When we talk about public sector companies, the first thought is loss-making companies with dilapidated offices and a pile of files that take years to push. This has been the general view of PSUs in India for decades. However, a few major PSUs have had a significant turnaround of their financials and stock prices over the past few years and have also seen green in their balance sheet after some stringent efforts and pulling up their strings. These PSUs are now perceived to be the ‘Maharatna’s’ of India and some of the top performing organisations giving employment to millions across the country. Here is a list of the top PSUs in India that also present attractive investment opportunities for investors

The top 10 PSUs (Public Sector Undertakings) in India in terms of their market capitalisation and their key details are highlighted below.

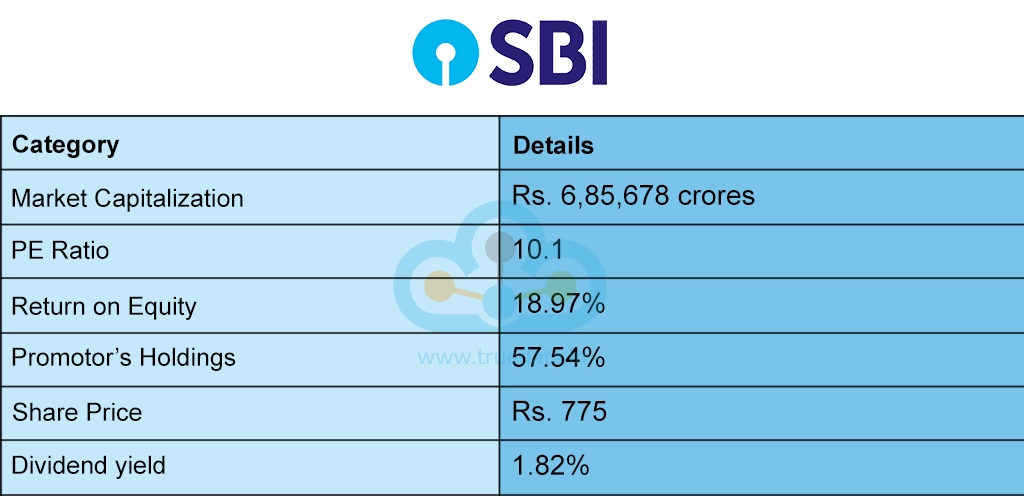

State Bank of India (SBI), a Fortune 500 company, is India's largest and oldest public sector bank, with over 200 years of history. Headquartered in Mumbai, SBI has an extensive network of 22,219 branches and around 62,617 ATMs across the country, along with nearly 71,968 business correspondent outlets. The bank holds a significant market share, commanding 22.84% in deposits and 19.69% in loans, while serving a vast customer base of approximately 450 million people.

The key details of the company include,

The trailing returns of SBI as of 12th September 2024 are,

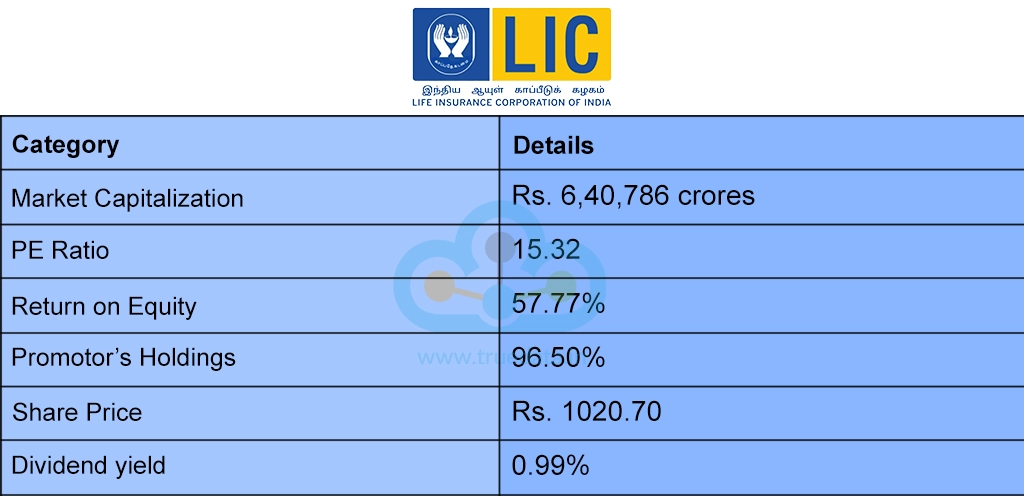

Life Insurance Corporation of India (LIC), established in 1956 through the merger and nationalisation of 245 private insurers, is the country's largest life insurance provider. As a government-owned entity, LIC holds a dominant market position, with over 66.2% share in new business premiums and a 61.6% share in overall premiums. It offers a variety of insurance products, including unit-linked, term, health, and pension plans. Globally, it ranks fifth in life insurance by gross written premiums and holds significant investments, including 4% of NSE's market capitalisation and more government bonds than the RBI.

