The company’s financial statements are the starting point for evaluating its stocks and determining an investment opportunity. However, what happens when you are dealing with massive conglomerates like Reliance, HUL, etc. that have multiple subsidiaries under their name? How do shareholders of such companies get a complete picture of the conglomerate’s financial health? The answer is in consolidated financial statements! Check out this blog to learn all about the consolidated financial statements of a company and their importance for users to make an informed analysis.

When we consider the financial statements of the parent company alone, they are referred to as the standalone financial statements. These statements provide an insight into the financial health and performance of the parent company alone for the particular period. However, this analysis is incomplete as the performance of the group as a whole also depends on its subsidiaries, associates and joint ventures. This is where the consolidated financial statements come into the picture. Consolidated financial statements are a single set of financial statements of a company presented as a whole after including the details from all its subsidiaries whether within the country or outside. The financial statements of the individual subsidiaries and relevant companies under the group are prepared separately and then combined under the group head to give the consolidated view or the complete picture of the organisation or the conglomerate as a whole. This gives all the stakeholders and analysts a clearer and more accurate picture of the company’s total assets, liabilities, revenues, and expenses. This statement thus helps in avoiding any misleading financial statements where a parent company might look profitable on its own while its subsidiaries are struggling.

The consolidated financial statements are prepared in the same format as the individual or standalone financial statements i.e., as per the provisions of the Companies Act 2013 and related laws. It includes the following components to present the true and fair picture of the organisation as a whole.

