In recent years, mutual fund investments have grown tremendously in India, helping millions of investors build wealth over time. Yet, for many investors seeking higher growth opportunities without meeting the steep entry barriers of Portfolio management Services (PMS), options have been limited, i.e., until now. Recognising this gap, SEBI introduced a new investment avenue in 2025, i..e, the Special Investment Funds (SIFs). These funds aim to bridge the space between mutual funds and PMS, offering investors the chance to pursue higher returns with more flexibility and accessibility. Curious to know how SIFs work and how they can complement your mutual fund portfolio? Let us dive in and explore how this new category could help you craft a more strategic and goal-driven investment plan.

Specialised Investment Funds (SIFs) are a new type of investment option introduced by the Securities and Exchange Board of India (SEBI) in 2025 to give investors more flexibility and opportunities to grow their wealth. In simple terms, SIFs are professionally managed funds, just like mutual funds, however, they are allowed to use more advanced investment strategies that were previously available only to very wealthy investors through Portfolio Management Services (PMS) or Alternate Investment Funds (AIFs) This means SIFs can invest in a wider range of assets and can also take both ‘long’ and ‘short’ positions in the market, allowing fund managers to make money in both rising and falling markets. SIFs, thus, act as a bridge between mutual funds and PMS as they combine the professional management and regulatory safety of mutual funds with the flexibility and higher return potential of PMS. The minimum investment amount for SIFs is Rs. 10,00,000, which makes them accessible to experienced retail investors as well as high-net-worth individuals. SIFs are, therefore, a niche investment product designed for investors who want to aim for higher growth and are comfortable taking a bit more risk, while still staying within SEBI’s regulatory framework.

The Securities and Exchange Board of India (SEBI) introduced a new set of rules in 2025 to govern Specialised Investment Funds (SIFs). These rules are designed to ensure that both fund managers and investors meet certain eligibility standards, maintaining transparency and investor protection while allowing more advanced investment strategies.

Under Regulation 49X(1) of SEBI’s Mutual Fund Regulations, the minimum investment in SIFs is Rs. 10,00,000 per investor. Further,

This limit applies at the PAN level across all SIF strategies offered by the same Asset Management Company (AMC), and it is not scheme-specific.

The Rs. 10,00,000 threshold only applies to SIFs and does not include investments in regular mutual fund schemes of the same AMC.

Accredited investors (those who meet SEBI’s higher income or net-worth standards) are exempt from this minimum investment rule.

Investors can participate in SIFs through Systematic Investment Plan (SIP), Systematic Withdrawal Plan (SWP), or Systematic Transfer Plan (STP). However, the total commitment across all these modes must meet the Rs. 10,00,000 minimum, unless the investor is accredited. SEBI requires daily monitoring of this threshold.

If the investment value falls below Rs. 10,00,000 due to market fluctuations, it is treated as a passive breach and not a violation.

If the drop occurs because of active redemption or transfer, the AMC may require the investor to exit the SIF.

To launch and manage a Specialised Investment Fund, an AMC must meet certain experience and credibility requirements.

The AMC should have been operational for at least 3 years with an average Assets Under Management (AUM) of Rs. 10,000 crore or more in the past three years.

If this condition is not met, the AMC can still qualify if it appoints a Chief Investment Officer (CIO) with at least 10 years of fund management experience, who has managed an average AUM of Rs. 5,000 crore, and a second fund manager with at least 3 years of experience handling Rs. 500 crore or more.

The AMC and its sponsors must have a clean regulatory record with no SEBI actions or penalties in the last three years.

SEBI requires each SIF to have a distinct brand identity, separate from the AMC’s regular mutual fund schemes. This helps investors clearly differentiate high-strategy SIFs from standard mutual funds, even if the AMC name is used for recognition or trust.

