The profit and loss statement is the second part of the company's financial statements. These statements reflect the profitability of the company during the period of consideration, usually a financial year or an interim period like a quarter. We have explored how to read the profit and loss statement in our earlier blog. Let us now take in detail and explore each component of this statement for better understanding and evaluation of the company’s profitability, starting with the revenues or the top line of the company.

The revenue component in the profit and loss statement is made up of the direct revenue and the indirect revenue that the business earns. It is the starting point for a company or investors to evaluate the viability and the future growth prospects of a business. Here is a detailed breakdown of the revenue side of the profit and loss statement.

This is the main income of the company, earned from its core business activities, i.e., selling goods or services. For example, for a cement company, it is the money earned from selling cement bags or for an IT services company, it is the fees earned from software projects. These core revenues show how well the company’s actual business is doing. A steady increase here means the company is selling more, entering new markets, or commanding better prices. However, if this number is falling, it signals trouble in demand, competition pressure, or loss of market share. This is the most reliable indicator of long-term business strength, because profits from other sources may not be sustainable.

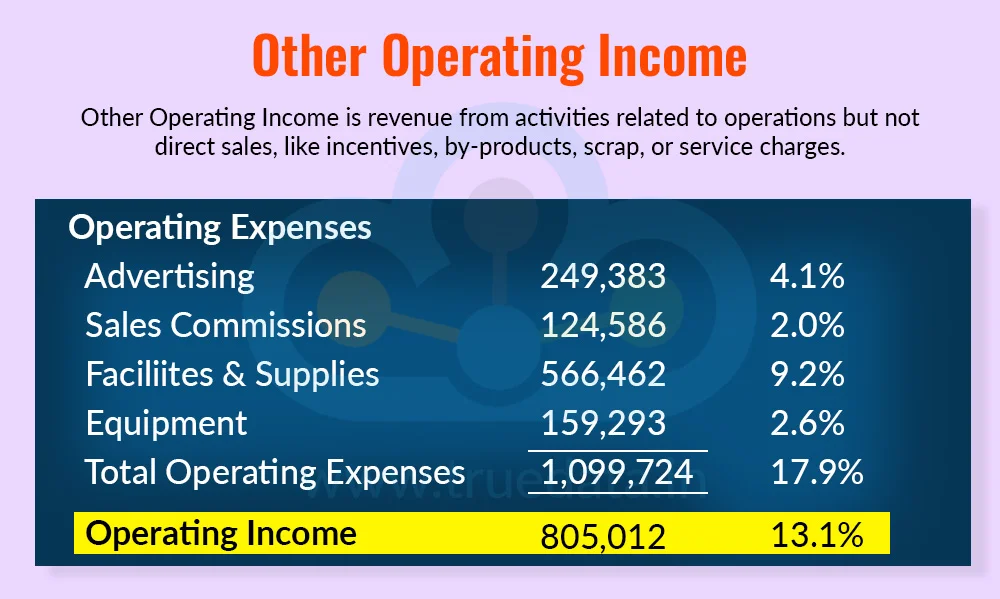

Companies can sometimes get income that is linked to their business operations but not from direct sales. Examples of such income can include export incentives from the government, the sale of by-products, scrap, or packaging material or service charges linked to sales. This revenue stream adds to the main revenue but is usually a small part. It can make a difference in industries where by-products (like chemicals or steel scrap) have value. Government incentives can also boost earnings for exporters and support them through tough global competition. However, investors must check if the business is too dependent on such benefits, because government policies can change.

