“In business, I look for economic castles protected by unbreachable moats,” said legendary investor Warren Buffett. This famous quote captures how the legendary investor thinks about long-term wealth creation. But what exactly is a ‘moat’, and why does Buffett place so much importance on it while choosing businesses to invest in? In simple terms, a moat represents a company’s ability to protect its profits from competitors over time. Curious to know more? Read on to understand the meaning of moats and their finer nuances to identify strong, long-lasting businesses and refine your investment choices for a more successful portfolio.

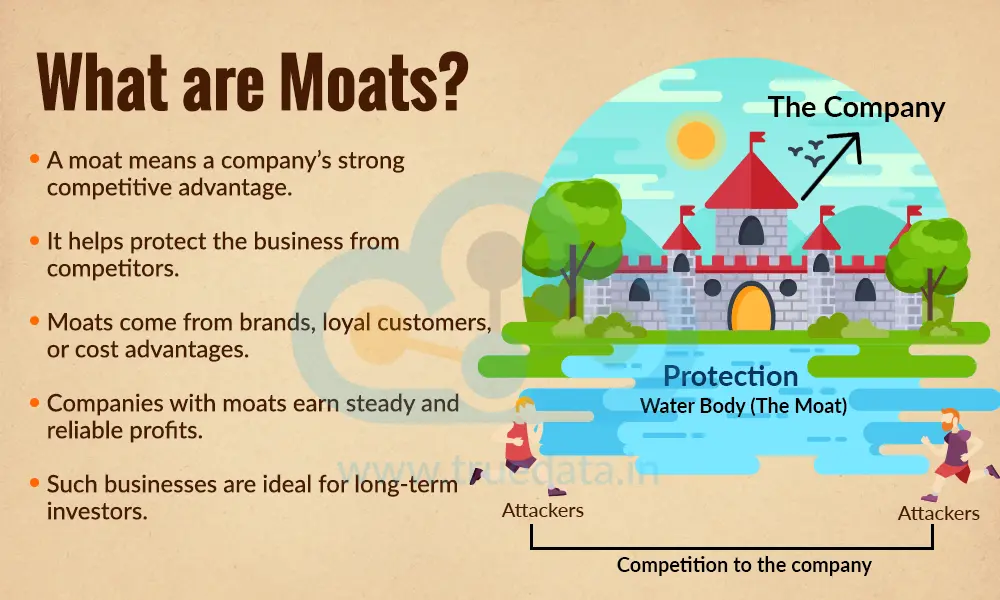

Moats, in investing, refer to a company’s strong and lasting competitive advantage that protects its business from competitors, much like a wide moat protects a castle from attackers. In simple words, a moat is what makes it difficult for other companies to steal customers, profits, or market share from a business. This advantage can come from factors such as a well-known brand, loyal customers, cost efficiency, unique products, government licences, or high switching costs. Companies with strong moats are often able to earn steady profits, maintain pricing power, and survive tough market cycles better than others, making them attractive for investors. Because of this, moat-driven businesses tend to grow consistently over the long term, making them attractive for long-term investors who value stability and predictable earnings.

