Solvency and leverage ratios play a vital role in understanding a company’s financial stability and long-term growth potential. In our earlier blog, we explored solvency ratios in detail. Continuing this deep dive into key financial ratios, we now turn our focus to the debt-to-equity ratio. Often seen as a quick snapshot of a company’s capital structure, this ratio helps assess how a business balances debt and equity, and how resilient it may be during both growth phases and challenging times. Read on to learn everything you need to know about the debt-to-equity ratio and why it matters to both investors and companies.

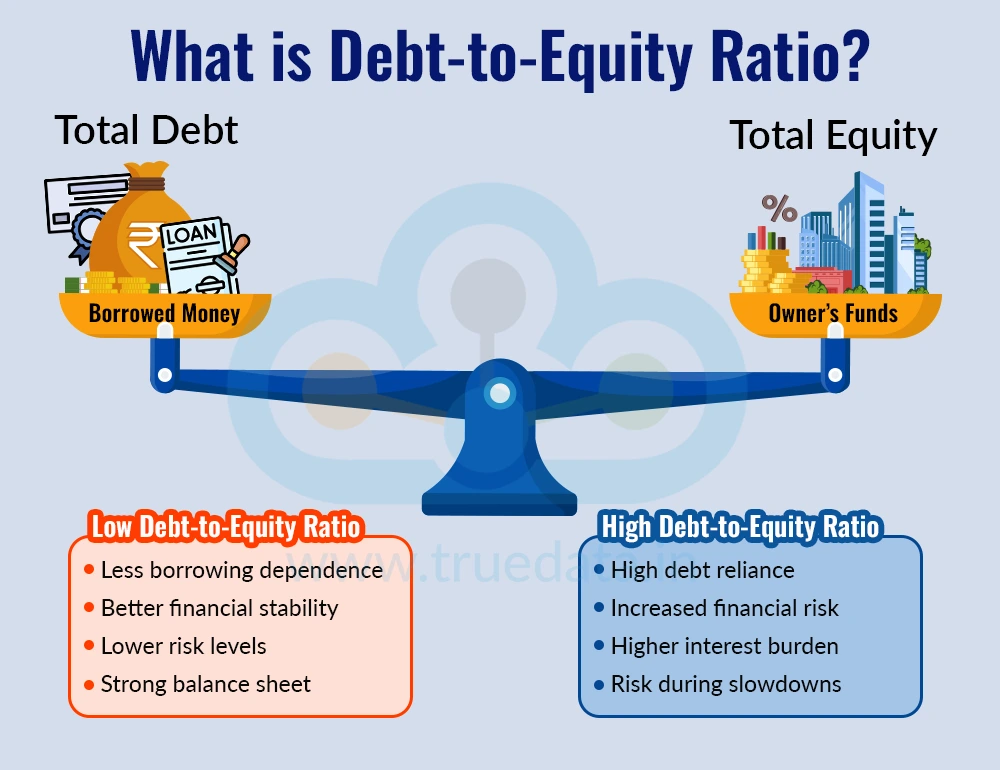

The debt-to-equity ratio is a simple financial measure that shows how much debt a company has compared to the money invested by shareholders or owners of the company. In other words, it tells investors how a company is funding its business, whether it relies more on borrowed money (like loans, bonds, or debentures) or on its own funds (share capital and reserves). The ratio is calculated by dividing a company’s total debt by its total equity. A lower debt-to-equity ratio usually means the company is less dependent on borrowings and may be financially more stable, while a higher ratio indicates higher reliance on debt, which can increase risk, especially during economic slowdowns. This ratio is important for investors as it helps assess a company’s financial strength, its ability to handle interest payments, and how resilient it may be in changing interest rates or business conditions.

The debt-to-equity ratio is calculated using two important elements, i.e., the debt of the company and its equity. However, there are a few variations to calculating the debt-to-equity ratio depending on how ‘debt’ is defined and the outcome needed for evaluation.

The various methods to calculate the debt-to-equity ratio are explained below.