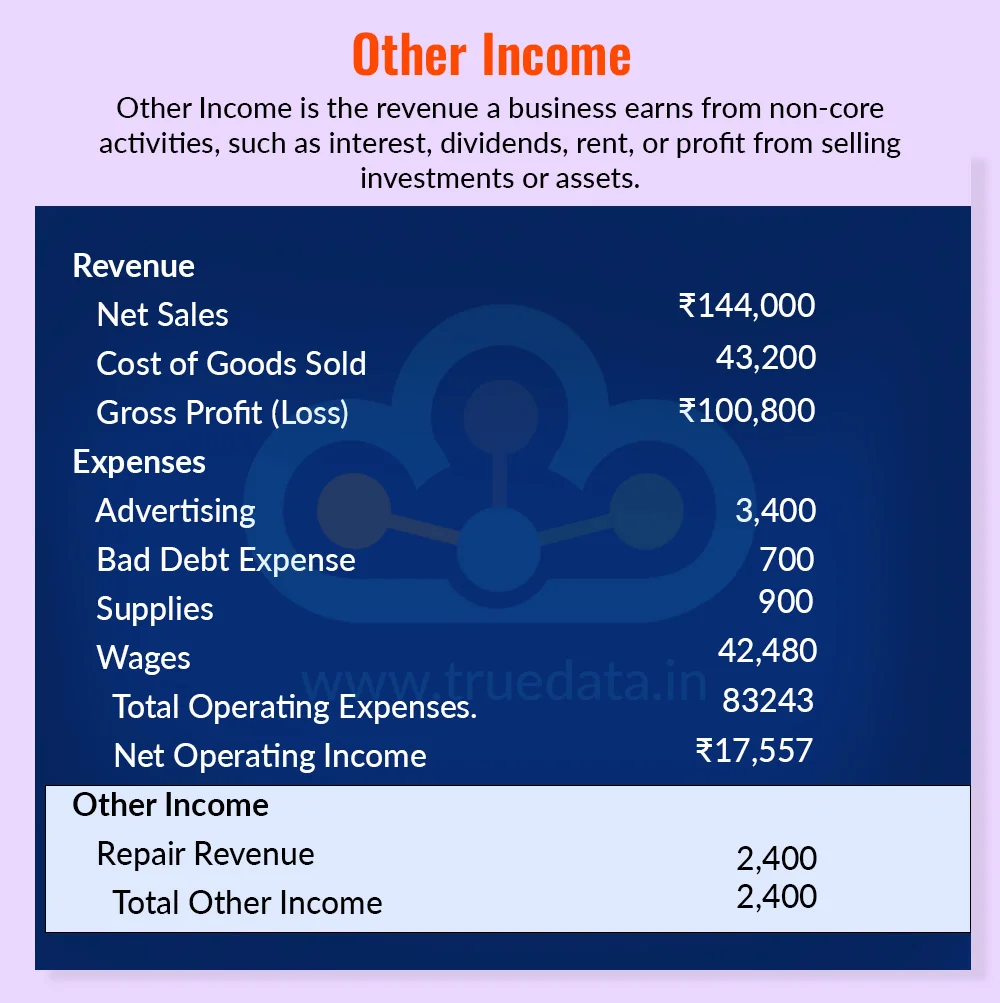

The other income portion of the revenues is additional income that is earned by the business outside of its core activities. Common examples of this income can be the interest earned by the business from fixed deposits, bonds, or loans given; dividends from shares held in other companies; rent from company-owned properties or profit from selling old investments or assets. This income provides an extra cushion, especially useful in tough times when core operations are slow. However, it is not predictable or sustainable for the company to depend on its other income for the long-term growth prospects. Therefore, if a large share of profit comes from ‘Other Income’ and not from operations, it may be a red flag. It shows the company is relying on the side activities rather than its main business.

