Analysing the financial statements is the first step in the fundamental analysis of stocks. To this end, we have covered the analysis of all three financial statements in our earlier blogs. Continuing with the series, let us now dissect each component of these financial statements for a deeper understanding of their reporting and analysis. First Stop, balance sheet assets!

Balance Sheet Assets refer to everything a company owns that has value and can help the business make money in the future. These are shown on the balance sheet, which is a financial statement that gives a snapshot of the company’s financial position at a specific point in time. Assets are important because they are used to run the business, pay bills, make products, and earn profits. Assets are divided into two main types,

Current Assets - things the company expects to use or turn into cash within one year

Non-Current Assets - things the company plans to use for more than one year.

Here is a deeper understanding of all the current and non-current assets

This is the most liquid asset, meaning it can be used right away. It includes physical cash kept in the office, money in bank accounts, and short-term fixed deposits or investments that mature in less than 3 months. Companies keep this to pay daily expenses like salaries, bills, or urgent purchases.

Example - Infosys Ltd. might keep Rs. 1,000 crore in its bank and short-term deposits to manage operations smoothly.

This is money that customers owe to the company for goods or services the company has already provided. Businesses often sell on credit, so they record the expected payment as receivables. This helps track who owes how much and when it is due.

Example - If Tata Steel sells steel to a construction company but allows payment after 60 days, the unpaid amount is shown as accounts receivable.

Inventories are items a company keeps to sell or use in making its products. This includes,

Raw materials (like metal, plastic),

Work-in-progress (half-built items), and

Finished goods (ready to sell).

Managing inventory well is important because too much stock means higher costs, and too little can delay sales.

Example - Maruti Suzuki keeps parts like tires, engines (raw materials), partly assembled cars (work-in-progress), and finished cars (ready for sale).

These are investments made to earn a quick return and can be sold or converted into cash within a year. They offer better returns than keeping money idle in a bank account. These may include mutual funds, treasury bills, or bonds with short maturity.

Example - HDFC Bank might invest Rs. 500 crore in short-term government securities, which they can easily sell when they need cash.

Companies sometimes pay in advance for services they will receive in the future, like rent, insurance, or subscriptions. These payments are recorded as assets because the benefit is yet to come. As time passes and the service is used, it turns into an expense.

Example - Wipro may pay Rs. 6,00,00 rent in advance for 6 months. Until those 6 months pass, the amount is recorded as a prepaid expense.

These are the physical things a company uses in its daily operations for the long term. It includes,

Land,

Buildings,

Machinery,

Vehicles, and

Office furniture.

These are not meant to be sold quickly but are used to produce goods or offer services.

Example - Tata Motors has large vehicle factories, machines, and testing units. These help make vehicles and are listed as PPE.

These are investments the company plans to hold for several years, not just for quick profits. They may include buying shares of another company, investing in bonds, or setting up a joint venture. These help the company grow in the long run.

Example - Reliance Industries might invest in an oil company abroad to explore new markets. This is not for short-term return, so it is a long-term investment.

These are valuable assets that cannot be touched or seen, but still have great importance. These include,

Patents (rights over an invention),

Trademarks (brand name/logo),

Copyrights (ownership of content/software),

Goodwill (value from brand reputation or acquisitions).

These help companies maintain their brand, develop products, and grow their market value.

Example - Infosys owns software copyrights and trademarks. Also, if it buys another company, the extra amount paid over its value is recorded as goodwill.

This is a future tax benefit that arises due to timing differences between accounting profit and taxable profit or losses carried forward. It is like prepaid tax benefits that the company can use to reduce future tax payments.

Example - If a startup in India suffers losses in the first 3 years, it can carry those losses forward to reduce future tax when it becomes profitable. This benefit is shown as a deferred tax asset.

This includes long-term advances, deposits, and other things that do not fit into the other categories. These are not quickly used up and stay with the company for a long time.

Example - A real-estate company like DLF may give a long-term advance of Rs. 200 crore to buy land from a government body. Since the land is not yet delivered, the money stays as a non-current asset.