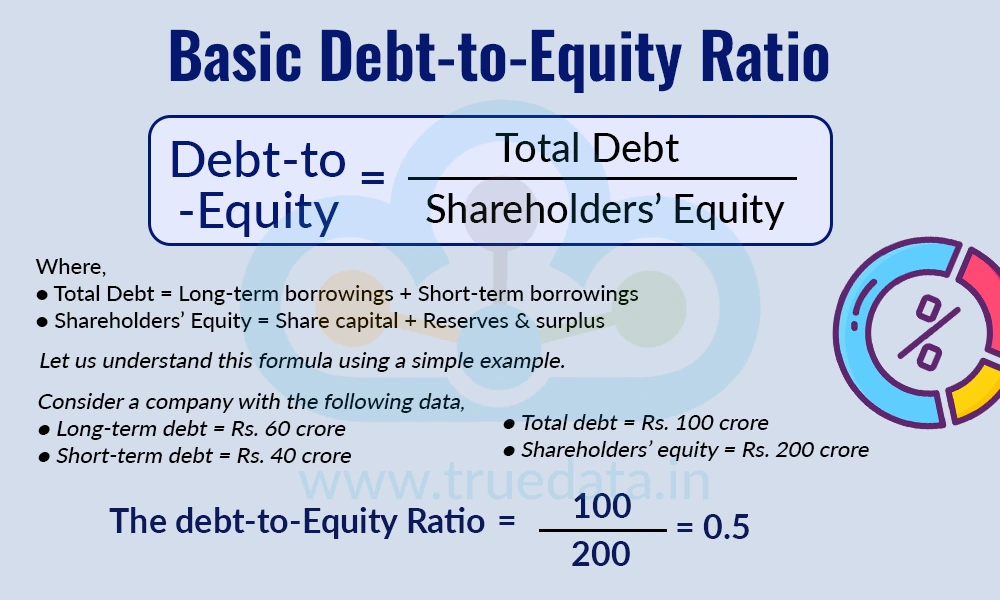

The standard or the basic debt-to-equity ratio considers the total debt and the total equity of the company to give the overall picture of the company’s leverage. This is also the standard formula used in practical cases and to compare this ratio across companies or even industries. Hence, this formula is also used by most financial portals and

The formula to calculate the basic debt-to-equity ratio is,

Debt-to-Equity = Total Debt / Shareholders’ Equity

Where,

Total Debt = Long-term borrowings + Short-term borrowings

Shareholders’ Equity = Share capital + Reserves & surplus

Let us understand this formula using a simple example.

Consider a company with the following data,

Long-term debt = Rs. 60 crore

Short-term debt = Rs. 40 crore

Total debt = Rs. 100 crore

Shareholders’ equity = Rs. 200 crore

The debt-to-Equity Ratio = 100 / 200 = 0.5

Thus, the company has Rs. 0.5 of debt for every rupee of shareholders’ money.

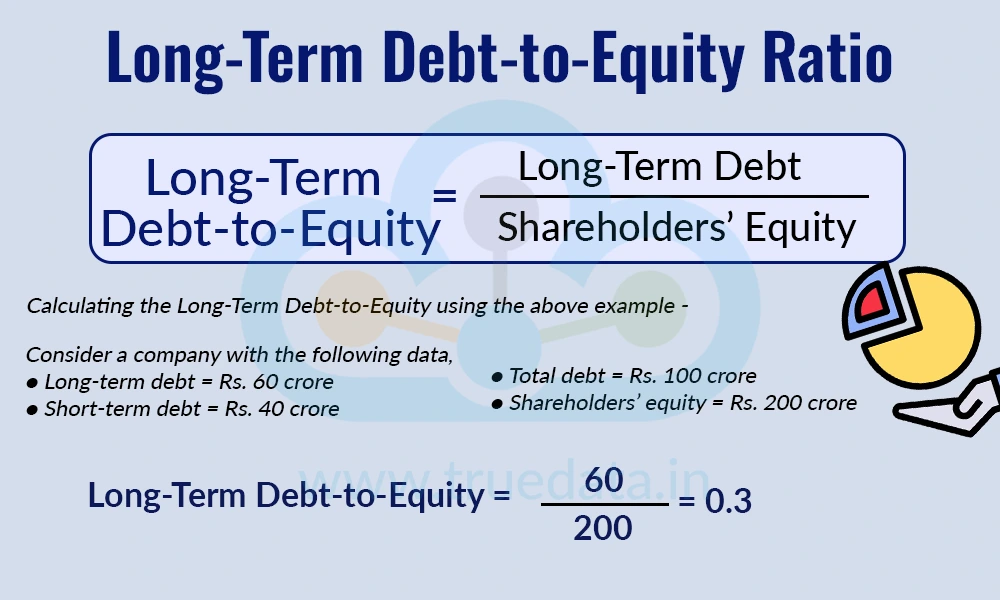

This version focuses only on long-term borrowings, ignoring short-term working capital loans.

