly following the WDV method and applied to a block of assets rather than individual assets. The purpose of tax depreciation is not financial reporting, but to determine how much tax a company must pay. Tax depreciation explains to investors why a company’s tax expense and cash flows may differ from its reported profits.

Book depreciation focuses on accurate financial reporting, while tax depreciation focuses on tax calculation and compliance. Due to the differences in objectives, methods, rates, and asset lives, the depreciation amount under books and tax laws often does not match. This difference is normal and disclosed in the financial statements. Understanding the difference between book depreciation and tax depreciation helps investors avoid confusion between reported profits and actual cash savings. A company may show lower profits due to book depreciation but still enjoy strong cash flows because of tax depreciation benefits. This insight helps investors better judge the earnings quality, tax efficiency, and long-term financial health of a business.

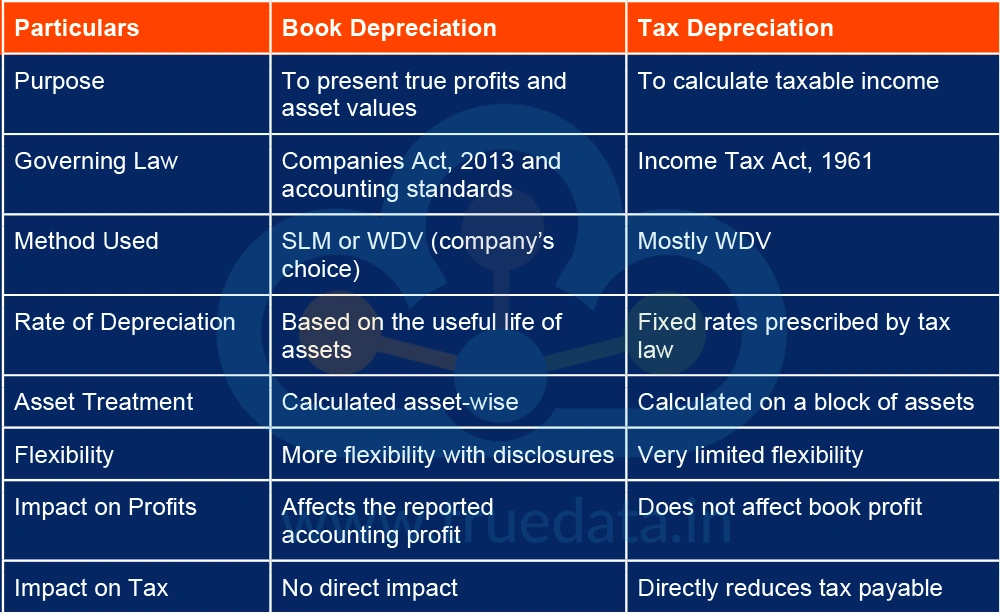

The key differences between book depreciation and tax depreciation are,

Depreciation is a vital accounting concept that helps businesses spread the cost of their assets over their useful life, ensuring that profits, asset values, and financial statements present a true and fair picture. It has a direct impact on profits and cash flows, and can help in understanding the true financial position of a company rather than what is presented on paper. This, in turn, helps in understanding the asset quality, long-term approach of the management and the business sustainability, thereby enabling investors to make better, more informed investment decisions.

This article takes a deep dive into a crucial concept in business and its impact on profits or the bottom line, as well as the overall asset health of the company. Let us know your thoughts on this topic, or if you need any further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: EPS TTM vs EPS Annual - Which Metric Should Investors Prioritise?

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Analysing the financial statements is the first step in the fundamental analysis...