Financial ratios often look like hard numbers that tell a clear story about a company’s performance. However, what if those numbers change, not because the business changed, but because the accounting rules did? Changes in accounting policies can quietly alter profits, assets, and liabilities, which in turn affect key financial ratios. Understanding this impact helps investors read financial statements more wisely and avoid drawing the wrong conclusions. Curious to know more? Check out this blog to explore how accounting policy changes can reshape key financial ratios and why investors should pay close attention.

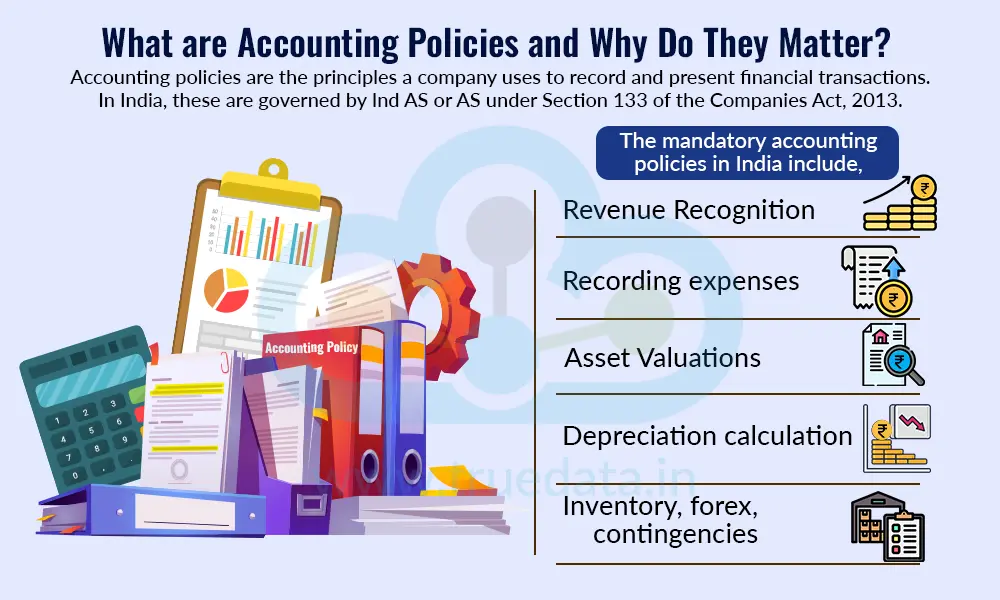

Accounting policies are the rules and methods a company chooses to record, measure, and present its financial transactions in its books of accounts. In India, companies follow accounting policies based on Indian Accounting Standards (Ind AS) or Accounting Standards (AS), as prescribed under Section 133 of the Companies Act, 2013, by the Ministry of Corporate Affairs, based on recommendations of the National Financial Reporting Authority (NFRA). Larger listed companies and those meeting certain net worth thresholds must follow Ind AS, which is aligned with global IFRS standards, while smaller companies follow AS, which is simpler but still mandatory.

The mandatory accounting policies in India include,

Revenue Recognition (for example, when a sale is considered complete)

Recording expenses (matching costs with the income they generate),

Asset Valuations (at cost or fair value)

Depreciation calculation (such as straight-line or reducing balance method).

Other important accounting policies include rules for valuing inventories, handling foreign currency transactions, and disclosing contingent liabilities.

Once a company chooses a method, it must apply it consistently year after year, unless a change is required by law or results in more accurate reporting. Any change must be explained in the notes to accounts along with its financial impact. These rules protect investors by ensuring financial statements are reliable, consistent, and comparable across companies.

Accounting policies have a direct impact on profits, assets, liabilities, and cash flows. For example, a change in depreciation method can increase or reduce profits without any real change in business performance. Similarly, revenue recognition policies affect when income is shown in the books. This is why accounting policies play a critical role in shaping the final financial statements that investors rely on.

Accounting policies help in judging the true financial health of a company. Two companies in the same industry may report very different profits simply because they follow different accounting policies. By understanding these policies, investors can make better comparisons, identify aggressive or conservative reporting, and avoid being misled by short-term jumps in earnings.

