Indian markets have been buzzing with record-high mutual fund inflows, clearly showing a sign of growing investor confidence. However, there is a flip side to this story, and that is the increasing global uncertainty, which is evident from the stock market volatility across the globe. Thus, staying invested in one's own economy is not sufficient anymore, and the need of the hour is to spread one's wings a bit more to have a balanced and robust portfolio. The easiest option for retail investors to diversify globally is through international funds. Eager to know more about them? Check out this blog to know all about international funds and how to invest in them to make informed portfolio decisions.

International funds are mutual funds that allow Indian investors to put their money into companies and markets outside India. Instead of being limited to stocks or bonds from the Indian economy, these funds invest in global opportunities such as U.S. technology companies, European industries, or fast-growing businesses in other emerging markets. Investing across different countries helps investors diversify their risk and reduce their dependence on a single economy. For example, if the Indian market goes through a slowdown, global investments can balance the portfolio by benefiting from growth elsewhere. These funds are managed by professionals who select and track international assets, so investors do not need to invest abroad themselves directly. This makes international funds an easy way for Indian investors to diversify, access global growth stories, and build a more balanced and resilient portfolio.

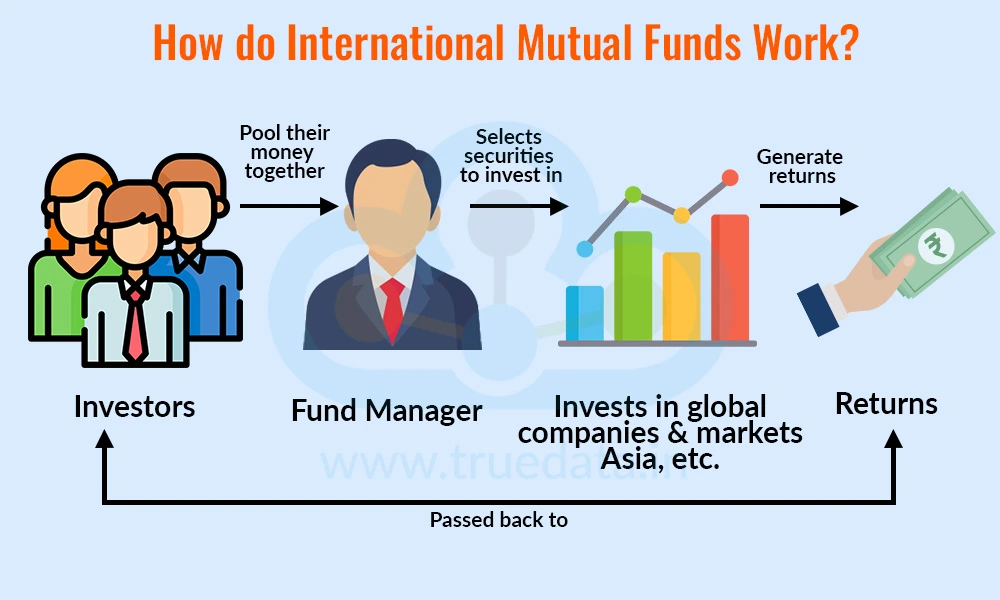

International mutual funds work by pooling money from many Indian investors and then investing that money in stocks, bonds, or other assets of companies and markets outside India. These funds are managed by professional fund managers, who decide which international markets and companies to invest in, based on research and growth potential. Investors do not have to open a foreign account or deal with the complex rules of global investing, as the fund does that on behalf of the investor. The returns of these funds depend on how the chosen international markets perform, and they are also influenced by currency movements between the Indian Rupee and foreign currencies like the U.S. Dollar. Thus, international funds make it easier for Indian investors to participate in the growth stories of global companies and economies, while staying invested through the familiar mutual fund route in India.

