Imagine building an investment portfolio without SIPs! Not possible, right? The power of SIPs and their integration in almost every portfolio make them an indispensable tool in today’s times. However, there is another side to investing in mutual funds, and that is the lump sum way. So how do you decide which way to go and what is ultimately better for your portfolio? Get answers to these questions and more in this blog, and maximise the potential of your mutual fund investments.

SIPs and lump sum mode are two different ways of investing in mutual funds. They offer different approaches to investing in mutual funds. They can be preferred for different investment goals or time frames depending on various factors such as the availability of investment capital, investment horizon and more. Let us understand the meaning of these approaches in detail.

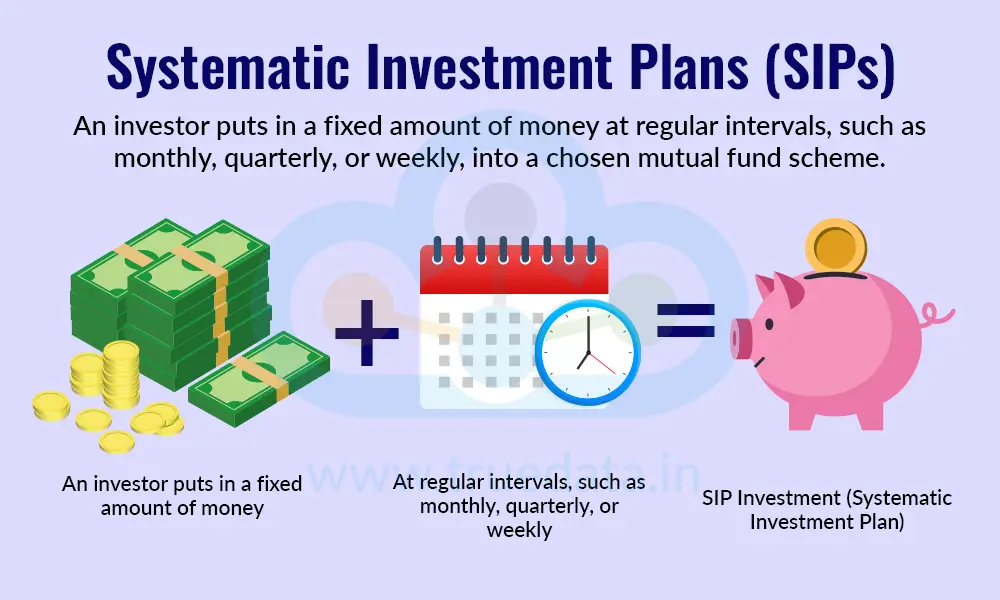

A Systematic Investment Plan (SIP) is a smart and disciplined way for an investor to invest in mutual funds. In this method, an investor puts in a fixed amount of money at regular intervals, such as monthly, quarterly, or weekly, into a chosen mutual fund scheme. SIPs enable investors to purchase mutual fund units systematically over time, without worrying about market fluctuations. This approach facilitates rupee cost averaging, meaning that when prices are high, fewer units are purchased, and when prices are low, more units are purchased. Over time, this balances the overall cost of investment. SIPs are ideal for people who want to build wealth gradually, even with small amounts, and prefer to stay invested for the long term. It encourages financial discipline, helps investors avoid emotional decisions, and is especially popular among salaried individuals who invest regularly from their monthly income.

A lump sum investment is when an investor invests a large amount of money all at once in a mutual fund scheme. Unlike SIPs, where investments are spread over time, the entire amount is invested on a single day. This method is typically preferred by investors who have a sizable sum available, such as from a bonus, sale of property, or matured fixed deposit, and want to put it to work immediately. Lump sum investments can be more rewarding if market conditions are favourable, as the entire amount starts earning returns from the very first day. However, it also carries a higher level of risk because the investment is made at one market level. If the market falls soon after the investment, the portfolio value may decline sharply. Hence, this mode is more suitable for experienced investors or for those investing during stable or rising market phases.

Mutual fund investments can be made in two main ways, i,e., through a Systematic Investment Plan (SIP) or a lump sum investment. Both methods help investors grow their money, but they work differently and suit different financial needs. Let us consider the following examples to understand the impact of SIP and lump sum investing.

