The cash flow statements and profit and loss statements are two distinct pillars that shed light on the company’s financial performance during the specified period. We have previously explored the basics of cash flow statements in our earlier blog. Continuing our series on understanding financial statements in greater depth, let us explore cash flow statements in detail and understand the nuances of this statement.

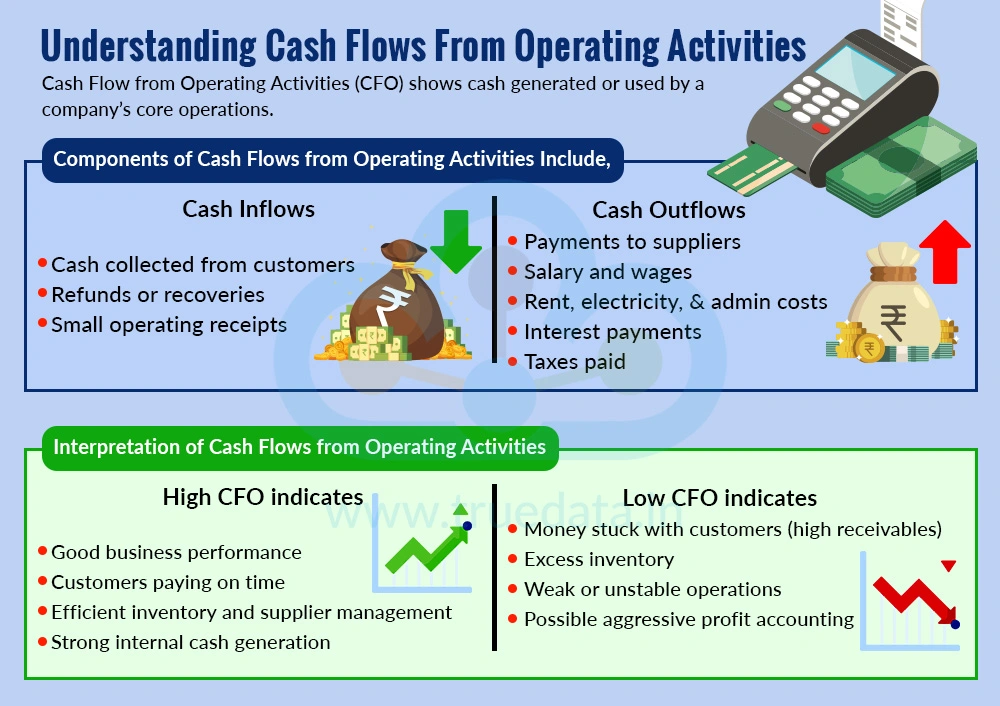

Cash Flow From Operating Activities (CFO) is the section of a company’s cash flow statement that shows the actual cash generated or used by the company’s core business operations. CFO is a crucial number because it reveals whether a company’s profits are backed by real cash flow, not just accounting entries. It shows the true cash earnings of the business, removing non-cash items such as depreciation, thus reflecting the company’s day-to-day financial strength.

Components of Cash Flows from Operating Activities Include,

Cash Inflows

Cash collected from customers

Refunds or recoveries

Small operating receipts

Cash Outflows

Payments to suppliers

Salary and wages

Rent, electricity, and admin costs

Interest payments

Taxes paid

Interpretation of Cash Flows from Operating Activities

The cash flow from operating activities can show the efficiency of the business to convert sales into cash and its financial stability. The interpretation of cash flows from operating activities is highlighted below.

