Valuation plays a central role in almost every investment decision, whether you are a retail investor building a long-term portfolio or a large stakeholder assessing business worth. Valuation ratios, therefore, form one of the strongest pillars of fundamental analysis. While we have already covered the basics of valuation ratios in our earlier blog, it is time to go a step deeper, starting with the PEG Ratio, i.e., the price/earnings to growth ratio. Check out this blog to learn about the PEG Ratio in detail and its core differences from the traditional PE Ratio.

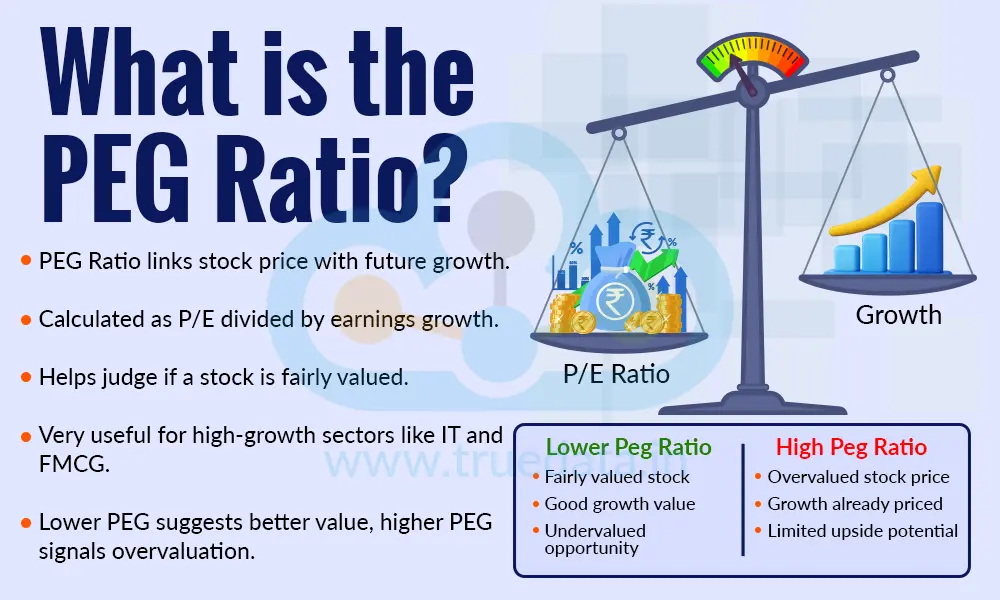

The PEG Ratio, or Price/Earnings to Growth Ratio, is a valuation metric that helps investors understand whether a stock’s price is reasonable when its future growth is taken into account. It builds on the popular P/E ratio by dividing the P/E ratio by the company’s expected earnings growth rate. In simple terms, while the PE Ratio tells you how expensive a stock looks today, the PEG Ratio shows whether that price is justified by how fast the company is expected to grow.

This is especially useful in analysing growing companies, such as those in IT, FMCG, or emerging sectors, where earnings growth plays a big role in long-term returns. A lower PEG Ratio generally suggests the stock may be fairly valued or undervalued compared to its growth potential, while a higher PEG Ratio can indicate that the stock price may already be too optimistic about future growth.