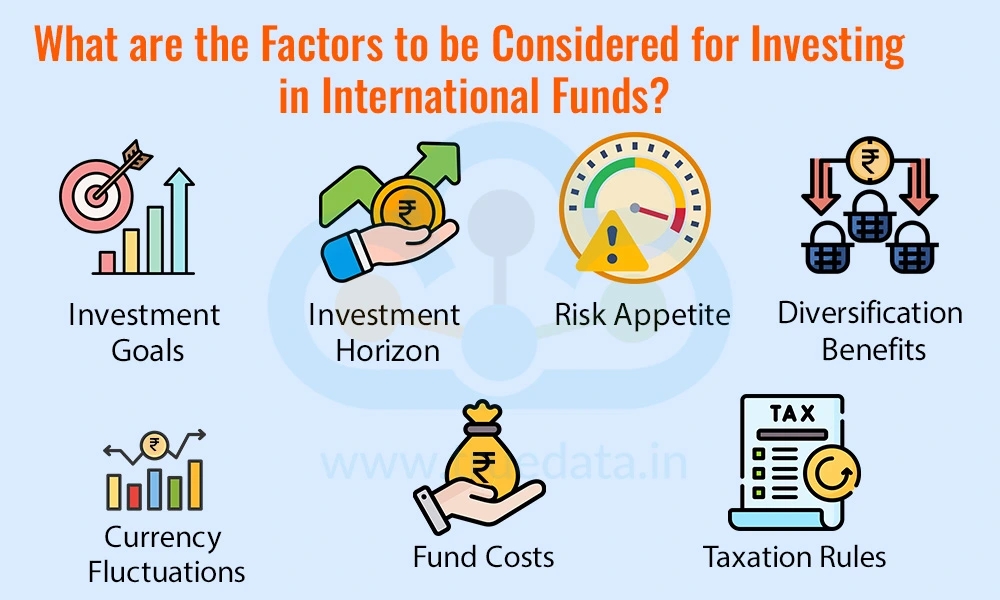

Investing in international funds is increasingly becoming popular among retail investors in India. However, investing without a clear direction can lead to losses or reduced profits rather than exploring their full potential. Therefore, here are a few key factors that should be considered while investing in international funds.

Investment Goals

Having clear investment goals is the first step before choosing an international fund. These goals can include long-term wealth creation, diversification, or benefit from the growth of global companies like Apple, Google, or Tesla. Having clarity on the goal helps in selecting the right type of international fund that matches their needs.

Investment Horizon

International funds are better suited for long-term investors. Since global markets can be unpredictable in the short run, staying invested for 5 years or more can help investors ride out volatility and benefit from long-term growth.

Risk Appetite

International funds can be more volatile compared to domestic funds. Global markets react to factors like geopolitical events, foreign policies, and global economic changes. If an investor has a higher risk tolerance and a longer investment horizon, these funds can be a good choice. However, those looking for stability may need to balance them with safer investments.

Diversification Benefits

One of the biggest advantages of international funds is diversification. Since these funds invest in markets outside India, they reduce the risk of being dependent only on the Indian economy. If the Indian market underperforms, gains from international markets can balance the portfolio.

Currency Fluctuations

Returns from international funds are also affected by changes in currency values. For example, if the U.S. Dollar becomes stronger against the Indian Rupee, an investor may get higher returns. On the other hand, if the Rupee strengthens, returns may reduce. Understanding this currency impact is important before investing.

Fund Costs

Investors should also look at the expenses charged by the fund. International funds sometimes have higher costs compared to domestic funds, because they involve global transactions and higher management fees. Checking the expense ratio and comparing it with similar funds is a smart step.

Taxation Rules

The taxation of international funds in India is different from that of domestic equity funds. They are usually taxed like debt mutual funds, which means a different set of rules applies for short-term and long-term capital gains. Thus, being aware of these tax implications helps in better financial planning.

International funds offer a dynamic investment opportunity for domestic investors. However, they come with higher risks and are subject to increased volatility. Therefore, the target investors for these funds are,

Investors looking for diversification - Anyone who wants to reduce dependence on the Indian economy and spread investments across global markets can consider international funds.

Long-term investors - People who can stay invested for 5 years or more may benefit the most, as these funds need time to overcome short-term market ups and downs.

Growth seekers - Investors who want exposure to global giants like Apple, Amazon, Google, or other international companies with strong growth potential can choose these funds.

Moderate to high risk-takers - Since international funds are affected by global events and currency fluctuations, they are more suitable for investors who can handle some volatility.

Investors planning for global expenses - Investors who may need funds in foreign currency in the future for overseas education or travel can find international funds useful, as they provide natural currency exposure.

Mutual fund investors with some experience - Beginners may start with domestic funds first, and rightly so, to have a stable base. On the other hand, seasoned investors who already understand mutual funds and want to expand further beyond borders, while being capable of handling the additional risk and the cost, can explore international funds.