High CFO indicates

Good business performance

Customers paying on time

Efficient inventory and supplier management

Strong internal cash generation

Low CFO indicates

Money stuck with customers (high receivables)

Excess inventory

Weak or unstable operations

Possible aggressive profit accounting

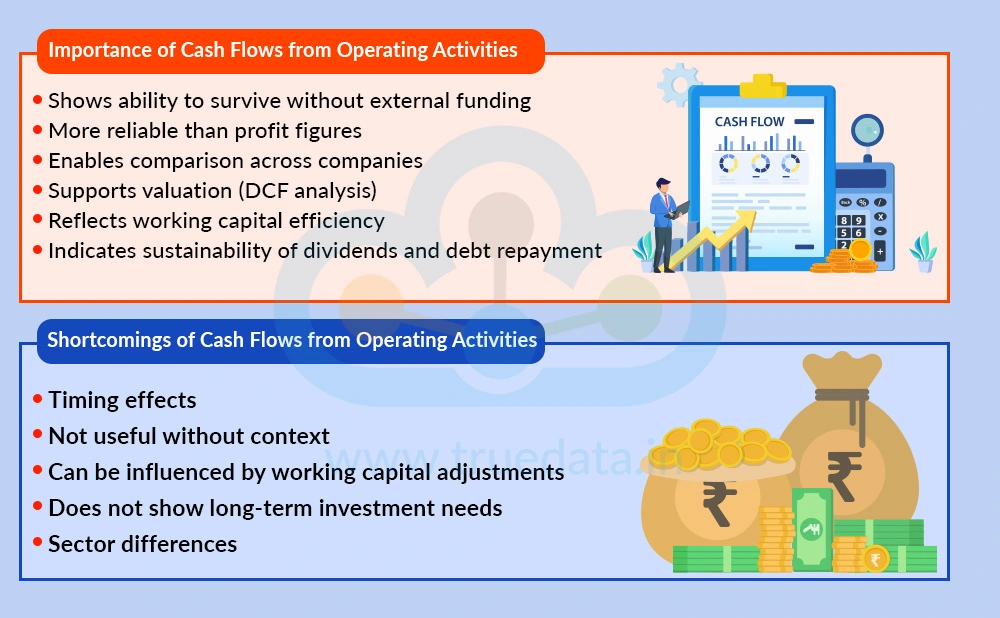

Importance of Cash Flows from Operating Activities

Cash flows from operating activities provide the following insights.

Shows the company’s ability to survive without external funding.

More trustworthy than profit, because cash cannot be manipulated easily.

Helps compare companies across industries.

Useful for valuations, like discounted cash flow (DCF) analysis.

Reveals the efficiency of working capital management.

Indicates the sustainability of dividend payments and debt repayment.

Shortcomings of Cash Flows from Operating Activities

Although CFO is very useful, it is not perfect. The shortcomings of the cash flows from operating activities include,

Timing differences - Some companies delay payments to suppliers to temporarily inflate the CFO's numbers. This improves cash flow but may create future pressure.

Not useful without context - CFO must be compared with profit, revenue, and past years. A single year’s CFO cannot show the full picture.

Can be influenced by working capital adjustments - A company may reduce inventory sharply to boost its CFO artificially, or may collect aggressively from customers for one quarter.

Does not show long-term investment needs - CFO does not include money required for future expansion (CapEx). A company may show a good CFO but still need heavy borrowing for growth.

Sector differences - Sectors like Banks and NBFCs calculate CFO differently. Thus, comparing CFO across industries like IT, manufacturing, and finance can be misleading.