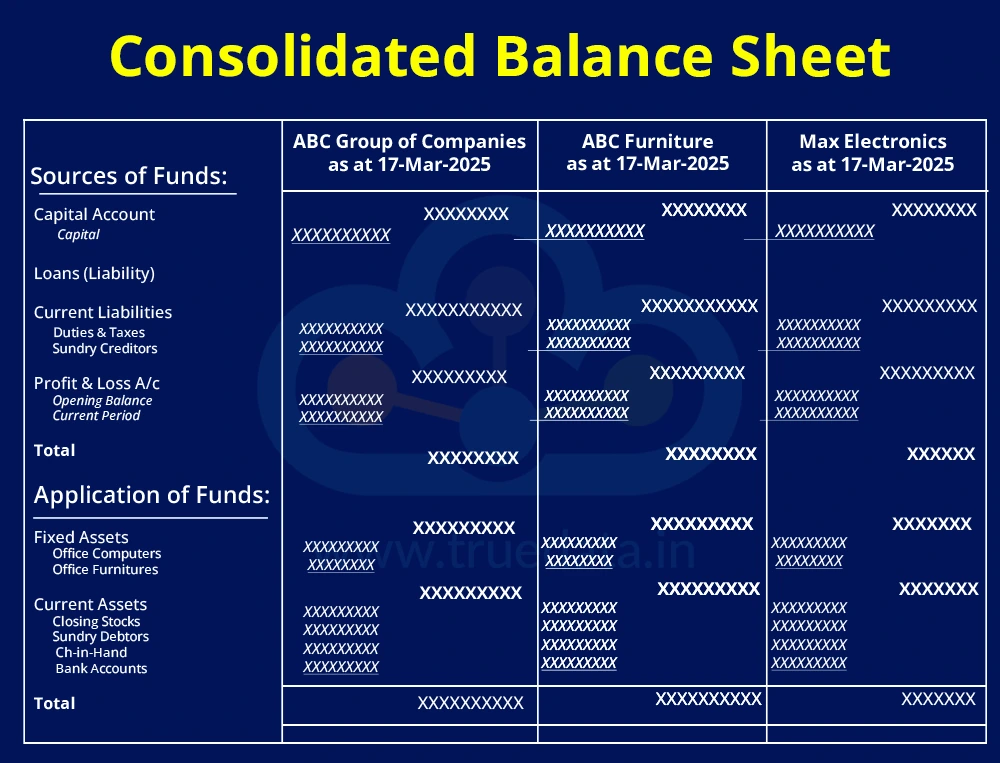

Consolidated Balance sheet

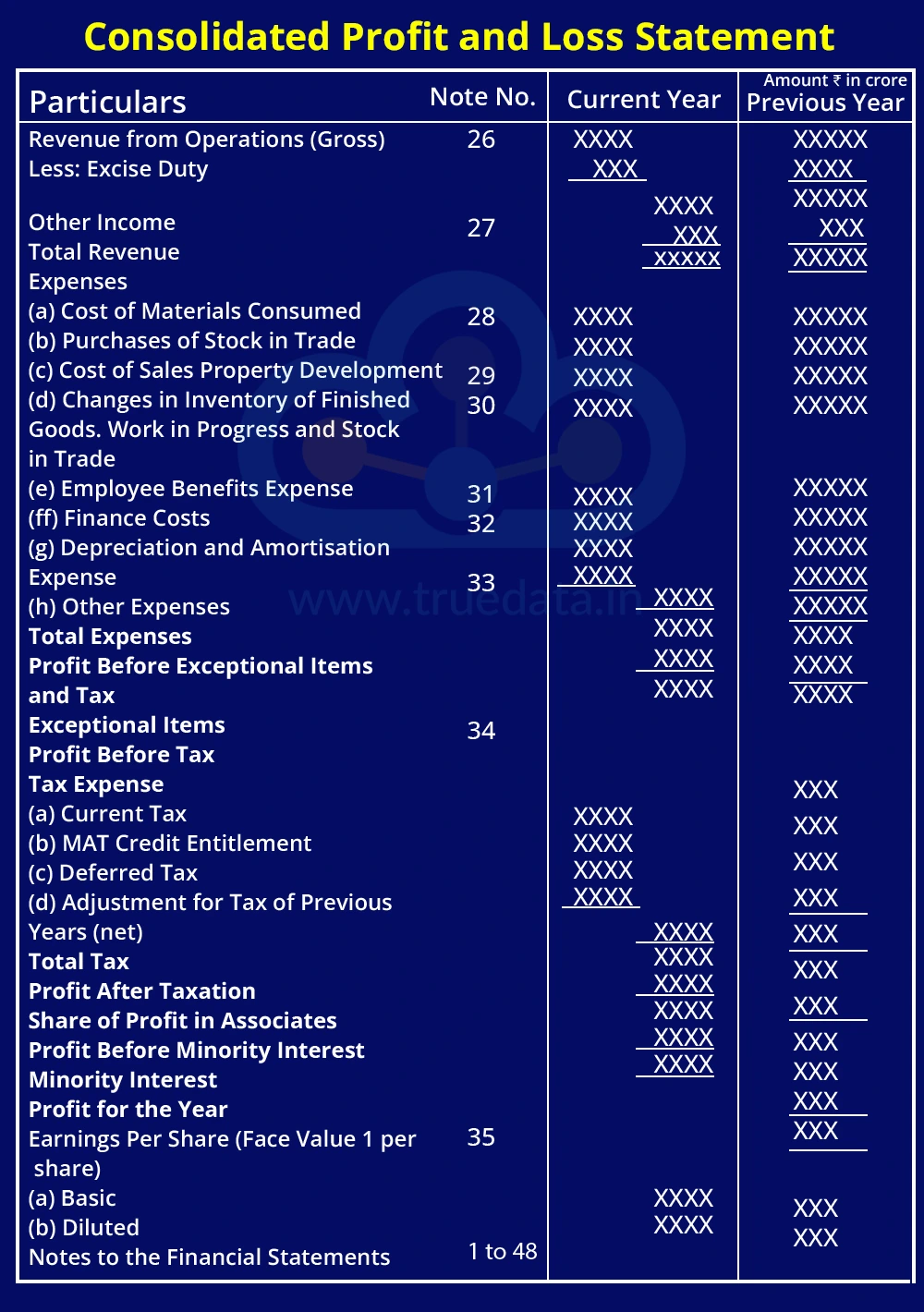

Consolidated Profit and Loss statement

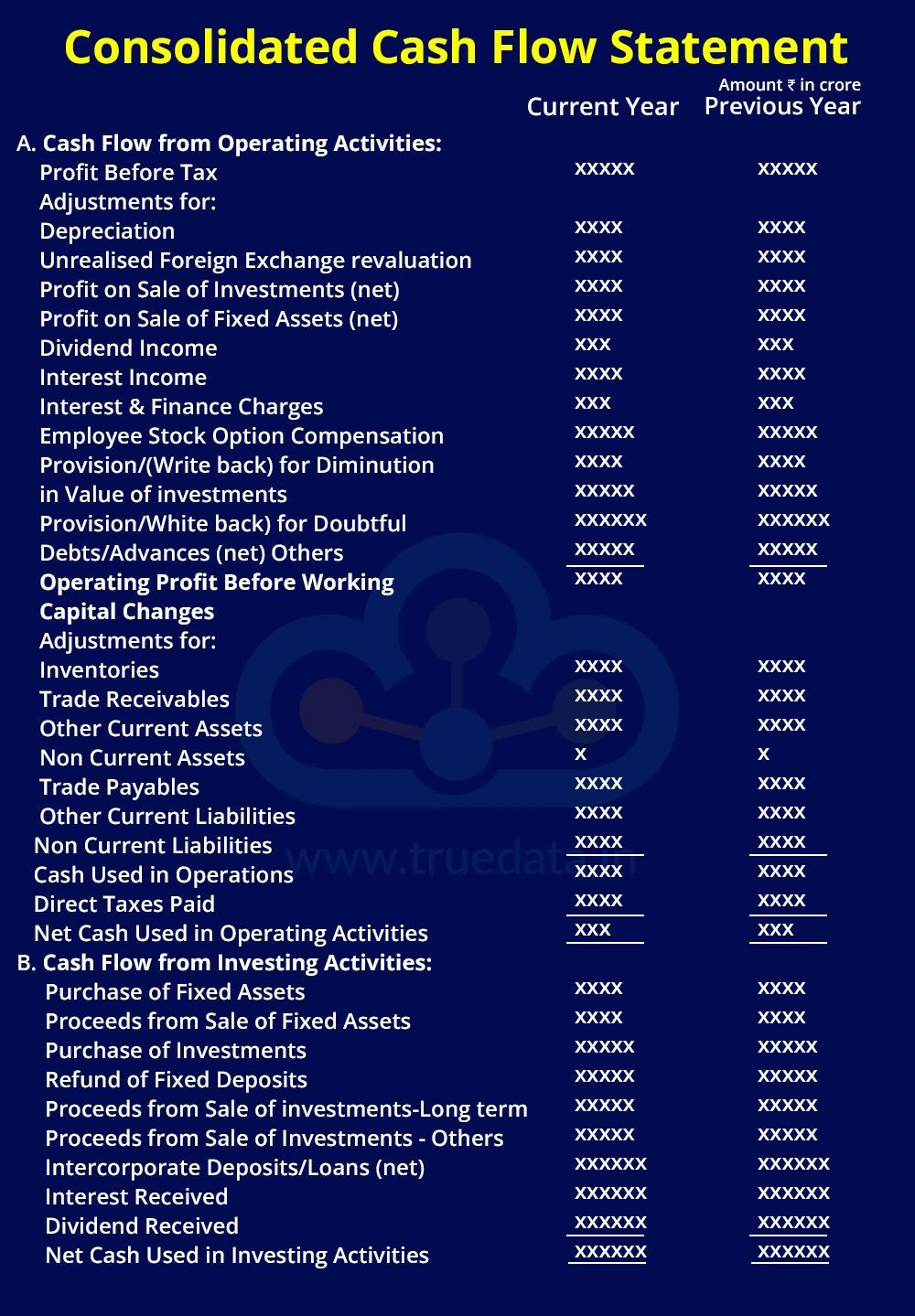

Consolidated Cash Flow Statement

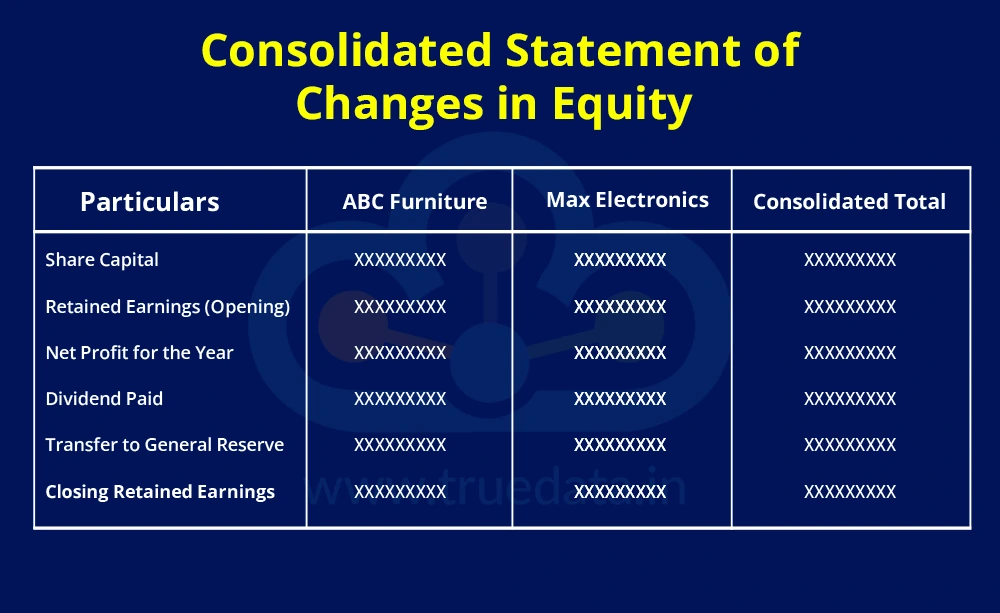

Consolidated Statement of Changes in Equity

Notes to Financial Statements

Many large businesses in India have grown multifold with subsidiaries within the country and outside. This makes it essential for such organisations to present the financial position of the entire organisation as a whole for fair analysis and reporting. The importance of consolidated financial statements can be explained as follows.

The purpose of the consolidated financial statements is to combine the standalone financial statements of individual companies of the group into a common statement for the group as a whole. This helps in a better review of the organisation as a whole rather than the time-consuming process of analysing the group companies separately.

The company's consolidated financial statements help investors understand the financial position of the group as a whole and not just the parent company. This enables them to accurately analyse key metrics like overall profitability, debt levels and more at the group level to make informed investment decisions.