The formula to calculate the debt-to-equity ratio in this case is,

Long-Term Debt-to-Equity = Long-Term Debt / Shareholders’ Equity

Calculating the Long-Term Debt-to-Equity using the above example -

Long-Term Debt-to-Equity = Long-Term Debt / Shareholders’ Equity

Long-Term Debt-to-Equity = 60/200 = 0.3

Thus, the company uses Rs. 0.30 of long-term debt for every Re. 1 of equity.

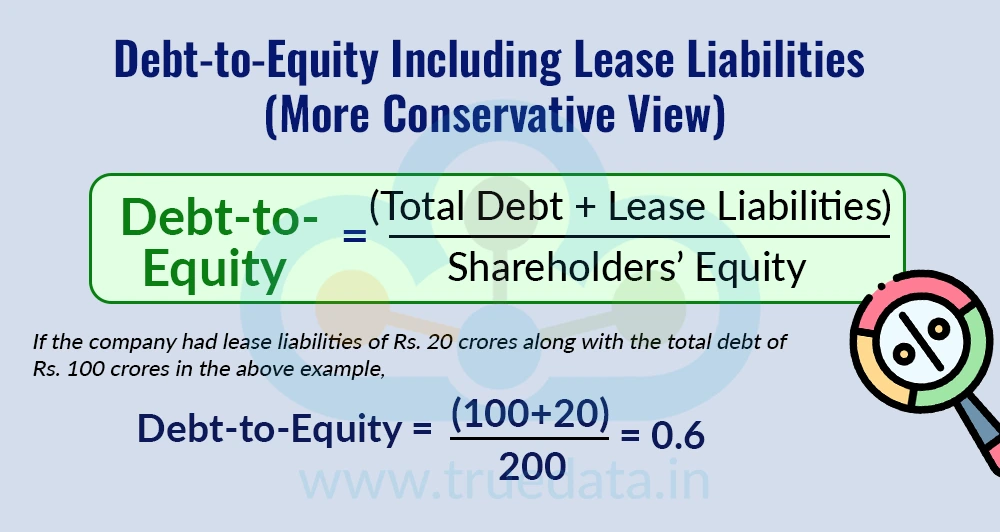

While this is less common, some investors include lease obligations (like long-term rental commitments) as debt to get a stricter view of leverage.

The formula to calculate the debt-to-equity ratio in this case is,

Debt-to-Equity = (Total Debt + Lease Liabilities) / Shareholders’ Equity

If the company had lease liabilities of Rs. 20 crores along with the total debt of Rs. 100 crores in the above example, the calculation of the debt-to-equity ratio in this case will be,

Debt-to-Equity = (Total Debt + Lease Liabilities) / Shareholders’ Equity

Debt-to-Equity = (100+20) / 200 = 0.6

Thus, after including leases, the company has Rs. 0.60 of obligations for every Re. 1 of equity.

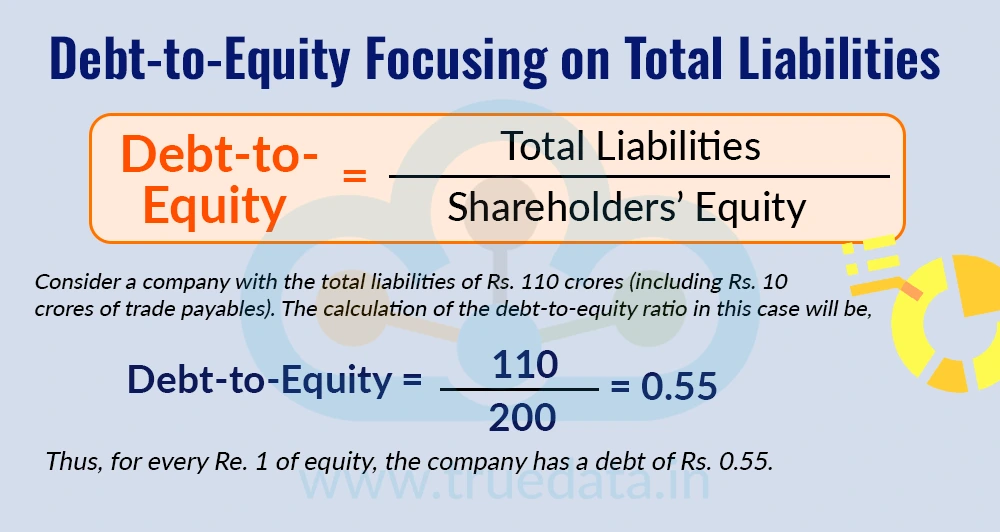

This formula focuses on the total liabilities of the company, i.e., including the trade payables, provisions, borrowings and unearned revenue.