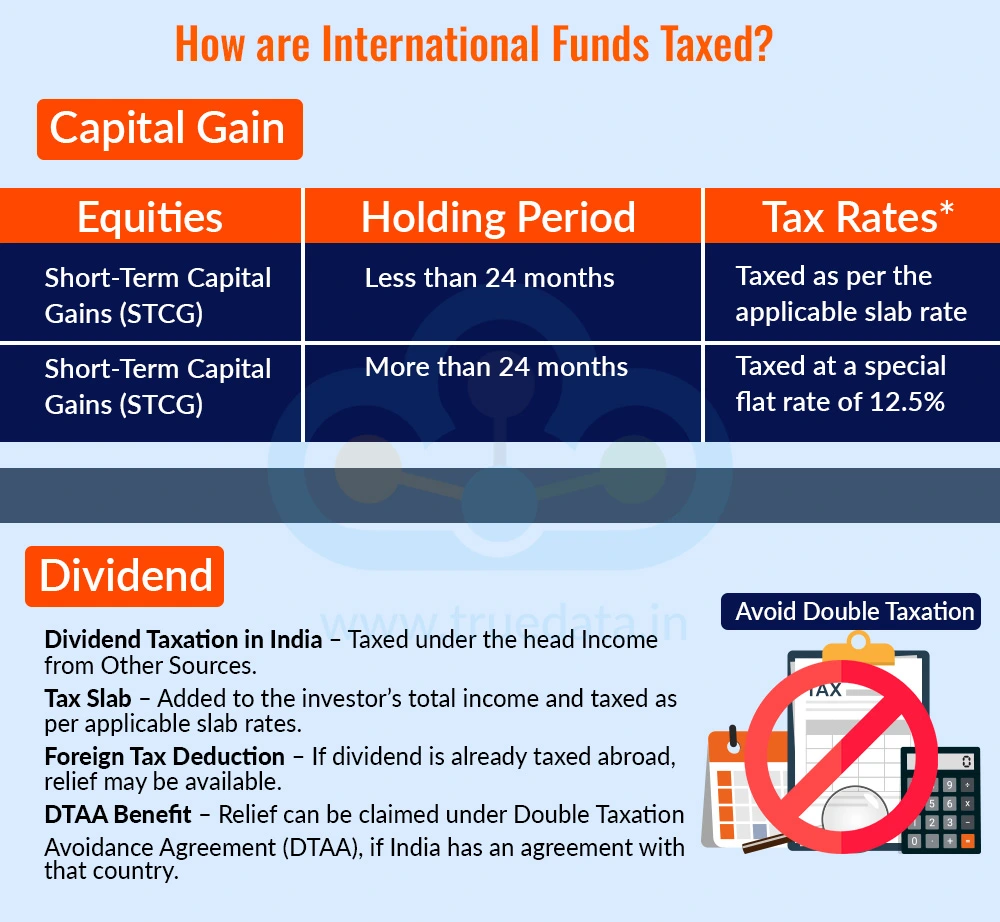

An international mutual fund is a fund that invests outside India (foreign equities, foreign ETFs, etc.). These are typically not classified as domestic equity mutual funds. The taxation of international funds is explained hereunder.

Capital gains refer to the profits made upon the sale of mutual funds. These gains are clarified as short-term capital gains or long-term capital gains, depending on the period of holding. The taxation of capital gain from these funds is explained below.

Short-Term Capital Gains (STCG) - Gains from selling units of international funds before a period of less than 24 months are considered STCG. These gains are added to the total income and taxed as per the applicable slab rate.

Long-Term Capital Gains (LTCG) - Gains from selling units of international funds before a period of more than 24 months are considered LTCG. These gains are taxed at a special flat rate of 12.5% (plus cess and surcharge), without indexation benefit.

Dividends are taxed in India under ‘Income from Other Sources’. This income is added to the total income and is taxable as per the applicable slab rates. If the fund or company abroad has already taxed the dividend in its country, investors may be able to claim relief under a Double Taxation Avoidance Agreement (DTAA) or under Section 91 of the Income Tax Act (if no DTAA) to avoid being taxed twice.