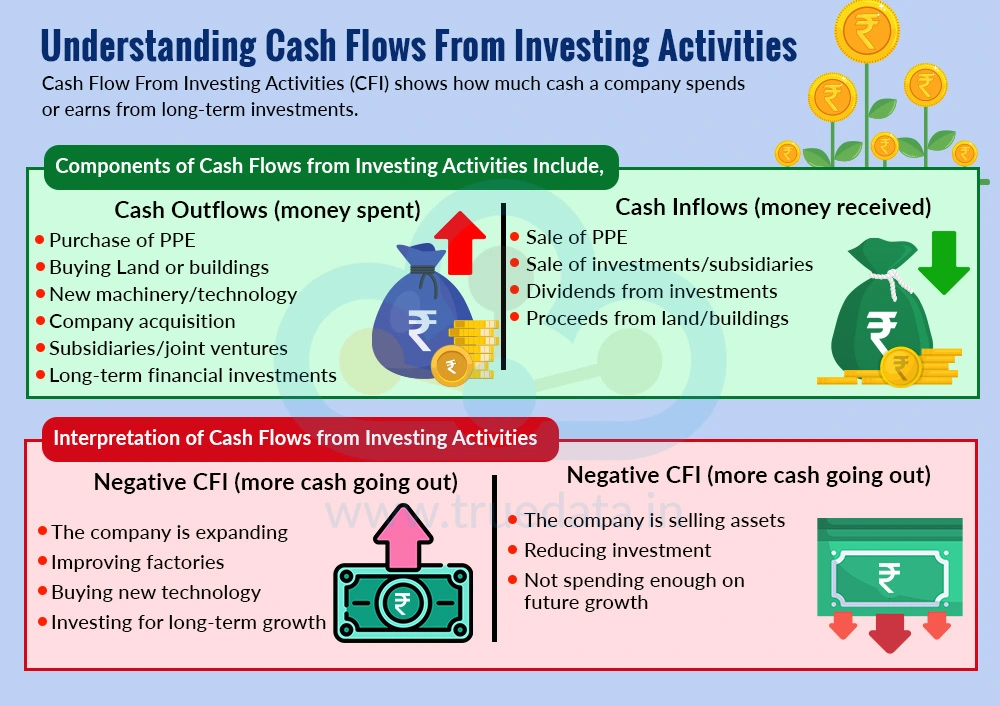

Cash Flow From Investing Activities (CFI) shows how much cash a company spends or earns from long-term investments. These include buying or selling property, factories, machines, technology, or investments in other companies. This part of the cash flow statement tracks cash used for long-term assets and reveals how much a company is investing in future growth, along with whether it is using its cash wisely. It does not include daily operational expenses. Instead, it focuses on big financial decisions that affect the company for many years.

Components of Cash Flows from Investing Activities Include,

Cash Outflows (money spent) - These are usually large expenses and are important for future capacity and expansion.

Purchase of property, plant, and equipment (PPE)

Buying land or buildings

Buying new machinery or technology

Acquiring another company

Investing in subsidiaries or joint ventures

Purchasing long-term financial investments

Cash Inflows (money received) - These inflows come from selling long-term assets and help increase the company’s cash reserves. Examples of these inflows include.

Sale of property or machinery

Sale of investments or shares in subsidiaries

Dividends or interest received from long-term investments

Proceeds from selling land or buildings

Interpretation of Cash Flows from Investing Activities

Cash flows from investing activities highlight the company’s ability for future growth and expansion. The interpretation of cash flows from investing activities is explained hereunder.

Negative CFI (more cash going out) - It is often a good sign, as it can indicate the following,

The company is expanding

Improving factories

Buying new technology

Investing for long-term growth

For example, a manufacturing company with high capex is often preparing for higher future sales.

