Dividends are one of the main reasons many investors, especially conservative ones, choose to invest in certain companies. After all, who does not appreciate a steady stream of income from their investments? However, did you know that companies are not required to declare dividends every year? And when they do, dividends can be paid not just in cash but also in the form of additional shares. So, how do companies decide whether to distribute dividends or hold on to their profits instead? The answer lies in a structured dividend policy. Curious to know how these policies work and what they mean for you as an investor? Read on to know different types of dividend policies and explore what each one reveals about a company’s financial strategy.

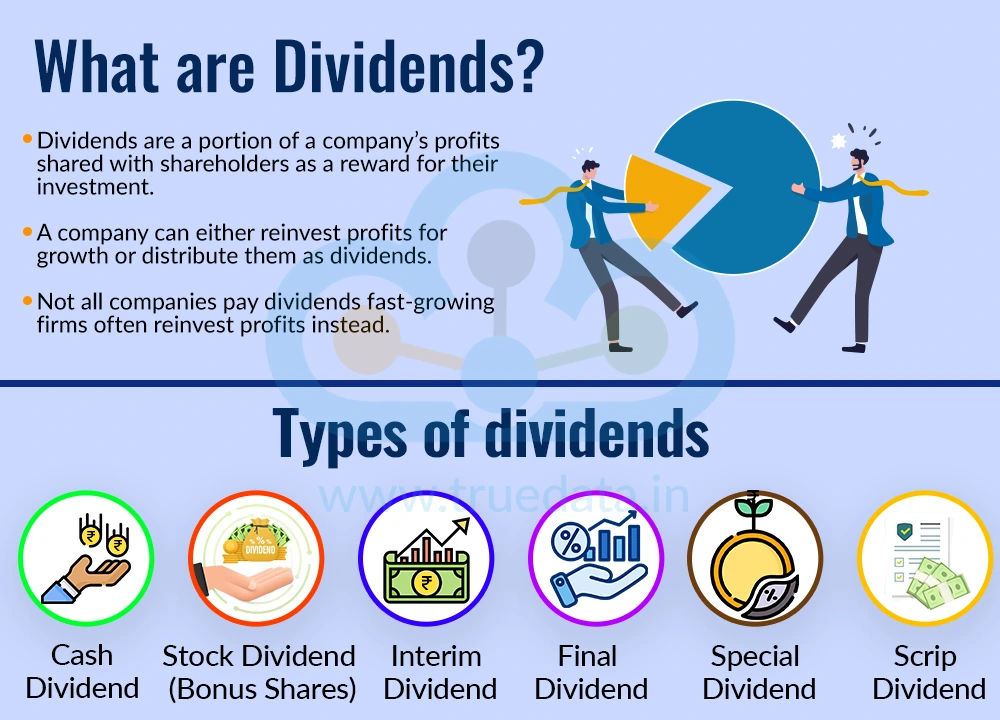

Dividends are a part of a company’s profits that are shared with its shareholders as a reward for their investment. When a company earns profits, it can either reinvest them in the business for future growth or distribute a portion of those profits among its shareholders. This distribution is called a dividend. However, not all companies pay regular dividends to their shareholders. Many fast-growing companies prefer to reinvest their profits to expand their operations, while stable and mature companies often pay dividends consistently to attract and retain investors. Companies usually announce dividends during their Annual General Meeting (AGM), and these dividends are paid only after approval from the company’s board of directors. The amount and frequency of dividend payments can vary from company to company, depending on their financial performance and dividend policy.

Companies can declare many types of dividends. These types of dividends are explained hereunder.

A cash dividend is the most common type of dividend. In this case, the company pays a portion of its profits to shareholders in cash, directly credited to their bank accounts. For example, if a company declares a dividend of Rs. 5 per share and an investor holds 100 shares, they will receive Rs. 500 as a dividend. Cash dividends are preferred by investors who want regular income, such as retirees or conservative investors. However, companies need to have sufficient cash reserves to distribute these dividends.

A stock dividend, also known as a bonus share, is when a company gives additional shares to its existing shareholders instead of paying cash. For example, if a company announces a 10% stock dividend, a shareholder owning 100 shares will receive 10 extra shares.

This type of dividend increases the number of shares a person owns, but the overall value of their investment remains the same. Over time, if the company performs well, the investor can benefit from receiving bonus shares, as this reduces the overall cost of investment and increases returns. Stock dividends are often issued when the company wants to reward shareholders but also retain cash for future business needs.

An interim dividend is declared and paid before the end of the company’s financial year. It is usually announced after the company’s quarterly or half-yearly financial results. This type of dividend reflects the company’s confidence in its performance during the year. For example, a company may declare an interim dividend in September and then a final dividend after the year-end results in March.