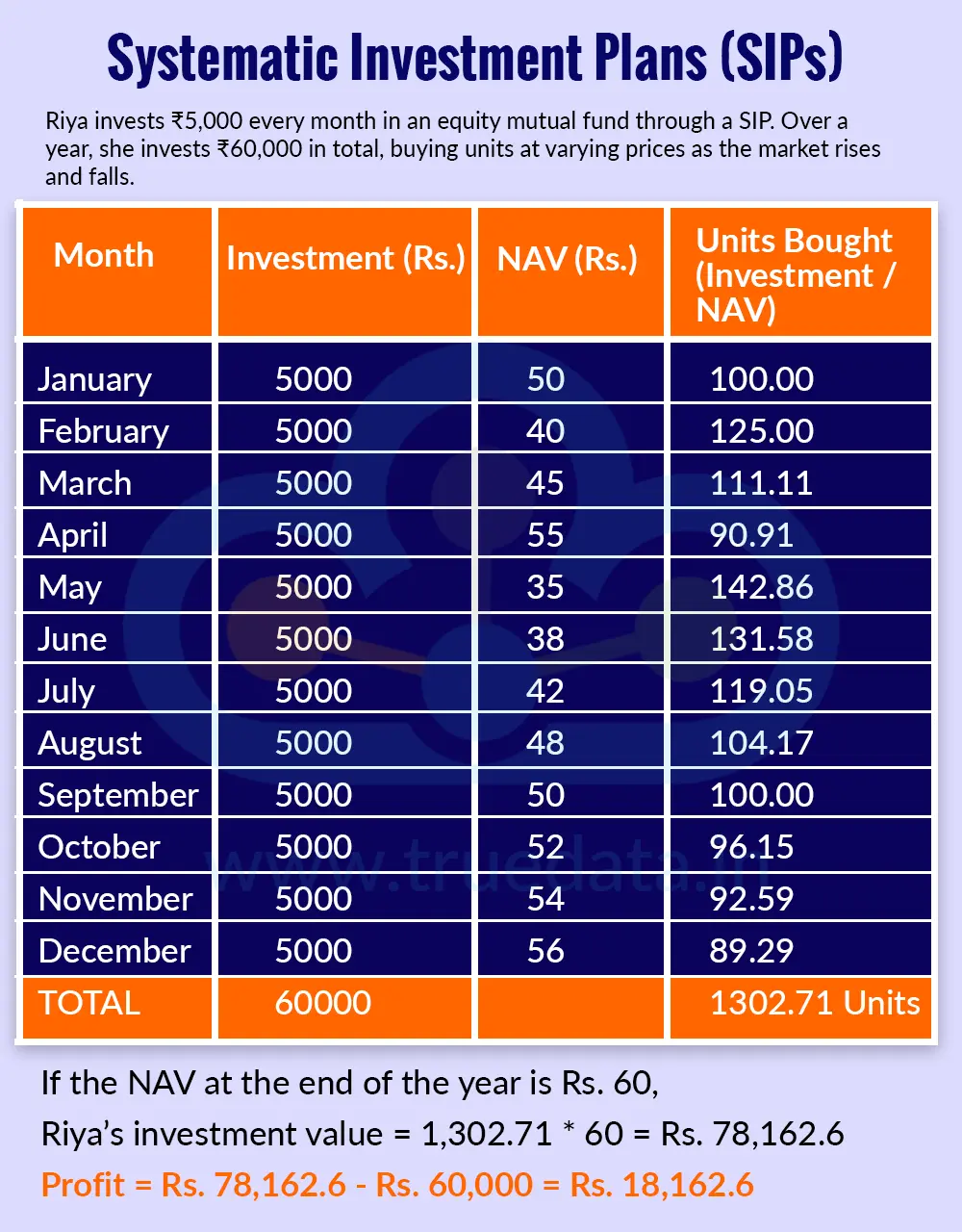

Systematic Investment Plans (SIPs)

Riya decides to invest Rs. 5,000 every month in an equity mutual fund through a Systematic Investment Plan (SIP). Over a year, she invests Rs. 60,000 in total. As she invests regularly, she buys mutual fund units at different prices, sometimes when the market is high and sometimes when it is low. Consider her investment data for a year.