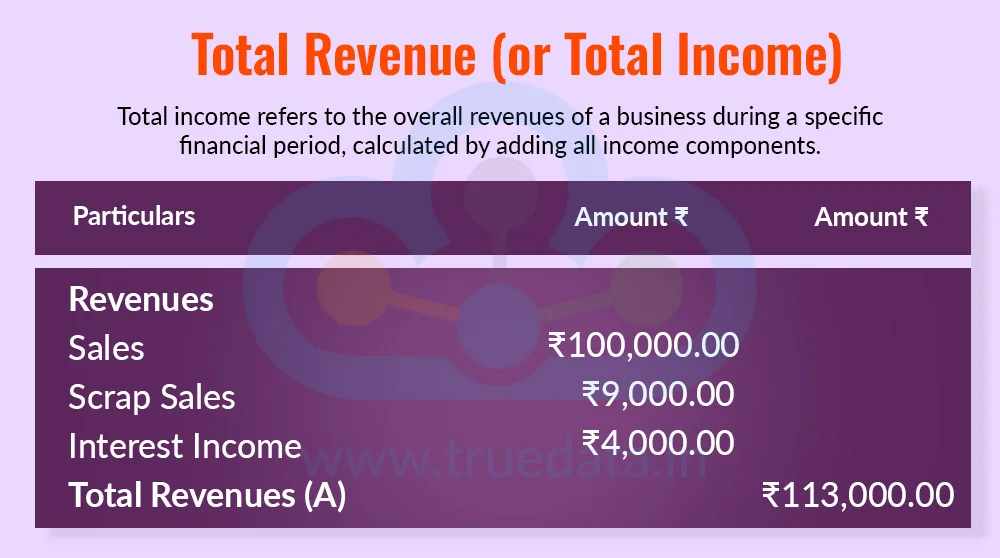

This segment represents the total income or revenues of the business during a particular period of consideration or a financial year. The mathematical formula to calculate the total income of the company is to add all the above components. It shows the overall size of the company’s earnings. However, investors should consider the mix of revenue in particular for accurate analysis. Ideally, a significant portion of the revenue should come from the core business operation or the first component of these total revenues. A company with strong, consistent operational revenue has a more stable future compared to one relying heavily on ‘Other Income’.

Revenue, also called income or top-line, is the money a company earns during a period before deducting expenses. Changes in revenue can give important clues for investors about how the company’s business is performing. When analysing revenue, it is important to look not only at the total number but also at where the revenue is coming from, i.e., the main business (Revenue from Operations), other operational income, or non-core income (Other Income).

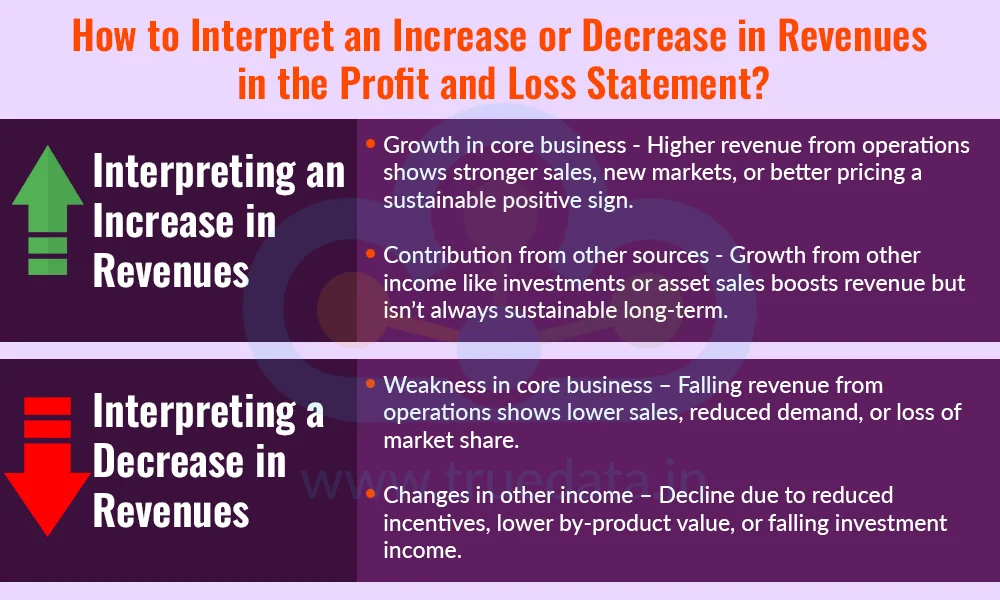

When a company reports higher revenue than the previous quarter or year, it usually indicates that the business is growing. Some key points to consider are,

Growth in core business - If the increase is in Revenue from Operations, it means the company is selling more products or services, expanding into new markets, or increasing prices successfully. This is the most sustainable and positive sign for investors.

