Certain corporate bonds provide higher interest as compared to their peers or even government bonds. The purpose of doing this is to attract more investments and meet their capital financing needs. However, are these returns worth the risk of investing in them? And why is it that certain corporates can offer higher interest on their bonds while others offer comparatively lower rates, yet they are preferred? Get answers to all these questions and more on corporate credit rating and its impact on investments in this blog.

Corporate Credit Ratings are opinions given by specialised agencies about how safe or risky it is to lend money to a company or invest in its bonds or debentures. These ratings show the company’s ability to repay its debt on time, including interest. Credit ratings, thus, act like a financial ‘report card’ for companies. A company with a high credit rating is considered more reliable and less risky, while one with a low rating means higher chances of delay or default in repayment. These ratings do not tell you whether to buy or sell an investment, but they help you understand the level of credit risk involved.

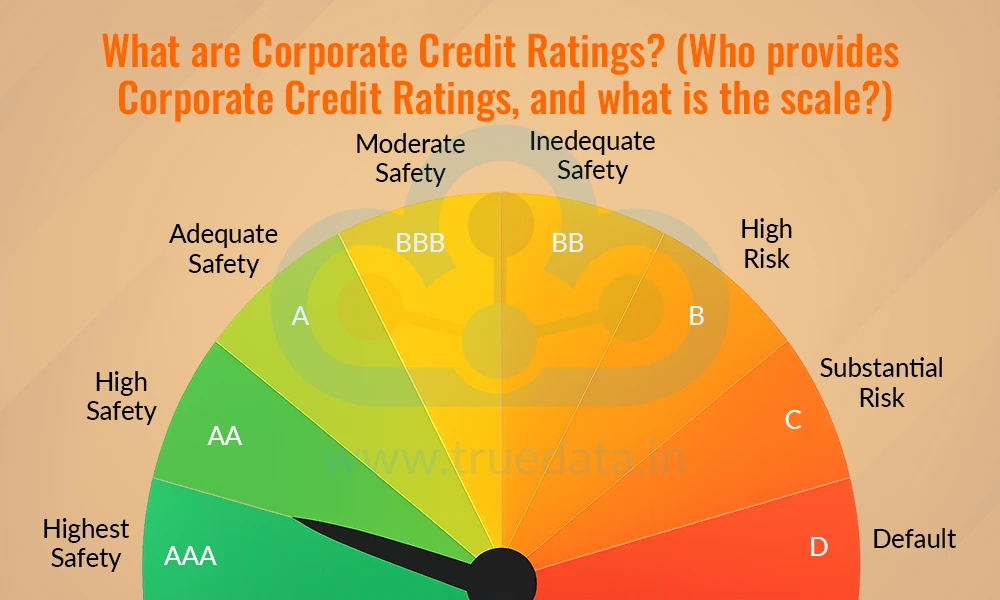

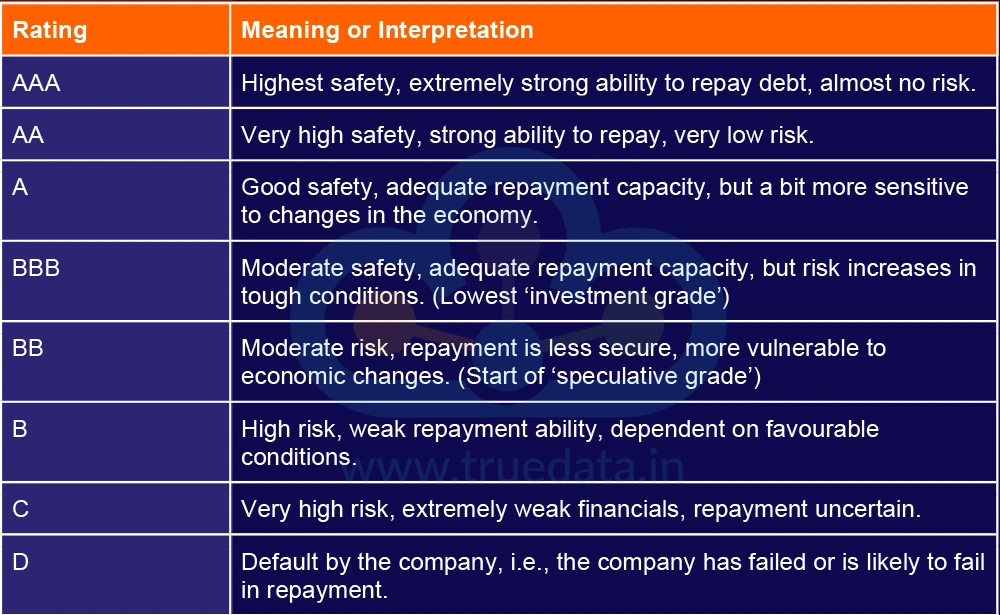

In India, credit ratings are given by registered agencies such as CRISIL (a subsidiary of S&P Global), ICRA (affiliated with Moody’s), CARE Ratings, India Ratings & Research (a Fitch Group company), and Brickwork Ratings. They follow scales similar to global standards, but adjusted for Indian market conditions. Ratings are expressed in symbols like AAA, AA, A, BBB, BB, B, C, and D, with ‘AAA’ showing the strongest safety and lowest risk, and ‘D’ indicating default. Sometimes a ‘+’ or ‘-’ is added to show relative standing within a category (for example, AA+, AA, AA-).

The corporate credit rating scale and its meaning are indicated below.

Corporate credit ratings are important for both companies and investors by acting similar to a litmus test and guiding investment decisions. The importance of corporate credit ratings is explained below.

Builds Financial Credibility - A good credit rating is like a company’s financial ‘trust badge’. Banks, financial institutions, and investors often check credit ratings before lending money or investing in bonds. When a company has a high rating, such as AAA or AA, it signals that the company is financially strong and reliable. This increases confidence among lenders and investors, making it easier for the company to raise funds whenever needed.

Reduces Borrowing Costs - Companies with high credit ratings can borrow money at lower interest rates. Lower interest means the company spends less on repaying loans, which improves its profitability. For example, a company rated AAA can get loans at cheaper rates than a company rated B or C. On the other hand, a company with a poor rating faces higher interest charges, increasing the cost of borrowing and reducing profits.