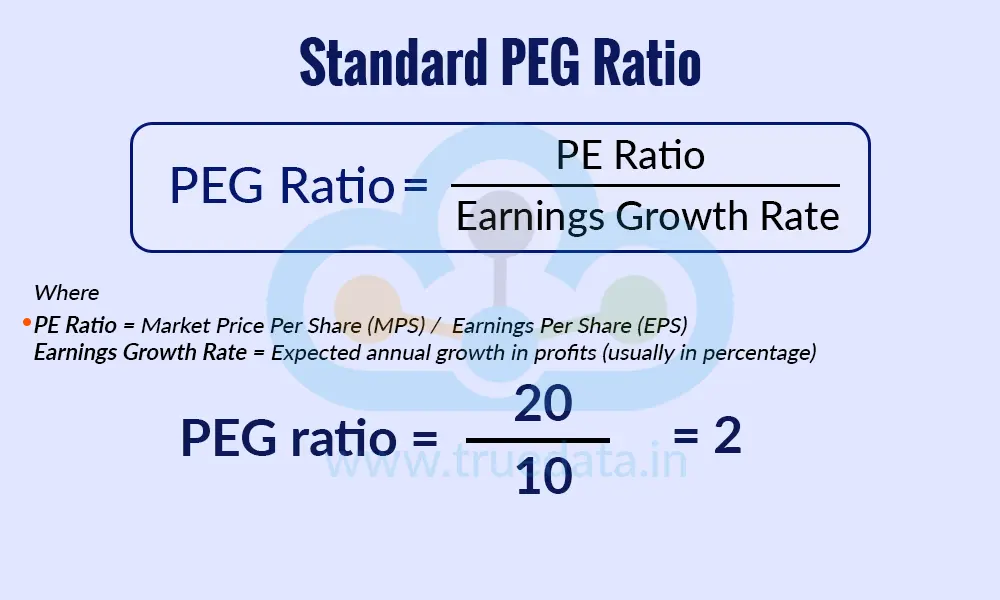

The PEG ratio is calculated by dividing a company’s Price-to-Earnings (P/E) ratio by its earnings growth rate. It adjusts the P/E ratio for growth, making it a more balanced valuation metric. The formulas to calculate the PEG Ratio are explained below.

PEG Ratio = PE Ratio / Earnings Growth Rate

Where,

PE Ratio = Market Price Per Share (MPS) / Earnings Per Share (EPS)

Earnings Growth Rate = Expected annual growth in profits (usually in percentage)

Understanding the Calculation of the Standard PEG Ratio with an Example

Consider company X Ltd. with a P/E ratio of 20 and the expected growth rate of 10% per annum. The PEG ratio for Company X Ltd. is calculated as follows.

PEG Ratio = PE Ratio / Earnings Growth Rate

PEG ratio = 20/10 = 2

Thus, A PEG Ratio of 2 suggests the stock may be expensive compared to its growth. Generally, a PEG close to 1 is considered fairly valued.

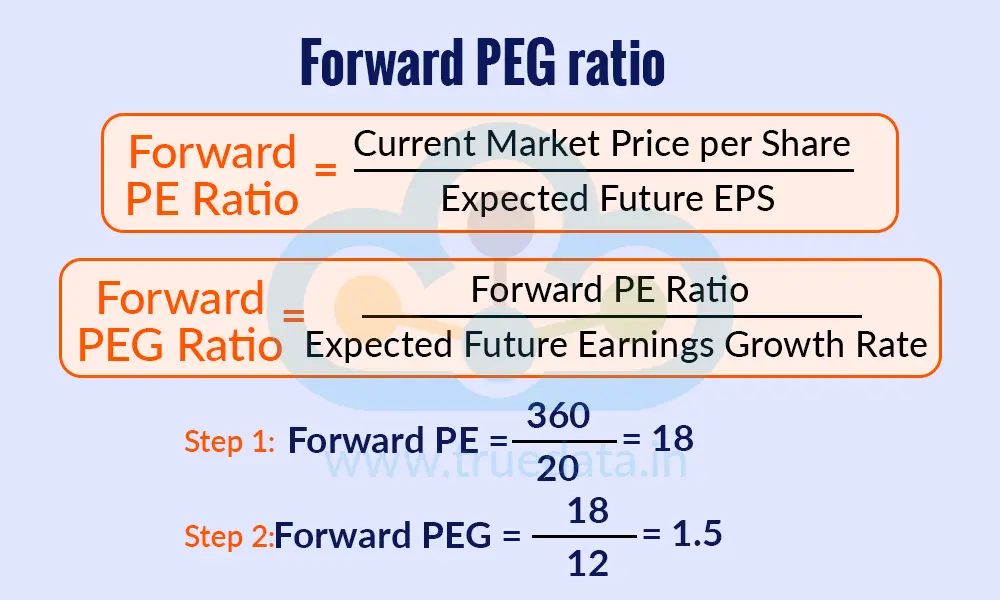

The Forward PEG Ratio is a valuation metric that looks ahead instead of backwards. Unlike the regular PEG Ratio, which may use past earnings growth, the Forward PEG Ratio uses expected future earnings growth to judge whether a stock’s current price is justified. The Forward PEG Ratio focuses on future growth by using the Forward PE Ratio, which is calculated using expected earnings instead of past profits. This helps investors judge whether today’s stock price is reasonable based on how the company is likely to perform in the coming years. The formula to calculate the Forward PEG Ratio is shown below.