The key details of the company include,

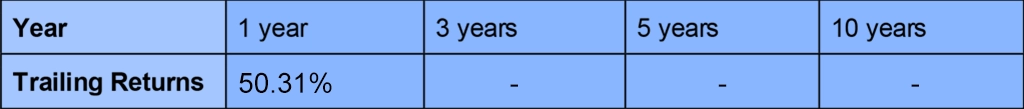

The trailing returns of LIC as of 12th September 2024 are,

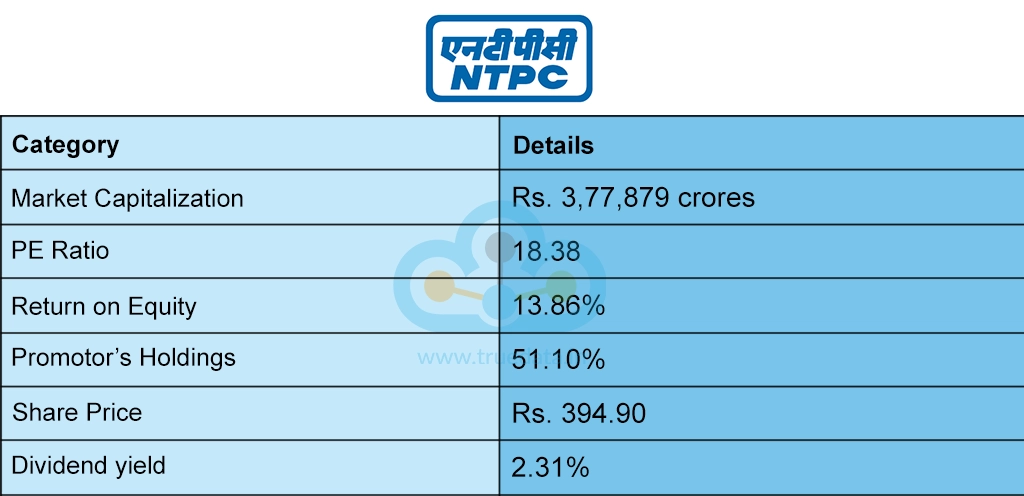

NTPC Ltd, India's largest power generation company, operates 89 plants with a total installed capacity of 75.958 GW as of March 2024, representing about 17.37% of the country's total capacity. In addition to power generation, the company engages in consultancy, project management, energy trading, and coal mining. NTPC aims to reach a total generation capacity of 130 GW by 2032, with 17.4 GW under construction and 39.5 GW under feasibility study. A key focus is expanding renewable energy, targeting 60 GW by 2032. To this end, NTPC Green Energy formed a joint venture with Indian Oil to develop 650 MW of renewable energy projects.

