Taxation is one of the key points to consider while making any career or investment decisions. However, what if you have to pay dual taxes both in the country of your work and the country of your residence? To avoid such double taxation and ultimately penalising taxpayers, countries often enter into double tax avoidance agreements to benefit their taxpayers as well as increase investment in their countries. Curious to know more about this topic? Dive into this blog and uncover everything you need to know about DTAA (Double Taxation Avoidance Agreement) and its nuances to invest better and save on extra taxes.

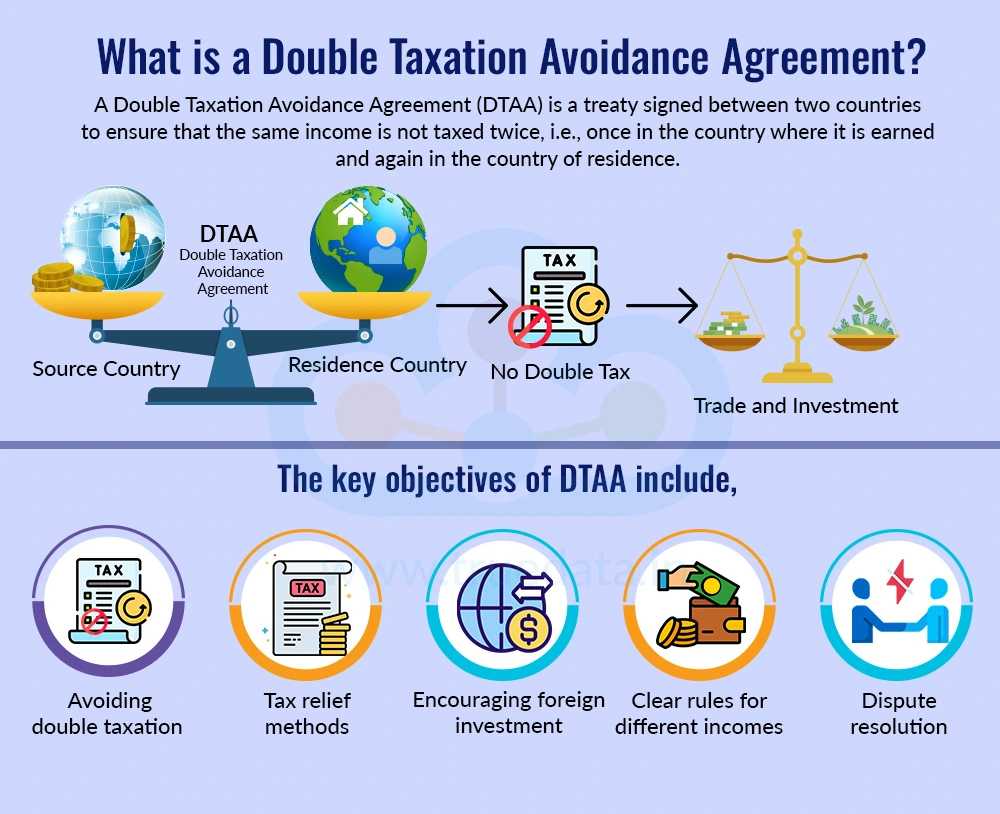

A Double Taxation Avoidance Agreement (DTAA) is a treaty signed between two countries to ensure that the same income is not taxed twice, i.e., once in the country where it is earned and again in the country of residence. Such agreements are crucial in the increasing globalisation, where earning income from foreign sources, such as salaries, business profits, or investments abroad, is common. The main objective of DTAA is to protect taxpayers from being overburdened and to encourage cross-border trade and investment.

The key objectives of DTAA include,

Avoiding double taxation - Ensures that income earned in another country is not taxed both there and in India.

Tax relief methods - Provides relief either by the exemption method (income is taxed only in one country) or the credit method (tax paid in one country is adjusted against tax liability in the other).

Encouraging foreign investment - Makes it easier for Indian citizens and businesses to invest or work abroad without worrying about extra taxes and vice versa.