Formula to Calculate Forward PE Ratio -

Forward PE Ratio = Current Market Price per Share / Expected Future EPS

Formula to Calculate Forward PEG Ratio -

Forward PEG Ratio = Forward PE Ratio / Expected Future Earnings Growth Rate

Understanding the Calculation of the Forward PEG Ratio with an Example

Consider a company Y Ltd. with the current share price of RS. 360 and expected EPS for the next year of Rs. 20, along with an expected growth earnings of 12% per annum. The calculation of the forward PEG ratio is shown below.

Step 1 - Calculating the Forward PE Ratio

Forward PE = 360 / 20 = 18

Step 2 - Calculating the Forward PEG Ratio

Forward PEG = 18 / 12 = 1.5

A Forward PEG Ratio of 1.5 suggests that the stock may be slightly expensive compared to its expected future growth. This combined approach is helpful because it links today’s price, tomorrow’s earnings, and long-term growth into one simple valuation measure.

The PEG Ratio compares a company’s valuation with its expected earnings growth, helping investors understand whether a stock is reasonably priced for its future potential. In simple terms, it answers one key question, i.e., is the price you are paying justified by how fast the company is expected to grow? The PEG Ratio is especially useful when analysing growing companies, where a high P/E Ratio alone may look expensive but could still be reasonable if growth is strong. A lower PEG Ratio generally means better value for money, while a higher PEG Ratio suggests that the stock price may already be factoring in very optimistic growth expectations. The PEG Ratio works best among companies in the same industry and is more meaningful when based on reliable and consistent earnings growth.

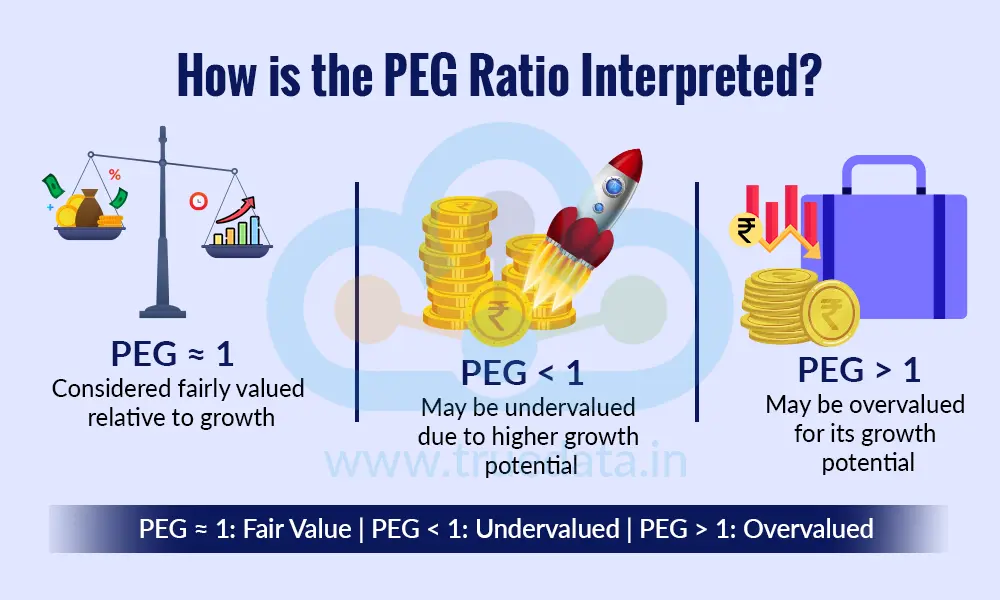

The key points to remember while interpreting the PEG Ratio are,

PEG ≈ 1 - The stock is usually considered fairly valued in relation to its growth.

PEG < 1 - The stock may be undervalued, as growth could be higher than what the price suggests.

PEG > 1 - The stock may be overvalued, meaning investors might be paying too much for expected growth.

