The stock market is always buzzing with news, opinions, and updates, and as investors, we often react to them faster than we realise. Sometimes, a single headline or number can sway our decisions and even negatively impact our portfolios. But why does one piece of information hold so much power over us? The answer lies in a common behavioural trap called anchoring bias. Let us explore what anchoring bias really is, how it silently shapes your investment decisions, and most importantly, how you can protect your portfolio from its effects.

Anchoring bias means we rely too much on the first piece of information we see, like a stock’s previous high price, a target price given on TV, or even a friend’s opinion, and then make all our decisions around that ‘anchor’. Instead of considering the latest facts, business performance, or market conditions, our minds keep going back to that initial number or idea and treat it as the right one. This can lead investors to hold on to a stock simply because it once traded at a higher level, or buy something only because it ‘looks cheap’ compared to an old price. Thus, anchoring bias causes us to cling to outdated or irrelevant information, which can cloud judgment and lead to poor investment decisions.

The common market situations where investors often get anchored are mentioned below.

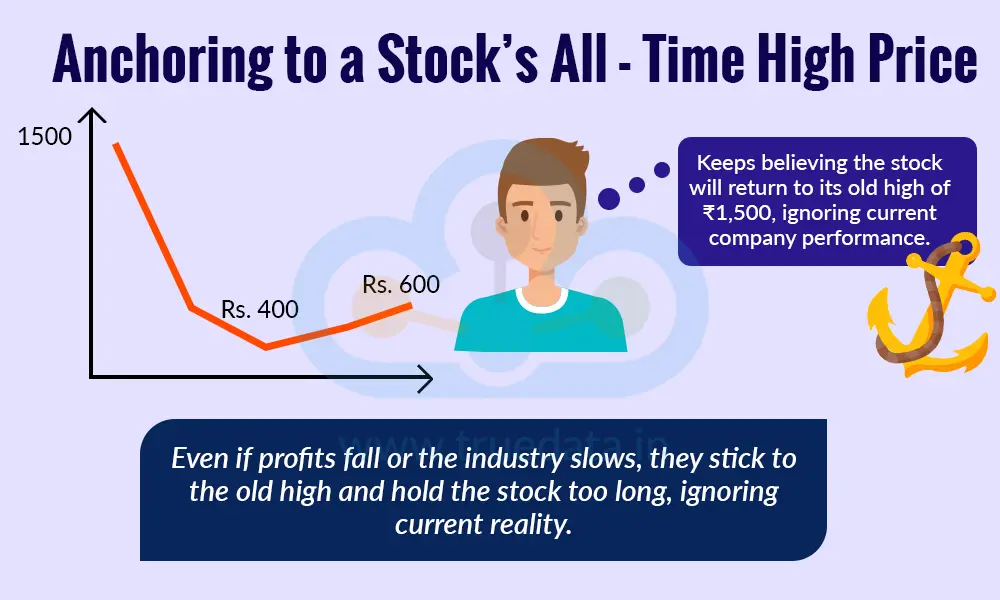

Many investors become fixated on a stock’s previous high. For example, if a stock once touched Rs. 1,500, they continue to believe it will return to that level no matter what. Even if the company’s profits fall or the industry slows down, the old high becomes their mental benchmark. This makes them hold the stock for too long, hoping it will ‘recover’, instead of looking at the company’s current reality.

Investors often treat the IPO price as the stock’s ‘true value’. If a stock lists below its issue price, many investors hold it for months or years just waiting to ‘break even’. Instead of checking whether the business is actually improving or declining, they focus solely on the IPO price and make decisions around it, which can sometimes worsen losses.

