Mutual funds are subject to market risks.’ This one familiar line has shaped how generations think about investing. However, for an everyday investor, the key question is ‘How do I actually know the risk level of a fund?’ To make this simpler and more transparent, mutual funds now display a Riskometer, which is a clear, visual tool that shows the exact risk category of each fund and helps investors make better, more confident decisions. Curious to understand how this Riskometer works and why it matters for your investment journey? Dive into this blog to explore everything you need to know about the Riskometer and its importance.

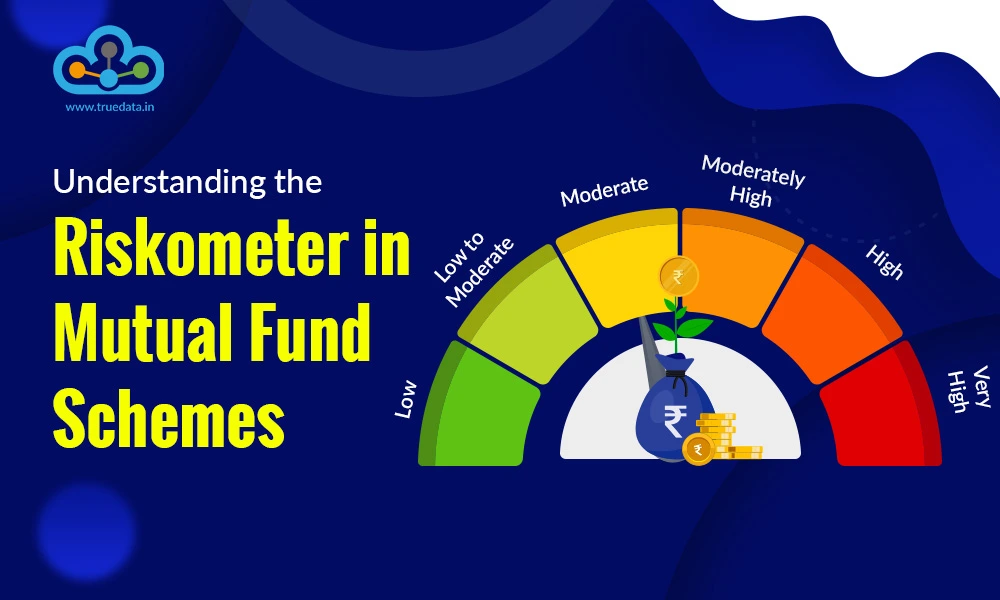

The Riskometer in mutual funds is a visual tool that is shaped like a speedometer, indicating the level of risk involved in a particular mutual fund. It helps investors quickly understand whether a fund is low risk, high risk, or somewhere in between, so they can choose investments that match their own comfort level. The idea is that mutual funds are not all the same, i.e., some invest in safer assets like government bonds, while others put money into stocks that can swing in value. By checking the Riskometer, investors can align their choices with their own risk tolerance.