The formula to calculate the debt-to-equity ratio in this case is,

Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

Consider a company with the total liabilities of Rs. 110 crores (including Rs. 10 crores of trade payables). The calculation of the debt-to-equity ratio in this case will be,

Debt-to-Equity Ratio = Total Liabilities / Shareholder’s Equity

Debt-to-Equity Ratio = 110 / 200 = 0.55

Thus, for every Re. 1 of equity, the company has a debt of Rs. 0.55

Understanding the Debt-to-Equity Ratio

A D/E ratio less than 1 indicates the company is primarily financed through equity. This indicates lower financial risk and better stability. A D/E ratio between 1-1.5 is considered to be a healthy balance of debt and equity. It shows that the company is leveraging debt for growth, but is not overexposed. Finally, the D/E ratio of more than 1 suggests heavy reliance on debt. This is Acceptable in capital-intensive sectors like infrastructure, power, or telecom, but risky elsewhere

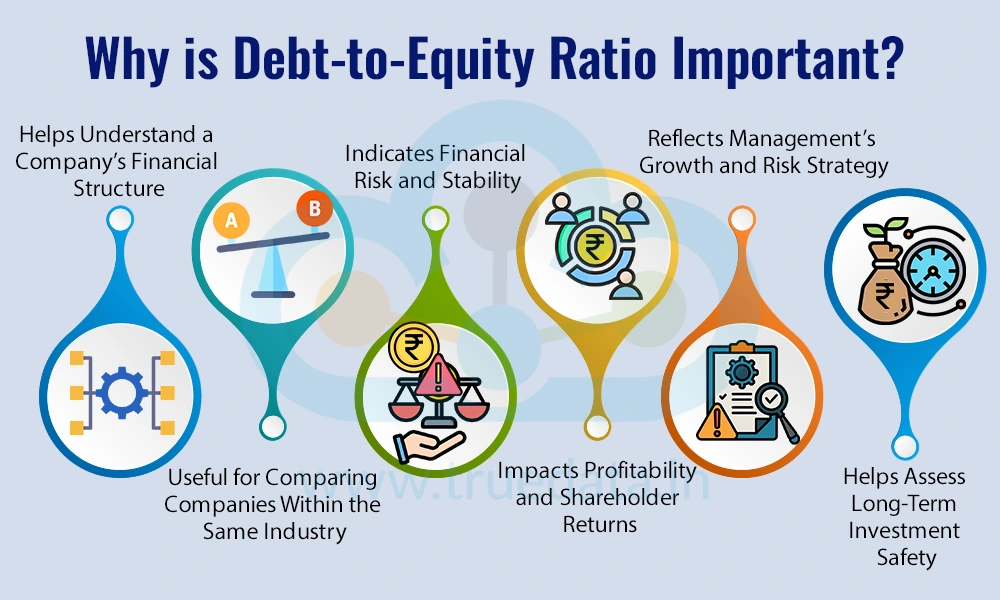

The debt-to-equity ratio is an important metric of a company’s fundamental analysis and can help investors and management understand the key indicator of financial risk. The importance of the debt-to-equity ratio is explained below.

The debt-to-equity ratio clearly shows how a company is funding its business, through borrowed money or shareholders’ funds. A company with a lower ratio relies more on its own capital, which generally means lower financial risk. On the other hand, a higher ratio indicates greater dependence on debt. This helps investors understand whether a company’s growth is being driven by strong internal resources or by heavy borrowing.

The debt-to-equity ratio allows investors to compare companies operating in the same sector. Different industries in India have different capital needs. Sectors like banks, infrastructure, power, and telecom companies typically operate with higher debt, while IT or FMCG companies usually have lower debt levels. By comparing this ratio among peers, investors can identify companies that are managing their borrowings more efficiently.

This ratio is a key indicator of financial risk. Companies with high debt-to-equity ratios must regularly pay interest and repay loans, regardless of how their business is performing. During economic slowdowns, rising interest rates, or weak demand, such companies may face stress. A lower ratio usually signals better financial stability and a stronger ability to survive difficult business cycles, which is especially relevant in volatile market conditions.

