Assets are the backbone of any business as they help companies run daily operations, grow steadily, and achieve long-term goals. However, assets do not just sit on the balance sheet. Assets being used efficiently can tell a powerful story about a company’s financial strength. Ratios such as the total assets turnover ratio and fixed assets turnover ratio help investors understand how well a business converts its assets into revenue. Dive into this blog to learn how these ratios work and what they reveal about a company’s efficiency and overall financial health.

The Total Assets Turnover Ratio shows how efficiently a company uses all its assets to generate sales. In simple words, it tells investors how much revenue a business earns for every rupee invested in its total assets, such as land, buildings, machinery, inventory, and cash. A higher ratio means the company is using its assets well to produce sales, while a lower ratio may indicate that assets are lying idle or are not being used effectively. This ratio is useful for comparing companies within the same industry and understanding which business is more efficient in converting its resources into income, especially when evaluating long-term performance and operational strength.

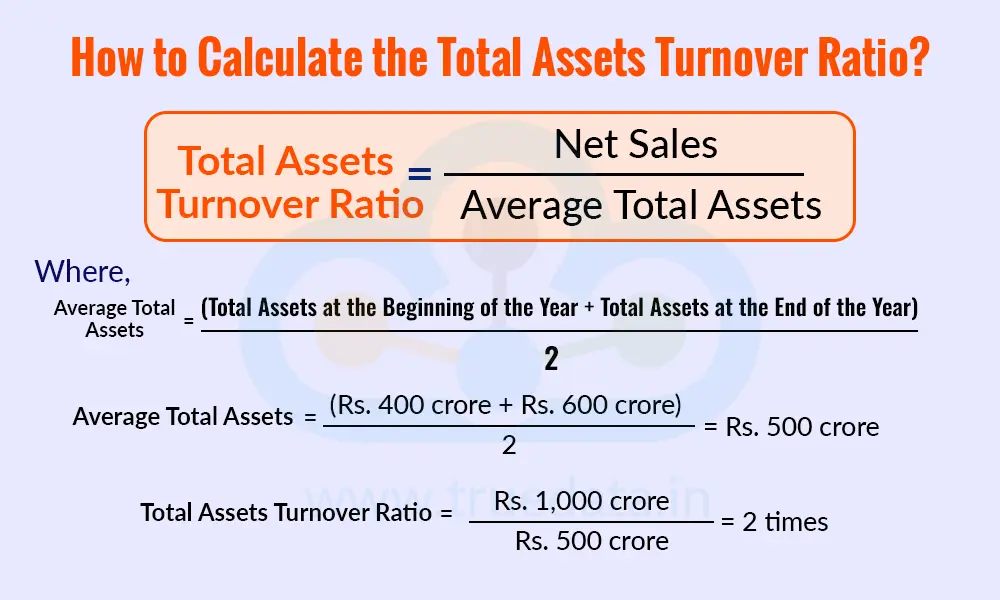

The Total Assets Turnover Ratio is easy to calculate and helps investors understand how efficiently a company uses its assets to generate revenue. The formula to calculate total assets turnover is,

Total Assets Turnover Ratio = Net Sales / Average Total Assets

Where,

Average Total Assets = (Total Assets at the Beginning of the Year + Total Assets at the End of the Year) / 2

Most analysts prefer using average total assets because asset levels can change during the year.

Understanding the Calculation of Total Assets Turnover Using an Example

Consider a company that reports net sales of Rs. 1,000 crore during the year. Its total assets were Rs. 400 crore at the start of the year and Rs. 600 crore at the end of the year. Calculating the total assets turnover for the company as follows,

First, calculate the average total assets -

Average Total Assets = (Total Assets at the Beginning of the Year + Total Assets at the End of the Year) / 2

Average Total Assets = (Rs. 400 crore + Rs. 600 crore) / 2 = Rs. 500 crore

Now applying the total assets turnover formula -

Total Assets Turnover Ratio = Rs. 1,000 crore / Rs. 500 crore = 2 times

This means the company generated Rs. 2 of sales for every Re. 1 invested in total assets. This ratio helps judge how efficiently a company is using its resources, especially when comparing similar companies within the same industry.

Total assets turnover is an important ratio and part of the fundamental analysis of a company. It provides deep insights into the financial stability and operational efficiency of the company. The importance of the total assets turnover for the company is explained below.