If the NAV at the end of the year is Rs. 60,

Riya’s investment value = 1,302.71 * 60 = Rs. 78,162.6

Profit = Rs. 78,162.6 - Rs. 60,000 = Rs. 18,162.6

Thus, even though the market moved up and down, Riya benefited through rupee cost averaging. She bought more units when prices were low and fewer when prices were high. This reduced her overall cost and gave her a steady return.

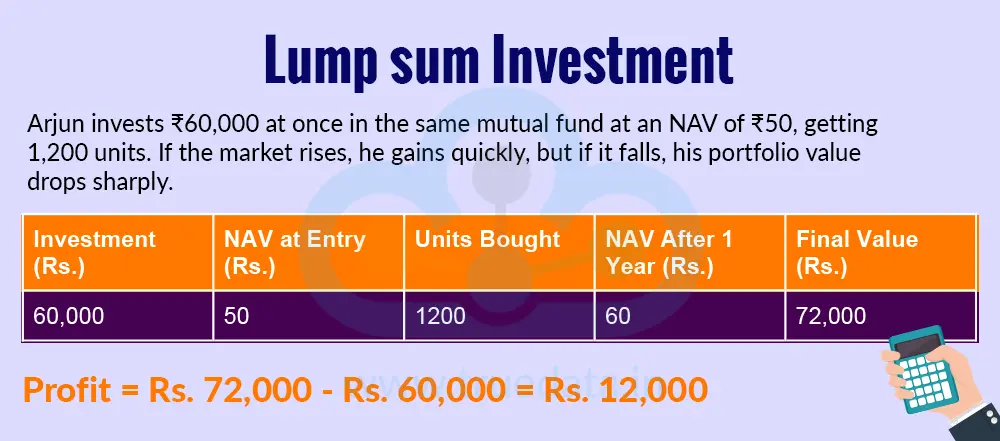

Lump sum Investment

Now consider another investor, Arjun, who invests Rs. 60,000 all at once in the same mutual fund through the lump sum mode. His entire investment is made at one Net Asset Value (NAV), say Rs. 50, which gives him 1,200 units immediately. If the market rises soon after, Arjun benefits quickly because his entire investment is already appreciating. However, if the market falls after his investment, the value of his portfolio will drop sharply because he entered at one price level. Consider his investment data for a year.

Profit = Rs. 72,000 - Rs. 60,000 = Rs. 12,000

Arjun earned a good return because the market rose after his investment. However, if the NAV had fallen to Rs. 40, his investment would drop to Rs. 48,000 (1200 * 40), showing how lump sum investments are more affected by market timing.

