The bond market has always been a comforting space for risk-averse investors, and with equity volatility and rising prices in gold and real estate, its appeal has only grown stronger. But when it comes to choosing bond options, most everyday investors find themselves torn between corporate bonds and gilt bonds. What really sets them apart, and which one aligns better with your goals? Get answers to these questions and more on corporate and gilt bonds to make smarter investment decisions.

Corporate Bond Funds are debt mutual funds that invest mainly in high-quality debt issued by strong and stable companies. Similar to any other fund, these funds pool the investors’ funds to invest in companies by buying their bonds. The companies, in return, pay interest on these bonds at regular intervals as per the bond contract. These funds aim to offer better returns than bank fixed deposits while still keeping risk at a moderate level as they invest in companies with good credit ratings. They are ideally suitable for investors who want steady, predictable income with relatively lower risk compared to equity funds. As bonds are carefully chosen based on a company’s financial strength and ability to repay, corporate bond funds can be a good choice for short-term to medium-term goals where safety and stability are considered to be crucial.

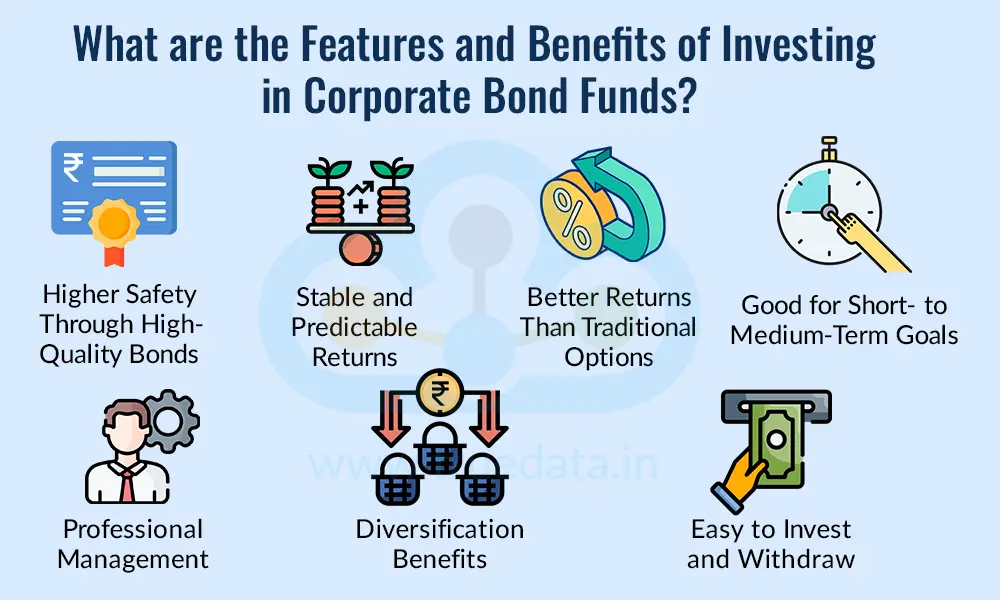

Corporate bond funds are an attractive investment option for investors. The benefits and features of these funds, which make them a good addition to the investment portfolio, are highlighted below.

Higher Safety Through High-Quality Bonds - Corporate bond funds mainly invest in companies with strong credit ratings. This means the chances of default are lower, providing investors with a safer investment compared to lower-rated debt funds.

Stable and Predictable Returns - These funds offer steadier returns than equity funds as they focus on interest-paying bonds. While returns are not guaranteed, they tend to be more predictable.

Better Returns Than Traditional Options - Corporate bond funds often provide higher returns than savings accounts or many bank FDs, especially over the medium term, because companies pay higher interest than the government.

Good for Short- to Medium-Term Goals - Since they aim for stability, these funds are suitable for goals that are 2–5 years away, ike buying a bike, planning a holiday, or creating an emergency buffer.

Professional Management - A fund manager carefully selects bonds after studying the company’s strength and ability to repay. This helps reduce risk and improves the chances of steady performance.

Diversification Benefits - Investors’ money is spread across many companies and sectors. So even if one company faces issues, the impact on their investment is reduced.