Positive CFI (more cash coming in) - This can indicate the following,

The company is selling assets

Reducing investment

Not spending enough on future growth

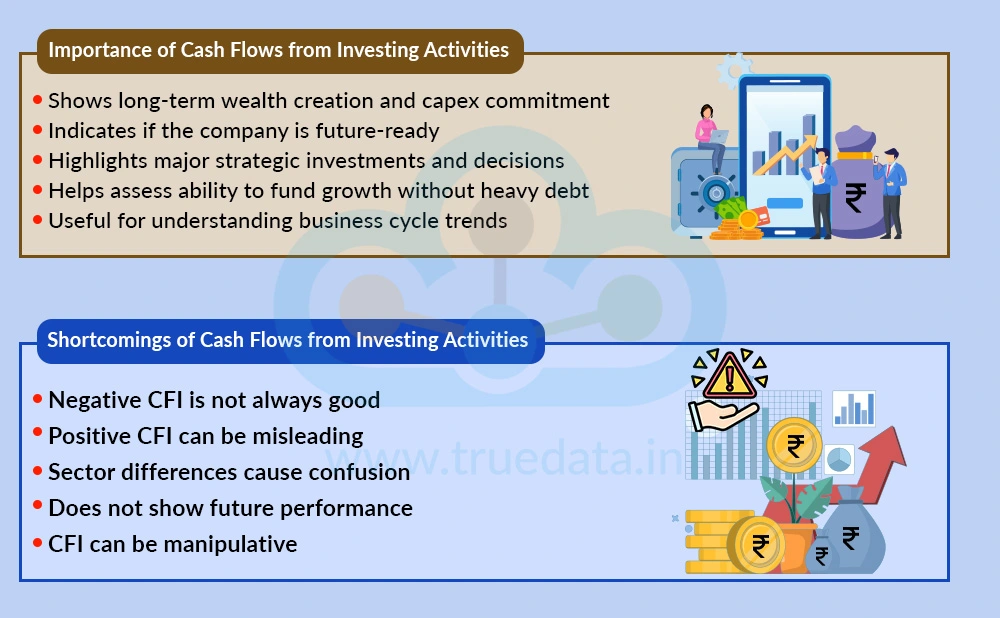

Importance of Cash Flows from Investing Activities

The importance of cash flows from investing activities is highlighted below.

CFI gives strong clues about long-term wealth creation and shows commitment to growth through capital expenditure (capex).

It helps find whether a company is future-ready.

These cash flows reveal major strategic decisions like acquisitions, new plants, big technology upgrades, etc.

They help investors understand if the company has enough cash to fund investments without heavy borrowing.

It is useful for analysing business cycles, i.e., capex rises during growth phases and falls in slowdown years.

Shortcomings of Cash Flows from Investing Activities

Even though CFI is helpful, it has some limitations. Some of these limitations are mentioned below.

Negative CFI is not always good - A company may invest heavily, but that investment may not generate returns later.

Positive CFI can be misleading - It might indicate that the company is selling important assets, along with other factors, such as the management is under financial pressure, and growth plans are slowing.

Does not show future performance - CFI only shows where cash is spent, not whether the investment will be successful.

Sector differences cause confusion - Different industries have different capex needs, such as IT companies need low capex and steel or cement companies need very high capex. Comparing them purely on CFI is not useful.

CFI can be manipulative - One-time transactions distort CFI. For example, selling a building, buying a large piece of land, or acquiring a business. These can make CFI appear unusually positive or negative for that year, without showing the real trend.