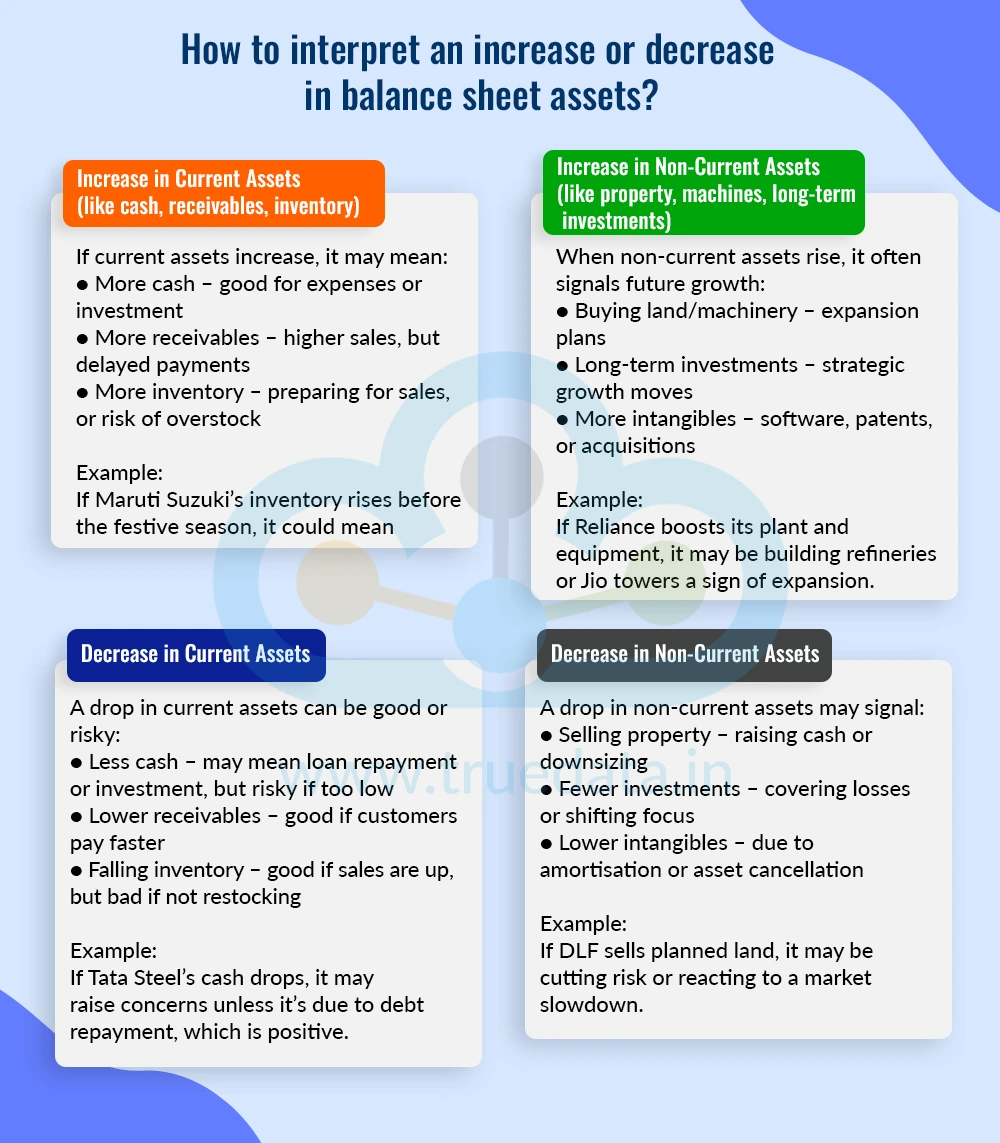

The balance sheet of a company shows its financial position on a specific date. One important part of the balance sheet is assets, which are everything the company owns and uses to run its business. When the total assets increase or decrease, it can mean different things depending on which type of asset is changing. Here is a brief explanation of the same.

If current assets go up, it might mean,

An increase in cash can be good for paying expenses or investing.

An increase in accounts receivable means the company sold more, but customers have not paid yet. This could be risky if payments are delayed.

An increase in inventory may be possible because the company is preparing for higher future sales. But if inventory is too high and not selling, it may indicate slow sales or overproduction.

Example -

If Maruti Suzuki’s inventory increases, it might mean they are ready for the festive season sales. However, if the cars are not selling, it could be a sign of slowing demand.

When non-current assets rise, it usually means the company is investing for the future.

Buying land, buildings, or machinery may mean the company is expanding its operations.

Investing in another business (long-term investment) could signal growth plans or a strategic partnership.