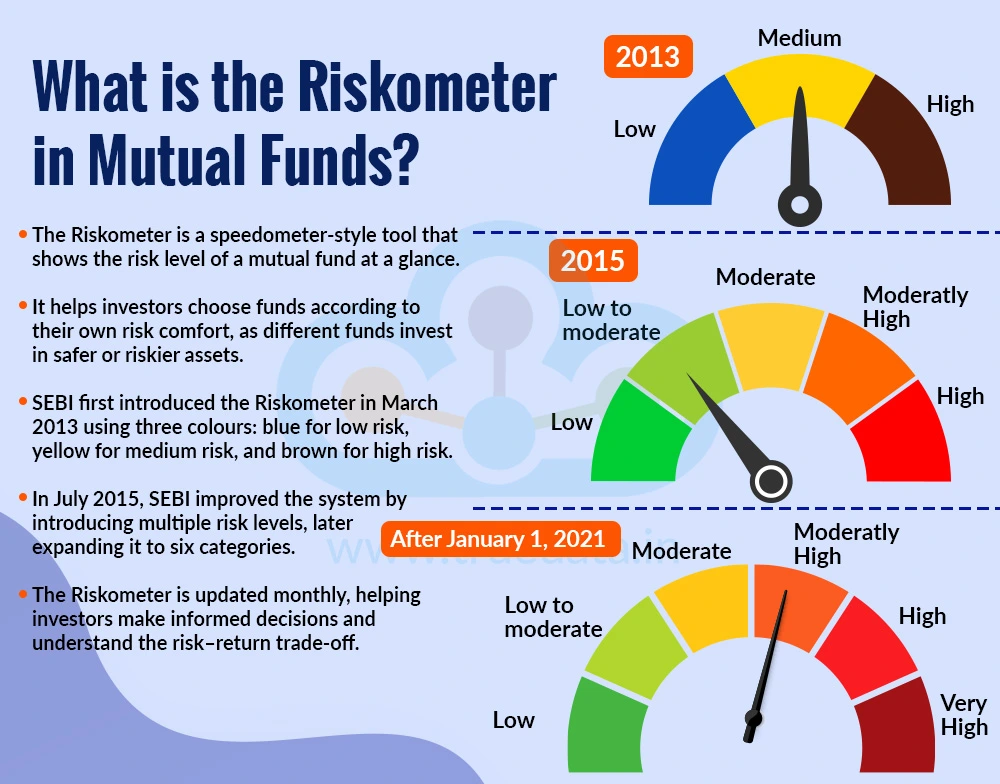

SEBI first introduced a riskometer in India in March 2013 through a product labelling system using three colours, i.e.,

Blue for low risk

Yellow for medium risk

Brown for high risk.

However, this system was too broad and did not capture the differences between funds. To improve clarity, SEBI launched the current Riskometer on July 1, 2015, with five levels of risk and later expanded to six categories, making it more precise and transparent. Fund houses are required to update the Riskometer every month, so investors always have the latest picture of how risky their chosen scheme is. This tool has become an essential part of mutual fund investing because it empowers people to make informed decisions without needing deep financial expertise. It also encourages realistic expectations where higher-risk funds may offer higher returns, but they also come with greater chances of loss.

The riskometer classifies the risk of a mutual fund into 6 categories. These six categories help Indian investors quickly judge whether a fund matches their risk tolerance and financial goals, making the Riskometer a simple yet powerful decision-making tool. These categories and their meaning are explained below.

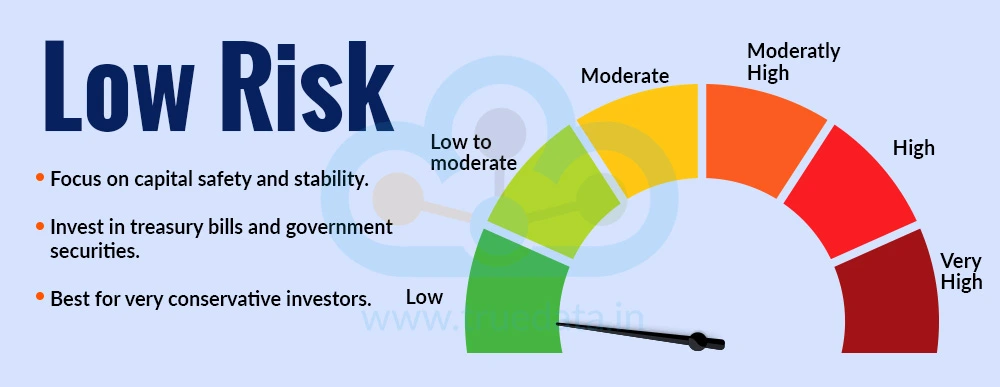

Funds in the Low Risk category aim to protect your capital and offer stable, predictable returns. These funds usually invest in very safe instruments like treasury bills or highly rated government securities. The chances of losing money are minimal, but the returns are also usually modest. This category suits extremely conservative investors who prefer safety over returns.