A final dividend is declared after the company’s financial year ends and after the accounts are audited. It is usually recommended by the Board of Directors and approved by shareholders at the Annual General Meeting. The final dividend represents the company’s final profit-sharing decision for the year. It is often higher than or equal to the interim dividend, depending on the company’s total yearly performance.

A special dividend is a one-time payment made by a company when it earns exceptionally high profits or has surplus cash. It is not a regular event and usually indicates strong financial health. For example, if a company sells a major asset or earns extraordinary income, it may share a part of that profit with shareholders through a special dividend.

A scrip dividend is when a company issues a promissory note to shareholders, promising to pay the dividend at a later date. This is usually done when the company does not have enough cash immediately, but still wants to reward its investors. The company might later pay the dividend in cash or convert it into shares, depending on its financial situation.

A dividend policy is the company’s official plan or guideline for deciding how much profit will be shared with shareholders as dividends and how much will be kept in the business for future growth. In simple terms, it helps the company maintain a balance between rewarding shareholders and retaining money for expansion, research, or paying off debts. Every company has its own approach to paying dividends. Some companies prefer to give regular, stable dividends every year, while others may pay only when profits are high. This decision depends on factors like the company’s earnings, future investment needs, cash flows, and overall financial stability. A company’s dividend policy provides clarity and consistency for investors and helps them understand what to expect from the company.

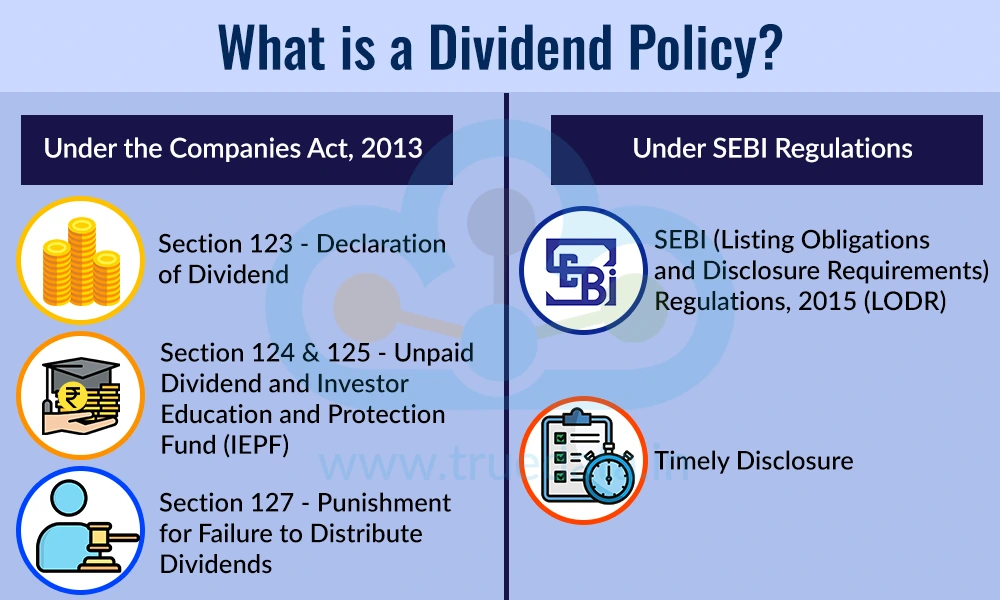

The declaration and payment of dividends in India are governed by specific laws and regulations to ensure fairness, transparency, and protection of shareholders’ interests.

Some of the key regulations include,

Section 123 - Declaration of Dividend

A company can declare dividends only out of its current year’s profits, profits from previous years, or money provided by the government in the case of a government company.

Before declaring any dividend, the company must set aside a portion of its profits as reserves, if required.

Dividends must be paid only in cash (through cheque, warrant, or electronic transfer). However, bonus shares (stock dividends) are also allowed.

The dividend amount must be transferred to a separate bank account within five days of declaration.

If a shareholder does not claim the dividend within 30 days, it must be moved to the Unpaid Dividend Account. Unclaimed dividends for seven years are transferred to the Investor Education and Protection Fund (IEPF).

Section 124 & 125 - Unpaid Dividend and Investor Education and Protection Fund (IEPF)

These sections ensure that unclaimed dividends are properly handled and that shareholders can later claim them from the IEPF.

Section 127 - Punishment for Failure to Distribute Dividends

If a company fails to pay the declared dividend within 30 days, its directors can face penalties unless there is a valid reason, such as government restrictions or disputes about ownership.

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (LODR)

Listed companies must disclose their dividend policy on their official website and in their annual report.

SEBI requires the top 1,000 listed companies (by market capitalisation) to formally adopt and publish a Dividend Distribution Policy.

The policy must clearly mention factors such as:

How profits are to be distributed,

Circumstances under which dividends may or may not be declared,

Internal and external factors influencing the decision,

Any restrictions or conditions on dividend declaration.