It is a common practice for group companies to conduct business with each other and also with the parent company. While the group companies record their revenues individually, this can present as a double recording of revenues for the group as a whole. The consolidated financial statements present a net position of the group as a whole and also provide relevant disclosures in case of related party transactions to ensure that the financial statements reflect the true performance of the business.

The Companies Act 2013 mandates all companies with subsidiaries to prepare consolidated financial statements. This ensures that businesses follow transparent financial reporting standards, aligning with global best practices and regulatory requirements set by SEBI and other authorities.

Banks and other financial institutions use consolidated financial statements to assess the overall financial health of the business group before granting any loans. A well-prepared consolidated financial statement can demonstrate a company’s ability to repay debt accurately. This can significantly improve its chances of securing funds on better terms.

With the ever-increasing globalisation, the need for a standard and comparable template for businesses across the world is paramount. Hence, preparing consolidated financial statements in line with IFRS (International Financial Reporting Standards) or US GAAP, especially for businesses expanding globally, allows them to be compared with global competitors. This becomes crucial, especially while attracting foreign investments and listing on international stock exchanges.

A company with clear, transparent, and consolidated financial reporting builds trust among investors and also avoids any cases of window dressing or inflating their financial positions. When shareholders see that a company follows proper accounting standards and presents a true picture of its finances, they are more likely to invest and stay confident in its growth prospects.

The Companies Act 2013 provides detailed guidelines for preparing and presenting a company's consolidated financial statements and the applicable accounting standards to be used in this regard. Here is a detailed analysis of the same.