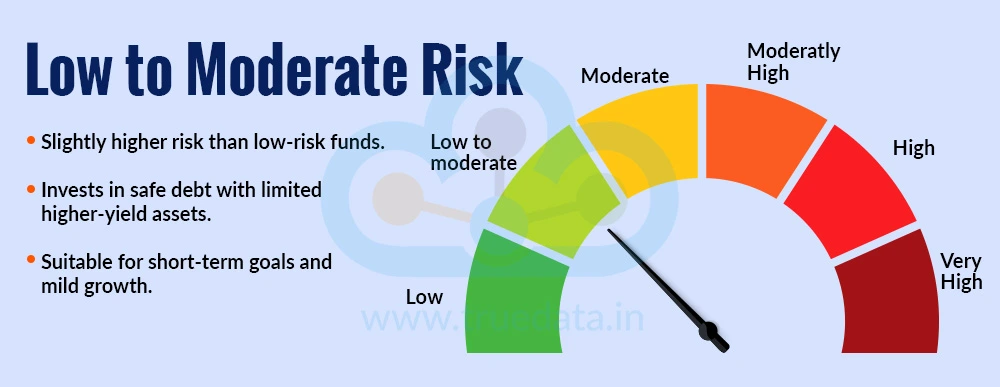

These funds carry slightly more risk than pure low-risk funds but still fall on the safer side. They invest in a mix of highly secure debt instruments along with a small portion of slightly higher-yield securities. Investors who want a little extra return without taking too much risk may find this category suitable. It is good for short-term goals and those who want stability with mild growth.

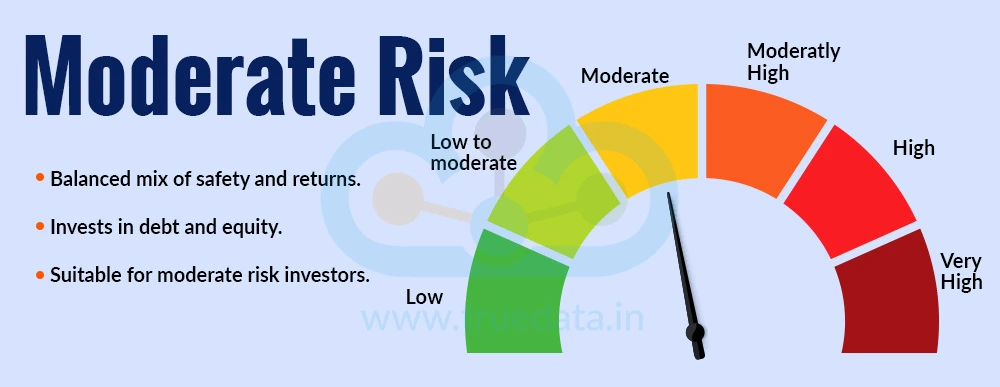

Moderate-risk funds balance safety and returns. They typically invest in a combination of debt and equity, or in debt instruments that carry average market risk. While the chances of short-term ups and downs exist, the overall risk remains manageable. This category is ideal for investors who can handle some fluctuation in returns in exchange for better long-term growth.