Growth in intangible assets might mean the company is developing software, filing patents, or acquiring other businesses.

Example -

If Reliance Industries increases its plant and equipment, it may be setting up new refineries or telecom towers for Jio. This is a positive sign of business expansion

A decrease in current assets can sometimes show improvement, but it could also be a warning sign, depending on what is going down.

Cash going down might mean the company is paying off loans or making investments. This is okay if planned, but dangerous if cash is too low to pay daily expenses.

Decreasing accounts receivables may be good if it means customers are paying faster.

Inventory falling could mean the company is selling more products. This is a good sign; however, if they are not restocking, it might signal supply chain issues or cash shortages.

Example -

If Tata Steel’s cash reserves drop sharply, investors may worry that the company is spending too much or facing cash flow problems. But if it is because they repaid debt, that can be a good sign.

If non-current assets go down, it might mean,

A company selling property or equipment might mean it is raising cash or downsizing.

A drop in long-term investments could mean they sold assets, possibly to cover losses or fund other projects or that the investments turned bad.

If intangible assets drop, it may reflect amortisation (gradual reduction in value), or cancellation of patents, software, or licenses.

Example -

If DLF sells land it had planned to develop, it might be reducing business risk or facing a slowdown in the real estate market.

All companies in India must follow specific rules and formats when reporting their assets on the balance sheet. These rules help make financial statements clear, consistent, and easy to compare across different companies and time periods. The primary requirements come from,

Companies Act, 2013 (Schedule III)

Indian Accounting Standards (Ind AS)

These standards apply to all registered companies, including public and private limited companies. Listed companies, along with companies falling under specific legislations, like banking and insurance companies, have to follow additional rules from such legislations as well as SEBI (Securities and Exchange Board of India).

The key reporting requirements include,

Assets must be shown under two main heads -

Current Assets (used or converted into cash within 1 year)

Non-Current Assets (used or held for more than 1 year)

This classification is mandatory so that anyone reading the balance sheet can understand the company’s short-term and long-term asset position.

Each category of assets must be shown separately with subcategories. Let us look at what companies must show under each type

Cash and Cash Equivalents - Must show amounts in cash, bank balances, and short-term deposits

Trade Receivables - Must show total due from customers and split it into -

Outstanding for less than 6 months

Outstanding for more than 6 months

Inventories - Must break down into,

Raw materials

Work-in-progress

Finished goods

Stores and spares

Short-term Loans and Advances - To be shown with names (if significant) and purpose.

Other Current Assets - Prepaid expenses, accrued income, etc.

Example - Infosys will show trade receivables from clients like Apple, Microsoft (if material), and may disclose the age of receivables.

Property, Plant, and Equipment (PPE) - Each asset, like land, building, machinery, etc., must be shown separately with the following details,

Original cost

Depreciation

Net book value (what it is worth today)

Intangible Assets - Software, patents, and goodwill to be shown separately with amortisation.

Capital Work-in-Progress (CWIP) - Assets under construction must be reported clearly.

Long-term Investments - Companies must show the type of investment (equity, debt) and the name of the company if significant.

Deferred Tax Assets - Must show the basis (e.g., carry-forward loss) and expected benefit period.

Other Non-Current Assets - Like long-term advances, deposits, etc.

Example - Tata Motors must show its machinery cost, depreciation applied, and net value. If it is building a new factory, that will go under CWIP.

Companies must report assets for

The current financial year, and

The previous year, side-by-side

This helps readers compare performance across years.

Every item on the balance sheet must be explained in the Notes. These notes highlight the details like,

Breakups of large numbers

Extra details (terms, accounting method used)

Assumptions or estimates made

Related party details (e.g., loans to group companies)

Example - If Reliance gives Rs. 200 crore advance to a subsidiary, it must explain this in the notes.

Companies must follow Ind AS to decide whether they use historical cost (original price paid) or fair value (market value).

For example,

Inventory is usually valued at the lower of cost or market value.

Fixed assets are shown at cost minus depreciation, unless revalued.

These reporting and disclosure requirements ensure that the company is providing a true and fair picture of its financial health and ensures transparency for investors, regulators, and lenders. It is also used to understand the company’s liquidity, solvency, and financial strength while allowing a better comparability across companies and industries.