PEG Ratio offers a balanced and realistic view of company valuations. It acts as a bridge between traditional valuation (PE Ratio) and future growth expectations, making it a powerful tool for smarter, growth-aware investment decisions. The importance of the PEG Ratio for companies and investors is explained below.

Many good companies trade at high P/E ratios simply because they are expected to grow faster in the future. The PEG Ratio adjusts the PE Ratio by adding earnings growth into the picture. This makes it easier for investors to judge whether a high-priced stock is genuinely expensive or just reflecting strong future potential.

The PEG Ratio allows investors to compare companies within the same sector more fairly. Two companies may have similar P/E ratios, but if one is growing faster, its PEG Ratio will be lower and more attractive. This helps investors choose better opportunities without relying only on headline valuation numbers.

A PEG Ratio close to 1 often indicates that the stock price is fairly matched with its growth rate. This makes the PEG Ratio a useful shortcut for investors who want to quickly filter stocks that may be undervalued or overvalued based on growth expectations.

The PEG Ratio pushes investors to think beyond short-term price movements and look at sustainable earnings growth. This aligns well with long-term investing, where consistent growth matters more than temporary market fluctuations.

From a company’s point of view, growth guidance directly influences how investors value the stock using metrics like the PEG Ratio. Clear and realistic growth projections can help investors better understand the company’s long-term strategy and value it more accurately.

The PEG Ratio is especially helpful for fast-growing businesses, such as technology, consumer brands, or emerging sectors. It shifts the focus from past performance to future earnings potential, which is often what drives long-term returns for investors.

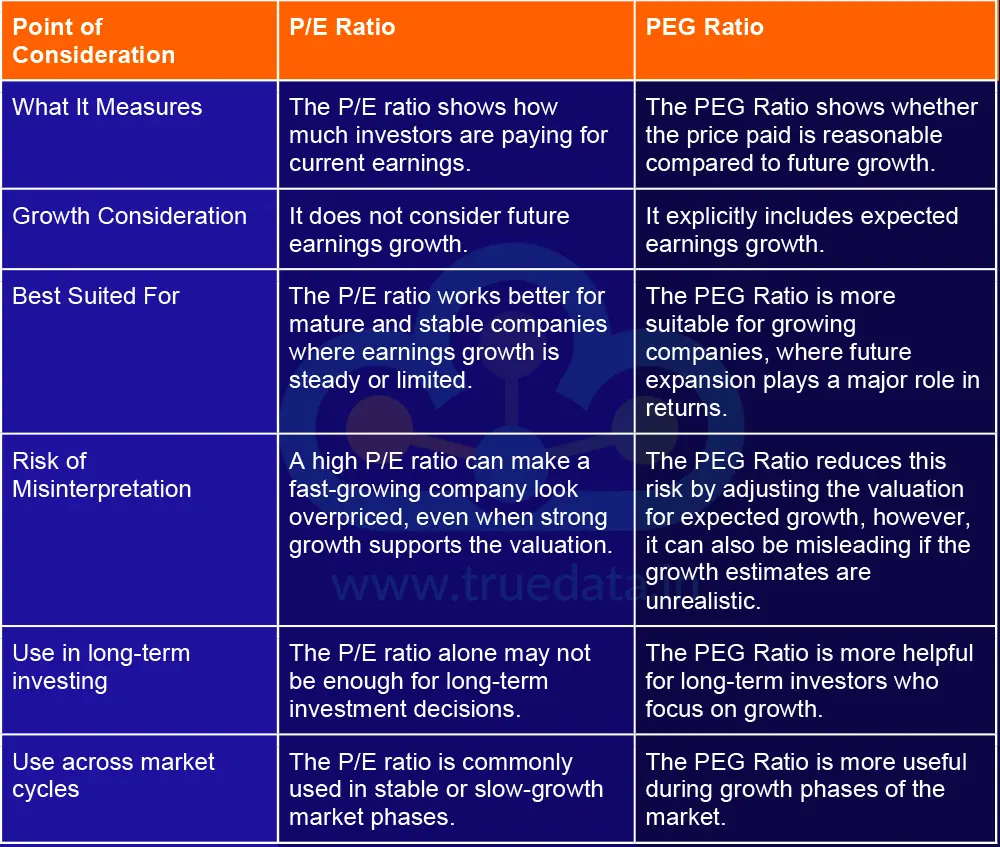

The PE Ratio and the PEG Ratio are both widely used valuation tools, but they serve different purposes in investment analysis. While the P/E ratio focuses only on current earnings, the PEG Ratio adds the important element of future growth. The key differences between the P/E Ratio and the PEG ratio are highlighted below.