Easy to Invest and Withdraw - Investors can invest through SIP or lumpsum investment, and can redeem their money at any time (subject to small exit loads, if any). This gives them more flexibility than traditional fixed-income products.

Gilt funds are mutual funds that invest mainly in government securities issued by the Government of India. These securities are considered one of the safest investment options because the government backs them, which means there is almost no credit risk or risk of default. When you invest in a gilt fund, your money is used to buy long-term and short-term government bonds that pay regular interest. While gilt funds are very safe in terms of credit quality, their value can fluctuate based on interest rate movements due to price fluctuations depending on changes in the RBI rate. They are suitable for investors who prefer high safety, transparency, and long-term stability, especially those comfortable with some short-term fluctuations in returns.

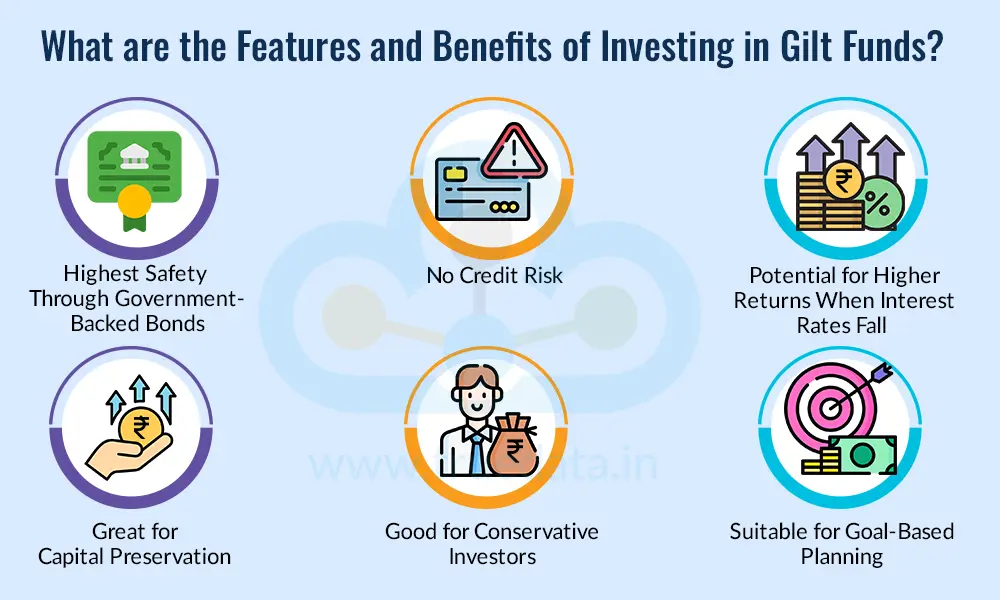

Gilt funds provide an opportunity to invest in a diversified pool of government securities. Some of the top benefits and features of these funds, giving them an edge over other debt investment options, are mentioned below.

Highest Safety Through Government-Backed Bonds - Gilt funds invest only in government securities, which have almost zero default risk. This makes them one of the safest options in the debt fund category.

No Credit Risk - Since the Government of India guarantees repayment, investors do not have to worry about a company failing to return money. This makes gilt funds an ideal choice for investors who prioritise safety.

Potential for Higher Returns When Interest Rates Fall - Gilt funds can deliver strong returns in periods when the RBI cuts interest rates. Bond prices rise during such times, which can boost fund performance.

Great for Capital Preservation - As gilt funds invest in government bonds, they help protect your capital while still giving you the chance to earn better returns than a savings account or short-term deposit.

Good for Conservative Investors - Gilt funds offer a balanced investment option for investors seeking safety and market-linked growth. Furthermore, they are considered to be much safer than corporate bonds but with higher potential than traditional fixed-income products.

Suitable for Goal-Based Planning - Gilt funds work well for medium-term to long-term goals like higher education, home down payment, or retirement planning, especially if investors want safety along with steady growth.