Facilitates Fundraising - High-rated companies find it easier to raise money from various sources. They can issue bonds, debentures, or even raise funds through stock markets. Investors prefer companies with strong credit ratings because they are less likely to default. This helps companies plan long-term projects and expand their business without facing financing difficulties.

Supports Business Growth and Stability - A strong credit rating directly impacts a company’s ability to grow and manage its finances efficiently. Companies with good ratings have smoother access to loans, which can be used for expansion, new projects, or operational needs. Poor-rated companies, on the other hand, struggle to get funds and may face financial instability. Therefore, maintaining a good credit rating is essential for sustainable growth and a strong market reputation.

Helps Assess Safety of Investments - Credit ratings act as a safety guide for investors. Before investing in corporate bonds, debentures, or debt mutual funds, investors want to know if the company will repay the money on time. A high rating, like AAA or AA, indicates that the company is financially strong and has a very low risk of default. This helps investors feel more confident that their money is safe. Conversely, a low rating, like B or C, signals higher risk and warns investors that the company may face difficulties in repaying loans or interest.

Guides Risk-Based Decisions - Credit ratings allow investors to match investments with their risk tolerance. Conservative investors, who prioritise safety, usually prefer high-rated companies to minimise the chance of losing money. On the other hand, some investors are willing to take higher risks for potentially higher returns and may consider investing in lower-rated companies. By checking credit ratings, investors can make informed choices and balance safety with the potential for higher earnings.

Influences Returns and Expectations - While high-rated companies are safer, they usually offer lower interest rates. Lower-rated companies, though riskier, may provide higher returns to compensate for the increased risk. Credit ratings help investors understand this trade-off between risk and reward, so they can set realistic expectations before investing. Without ratings, it would be much harder to compare the safety and profitability of different investment options.

Promotes Confidence and Transparency - Credit ratings also build trust in the market. Investors rely on ratings to quickly assess the credibility of companies, saving time and reducing uncertainty. Ratings act as a neutral, professional opinion on a company’s financial health, allowing even small investors to make safer investment decisions.