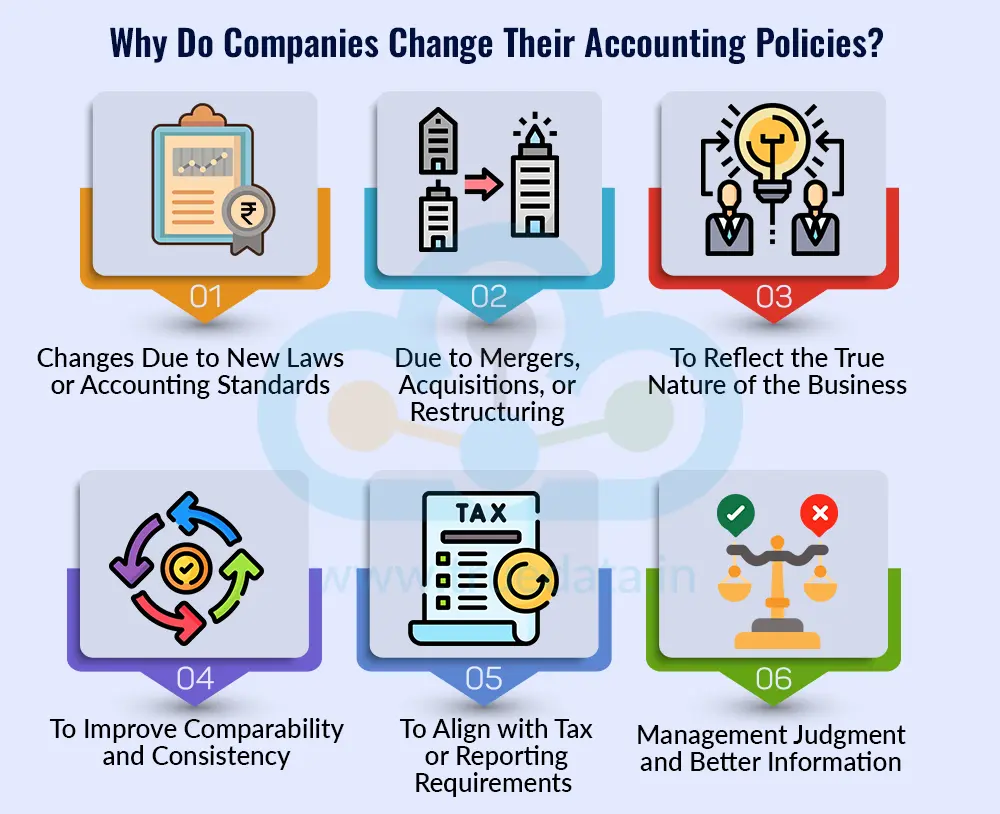

Companies do not change accounting policies frequently, but when they do, the reasons are usually important for investors to understand. Such changes can affect profits, assets, and key financial ratios, sometimes without any real change in business performance. Here are the main reasons why companies may change their accounting policies.

Changes Due to New Laws or Accounting Standards - One of the most common reasons is changes in regulations or accounting standards. When the government or regulators introduce new rules, such as the adoption of Ind AS under the Companies Act, 2013, companies are required to align their accounting policies accordingly. These changes are compulsory and aim to improve transparency, consistency, and global comparability of financial statements.

Due to Mergers, Acquisitions, or Restructuring - Corporate actions such as mergers, acquisitions, or restructuring can require changes in accounting policies. When two businesses combine, they may need to adopt uniform accounting methods across the group. These changes help present consolidated financial statements in a clear and consistent manner.

To Reflect the True Nature of the Business - As a company grows or changes its business model, old accounting policies may no longer reflect reality. For example, a company expanding into long-term contracts or digital services may change its revenue recognition policy to better match income with its actual performance. Such changes are often made to present a more accurate and fair view of the company’s financial position.

To Improve Comparability and Consistency - Sometimes companies change policies to make their financial statements more comparable with peers or industry practices. This is common when companies want to align with best practices or prepare for listings, mergers, or global investors. Improved comparability helps investors analyse the company more easily against competitors.