Timely Disclosure

Whenever a company declares a dividend, it must immediately inform the stock exchanges (like NSE and BSE).

The company must also announce record dates (to identify eligible shareholders) and ensure transparency with investors.

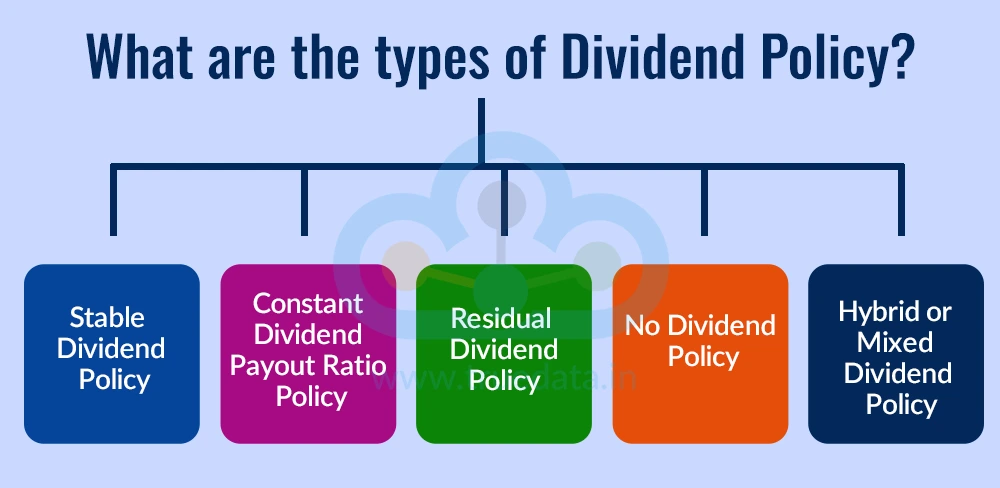

A dividend policy helps a company decide how much profit should be shared with shareholders as dividends and how much should be kept for business growth. The policy also ensures consistency in dividend payments and helps investors know what to expect. The types of dividend policies followed by companies and their impact are highlighted below.

A stable dividend policy means the company pays a fixed amount of dividend regularly, regardless of small changes in its yearly profits. For example, a company may decide to pay Rs. 5 per share every year, even if its profits rise or fall slightly. This approach gives shareholders a sense of security and reliability because they receive a steady income each year. Many investors, especially retirees or conservative investors, prefer companies with a stable dividend policy. Large and well-established companies like those in the FMCG or utility sectors often follow this policy because their earnings are relatively consistent.

Advantages -

It helps build investor confidence.

It can attract investments from long-term and risk-averse investors.

It shows the financial stability of the company.

Disadvantages -

It may put pressure on the company to maintain payments even in low-profit years.

Under a constant dividend payout ratio policy, the company pays a fixed percentage of its profits as dividends each year. For example, if a company decides to distribute 40% of its profits as dividends, the actual dividend amount will change depending on the profits earned in that year. This means if profits increase, shareholders get a higher dividend, and if profits fall, the dividend also decreases. This policy is common among companies whose earnings fluctuate, such as those in cyclical industries (like automobiles or metals). It allows flexibility because the company’s dividend payments automatically adjust with its financial performance.

Advantages -

It reflects the company’s actual profit performance.

It is easy to implement and understand.

Disadvantages -

Income for shareholders is uncertain, as it changes every year.

In a residual dividend policy, the company first uses its profits to fund business operations and investment projects. Whatever profit remains after these needs are met is then distributed as dividends. For example, if a company earns Rs. 100 crore in profit and needs Rs. 80 crore for new projects or debt repayment, the remaining Rs. 20 crore may be distributed as dividends. This policy is suitable for companies that are growing and have high investment requirements. It ensures that the company’s growth is not affected by just maintaining dividend payments.

Advantages -

It helps the company maintain financial flexibility.

It encourages reinvestment for growth.

Disadvantages -

Dividend payments may be irregular, which can disappoint investors seeking steady income.

Some companies, especially new or fast-growing companies, may choose a no dividend policy, meaning they do not pay any dividends at all. Instead, they reinvest all their profits back into the business to fund expansion, research, or product development. In such cases, shareholders benefit indirectly as the value of their shares may rise when the company grows and becomes more profitable in the long run. This policy is common among technology startups or companies in the growth phase.

Advantages -

It maximises reinvestment for faster growth.

It is suitable for companies with large expansion plans.

Disadvantages -

It may not attract investors looking for regular income.

A hybrid dividend policy combines features of both stable and residual policies. Under this approach, the company pays a minimum regular dividend to assure investors of steady income, and may also pay extra dividends when profits are higher than expected. For example, a company might pay Rs. 4 per share every year and add a special dividend when it earns exceptional profits. This policy balances the needs of both the company and its investors, thus providing stability as well as flexibility.