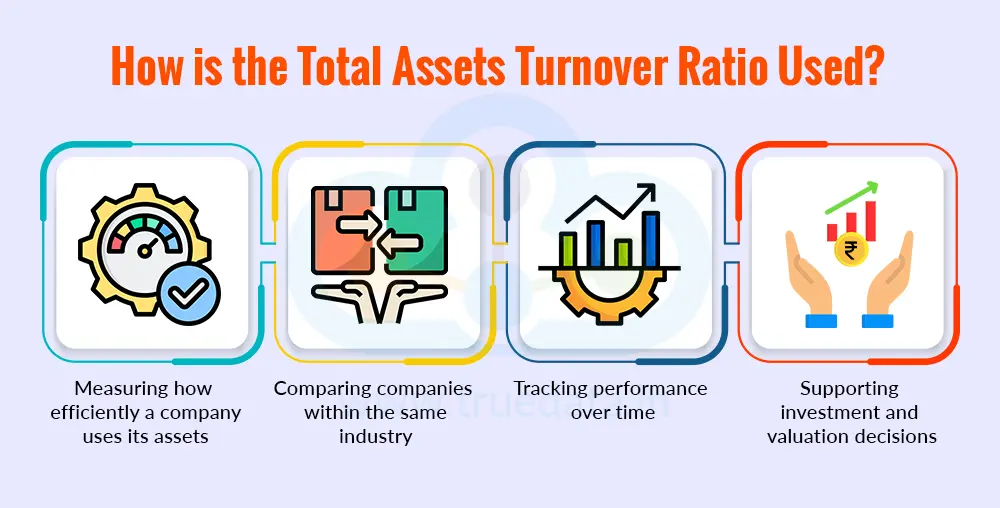

The Total Assets Turnover Ratio helps investors understand how well a company is using all its assets, such as land, buildings, machinery, inventory, and cash, to generate sales. A higher ratio generally means the business is making good use of its resources, while a lower ratio may suggest that assets are not being used efficiently. This provides investors with a quick snapshot of operational efficiency and shows whether the company is getting enough revenue from the money invested in its assets.

This ratio is especially useful when comparing companies operating in the same industry. Different industries have different asset needs, for example, manufacturing companies usually need heavy machinery, while service companies rely more on people than physical assets. By comparing the total assets turnover ratio of similar companies, investors can identify which business is better at converting its assets into sales and which one may be lagging behind.

Investors can also use the total assets turnover ratio to track a company’s performance over multiple years. An improving ratio may indicate better asset management, rising demand, or improved operations. On the other hand, a declining ratio could signal slowing sales, overinvestment in assets, or inefficient use of resources. This trend analysis helps investors judge whether the company’s efficiency is improving or deteriorating over time.

The total assets turnover ratio plays an important role in overall investment analysis. When used along with profitability ratios, debt ratios, and cash flow analysis, it helps investors form a clearer picture of a company’s financial health. This ratio is a practical tool for investors to assess business efficiency, support stock selection, and make more informed long-term investment decisions.

The Fixed Assets Turnover Ratio shows how efficiently a company uses its long-term physical assets, such as land, buildings, plant, and machinery, to generate sales. In simple words, it tells investors how much revenue a business earns for every rupee invested in fixed assets. A higher ratio indicates that the company is using its factories and equipment effectively, while a lower ratio may suggest underutilised capacity or heavy investment in assets that are not yet producing enough sales. This ratio is especially useful in analysing capital-intensive sectors like manufacturing, infrastructure, and utilities, where fixed assets play a major role in business performance.