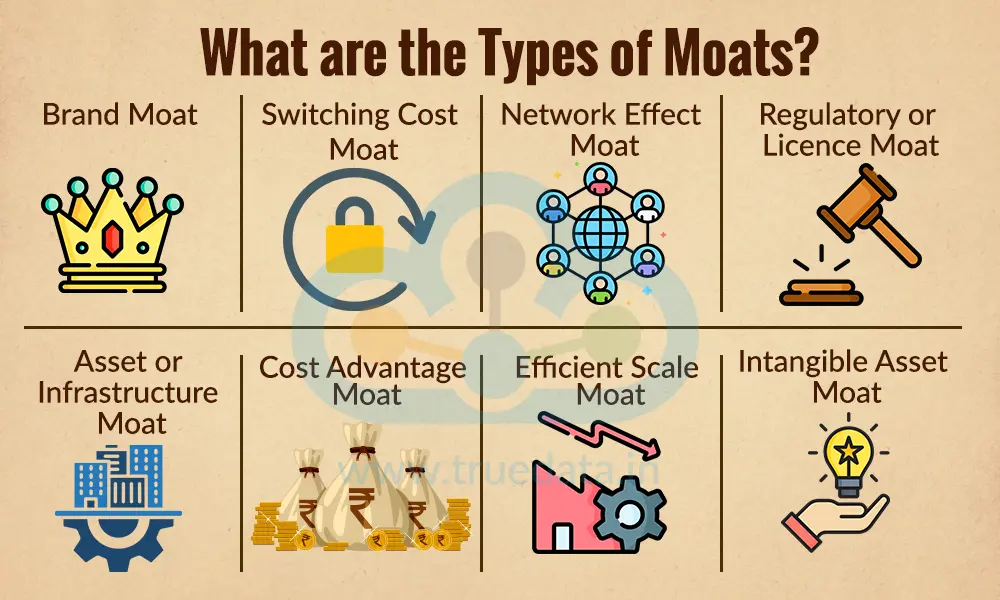

Companies build economic moats in different ways. Each type of moat helps a business protect its profits and market position from competitors. Identifying the type of moat a company has helps in judging long-term sustainability, not just short-term performance. Businesses with strong and durable moats are better positioned to handle competition, economic slowdowns, and industry changes, making them suitable for long-term wealth creation.

A brand moat exists when customers trust and prefer a company’s brand over others, even if cheaper options are available. Strong brands allow companies to charge premium prices and retain loyal customers. Brands like Asian Paints, Tata, or HUL enjoy strong recall and trust, which new or smaller competitors find very difficult to replicate. This emotional connection with customers helps such companies maintain stable sales and margins over the long term.

A cost advantage moat arises when a company can produce goods or services at a lower cost than its competitors. This may be due to economies of scale, efficient operations, access to cheaper raw materials, or superior supply chain management. Companies with this moat can either offer lower prices to gain market share or maintain higher profit margins. In price-sensitive markets, cost-efficient businesses often dominate their sectors for many years.

A switching cost moat exists when customers find it inconvenient, expensive, or risky to shift from one company’s product or service to another. This is common in businesses such as banking, software, telecom, and enterprise services. For example, once a company uses a particular accounting software or a bank for long-term loans, switching involves paperwork, retraining, and potential disruption. This keeps customers ‘locked in’ and ensures steady revenue for the business.

A network effect moat is created when a product or service becomes more valuable as more people use it. Payment apps, marketplaces, and social platforms benefit from this type of moat. Platforms like digital payment networks and online marketplaces become stronger as more users, merchants, and service providers join. New competitors struggle because they must build a large user base before their service becomes equally useful.

A regulatory moat exists when government rules, licences, or approvals limit competition. Sectors such as banking, insurance, telecom, and utilities in India often require strict regulatory permissions, large capital, and compliance. These barriers make it difficult for new players to enter, protecting established companies from excessive competition and supporting long-term business stability.

An asset moat arises when a company owns valuable physical or intangible assets that are hard to replicate. This can include ports, airports, power plants, pipelines, warehouses, or exclusive rights over natural resources. Building such assets requires huge investment, time, and approvals, which discourages new entrants and gives existing players a long-term advantage.

An intangible moat comes from patents, copyrights, proprietary technology, or unique know-how. Pharmaceutical companies with patented drugs or technology-driven firms with proprietary processes benefit from this moat. This is especially relevant in sectors like pharma, speciality chemicals, and IT services, where knowledge and innovation protect profits.

An efficient scale moat exists in industries where the market is too small to support many players profitably. Once a few companies serve the market efficiently, adding new competitors only reduces returns for everyone. This is common in sectors such as utilities, exchanges, and niche infrastructure businesses.