Clear rules for different incomes - Specifies how salaries, business income, dividends, interests, royalties, and capital gains are taxed.

Dispute resolution - Provides a legal framework to resolve conflicts between countries over taxation issues.

The main purpose of DTAA is to provide tax relief to taxpayers from double taxation. To achieve this, countries can enter into different forms of agreement depending on the negotiations and relationships between countries. The popular forms of DTAA include,

A bilateral DTAA is the most common type of double taxation agreement. It is signed between two countries to avoid taxing the same income twice. For example, India may sign a bilateral DTAA with the USA, UK, or UAE. Under such agreements, if an Indian resident earns income in one of these countries, they can claim relief either through tax exemption or by adjusting the tax paid abroad against their Indian tax liability. Bilateral DTAAs clearly define how different types of incomes, like salary, dividends, business income, interest, royalties, and capital gains, will be taxed, ensuring there is no confusion for taxpayers.

A multilateral DTAA involves more than two countries. It is designed to provide tax relief across multiple jurisdictions under a single agreement. Although less common than bilateral treaties, multilateral agreements are useful for multinational companies or individuals earning income in several countries. These agreements aim to simplify taxation, prevent double taxation, and reduce disputes between multiple countries, making it easier for global investment and business.

A comprehensive DTAA covers all types of income earned in the foreign country and is detailed in terms of tax rates, methods of relief, and rules for dispute resolution. It provides a complete framework for avoiding double taxation on every type of income, from salary to business profits, capital gains, interest, dividends, and royalties. Most DTAAs that India signs are comprehensive, ensuring that residents and non-residents have clarity on taxation.

A limited DTAA applies to specific types of income only, rather than covering all income. For example, it may cover only interest, royalties, or dividends, but not salary or business profits. Limited DTAAs are less common and are usually signed to encourage specific types of investment, like foreign lending or technical services, between countries.