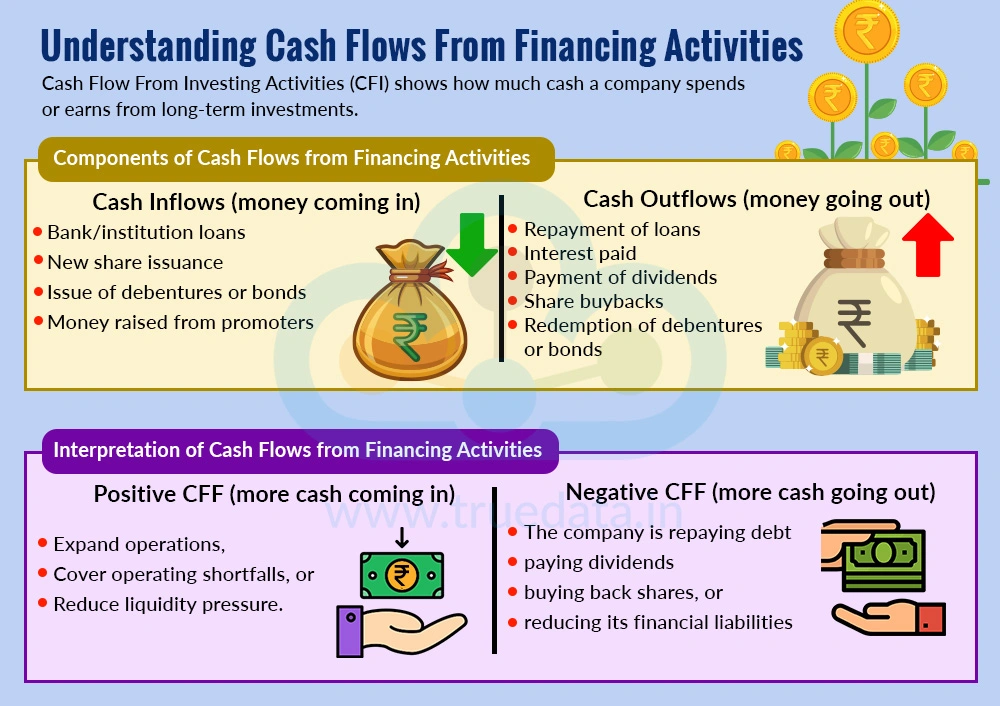

Cash Flow From Financing Activities (CFF) shows how a company raises money and how it returns money to its lenders and shareholders. This section tracks borrowing, repayment, equity issuance, share buybacks, and dividend payments. CFF reveals how dependent a company is on external funding and whether it manages its capital structure wisely. CFF shows how the company funds its business, whether through debt or equity, and how it rewards investors.

Components of Cash Flows from Financing Activities

Financing cash flows include both inflows (money coming in) and outflows (money going out) related to funding.

Cash Inflows (money coming in) - These increase the company's cash reserves. These inflows support expansion, working capital needs, or acquisitions. Some examples include,

New loans taken from banks or institutions

Issue of new shares (IPO, FPO, QIP, rights issue)

Issue of debentures or bonds

Money raised from promoters

Cash Outflows (money going out) - These reduce the company's cash reserves. Some examples include,

Repayment of loans

Interest paid (sometimes shown in operating cash flow, depending on accounting policy)

Payment of dividends

Redemption of debentures or bonds

Interpretation of Cash Flows from Financing Activities

Cash flows from the financing activities can be negative or positive when summed up, depending on the nature and quantum of activities. The interpretation of the net cash flows from financing activities is explained below.

Positive CFF (more cash coming in) - Positive cash flows from financing activities may indicate the company is raising money for various purposes, but also indicate high dependence on external funding. This often means the company is raising money to

expand operations,

cover operating shortfalls, or

reduce liquidity pressure.

Negative CFF (more cash going out) - Negative CFF is often seen in mature, stable companies that generate enough internal cash. It usually indicates the following,

The company is repaying debt

paying dividends

buying back shares, or

reducing its financial liabilities

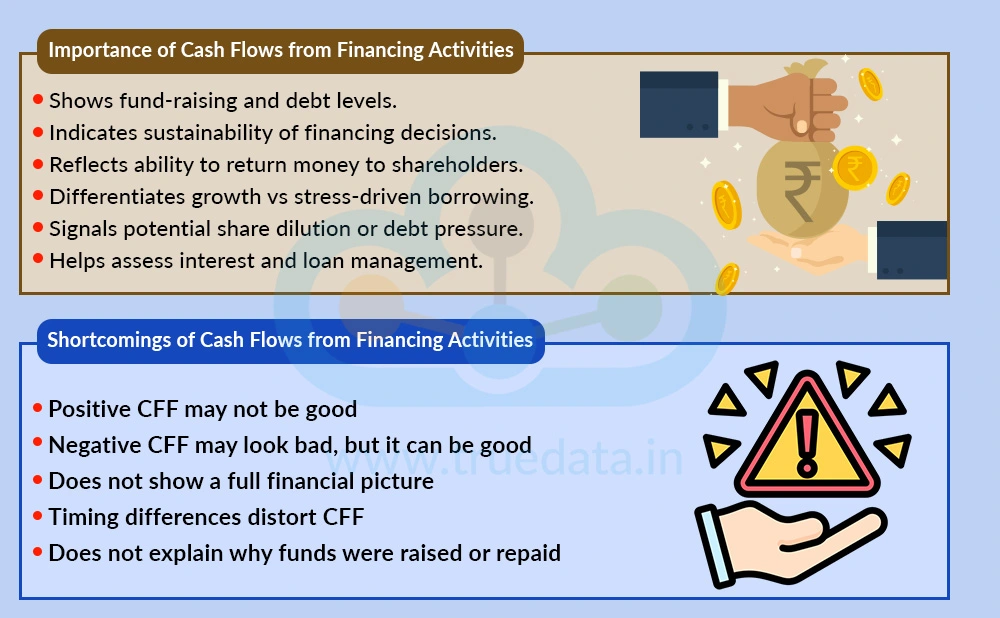

Importance of Cash Flows from Financing Activities

Cash flows from financing activities indicate the financial risk and help investors evaluate sustainability. The importance of cash flows from financing activities is explained below.