To Align with Tax or Reporting Requirements - In some cases, companies adjust accounting policies to better align with tax regulations or reporting requirements. While accounting profits and taxable profits are different, policy changes can simplify compliance and reporting. However, investors should closely review such changes to ensure they are not made solely to manage short-term profits.

Management Judgment and Better Information - Accounting standards often allow multiple acceptable methods. As management gains better data, systems, or experience, they may decide that a different accounting policy provides more reliable information. For example, changing the method of valuing inventory or depreciation may better reflect actual usage of assets.

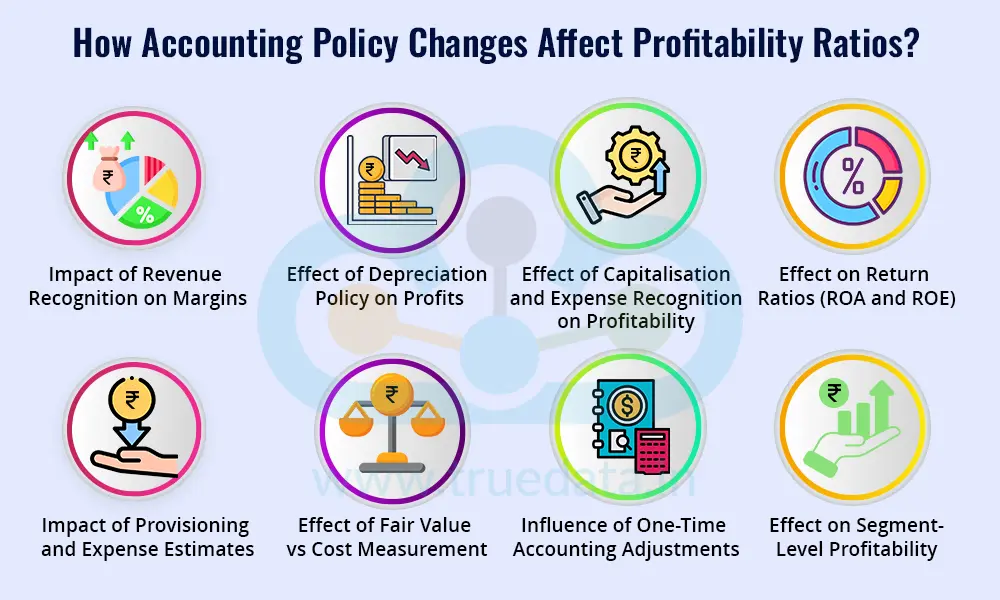

Profitability ratios help investors understand how efficiently a company generates profit from its sales, assets, and equity. Ratios like operating margin, net profit margin, Return on Assets (ROA), and Return on Equity (ROE) are widely tracked by investors. However, changes in accounting policies can significantly alter these ratios, even if the company’s core business performance remains the same. The effect of changes in accounting policies on profitability ratios can be explained hereunder.

When a company changes its revenue recognition policy, the timing of when income is recorded can shift. Revenue may be recognised earlier or later, depending on the new method. If revenue is recognised earlier, sales and profits may look higher in the short term, improving operating and net profit margins. Investors should remember that higher margins in such cases may reflect accounting timing, not actual improvement in demand or pricing power.

A change in depreciation method or useful life of assets directly affects expenses. For example, extending the useful life of machinery lowers annual depreciation, increasing reported profits. This can improve ratios like operating margin, ROA, and ROE. However, the company’s cash flows and asset usage remain unchanged, which is why investors must check whether profit growth is sustainable.

When companies capitalise costs instead of expensing them, short-term profits and ratios like operating margin, net profit margin, and ROE look better. However, these costs do not disappear; rather, they reduce profits later through depreciation or amortisation. Investors should understand this timing difference to judge whether higher profitability is real or just an accounting effect.

Profitability ratios like ROA and ROE depend on both profits and the asset or equity base. Accounting policy changes can affect either side of this equation. Higher reported profits or changes in asset values can make these ratios look stronger, even if the company’s operating efficiency has not improved. This makes year-to-year comparisons tricky without adjusting for policy changes.

Changes in how a company estimates provisions for bad debts, warranties, or employee benefits can directly affect profits. Lower provisions increase reported earnings and improve net profit margin and ROE, while higher provisions reduce profitability. Since these are based on management judgement, investors should check whether such changes are reasonable and consistent with business conditions.