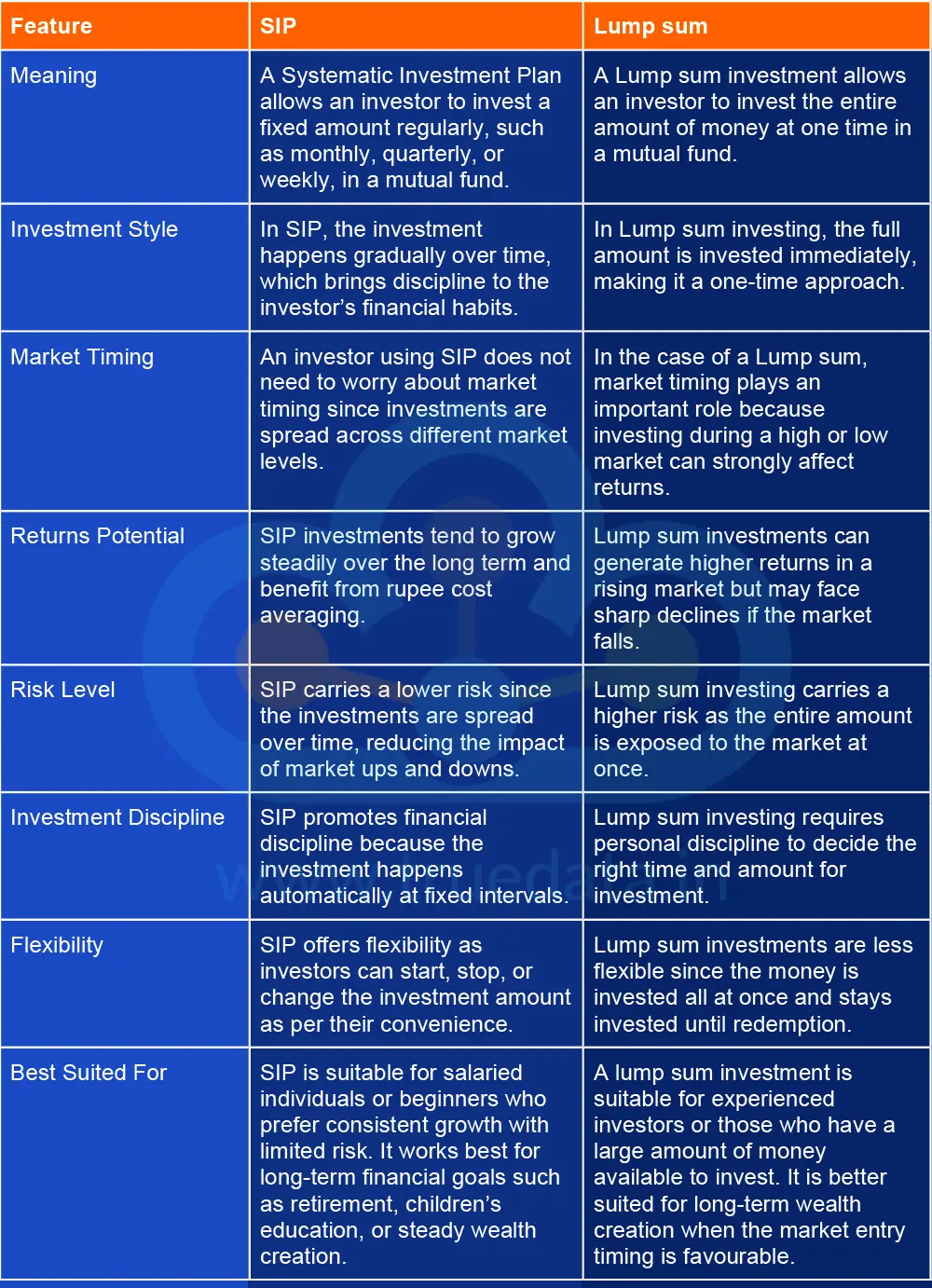

SIP and lump sum investments in mutual funds are like opposite ends of reaching the same goal, i.e., wealth creation through mutual funds. The key difference between these approaches is explained hereunder.

The choice between SIP and Lump Sum depends on various factors like the investor’s financial situation, risk appetite, and investment goals. A Systematic Investment Plan (SIP) is usually the better option for most investors as it allows regular investing in small amounts, reduces the impact of market volatility, and encourages financial discipline. It is ideal for salaried individuals who receive a fixed income every month and wish to build wealth gradually. SIPs work well in both rising and falling markets through rupee cost averaging, which helps investors buy more units when prices are low and fewer when prices are high.

On the other hand, a Lump Sum investment can be more suitable for investors who have a large amount of money available, for example, from a bonus, inheritance, or sale of property, and who can stay invested for a long period. Lump Sum investing can deliver higher returns if the investment is made when the market is at a favourable level, but it also carries higher short-term risk if the market declines soon after.

Thus, to put it simply, SIPs are better for investors who prefer steady and consistent growth with lower risk, while Lump Sum investments are better for investors with higher risk tolerance and a long-term horizon. A balanced approach, where an investor regularly invests through SIPs and adds Lump Sum amounts during market corrections, can offer the best combination of stability and growth.

SIP and Lump sum investments play an important role in building wealth through mutual funds. Systematic Investment Plan (SIP) helps investors grow their money gradually, promotes regular saving habits, and protects against market ups and downs through rupee cost averaging, making it suitable for salaried individuals or beginners who prefer consistent and disciplined investing. Lump sum investment, on the other hand, allows an investor to invest a large amount at once and can give higher returns when the market performs well, though it carries more short-term risk. The best approach for investors is to combine both using SIPs for steady long-term growth and Lump sum investments when extra funds are available or when the market offers good opportunities. This balanced strategy helps in achieving financial goals with both stability and growth.

This article explains the two pillars of mutual fund investing and their impact on the portfolio. We hope this clarifies the universal question of choosing between the two and helps you create a robust portfolio. Let us know if you need further information on this topic or have any queries on the same, and we will address them.

Till then, Happy Reading!

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Thestock market never stands still, and prices swing constantly with every new h...

Introduction For the longest time, investment in stock markets was thought to b...