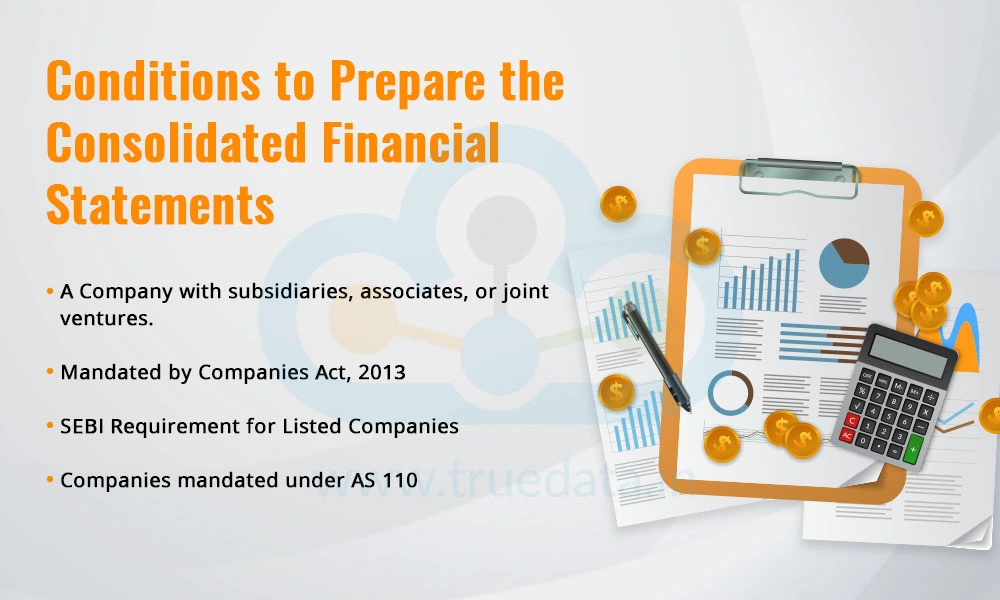

Conditions to Prepare the Consolidated Financial Statements

The conditions that warrant a company to prepare consolidated financial statements are,

A Company with subsidiaries, associate companies, or joint ventures

A company controlling one or more subsidiaries (owns more than 50% voting power or has decision-making control) must prepare consolidated financial statements.

A company having a joint venture (a jointly controlled business) or an associate company (where it owns 20% to 50% of voting power) must include them in consolidated financial statements.

Mandated by Companies Act, 2013

Section 129(3) of the Companies Act, 2013 mandates companies with subsidiaries to prepare both standalone financial statements and consolidated financial statements.

SEBI Requirement for Listed Companies

As per the SEBI requirements, a company listed on stock exchanges (NSE and BSE) is required to publish their consolidated financial statements along with standalone financial statements.

Companies mandated under AS 110

Parent companies where AS 110 is applicable are required to consolidate their financials.

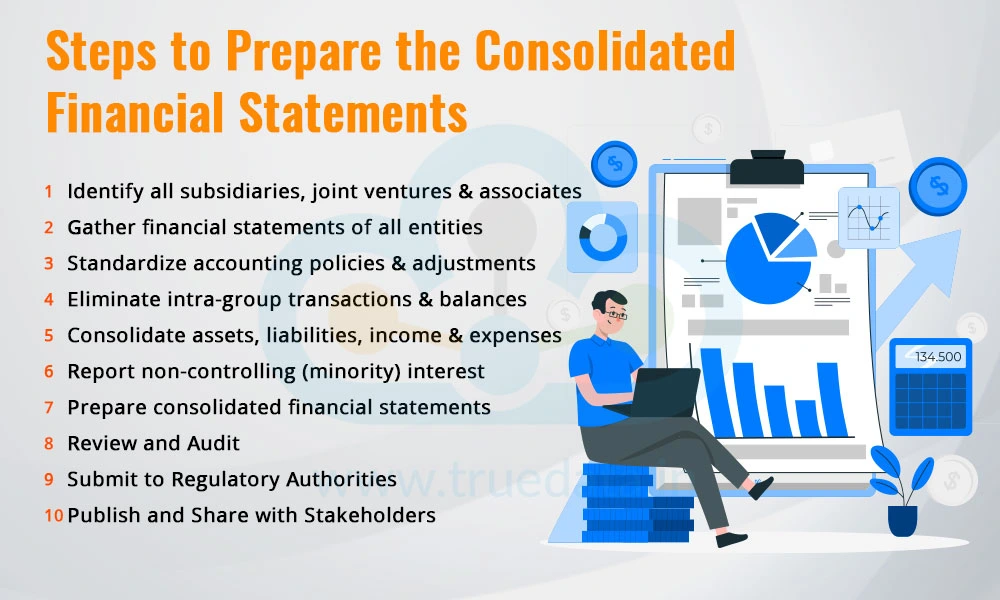

Steps to Prepare the Consolidated Financial Statements

The steps to prepare the consolidated financial statements include,

Identify and List All Subsidiaries, Joint Ventures, and Associates

The company should list all entities it has control over, including subsidiaries, joint ventures, and associate companies.

Ownership percentage and control rights should be clearly defined.

Collect Financial Statements of All Entities

The parent company must obtain the latest financial statements of each subsidiary, joint venture, and associate company.

These statements should follow the same accounting period as the parent company.

