The Indian stock markets have been experiencing a bloodbath for the past several weeks. While investors have lost over 9 lakh crores in this market slide, the cardinal truth is that stock markets will always go up in the long run! Therefore, rather than seeing this as a disaster, investors should take this as an opportunity to fill their portfolios with quality stocks. So what if there was a clear formula to pick fundamentally strong stocks? The answer lies in the Piotroski Score! Check out this blog to know the meaning of this term and how it can help in stock selection.

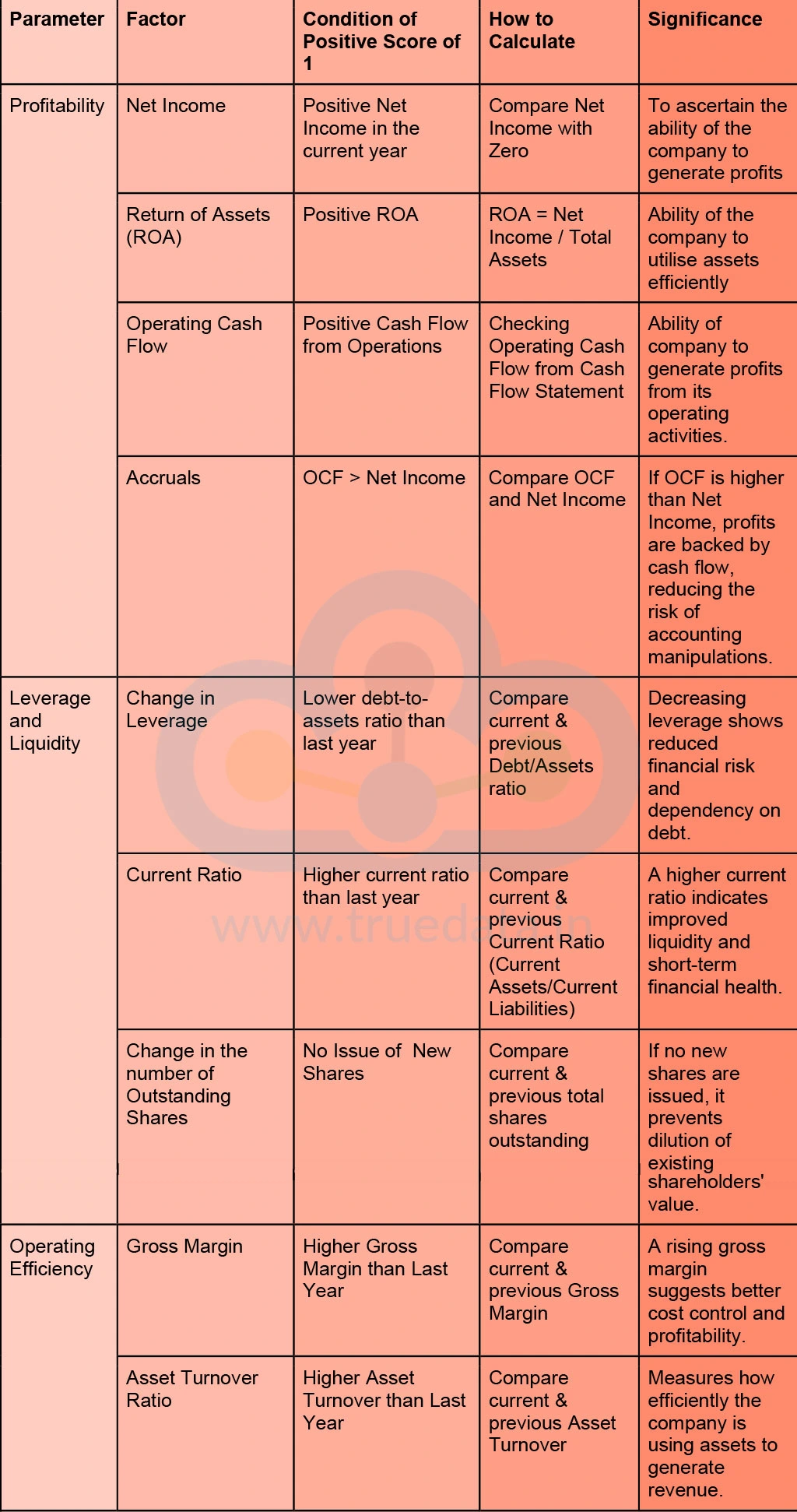

The Piotroski Score is a stock evaluation and selection tool used by investors to check a company's financial strength before investing. It was created by Joseph Piotroski, an accounting professor at the University of Chicago, in the year 2000. The score helps investors find fundamentally strong companies by analysing various financial factors related to crucial parameters like the company’s profitability, debt levels, liquidity, and operating efficiency. Each factor is assigned a score of 0-1, making the total Piotroski Score for a company ranging between 0-9. This method is especially useful for value investors who look for undervalued stocks with strong fundamentals.

The total Piotroski Score is calculated by evaluating a company based on 9 financial factors under three broad parameters.

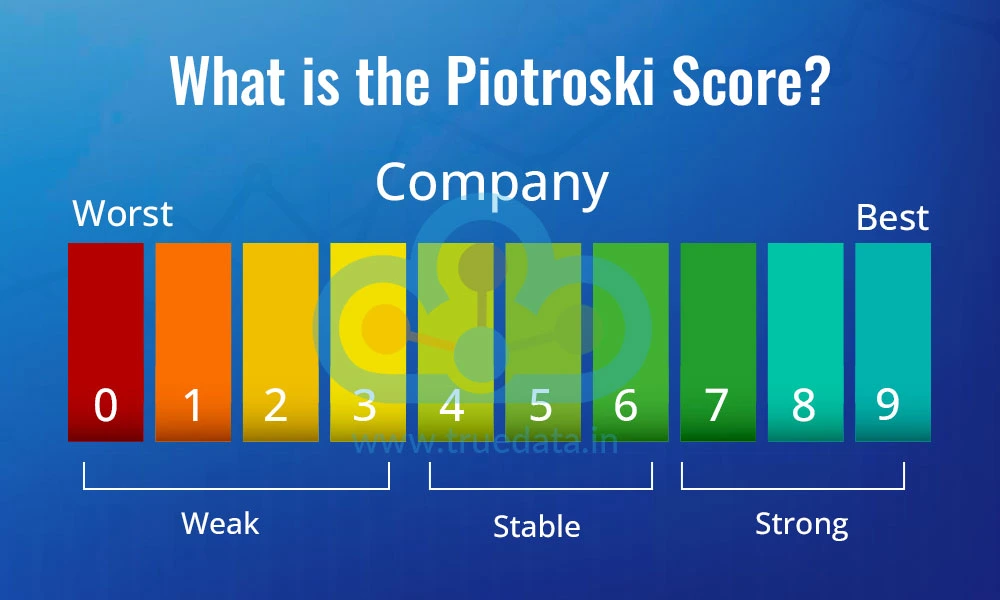

The Piotroski Score allocates a score of 0 or 1 to various factors of fundamental analysis to eventually get the total Piotroski Score for a company. A company with a higher score indicates a financially stable and potentially profitable investment opportunity, while a company with a lower score is considered to be a high-risk investment option.

The interpretation of the Piotroski Score is given below.

A company with a Piotroski Score between 7 and 9 shows that the business is financially strong. It highlights that the company is generating profits, managing its debt well, improving efficiency, and has strong cash flow. These companies are less likely to face financial distress and often have stable or growing business operations. Companies in this range could be good long-term investment options, especially when they are available at reasonable valuations. However, investors should still check other factors like market trends, management quality, and industry conditions before investing.

A company with a Piotroski Score between 4 and 6 falls in the middle range. This means the company has some strong financial aspects but also some weaknesses. It could be a growing company that has not yet fully stabilised or a mature company facing challenges in profitability, efficiency, or debt management. Thus, stocks in this range should be analysed further before making investment decisions to check if the company’s weak areas are temporary or signs of deeper problems. If the company's fundamentals are improving, it may still be a good investment opportunity. However, if financial health is deteriorating, it could pose to be a risky investment.