It shows how a company raises funds and how much debt it carries.

Cash flows from financing activities help judge whether financing decisions are sustainable.

It also indicates the company’s ability to return money to shareholders.

These cash flows help differentiate between growth-driven borrowing and stress-driven borrowing.

Investors can get clues about future dilution (new shares) or future debt pressure from these cash flows.

Cash flows from financing activities are also useful for understanding how a company manages interest costs and loan obligations.

Shortcomings of Cash Flows from Financing Activities

Cash flows from financing activities can provide deep insights into the risk and stability of the company. However, there are a few shortcomings that need to be addressed as well. These limitations include,

Positive CFF may not be good - High inflows may mean that the company is short on cash, operations are weak, or too much debt is being taken.

Negative CFF may look bad, but it can be good - A company repaying debt or buying back shares will show negative CFF, but this is often a positive sign.

Does not show a full financial picture - CFF must be read along with the Profit and Loss Statement, Balance Sheet and Operating Cash Flow. On its own, cash flows from financing activities can be misleading.

Timing differences distort CFF - Borrowings or repayments made once in a few years can make a single year look unusual.

Does not explain why funds were raised or repaid - A company may borrow for expansion or simply to cover losses, hence, CFF alone cannot tell the difference.

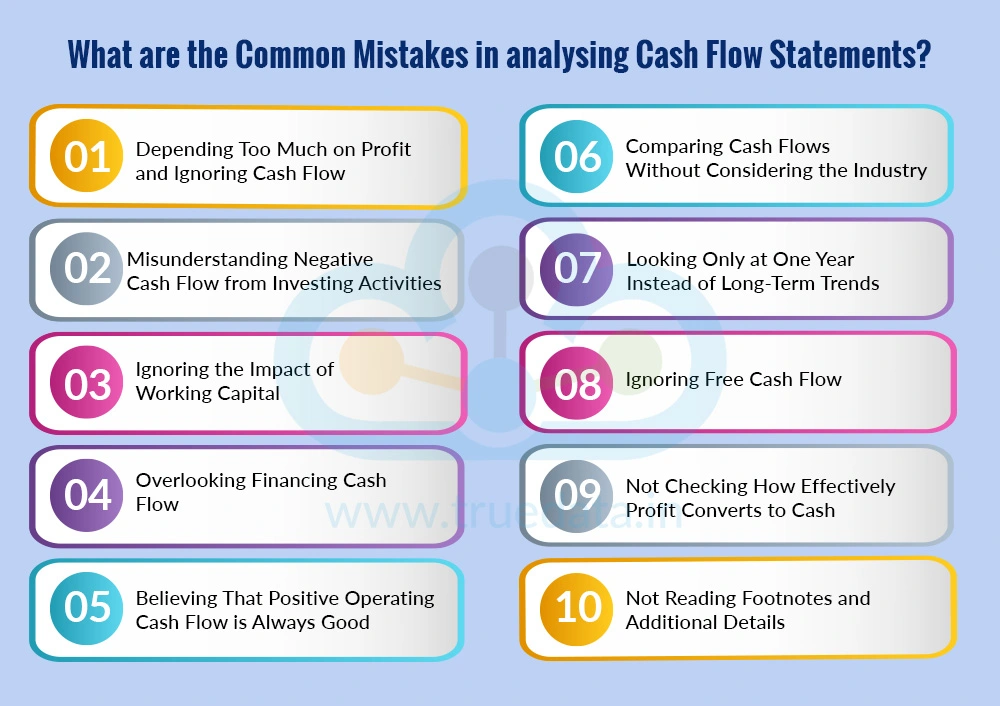

Understanding a cash flow statement is essential because it shows the real money movement within a business. While profits can look good on paper, cash flow reveals whether the company actually has the funds to run daily operations, invest for growth, and repay debts. However, many investors, especially new ones, make certain mistakes that lead to wrong conclusions. Such common mistakes in using and interpreting cash flows are explained below.