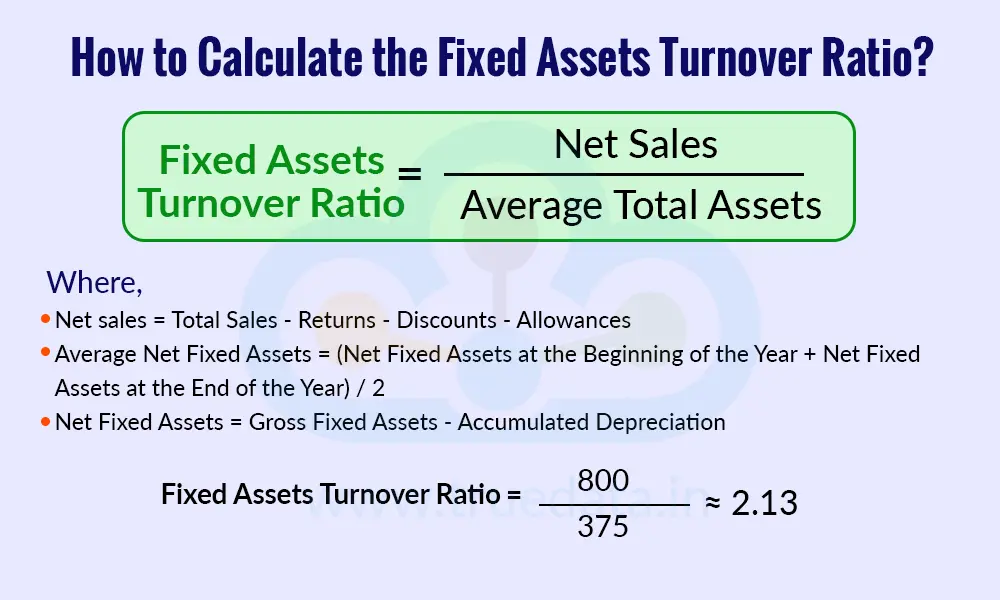

The Fixed Assets Turnover Ratio helps investors understand how efficiently a company uses its long-term physical assets to generate sales. The formula to calculate the fixed assets turnover is,

Fixed Assets Turnover Ratio = Net Sales / Average Net Fixed Assets

Where,

Net sales = Total Sales - Returns - Discounts - Allowances

Average Net Fixed Assets = (Net Fixed Assets at the Beginning of the Year + Net Fixed Assets at the End of the Year) / 2

Net Fixed Assets = Gross Fixed Assets - Accumulated Depreciation

Understanding the Calculation of Fixed Assets Turnover Using an Example

Consider a company with the net sales during the year of Rs. 800 crores. It has the opening Gross Fixed Assets of Rs. 500 crores and accumulated depreciation of Rs. 150 crores. The closing Gross Fixed Assets of Rs. 600 crore and Accumulated Depreciation of Rs. 200 crores. The fixed assets turnover for this company is calculated as follows,

Calculate Net Fixed Assets -

Net Fixed Assets = Gross Fixed Assets - Accumulated Depreciation

Opening Net Fixed Assets = 500 - 150 = Rs. 350 crores

Closing Net Fixed Assets = 600 - 200 = Rs. 400 crores

Calculate Average Net Fixed Assets -

Average Net Fixed Assets = (Net Fixed Assets at the Beginning of the Year + Net Fixed Assets at the End of the Year) / 2

Average Net Fixed Assets = (350 + 400) = Rs. 375 crores

Calculate Fixed Assets Turnover Ratio -

Fixed Assets Turnover Ratio = Net Sales / Average Net Fixed Assets

Fixed Assets Turnover Ratio = 800/375 ≈ 2.13

This means the company generated about Rs. 2.13 of sales for every Rs. 1 invested in its fixed assets. This detailed calculation helps in understanding not just asset usage, but also the impact of depreciation and new investments on a company’s operational efficiency.