Debt can boost returns when business conditions are good, as borrowed funds are used to grow profits. However, excessive debt can reduce profits due to high interest costs. The debt-to-equity ratio helps investors assess whether leverage is helping improve returns or putting pressure on earnings, dividends, and future growth prospects.

A company’s debt-to-equity ratio also reveals management’s approach to growth and risk. Some companies use debt wisely to expand operations and increase returns, while others may over-borrow and expose themselves to unnecessary risk. A balanced ratio often indicates disciplined financial management and thoughtful capital allocation, which is a positive sign for long-term investors.

This ratio is a useful tool to judge whether a company can sustain growth without financial strain, which is a focal point, especially for long-term investors. A reasonable debt-to-equity ratio suggests that the company can handle its obligations while continuing to invest in its business. When used along with other ratios like interest coverage and cash flow analysis, it provides a clearer picture of a company’s overall financial health.

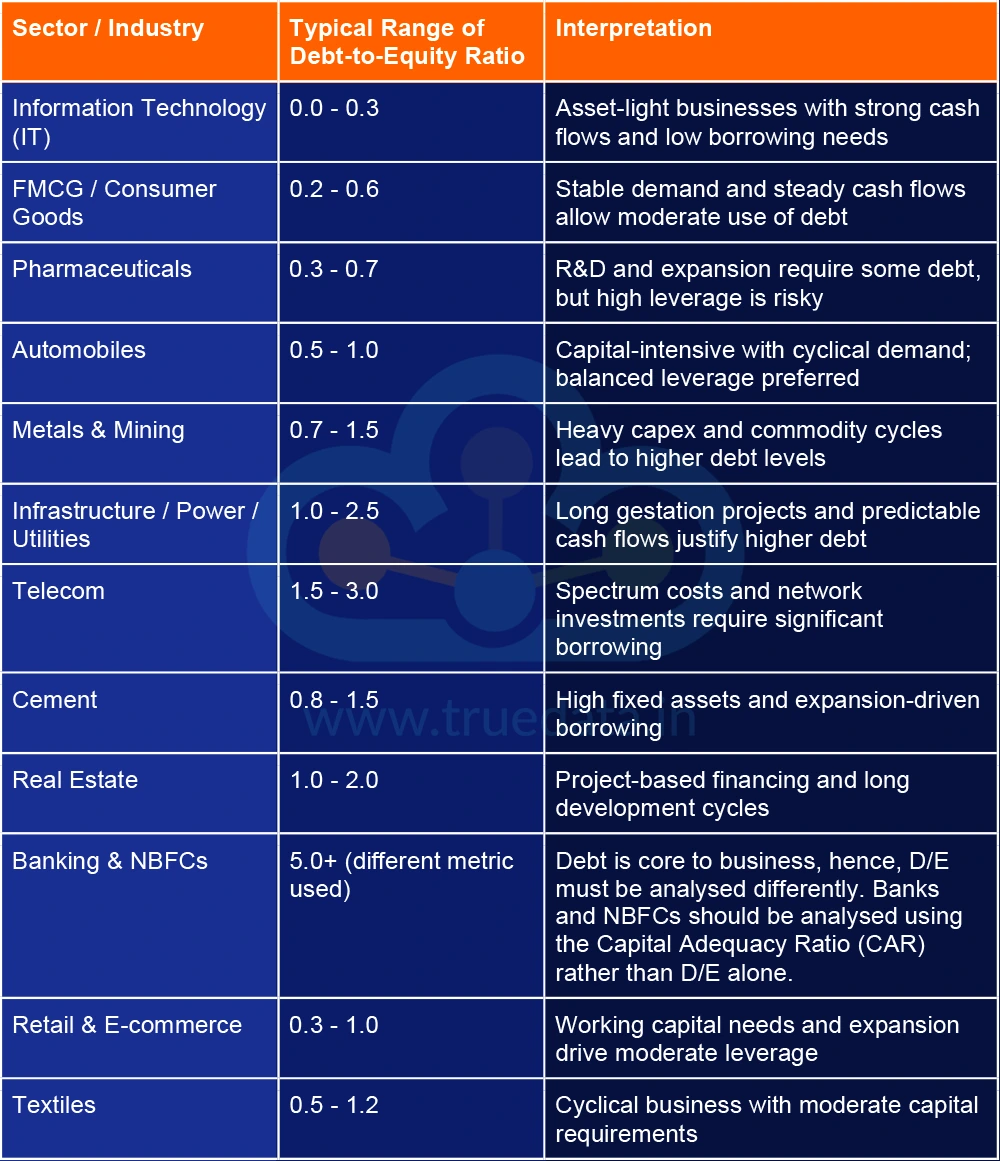

While there is no standard debt-to-equity ratio, as a thumb rule, the debt-to-equity ratio of 1 is considered to be healthy. However, the ideal debt-to-equity ratio varies across sectors or industries. Some examples of the debt-to-equity ratio are tabled below.

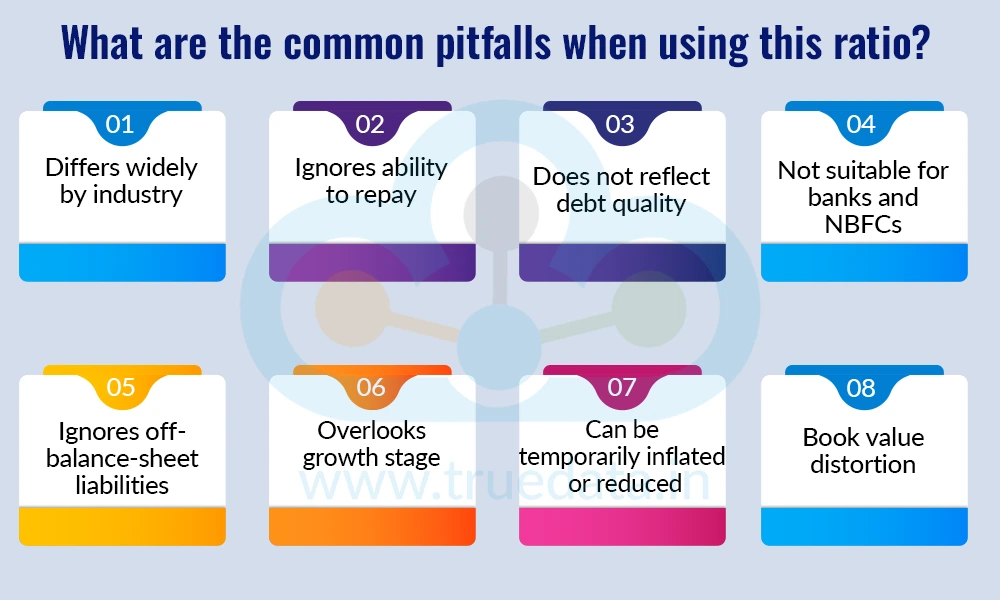

The debt-to-equity ratio, while providing insights into the financial risk of the company, does come with certain limitations. These limitations include,

Differs widely by industry - A high ratio may be normal for infrastructure or telecom companies, but risky for IT or FMCG firms, so cross-industry comparison can be misleading.

