Investing in shares listed on stock exchanges has become an integral part of many portfolios over the decades. However, there may be a whole unexplored area that many investors often overlook. We are talking about the potentially unlimited opportunities that dealing in unlisted shares presents. Now the key question for most investors, especially beginners, is how to buy and sell unlimited shares. Check out this blog to get an answer to this question and get other relevant details about unlisted shares.

Unlisted shares are shares of a company that are not traded on any stock exchange, like the Bombay Stock Exchange (BSE) or National Stock Exchange (NSE) in India. In simple words, when you hear about companies like Reliance, TCS, or Infosys, their shares are ‘listed’ on the stock exchange, and anyone can buy or sell them through the share market. However, some companies, especially private companies or startups, choose not to list their shares publicly. These shares are called unlisted shares. It is still possible to buy or sell unlisted shares, but usually through private deals, brokers, or employee stock options (ESOPs). The price of unlisted shares is not visible like listed shares, and it depends on the company's performance, demand, and private negotiations. Many people invest in unlisted shares, hoping the company will grow and eventually list on the stock exchange (called an IPO), which could increase the value of their investment. However, buying unlisted shares involves more risk and less liquidity, meaning it is harder to find a buyer quickly.

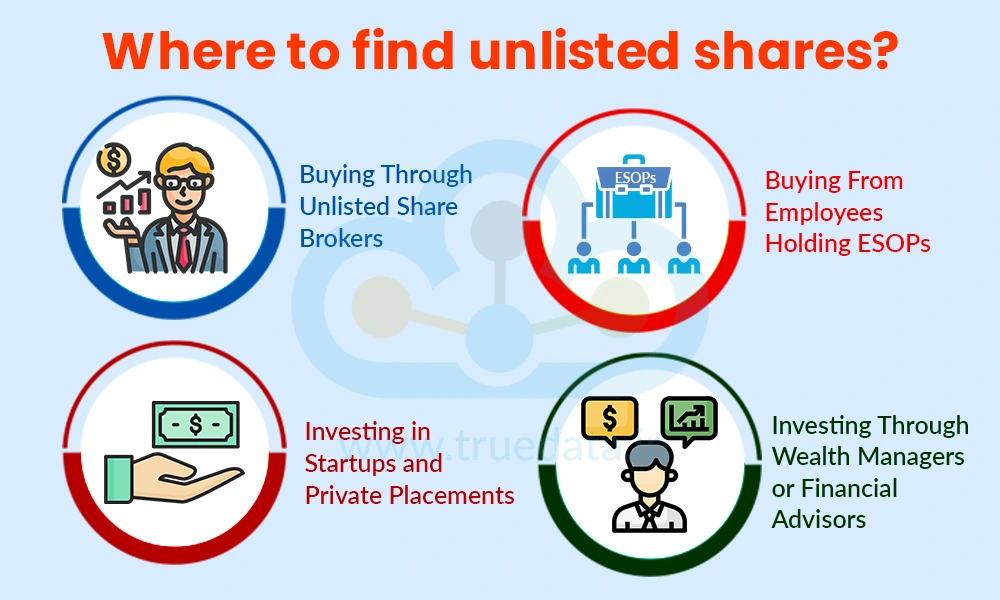

Buying and selling listed shares is quite easy and is available through multiple options. Unlisted shares, on the other hand, are not traded on stock exchanges like NSE or BSE and are usually shares of private companies, startups, or companies that are planning to go public in the future (pre-IPO). Since they are not available on regular stock markets, investors can buy them through other channels.

Investors can buy unlisted shares through specialised brokers or dealers who focus only on private companies. These brokers help people buy shares of well-known but unlisted companies like Reliance Retail, Tata Capital, or HDFC Securities. These brokers operate outside regular stock exchanges like the NSE or the BSE. These platforms show the price, company background, and help with the transaction and paperwork. They are often used by investors looking for early opportunities in strong companies before they go public.

Many private companies offer shares to their employees through Employee Stock Option Plans (ESOPs). Sometimes, employees who receive these shares decide to sell them before the company goes public. In such cases, investors can purchase shares directly from employees. These deals usually happen with the help of a broker or financial contact. It allows investors to buy into promising companies at early-stage prices, but proper documentation and due diligence are important.

Investors can also buy unlisted shares by directly investing in startups or private companies through angel investor networks or venture capital platforms. These opportunities are available on designated websites or during private fundraising events. This type of investment usually requires more capital and is considered higher risk, but it can give high returns if the company grows successfully or goes public.