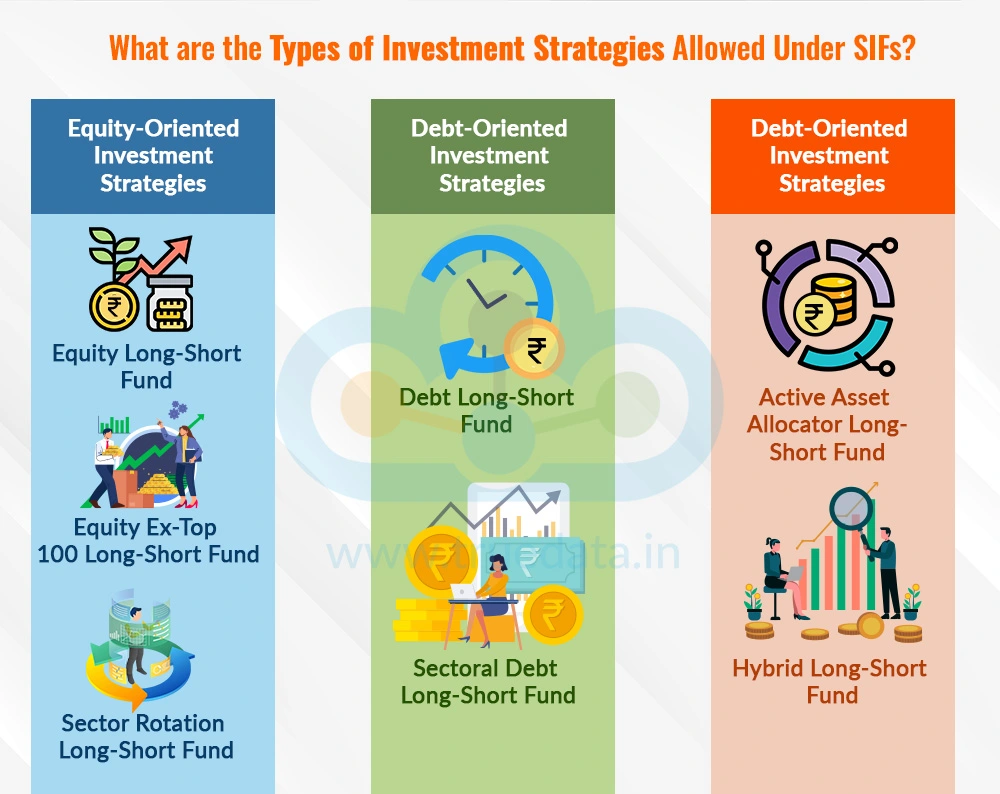

Specialised Investment Funds (SIFs) offer investors an opportunity to participate in professionally managed, flexible investment strategies that go beyond traditional mutual funds. Depending on the fund’s structure, an SIF can be open-ended, closed-ended, or an interval scheme, with the subscription and redemption frequency clearly defined in its offer document. SIF investment strategies fall under three main categories, i.e., Equity-Oriented, Debt-Oriented, and Hybrid Strategies, each designed with specific asset allocation limits and short exposure rules as per SEBI guidelines. These strategies allow fund managers to aim for higher returns by managing investments more actively while still staying within SEBI’s risk control framework.

Equity-Oriented SIFs focus mainly on listed equities and equity-related instruments. These funds have the flexibility to take short positions (up to 25%) using unhedged derivatives, allowing fund managers to generate returns in both rising and falling markets. Redemptions under this category can happen daily or at a lower frequency as decided by the Asset Management Company (AMC).

Equity Long-Short Fund

Equity Allocation - Minimum 80% of the portfolio in equities and equity-related instruments.

Short Exposure - Up to 25% using unhedged derivatives.

Strategy Focus - Generate returns by taking long positions in undervalued stocks and short positions in overvalued ones.

Structure - Open-ended or interval fund.

This strategy suits investors who seek long-term capital growth with an appetite for moderate-to-high market risk.

Equity Ex-Top 100 Long-Short Fund

Equity Allocation - At least 65% in stocks outside the top 100 by market capitalisation.

Short Exposure - Limited to 25% via unhedged equity and equity-related derivatives.

Strategy Focus - Capture opportunities in mid-cap and small-cap companies that are often undervalued or under-researched.

Structure - Open-ended or interval fund.

This strategy is ideal for investors looking to diversify beyond large-cap stocks and willing to accept higher volatility for greater return potential.

Sector Rotation Long-Short Fund

Equity Allocation - Minimum 80% invested across a maximum of four sectors.

Short Exposure - Up to 25% at the sector level using unhedged derivatives.

Strategy Focus - Tactical rotation between sectors based on market outlook, investing in sectors expected to perform well and shorting those likely to underperform.

Structure - Open-ended or interval fund.

This strategy works well for investors who want focused exposure to changing economic trends and sectoral opportunities.

Debt-Oriented SIFs are designed for investors seeking steady income with moderate risk, while still benefiting from active management. These funds invest in various fixed-income securities such as bonds, debentures, and money market instruments. They can also take short positions through exchange-traded debt derivatives to manage interest rate and credit risks. Redemptions are typically allowed weekly or at a lower frequency, as determined by the AMC.

Debt Long-Short Fund

Core Investments - Across a range of debt instruments with varying maturities and credit ratings.

Short Exposure - Through exchange-traded debt derivatives.

Strategy Focus - Generate returns by actively managing duration and interest rate exposure, going long when interest rates are expected to fall and short when they may rise.

Structure - Interval fund.

This fund is suitable for investors looking for income stability with a slightly higher return potential than traditional debt funds.