The key details of the company include,

The trailing returns of NTPC as of 12th September 2024 are,

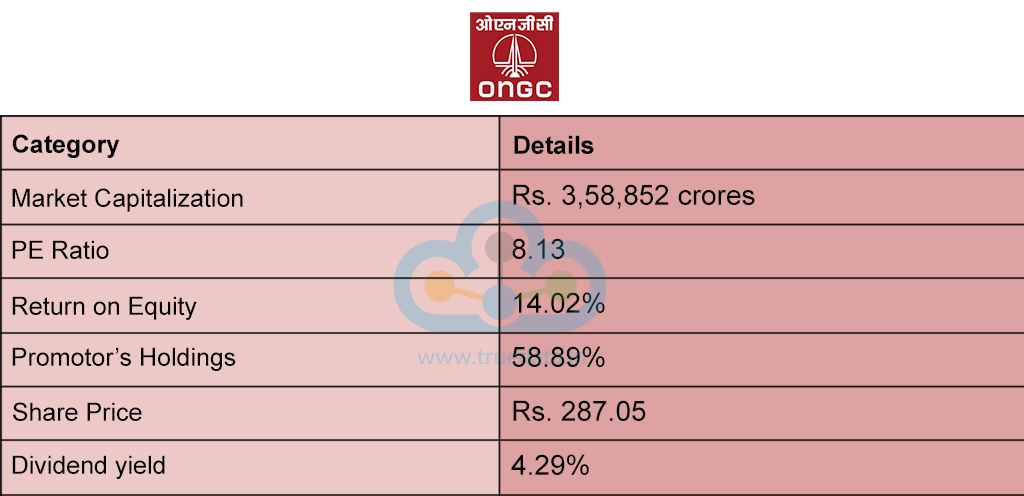

ONGC, a Maharatna PSU, is India’s largest crude oil and natural gas producer, contributing around 71% of the country's domestic output. With over 60 years of exploration, ONGC has discovered 8 of India’s 9 producing basins. Its subsidiary, ONGC Videsh, handles international operations across 37 projects in 17 countries. ONGC also holds a 5% stake in the India Gas Exchange, the nation's first automated gas trading platform. The company plans to invest Rs. 31,000 crore in oil and gas exploration by FY25 and aims to collaborate with international firms to develop its oil fields.

The key details of this company are,

The trailing returns of ONGC as of 12th September 2024 are,

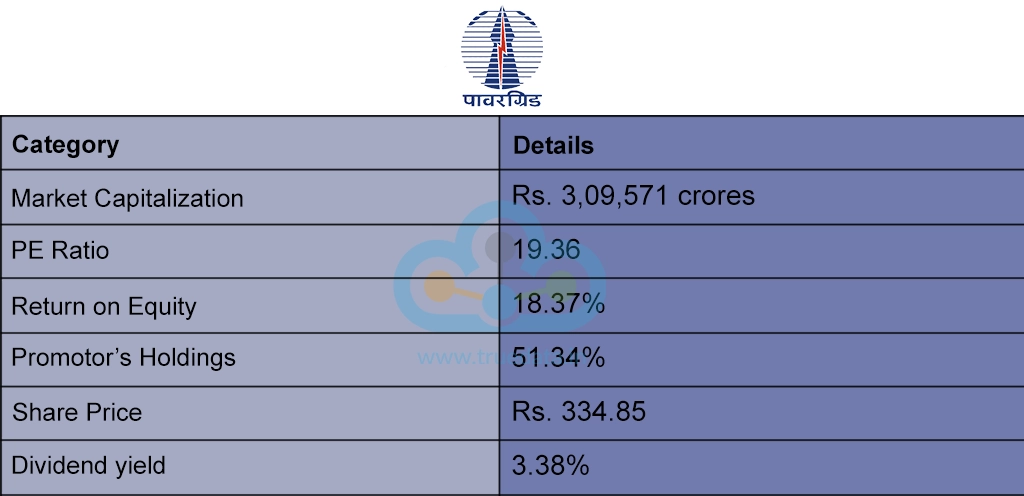

Power Grid Corporation of India Limited (PGCIL), a Maharatna CPSU under the Ministry of Power, is the largest electric power transmission company in India, with the government holding a 51.34% stake as of March 2021. Established in 1989, PGCIL manages extra-high voltage AC and HVDC transmission lines, transferring power from surplus regions to load centers across the country. It owns 85% of India’s interstate transmission network and carries 45% of the nation’s generated power. In addition to its core transmission business, PGCIL supports e-mobility by adopting electric vehicles and setting up fast EV charging stations, with 16 public charging stations operational across several cities.

