Options trading is a dynamic and complex arena, filled with intricacies like options Greeks, various trading strategies, and the ever-changing price movements of underlying assets. Navigating this landscape can be challenging, but one crucial factor that can significantly enhance your trading effectiveness is keeping a close eye on open interest. Understanding open interest is key to shaping a robust trading portfolio in futures and options. Dive into this blog to learn the basics of open interests and their role in the options trading segment.

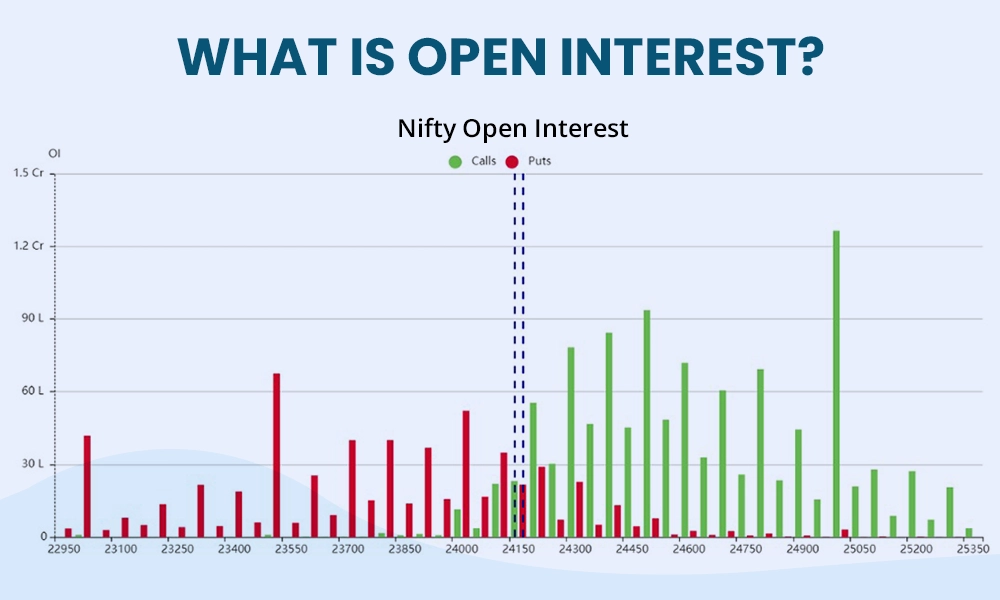

Open interest refers to the total number of outstanding contracts in the futures or options market that have not been settled yet. In simpler terms, it is the total number of open positions (either long or short) that remain active and have not been squared off or expired. Understanding open interest is crucial because it indicates the flow of money in the market. If open interest increases, it usually suggests that new money is entering the market, which can lead to stronger trends. Conversely, a decrease in open interest might indicate that money is leaving the market, potentially signalling a weakening trend. Therefore, analysing changes in open interest along with price movements can help traders gain insights into the strength or weakness of a particular trend in the market.

Open interest is calculated by determining the total number of outstanding contracts in the market, adjusted for any contracts that have been closed. The formula can be expressed in two ways as shown below.

Open Interest = Total Outstanding Contracts - Closed Contracts

Open Interest = Total Open Long Positions + Total Open Short Positions

These methods help traders understand the level of market participation and the net number of active contracts.

Let us consider an example to illustrate this.

Suppose at the start of the trading day, there are 600 open contracts in the market. During the day, 200 new contracts are created, and 150 contracts are closed. The open interest at the end of the day will be,

Open Interest = 600 (starting contracts) + 200 (new contracts) - 150 (closed contracts) = 650

This means there are 650 active contracts in the market at the end of the trading session. Understanding open interest in this way helps traders gauge the flow of money and the level of activity in the market.