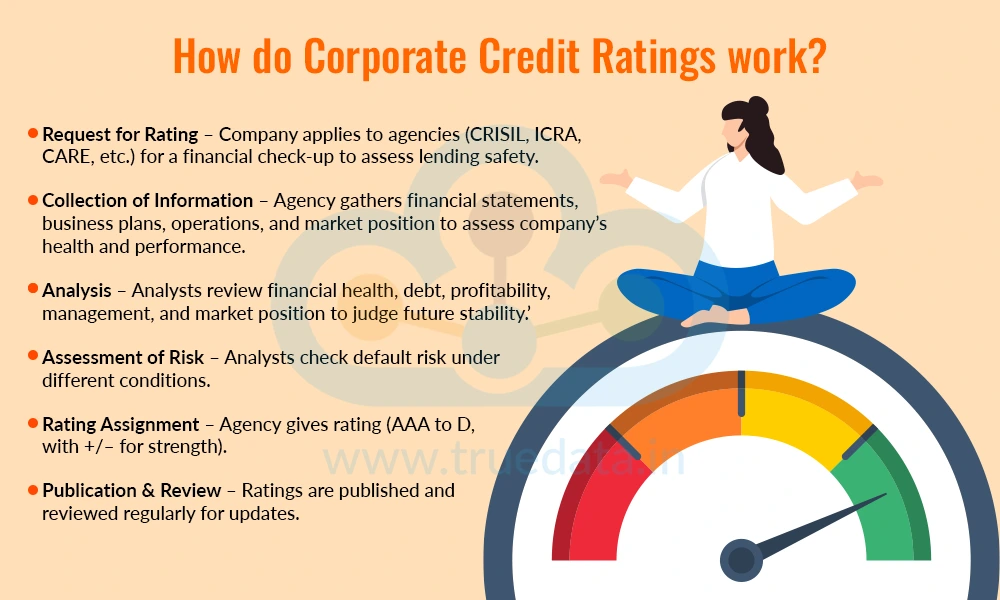

The corporate credit ratings provide a benchmark for investors to understand the financial creditworthiness and the investment risk. The process of issuing a corporate credit rating is highlighted below.

Request for Rating - The process starts when a company wants its bonds or debt to be rated. It applies to a credit rating agency in India, such as CRISIL, ICRA, CARE, India Ratings, or Brickwork. This step is like asking for a financial ‘check-up’ to show investors how safe it is to lend money to the company.

Collection of Information - Once the request is made, the agency collects detailed information about the company. This includes financial statements like balance sheets, income statements, cash flows, and future business plans. They may also look at the company’s operations, products, and market position. This helps the agency understand the company’s overall health and performance.

Analysis - After collecting information, the agency’s analysts carefully study the company. They check financial health, debt levels, profitability management quality, and market position. Analysts try to see if the company can manage its business effectively and handle challenges in the future.

Assessment of Risk - The analysts then evaluate the risk of default, meaning the likelihood that the company might fail to pay interest or repay the principal on time. They consider different scenarios, including tough economic conditions, to see if the company can survive financial stress and still meet its obligations.

Rating Assignment - Based on the analysis and risk assessment, the agency assigns a rating, such as AAA, AA, A, BBB, BB, B, C, or D. A ‘+’ or ‘-’ may be added to show if the company is stronger or weaker within that category. For example, AA+ is slightly better than AA, while AA- is slightly weaker.

Publication and Review - Finally, the rating is published so that investors and other stakeholders can see it. Credit rating agencies also review ratings regularly to account for changes in the company’s financial health, market conditions, or economic environment. This ensures that investors always have up-to-date information about the company’s creditworthiness.

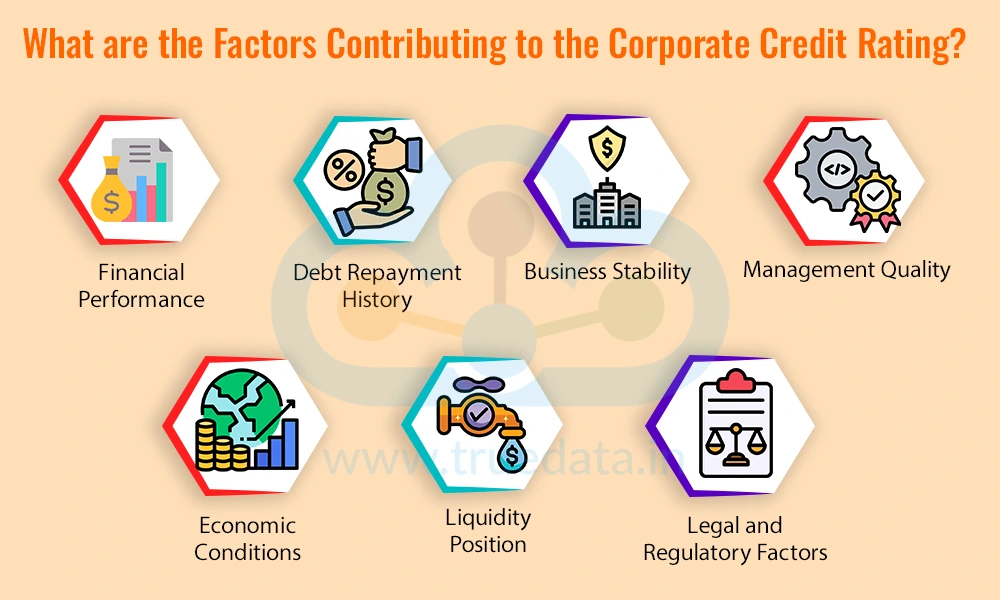

A corporate credit rating is based on many factors that contribute to defining the rating and the financial health of the company to repay any debt. These factors include,

Financial Performance - This looks at the company’s revenue, profits, cash flow, and debt levels. Companies that earn good profits, manage cash well, and keep debt under control are considered financially strong. Strong financial performance usually leads to higher credit ratings because it shows the company can meet its debt obligations on time.

