When we talk about company reports, the most common names to pop up are the Annual Reports and the Auditors’ Reports. However, did you know that before these reports are finalised, the company’s management has to put together a crucial report, i.e., the Directors’ Report. So what is this report, and why is it prepared? Read on to get answers to these questions and more about the Directors’ Report in this blog, and simplify your journey of reading corporate data.

The Directors’ Report is a formal document prepared by the Board of Directors of a company to communicate with its shareholders and other stakeholders. It gives an overview of the company’s financial performance, important decisions taken during the year, challenges faced, future plans, and compliance with legal requirements. Preparing this report is not optional in India, and is rather a legal requirement under the Companies Act, 2013. Specifically, Section 134 of the Act (and the rules made under it) lays down what must be included in the Director’s Report, such as details about financial results, dividends, changes in the company’s structure, board meetings, corporate social responsibility (CSR) activities, and more. The idea is to make sure that shareholders, who are the real owners of the company but not involved in day-to-day management, get a transparent and reliable picture of how the company has been run. In short, the Director’s Report acts as a bridge between the management and the shareholders, ensuring accountability and trust.

The Director’s Report is prepared in a set format and covers financial performance, major decisions, compliance, and accountability, giving shareholders a clear picture of how the company is being managed. The key contents of this report are,

Financial summary - Highlighting the details of the company’s financial results (profit and loss, cash flows).

Dividends - Information about whether a dividend is declared or not.

Reserves - Details of money transferred to reserves for future use.

Changes in share capital - Details of any new shares issued by the company, bought back shares, or any changes to capital.

Changes in directors/key managers - Appointments, resignations, or changes in the Board of Directors or senior management.

Number of board meetings - The number of times the Board met during the year.

Material changes - Any major events that happened after the financial year that could affect the company.

Subsidiaries, associates, joint ventures - Performance of group companies, if any.

Corporate Social Responsibility (CSR) - Details of CSR activities (for companies that must do CSR).

Extract of Annual Return - A summary of the company’s Annual Return (earlier Form MGT-9, now MGT-7 on the MCA portal).

Auditor’s qualifications or remarks - Explanations from directors if auditors made comments in their report.

Related party transactions - Details of transactions with promoters, directors, or related businesses.

Internal financial controls - Confirmation that proper systems and controls are in place.

Risk management - How the company identifies and manages risks.

Loans, guarantees, and investments - Information about loans given, guarantees provided, or investments made by the company.

The Board of Directors of a company is responsible for preparing the Directors’ Reports. Since directors are in charge of managing the company on behalf of the shareholders, they are legally required under the Companies Act, 2013 (Section 134) to prepare this report every year. Once prepared, the report is signed by the Chairperson of the company (if authorised by the Board), or by at least two directors, one of whom must be a Managing Director, if the company has one. This ensures that the report comes directly from the people responsible for the company’s decisions and performance.

The main target readers of the Directors’ Reports are the shareholders, who are the actual owners of the company. Since they do not manage daily operations, this report keeps them informed about how their company is being run. Apart from shareholders, the report is also useful to investors, regulators, lenders, employees, and other stakeholders who want to understand the company’s performance, compliance, and future direction.

The Importance of the Directors’ Reports is explained below.

The Director’s Report brings clarity to how the company has been run throughout the year. Shareholders, who own the company, are not usually involved in day-to-day operations. Without such a report, they would have very little idea about what is happening inside the company. The report provides a structured summary of the company’s financial results, decisions made, future plans, and even risks faced. This makes sure that the company is not hiding important information, but instead keeping its owners fully informed.

Since the Board of Directors prepares this report, they must explain and justify their decisions, strategies, and financial performance. For example, if profits have fallen or losses have increased, the directors must mention the reasons in the report. If there are risks or legal issues, they must disclose them as well. This means the directors cannot run the company without answering to the shareholders. The report ensures that directors are accountable for every important action they take on behalf of the company.

Trust is the foundation of any company-shareholder relationship. When directors present a report that gives a true and fair picture of the company’s affairs, it builds confidence among shareholders and potential investors. For example, if the report shows growth, new opportunities, and proper compliance, shareholders feel reassured about their investment. On the other hand, if the company is facing difficulties, an honest disclosure creates respect and trust because the management is being open instead of hiding problems.