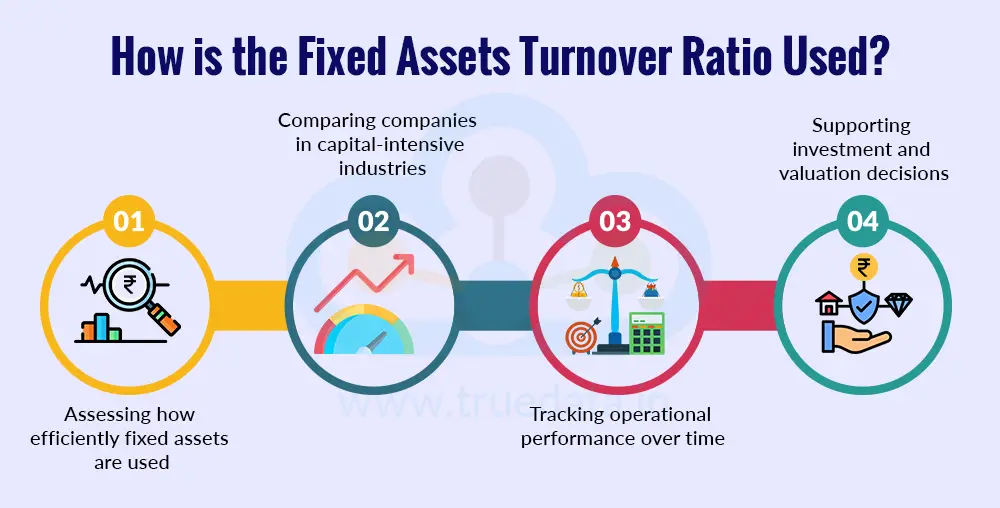

The fixed assets turnover ratio is an extension of the total assets turnover ratio, providing deeper insights into the optimal use of the company’s assets and efficiency. The importance of the fixed assets turnover is explained below.

The Fixed Assets Turnover Ratio helps investors understand how well a company uses its long-term physical assets, such as land, buildings, plants, and machinery, to generate sales. A higher ratio usually means the company is using its factories and equipment efficiently, while a lower ratio may point to underutilised capacity or idle assets. This is especially useful for investors when analysing businesses that require heavy investment in fixed assets.

This ratio is most meaningful when used to compare companies within the same industry. Sectors like manufacturing, power, infrastructure, and metals tend to have large investments in fixed assets, so comparing their fixed assets turnover ratios helps investors see which company is better at converting those assets into revenue. A company with a consistently higher ratio often has better operational efficiency than its peers.

Investors can use the fixed assets turnover ratio to track a company’s performance across multiple years. An improving ratio may indicate better capacity utilisation, rising demand, or improved production processes. On the other hand, a falling ratio could suggest overinvestment in new plants, a slowdown in sales, or inefficiencies in operations. This trend analysis helps investors judge whether the company’s asset usage is improving or weakening over time.

The fixed assets turnover ratio should not be used in isolation, but along with other ratios, including profitability, cash flow, and debt ratios. This ratio provides valuable insight for investors into how effectively management is using long-term assets to support growth. When combined with other financial measures, it helps investors make more informed decisions about a company’s long-term financial health and sustainability.

