When it comes to investing in mutual funds, investors often consider popular factors like risk-return balance, financial goals and duration. However, have you ever wondered why some investors also pay close attention to the fund’s AUM? Does it really make a difference? Dive into this blog to know the meaning and importance of AUM and how it impacts your investment decisions.

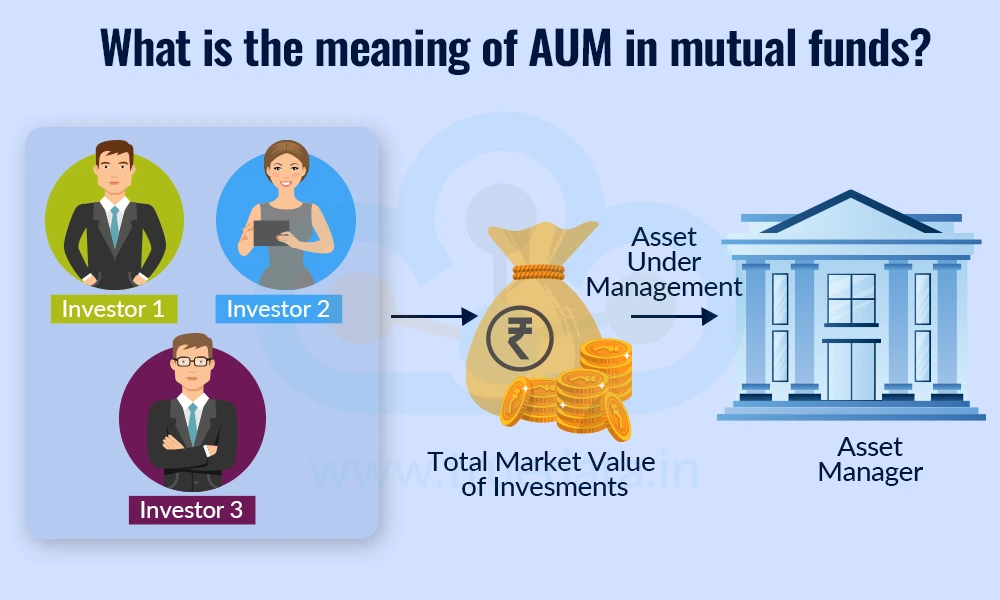

AUM, ot the Assets Under Management, refer to the total market value of all the assets and investments that a mutual fund manages on behalf of its investors (retail and institutional investors). This includes the total capital after considering all the assets like equity, debt, gold and more. The total AUM amount can change every day as it depends on the market value of the securities the fund holds and whether new investors are joining or existing ones are withdrawing their money. A higher AUM usually means that the fund has earned the trust of many investors and has grown over time. On the other hand, a smaller AUM might indicate that the fund is newer or has a more focused investment base. However, it is essential to recognise that a large AUM does not necessarily imply that the fund is superior or will yield higher returns. It is just one of many factors to consider when choosing where to invest.

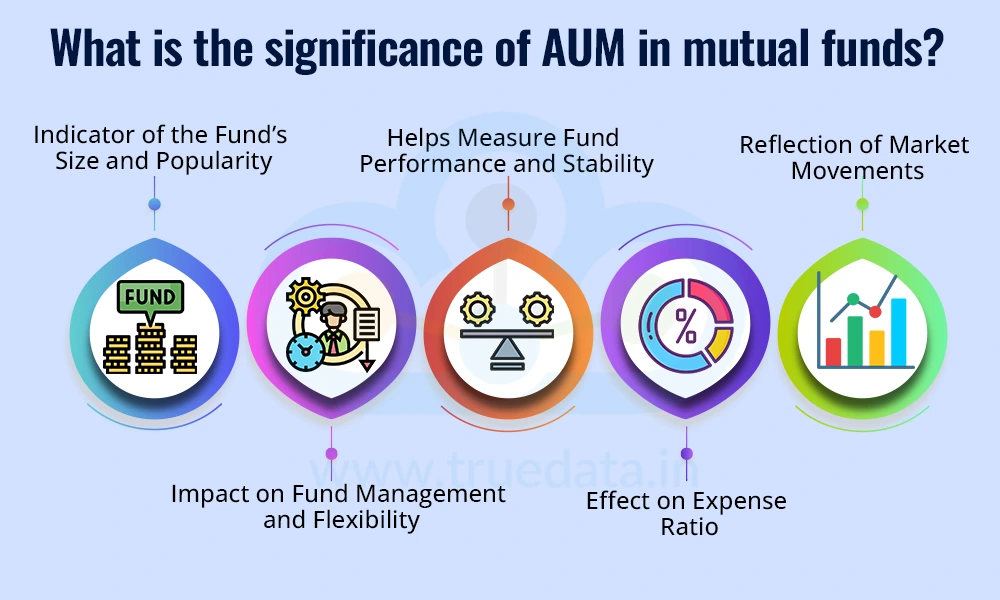

AUM indicates the total value of the assets managed by the fund, and thus, it is important to understand its significance in shaping an investment portfolio. The importance of AUM and its overall impact are explained below.

