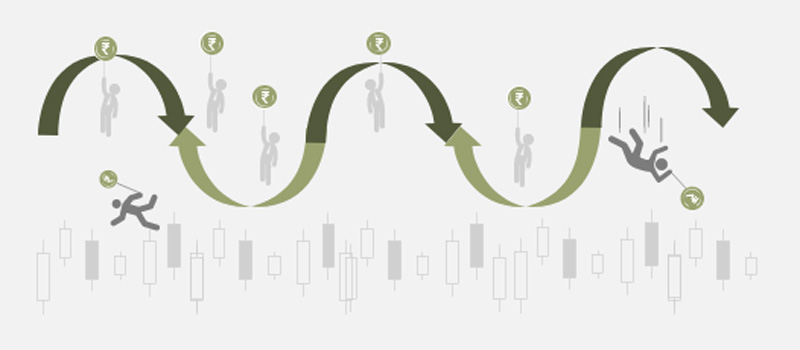

Terminology of Stock Market What Is a Stock Market? A stock market is a place where you can buy and sell equity shares of companies. You can participate as an investor or trader who seeks profits over a short time or in the long run. Investors mainly have a long-term horizon and want to benefit from capital appreciation over time. While Traders, on the other hand, seek quick profits and focus on the small price changes in equity shares. Bull and bear markets are two of the basic concepts of stock market trading, where the term bull market refers to a stock market in which the price of stocks is generally rising. Most investors see bull markets as a great opportunity to excel. It is because, in a bull market, the majority of stock investors are buyers instead of short-sellers of stocks. A bear market exists when we have stock prices declining in price. Investors can benefit from bear markets, too. They can do it via short selling, a practice of borrowing stock that the investor does not hold from a brokerage firm that owns shares of the stock. Investors can sell the borrowed stock shares in the secondary market and receive money from the sale of that stock.

Terminology of Stock Market What Is a Stock Market? A stock market is a place where you can buy and sell equity shares of companies. You can participate as an investor or trader who seeks profits over a short time or in the long run. Investors mainly have a long-term horizon and want to benefit from capital appreciation over time. While Traders, on the other hand, seek quick profits and focus on the small price changes in equity shares. Bull and bear markets are two of the basic concepts of stock market trading, where the term bull market refers to a stock market in which the price of stocks is generally rising. Most investors see bull markets as a great opportunity to excel. It is because, in a bull market, the majority of stock investors are buyers instead of short-sellers of stocks. A bear market exists when we have stock prices declining in price. Investors can benefit from bear markets, too. They can do it via short selling, a practice of borrowing stock that the investor does not hold from a brokerage firm that owns shares of the stock. Investors can sell the borrowed stock shares in the secondary market and receive money from the sale of that stock.

An income stock is a type of equity security that offers you a high yield. This yield may generate from the majority of security’s overall returns. Income stock is a very popular type of stock among investors since it is the least volatile among all and offers a higher-than-market dividend yield to its investors.

An income stock is a type of equity security that offers you a high yield. This yield may generate from the majority of security’s overall returns. Income stock is a very popular type of stock among investors since it is the least volatile among all and offers a higher-than-market dividend yield to its investors.

Mostly, small companies issue penny stocks, especially start-ups, to raise funds from investors. These stocks are usually illiquid that are traded at a very low price. Companies issue penny stocks with a very low market capitalization.

Mostly, small companies issue penny stocks, especially start-ups, to raise funds from investors. These stocks are usually illiquid that are traded at a very low price. Companies issue penny stocks with a very low market capitalization.

Speculative stocks usually come from companies that are looking to tap unexplored territory, developing new products, or the ones that have done major changes to their management or financial level. These stocks carry high risk since the company, product, and management are often untested. However, it gives a promise of a high return, but the risk is also high.

Speculative stocks usually come from companies that are looking to tap unexplored territory, developing new products, or the ones that have done major changes to their management or financial level. These stocks carry high risk since the company, product, and management are often untested. However, it gives a promise of a high return, but the risk is also high.

In this type of stock, whenever an organization earns any profit, the money gained via profit gets reinvested into the company itself to help it boost its innovation and business expansion. In this type of stock, investors do not get any dividends, but they receive capital gain whenever they sell their stocks.

In this type of stock, whenever an organization earns any profit, the money gained via profit gets reinvested into the company itself to help it boost its innovation and business expansion. In this type of stock, investors do not get any dividends, but they receive capital gain whenever they sell their stocks.