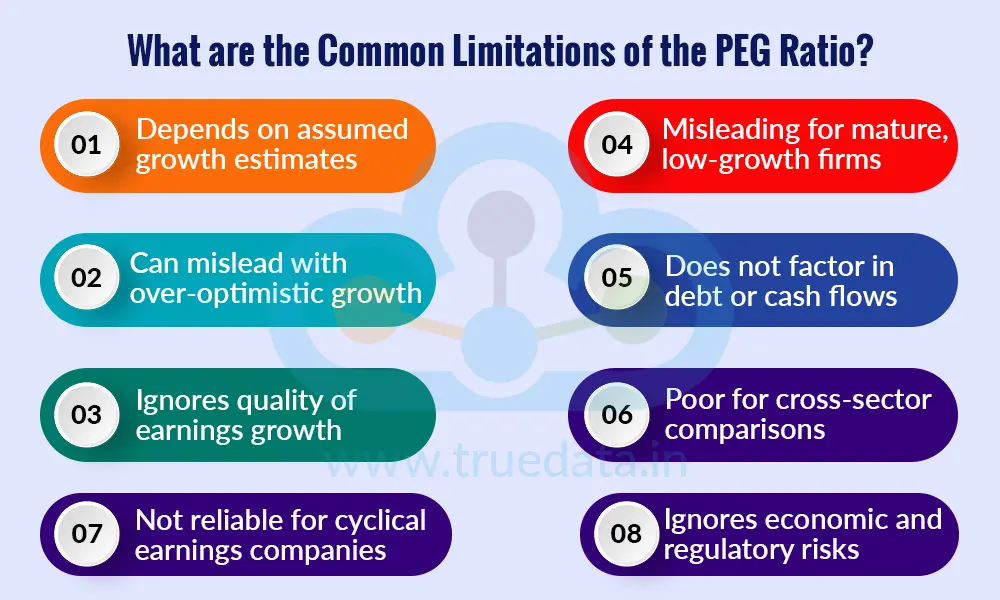

Although the PEG ratio is a step up from using the traditional P/E ratio and is a valuable tool for investors and companies alike in fundamental analysis, it is not without limitations. These limitations are highlighted below.

The PEG Ratio depends heavily on earnings growth estimates, which are based on assumptions and may not always turn out to be accurate.

The ratio can be misleading if the expected growth rate is unrealistically high or overly optimistic.

The PEG Ratio does not consider the quality or sustainability of growth, such as whether growth is driven by one-time factors or long-term business strength.

It is less useful for companies with unstable or cyclical earnings, where growth rates fluctuate widely.

The PEG Ratio may not work well for mature companies with low or declining growth, as the ratio can appear very high even if the company is fundamentally strong.

It does not take into account important factors like debt levels, cash flows, or return on capital.

Comparing PEG Ratios across different sectors can be misleading, as growth rates and business models vary widely between industries.

The ratio ignores external risks such as economic slowdowns, regulatory changes, or competitive pressures that can affect future growth.

The PEG Ratio is a practical and insightful valuation tool that helps investors look beyond price and current earnings by bringing future growth into the analysis. By linking the P/E Ratio with expected earnings growth, it offers a more balanced view of whether a stock is fairly valued, undervalued, or overvalued. The PEG Ratio is especially useful for analysing growing companies and for making long-term investment decisions, but it should not be used in isolation.

This article is an extension of our series on breaking down financial ratios in detail. Let us know your thoughts on the topic or if you need further information on ratios, and we will address them soon.

TIll then, Happy Reading!

Read More: Gross Profit Margin and Net Profit Margin

Thestock market never stands still, and prices swing constantly with every new h...

Net profits in the P&L statement are usually a sign of a healthy company. Ho...

Analysing the financial statements is the first step in the fundamental analysis...