AUM shows the size or the strength of a mutual fund and the extent of investor money it manages. A fund with a high AUM usually means that many investors trust it based on several factors, and they have invested their money in it. This popularity can be a sign of consistent performance and confidence in the fund manager’s ability. However, it is also important to remember that a bigger fund is not always better, as smaller funds can also perform well depending on their strategy, focus and asset allocation.

The size of the AUM can affect how a fund is managed. Funds with a very large AUM may find it harder to move in and out of certain investments quickly, especially in smaller or less liquid markets. Smaller funds, on the other hand, can be more flexible and take advantage of specific investment opportunities. So, depending on the fund’s strategy, the size of the AUM can have both advantages and challenges.

When a mutual fund’s AUM grows over time, it often means that the fund has delivered good returns and attracted more investors. A stable or growing AUM gives confidence that the fund is being managed efficiently, even in the face of market volatility. On the other hand, if the AUM keeps falling, it might suggest that investors are withdrawing money due to poor performance, market conditions, better investment options with a lower expense ratio or higher returns at similar risks.

AUM also plays a role in determining the expense ratio, i.e., the percentage of total assets that go toward managing the fund. Generally, funds with a larger AUM can spread their costs over more investors, which may result in a lower expense ratio. This means that investors might pay slightly less in fees compared to smaller funds with higher costs per investor.

AUM changes not only because investors buy or sell fund units but also due to market performance. When the value of the stocks or bonds held by the fund increases, the AUM rises, and when markets fall, the AUM decreases. So, AUM can give a quick snapshot of how the fund is performing in the current market environment.

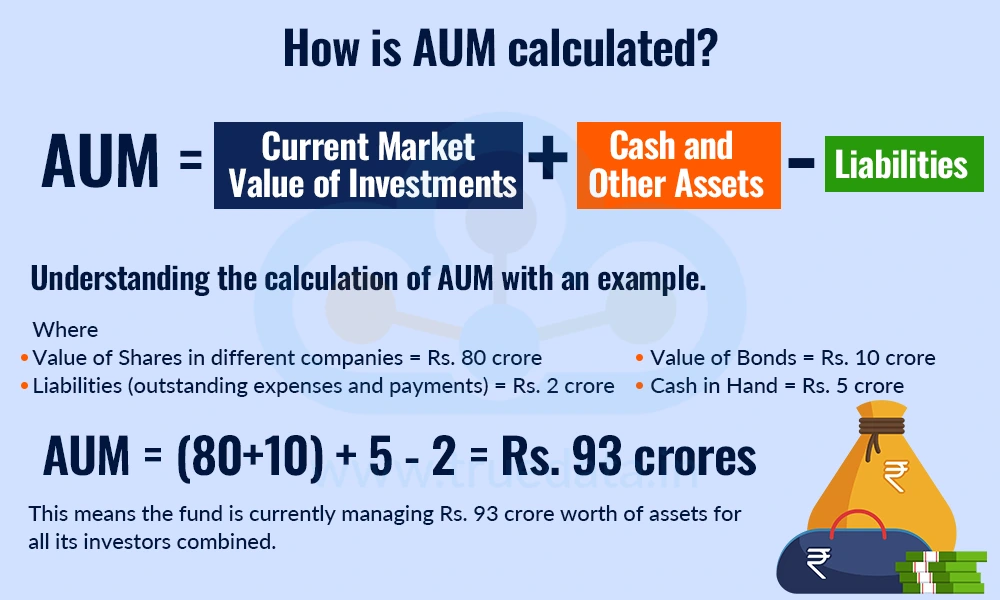

AUM (Assets Under Management) is calculated by adding up the total market value of all the investments that a mutual fund currently manages on behalf of its investors. This includes the value of shares, bonds, cash, and other securities held in the fund’s portfolio. The AUM can change daily because the market prices of these investments go up and down, and investors may add or withdraw their money from the fund.

The formula to calculate the AUM of a fund is,

AUM = Current Market Value of Investments + Cash and Other Assets - Liabilities

Understanding the calculation of AUM with an example.

Consider a Fund ABC with the following details,

Value of Shares in different companies = Rs. 80 crore

Value of Bonds = Rs. 10 crore

Cash in Hand = Rs. 5 crore

Liabilities (outstanding expenses and payments) = Rs. 2 crore

Thus, the AUM of Fund ABC is,

AUM = (80+10) + 5 - 2 = Rs. 93 crores

This means the fund is currently managing Rs. 93 crore worth of assets for all its investors combined. As the market value of its holdings changes or as investors add or withdraw money, the AUM will also change accordingly.