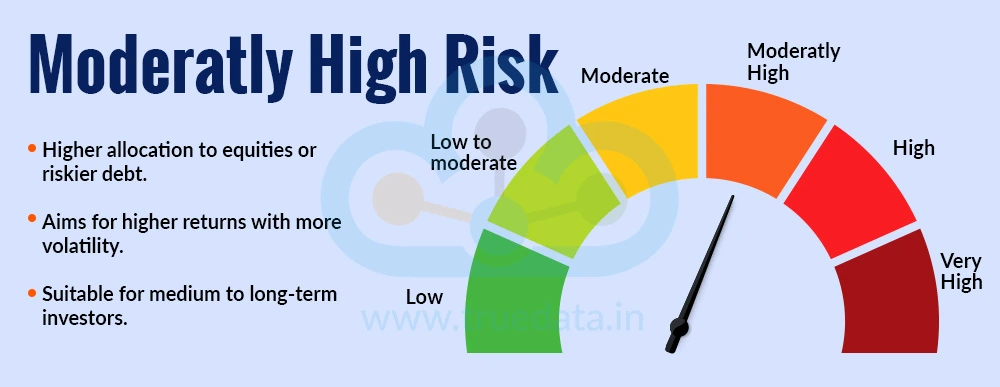

Funds in this category invest a larger portion in equities or riskier debt instruments. They aim for higher growth but come with more volatility. Investors may see sharper ups and downs in the short term. This category suits those with medium to long-term goals who are comfortable with some market fluctuations in return for potentially higher returns.

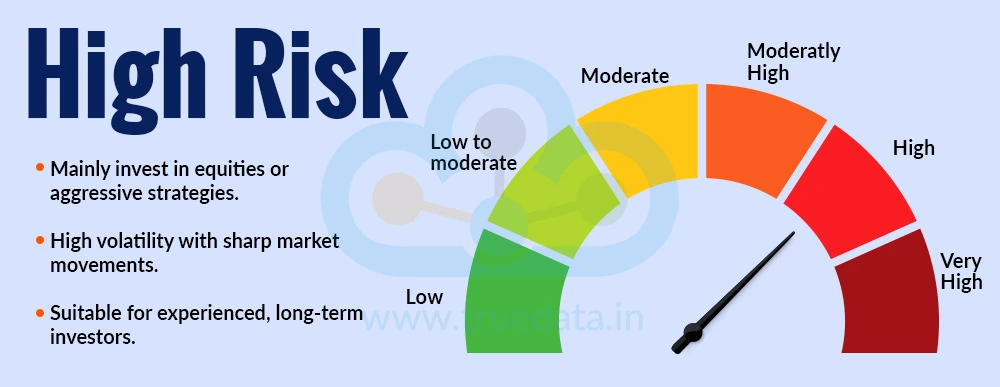

High-risk funds are mainly equity-focused or include aggressive investment strategies. They can experience significant movement in either direction based on market conditions. These funds are typically chosen by investors who understand market behaviour and are willing to take more risk for the possibility of strong long-term gains. A longer time horizon usually helps manage the volatility.

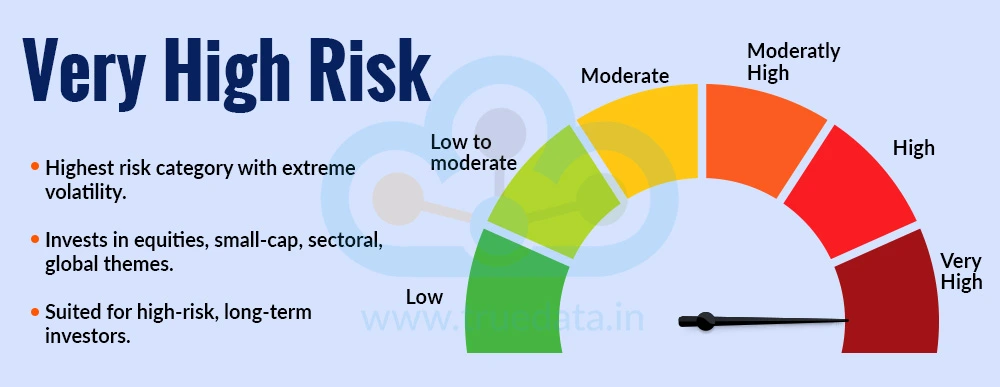

This is the riskiest category on the Riskometer. Such funds invest heavily in equities, sector-specific themes, international markets, small-cap stocks, or other highly volatile instruments. They have the potential to deliver high returns, but they can also see steep declines during market corrections. This category is suitable only for investors with a high risk appetite and a long-term investment mindset who can handle major fluctuations.