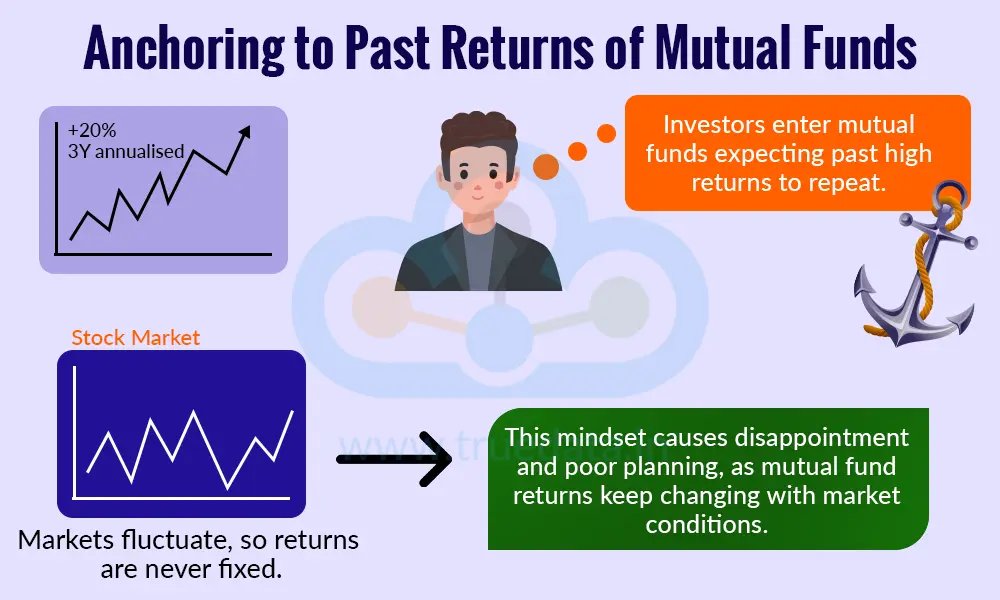

Investors often enter mutual funds expecting the same high returns they saw in past performance charts. For example, if a fund delivered 20% returns last year, it anchors to that number and expects similar results every year. This mindset can lead to disappointment and poor planning, because mutual fund returns fluctuate based on market conditions.

Many investment decisions today are influenced by friends, relatives, or recommendations that are trending on social media platforms such as YouTube and Telegram groups. If a friend says a stock is a ‘sure shot’, that opinion becomes an anchor. Even when the stock starts falling or new negative information emerges, the investor sticks to the initial recommendation and hesitates to review the decision.

Financial news channels and analysts often share target prices that become strong anchors for investors. If an analyst predicts a stock will reach Rs. 2,000, investors might hold on to that number even when market conditions change. This can prevent them from making sensible decisions, such as booking profits early or exiting a risky position when necessary.

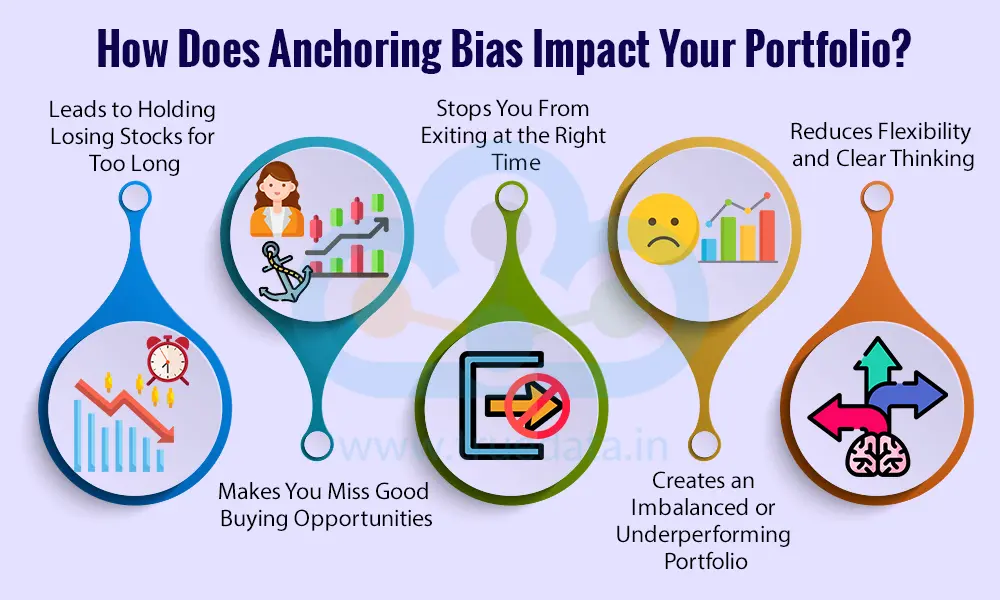

Anchoring bias can have a direct impact on the portfolio, particularly in terms of asset selection or holding on to them even if they no longer meet the investment parameters set at the start of the investment journey. The complete impact of the anchoring bias is explained below.