When companies shift from historical cost to fair value measurement for certain assets or investments, unrealised gains or losses may flow into profits. This can temporarily inflate profitability ratios without generating actual cash. Investors should be cautious when profits rise mainly due to valuation changes rather than operating performance.

Some accounting policy changes require one-time adjustments to past reserves or current profits. These can distort year-on-year profitability ratios, making a single year look unusually strong or weak. Investors should adjust ratios mentally or focus on multi-year averages for better clarity.

Policy changes may affect different business segments differently. For example, changes in revenue recognition or cost allocation can improve margins in one segment while weakening another. Investors analysing segment-wise profitability should read disclosures carefully to avoid misinterpreting segment performance.

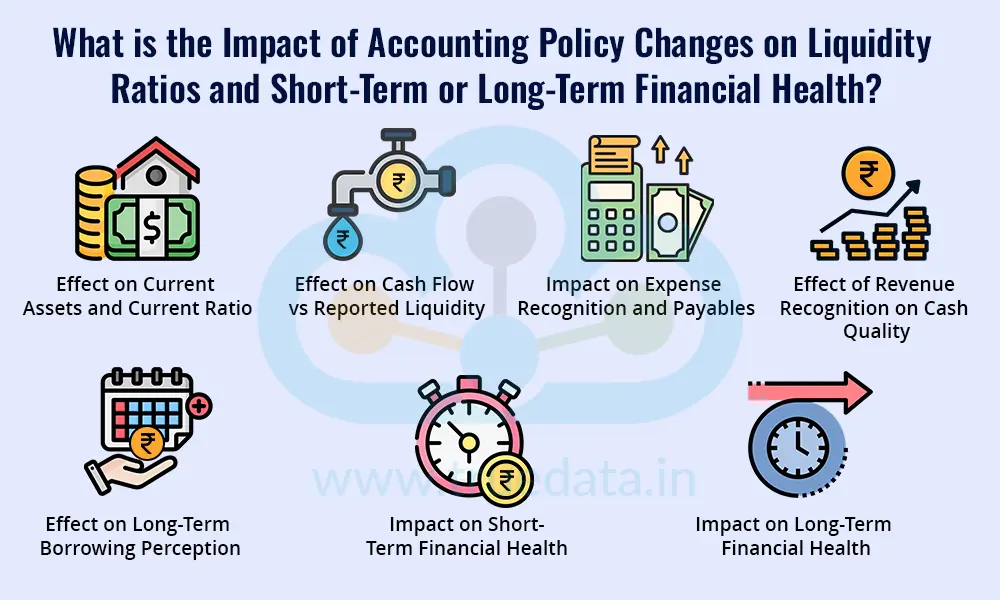

Liquidity ratios help investors understand a company’s ability to meet its short-term and long-term obligations. Ratios like the current ratio, quick ratio, and cash ratio are commonly used to assess financial stability. Changes in accounting policies can influence these ratios significantly, sometimes making a company appear more liquid, or more stressed, than it really is. The impact of accounting policy changes on these ratios is explained below.

Accounting policy changes related to inventory valuation, trade receivables, or revenue recognition can alter the value of current assets. For example, recognising revenue earlier may increase receivables, improving the current ratio. However, higher receivables do not always mean better cash flow. Investors should check whether the increase in current assets is backed by actual cash generation. Accounting policy changes related to inventory or receivables affect the working capital cycle. Shorter reported cycles may look positive, but investors should confirm whether these improvements are due to better operations or accounting adjustments.

liquidity ratios are based on balance sheet numbers, not cash flow. Accounting policy changes may improve reported liquidity while cash flows may remain weak. Investors should, thus, always compare liquidity ratios with operating cash flow to assess true financial health.

Changes in how expenses are recognised can affect current liabilities. If certain costs are deferred or capitalised, short-term expenses appear lower, reducing payables and improving liquidity ratios. While this may improve the current ratio on paper, it does not necessarily strengthen the company’s real ability to pay its dues.

When revenue is recognised earlier, receivables increase and liquidity ratios may look stronger. However, if customers take longer to pay, actual cash inflows remain weak. Rising liquidity ratios without improvement in operating cash flow can thus be seen as a warning sign.

