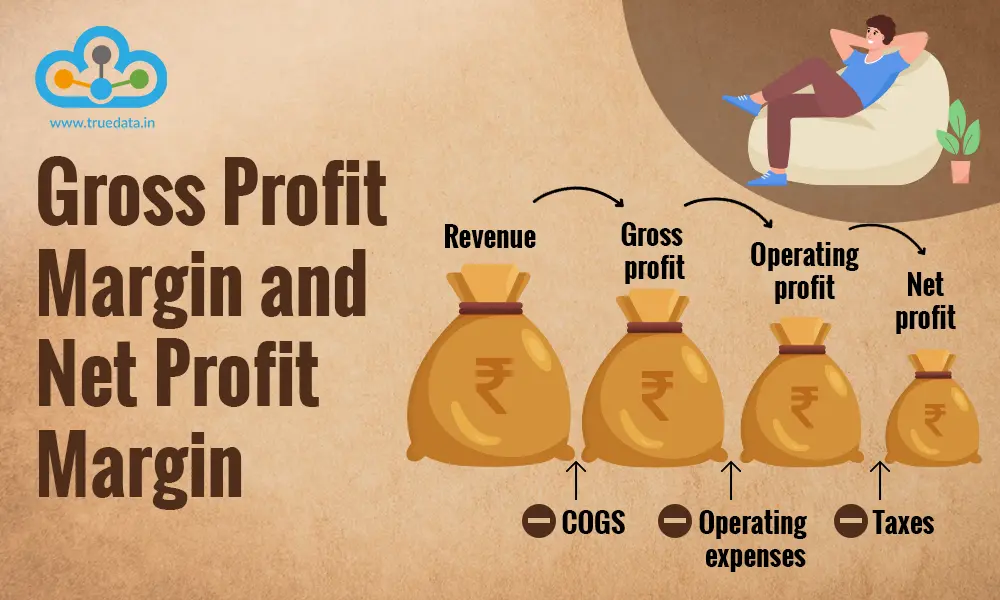

Profitability is often the first thing investors look at when analysing a company. However, it is not just a single number. Companies operate at different levels of profitability, and two of the most widely used measures are the gross profit margin and the net profit margin. These margins go beyond surface-level profits and offer valuable insights into the company’s operational efficiency and its true financial health. Dive into this blog to learn all about these profit levels and what they indicate for a company.