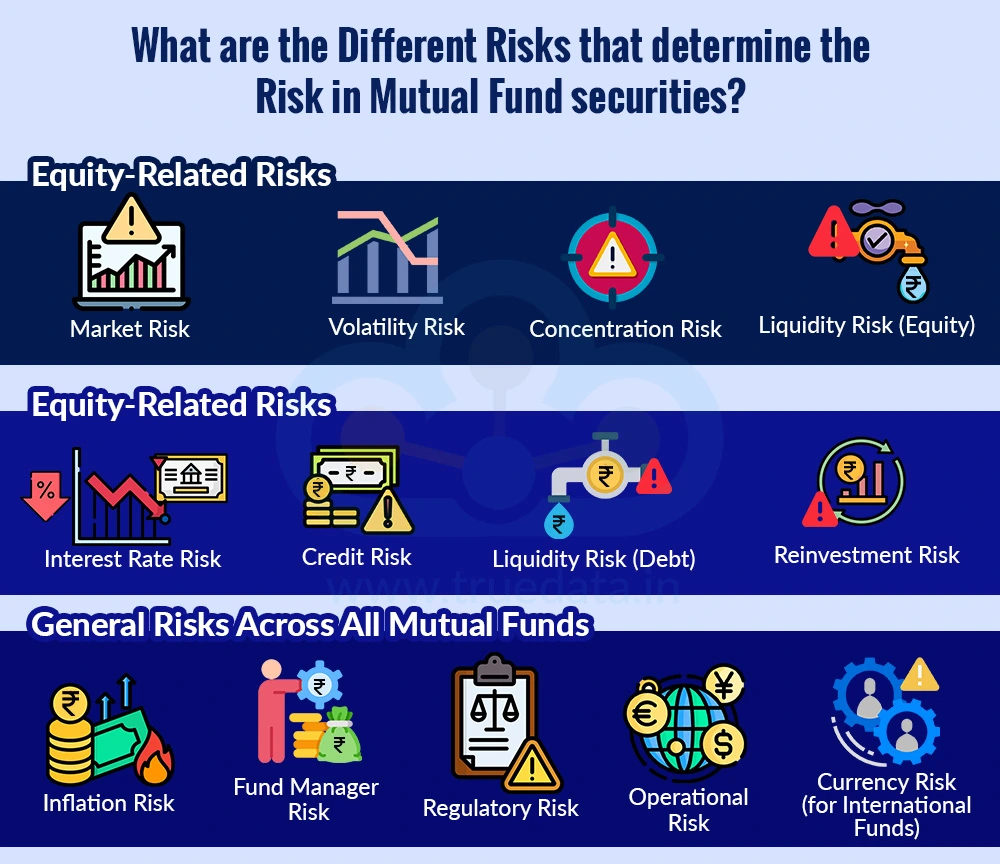

The different risks that contribute to computing the risk level of a fund are explained hereunder.

Market Risk - Market risk refers to the possibility that the stock market may fall due to economic slowdowns, global events, political changes, or investor sentiment. When markets go down, equity mutual funds also fall in value. Global trends, government policies, and corporate earnings strongly influence market movements in India. Investors must be prepared for short-term ups and downs, especially in equity-heavy funds.

Volatility Risk - Equity prices can fluctuate sharply within short periods. This is known as volatility risk. Factors like company performance, news, and global events can cause sudden price swings. Indian markets, especially small-cap and mid-cap segments, often show high volatility. Investors should have a long-term horizon to ride out these fluctuations.

Concentration Risk - If a fund invests heavily in a few stocks or a specific sector (like banking, IT, or pharma), it faces concentration risk. If that sector performs poorly, the fund suffers more. Sectoral or thematic mutual funds can deliver high returns but also come with high risk. Thus, portfolio diversification is important unless the investor understands the sector well.

Liquidity Risk (Equity) - Some stocks, especially small-cap ones, may not be traded frequently. This makes it difficult for the fund to buy or sell them quickly. Liquidity issues can increase risk during volatile markets when many investors redeem at once.

