The P/E ratio is one of the most popular tools to analyse a company’s value. However, many investors overlook that the P/E ratio is not just useful at the company level. It also plays a powerful role at the industry level, helping you understand broader trends, sector strength, and hidden investment opportunities. So what exactly is the industry P/E ratio, and what can it tell you about market conditions and potential returns? Dive into this blog to explore these insights and sharpen your investment strategy with a clearer, bigger-picture view.

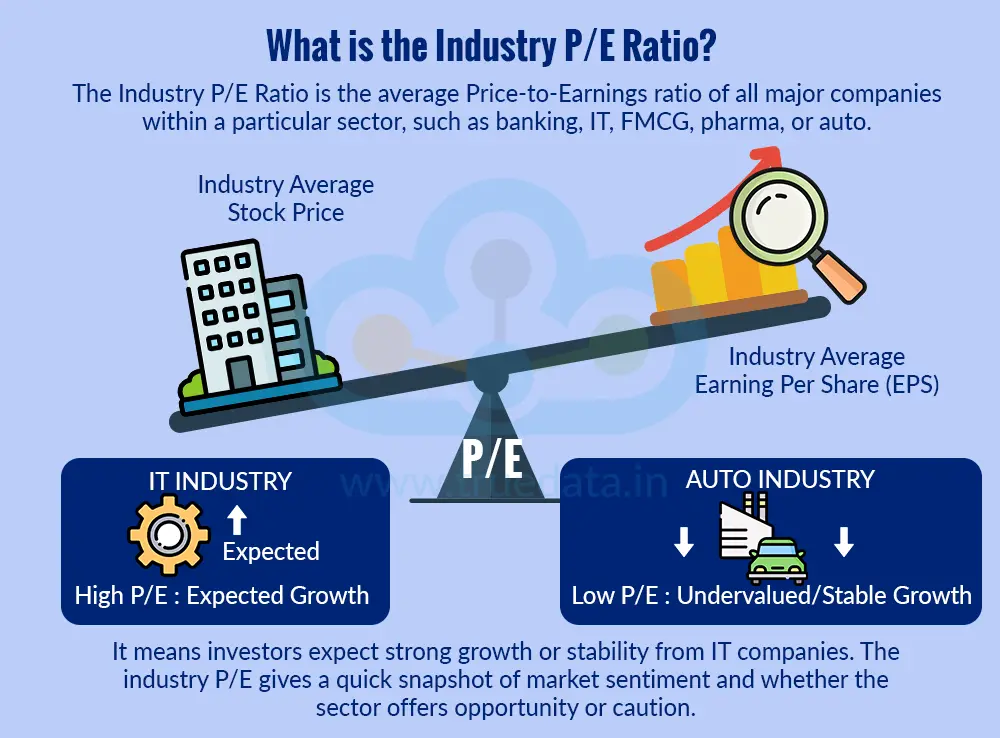

The Industry P/E Ratio is the average Price-to-Earnings ratio of all major companies within a particular sector, such as banking, IT, FMCG, pharma, or auto. It shows how much investors, on average, are willing to pay for Re. 1 of earnings in that industry. In simple words, it helps investors understand whether a sector is valued high, low, or fairly compared to its profit levels. For example, if the IT industry has a higher P/E than the auto industry, it means investors expect more growth, stability, or future potential from IT companies. Thus, the industry P/E acts like a quick snapshot of how the market views that sector’s future and whether it might offer attractive investment opportunities or signal caution.

The Industry P/E Ratio can be calculated in two ways, i.e., using the simple average and the market-cap-weighted average method. These methods and their calculations are explained below.