Ignores ability to repay - The ratio shows how much debt exists, but not whether the company generates enough cash to service that debt.

Does not reflect debt quality - Short-term, high-interest loans and long-term, low-cost debt are treated the same, even though their risks differ.

Not suitable for banks and NBFCs - Debt is a core part of their business, so this ratio alone is not meaningful for financial companies.

Ignores off-balance-sheet liabilities - Lease obligations or guarantees may not be fully captured, understating true leverage.

Overlooks growth stage - Young or fast-growing companies may carry higher debt, which is not always a negative if growth is strong.

Can be temporarily inflated or reduced - One-time borrowings, repayments, or equity infusions can distort the ratio for a single year.

Book value distortion - Equity is based on book value, which may not reflect the company’s true market value or asset strength.

The debt-to-equity ratio is a useful and easy-to-understand measure that shows how a company balances debt and shareholders’ funds in its capital structure. It helps investors judge financial risk, stability, and how resilient a company may be during different business cycles. While a lower ratio generally signals lower risk, a higher ratio can be normal in capital-intensive industries, making industry-wise comparison essential.

This article is the extension of our broad discussion on solvency ratios. Watch this space for a detailed breakdown of similar solvency ratios and more. Also, let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: What is the Industry PE Ratio and How to Calculate It?

Thestock market never stands still, and prices swing constantly with every new h...

When analysing a company, ratios act like signposts that guide us toward its tru...

One of the facts of stock market investing is having fundamental analysis as mor...