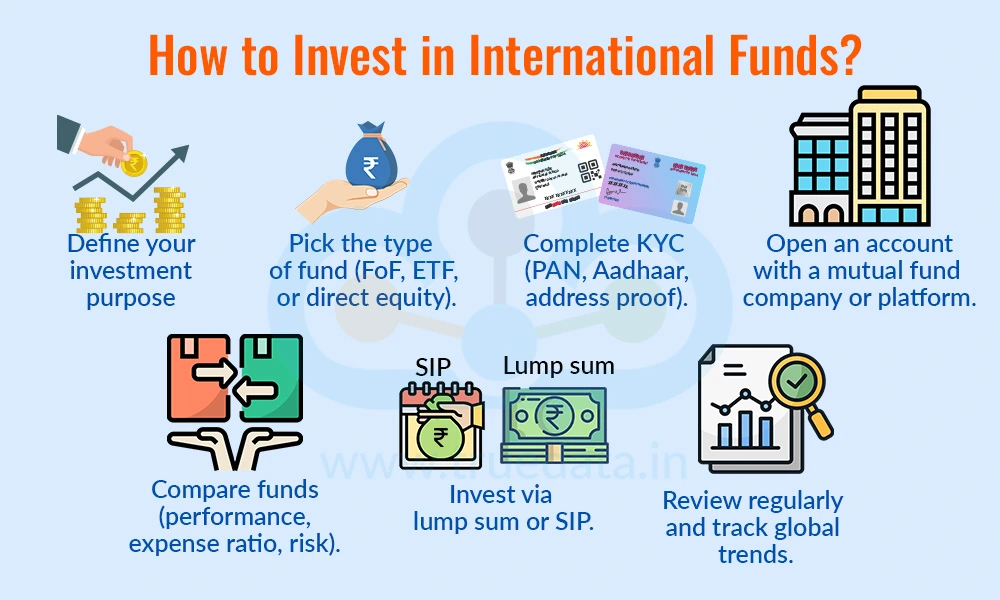

The process of investing in International funds is quite similar to that of investing in any other mutual fund. The key point of consideration is to find the AMC or the broker platform offering international funds. The steps for investing in international funds are mentioned below.

Decide the purpose for investing, such as diversification or exposure to global companies.

Choose the type of international fund for investment, i.e., Fund of Funds (FoF), Exchange Traded Fund (ETF), or a direct international equity fund.

Complete the KYC process (PAN, Aadhaar, and address proof) if not already done.

Open an account with a mutual fund company, distributor, or online investment platform offering international funds.

Compare funds by checking past performance, expense ratio, and risk level.

Start investing either through a lump sum or a Systematic Investment Plan (SIP).

Review the investment regularly and track global market trends and currency movements.

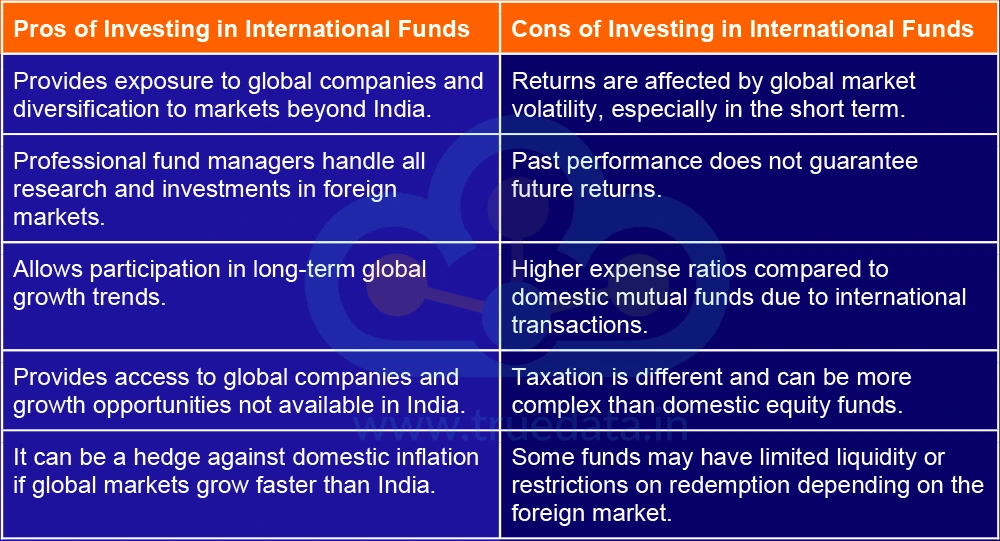

The pros and cons are an important step for investing in international funds and help investors make informed portfolio decisions. Here are a few pros and cons of investing in international funds.

Investing in international funds gives Indian investors a simple way to access global markets and diversify their portfolios beyond India. These funds allow participation in the growth of global companies, reduce dependence on the Indian economy, and can balance domestic market risks. However, these funds do not come without high risks. Therefore, investors need careful planning, a long-term investment horizon, and regular monitoring to make international funds a valuable tool to build a balanced, resilient, and globally diversified portfolio.

This blog explores a growing investment opportunity and its nuances. Let us know your thoughts on this topic or if you need further information on the same and we will address it soon.

Till Then, Happy Reading!

Read More: Rise of Silver Lithium Energy- Thematic Mutual Funds

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...