These stocks are issued by the companies that offer luxury and discretionary goods and services. For instance, stocks of airlines, restaurants, vehicle manufactures, hotels, and clothing. The performance of cyclical stocks is interlinked with the health of the economy, i.e., if the economy does well, prices remain high, and when it performs ill, stocks lose a substantial value.

These stocks are issued by the companies that offer luxury and discretionary goods and services. For instance, stocks of airlines, restaurants, vehicle manufactures, hotels, and clothing. The performance of cyclical stocks is interlinked with the health of the economy, i.e., if the economy does well, prices remain high, and when it performs ill, stocks lose a substantial value.

A stock is considered a value stock when a company has assets worth more than its stock price. These stocks are often undervalued by the investors since their value increases gradually, i.e., it takes a lot of time. If the company does perform well, the losses will be severe.

A stock is considered a value stock when a company has assets worth more than its stock price. These stocks are often undervalued by the investors since their value increases gradually, i.e., it takes a lot of time. If the company does perform well, the losses will be severe.

Every human has some basic needs, such as food, fuel, healthcare services, etc. No one stops eating food, refilling empty tanks, or avoid going to hospitals. Stocks related to such vital services are defensive stocks. Defensive stocks are immune to any economic downturn or profits.

Every human has some basic needs, such as food, fuel, healthcare services, etc. No one stops eating food, refilling empty tanks, or avoid going to hospitals. Stocks related to such vital services are defensive stocks. Defensive stocks are immune to any economic downturn or profits.

We can classify stocks into multiple categories based on various parameters, such as the company size, dividend payment, industry, risk, volatility, and fundamentals.

It is the most basic parameter that we use to classify stocks. For this category, the issuing company has full power to decide whether it will issue common, preferred or hybrid stocks.

It is the most basic parameter that we use to classify stocks. For this category, the issuing company has full power to decide whether it will issue common, preferred or hybrid stocks.

Stocks can also be classified based on the market value of the total shareholding of an organization. You can calculate the same using market capitalization, in which you need to multiply the share price with the total number of issued shares. We have three kinds of stocks under this category: small-cap, mid-cap, and large-cap stocks.

Stocks can also be classified based on the market value of the total shareholding of an organization. You can calculate the same using market capitalization, in which you need to multiply the share price with the total number of issued shares. We have three kinds of stocks under this category: small-cap, mid-cap, and large-cap stocks.

Until and unless you sell all the shares for a profit, dividends remain the primary source of income. You can divide stocks based on how much dividend your company pays. Stocks that fall under this category are income stocks and growth stocks.

Until and unless you sell all the shares for a profit, dividends remain the primary source of income. You can divide stocks based on how much dividend your company pays. Stocks that fall under this category are income stocks and growth stocks.

Ideally, as per the followers of value investing, the share price should be equal to the intrinsic value of the company’s share. To arrive at the intrinsic value per share, you need to compare recent share prices with per-share earnings, profits, and other financials. The stock is believed to be overvalued if a share price exceeds this intrinsic value. If it is lower, the stock is undervalued.

Ideally, as per the followers of value investing, the share price should be equal to the intrinsic value of the company’s share. To arrive at the intrinsic value per share, you need to compare recent share prices with per-share earnings, profits, and other financials. The stock is believed to be overvalued if a share price exceeds this intrinsic value. If it is lower, the stock is undervalued.

Some stocks have more risk than others because of their fluctuating share prices. Nevertheless, risky stocks can make you greater profits. Blue-chip stocks and beta stocks fall under this category.

Some stocks have more risk than others because of their fluctuating share prices. Nevertheless, risky stocks can make you greater profits. Blue-chip stocks and beta stocks fall under this category.

Mostly, the prices of stocks move in tandem with the earnings of your company. Based on the same, stocks can be classified as cyclical stocks or defensive stocks.

Mostly, the prices of stocks move in tandem with the earnings of your company. Based on the same, stocks can be classified as cyclical stocks or defensive stocks.

The stock market can be overwhelming at times, especially if you are new to it. It is even hard for those who don’t know about its terminologies or types. But by keeping these terminologies we discussed above handy, you can make your experience easier. Once fluent, you can even make a career in the stock market.

The stock market in India has fascinated general Indian masses for long, perhap...

Options trading is a dynamic and complex arena, filled with intricacies like opt...

India has seen a tremendous stock market boom in the post-COVID world and this h...