Interest Rate Risk - Debt fund prices move opposite to interest rates. When interest rates rise, bond prices fall, and the fund’s value decreases. With the RBI frequently adjusting rates, debt funds, especially long-duration funds, face interest rate risk. Thus, investors must pick debt funds based on their investment horizon.

Credit Risk - Credit risk is the risk that a bond issuer may fail to repay interest or principal. Funds that invest in lower-rated bonds carry higher credit risk. Past cases of corporate defaults have shown how credit events can impact debt funds. Investors should check credit ratings before investing.

Liquidity Risk (Debt) - Some debt securities may not be easily tradable. If many investors redeem at once, the fund may struggle to sell bonds quickly without losses. This risk becomes important during periods of financial stress or sudden market shocks.

Reinvestment Risk - When a bond matures or pays interest, the fund must reinvest that money. If the prevailing interest rates are lower, returns may decrease. This risk affects investors who expect stable income from debt funds, especially during falling interest rate cycles.

Inflation Risk - Inflation reduces the purchasing power of your returns. If your mutual fund returns are lower than inflation, your wealth grows slowly. With inflation often fluctuating in India, investors need funds that can generate real (inflation-beating) returns over time.

Fund Manager Risk - The performance of a fund depends on the decisions made by the fund manager. Poor strategies or incorrect market calls may affect returns. Thus, investors should review the track record and consistency of a fund house and its managers.

Regulatory Risk - Changes in SEBI rules, tax laws, or government policies can affect mutual fund performance. For example, tax rule changes or category restrictions have impacted how funds operate in India. Staying updated helps investors make better decisions.

Operational Risk - This includes technical issues, fraud, mismanagement, or errors in transaction processing by the fund house. While rare, operational risks highlight the importance of investing with reputed fund houses with strong governance.

Currency Risk (for International Funds) - USD-INR Rate fluctuations can significantly impact returns from foreign equity or debt funds. If a fund invests overseas, the value of investments may change with currency movements.