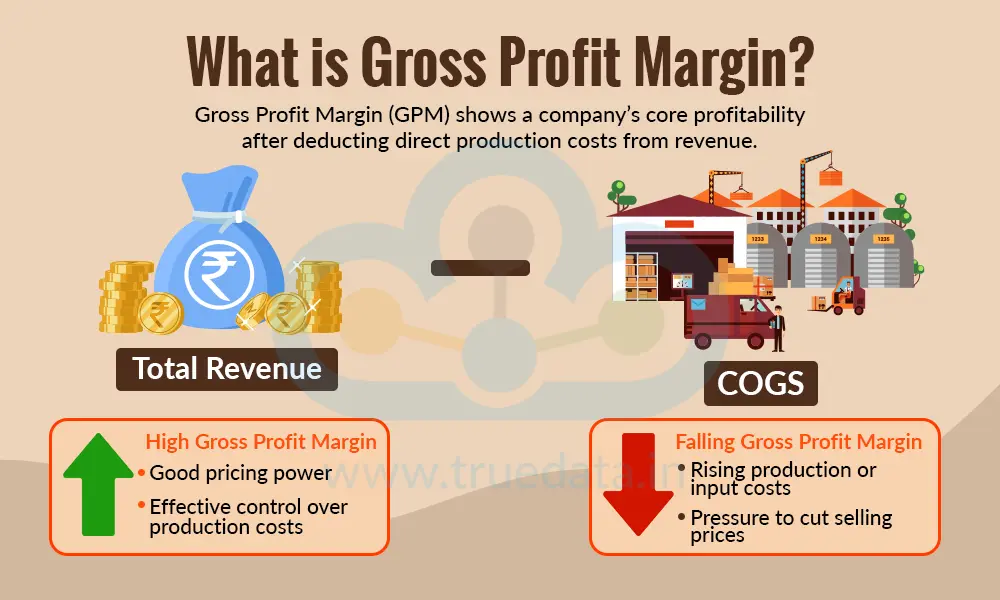

Gross Profit Margin (GPM) is the first level of profitability for a company. It indicates the profitability of a company from its core business after paying for the direct costs of producing goods or services, such as raw materials, factory costs, or direct labour. It is calculated by subtracting the cost of goods sold (COGS) from revenue and then dividing the result by revenue, thereby showing it as a percentage. In simple terms, it shows how efficiently a company turns sales into profit before accounting for indirect expenses like rent, salaries, interest, and taxes. A higher gross profit margin usually means the company has good pricing power, controls its production costs well, or both, while a falling margin may indicate rising costs or pressure to cut prices. Comparing a company’s gross profit margin with its past performance and with other companies in the same industry can help investors assess its operating strength and business quality.

Gross Profit Margin (GPM) is easy to calculate and helps investors understand how efficiently a company earns profit from its core business.

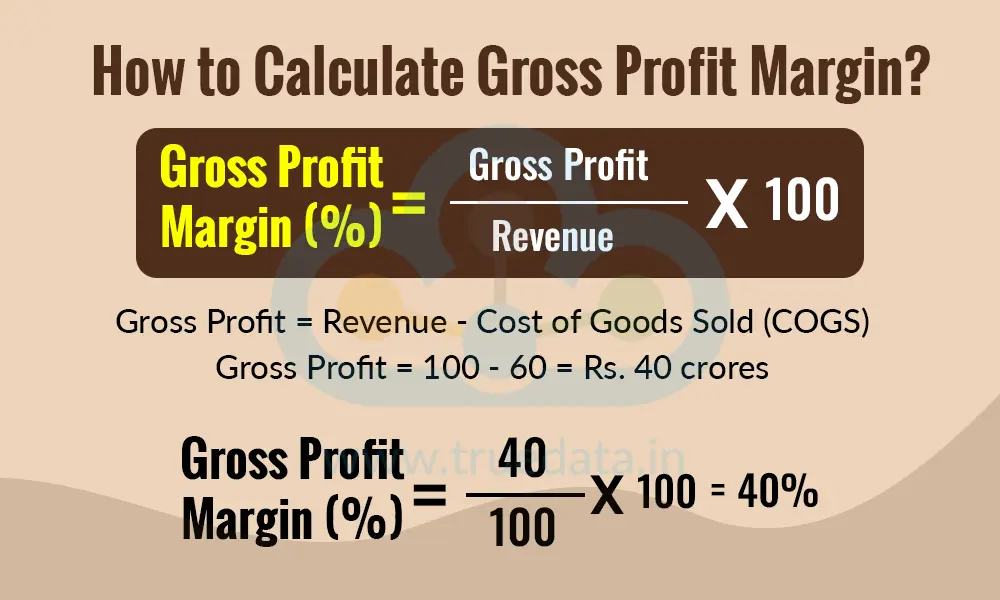

Formula to Calculate Gross Profit Margin

Gross Profit Margin (%) = (Gross Profit / Revenue) * 100

Where,

Gross Profit = Revenue - Cost of Goods Sold (COGS)

COGS includes direct costs like raw materials, manufacturing expenses, and direct labour.

Understanding the Calculation of Gross Profit Margin Using an Example

Consider a company with revenues of Rs. 100 crores from selling its products. The direct cost of making those products (raw materials, factory wages, etc.) is Rs. 60 crore. The gross profit margin for this company is calculated hereunder,

Gross Profit = Revenue - Cost of Goods Sold (COGS)

Gross Profit = 100 - 60 = Rs. 40 crores

Gross Profit Margin (%) = (Gross Profit / Revenue) * 100

Gross Profit Margin (%) = (40 / 100) * 100 = 40%

A 40% gross profit margin means the company keeps Rs. 40 as gross profit for every Rs. 100 of sales before paying other expenses like salaries, rent, interest, and taxes. A higher and stable gross profit margin often signals strong cost control and better pricing power, especially when compared with peers in the same industry.