A Piotroski Score between 0 and 3 is a red flag. It means the company is struggling with low profitability, increasing debt, poor cash flow, or inefficient operations. These companies are at a higher risk of financial trouble, which can lead to falling stock prices, loss of investor confidence, and in extreme cases, bankruptcy. Investors should be cautious when considering stocks in this category, especially for long-term investments. These companies may be value traps where the stock price looks cheap but continues to decline due to weak financials. Unless there is a strong turnaround plan or external factors improving the company’s prospects, it is generally safer to avoid such stocks.

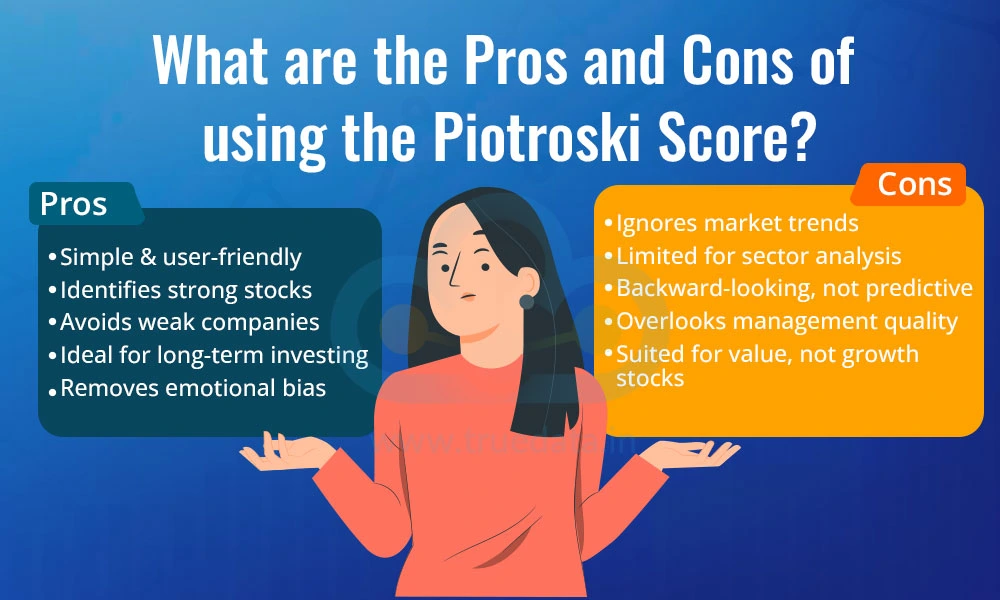

The Piotroski Score is an efficient way to find hidden gems from the abundance of stocks in the stock markets. However, before using this tool, it is also important to know the pros and cons of using it to make informed investment decisions.

Simple and easy to use

Aids in identifying strong stocks

Helps in avoiding financially weak companies

Useful for long-term investing strategy

Reduces emotional bias by using objective financial data

Does not consider market trends

Limited use for sector-specific analysis

Backward-looking data and does not help in predicting future performance

Does not consider management quality

Designed for value investing and may not be suitable for evaluating growth stocks

The Piotroski Score is a method used in the fundamental analysis of stocks. It provides investors with a simple yet effective checklist for picking out quality stocks. The Piotroski Score is especially important for value investors looking for fundamentally strong stocks currently available at a lower valuation, making them a good addition to their portfolio. However, it is also important for investors to focus on the overall performance of the stock based on other factors like market trends, industry trends, future growth potential, etc., to make informed decisions for the overall portfolio profitability.

We hope this blog can provide valuable insights into the stock selection process, making it a bit easier, especially for new investors. Let us know your thoughts on this topic or if you have any queries on the same.

Till then, Happy Reading!

Read More: What are Top-Down and Bottom-up Approaches in Stock Selection?

The Japanese Yen (JPY) has long been one of the world’s major currencies, ...

The stock market in India has fascinated general Indian masses for long, perhap...

Options trading is a dynamic and complex arena, filled with intricacies like opt...