Anchoring bias often causes investors to stick to old price levels, like a stock’s previous high or their own purchase price, and wait endlessly for the stock to return to that level. Even if the company’s performance is weakening, the investor continues to hope it will rebound to the anchor point. This emotional attachment can lead to increased losses and stop the portfolio from recovering in time.

Anchoring does not just affect selling, but it also affects the buying decisions. For example, if a stock once traded at a significantly lower price, investors may wait for it to fall back to that old level before investing. This anchor can cause them to miss out on strong companies at fair valuations, limiting potential gains and slowing long-term portfolio growth.

When investors get anchored to a target price shared on TV or by analysts, they may refuse to book profits or cut losses until that number is reached. This rigid thinking prevents them from reacting to new information, such as poor earnings, changing market conditions, or rising risks. As a result, the portfolio may suffer if timely action is not taken.

Anchoring often keeps investors stuck with outdated opinions or fixed expectations, even when the market changes. They may hold too much of a weak stock or avoid diversifying due to outdated beliefs. Over time, this leads to an unbalanced portfolio that fails to align with current market reality and may underperform expectations.

A portfolio grows best when investors stay open to new information and adjust their strategy when needed. Anchoring bias hinders this flexibility by causing investors to rely too heavily on the first number or idea they encounter, such as an IPO price, a friend’s tip, or a news headline. This limits objective thinking and can reduce overall returns.

Now that we have seen the meaning and importance of anchoring bias in shaping an investment portfolio, the next step is to understand the factors or steps that can help avoid the perils of anchoring bias in the portfolio.

The best way to avoid anchoring is to rely on the most recent data rather than outdated numbers. Before making any investment decision, an investor should check recent earnings reports, market trends, industry news, and expert analysis. When decisions are based on current facts rather than past prices or old opinions, anchoring becomes much weaker, and judgment becomes clearer.

Creating a clear plan helps reduce the likelihood of emotional decisions. Investors can establish rules, such as buying only when fundamentals are strong or selling if a stock falls below a certain point for valid reasons. These predefined rules prevent the mind from holding on to a random anchor, such as an old peak price or a target seen on TV, and encourage more disciplined investing.

Reviewing the portfolio every few months keeps the investor updated and prevents old anchors from influencing decisions. During the review, the focus should be on current valuation, business strength, and future potential, rather than past prices or personal expectations. This ensures the portfolio stays aligned with reality and avoids unnecessary risks.

News channels, social media, and stock tips often create strong anchors by highlighting specific prices or predictions. To avoid anchoring, investors should treat these numbers as just opinions, not facts. By filtering out unnecessary noise and focusing only on meaningful updates, they reduce the chance of getting stuck on a random figure that may later mislead them.

Setting a stop-loss or target based on proper analysis, rather than guesswork or old prices, helps keep emotions in control. Stop-loss limits help investors exit promptly, while realistic targets based on fundamentals prevent them from waiting for unrealistic price levels. This structured approach reduces the influence of anchoring on everyday decisions.

Anchoring happens easily when investors focus only on the price at which they bought or the price a stock once reached. Instead, they should analyse valuation metrics like P/E ratio, growth potential, and company fundamentals. When decisions are based on valuation rather than past price levels, anchoring weakens, and investment choices become more logical.

Sometimes, investors cannot identify their own anchors because they are emotionally attached to them. A financial advisor can offer unbiased guidance and help determine when outdated information is influencing decisions. Professional advice keeps the investor disciplined and prevents the portfolio from drifting due to the anchoring effect.

Anchoring bias is a quiet but powerful trap that can shape investment decisions without investors even realising it. By holding onto factors such as old prices, past highs, analyst targets, or opinions from social media, friends and news channels, investors may act on outdated information instead of today’s reality. This can lead to a detrimental impact on the portfolio, including holding onto losing stocks for too long, missing good opportunities, or keeping an unbalanced portfolio. The good news is that anchoring can be avoided by adopting various practices that can lead to a healthy portfolio that can weather all storms.

This article highlights a core stock market psychology and how anchoring bias can influence a portfolio. Let us know your thoughts on the topic or if you need further information on the same, and we will address it soon.

Till then, Happy Reading!

Read More: Fear and Greed Index - What is it and How to use it?

NSE Stock Prices in Excel in Real Time - Microsoft Excel is a super software cap...

Share prices of a company are affected by numerous external and internal factors...

Did you know the number of intraday traders in India increased by over 300 from ...