Strong liquidity ratios created by accounting changes can make a company appear safer to lenders. However, if these ratios are not backed by stable cash flows, refinancing risks may increase in the long run. Long-term financial health depends more on cash discipline than accounting presentation.

In the short term, accounting policy changes can make a company look financially stronger by improving liquidity ratios. However, if these improvements are driven mainly by accounting adjustments rather than better working capital management, the company may face cash stress later. This is especially important during economic slowdowns or periods of tight credit.

Over the long term, repeated or aggressive policy changes can weaken financial discipline. Capitalising too many costs or delaying expense recognition may lead to higher asset values and future write-offs. This can hurt long-term stability and increase financial risk. Investors should prefer companies that show consistent liquidity backed by strong cash flows.

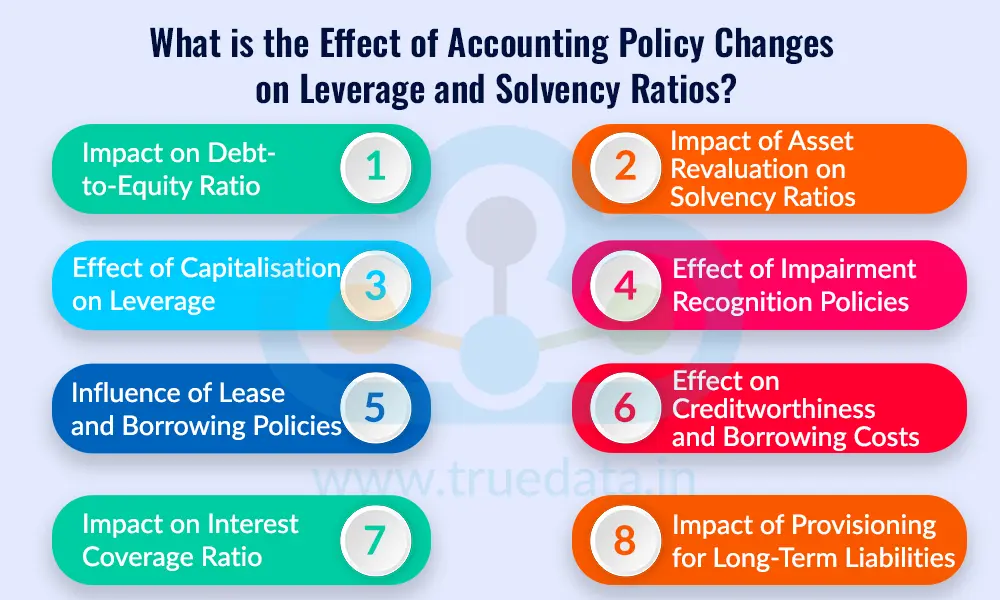

Leverage and solvency ratios help investors understand how much debt a company uses and its ability to meet long-term obligations. Ratios such as the debt-to-equity ratio, interest coverage ratio, and debt-to-assets ratio are closely watched by investors. Changes in accounting policies can influence these ratios significantly, sometimes without any real change in the company’s borrowing or repayment capacity. The impact of accounting policy changes on leverage and solvency ratios is explained below.

Accounting policy changes that affect equity or liabilities can alter the debt-to-equity ratio. For example, changes in asset valuation or recognition of reserves can increase equity, making leverage look lower. Similarly, reclassification of liabilities can temporarily reduce reported debt. Investors should remember that a lower debt-to-equity ratio due to accounting changes does not always mean the company has reduced its financial risk.

When companies capitalise expenses instead of expensing them, total assets increase. This can reduce ratios like debt-to-assets and make the balance sheet look stronger. However, the company still has to bear the same cash obligations. Over time, higher depreciation or amortisation may pressure profits and weaken solvency.

Changes in lease accounting or borrowing cost recognition can bring more liabilities onto the balance sheet. This may increase reported debt and worsen leverage ratios, even though the company’s actual cash outflows remain unchanged. Investors should understand whether such changes reflect stricter accounting rules or real increases in financial risk.