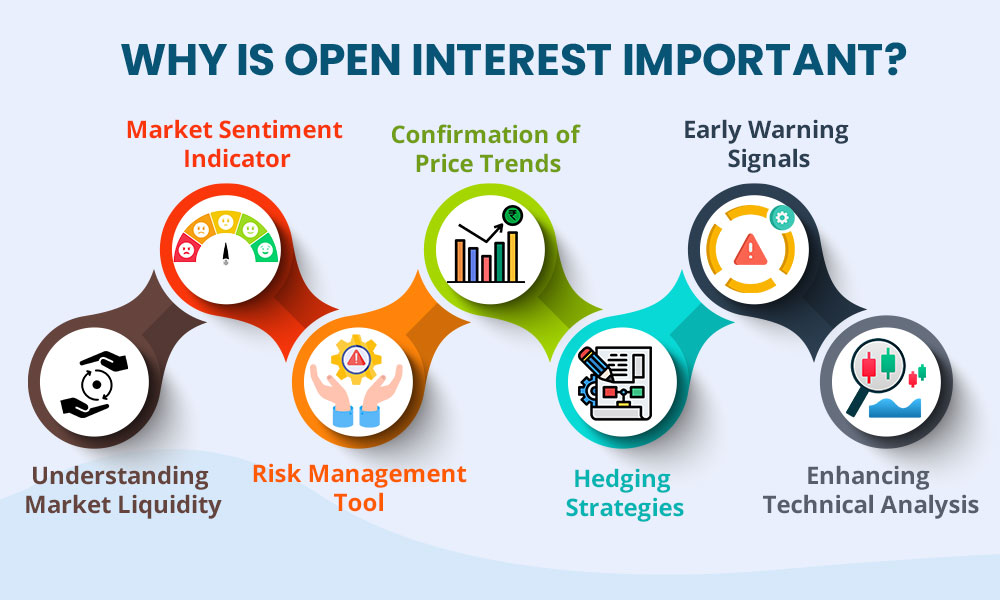

The importance of open interest in navigating the options trading minefield is highlighted below.

Open interest also helps in assessing market liquidity. Higher open interest usually means there is more activity and interest in that particular futures or options contract, making it easier for traders to enter or exit positions. This is particularly important in volatile markets, where liquidity can affect how easily trades can be executed without impacting prices significantly.

Open interest is a key indicator of market sentiment. When open interest increases, it suggests that new money is flowing into the market, indicating strong or emerging trends. Conversely, a decrease in open interest can signal that traders are closing their positions, which may indicate a weakening trend or market uncertainty. By monitoring changes in open interest, traders can gauge the strength of current market movements.

For traders, open interest serves as a valuable risk management tool. By understanding how many contracts are currently active in the market, traders can better assess the potential risk of their positions. For instance, a sudden increase in open interest might signal that more participants are entering the market, which could lead to increased volatility. Being aware of these changes can help traders adjust their strategies accordingly.

Open interest can be used to confirm price trends. For example, if a market is in an uptrend and open interest is rising, it often indicates that the trend is strong and likely to continue. On the other hand, if prices are rising but open interest is declining, it might suggest that the trend is losing momentum and could reverse. Traders can use this information to make more informed trading decisions.

Open interest can serve as an early warning signal for potential market reversals. For example, if a market is trending upward but open interest starts to decline, it might indicate that traders are beginning to close their positions, signalling a possible end to the trend. Traders can use this as a cue to either lock in profits or prepare for a potential reversal.

Open interest is also crucial for traders who use hedging strategies. Higher open interest can indicate that more participants are hedging their positions, either to protect against adverse price movements or to lock in profits. This is especially relevant for traders involved in commodities or currency futures, where effective hedging can minimise potential losses in volatile markets.

Open interest is a valuable addition to technical analysis. When combined with other indicators like moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence), open interest can provide deeper insights into market trends. For example, a rising open interest alongside a bullish crossover in MACD might reinforce the signal to buy, giving traders more confidence in their analysis.

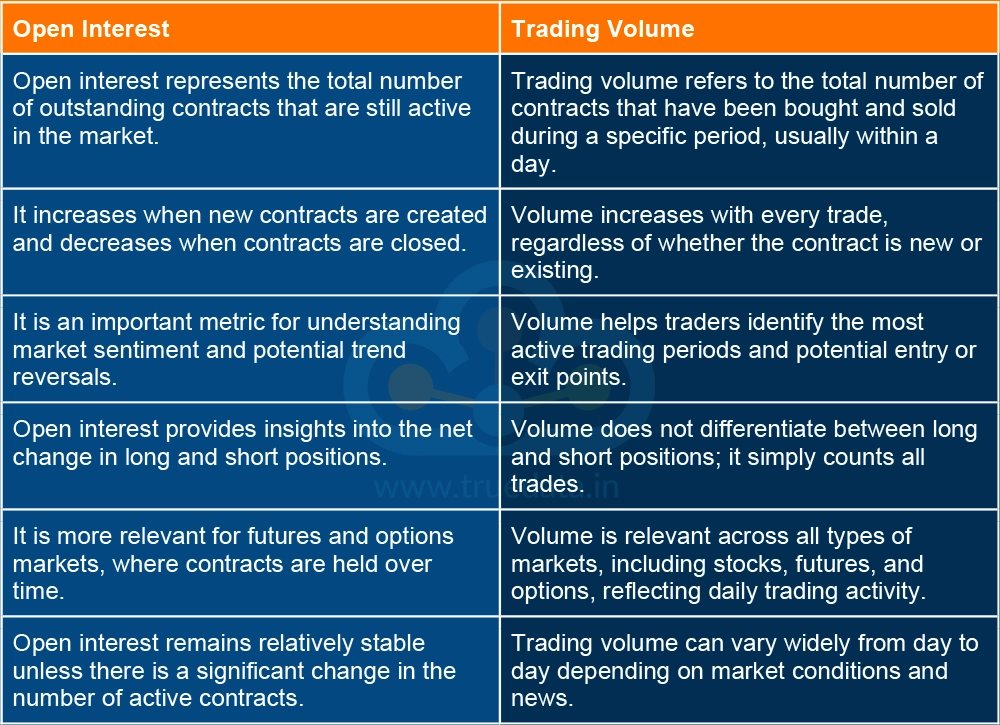

The terms trading volume and open interest are often interchanged, especially by novice traders. Here are the meaning and key points of differences between trading volume and open interest.