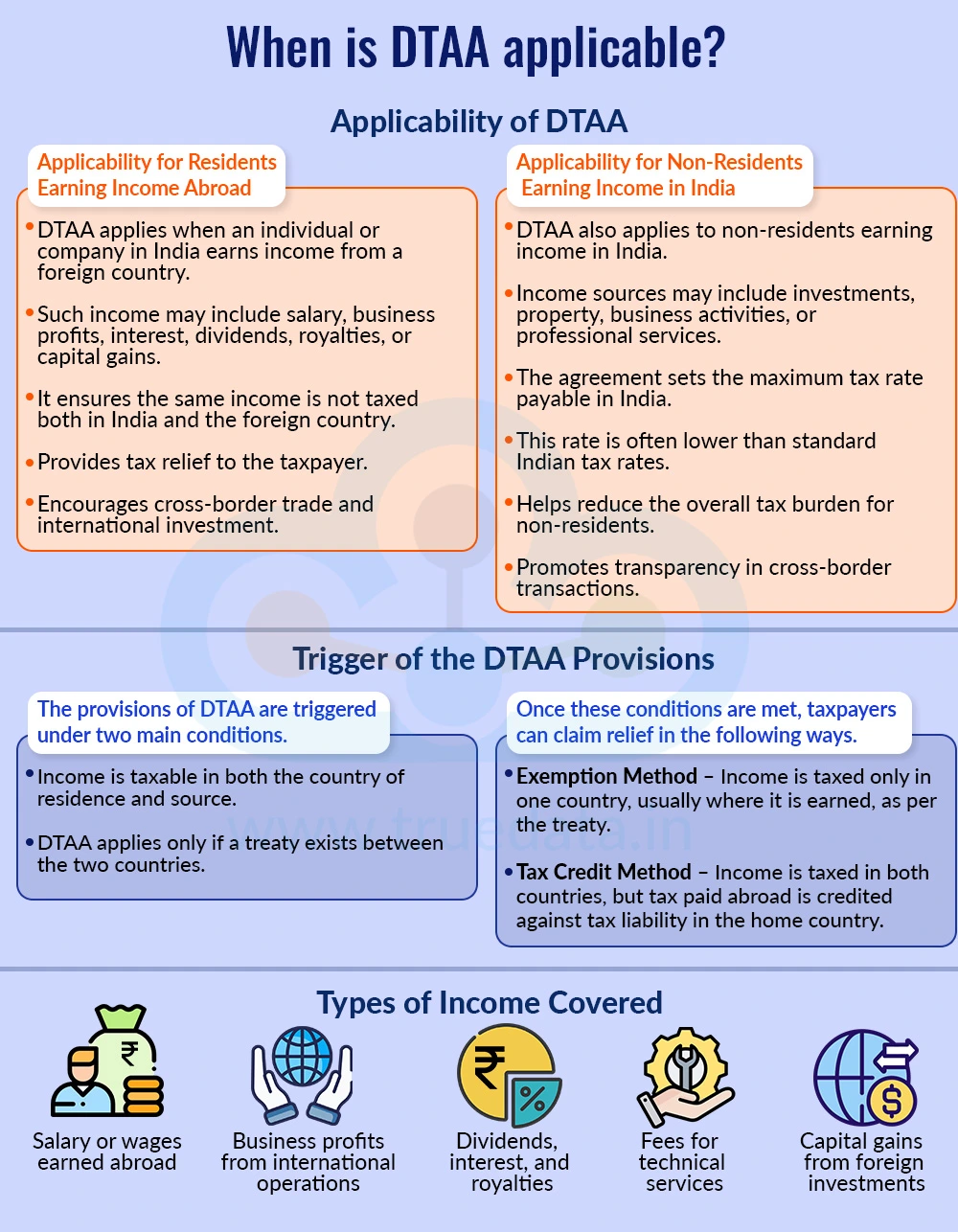

DTAA is considered to be an important tool to avoid double taxation and boost investments, as well as the participation of a skilled workforce in a country. The applicability of DTAA and its nuances are explained below.

Applicability for Residents Earning Income Abroad

DTAA becomes applicable when an individual or company residing in India earns income from a foreign country. This income could include salary, business profits, interest, dividends, royalties, or capital gains. In such cases, DTAA ensures that the same income is not taxed both in India and the foreign country, providing relief to the taxpayer and encouraging international investment.

Applicability for Non-Residents Earning Income in India

DTAA also applies to non-residents who earn income in India. This could be through investments property, business activities, or professional services. The agreement determines the maximum tax rate the non-resident is liable to pay in India, which is often lower than the standard tax rates under Indian law. This reduces the tax burden and makes cross-border transactions more transparent.

The provisions of DTAA are triggered under two main conditions.

Income is taxable in both countries, i.e., the country of residence and the country where the income originates.

A DTAA exists between the two countries, i.e., only countries that have signed a double taxation treaty can invoke its provisions.

Once these conditions are met, taxpayers can claim relief through the following modes.

Exemption Method - Under this method, the income is taxed only in one country, usually the country where it is earned or as specified in the treaty. For example, if the DTAA specifies that salary earned in the USA by an Indian resident is taxed only in the USA, India will not tax the same salary again.

Tax Credit Method - In this method, the taxpayer pays tax in both countries, but the tax paid in the foreign country is credited against the tax liability in India or vice versa, depending on the agreement. For example, consider an Indian resident paying a tax of $1,000 in the USA on their salary. This amount can be adjusted against the income tax payable in India on the same salary, thereby relieving the taxpayer from double taxation.