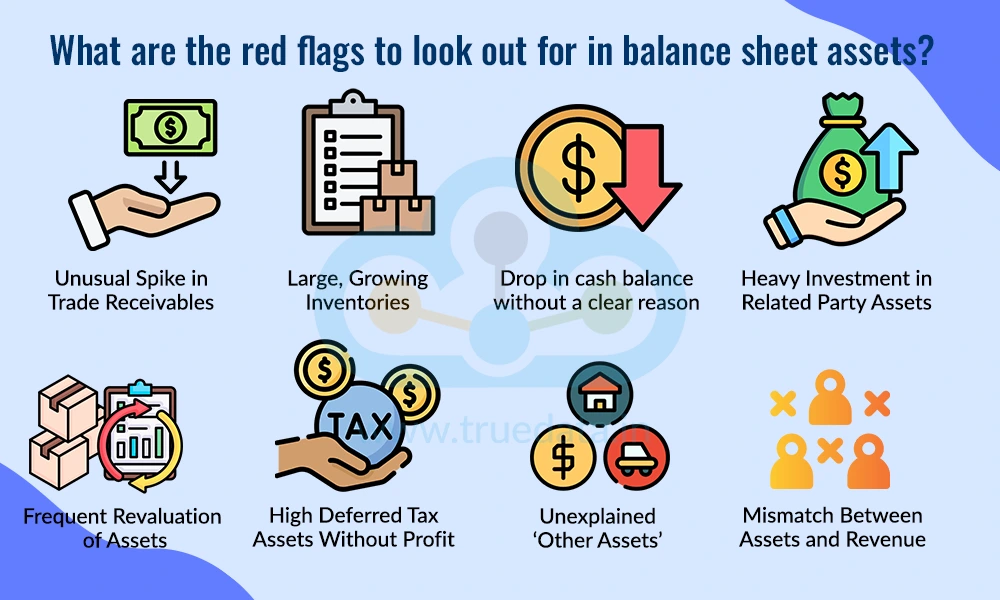

Red flags in a balance sheet help understand the deeper meaning of the numbers shown, and also an insight into the actual financial health of the company rather than what is projected. Some of these red flags to watch out for include,

Unusual Spike in Trade Receivables - This may indicate that customers are not paying on time, even though sales are increasing. It can be a sign of fake or forced sales just to boost revenue numbers. For example, if a company’s sales rise by 10% but trade receivables rise by 40%, something could be wrong.

Large, Growing Inventories - A rising inventory number can signal that the company is not able to sell its products quickly. This might lead to waste, damage, or losses later, especially in fast-moving industries like electronics or fashion.

Drop in cash balance without a clear reason - If profits look strong but cash in the bank is falling, it is a red flag. It could mean the company is spending too much, or the profits are not real or not collected in cash yet. This can hurt daily operations.

Heavy Investment in Related Party Assets - When a company gives big loans or makes investments in related parties (like subsidiaries or sister companies), it should raise questions. This might be a way to shift funds or cover up poor performance in other parts of the business.

Frequent Revaluation of Assets - Revaluing land, buildings, or other assets too often may be used to artificially boost the balance sheet. If the assets are not being sold, these higher values do not help with real profits or cash.

High Deferred Tax Assets Without Profit - Companies sometimes show ‘deferred tax assets’, assuming they will earn enough profit later to use them. However, if the company has been loss-making for years, this benefit may never be used and should be viewed carefully.

Unexplained ‘Other Assets’ - A large amount under ‘other assets’ without a clear explanation can be suspicious. It might include non-performing loans, old advances, or unwanted investments. Always read the footnotes to understand what is inside and is actually classified as other assets.

Mismatch Between Assets and Revenue - When a company’s assets grow fast but its sales or income stay the same, it means the company is not using its resources properly. It may be investing too much without good returns, which can hurt long-term performance.

Understanding balance sheet assets is a crucial insight into the utilisation of company resources. It is, therefore, important to dig deeper and compare the balance sheet figures with the past performance as well as industry peers. This helps investors and company management understand the areas of concern and chalk out the necessary plan of action for remedial measures.

This article is the first in our series of dissecting each component of financial statements. Let us know your thoughts on the topic or if you need further information on the same.

Till then, Happy reading!

Read More: How to Spot Financial Fraud and Accounting Manipulation from Financial Statements?

Thestock market never stands still, and prices swing constantly with every new h...

Abalance sheet is built on two pillars, assets and liabilities. We have explored...

We have seen the basics of thebalance sheet and how to read it in our earlier bl...