Standardise Accounting Policies and Adjustments

Any subsidiary following different accounting methods, accounting policies or accounting standards should adjust its statements to match Ind AS or IFRS.

Eliminate Intra-Group Transactions and Balances

Double reporting of transactions between the parent company and its subsidiaries should be removed from the consolidated financial statements to avoid double counting. For example, transactions like intercompany sales, loans, dividends, and unrealised profits should be eliminated.

Consolidate Assets, Liabilities, Income, and Expenses

The financial figures of all subsidiaries must be combined into a single consolidated report.

The equity method is used for joint ventures and associate companies instead of full consolidation.

Recognise and Report Non-Controlling Interest (Minority Interest)

If the parent company does not own 100% of a subsidiary, the share belonging to other investors (minority shareholders) is shown separately as Non-Controlling Interest (NCI) in consolidated financial statements.

Prepare the Consolidated Financial Statements

The final consolidated financial statements should include the following statements as per the prescribed format.

Consolidated Balance Sheet (assets, liabilities, and equity of the entire group)

Consolidated Statement of Profit & Loss (total revenue, expenses, and profits)

Consolidated Cash Flow Statement (cash inflows and outflows of the group)

Statement of Changes in Equity or Funds

Notes to Accounts (additional disclosures and financial policies)

Review and Audit

Consolidated financial statements should be reviewed to ensure accuracy, compliance, and elimination of errors.

An external audit is conducted before publishing the financial statements.

Submit to Regulatory Authorities

Listed companies must submit consolidated financial statements to SEBI and stock exchanges.

All companies must file consolidated financial statements with the Registrar of Companies (ROC) as part of their annual financial reporting.

Publish and Share with Stakeholders

The company should finalise and share it with investors, creditors, and other stakeholders to ensure transparency.

We have mentioned above that companies with subsidiaries and associate companies need to prepare consolidated financial statements. However, the Companies Act 2013 and applicable Indian Accounting Standards also provide a few cases of exceptions where eligible companies are not required to present any consolidated financial statements. These exceptions are highlighted hereunder.

Small companies and businesses not listed on a stock exchange (NSE or BSE) may be exempt from preparing consolidated financial statements. The requirement for consolidated financial statements is largely applicable to large companies that fall under Ind AS rules. However, when a company does not meet the mandated threshold for Ind AS applicability, based on net worth, turnover, or listing status, it can choose to only prepare standalone financial statements instead of consolidated financial statements. However, even though consolidated financial statements are not mandatory for such companies, they still need to maintain proper accounting records and financial disclosures as per the Companies Act, 2013.

Certain industries belonging to sectors like banking, insurance, and non-banking financial companies (NBFCs) have their own regulatory bodies like the Reserve Bank of India (RBI) and the Insurance Regulatory and Development Authority of India (IRDAI). These regulators may provide exemptions for companies in these industries from preparing consolidated financial statements under specific circumstances. For example, an NBFC that is regulated under RBI guidelines may follow a different financial reporting structure instead of the Indian AS-based consolidated financial statements. Similarly, insurance companies may follow separate reporting formats as per IRDAI norms. However, even if these companies are exempt from consolidated financial statements, they still need to submit detailed financial reports to their respective regulatory bodies.

An intermediate holding company is a company that is both a subsidiary of another company and a parent to one or more subsidiaries. In such cases, an intermediate holding company may not need to prepare consolidated financial statements if its ultimate holding company (the topmost parent company) is already preparing consolidated financial statements. This exemption is put in place to remove any redundancy leading to optimisation of resources at the group level. However, the exemption is only valid if the ultimate holding company’s consolidated financial statements follow Ind AS 110 or IFRS and are made available for public reference.