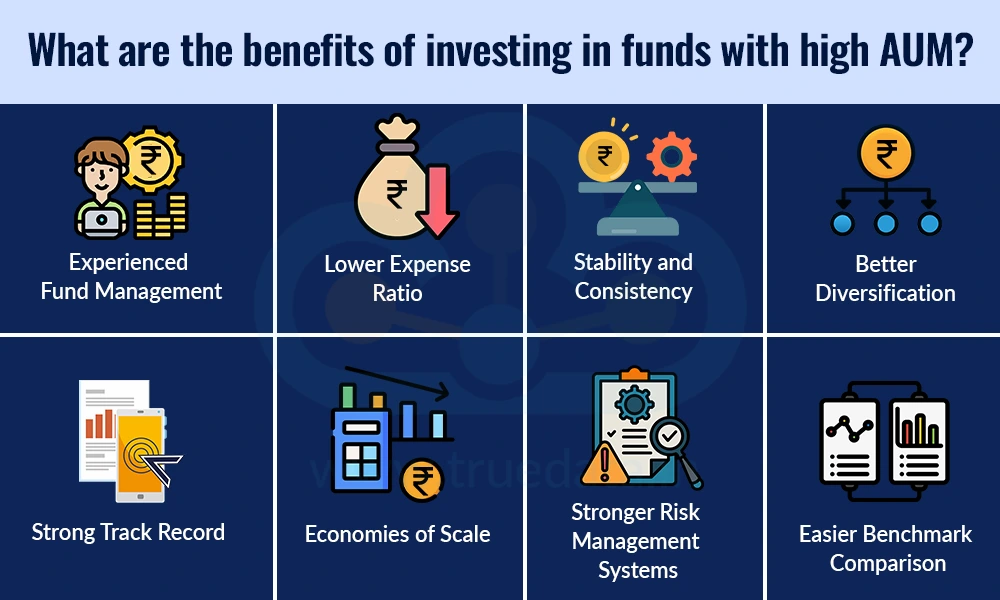

The benefits of investing in funds with high AUM can be multiple, including the trust in the fund built over time. Some of these key benefits are mentioned below.

Experienced Fund Management - Funds with large AUMs are usually managed by experienced and skilled fund managers. Since they handle large sums of money, these funds often have access to better research, analysis tools, and professional expertise.

Lower Expense Ratio - A higher AUM allows the fund to spread its operating costs over a larger pool of money. This usually leads to a lower expense ratio, i.e., smaller fees for fund management, thus leading to more of the net returns.

Stability and Consistency - Funds with high AUM tend to be more stable since they have a larger base of investors and diversified investments. Even if some investors withdraw money, it is less likely to affect the fund’s overall performance significantly.

Better Diversification - A fund with a large AUM usually invests in a wide variety of companies, sectors, and instruments. This diversification helps reduce risk, i.e., if one investment does not perform well, others in the portfolio may balance it out.

Strong Track Record - Often, funds with a high AUM have reached that level due to their ability to consistently deliver good returns over time. While past performance does not guarantee future results, it can still give confidence to new investors.

Economies of Scale - When a fund manages a large amount of money, it can negotiate better deals on transaction costs, research, and other services. These savings can indirectly benefit investors by improving returns or keeping costs low.

Stronger Risk Management Systems - Big funds usually have dedicated teams and advanced tools for monitoring risk. This helps them manage market volatility, credit risks, and portfolio balance more effectively, which provides an added layer of safety for investors.

Easier Benchmark Comparison - Funds with higher AUM are often compared against well-known market benchmarks and peer funds. This transparency makes it easier for investors to evaluate how the fund is performing relative to others in the same category.

AUM is an important tool for evaluating a fund. However, it cannot be the sole consideration. A high AUM may show that the fund is popular and trusted by many investors, but that alone does not guarantee good returns or performance. Sometimes, funds with smaller AUMs can perform better because they are more flexible and can easily adjust their investments based on market conditions. Therefore, while analysing a mutual fund, an investor should also look at other key aspects such as the fund’s past performance, returns compared to its benchmark, risk level, expense ratio, investment strategy, and the experience of the fund manager. It is equally important that the fund aligns with the investor’s financial goals, risk appetite, and time horizon. Thus, AUM can give an idea about the fund’s size and reputation, but a wise investment decision should be based on a complete evaluation of all these factors together.

AUM (Assets Under Management) is an important indicator of a mutual fund’s size, popularity, and investor confidence. It helps understand how much money a fund manages and can reflect its stability and reputation in the market. However, investors should use AUM as just one of many factors to make well-informed and balanced investment decisions rather than solely depending on it or giving undue importance to it.

This article talks about a very basic concept in mutual funds and its importance in making investment decisions. Let us know your thoughts on the topic or if you need any further information on the same.

Till then, Happy Reading!

Read More: How to Calculate Returns on Mutual Fund Investments?

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Mutual fund investments have simplified greatly with just a tap on your smartpho...

Introduction For the longest time, investment in stock markets was thought to b...