One of the biggest mistakes is focusing only on the company’s net profit and assuming everything is fine. Profit is calculated using accounting rules and may not represent real money coming in. A company can show high profit but still struggle if customers delay payments or if too much money is tied up in inventory. Cash flows indicate whether profits are actually turning into money. The safer approach for investors is to check whether both profit and operating cash flow move in the same direction.

Many investors get worried when they see negative cash flow from investing activities. However, in reality, negative cash flow from investing activities often indicates that the company is spending money to grow, such as by purchasing machinery, upgrading technology, or expanding capacity. These investments help future earnings. In India, sectors like manufacturing, telecom, and power naturally indicate negative cash flow from investing activities because they require heavy capital spending. The key is to understand why the company is spending, not just whether the number is negative.

Working capital changes, such as inventory levels, customer payments, and supplier payments, have a major impact on operating cash flow. Ignoring these movements can lead to a wrong interpretation. For example, if a company’s inventory increases, cash goes down because money is stuck in goods. If customers do not pay on time, receivables increase and cash falls. On the other hand, if the company delays paying suppliers, cash flow temporarily improves. Investors must check whether the company consistently manages working capital well, or is just adjusting payments to boost cash temporarily.

Another common mistake is ignoring cash flow from financing activities. This part of the statement shows whether the company is borrowing money, repaying loans, issuing shares, buying back shares, or paying dividends. If a company is borrowing too much, it may face high interest costs and financial risk later. If it issues shares too often, shareholders may face dilution. Reviewing financing cash flow helps investors understand how the company funds its growth and whether its financial decisions are sustainable.

Positive cash flow from operations is important, but investors should look deeper to understand how that cash was generated. Sometimes, cash flows rise because the company is delaying payments or cutting back on essential expenses, or the improvement may come from a one-time refund or seasonal change. A strong business generates steady cash from its core operations and not from short-term tricks. Investors should focus on the quality of cash flow rather than just the final number.

Cash flow patterns vary widely between industries. For example, FMCG companies usually enjoy strong operating cash flows because their products sell quickly. However, infrastructure or telecom companies often have weaker or uneven cash flows due to heavy investments and long project cycles. Comparing companies from different industries can give a confusing picture. Investors should always compare cash flows with sector peers to understand whether performance is truly strong or weak.

A cash flow statement for a single year does not reveal the full story. One year may include unusual events such as asset sales, refunds, or temporary delays in payments. To get a realistic view, investors must analyse trends over at least three to five years. Consistent and stable cash flow over time is a sign of a strong business model. Short-term spikes or drops often hide the real financial health of a company.

Many investors do not look at Free Cash Flows (FCF), which is the cash left after the company spends on capital investments. FCF shows how much money the business truly has available for dividends, debt repayment, or expansion. A company may show strong operating cash flow, but high capital expenses may reduce free cash flow significantly. Checking free cash flow helps investors understand whether the company generates surplus cash consistently.

A company may report high profits but struggle to turn these profits into real cash. This may happen due to poor customer collection, excess inventory, or aggressive accounting. Investors should observe whether operating cash flow is consistently close to or higher than net profit. If profits rise but cash flows do not, it could be a warning sign of deeper issues.

Footnotes in financial statements often contain important explanations, such as unusual transactions, reclassifications, or one-time adjustments. Ignoring these details can lead to misinterpretation of the cash flow statement. Investors should always read the notes because they help clarify why cash flow numbers changed and whether those changes are temporary or permanent.

Understanding and breaking down cash flow statements helps investors see the real financial health of a company beyond just profits. By studying operating, investing, and financing cash flows, investors can learn how well a business generates cash, how wisely it invests for the future, and how it manages debt and shareholder returns. When analysed correctly, cash flow statements become a powerful tool to identify stable, growing companies and make smarter investment decisions.

This topic is an extension of our detailed analysis of cash flow statements, aimed at further simplifying the data. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: What is Discounted Cash Flow?

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Depreciation is a term that frequently appears in business andfinancial statemen...