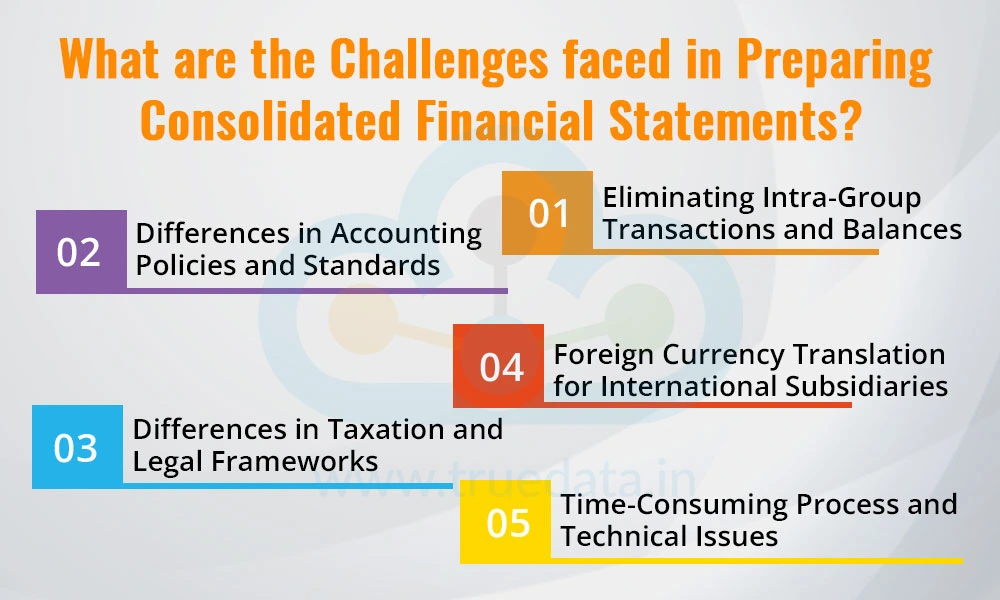

The preparation of consolidated financial statements is a complex process, especially for companies with multiple subsidiaries, joint ventures, and associate companies. It involves several accounting adjustments, legal challenges and sometimes technical issues too making it a cumbersome process. Some of the key challenges faced in the preparation of consolidated financial statements are highlighted below.

The parent companies and subsidiaries in a business group often conduct business with each other. When preparing consolidated financial statements, all such intra-group transactions and balances must be eliminated to avoid duplication and misrepresentation of financial data. If these transactions are not properly identified and removed, it can result in inflated revenues or profits, leading to misleading financial reports. Identifying and eliminating these transactions is a major challenge, especially in large conglomerates with multiple internal dealings.

One of the biggest challenges in preparing consolidated financial statements is that different subsidiaries may follow different accounting policies. For example, some subsidiaries may follow Indian Accounting Standards (Ind AS), while others might still use Accounting Standards (AS) under the Companies Act, 2013. If the parent company operates globally, its foreign subsidiaries may follow IFRS (International Financial Reporting Standards) or US GAAP (Generally Accepted Accounting Principles in the USA). Before preparing consolidated financial statements, companies must adjust and standardise the accounting policies across all subsidiaries to ensure consistency, which can be time-consuming and complex.

A company with foreign subsidiaries will have the financial statements of such subsidiaries prepared in a different currency. For example, an Indian company with a subsidiary in the USA will have financial reports in US dollars (USD), while another subsidiary in Europe may report in Euros (EUR). Before consolidating, all financial data must be converted into Indian Rupees (INR) using appropriate exchange rates as per Ind AS 21 (Effects of Changes in Foreign Exchange Rates). Currency fluctuations can impact the valuation of assets, liabilities, and profits, making consolidation difficult.

A company operating in multiple states in India or internationally may have to deal with different tax structures, corporate laws, and reporting requirements. For example, tax benefits applicable in one country or state may not apply in another. These tax differences must be adjusted properly while preparing consolidated financial statements to ensure the financial statements reflect an accurate tax liability. Mismanagement of taxation-related consolidations can lead to unexpected tax burdens or compliance issues.

Collecting financial statements from each entity for a large group with multiple subsidiaries within time can be a major challenge. Different subsidiaries may close their accounts at different times, leading to delays in consolidation. Moreover, each subsidiary may maintain financial records in different software or formats, making it difficult to compile and verify data quickly. This is especially challenging when subsidiaries operate in different states or countries with different tax laws and reporting deadlines.

Consolidated financial statements are an integral part of the financial analysis of large organisations as they enable investors and other stakeholders to understand the performance of the company as a group as well as on an individual basis. This helps in making informed investment decisions leading to a robust portfolio meeting the investment specifications accurately.

This article talks about the various aspects of consolidated financial statements and another addition to our series on ‘How to read financial statements’. Let us know your thoughts on this topic or if you need further information on the same.

Till then Happy Reading!

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Theprofit and loss statement is the second part of the company's financial state...