Gross Profit Margin (GPM) is one of the most important numbers investors look at, as it shows how strong a company’s core business really is. It helps in understanding whether a company can earn healthy profits from its main operations before other expenses come into play. The importance of gross profit margin is explained hereunder.

Shows Core Business Strength - Gross profit margin tells you how efficiently a company produces goods or delivers services. A higher margin means the company controls its direct costs well or can sell its products at better prices. This is crucial for investors as companies with strong core operations are usually better placed to handle competition and market ups and downs.

Early Warning of Cost Pressures - A falling gross profit margin can be an early signal of rising raw material costs, higher wages, or the need to reduce selling prices due to competition. Tracking GPM over time helps investors spot these issues early and understand potential risks to future profitability.

Indicates Pricing Power - A consistently high gross profit margin often shows that a company has pricing power and customers are willing to pay more for its products or services. This can happen due to strong brands, unique products, or limited competition. In India’s competitive markets, companies with pricing power tend to enjoy more stable profits over time.

Helps Compare Companies in the Same Industry - Gross profit margin makes it easier to compare companies within the same sector. For example, comparing two FMCG or auto companies using GPM helps investors see which one manages costs better. This comparison is especially useful where cost structures and input prices can vary widely across industries.

Foundation for Overall Profitability - Gross profit margin is the base on which all other profits are built. If this margin is weak, it becomes difficult for a company to generate strong operating and net profits, even with good cost control elsewhere. Hence, GPM is often the first profitability checkpoint when analysing a company’s financial health.

Reflects Operational Efficiency - Gross profit margin highlights how efficiently a company converts raw materials and inputs into finished products. Companies that improve processes, reduce wastage, or negotiate better supplier contracts usually see stronger margins. This efficiency often separates well-managed companies from average ones.

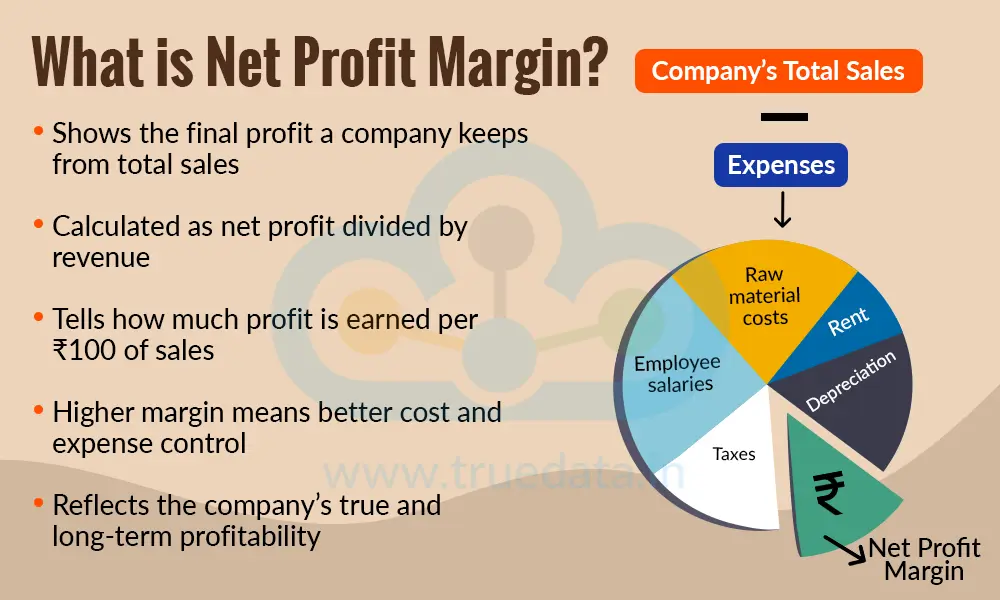

Net Profit Margin (NPM) shows how much profit a company finally keeps from its total sales after paying all expenses, including raw material costs, employee salaries, rent, interest on loans, depreciation, and taxes. It is calculated as net profit divided by revenue and expressed as a percentage. In simple words, it tells you how much money actually goes into the company’s pocket for every Rs. 100 of sales made. A higher net profit margin means the company is managing its overall costs well and running the business efficiently, while a low or declining margin may signal rising expenses, high debt, or tax pressure. Thus, net profit margin is important because it reflects the company’s true profitability and helps judge whether earnings are sustainable over the long term.