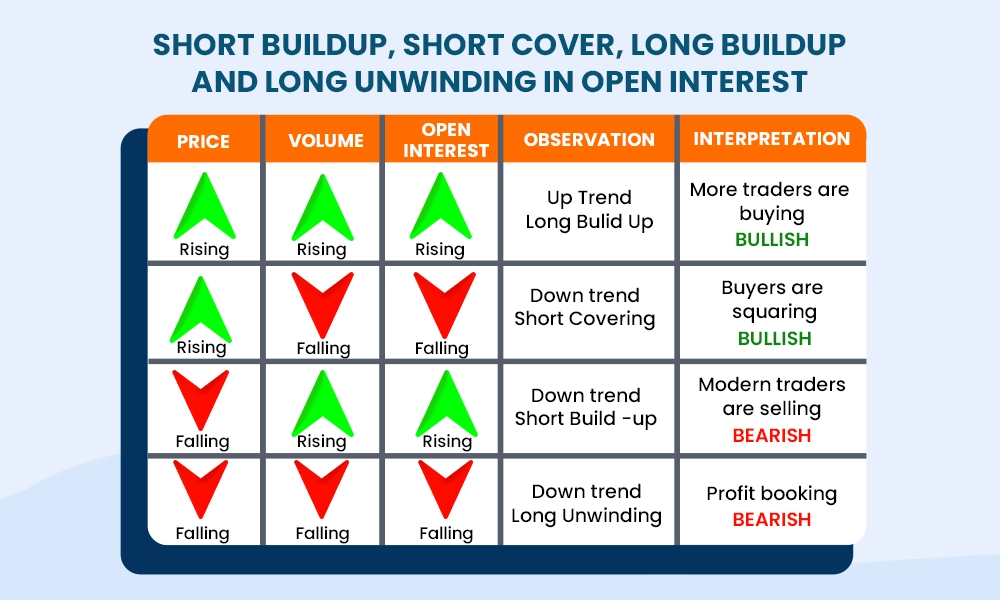

The terms short buildup, short covering, long buildup, and long unwinding refer to market sentiment and potential price movements based on the activity of traders. Here is a brief explanation of these terms.

A short buildup happens when traders expect the price of a stock or asset to fall. They sell (short-sell) shares they do not own, planning to buy them back later at a lower price. This increases the open interest and pushes prices downward. For traders, it signals a bearish trend. When they spot a short buildup, it is typically seen as an opportunity to sell or avoid buying until the market shows signs of reversal.

Short covering happens when traders who previously shorted a stock buy it back because the price is rising, and they want to avoid losses. This creates buying pressure, pushing prices up. For traders, seeing short covering signals a possible end of a downtrend, and prices might rise quickly. Traders may look for opportunities to enter a long position or close their short positions in such cases.

Long buildup occurs when traders expect prices to go up, so they buy shares, increasing both price and open interest. This shows a bullish sentiment in the market. Traders often interpret this as a sign to continue buying or hold onto their positions, expecting further price appreciation. A long buildup suggests a growing confidence among investors.

Long unwinding happens when traders who had bought earlier start selling, as they believe prices might fall or have already peaked. This leads to a decline in both open interest and price. For traders, this indicates a weakening trend, and they may consider exiting their long positions to lock in profits or avoid losses. It signals that bullish momentum is slowing down.

As mentioned above, each of these phases reflects trader sentiment and can guide buying or selling decisions based on market conditions.

Reference pic given below for the above explanation to create a new one.

Open interest is a crucial metric for traders, particularly in the futures and options markets. It reflects the total number of active contracts that remain open and helps gauge market sentiment, strength of trends, and overall participation. It is particularly useful for understanding how active or inactive the market is and for managing risk. Open interest, thus, helps traders make more informed decisions by offering a deeper view of market dynamics beyond just daily trading activity.

This article talks about open interest, which is an integral part of F&O trading. Let us know if you have any queries on this topic or need further information on any aspect of options trading, and we will take it up in our upcoming blogs.

Till then, Happy Reading!

Read More: What are Options Expiration Strategies to Avoid Traps on Options Expiration Day?

When we talk about trading, which security is the most common one that comes to ...

India is increasingly becoming a dominant options trading market with the highes...

Options trading has become one of the hottest topics in the Indian stock markets...