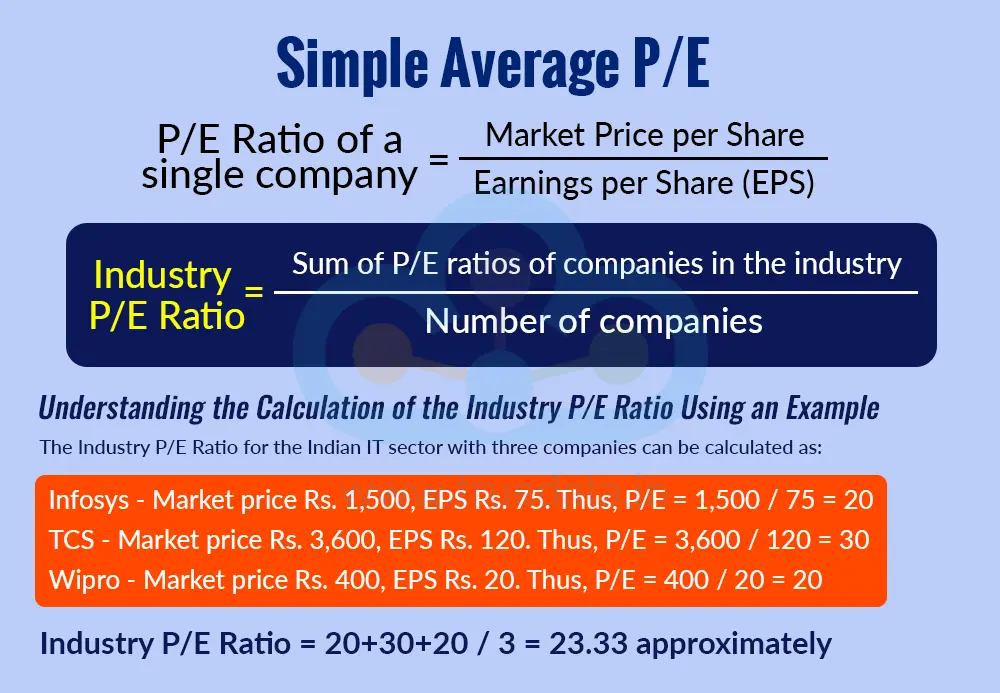

The calculation of the industry P/E ratio can be done by considering the P/E ratios of all the companies in the industry. This approach is straightforward and allows investors to simply gather the P/E ratios of all the individual companies in the sector and consider their average for the industry's P/E ratio. It is a simple and easy-to-calculate approach and helps investors judge whether a stock is expensive or cheap compared to its peers.

The formula to calculate the industry P/E ratio using the simple average of all the companies in the industry or the sector is explained below.

P/E Ratio of a single company = Market Price per Share / Earnings per Share (EPS)

Industry P/E Ratio = Sum of P/E ratios of companies in the industry / Number of companies

Understanding the Calculation of the Industry P/E Ratio Using an Example

Consider an investor who wants to calculate the Industry P/E Ratio for the Indian IT sector. If the industry has three companies, the industry P/E ratio is calculated as follows,

Infosys - Market price Rs. 1,500, EPS Rs. 75. Thus, P/E = 1,500 / 75 = 20

TCS - Market price Rs. 3,600, EPS Rs. 120. Thus, P/E = 3,600 / 120 = 30

Wipro - Market price Rs. 400, EPS Rs. 20. Thus, P/E = 400 / 20 = 20

Industry P/E Ratio = 20+30+20 / 3 = 23.33 approximately

Interpretation -

The IT Industry PE ratio is 23.3. Thus, investors can use this to compare whether a particular IT stock is overvalued (P/E much higher than 23.3) or undervalued (P/E much lower than 23.3) compared to the industry average.