The key details of this company are,

The trailing returns of PGCIL as of 12th September 2024 are,

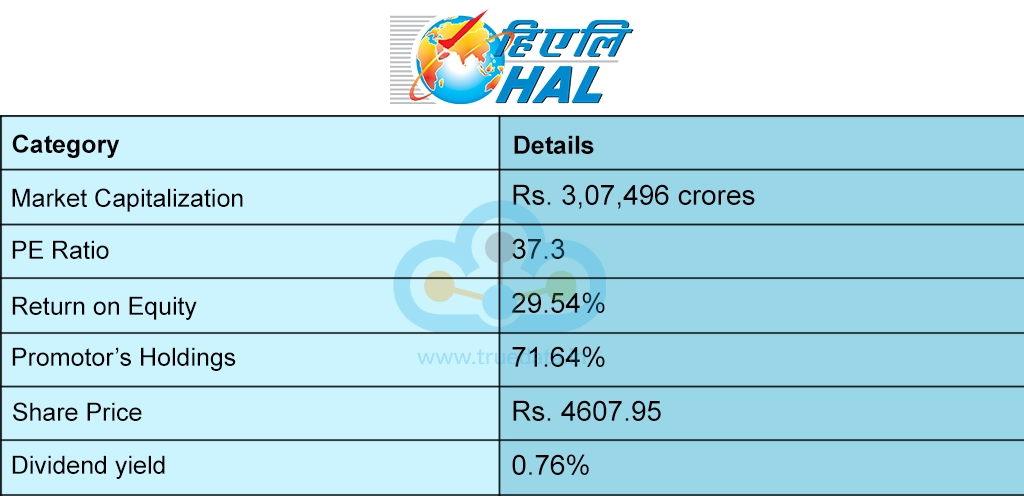

Hindustan Aeronautics Limited (HAL) is India's leading manufacturer and service provider for aircraft and helicopters, playing a key role in the country’s defence sector. As the only Indian company specialising in aircraft production and maintenance, HAL had an order book of Rs. 94,000 crore in FY24, with further major orders expected in FY25. The company signed a MoU with Safran to establish a joint venture for helicopter engine development and support. Additionally, HAL partnered with Israel Aerospace Industries (IAI) in March 2022 to convert civil passenger aircraft into multi-mission tanker aircraft. With strong financials, HAL fully repaid external debt and maintained a cash balance of Rs. 14,000 crore as of August 2022.

The key details of the company are,

The trailing returns of HAL as of 12th September 2024 are,

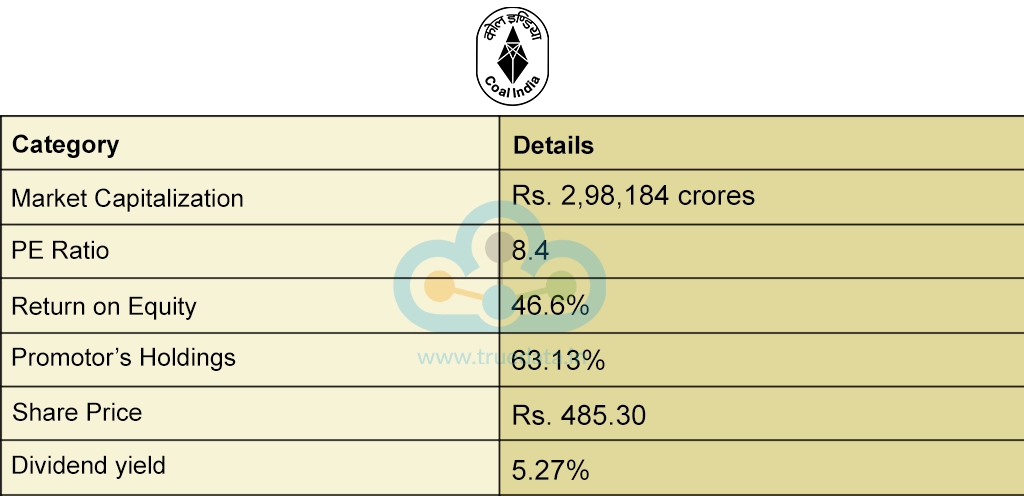

Coal India Ltd (CIL), established in 1973 as Coal Mines Authority Ltd, is the world's largest coal producer and a major corporate employer, operating under the Ministry of Coal, Government of India. Headquartered in Kolkata, CIL manages coal mining and washeries across eight Indian states, serving key sectors like power and steel, as well as cement, fertilizers, and brick kilns. CIL aims to achieve net-zero emissions by FY 25-26 by setting up 5 GW of renewable energy projects, including 3 GW of solar power. It is actively participating in national solar tenders and has signed an MoU with Rajasthan Rajya Vidyut Utpadan Nigam Ltd for a solar power project in Rajasthan.