High-net-worth investors often access unlisted shares through wealth managers or investment advisors. These professionals have contacts in private equity and startup networks, and they can help investors get private placements or pre-IPO opportunities. They also offer guidance on whether the investment is safe or profitable. This route is helpful for those who want expert advice and have a larger amount to invest.

Investors can buy and sell unlimited shares through the online and offline modes. The steps for the same are explained below.

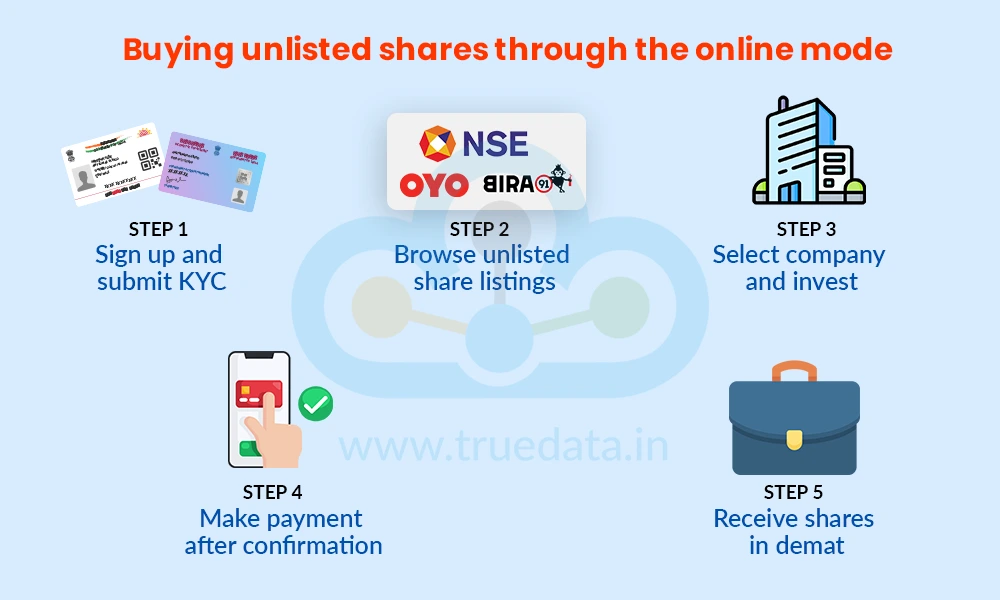

The first step in buying or selling unlisted shares online is finding a trusted platform. The further steps in this process include,

Sign up on the platform and submit your KYC documents like the PAN card, Aadhaar, bank details, and demat account.

Check the list of unlisted companies available for buying. Each listing will show details like company name, share price, and minimum quantity.

Click on the company you want to invest in and place a buy request for the number of shares you want.

Once the broker or platform confirms availability, pay through the available payment options (NEFT/RTGS/UPI).

After payment, the shares will be transferred to your demat account in 2 to 5 working days, along with a contract note or invoice.

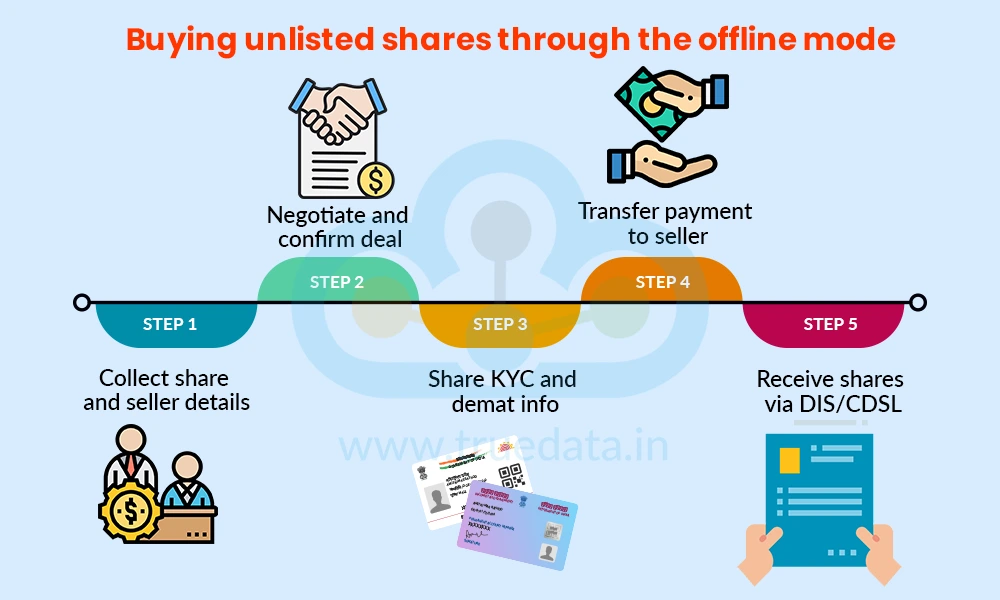

The first step for the offline mode also includes finding a trusted dealer or broker who specialises in unlisted shares. The further steps in this process include,

Get all company details, price per share, number of shares, and seller’s demat info.