Net Profit Margin (NPM) helps investors understand how much profit a company actually keeps after paying all its expenses.

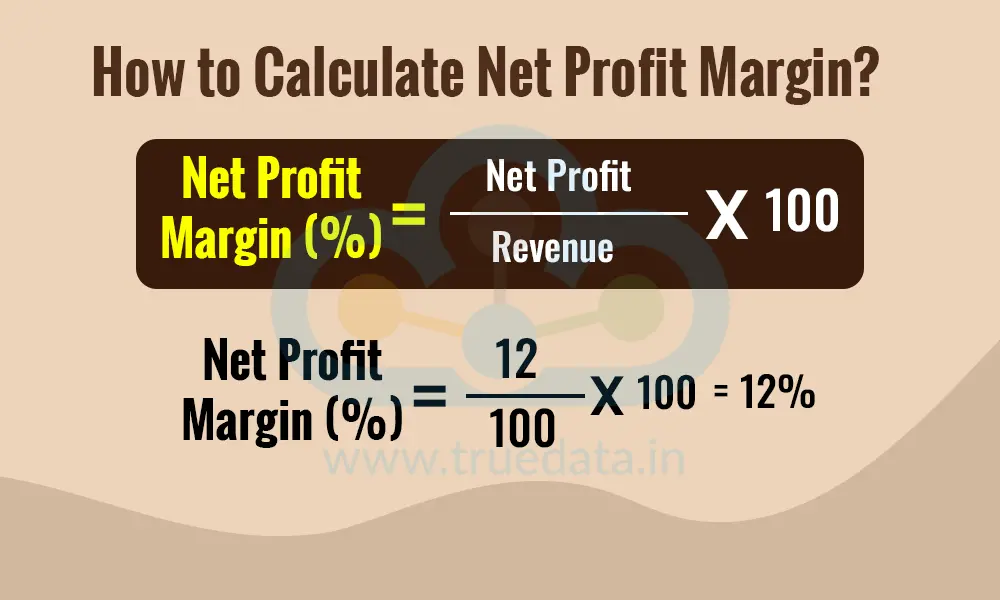

Formula to Calculate Net Profit Margin

Net Profit Margin (%) = (Net Profit / Revenue) * 100

Where,

Net Profit is the profit left after deducting all costs, such as raw materials, employee salaries, rent, interest on loans, depreciation, and taxes.

Revenue is the total sales made by the company.

Understanding the Calculation of Net Profit Margin Using an Example

Let us take an example of a company that reports Rs. 100 crore in revenue. After accounting for all expenses like production costs, operating expenses, interest, and taxes, the company is left with a net profit of Rs. 12 crore. The company's net profit margin is calculated as follows.

Net Profit Margin = (12 / 100) * 100 = 12%

A 12% net profit margin means the company earns Rs. 12 as pure profit for every Rs. 100 of sales. A higher and consistent net profit margin usually indicates good cost control, efficient management, and a financially healthy business, especially when compared with other companies in the same industry.

Net Profit Margin (NPM) is one of the most important indicators of a company’s overall financial health. It shows how much profit is left after all expenses are paid and helps investors understand the company’s true earning power.

Shows True Profitability - Net profit margin reveals the actual profit a company makes from its sales. Unlike other margins, it considers every cost, i.e., operational expenses, interest, depreciation, and taxes. This makes NPM a reliable measure for investors to judge whether a company is genuinely profitable and not just showing strong sales numbers.

Indicates Financial Stability - Companies with steady net profit margins are generally better prepared to handle economic slowdowns, rising interest rates, or higher taxes. Markets which go through frequent economic and policy changes may consider a stable NPM as a company’s ability to stay profitable through different market cycles.