The key details of the company are,

The trailing returns of Coal India as of 12th September 2024 are,

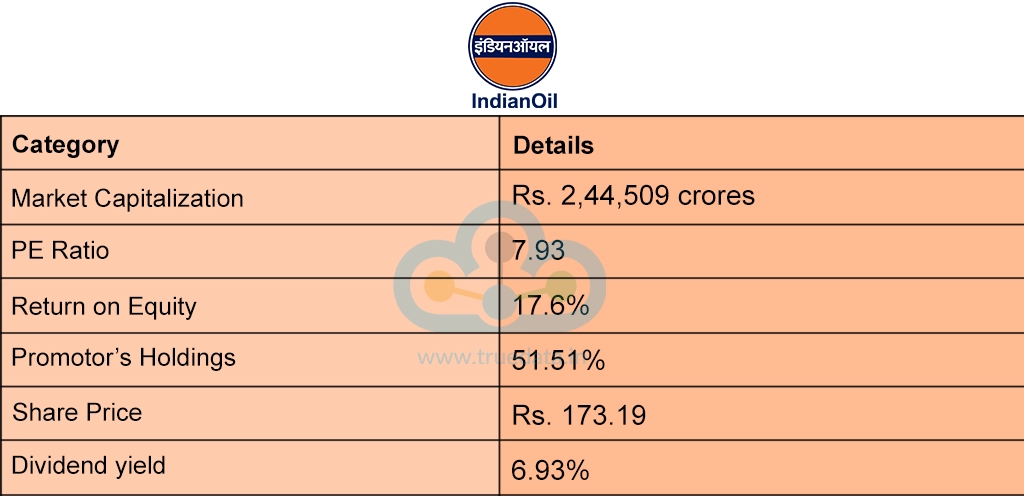

Indian Oil Corporation Ltd, a Maharatna company under the Government of India, plays a pivotal role across the entire hydrocarbon sector, covering refining, pipeline transportation, petroleum product marketing, R&D, exploration, natural gas, and petrochemicals. It leads India's oil refining and petroleum marketing sectors, operating 11 refineries with a combined capacity of 80.60 MMTPA, accounting for 32% of the country's refining capacity. Additionally, the company dominates market infrastructure, managing 42% of retail outlets, 51% of LPG distributorships, and 48% of aviation fuel stations across India.

The key details of the company are,

The trailing returns of IOCL as of 12th September 2024 are,

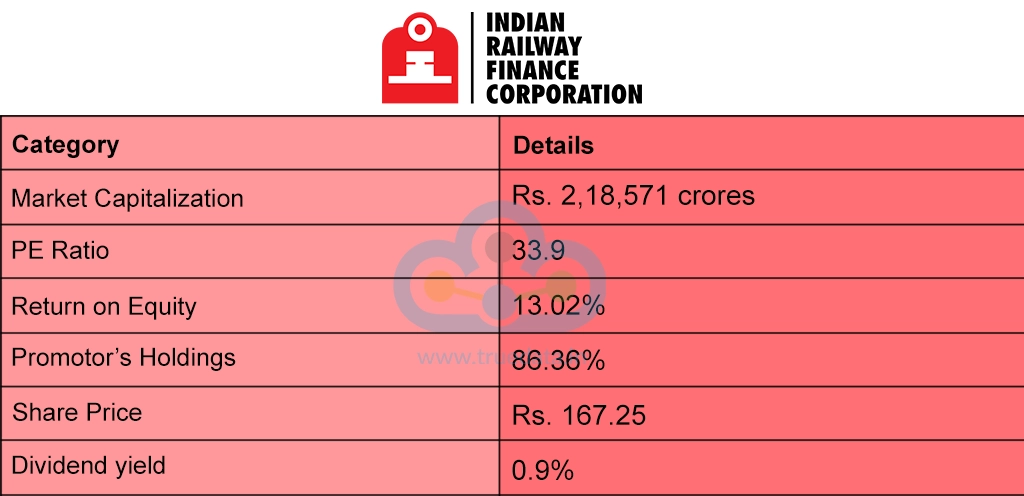

Indian Railway Finance Corporation (IRFC), established in 1986, acts as the financial arm of Indian Railways, raising funds from domestic and international capital markets to support the acquisition and development of railway assets, which are leased back to Indian Railways. Operating as a Mini Ratna I and Schedule 'A' Public Sector Enterprise under the Ministry of Railways, IRFC is also classified as a Systemically Important Non-Deposit Taking NBFC and an Infrastructure Finance Company.