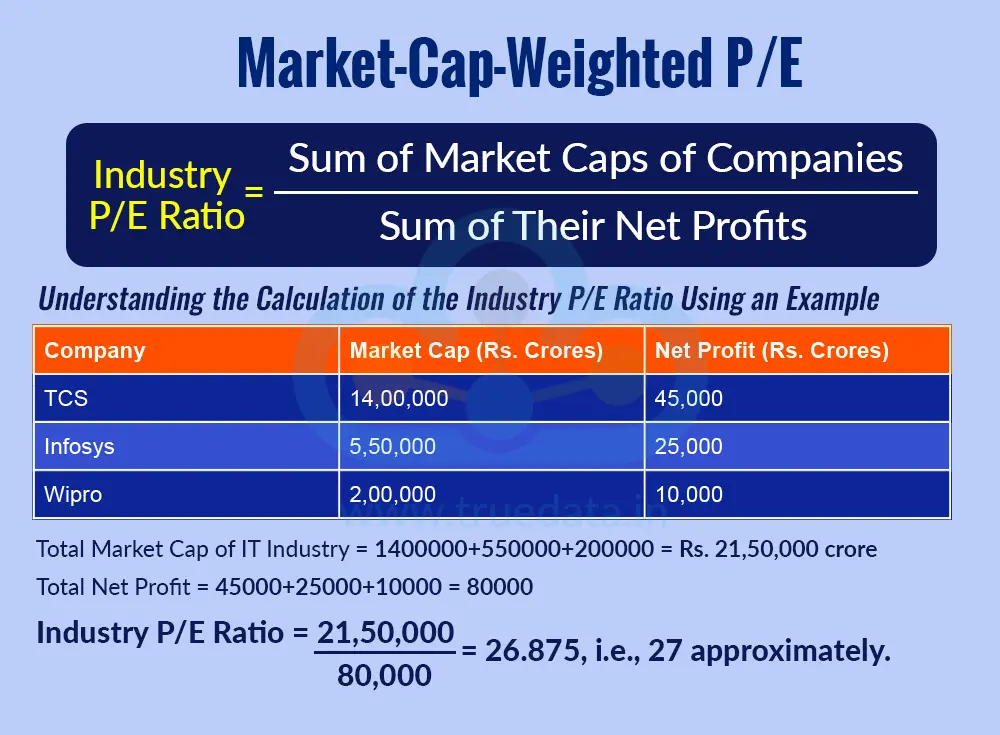

The Industry P/E Ratio can also be calculated by taking the market-cap-weighted average of the P/E ratios of all major companies in that industry. This version is considered to be more accurate and is also used by exchanges and index providers to calculate the industry P/E Ratio. This gives a more accurate picture as larger companies have a bigger impact on the sector than smaller ones.

The formula to calculate the Industry P/E ratio = Sum of Market Caps of Companies / Sum of Their Net Profits

This formula considers calculating the P/E ratio of the entire industry as one combined company.

Understanding the Calculation of the Industry P/E Ratio Using an Example

Consider an investor who wants to calculate the Industry P/E Ratio for the Indian IT sector. If the industry has three companies, consider the following data to calculate the industry P/E ratio using the Market-Cap-Weighted P/E method.

Total Market Cap of IT Industry = 1400000+550000+200000 = Rs. 21,50,000 crore

Total Net Profit = 45000+25000+10000 = 80000

Industry P/E Ratio = Sum of Market Caps of Companies / Sum of Their Net Profits

Industry P/E Ratio = 21,50,000 / 80,000 = 26.875, i.e., 27 approximately.

Interpretation -

This means investors are willing to pay Rs. 27 for every Re. 1 of earnings generated by the IT sector.

A market-cap-weighted Industry P/E Ratio gives more weight to bigger companies in the sector, so it reflects the valuation of the industry leaders, not just a simple average of all companies. Comparing a company’s P/E with this weighted industry P/E helps in checking whether the company is valued higher or lower than the major players in the sector. If a company’s P/E is higher than the weighted industry P/E, it may mean the market expects stronger growth from that company, or it may be overpriced. If the company’s P/E is lower, it could be undervalued or facing weaker growth. This helps investors judge whether a stock is expensive or cheap relative to the sector’s biggest and most influential companies, giving a more realistic comparison than a simple average.

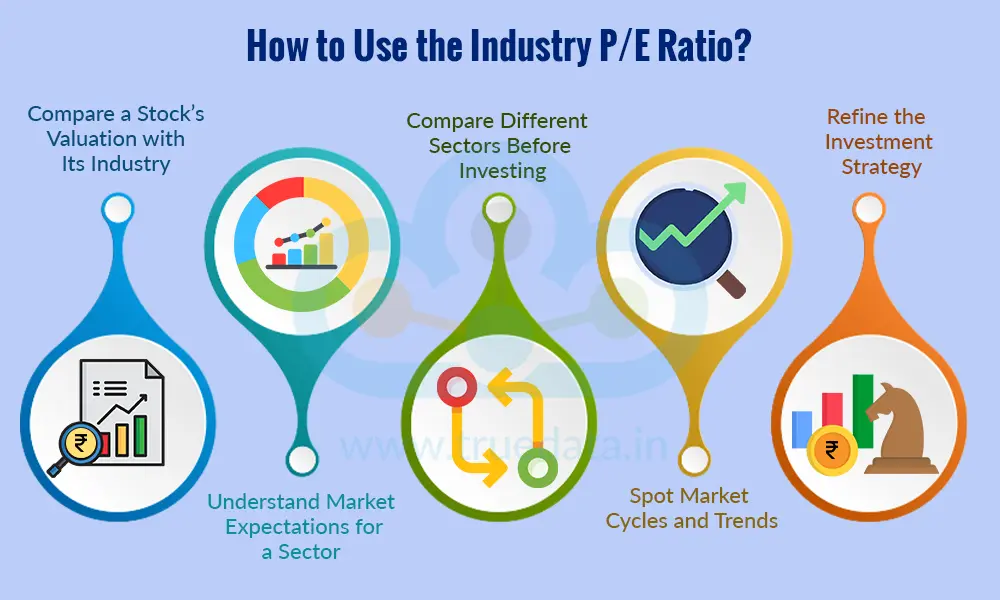

The industry P/E ratio is used to gain deep insights about an industry’s investment opportunities and the relative performance of the companies in the industry. The use of the industry P/E ratio is explained hereunder.