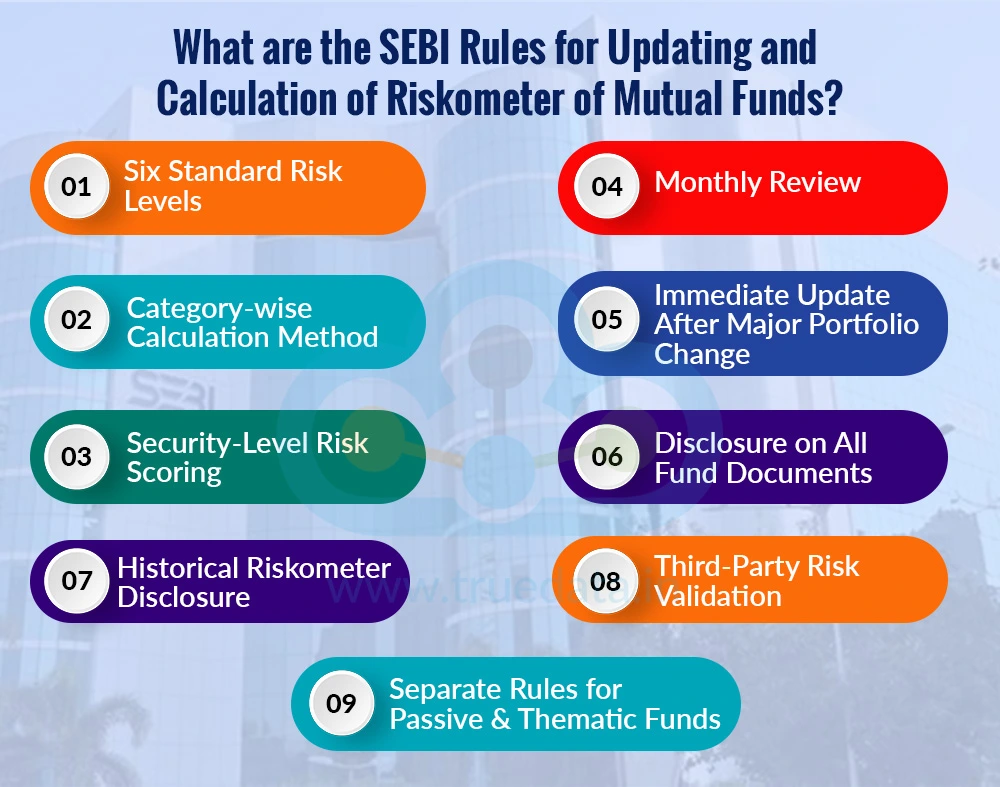

The primary role of SEBI is the protection of investors’ interests. The introduction of Riskometer is also part of this primary objective to ensure investors make informed investment decisions for their portfolio. The key SEBI rules regarding the update and calculation of the riskometer in mutual funds include,

Six Standard Risk Levels - SEBI has fixed six categories that every mutual fund must use, i.e., Low, Low to Moderate, Moderate, Moderately High, High, and Very High. No fund house can create its own scale.

Category-wise Calculation Method - Each fund must calculate its risk level using SEBI’s standard formula. Every asset in the fund is assigned a Risk Value, and the final score decides the fund’s Riskometer level.

Equity funds - Risk is calculated based on factors like volatility, market cap, liquidity, etc.

Debt funds - Risk is calculated using credit ratings, interest rate sensitivity (duration), liquidity, etc.

Hybrid funds - Risk is calculated using the weighted average risk of equity and debt in the portfolio.

Security-Level Risk Scoring - SEBI requires AMCs to calculate the risk of each individual security (every stock, bond, etc.). This ensures the Riskometer reflects the actual portfolio and not just the category name.

Monthly Review - Every mutual fund must formally review and update its Riskometer once a month. The updated risk level must be published on the AMC website and shared with SEBI.

Immediate Update After Major Portfolio Change - If there is any major shift in the portfolio (for example, a big change in equity allocation or a new high-risk security added), the fund house must update the Riskometer immediately and notify investors within 10 days.

Disclosure on All Fund Documents - SEBI mandates that the Riskometer must appear on the following consistently to ensure investors see the risk level at every touchpoint.

Scheme Information Document (SID)

Key Information Memorandum (KIM)

Monthly Portfolio Statement

Fund house website

Historical Riskometer Disclosure - AMCs must keep previous Riskometer levels on their website so investors can track how the fund’s risk has changed over time.

Third-Party Risk Validation - SEBI requires fund houses to follow a uniform calculation method and may seek audits or reviews to ensure the risk score is accurate and not manipulated.

Separate Rules for Passive & Thematic Funds - Index funds and ETFs must reflect the risk of the underlying index. Sectoral and thematic funds usually fall in High or Very High due to concentrated exposure.

Riskometer is a snapshot of the risk of investing in a fund. The importance of the riskometer in mutual funds is highlighted below.

Helps investors quickly understand how risky a mutual fund is.

Allows easy comparison of risk levels across different funds.

Ensures transparency because all fund houses follow the same SEBI rules.

Helps investors choose funds that match their own risk appetite.

Prevents investors from unknowingly entering very high-risk schemes.

Guides beginners who may not understand complex fund documents.

Helps investors make safer, more informed financial decisions.

Keeps investors updated as SEBI mandates monthly risk reviews.

The Riskometer in mutual funds is a simple yet powerful tool that helps investors understand the level of risk in any fund at a glance. Highlighting different risks, whether from equity, debt, or general market conditions, allows investors to choose funds that match their comfort level and financial goals. Thus, the riskometer brings transparency, confidence, and better decision-making to every investor’s mutual fund journey.

This article talks about a key parameter of investing in mutual funds and thus selecting a fund that aligns better with our risk perceptions. Let us know your thoughts on the topic or if you need further information on the same and we will address it soon.

Till then, Happy Journey!

Read More: Can Algorithms Beat Human Fund Managers? - Know all about Quant Based Mutual Funds?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...