Reflects Overall Cost Control - A healthy net profit margin indicates that management is controlling costs well across the business. This includes production costs, administrative expenses, and finance costs. In cases where input prices and borrowing costs can fluctuate, strong cost control is a big positive sign for long-term investors.

Supports Dividend Payments and Growth - A strong net profit margin gives companies enough surplus to pay dividends, reduce debt, or reinvest in growth. This makes NPM a key number to track for investors who look for both income and capital appreciation

Helps Identify Red Flags Early - A declining net profit margin may signal rising costs, falling demand, higher debt burden, or operational inefficiencies. Tracking this trend over time helps investors spot potential problems early and make better investment decisions.

Reflects Management Efficiency - Net profit margin shows how efficiently the management runs the entire business, i.e., from operations to financing decisions. A higher margin often indicates smart cost management, controlled borrowing, and effective tax planning. This helps investors judge the quality of a company’s leadership.

Useful for Trend Analysis - Tracking net profit margin over several years shows whether a company is improving or struggling. An upward trend signals strengthening profitability, while a downward trend raises caution. Investors often rely on such trends to make long-term investment decisions.

Highlights Business Resilience - Companies with strong net profit margins can absorb shocks such as inflation, higher taxes, or temporary drops in demand. This resilience is especially valuable in a dynamic and competitive business environment.

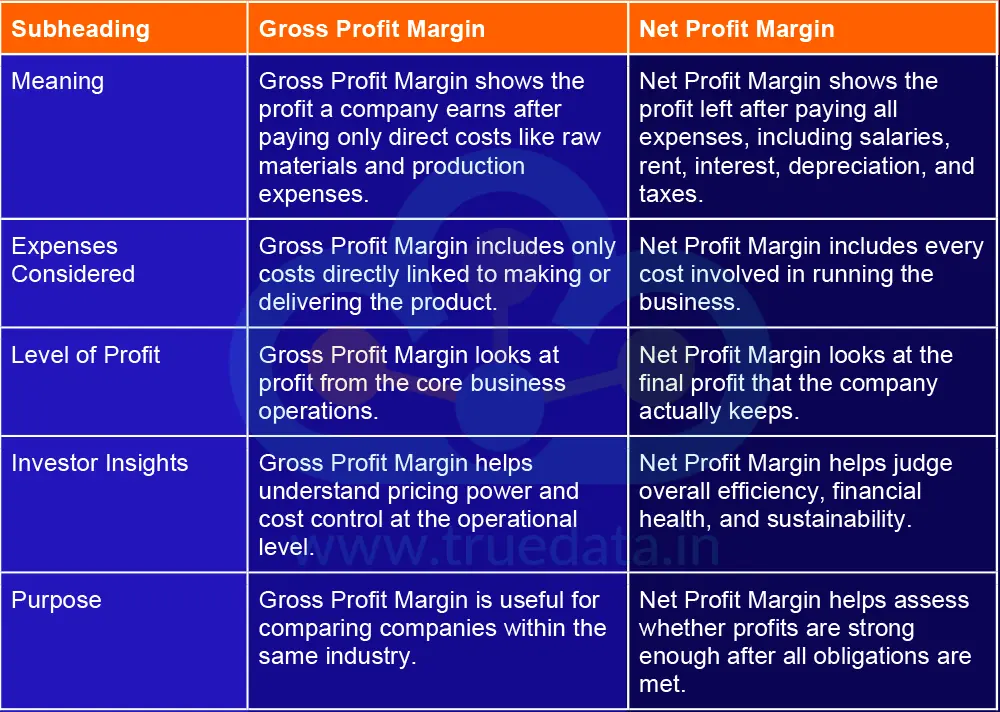

Gross profit margin and net profit margin are two key pillars of evaluating financial health and stability. However, they are used to gain strategic insights for deeper analysis. The key differences between gross profit margin and net profit margin are explained hereunder.