Contribution from other sources - Sometimes, revenue grows because of Other Operating Income or Other Income, such as interest from investments or the sale of assets. While this adds to total revenue, it may not be sustainable year after year.

A revenue increase is good, but investors should check the source of growth. Growth from operations is stronger than growth from non-core income. Also, comparing growth with peers in the same sector helps determine if the increase is due to company-specific strengths or general market conditions.

When a company reports lower revenue than before, it can be a warning signal or a temporary issue. Key points to consider include,

Weakness in core business - If Revenue from Operations falls, it may indicate lower sales, loss of market share, or reduced demand. For example, economic slowdown, higher competition, or seasonal factors could reduce revenue.

Changes in other income - A decline in Other Operating Income or Other Income can happen if government incentives are reduced, by-products are less valuable, or investment income falls. These declines can affect total revenue, even if the core business is stable.

A fall in revenue is not always bad, but a persistent decline in core operations requires attention. Investors should investigate the reason for the decrease and check whether it is a short-term challenge or a long-term business problem.

The financial statements are prepared in accordance with the principles and guidelines laid down by the various authorities, like the SEBI, Companies Act 2013 and the relevant accounting standard issued by ICAI from time to time. These regulations specify the reporting requirements for the preparation and presentation of the financial statements in a set format, ensuring consistency, transparency and effective comparison with industry peers within the country and abroad. The broad principles guiding the preparation and presentation of the financial statements are,

Clarity and Segmentation - Revenues must be reported separately for operations, other income, and total revenue. This helps investors see the real business performance.

Consistency - Companies must follow uniform accounting standards, enabling comparison across quarters and competitors.

Transparency - Notes to accounts and management commentary explain unusual items, one-time gains, or government incentives.

Timing of Recognition - Revenue is recognised when the service/product is delivered, not necessarily when payment is received.

Compliance - Adhering to the Companies Act, SEBI regulations, and Ind AS is mandatory, giving investors confidence that the financial statements are reliable and auditable.

The mandatory reporting requirement for Revenues in the profit and loss statements includes,

Companies must prepare financial statements, including the P&L, giving a true and fair view of financial performance.

Revenue should be clearly classified and separately disclosed as,

Revenue from operations (core business, i.e., sale of goods or services)

Other operating income (by-product sales, export incentives, service-related income)

Other income (interest, dividends, or non-operating gains)

The company should also prepare detailed notes to accounts to explain revenue recognition policies, unusual items, one-time gains, and significant judgments or estimates.

Publicly listed companies must disclose quarterly and annual results to stock exchanges, including a breakdown of revenues.

Significant changes in revenue, such as major contracts, acquisitions, or one-time gains, must be explained in management commentary or investor communications.

Companies must follow uniform accounting practices for transparency and comparability across sectors.

Revenue is recognised when the company transfers control of goods or services to the customer, not necessarily on cash receipt.

Revenue is measured at the expected amount to be received, after accounting for discounts, returns, or incentives.

Companies with multiple business segments have to report segment-wise revenue disclosure to provide clarity on revenue sources.

These reporting regulations ensure the transparency and reliability of revenue data and help investors distinguish core operational revenue from one-time or non-operating income to make informed decisions.