DTAA applies to specific categories of income to prevent double taxation. These generally include,

Salary or wages earned abroad

Business profits from international operations

Dividends, interest, and royalties

Fees for technical services

Capital gains from foreign investments

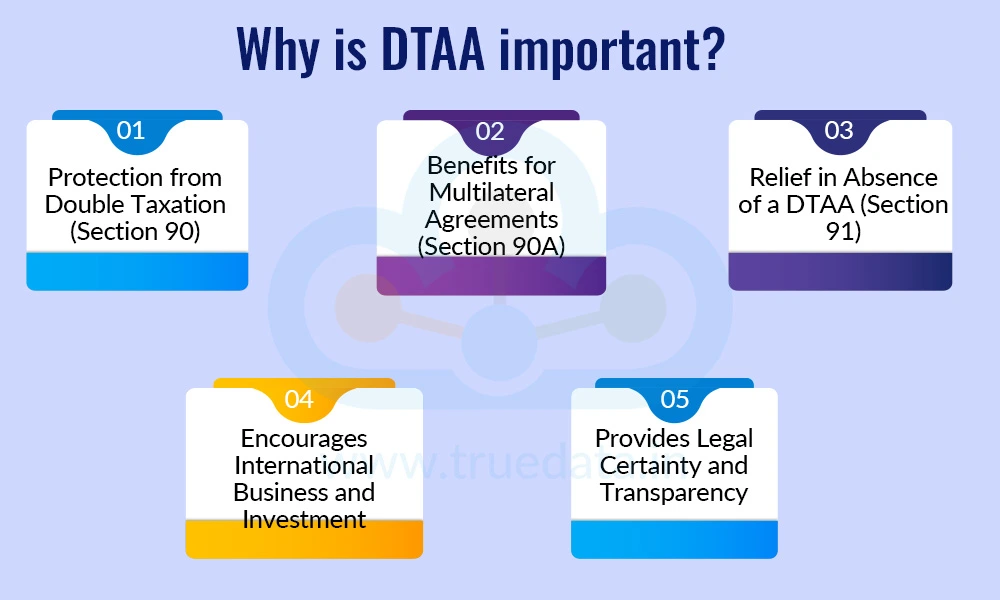

The importance and the benefits of DTAA are explained below.

Section 90 of the Income Tax Act allows the Government of India to enter into Double Taxation Avoidance Agreements (DTAAs) with other countries. This section ensures that an Indian resident earning income abroad is not taxed twice, i.e., once in India and again in the foreign country. Under this provision, the taxpayer can either claim a tax exemption or set off the tax paid abroad against the Indian tax liability. This helps individuals and businesses reduce unnecessary financial burden while engaging in cross-border income or investment.

Section 90A deals with DTAAs signed by India with more than one country or under multilateral agreements. It allows Indian residents and businesses to claim relief from double taxation even when income is earned in multiple countries covered under such agreements. This ensures that taxpayers involved in international trade or multinational operations can plan their taxes efficiently and avoid paying excessive taxes in multiple jurisdictions.

Section 91 provides a fallback mechanism for Indian residents earning income in countries with which India has no DTAA. In such cases, if the income is taxed abroad, Section 91 allows the taxpayer to claim credit for foreign taxes paid against their Indian tax liability. This ensures that even in the absence of a formal agreement, the taxpayer is protected from being penalised with double taxation.

By providing relief through Sections 90, 90A, and 91, DTAA encourages Indian individuals and companies to invest, work, and do business abroad. Similarly, foreign investors are motivated to invest in India because the agreements provide clarity on tax obligations. This helps boost international trade, strengthens economic ties, and promotes a more business-friendly environment.

These sections ensure that Indian taxpayers have a clear and legally recognised method to avoid double taxation. They define which income is covered, how relief is claimed, and in which country tax is applicable. This reduces disputes with tax authorities and promotes transparent and fair taxation.

Claiming relief under DTAA requires taxpayers to adhere to the specific rules mentioned under the provisions of the Income Tax Act as well as the DTAA entered into between countries. Some of the key eligibility requirements include,

Resident of India - The person (individuals or business entity) must be a tax resident of India, as per the Income Tax Act.

Income Earned Abroad - The taxpayer should have earned income from a foreign country.

Country with DTAA - The foreign country must have a signed DTAA with India.

Tax Paid Abroad - Tax must have been paid or is liable to be paid in the foreign country.

Proper Documentation - Required documents like Tax Residency Certificate (TRC), PAN, proof of income, and tax paid should be available.

No Double Claim - The taxpayer should not claim the same income for tax benefits under another method or agreement.