Negotiate the price and number of shares, then confirm the deal.

Provide your PAN, Aadhaar, and demat account number to the dealer or seller.

Transfer the money directly to the seller's or dealer’s bank account.

Once payment is confirmed, shares are transferred offline via DIS (Delivery Instruction Slip) or online via CDSL/NSDL. It may take 2–5 days.

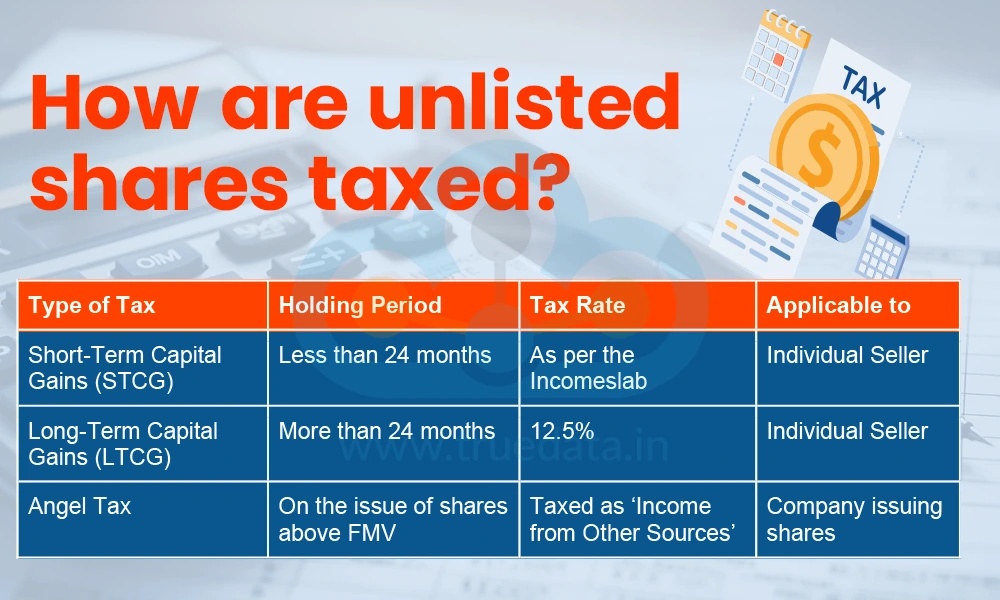

Unlisted shares are a capital asset and attract capital gains tax when sold. The taxation of unlisted shares is explained hereunder.

If unlisted shares are sold within 24 months (2 years) of buying them, the profit is termed as short-term capital gain. This gain is added to the total income and taxed as per the applicable income tax slab.

If unlisted shares are sold after 24 months, the profit is termed as a long-term capital gain. As per Budget 2024, LTCG on unlisted shares is now taxed at a flat rate of 12.5%, without indexation benefit. Earlier, it was 20% with indexation, but that benefit has been removed.

If a company issues unlisted shares at a price higher than their Fair Market Value (FMV), the extra amount received is taxed as ‘Income from Other Sources’ in the hands of the company. This applies to both resident and non-resident investors now. The FMV is calculated using updated methods under Rule 11UA, including new global valuation techniques.

Unlisted shares present a whole new arena of investment opportunities with potentially higher returns. However, before investing in them, it is crucial to have all the facts along with the core pros and cons of such an investment. Here is a brief list of the same.

Buying and selling unlisted shares can be a good way to invest early in strong private companies or startups, especially before they launch an IPO. These shares can offer high returns and help diversify your investment portfolio. However, they also come with significant risks like low liquidity, limited price transparency, and no guarantee of listing. Thus, it is important to invest in these assets with full disclosure to ensure that investors are making an informed decision.

This article talks about a less ventured road, i.e., investment in unlimited shares. Let us know your thoughts on this topic or if you need further information on the same and we will address them.

Till then, Happy Reading!

Read More: Shares and Debentures - What are the differences?

Thestock market never stands still, and prices swing constantly with every new h...

The term stock is the starting point to invest or trade instock markets. While m...

In our previous article, we saw the importance of working capital in keeping the...