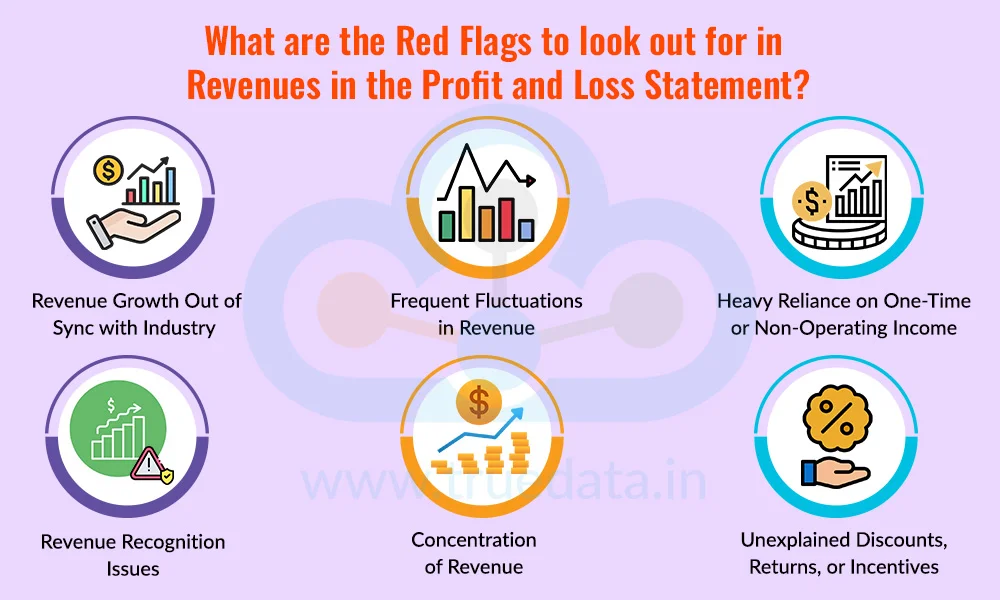

The revenue segment of the profit and loss statements highlights the ability of the company to drive its business and handle the day-to-day operations. Hence, this segment needs to be carefully analysed to spot any potential window dressing of the facts to hide any core issues. Some of the red flags to look out for in the revenue of the business are,

Revenue Growth Out of Sync with Industry - Investors should note if a company’s revenue is growing much faster or slower than its peers in the same sector. Extremely high growth could indicate aggressive accounting or one-time sales, while slower growth may signal loss of market share or weak demand.

Frequent Fluctuations in Revenue - Sudden spikes or drops in revenue across quarters without clear explanations can indicate seasonal dependence, irregular sales recognition, or accounting manipulations. Consistency in operational revenue is a better indicator of sustainable growth.

Heavy Reliance on One-Time or Non-Operating Income - A company that reports large revenue growth mainly from Other Income (like asset sales, dividends, or interest) rather than core business operations may be masking weak operational performance. Investors should be cautious and check if revenue from operations is consistent.

Revenue Recognition Issues - If revenue is recognised before products or services are delivered, or cash has not been received for a long time, it may inflate reported revenues. Investors should examine accounting policies and notes to accounts to understand revenue recognition practices.

Concentration of Revenue - Revenue coming from a few customers, a single product, or a specific region can be risky. If one customer stops buying, or a region faces a slowdown, the company’s revenue can drop sharply. Diversification of revenue sources is generally safer.

Unexplained Discounts, Returns, or Incentives - Significant reductions in revenue due to high discounts, sales returns, or incentives may hide weak demand or aggressive sales practices. A company consistently reporting such adjustments may not have sustainable revenue growth.

The revenue segment of the Profit and Loss statement is the foundation for understanding a company’s financial performance. It shows how much the company earns from its core operations and other operational or non-operational activities. Careful analysis of the revenue segment helps investors make informed decisions, assess the company’s health, and judge the long-term reliability of profits.

This article is an addition to our series on understanding financial statements in a better light for deeper analysis. Watch this space for similar analysis of the remaining components of the profit and loss statement in our upcoming blogs.

TIll then, Happy Reading!

Read More: Investing Smarter - The Power of Corporate Data and Market Sentiment Analysis

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Over the years, India’s financial sector has witnessed several high-profil...