Interest coverage depends on operating profits. Accounting policy changes that increase reported profits, such as lower depreciation or deferred expenses, can improve this ratio. However, interest payments are made in cash, and if cash flows do not improve, the company’s ability to service debt may still be weak.

When companies revalue assets upward due to a change in accounting policy, total assets and reserves increase. This can improve solvency ratios and lower leverage on paper. However, higher asset values do not improve the company’s ability to repay debt, so investors should be cautious while interpreting such improvements.

Changes in impairment policies can delay or accelerate recognition of asset losses. Delaying impairment keeps assets and equity higher, improving solvency ratios temporarily. However, when impairments are finally recognised, solvency ratios may deteriorate sharply, affecting investor confidence.

Improved leverage ratios due to accounting changes may enhance the company’s perceived credit profile. However, lenders often look beyond accounting numbers to cash flows. If policy-driven improvements are not backed by strong cash generation, borrowing costs may rise in the long term.

Adjustments in policies related to long-term provisions, such as employee benefits or warranties, can change long-term liabilities. Lower provisions improve solvency ratios but may understate future obligations. Over time, this can increase financial risk if actual payouts are higher.

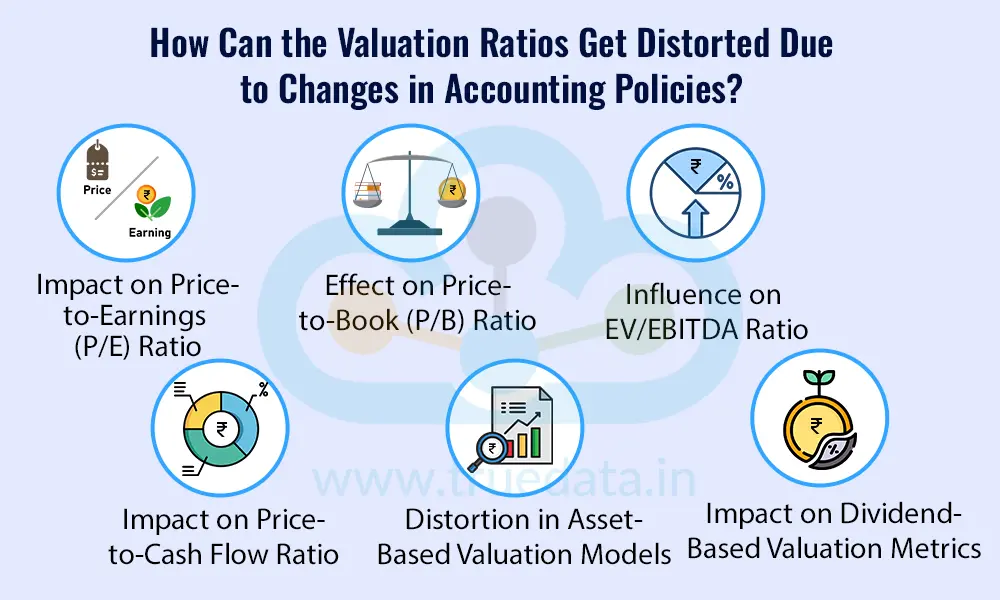

Valuation ratios help investors judge whether a stock is cheap or expensive compared to its earnings, book value, or cash flows. Common ratios used by investors include the price-to-earnings (P/E), price-to-book (P/B), EV/EBITDA, and price-to-cash flow ratios. Changes in accounting policies can distort these ratios, sometimes making a stock look more attractive, or more expensive, than it truly is. The impact of accounting policy changes on valuation ratios is explained below.

The P/E ratio depends directly on reported earnings. Accounting policy changes that boost profits, such as lower depreciation, deferred expenses, or early revenue recognition, reduce the P/E ratio, making the stock appear cheaper. However, if the earnings increase is driven by accounting treatment rather than real business growth, the low P/E can be misleading for investors.

Changes in asset valuation, revaluation reserves, or capitalisation policies affect the book value of equity. When book value increases due to accounting changes, the P/B ratio falls, suggesting better valuation. However, higher book value does not always mean higher earning power, so investors should check whether asset values are realistic and productive.