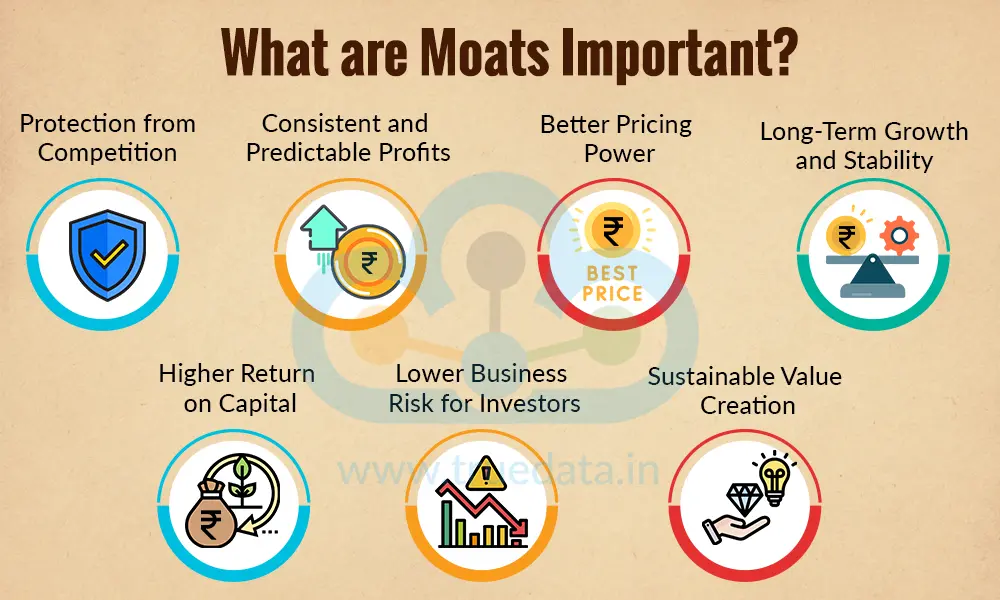

Economic moats play a crucial role in determining how strong and sustainable a business is over the long term and are a sign of strength, durability, and quality. Identifying and nurturing moats can lead to stable growth for companies and more confident, long-term investment decisions for investors. The importance of moats can be explained as follows,

A strong moat helps a business defend itself against competitors. When a company has brand loyalty, cost advantages, or regulatory protection, it becomes difficult for new or existing players to take away its customers. Moats act as a shield that preserves market share for companies operating in highly competitive and price-sensitive markets.

Businesses with strong moats are able to generate steady earnings over time. Since competition is limited, these companies face less pressure to cut prices or increase spending aggressively. For investors, this means more predictable cash flows and earnings, which are essential for long-term investing.

Moats give companies the ability to increase prices without losing customers. Strong brands, essential services, or high switching costs allow businesses to pass on rising costs to customers. In India, where input costs and inflation fluctuate, pricing power helps protect profit margins.

Companies with durable moats are better positioned to survive economic slowdowns, industry disruptions, and market cycles. Their competitive advantages help them continue growing even when conditions are tough. This stability makes such businesses attractive for long-term investors and reliable partners for stakeholders.

Moat-driven businesses often earn higher returns on capital because they do not need to constantly spend heavily to defend their position. This efficient use of capital allows companies to reinvest profits wisely, pay dividends, or reduce debt, thus benefiting both the business and its shareholders.

From an investor’s point of view, moats reduce uncertainty and downside risk. While no investment is risk-free, companies with strong competitive advantages are less likely to see sudden declines in profits due to aggressive competition. This makes them suitable for conservative and long-term investors.

For companies, moats help in building long-term value rather than short-term success. A strong moat encourages disciplined growth, customer loyalty, and operational efficiency. This translates into wealth creation for investors over the years, not just short-term market gains.