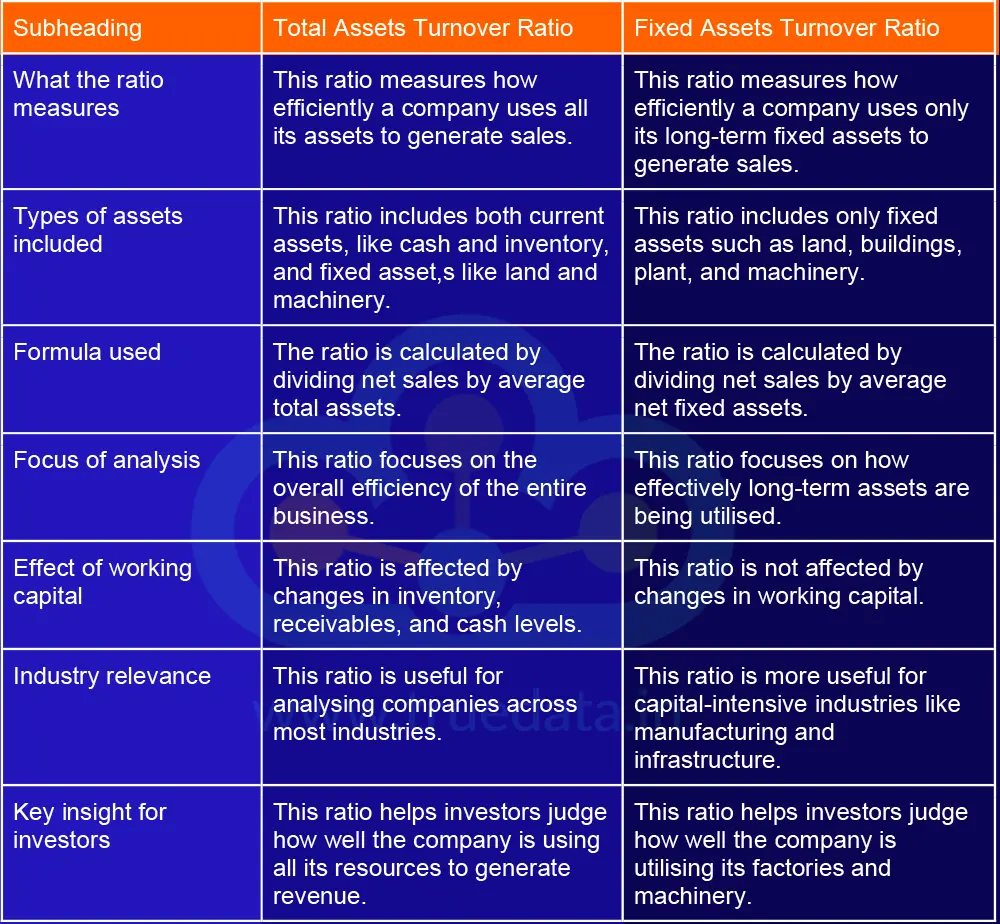

Both the total assets turnover ratio and the fixed assets turnover ratio help investors understand how efficiently a company generates sales from its assets. However, they differ in scope and usage. The difference between these two important ratios is explained below.

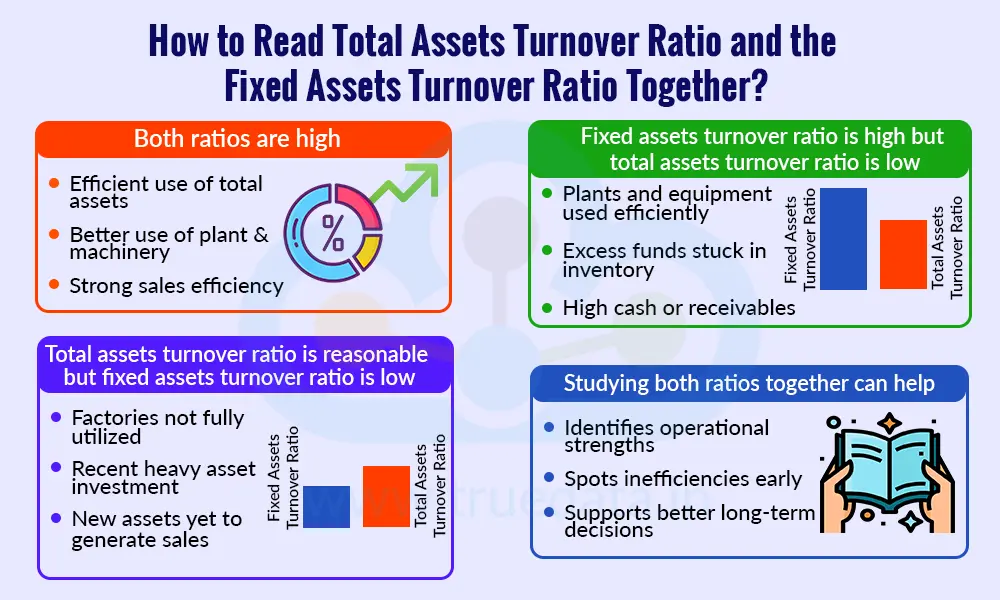

Reading the total assets turnover ratio and the fixed assets turnover ratio together gives investors a clearer and more balanced view of how efficiently a company uses its resources. When both ratios are high, it usually means the company is using its overall assets as well as its factories and machinery effectively to generate sales. If the fixed assets turnover ratio is high but the total assets turnover ratio is low, it may indicate that while plants and equipment are being used well, too much money is tied up in inventory, cash, or receivables. On the other hand, if the total assets turnover ratio is reasonable but the fixed assets turnover ratio is low, it could suggest underutilised factories or recent heavy investment in new assets that have not yet started contributing to sales. Thus, studying both ratios together can help identify operational strengths, spot inefficiencies early, and make better long-term investment decisions.

The total assets turnover ratio and the fixed assets turnover ratio are practical tools that help investors understand how efficiently a company uses its resources to generate sales. While the total assets turnover ratio shows how well the entire balance sheet supports revenue, the fixed assets turnover ratio focuses on how effectively long-term assets like plants and machinery are utilised. When used together, these ratios highlight operational efficiency, capacity utilisation, and possible inefficiencies in working capital or asset investments.

This article explains the understanding of the assets of a business beyond its usual use. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: Impact of Accounting Policy Changes on Financial Ratios

Thestock market never stands still, and prices swing constantly with every new h...

Financial ratios often look like hard numbers that tell a clear story about a co...

When analysing a company, ratios act like signposts that guide us toward its tru...