Sectoral Debt Long-Short Fund

Portfolio Allocation - Investments in debt instruments from at least two sectors, with no more than 75% exposure to any single sector.

Short Exposure - Up to 25% via unhedged debt derivatives within specific sectors.

Strategy Focus - Relative value investing, i.e., identifying sectors where debt instruments are undervalued while shorting overvalued ones.

Structure - Interval fund.

This fund suits investors who prefer debt exposure but want an actively managed, sector-diversified approach to enhance returns.

Hybrid SIFs combine equity, debt, and alternative assets such as Real Estate Investment Trusts (REITs), InvITs, and commodity-linked derivatives into one dynamic portfolio. These strategies aim to balance growth and stability by actively adjusting allocations across asset classes. Redemptions are allowed twice a week or at a lower frequency, depending on the AMC’s policy.

Active Asset Allocator Long-Short Fund

Asset Coverage - Equity, debt, derivatives, REITs/InvITs, and commodities.

Short Exposure - Up to 25% across instruments.

Strategy Focus - Dynamic asset rebalancing, i.e., increasing exposure to growth assets (like equity) when markets rise, and shifting to defensive assets (like debt or commodities) in volatile periods.

Structure - Interval fund.

This fund is ideal for investors who want diversification across multiple asset classes with active risk management.

Hybrid Long-Short Fund

Equity Allocation - Minimum 25%

Debt Allocation - Minimum 25%

Short Exposure - Up to 25% across equity and debt via unhedged derivatives.

Strategy Focus - Maintain a balanced risk-return profile, using tactical short positions to protect against market downturns.

Structure - Interval fund.

This fund suits investors looking for a balanced portfolio that can perform well in different market cycles.

SIFs are a unique investment option that is aimed at bridging the gap between the mutual funds, PMS and AIFs. They are designed for investors who want to take advantage of advanced investment strategies and aim for higher long-term growth than traditional mutual funds. The target investors for SIFs include,

Investors who can invest a minimum of Rs. 10,00,000 in SIFs.

Accredited investors are those who meet SEBI’s higher income or net-worth criteria.

Institutional and Non-Individual investors (like Insurance companies, Corporates and partnership firms, etc.) who can use SIFs to diversify their investment portfolios and access professionally managed long-short strategies.

HNIs and UHNIs who want to diversify beyond mutual funds and fixed deposits and have the financial capacity and risk tolerance for dynamic, higher-return investments.

Investors with long-term investment horizons (5 to 10 years).