Advantages -

It maintains investor trust while allowing flexibility.

It reflects the company’s profitability and confidence.

Disadvantages -

It requires careful financial management and planning.

The dividend policy enables companies to have a structured plan for the distribution of profits and also gives insight to investors about the company’s approach. The importance of a structured and detailed dividend policy is explained hereunder.

Builds Investor Confidence - A clear and consistent dividend policy gives investors confidence in the company’s stability and management. When investors know how and when they can expect dividends, they see the company as reliable and trustworthy. For example, companies that pay dividends regularly are often preferred by conservative investors who depend on steady income, such as retirees.

Shows Financial Stability - Regular and well-managed dividend payments indicate that a company is earning enough profits and managing its finances efficiently. A consistent dividend policy signals that the company has a strong financial base and a positive outlook for the future.

Ensures Proper Profit Utilisation - A dividend policy helps the company decide how to use its profits wisely. This ensures that the company continues to grow while also keeping shareholders satisfied.

Helps Attract and Retain Investors - A good dividend policy can attract both new and long-term investors. Many investors look for companies that provide a stable income in addition to capital growth. When a company has a clear dividend policy, it becomes more appealing in the stock market and builds a loyal investor base.

Reduces Uncertainty and Speculation - When a company clearly communicates its dividend policy, it reduces confusion and speculation among investors. They do not have to guess whether the company will pay dividends or not. This stability can help reduce sudden price fluctuations in the company’s shares.

Supports Long-Term Planning - A well-framed dividend policy helps the company’s management plan for the long term. By setting clear guidelines on profit distribution, the company can ensure it always has enough funds for expansion, debt repayment, or emergencies, while still rewarding its shareholders.

Reflects Management’s Confidence - Dividends often reflect the management’s outlook on future performance. When a company declares dividends regularly, it shows that the management is confident about the company’s earnings and future growth. On the other hand, cutting dividends may signal financial challenges.

A company’s dividend policy is affected by many internal and external factors. These factors help the management decide how much dividend to declare, when to pay it, and in what form (cash or shares). The following are some of the key factors that influence a company’s dividend decisions.

Profitability of a Company - The most important factor is the company’s profit. Dividends can only be paid when the company earns sufficient profit. A company with stable and high profits is more likely to pay regular dividends. On the other hand, if profits are low or uncertain, the company may reduce or skip dividends to save funds.

Availability of Cash and Liquidity - Even if a company shows profits on paper, it needs enough cash in hand to pay dividends. Companies with strong cash flow can afford to pay regular dividends, while those with limited liquidity may prefer to retain cash for operational needs.

Stability of Earnings - Companies with stable and predictable earnings can maintain a consistent dividend policy. However, businesses in industries where profits fluctuate may follow a flexible dividend policy depending on their performance each year.

Future Investment and Expansion Plans - If a company plans to expand its operations, purchase new equipment, or enter new markets, it may keep more of its profits instead of paying high dividends. This ensures that the company has enough funds for growth without relying on external loans.

Management’s Outlook and Policy - The attitude of the company’s management also plays a key role. Some management teams prefer a stable dividend approach to build investor confidence, while others may focus more on reinvestment and long-term growth.

Legal Restrictions - In India, dividend payments are regulated by the Companies Act, 2013. According to Section 123, dividends can only be declared out of profits, and companies must comply with specific rules regarding reserves, payments, and disclosures. These legal provisions influence how and when a company can pay dividends.

Taxation Policies - Tax laws also affect dividend decisions. Dividends are now taxable in the hands of shareholders as per the Income Tax Act, which can influence investor preferences and company policies. Thus, if dividend income is taxed heavily for shareholders or the company, management might prefer to retain profits instead of paying dividends.

Access to Capital Markets - Companies that can easily raise funds from banks or the stock market may pay higher dividends because they can get money from other sources when needed. In contrast, smaller companies or those with limited access to capital markets may retain more profits for internal funding.

Inflation and Economic Conditions - During periods of inflation or economic slowdown, companies may retain profits to cover rising costs or uncertain future expenses. When the economy is strong, they may increase dividends to share higher profits with shareholders.

A dividend policy plays a vital role in shaping a company’s financial strategy and investor relations. It helps the company decide the optimum utilisation of its profits. A well-framed dividend policy builds investor confidence, ensures financial stability, and supports the company’s long-term goals. Companies with clear and consistent dividend policies are often viewed as trustworthy and well-managed, making them attractive to both existing and potential investors.

This article talks about the company's policy to share its profits and its importance for shareholders. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: Can You Buy and Sell Unlisted Shares?

Thestock market never stands still, and prices swing constantly with every new h...

Dividends are a great way for investors to enjoy a steady income from theirinves...

Dividends are a classic source of additional income that most investors favour. ...