Trading in stock markets is not simply buying and selling shares and other securities. It is a careful analysis of different types of trading available and selecting the right fit for a trader. Traders can select the different types of trading like swing trading, intraday trading, scalping, swing trading, etc. based on their risk-return perception, the time they can allot to trading, the capital available for trading, and more. But the common question across any form of trading is how to select stocks to trade and make a profit. Given here is a brief understanding of how traders can pick stocks for intraday trading and the common strategies adopted by them. Read More: What is swing trading?- All you need to know

Trading in stock markets is not simply buying and selling shares and other securities. It is a careful analysis of different types of trading available and selecting the right fit for a trader. Traders can select the different types of trading like swing trading, intraday trading, scalping, swing trading, etc. based on their risk-return perception, the time they can allot to trading, the capital available for trading, and more. But the common question across any form of trading is how to select stocks to trade and make a profit. Given here is a brief understanding of how traders can pick stocks for intraday trading and the common strategies adopted by them. Read More: What is swing trading?- All you need to know

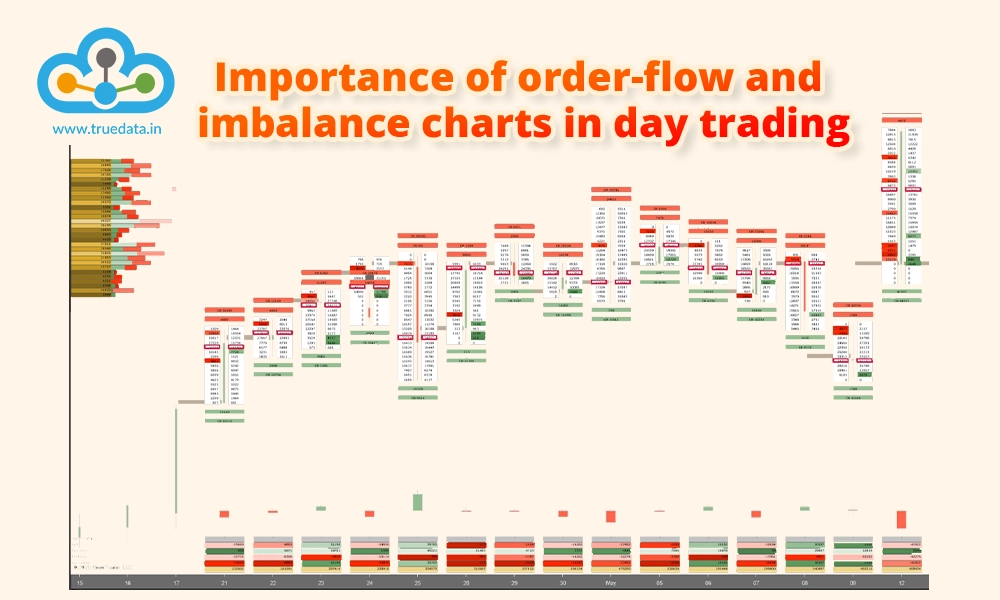

Intraday trading, also known as day trading, is a type of trading where traders buy and sell stocks, commodities, or other financial instruments within the same trading day. In simple words, it means making trades and closing all positions before the market closes for the day. The objective of intraday trading is to take advantage of short-term price movements and make profits from the fluctuations that occur during the day. Traders who engage in intraday trading closely monitor the market and look for opportunities to enter and exit trades quickly. Intraday traders use various techniques and strategies to make trading decisions, such as technical analysis, chart patterns, and indicators. They often rely on real-time market data, charts, and tools to analyze price trends, volume, and market behavior to make informed trading decisions.

Selecting the right stocks for intraday trading is the basis to create a successful trading portfolio. Some of the strategies or points to be considered while selecting stocks for intraday trading are mentioned hereunder.

Selecting the right stocks for intraday trading is the basis to create a successful trading portfolio. Some of the strategies or points to be considered while selecting stocks for intraday trading are mentioned hereunder.

It's important for new traders to identify their trading style and risk tolerance. Conservative traders may prefer stable stocks with lower volatility, while more aggressive traders may be comfortable with higher-risk, high-potential-return stocks. Knowing your trading style helps you narrow down the types of stocks to focus on and align your trading strategy accordingly.

Liquidity is crucial in intraday trading. Opt for stocks that have high trading volumes and are actively traded. High liquidity ensures that you can easily enter and exit positions without significantly impacting the stock price. It also allows for the efficient execution of trades, reducing the risk of slippage.

Volatility refers to the magnitude of price fluctuations. Intraday traders seek stocks with sufficient volatility to capitalize on short-term price movements. Higher volatility stocks tend to offer more trading opportunities. However, traders should exercise caution with excessively volatile stocks, as they can be riskier to trade and may require advanced risk management strategies.

Technical analysis involves studying historical price and volume data to identify patterns, trends, and potential trading opportunities. New traders should learn and utilize various technical analysis tools and indicators. These can include moving averages, trend lines, support and resistance levels, and oscillators like RSI and MACD. Technical analysis helps traders make informed decisions about entry and exit points.