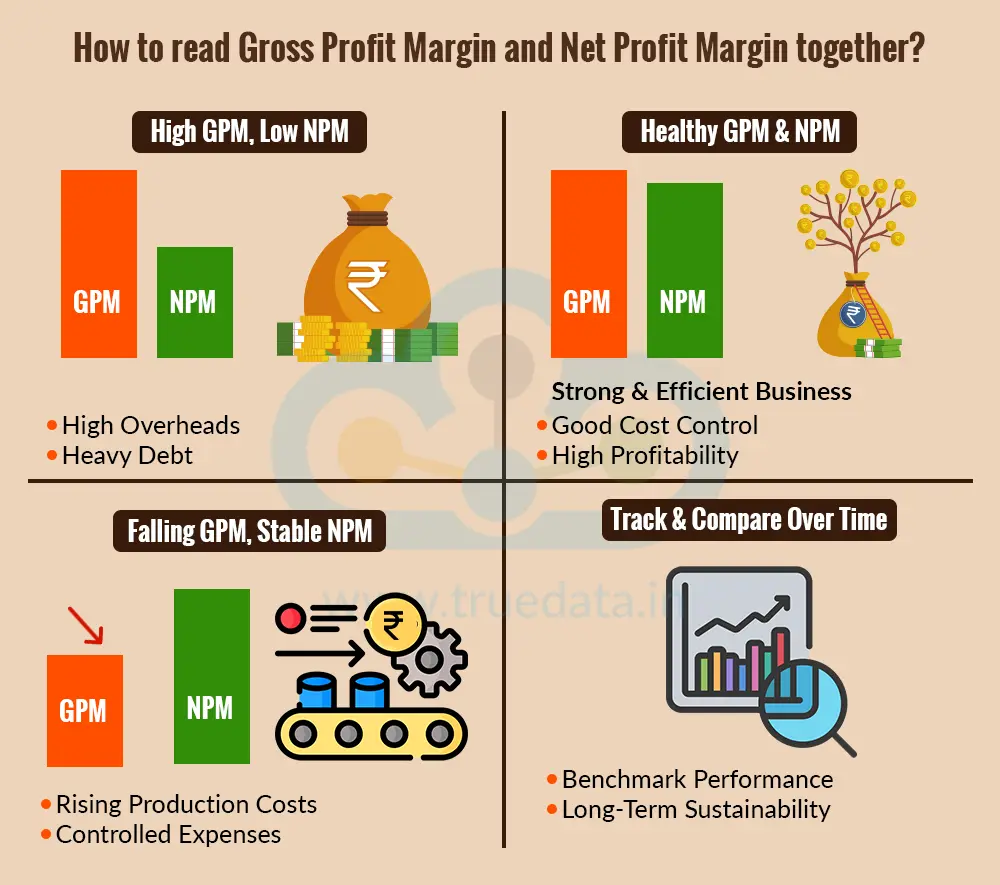

Reading Gross Profit Margin (GPM) and Net Profit Margin (NPM) together helps investors understand both how a company earns money and how much it finally keeps. A high gross profit margin but a low net profit margin usually means the company’s core business is strong, but its operating costs, interest expenses, or taxes are eating into profits. This may point to high overheads or heavy debt. On the other hand, if both gross and net profit margins are healthy and stable, it indicates good cost control across the business and strong overall profitability. If gross profit margin is falling while net profit margin remains stable, it may suggest that the company is managing other expenses better to offset rising production costs. Thus, tracking both margins over time and comparing them with industry peers gives a clearer picture of business quality, efficiency, and long-term sustainability.

Gross profit margin and net profit margin together give investors a clear and complete picture of a company’s profitability. Gross profit margin helps assess the strength and efficiency of the core business, while net profit margin shows how much of those profits finally turn into real earnings after all expenses. Analysing both margins over time and comparing them with industry peers helps identify strong, well-managed companies, spot cost pressures early, and make more informed long-term investment decisions.

This blog explains the core profitability ratios in detail and how to read them together to analyse a company's profitability and long-term growth potential. Let us know your thoughts on the topic or if you need additional information on the same, and we will address it soon.

Till then, Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

Theprofit and loss statement is the second part of the company's financial state...

Theprofit and loss statement is a vital part of the financial statements of a co...