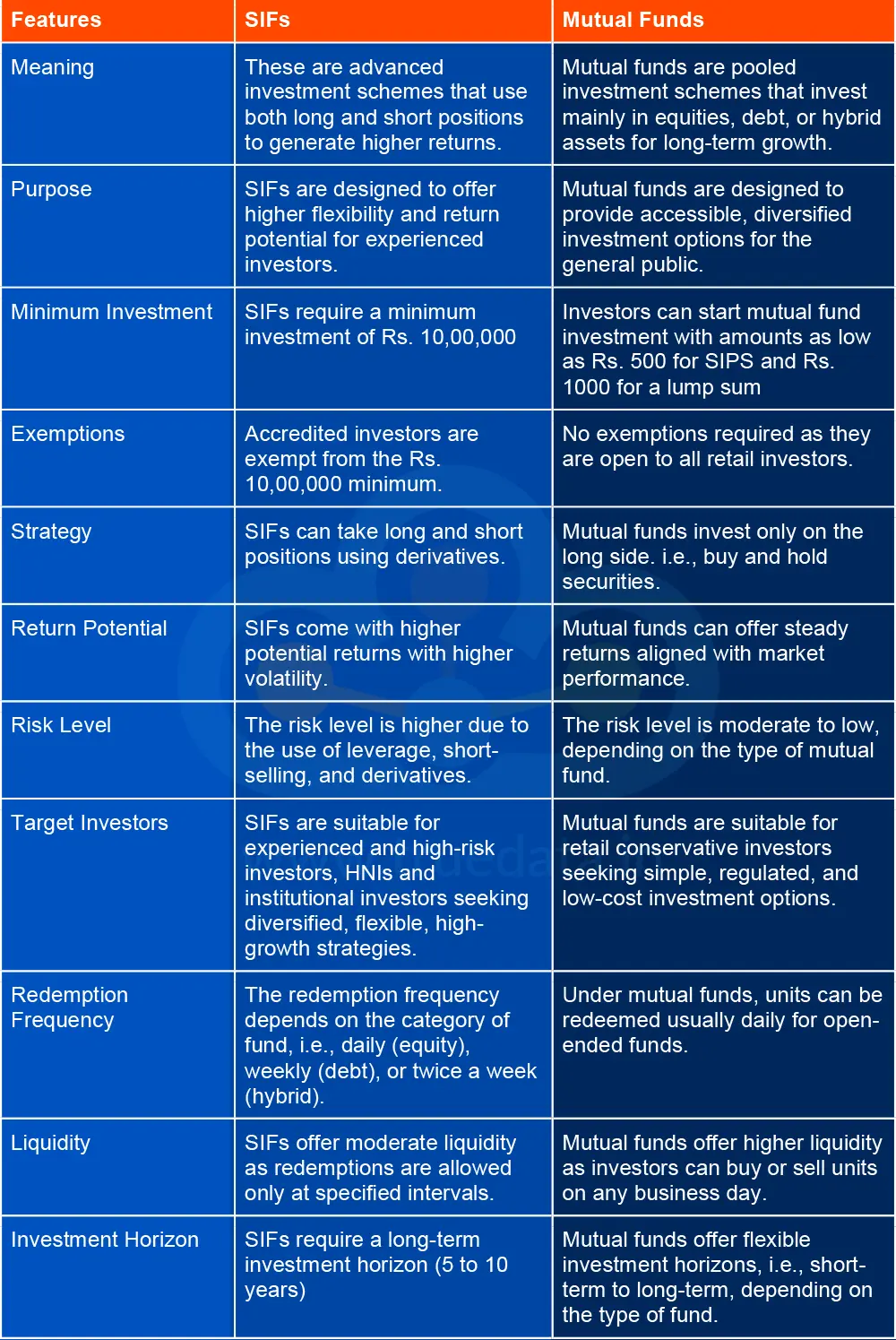

Both SIFs and mutual funds are regulated by SEBI and managed by professional fund managers. However, they differ in their structure, strategy, risk level, and investor eligibility. The key differences between SIFs and mutual funds are mentioned hereunder.

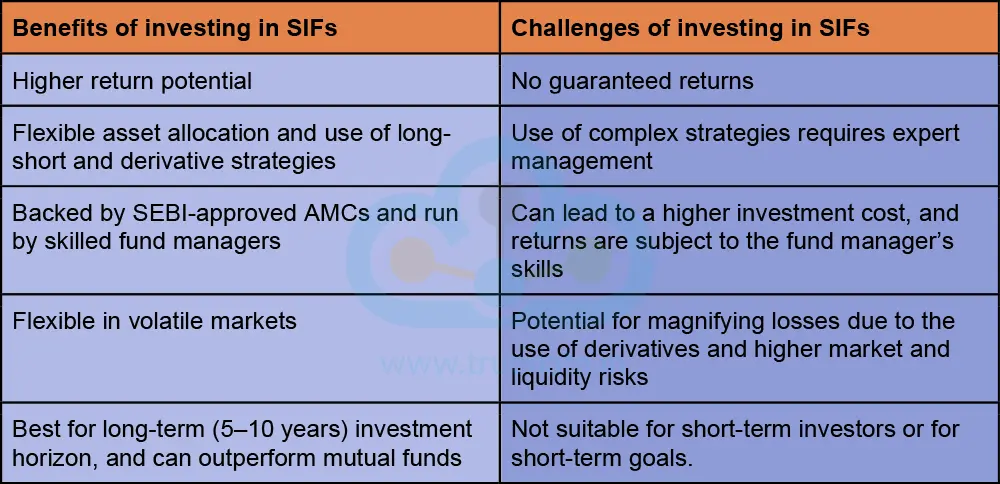

After understanding the key details of SIFs and the core differences between them and mutual funds, let us now understand the benefits and challenges of investment in this unique instrument.

Specialised Investment Funds (SIFs) are a new-age investment option introduced by SEBI in 2025 to bridge the gap between mutual funds and portfolio management services (PMS). They give investors access to advanced long-short and multi-asset strategies, offering the potential for higher returns along with professional management and regulatory safety. With a minimum investment of Rs. 10,00,000, SIFs are ideal for experienced and high-net-worth investors who can take moderate to high risks and aim for long-term wealth creation. While they offer flexibility, diversification, and growth opportunities, they also come with higher complexity and risk than regular mutual funds. Overall, SIFs can be a strong addition to a strategic investment portfolio for those seeking to balance growth, diversification, and innovation in their investments.

This article sheds light on a new investment option that serves as a bridge between mutual funds and high-end PMS. Under SEBI supervision, this new investment option aims to cater for the needs of the growing HNI population in India and create niche portfolios. Let us know your thoughts on the topic or if you need further information on the same, and we will address it.

Till Then, Happy Reading!

Read More: Can Algorithms Beat Human Fund Managers? - Know all about Quant Based Mutual Funds

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...