News and events can significantly impact stock prices. Stay updated on relevant news, such as earnings reports, economic data releases, company announcements, and industry trends. Consider how these factors may influence the stock market and individual stocks. Being aware of news and events helps traders avoid unexpected price movements that can affect their intraday trades.

Pay attention to the overall market trend and sentiment. Market trends can influence stock behavior and trading opportunities. In an uptrending market, traders may focus more on buying opportunities, while in a downtrending market, short-selling opportunities may be more prevalent. Understanding the broader market trend allows traders to align their strategies accordingly.

Implementing risk management techniques is essential in intraday trading. Stop-loss orders help limit potential losses by setting a predetermined price level at which a trader will exit a trade. By placing stop-loss orders, traders protect their capital and manage risk in case a trade moves against their expectations. Setting appropriate stop-loss levels is crucial for disciplined risk management.

Now that we know the tips and tricks to pick the right stocks for intraday trading, let us look at the common intraday trading strategies adopted by traders.

This strategy involves identifying key levels of support and resistance on a stock's price chart. When the price breaks out above a resistance level or below a support level with high trading volume, it may signal a potential trend continuation. Traders can enter a long (buy) or short (sell) position based on the breakout direction and set appropriate stop-loss and take-profit levels.

This strategy involves identifying key levels of support and resistance on a stock's price chart. When the price breaks out above a resistance level or below a support level with high trading volume, it may signal a potential trend continuation. Traders can enter a long (buy) or short (sell) position based on the breakout direction and set appropriate stop-loss and take-profit levels.

The momentum strategy focuses on stocks that are exhibiting strong upward or downward price movements. Traders look for stocks with high trading volume and price momentum, indicating strong buying or selling pressure. They aim to join the trend early and ride the momentum for potential profits. Technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions.

The momentum strategy focuses on stocks that are exhibiting strong upward or downward price movements. Traders look for stocks with high trading volume and price momentum, indicating strong buying or selling pressure. They aim to join the trend early and ride the momentum for potential profits. Technical indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help identify overbought or oversold conditions.

This strategy aims to identify potential reversals in the stock price direction. Traders look for signs that a stock's upward or downward movement is losing steam and may reverse. They monitor indicators like candlestick patterns, trendline breaks, or divergences in oscillators. When they spot a possible reversal, they enter a position in the opposite direction of the current trend, with appropriate stop-loss levels to manage risk.

This strategy aims to identify potential reversals in the stock price direction. Traders look for signs that a stock's upward or downward movement is losing steam and may reverse. They monitor indicators like candlestick patterns, trendline breaks, or divergences in oscillators. When they spot a possible reversal, they enter a position in the opposite direction of the current trend, with appropriate stop-loss levels to manage risk.

Scalping is a high-frequency trading strategy where traders aim to profit from small price movements within a short timeframe. Traders enter and exit positions quickly, often within seconds or minutes, capturing small price differentials. This strategy requires swift decision-making, closely monitoring price charts, and utilizing tight stop-loss orders to manage risk.

Scalping is a high-frequency trading strategy where traders aim to profit from small price movements within a short timeframe. Traders enter and exit positions quickly, often within seconds or minutes, capturing small price differentials. This strategy requires swift decision-making, closely monitoring price charts, and utilizing tight stop-loss orders to manage risk.

News-based strategies involve trading on the back of significant news or events that can impact stock prices. Traders stay updated on corporate announcements, earnings reports, economic indicators, and other relevant news. They quickly analyze the news and take positions accordingly, aiming to profit from the resulting price volatility.

News-based strategies involve trading on the back of significant news or events that can impact stock prices. Traders stay updated on corporate announcements, earnings reports, economic indicators, and other relevant news. They quickly analyze the news and take positions accordingly, aiming to profit from the resulting price volatility.

Range trading involves identifying stocks that are trading within a defined price range. Traders aim to buy near the support level and sell near the resistance level. They can enter long or short positions based on the stock's movement within the range. Technical indicators like Bollinger Bands or Moving Average Envelopes can help identify the upper and lower boundaries of the range.

Range trading involves identifying stocks that are trading within a defined price range. Traders aim to buy near the support level and sell near the resistance level. They can enter long or short positions based on the stock's movement within the range. Technical indicators like Bollinger Bands or Moving Average Envelopes can help identify the upper and lower boundaries of the range.

Intraday trading is a very common form of trading across the globe and is ideal for traders with a high-risk appetite and the ability to trade at a faster pace. However, the basis or the starting point for any type of trading is selecting the right stocks and having a clear understanding of the stock markets in general. Therefore, we hope that with this blog we are able to give you some valuable insights into this process and related details that can aid you in your intraday trading. Let us know what you think of these points to be considered or if you have any further points in the checklist to select intraday stocks. Till Then Happy Reading!

In the world of high-speed trading, success often hinges on capitalising on even...

The use of technical analysis for trading is vital for creating a successful tr...

Do you know, only about 3 of India’s population is actively invested in st...