EV/EBITDA is often seen as less affected by accounting, but it is not immune. Changes in expense recognition or depreciation policies can increase EBITDA, lowering the EV/EBITDA ratio. This can make companies appear undervalued, even though future expenses may still impact cash flows and profitability.

Accounting policy changes usually affect profits more than cash flows. If profits rise due to accounting changes while cash flows remain weak, the price-to-cash flow ratio may signal overvaluation. Investors should always compare profit-based valuation ratios with cash-based ratios for a clearer picture.

Asset revaluation or capitalisation policies can inflate asset values used in valuation models. This can make asset-heavy companies appear undervalued on a P/B basis. Investors should assess whether these assets generate adequate returns rather than focusing on mere numbers.

Accounting policy changes that increase reported profits may support higher dividends, affecting dividend yield ratios. If higher dividends are not backed by cash flows, they may not be sustainable. Investors should, thus, always check the cash flow coverage of dividends.

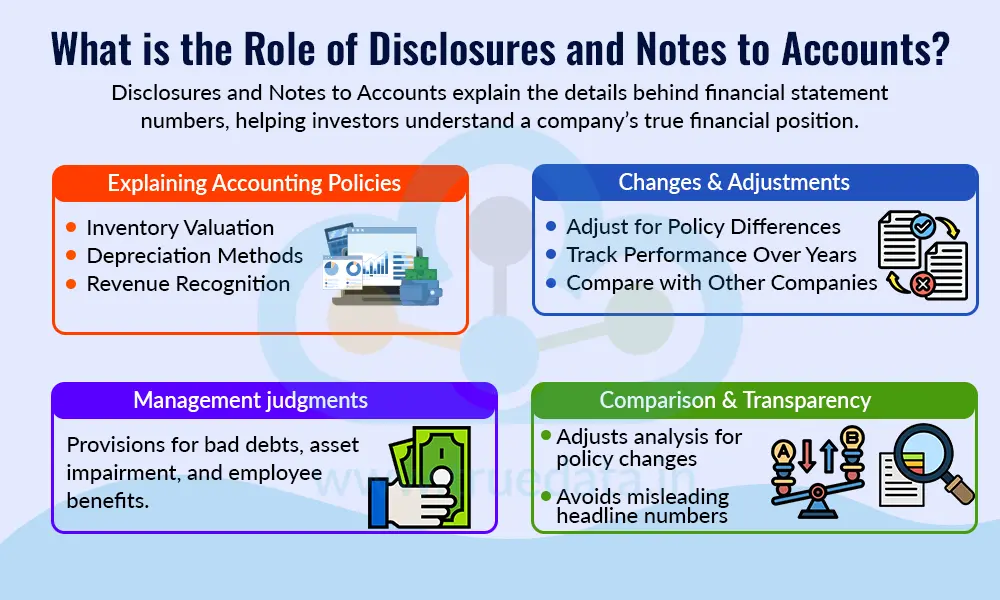

Disclosures and Notes to Accounts are important parts of a financial statement and a company’s annual reports. They highlight important details beyond the mandatory statements and help investors understand the real meaning behind a company’s financial numbers. While the balance sheet, profit and loss statement, and cash flow statement show summary figures, the notes explain how those numbers were arrived at. They describe the accounting policies followed by the company, such as revenue recognition, depreciation methods, inventory valuation, and treatment of expenses. These details are essential to judge whether the reported figures truly reflect business performance.

When a company changes its accounting policies, the impact is usually not obvious from the main financial statements. The notes to accounts clearly explain what has changed, why it has changed, and how it has affected profits, assets, liabilities, and financial ratios. This helps investors understand whether a sudden rise or fall in profits is due to an actual improvement in operations or simply a result of accounting adjustments.

Disclosures, on the other hand, also provide insight into management judgments and estimates, such as provisions for bad debts, asset impairment, and employee benefits. These estimates can significantly affect financial results, especially in uncertain economic conditions. Thus, by reading the notes, investors can assess whether these assumptions are conservative, aggressive, or reasonable.

Most importantly, disclosures help investors compare performance across years and with other companies. Even when accounting policies differ or change over time, the notes allow investors to adjust their analysis and avoid being misled by headline numbers. Hence, regularly reading disclosures and notes to accounts leads to more informed, confident, and disciplined investment decisions.