Under the Companies Act, 2013, every company must prepare a Director’s Report. This is not just a formality, as it is a legal duty. If a company fails to prepare and present the report, the directors can face penalties or legal consequences. This ensures that companies take the preparation seriously and provide all necessary disclosures. In other words, the Director’s Report is not just a goodwill gesture, but a legal safeguard for shareholders and the wider public.

The Director’s Report is a valuable tool for investors and shareholders to make informed choices. For instance, a shareholder may read the report to decide whether to hold, increase, or sell their shares. A potential investor may look at the company’s performance and future plans to decide whether to invest money. Even lenders or regulators can use the information to judge the company’s financial health. By presenting facts and explanations in one place, the report makes it easier for stakeholders to take sound financial and business decisions.

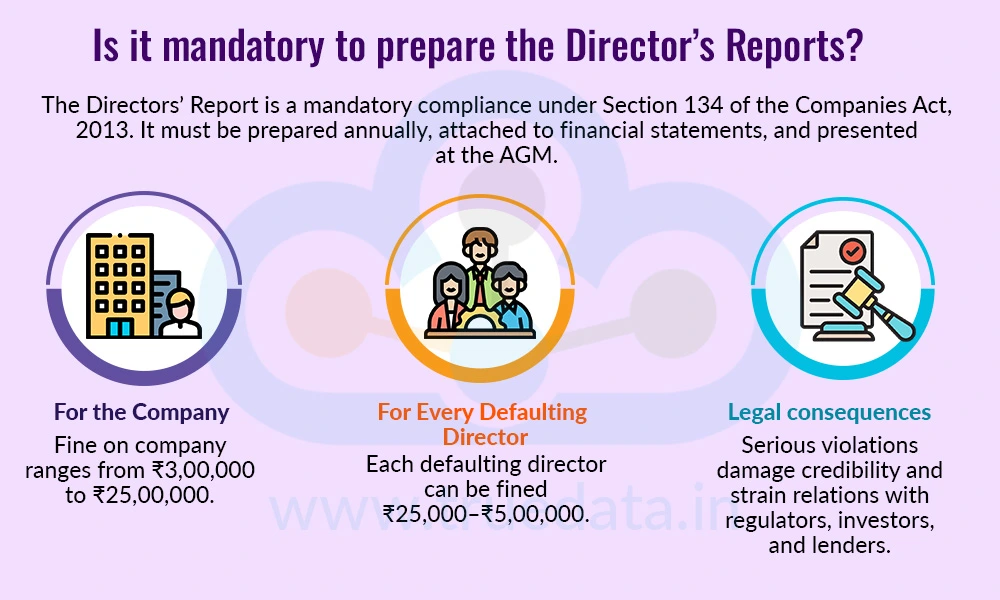

Directors’ Reports are part of the mandatory compliance requirements set by the Companies Act, 2013, and are to be prepared every year. They are not just considered to be part of good corporate governance, but also a legal duty of the Board to prepare and present this report in due format and within the regulatory framework. This requirement is laid down under Section 134 of the Companies Act, 2013. The report must be attached to the company’s financial statements and presented at the Annual General Meeting (AGM). The idea is to ensure that shareholders and other stakeholders get a complete picture of the company’s performance, decisions, and compliance with laws. Since the Director’s Report is a legal requirement, companies cannot treat it as optional. Non-compliance is taken seriously, and penalties are imposed if the report is not prepared, signed, or presented properly.

The consequences or penalties in case of non-compliance with this requirement include,

For the Company - A fine of Rs. 3,00,000 to Rs. 25,00,000 can be imposed on the company.

For Every Defaulting Director - Each director who is responsible for the default can be fined between Rs. 25,000 and Rs. 5,00,000.

Legal consequences - Repeated or serious violations can also harm the company’s credibility and create problems with regulators, investors, and lenders.

Director reports reflect the decisions taken by the management to achieve the company's objectives. It provides an abundance of knowledge and information about the company, along with potential red flags to look out for while analysing a company. Some of such red flags that can be found in the Directors’ Reports are highlighted below.

Declining Profits or Rising Losses - If the company shows falling profits or continuous losses without proper reasons, it may mean the business is facing financial trouble.