The key details of the company are,

The trailing returns of IRFC as of 12th September 2024 are,

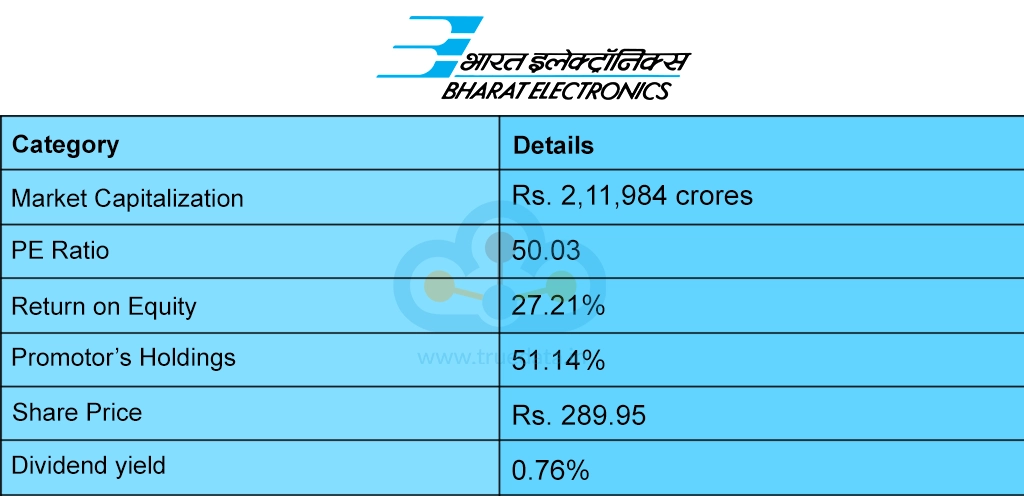

Founded in 1954, Bharat Electronics Ltd (BEL) primarily manufactures and supplies electronic systems for India's defense sector, with a limited footprint in the civilian market. Operating under the Ministry of Defence, BEL provides a wide range of products including radar and fire control systems, missile systems, communication, electronic warfare, avionics, and naval systems, among others. The company has expanded into solar power projects and established a new Micro SBU. BEL is also collaborating with ISRO to produce multi-junction solar cells for space use and has been selected as a partner for satellite assembly, integration, and testing.

The key details of the company are,

The trailing returns of BEL as of 12th September 2024 are,

PSU stocks refer to shares of Public Sector Undertakings (PSUs), which are companies owned or controlled by the government. In India, PSUs are major players in various sectors such as banking, oil and gas, power, and infrastructure stocks. These companies are established to carry out public services and contribute to the country's economic development. Examples include the State Bank of India, Oil and Natural Gas Corporation (ONGC), and Power Grid Corporation of India. PSU stocks are traded on stock exchanges like NSE and BSE, and they often attract investors because of their stable performance and regular dividends. Investing in PSU stocks can be a way to gain exposure to key industries that are crucial for India's growth, with the added security of government backing.

Investing in PSUs is often part of the long-term investment strategy and is preferred by risk-averse investors on account of their regular and stable dividend policies as well as the opportunity for wealth creation in the long run. However, there not all PSUs present profitable investment opportunities despite these benefits. Here are the top factors to be considered while investing in PSUs to ensure that they align with the financial goals of investors.

Financial Health - Check the company’s financial statements for indicators like revenue, profit margins, and debt levels. Healthy PSUs typically have strong financials with consistent profits and manageable debt, ensuring stability and potential for steady returns.

Government Support - Since PSUs are government-owned, consider the level of government support and its impact on the company's operations. High government backing often means financial stability and the potential for a bailout in tough times.

Dividend Yields - PSUs are known for paying regular dividends. Check the dividend history and yield of the PSU stock, as this can be a significant source of income for investors, particularly those seeking stable returns.

Market Position and Competitive Edge - Evaluate the company’s position in its industry and its competitive advantages. PSUs in sectors like oil, gas, and power often have a strong market presence due to their scale and government backing, but it is important to consider how well they are positioned against private sector competitors.

Government Policies and Reforms - Be aware of any recent or upcoming government policies that could affect PSU companies. Policies related to privatisation, subsidies, or sector-specific reforms can significantly impact stock performance. Staying updated on political and economic news is crucial.

Market Conditions - Consider the overall market conditions and economic outlook. PSUs may be influenced by broader economic trends, so understanding the market environment can help in making informed investment decisions.

PSUs are considered to be significantly important in a country like India where the government is still at the forefront of major capital-intensive projects as well as the top employment generator and preferred employer for a vast majority of the masses. Therefore, the PSUs must focus on their financial health and stability to achieve their goals of contributing to the wealth-building and economic empowerment of the nation.

This article talks about the major PSUs in India and their significant contribution to key sectors in the country. Do they account for being a preferred investment choice in your portfolio? How do you view them? Let us know your thoughts or if you need information on such key companies or sectors and we will take them up in our coming blogs.

Till Then Happy Reading!

Read More: Best Defence Sector Stocks in India

Introduction For the longest time, investment in stock markets was thought to b...

Process of Selecting Top Stocks for Investing The first step towards picking a ...

Like starting any new venture, the first step in stock investments is knowing t...