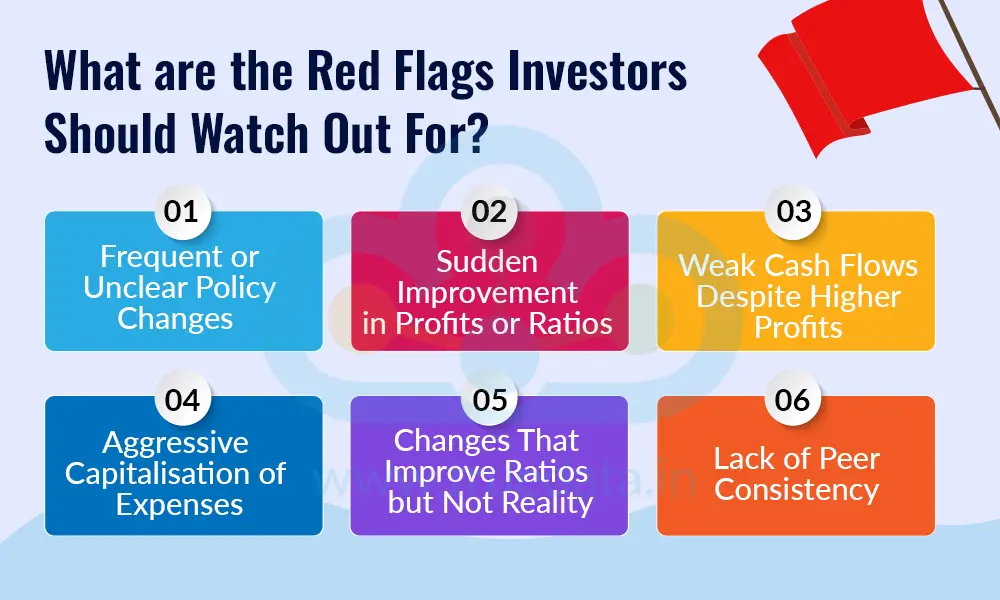

If accounting changes make numbers look too good to be true, they usually are. Investors should always read disclosures carefully and focus on cash flows, consistency, and long-term performance. A few key red flags that can highlight deeper concerns for investors and other stakeholders include,

Frequent or Unclear Policy Changes - When the company changes its accounting policies often without giving clear and convincing reasons, such repeated changes make it hard for investors to compare performance across years.

Sudden Improvement in Profits or Ratios - When profits, margins, or return ratios rise sharply even though sales growth or business conditions have not improved, the improvement comes mainly from accounting adjustments, not from better operations.

Weak Cash Flows Despite Higher Profits - When reported profits increase, but operating cash flows remain flat or negative, it suggests earnings may be driven more by accounting treatment than real cash generation.

Aggressive Capitalisation of Expenses - When more costs are capitalised instead of being expensed, boosting short-term profits, it can understate current expenses and create profit pressure in future years.

Changes That Improve Ratios but Not Reality - Liquidity or leverage ratios improve mainly due to reclassification of items, not actual reduction in debt or liabilities. Such changes affect presentation, not financial strength.

Lack of Peer Consistency - When the company’s accounting policies differ widely from industry peers, making it look better on paper, it reduces the reliability of ratio comparisons.

Changes in accounting policies can significantly influence financial ratios, often making a company’s performance look better or worse without any real change in its business fundamentals. Profitability, liquidity, leverage, and valuation ratios can all get distorted due to differences in revenue recognition, expense treatment, asset valuation, or classification of items. This makes it essential to look beyond headline ratios, carefully read disclosures and notes to accounts, and compare performance over multiple years. By focusing on consistency, cash flows, and the reasons behind accounting changes, investors can gain a clearer and more reliable view of a company’s true financial health.

This article takes you through the detailed impact of accounting policy changes that are often hidden beneath the financial numbers. We hope this article helps you understand the concept of reading financial statements in a deeper light. Let us know your thoughts on the topic or if you need further information on the same and we will address it soon.

Till then, Happy Reading!

Read More: What are moats, and How to Evaluate Moats Using Corporate & Industry Data?

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Analysing the financial statements is the first step in the fundamental analysis...