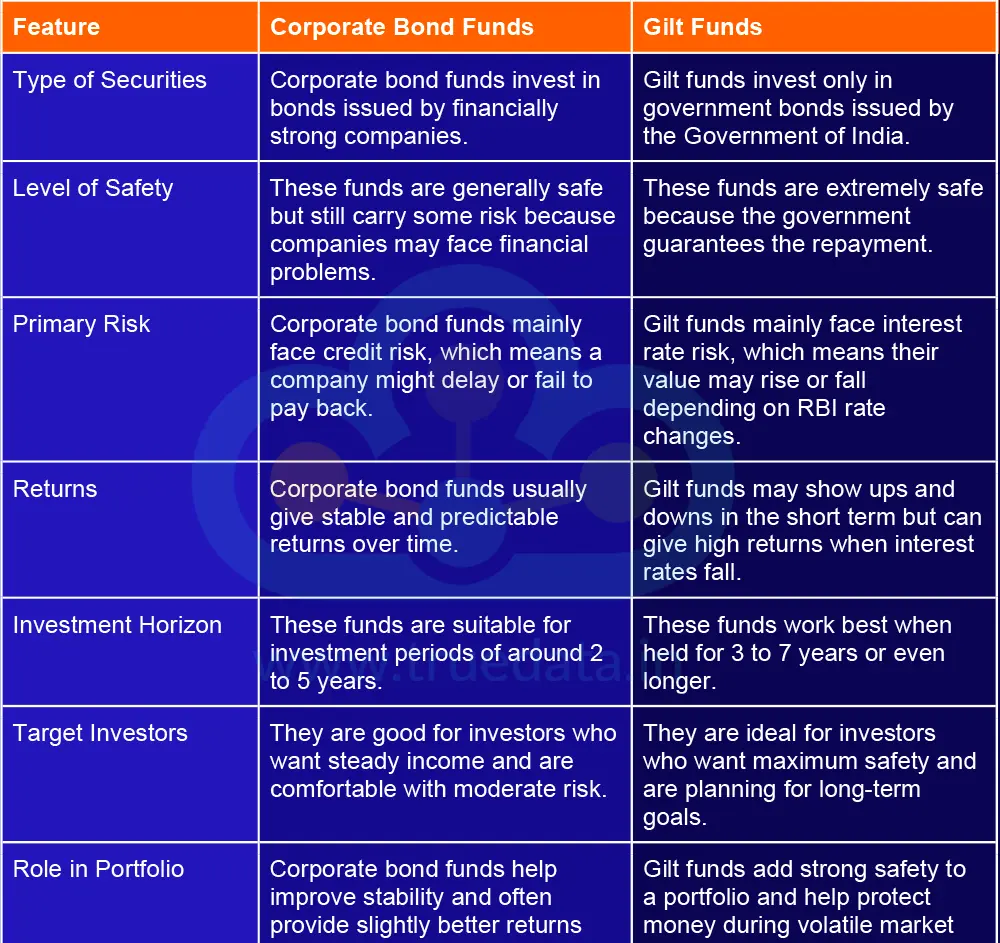

Now that we have seen the meaning and highlights of the two strong pillars of debt funds, let us focus on the key difference between the two.

The choice between corporate bond funds and gilt funds is based on their risk comfort, financial goals, and the time they plan to stay invested. Corporate bond funds are ideally suited for investors seeking steady and predictable returns with minimum market-linked risk. These funds invest in strong companies (typically with an AA+ credit rating or higher), offering a balance of safety and slightly better returns than many traditional options.

Gilt funds, on the other hand, may be the better choice for investors who prioritise maximum safety and are comfortable with short-term fluctuations. Since these funds invest only in government bonds, there is almost no chance of default, making them one of the safest mutual fund categories. However, they are not immune to the impact of interest rate fluctuations, so they are more suitable for long-term investors who can stay invested through them.

Thus, investors seeking steady income with moderate risk tend to lean towards corporate bond funds, while those who prefer government-backed safety and long-term growth may find gilt funds a better fit. The right choice depends on how much risk the investor is willing to handle and how long they can stay invested.

Choosing between corporate bond funds and gilt funds depends on what an investor values more, i.e., steady returns or maximum safety. The choice between the two thus depends on careful understanding and consideration of key factors like risk, return behaviour, and investment horizon, and more to make them a valuable addition to the investment portfolio.

We have explored two important aspects of debt investment options and how to choose between them. Let us know your thoughts on this topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: Specialised Investment Funds (SIFs) - Meaning, Rules, Benefits & Risks

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...

Every investor knows that the stepping stones to a good investment in thestock m...