The Industry P/E Ratio helps investors understand whether a particular stock is priced fairly compared to others in the same sector. If a stock’s P/E is much higher than the industry P/E, it may be overvalued, meaning investors are paying a premium for its future growth. If it is much lower, it may be undervalued, signalling a possible buying opportunity. This comparison is one of the easiest ways to judge if a stock is expensive or cheap relative to its peers.

A high Industry P/E shows that the market expects strong growth, innovation, or high stability from that sector in the coming years. For example, sectors like IT or FMCG often have higher P/E ratios because investors believe these sectors will grow steadily. On the other hand, sectors like metals or PSU Banks may have lower P/Es due to cyclicality or slower growth. This helps investors understand where the market is placing its trust and where caution may be needed.

The Industry P/E allows investors to compare sectors with each other and decide where to invest. For example, if the Banking sector has an Industry P/E of 12 while FMCG has 40, it means FMCG is valued much higher due to stronger perceived stability and growth. This gives a clear picture of which sectors the market finds attractive and which ones may offer value opportunities. It is, thus, a helpful tool when building a diversified portfolio.

Industry P/E ratios change over time. If a sector’s P/E suddenly rises, it may signal increasing demand or improving future prospects. A sudden fall might indicate market stress, regulatory risk, or declining earnings. By tracking the Industry P/E regularly, investors can pick up early signs of sector rotation, i.e., where money moves from one sector to another, helping them stay ahead in their investment decisions.

For long-term investors, using the Industry P/E ratio can help identify which sectors to accumulate and which to avoid. If a sector has a very high P/E, it may be better to wait for a correction before entering. If a sector has a low P/E but strong fundamentals, it may be a good time to explore opportunities. The Industry P/E acts as a guide to refine investment strategy and invest with more confidence.

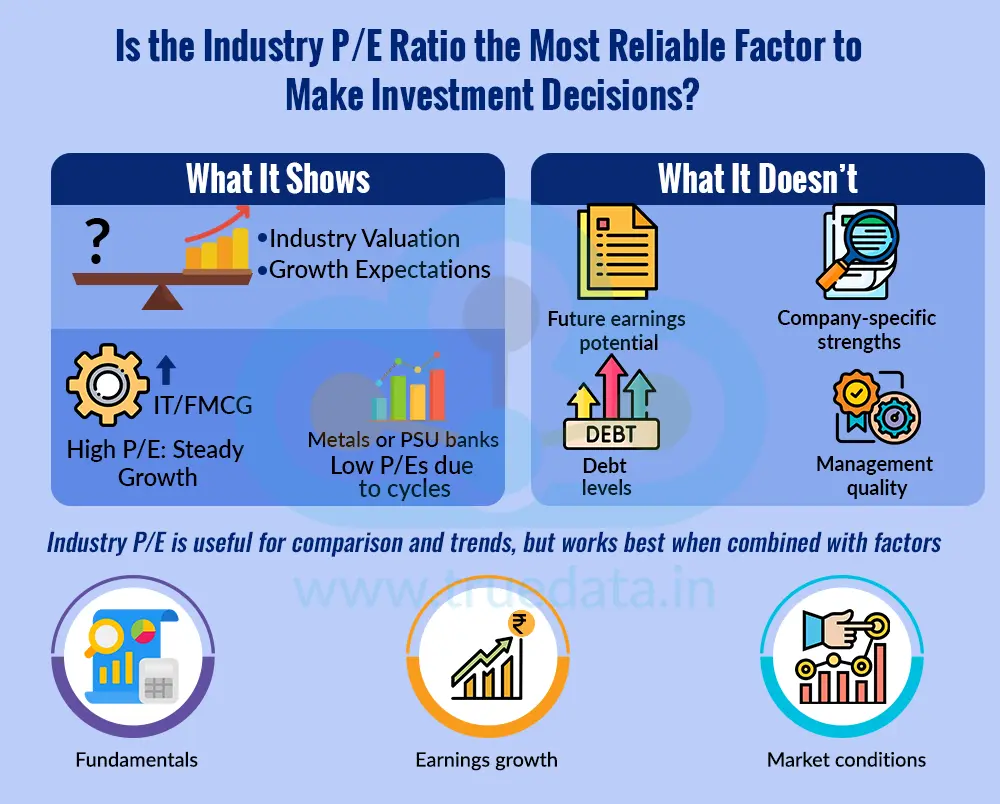

The Industry P/E Ratio is a useful tool, but it should not be the only factor to rely on when making investment decisions. It helps in understanding how the market values an entire sector and whether investors expect strong or weak growth in that industry. However, P/E alone cannot tell everything. It does not show future earnings potential, company-specific strengths, debt levels, management quality, or economic conditions that may affect the sector. In India, sectors like IT or FMCG may naturally have higher P/Es because they grow steadily, while sectors like metals or PSU banks often have low P/Es due to cycles. So, the Industry P/E Ratio is helpful for comparison and trend analysis, but it works best when combined with other factors like fundamentals, earnings growth, and overall market conditions.