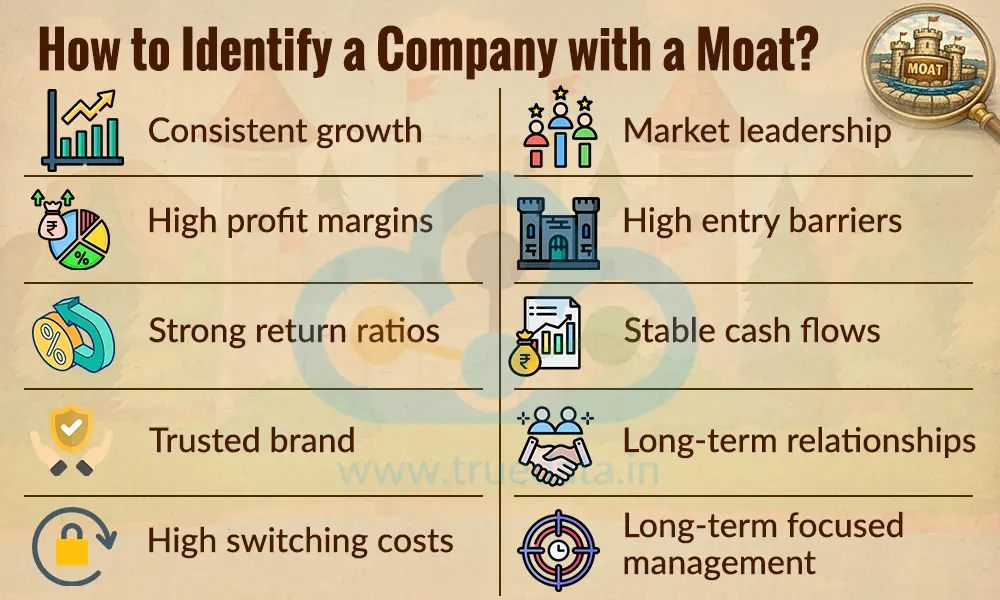

Identifying a company with a strong moat is the first step for picking successful stocks. However, for average investors, this can be tricky. Here are a few pointers that can help in picking companies with strong moats.

A company with a moat usually shows consistent revenue and profit growth over many years, even during weak market conditions.

Such companies often report high and stable profit margins, which indicates pricing power and limited competitive pressure.

A strong moat is reflected in high return ratios like ROE or ROCE compared to industry peers, showing efficient use of capital.

Companies with moats usually have a well-known and trusted brand, making customers prefer their products or services over alternatives.

If customers find it difficult or costly to switch to another provider, it is a clear sign of a switching cost moat.

Businesses with a moat often enjoy market leadership or dominant market share in their core segment.

A company with a moat typically faces limited new competition due to high entry barriers such as regulations, large capital needs, or technology.

Strong and steady operating cash flows over time indicate that the business model is sustainable and well-protected.

Companies with moats usually maintain long-term relationships with customers, suppliers, or distributors, which competitors find hard to break.

Management of moat-driven companies generally focuses on long-term growth and capital discipline rather than short-term gains.