Income Must Be Taxable in India - The foreign income should also be taxable under Indian law to claim relief.

Compliance with DTAA Provisions - The taxpayer must follow the rules and methods of tax relief mentioned in the treaty (exemption method or tax credit method).

Accurate Reporting - Income from abroad should be accurately declared in the Indian income tax return.

Timely Filing - The claim for DTAA benefits should be made within the deadlines prescribed by the Income Tax Department.

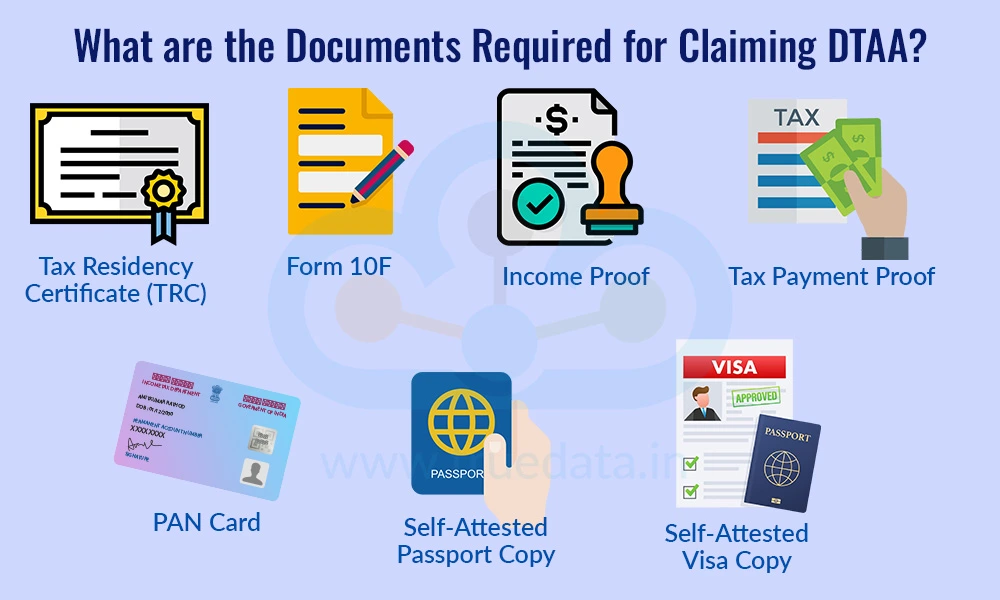

Claiming a relief under the DTAA requires the taxpayer to submit a list of documents to support their claim. These documents help the Income Tax Department verify eligibility and ensure that taxpayers claim DTAA benefits correctly. The key documents for this process include,

Tax Residency Certificate (TRC) - Proof of being a resident of India (or the other country) for tax purposes.

Form 10F - A declaration providing details like residential status, PAN, and other personal information.

Income Proof - Documents showing the income earned abroad (salary slips, bank statements, dividend statements, etc.).

Tax Payment Proof - Evidence of tax paid in the foreign country (tax challans, receipts, or withholding tax certificates).

PAN Card - Proof of Permanent Account Number for identification with the Indian tax authorities.

Self-Attested Passport Copy - Verifies your identity and nationality.

Self-Attested Visa Copy - Serves as proof of your current residency in the foreign country.

Double Taxation Avoidance Agreement (DTAA) is a vital tool for Indian residents and businesses earning income from foreign countries. It helps avoid paying tax twice on the same income, provides clarity on how different types of income are taxed, and encourages international investment and trade. DTAA helps in providing clarity, fairness, and financial relief, making cross-border income and investment simpler and more beneficial for taxpayers.

This post is about an important aspect of international taxation and the benefit of having a clear tax agreement with a foreign nation. Let us know your thoughts on this topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: How to Declare Mutual Funds Returns in ITR?

The Union Budget 2025 created a huge buzz due to its changes in the income tax s...

The world today is bursting with opportunities, and the spirit of hustling defin...

'Mutual funds' - A generation of investors has grown up listening to these words...