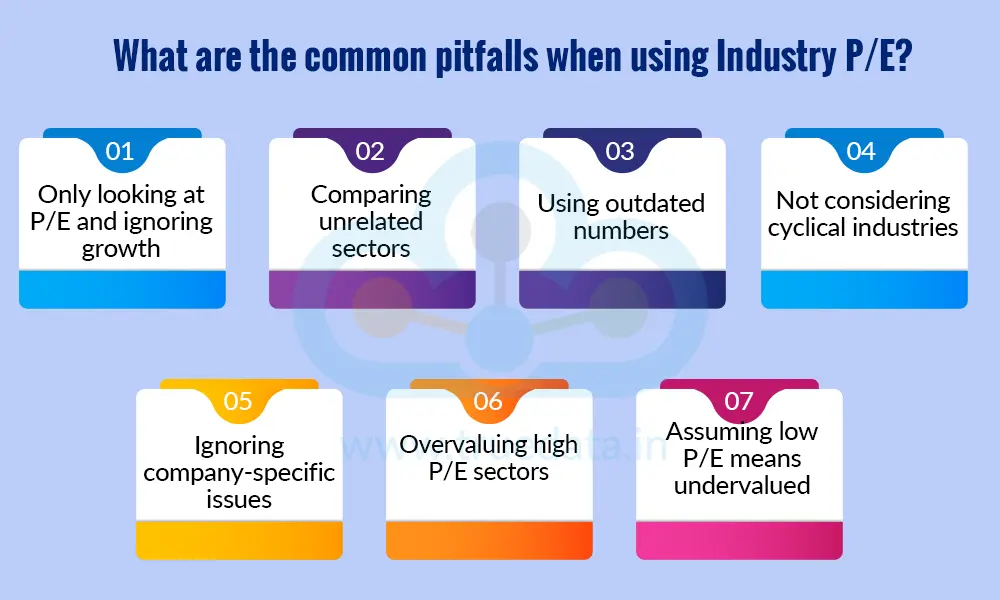

The industry P/E ratio is an important metric of fundamental analysis. However, there are some limitations to using the same. These limitations include,

Only looking at P/E and ignoring growth - A low P/E may look cheap, but the sector might have weak or falling earnings. Always check growth trends.

Comparing unrelated sectors - Different sectors have very different business models; hence, comparing their P/Es directly can mislead investors.

Using outdated numbers - Industry P/E changes with market prices and earnings. Using old data can lead to wrong conclusions.

Not considering cyclical industries - Sectors like metals, autos, and real estate move in cycles. Their P/E can look low at the top of a cycle and high at the bottom, i.e., the opposite of what is expected.

Ignoring company-specific issues - A stock may have a high or low P/E for reasons unique to that company, not the industry. Thus, it is not wise to assume all companies follow the same pattern.

Overvaluing high P/E sectors - An industry with high PE does not imply that it is always a good investment. It could be overpriced.

Assuming low P/E means undervalued - Low P/E may signal risk, poor demand, or weak future earnings, not necessarily a bargain.

The Industry P/E Ratio is a helpful tool that gives investors a quick view of how the market values an entire sector and what kind of growth or stability investors expect from it. It helps you compare stocks within the same industry, understand whether a sector is considered expensive or cheap, and spot overall trends in the market. However, it is not perfect and can change with market cycles, differ across sectors, and may not reflect company-specific strengths or risks. So, while the Industry P/E Ratio is a useful guide for Indian investors, it should always be used along with other checks like earnings growth, fundamentals, and long-term sector outlook. This balanced approach leads to smarter and more confident investment decisions.

This article takes a step further in the fundamental analysis of a company with a focus on analysing the key industry ratios. Let us know your thoughts on the topic or if you need any further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: ROE vs ROCE - Which Matters More in Evaluating Companies?

Thestock market never stands still, and prices swing constantly with every new h...

Every investor knows that the stepping stones to a good investment in thestock m...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...