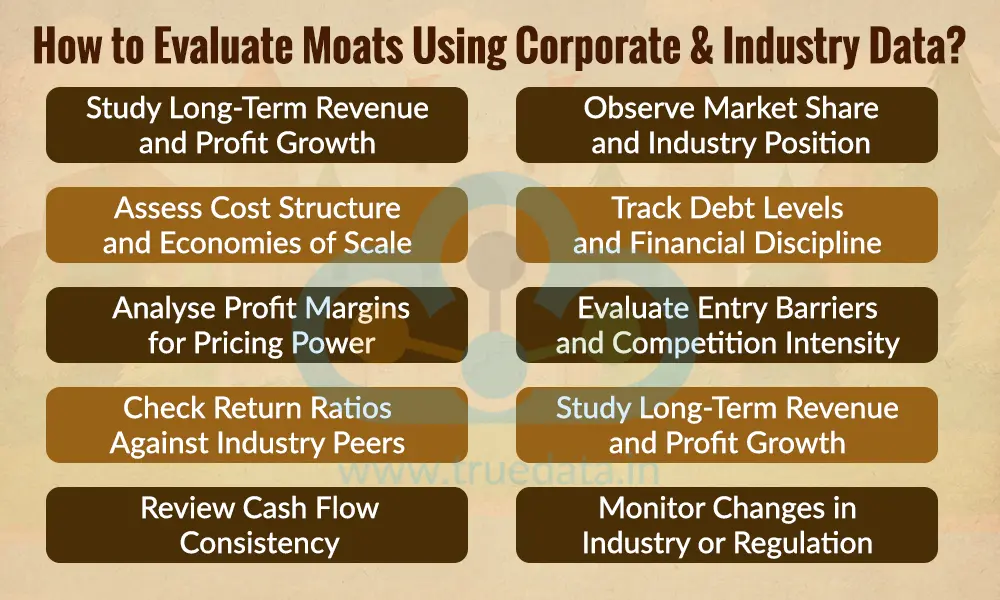

Evaluating moats using corporate and industry data requires looking beyond short-term performance. After understanding the key to identifying companies with moats, let us now focus on how to evaluate them. Here are a few factors to be considered.

Study Long-Term Revenue and Profit Growth - A strong moat is often visible in consistent growth over many years, not just in one good phase. By analysing corporate data such as 5-10 year revenue and profit trends, investors can see whether the company continues to grow despite economic slowdowns or industry challenges. If a company keeps expanding while peers struggle, it suggests protection from competition.

Assess Cost Structure and Economies of Scale - Corporate data related to operating costs and efficiency can highlight cost advantages. Large companies with scale often enjoy lower per-unit costs compared to smaller peers. Industry data helps validate whether this advantage is difficult for others to match.

Analyse Profit Margins for Pricing Power - Gross, operating, and net profit margins reveal a lot about a company’s moat. Stable or improving margins indicate pricing power and cost control. When industry data shows rising raw material or operating costs, but a company still maintains margins, it signals a strong moat that allows it to pass costs to customers.

Check Return Ratios Against Industry Peers - Return ratios like ROE and ROCE show how efficiently a company uses its capital. A company with a moat usually reports higher and more stable returns than the industry average. Comparing these ratios with peers helps investors identify which businesses truly enjoy a competitive edge.

Review Cash Flow Consistency - Corporate cash flow data helps confirm whether profits are backed by real cash. Companies with strong moats generally generate steady operating cash flows year after year. When industry data shows volatile demand, but a company’s cash flows remain stable, it highlights business strength and sustainability.

Observe Market Share and Industry Position - Industry data helps track market share trends over time. A company that consistently holds or increases its market share likely has entry barriers such as brand strength, cost advantage, or distribution reach. If new competitors struggle to gain share, it reinforces the presence of a moat.

Track Debt Levels and Financial Discipline - A genuine moat company usually maintains healthy balance sheets. Corporate data showing manageable debt and strong interest coverage indicates that the business does not rely on excessive borrowing to stay competitive. This financial strength adds durability to the moat.

Evaluate Entry Barriers and Competition Intensity - Industry reports reveal how easy or difficult it is for new players to enter a sector. High capital requirements, strict regulations, or limited customer capacity indicate strong entry barriers. When corporate data shows stable performance in such industries, it confirms that the company is protected by a structural moat.

Monitor Changes in Industry or Regulation - Industry and regulatory data in India are crucial, as policy changes can strengthen or weaken moats. Investors should track government regulations, licensing rules, and compliance requirements to understand how they affect competitive advantages over time.