Debt Repayment History - A company’s track record of paying loans and interest is very important. If a company has consistently repaid its debts on time in the past, it gives confidence to investors and lenders. Companies with poor repayment history may get lower ratings because they are seen as higher risk.

Business Stability - This factor examines the company’s position in its industry, market share, and competitiveness. Well-established companies, have stable revenues and face less competition are considered safer investments. Unstable businesses or those in highly volatile industries may receive lower ratings due to higher risk.

Management Quality - The experience, credibility, and decision-making ability of the company’s leaders play a key role. Strong and experienced management can guide the company through difficult times and make better financial decisions. Investors trust companies with good leadership, which can lead to higher ratings.

Economic Conditions - The overall economy, interest rates, inflation, and industry trends affect a company’s ability to repay debt. Even a financially strong company can struggle if economic conditions are poor. Rating agencies consider these external factors when assessing risk.

Liquidity Position - Liquidity measures how easily a company can meet its short-term obligations using cash or easily sellable assets. Companies with high liquidity can quickly pay their debts if needed, which reduces risk and improves ratings. Low liquidity indicates potential repayment problems and can lower the rating.

Legal and Regulatory Factors - Compliance with laws, government regulations, and industry policies is also considered. Companies that follow rules properly face fewer legal or regulatory risks. Those with legal disputes or regulatory violations are seen as higher risk and may receive lower ratings.

Corporate credit ratings have a direct impact on the investments and their popularity or preference among investors. The true impact of corporate credit ratings on the investments and, thereby, the company is explained below.

Corporate credit ratings act as a safety guide for investors. High ratings, like AAA or AA, indicate that a company is financially strong and has a very low risk of default. This reassures investors that their money is relatively safe. Lower-rated companies, like B or C, carry a higher risk of delay or default in repayment. By checking ratings, investors can quickly gauge how secure an investment is before committing their money.

Credit ratings help investors balance risk and returns. Safer investments in high-rated companies usually offer lower interest rates or returns. Riskier investments in lower-rated companies may offer higher returns but come with a greater chance of loss. By understanding ratings, investors can choose investments that match their risk appetite. Conservative investors may stick to high-rated options, while aggressive investors might consider lower-rated options for higher potential gains.

High credit ratings build trust and confidence in the market. Investors are more likely to invest in a company that is professionally rated as financially strong. This trust reduces anxiety about potential losses and helps attract more investment to high-rated companies. Conversely, low ratings can discourage investment and may even lead to reduced liquidity for the company’s securities.

Credit ratings make it easier for investors to compare multiple companies quickly. Instead of analysing every company’s financial statements in detail, investors can use the ratings as a benchmark. For example, a bond from an AAA-rated company is considered safer than a bond from a BB-rated company. This simplifies decision-making, especially for individual investors who may not have the time or expertise to analyse financial data deeply.

Ratings help investors make long-term investment plans. If an investor is looking for stable income from interest payments, they may prefer high-rated companies that are less likely to default over a long period. On the other hand, investors looking for higher short-term gains may take calculated risks with lower-rated companies. This ensures that investments align with financial goals and time horizons.

Credit ratings also influence market prices of bonds and securities. Higher-rated bonds are usually more attractive and can trade at lower yields (interest rates), while lower-rated bonds must offer higher yields to attract investors. This affects the cost of borrowing for companies and the potential returns for investors, linking ratings directly to both risk and reward in the market.

Credit ratings help investors respond to market changes more confidently. If a company’s rating is downgraded, investors understand that the company has become riskier, and they can adjust their investments accordingly. Conversely, an upgrade signals improved financial health, which may encourage investment. This allows investors to make informed decisions in dynamic markets like India.

Corporate credit ratings are an important tool for investors in India to understand the safety and risk of investing in companies. They reflect a company’s financial health, debt repayment ability, management quality, and stability in the market. Higher ratings build investor confidence, reduce borrowing costs for companies, and make bonds more attractive, while lower ratings indicate higher risk and potential repayment issues. These ratings help investors make informed decisions, balance risk and returns and plan their investments according to their financial goals and risk appetite.

This article explains the need for corporate credit ratings to make investments in corporate bonds safer, giving investors an opportunity to make well-informed portfolio decisions. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Read More: Corporate Governance and its Influence on Stock Performance

Thestock market never stands still, and prices swing constantly with every new h...

Corporate financial data is the backbone ofsmart investing. It helps investors d...

Share prices of a company are affected by numerous external and internal factors...