Frequent Changes in Accounting Policies - When a company keeps changing its accounting methods without clear reasons, it may be trying to hide losses or make results look better than they are.

Irregular Board Meetings - If the number of Board Meetings is very low or directors often skip them, it shows a lack of active involvement in managing the company.

Frequent Resignations of Directors - If many directors or key managers are leaving, it could signal internal conflicts, poor governance, or instability in leadership.

Rising Debt Levels - If the company is taking on too many loans year after year without showing how it will repay, it could mean financial stress and risk for shareholders.

Large Related Party Transactions - Too much business with promoters, directors, or relatives can create conflicts of interest and harm shareholders’ trust.

Sudden Changes in Share Capital - Frequent changes in shares (like fresh issues or buy-backs) without strong reasons can reduce the value of existing shareholders’ investments.

Delays in CSR Spending - For companies required to do CSR, if the report shows delays or non-fulfilment of CSR obligations, it may signal poor compliance and weak governance.

Too Many Legal Cases - Frequent mentions of court cases, penalties, or government actions show that the company might have compliance or ethical problems.

Negative Auditor Comments Ignored - If auditors point out problems and directors do not explain them properly, it is a strong red flag for a lack of transparency.

Delays in Project Completion - When projects or expansions are repeatedly delayed, it may show poor management quality or a lack of funds.

Incomplete Disclosures - If the report skips required details like related party transactions, loans, or risk factors, it is a sign of weak transparency.

The Director’s Report is much more than just a legal requirement under the Companies Act, 2013. It is a vital tool of transparency, accountability, and trust between a company’s management and its shareholders. Reading the report carefully allows the stakeholders to understand the company's performance and the management’s future plans for growth and expansion. It acts like a bridge of information that helps shareholders to regulators understand how well a company is being managed.

This blog talks about yet another crucial report in understanding corporate data to analyse a company’s performance. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: How to Analyse a Company’s Competitive Advantage Using Porter’s Five Forces?

Thestock market never stands still, and prices swing constantly with every new h...

Analysing the financial statements is the first step in the fundamental analysis...

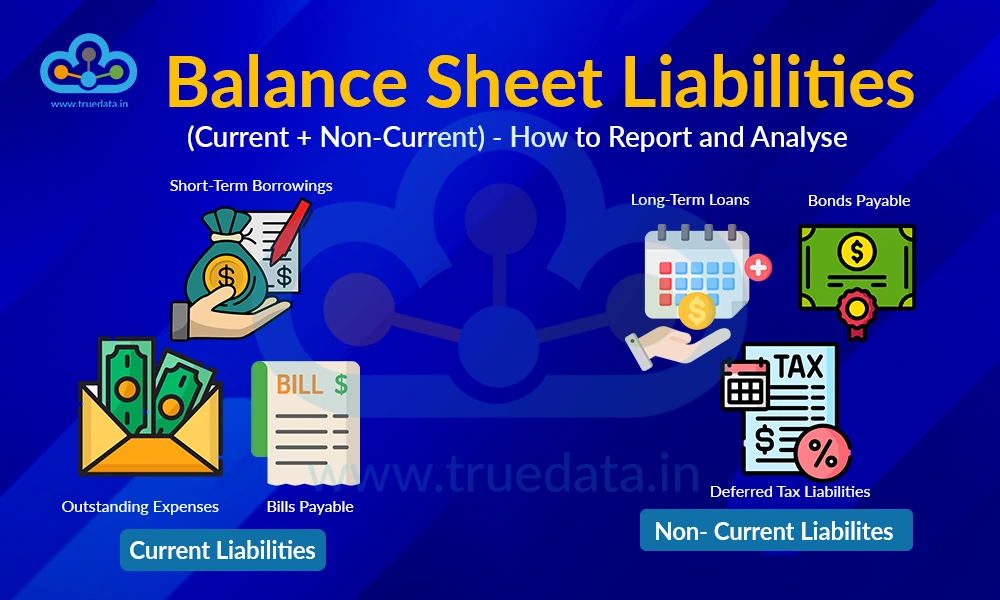

Abalance sheet is built on two pillars, assets and liabilities. We have explored...