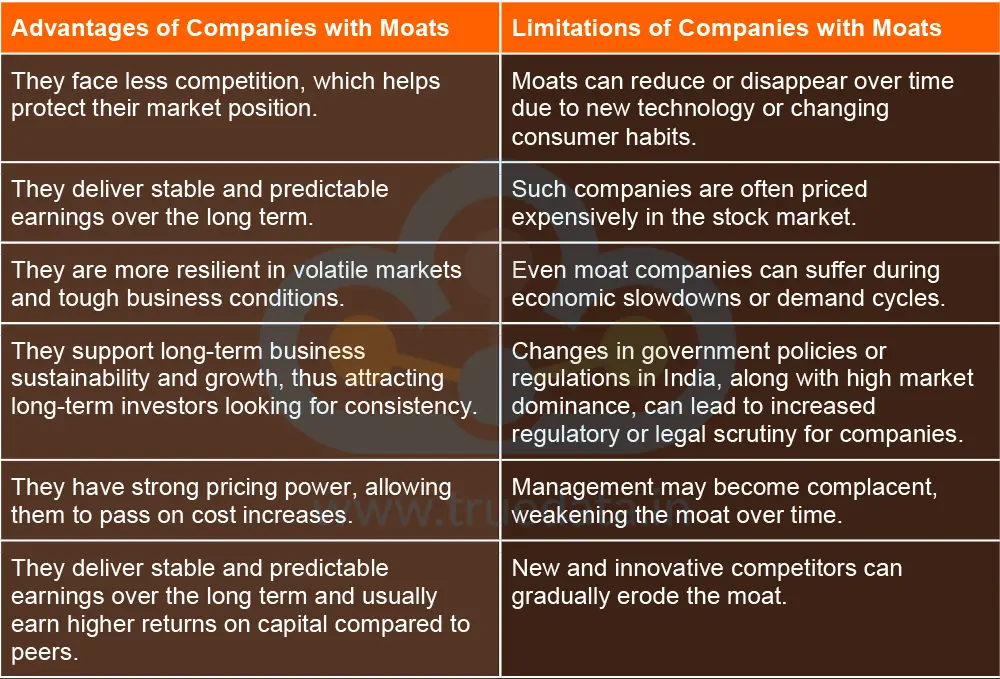

Companies with strong moats offer quality and stability, however, they do have some limitations that can erode the benefits presented by moats. Thus, investors should review valuations and monitor changes in the business environment regularly before investing. Here are a few advantages and limitations of investing in companies with moats.

A strong real-life example of an economic moat in India is Hindustan Unilever Limited (HUL). Over many decades, HUL has built a powerful competitive position that is extremely difficult for competitors to challenge. One of its biggest strengths lies in its unmatched distribution reach, which covers millions of retail outlets across urban and rural India. This deep reach ensures that HUL products are easily available even in the most remote areas, something new or smaller companies find hard to replicate.

HUL also benefits from a strong brand and trust moat. Its products in categories like soaps, detergents, foods, and personal care are part of daily life for Indian households. This brand familiarity and trust allow HUL to retain customers for years and even generations. As a result, the company enjoys steady demand and the ability to introduce new products successfully under established brand names.

Another key advantage is economies of scale, which give HUL a cost advantage. Its large manufacturing base, bulk procurement, and efficient supply chain help keep costs under control. This allows the company to maintain healthy margins while staying competitive on pricing in India’s cost-sensitive market. Smaller competitors often struggle to match this balance of price and quality.

Backed by these strengths, HUL has consistently delivered stable revenues, strong cash flows, and reliable returns over long periods. Thus, HUL clearly demonstrates how a durable moat can protect a company’s leadership position and support long-term wealth creation, even in highly competitive consumer markets.

Economic moats play a vital role in identifying strong and sustainable businesses for long-term investing. A company with a strong moat enjoys protection from competition through numerous factors, helping it derive long-term profit stability. However, moats are not permanent and can weaken over time. Thus, the key is to look for durable moats combined with reasonable valuations and good management, and to review them regularly, as this balanced approach can support steady and long-term wealth creation.

This article talks about the strategic advantage that a company can have over its competitors and how it can be advantageous for the company in the long run. Let us know your thoughts on this topic or if you need further information on the same and we will address it soon.

Till then, Happy Reading!

Read More: How to Evaluate Newly Listed Companies?

Thestock market never stands still, and prices swing constantly with every new h...

Thestock market never stands still, and prices swing constantly with every new h...

Share prices of a company are affected by numerous external and internal factors...